Oct 4, 2021 | coins, commemorative, legislative

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

Regardless of the side of the aisle you follow, Congress is a very frustrating body. Members live in their own world, interested in what they can do to make them look better. When a citizen is interested in something that is not prominent in the daily news cycle, the response is cold or non-existent.

In the last few months, I tried to inquire about the scheduling of hearings in the Congressional committees regarding coin legislation. There were no answers.

For the last ten years, every Congress has promised to return to regular order. It seems that what we have now is regular order, meaning that coin-related legislation will not be heard until a holiday period or during the lame-duck session in 2022.

Welcome to the new regular order.

H.R. 4429: Semiquincentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue $25.00 gold coins, $2.50 silver coins, 25 cent clad coins, and proof silver $2.50 coins in commemoration of the 250th anniversary of the establishment of the United States. The designs of the coins shall be emblematic of the semiquincentennial anniversary of the establishment of the United States of America and celebrate 250 years of our nation. On each coin there shall be

- a designation of the value of the coin;

- an inscription of the years 1776-2026; and

- inscriptions of the words Liberty, In God We Trust, United States of America, and E Pluribus Unum.

Treasury may issue coins under this bill only during the period beginning on January 1, 2026, and ending on December 31, 2026. All sales of coins issued shall include a surcharge as prescribed by this bill. All surcharges received by Treasury from the sale of such coins shall be paid to the America 250 Foundation to fund the restoration, rehabilitation, and interpretation of units of the U.S. National Park System and its related areas, as a legacy of the semiquincentennial commemoration.

Introduced in House — Jul 13, 2021

Referred to the House Committee on Financial Services. — Jul 13, 2021

S. 2384: Semiquincentennial Commemorative Coin Act

Introduced in Senate — Jul 20, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jul 20, 2021

H.R. 4703: Sultana Steamboat Disaster Commemorative Coin Act of 2021

Summary: This bill directs the Department of the Treasury to mint and issue $5 gold coins, $1 silver coins, and half-dollar clad coins in recognition and remembrance of the Sultana Steamboat explosion of 1865. The designs of the coins shall be emblematic of the historical significance of the Sultana disaster, with special recognition and remembrance given to the lives lost, including the recently released Union soldiers returning home after having been prisoners of war during the American Civil War at Confederate prisons located at Andersonville and Cahaba. Treasury may issue coins minted under this bill to the public only during the one-year period beginning on January 1, 2023. All sales of such coins shall include a surcharge to be paid to the Sultana Historical Preservation Society, Inc. to establish and maintain a new Sultana disaster museum.

Introduced in House — Jul 27, 2021

Referred to the House Committee on Financial Services. — Jul 27, 2021

H.R. 5232: Working Dog Commemorative Coin Act

Introduced in House — Sep 10, 2021

Referred to the Committee on Financial Services, and in addition to the Committee on the Budget, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. — Sep 10, 2021

H.R. 5472: To amend title 31, United States Code, to limit the face value of coins.

Introduced in House — Sep 30, 2021

Referred to the House Committee on Financial Services. — Sep 30, 2021

Jun 1, 2021 | commemorative, legislative

Congress became quiet on the numismatic front in May. After a flurry of vanity bills introduced in March and April, the only bill to be introduced in May was to create a commemorative to raise money for the National World War II Memorial in Washington, D.C.

Congress became quiet on the numismatic front in May. After a flurry of vanity bills introduced in March and April, the only bill to be introduced in May was to create a commemorative to raise money for the National World War II Memorial in Washington, D.C.

The National World War II Memorial opened in 2004 to a lot of acclaim for its design. Surrounding a reflecting pool are 56 granite pillars arranged in a semicircle. Each pillar has the name of the 48 states and eight territories at the time of the war. Two sides represent the two theaters of the war, the Atlantic and Pacific.

One of the “Kilroy was here” engravings on the WWII Memorial. (Source: Wikipedia)

The memorial is open 24 hours a day, and the National Parks Service does not charge admission fees to enter. The only money the NPS receives to maintain the memorial is from the budget process and donations. Neither is enough to prevent the deterioration caused by Washington weather extremes and the wear of visitors. Unfortunately, there has also been vandalism.

Because of the condition problems, groups are looking for ways to raise money to refurbish and improve the memorial. Ideas included the creation of a commemorative coin to help raise money for the construction. If passed, S. 1596 will create a commemorative coin series to raise construction money for the memorial.

S. 1596: A bill to require the Secretary of the Treasury to mint coins in commemoration of the National World War II Memorial in Washington, DC, and for other purposes.

Introduced in Senate — May 12, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — May 12, 2021

If you like what you read, share, and show your support

May 3, 2021 | legislative

After posting last month’s Numismatic Legislation Review, someone reminded me that politicians submit bills they know will never be considered. Political watchers call these “vanity bills.” Members of Congress submit vanity bills to have their names published to show the folks at home that they are doing something.

After posting last month’s Numismatic Legislation Review, someone reminded me that politicians submit bills they know will never be considered. Political watchers call these “vanity bills.” Members of Congress submit vanity bills to have their names published to show the folks at home that they are doing something.

Submitting a bill is easy. Members can develop an idea, format it in the appropriate form, and press a button on their computers to send it to the clerk. Aside from having a standard format, the House of Representatives published instructions on submitting numismatic bills.

Members do not write the bills. Interest groups promoting a cause will write the bill text for the member or written by a staff member.

Rep. Paul Gosar (R-AZ) submitted a bill to create a commemorative coin program for Cesar Chavez. The Arizona-born Chavez founded the National Farm Workers Association to organize farmworkers. Considering the ethnicity of many farmworkers, honoring Chavez will not be popular with certain members of Congress. Even though this bill has almost no chance of passing, Gosar can go home to Arizona and say that he tried.

H.R. 2404: To require the Secretary of the Treasury to mint coins in commemoration of Cesar Chavez's work for the betterment of legal workers, and for other purposes.

Introduced in House — Apr 8, 2021

Referred to the House Committee on Financial Services. — Apr 8, 2021

Apr 2, 2021 | coins, legislative, news

Every month we look at the numismatic legislation that Congress worked on the previous month. Since the 117th Congress is only three months into its first session, most of the legislative action is introducing bills.

Every month we look at the numismatic legislation that Congress worked on the previous month. Since the 117th Congress is only three months into its first session, most of the legislative action is introducing bills.

Nowadays, Congress members do not have to drop their papers into the hopper in their respective chambers. Bills are submitted electronically. To prove that they are doing something, these legislators also post the bill on their official websites. Inevitably, an intern or low-level staffer makes a mistake that gets misinterpreted by the press, making it sound like a bill has been passed. According to the Government Printing Office, there has been no numismatic-related bill that has made it past its committee assignment.

A few days ago, Rep. Alexander Mooney (R-WV) introduced H.R. 2285, a bill “To amend the Internal Revenue Code of 1986 to clarify that gain or loss on the sale or exchange of certain coins or bullion is exempt from recognition.” Although this bill’s text has yet to be published, the title suggests that it will make the sale of coins and bullion exempt from capital gains taxes.

Currently, collectors who sell items from their collections are required to pay capital gains taxes on the profit from the sale of their coins. If you bought a coin for $100,000 then sell it for $150,000, the capital gains tax is applied to the $50,000 profit. Under the 2020 rate schedule, that is a 0% tax, except if you bought the coin within the last year, it is taxed as part of your regular income. But if you bought the coin for $50,000 before 2020 and sold it for $150,000 in 2020, then the $100,000 profit is taxed at 15%.

Are you confused? This is why the potential of eliminating the capital gains tax on coins and bullion will help the industry.

Here is the list of the eight bills introduced in March 2021.

H.R. 1648: To require the Secretary of the Treasury to mint coins in recognition and celebration of the National Women’s Hall of Fame.

Introduced in House — Mar 8, 2021

Referred to the House Committee on Financial Services. — Mar 8, 2021

S. 672: A bill to amend title 31, United States Code, to save Federal funds by authorizing changes to the composition of circulating coins, and for other purposes.

Introduced in Senate — Mar 10, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Mar 10, 2021

H.R. 1842: To require the Secretary of the Treasury to mint commemorative coins in recognition of the Bicentennial of Harriet Tubman’s birth.

Introduced in House — Mar 11, 2021

Referred to the House Committee on Financial Services. — Mar 11, 2021

H.R. 1789: To amend title 31, United States Code, to save Federal funds by authorizing changes to the composition of circulating coins, and for other purposes.

Introduced in House — Mar 11, 2021

Referred to the Committee on Financial Services, and in addition to the Committees on the Budget, and Rules, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. — Mar 11, 2021

S. 697: A bill to require the Secretary of the Treasury to mint commemorative coins in recognition of the Bicentennial of Harriet Tubman’s birth.

Introduced in Senate — Mar 11, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Mar 11, 2021

H.R. 1900: To require the Secretary of the Treasury to mint coins in commemoration of the health care professionals, first responders, scientists, researchers, all essential workers, and individuals who provided care and services during the coronavirus pandemic.

Introduced in House — Mar 16, 2021

Referred to the House Committee on Financial Services. — Mar 16, 2021

S. 867: A bill to require the Secretary of the Treasury to mint coins in recognition and celebration of the National Women’s Hall of Fame.

Introduced in Senate — Mar 18, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Mar 18, 2021

H.R. 2284: To amend the Internal Revenue Code of 1986 to clarify that gain or loss on the sale or exchange of certain coins or bullion is exempt from recognition.

Introduced in House — Mar 29, 2021

Referred to the House Committee on Ways and Means. — Mar 29, 2021

If you like what you read, share, and show your support

Mar 4, 2021 | coins, legislative, news

Welcome to the first legislative report for the 117th Congress.

Welcome to the first legislative report for the 117th Congress.

Every two years, a new Congress opens to an alleged promise of a productive session. But like all political promises, the ideals disappear after the opening gavel.

Aside from the public business that makes the news, the House of Representatives set itself up for a lot of busywork. Through February, members of the House have submitted 1,461 bills to be considered. It is the soonest the House has reached 1,000 bills in the last ten years.

If the House is nicknamed “The Raucus Caucus,” then the Senate is the more deliberative body. That is until they appear in the well of the chamber to wax poetic about some issue only to change their minds when the cameras are on them. But the 100 members of the Senate, with two seat changes in January, proposed 479 bills through February. The pace is a little faster than in previous sessions.

Of the 1,907 bills proposed in either chamber, only three had to do with numismatics. Two of the bills are the typical commemorative proposals and the nonsense proposed by Mike Lee.

If this is representative of what we can expect from the 117th Congress, it will be a boring session for numismatics.

H.R. 1057: To require the Secretary of the Treasury to mint coins in commemoration of the National World War II Memorial in Washington, DC, and for other purposes.

Introduced in House — Feb 15, 2021

Referred to the House Committee on Financial Services. — Feb 15, 2021

Sponsor introductory remarks on measure. (CR E134) — Feb 15, 2021

H.R. 905: To require the Secretary of the Treasury to mint coins in commemoration of the health care professionals, first responders, scientists, researchers, all essential workers, and individuals who provided care and services during the coronavirus pandemic.

Introduced in House — Feb 8, 2021

Referred to the House Committee on Financial Services. — Feb 8, 2021

S. 185: Cancel the Coin Act

Summary: This bill prohibits the Department of the Treasury from minting or issuing any coin, including platinum bullion coins and proof platinum coins, having a nominal or face value exceeding $200.

Introduced in Senate — Feb 2, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Feb 2, 2021

Feb 4, 2021 | commentary, legislative

It’s back!

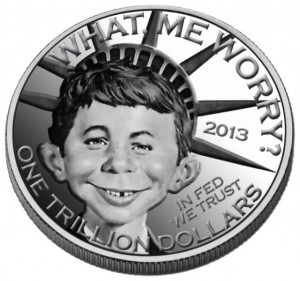

The inane concept of the $1 trillion coin has reared its ugly head again by a member of congress that lost the ability to think after being elected.

The idea was first conjured up in 2013 by conservative economists and pundits with some minor vocal support from some members of congress. It was brought up again in 2020 by a liberal freshman member who missed the earlier lessons about why it is a stupid idea.

Now Sen. Mike Lee (R-UT) has doubled down on the moronic by introducing S. 185, Cancel the Coin Act, to “remove the Treasury Secretary’s ability to mint coins of any value.”

Mike Lee was first elected to the Senate in 2011. He was in congress when the discussion of the $1 trillion coin began. Nearly every competent member of congress on both sides of the aisle dismissed the idea. They understood that issuing a $1 trillion coin will not work.

Lee did not learn the lesson.

Lee introduced the Cancel the Coin Act as a partisan measure because he is suddenly worried about a federal deficit. Even though the deficit was projected to be $1.083 trillion before the pandemic on a budget he voted for, Lee becomes concerned because a different party is in the White House.

The last time the government tried to curb deficit spending and manipulate coinage, Treasury Secretary Andrew Mellon was on his way to being impeached. President Herbert Hoover appointed Mellon as Ambassador to the Court of St. James to get him out of town.

With the worldwide economy crashing, gold was becoming the primary means of international trade. Gold exports were happening faster than could be managed. To stop the hemorrhaging of money, congress passed the Emergency Banking Act on March 9, 1933, with bipartisan support. The act allowed the government to close the banks to allow the system to be recapitalized. It would be the last bank holiday of the Great Depression.

Om May 1, 1933, President Franklin D. Roosevelt issued Executive Order 6102 to recall gold held by the public except for some coins and jewelry. The gold would go to replenishing the country’s gold reserves. The Gold Reserve Act of 1934 codified the Executive Order.

From this point, we can pick up the story of the 1933 Saint Gaudens Double Eagles.

President Gerald Ford reversed Roosevelt’s Executive Order the same day that the law that reverse the Gold Reserve Act was signed: December 31, 1974.

While the story of the 1933 Double Eagles makes for an intriguing drama, the lesson of unintended consequences should be a concern over making political statements the way Sen. Lee is doing.

If you like what you read, share, and show your support

Feb 1, 2021 | legislative

Since the 117th Congress just convened and other work has taken their time, there have been no numismatic-related bills introduced. So let’s take the time to review the numismatic-related legislation from the 116th Congress.

Since the 117th Congress just convened and other work has taken their time, there have been no numismatic-related bills introduced. So let’s take the time to review the numismatic-related legislation from the 116th Congress.

Political analysts describe the 116th Congress as frantic and chaotic. When looking at the numismatic-related legislation, this congress was very active. Since tracking numismatic-related bills for the last five congressional sessions, the 116th Congress introduced more numismatic-related legislation than previous sessions.

Representatives introduced two unique bills, one of which resulted in a law with wide-ranging changes. The Route 66 Centennial Commission Act would have created a commission to honor the centennial of the famed Route 66. The law allowed the commission to recommend commemorative coin programs that would have likely led to fundraising efforts for the route’s preservation. The Route 66 Centennial Commission Act (H.R. 66) passed in the House but died in the Senate.

The United States Semiquincentennial Quarter Series Act would have created a quarters series to celebrate the nation’s 250th anniversary. Along with several others, this bill was combined into the Circulating Collectible Coin Redesign Act of 2020 (Public Law No. 116-330). What sets this law apart is that it creates changing circulation coin designs for the next ten years.

Numismatic Laws

The following were passed by Congress and signed by the President. Some of these laws have lead to new commemorative issues by the U.S. Mint, like the Women’s Suffrage Centennial Commemorative Coin Act.

- S. 239: Christa McAuliffe Commemorative Coin Act of 2019

Sponsor: Sen. Jeanne Shaheen (D-NH)

Summary: (Sec. 3) This bill directs the Department of the Treasury to mint and issue not more than 350,000 $1 silver coins in commemoration of Christa McAuliffe, a teacher tragically killed in the Space Shuttle Challenger Disaster. (Sec. 4) The design of the coins shall bear an image and the name of Christa McAuliffe on the obverse side and a design on the reverse side that depicts the legacy of McAuliffe as a teacher. (Sec. 5) Treasury may issue the coins from January 1-December 31, 2020. (Sec. 7) All surcharges received by Treasury from the sale of the coins shall be paid to the FIRST robotics program for the purpose of engaging and inspiring young people, through mentor-based programs, to become leaders in the fields of science, technology, engineering, and mathematics.

LAST ACTION: Signed by the President and became Public Law No: 116-65. — Oct 9, 2019

- H.R. 2423: Women’s Suffrage Centennial Commemorative Coin Act

Sponsor: Rep. Elise M. Stefanik (R-NY)

Summary: (Sec. 3) This bill directs the Department of the Treasury to mint and issue up to 400,000 $1 silver coins that are emblematic of the women who played a vital role in rallying support for the 19th Amendment to the U.S. Constitution. (Sec. 5) Such coins may be issued during the period beginning on January 1, 2020, and ending on December 31, 2020. (Sec. 7) All surcharges received from the sales of such coins shall be paid to the American Women’s History Initiative of the Smithsonian Institution.

LAST ACTION: Signed by the President and became Public Law No: 116-71. — Nov 25, 2019

- H.R. 1865: Further Consolidated Appropriations Act, 2020

Sponsor: Rep. William J. Pascrell (D-NJ)

Summary: The National Law Enforcement Museum Commemorative Coin Act is buried in this law.

LAST ACTION: Signed by the President and became Public Law No: 116-94. — Dec 20, 2019

- H.R. 4104: Negro Leagues Baseball Centennial Commemorative Coin Act

Sponsor: Rep. Emanuel Cleaver (D-MO)

Summary: This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 gold coins, 400,000 $1 silver coins, and 400,000 half-dollar clad coins in commemoration of the 100th anniversary of the establishment of the Negro National League, a professional baseball league that was formed in response to African-American players being banned from baseball’s major leagues. The design of the coins shall be emblematic of the Negro Leagues Baseball Museum and its mission to promote tolerance, diversity, and inclusion. Only during a one-year period beginning on January 1, 2022, may Treasury issue coins minted under this bill. All surcharges from sales of these coins shall be paid to the Negro Leagues Baseball Museum to fund educational and outreach programs and exhibits. Treasury shall develop and execute a marketing, advertising, promotional, and educational program to promote the collecting of these coins.

LAST ACTION: Signed by the President and became Public Law No: 116-209. — Dec 4, 2020

- H.R. 1830: National Purple Heart Hall of Honor Commemorative Coin Act

Sponsor: Rep. Sean P. Maloney (D-NY)

Summary: This bill directs the Department of the Treasury to mint and issue $5 gold coins, $1 silver coins, and half-dollar clad coins emblematic of the National Purple Heart Hall of Honor. The bill limits the issuance of such coins to the one-year period beginning on January 1, 2022. The bill prescribes surcharges for coin sales, which shall be paid to the National Purple Heart Honor Mission, Inc., to support the mission of such organization, including capital improvements to the National Purple Heart Hall of Honor facilities.

LAST ACTION: Signed by the President and became Public Law No: 116-247. — Dec 22, 2020

- H.R. 6192: 1921 Silver Dollar Coin Anniversary Act

Sponsor: Rep. Andy Barr (R-KY)

Summary: (Sec. 3) The Department of the Treasury shall mint and issue $1 coins in recognition of the 100th anniversary of completion of coinage of the Morgan dollar and the 100th anniversary of commencement of coinage of the Peace dollar. (Sec. 5) Treasury may issue such coins beginning on January 1, 2021. (Sec.6) Treasury must sell such coins at a price equal to the sum of their face value and the cost of designing and issuing the coins and may make bulk sales of the coins issued at a reasonable discount.

LAST ACTION: Signed by the President and became Public Law No: 116-286. — Jan 5, 2021

A previous post described the full impact of Public Law No. 116-330.

Passed by the House

The following bills were passed by the House of Representatives but died in committee in the Senate.

- H.R. 66: Route 66 Centennial Commission Act

Sponsor: Rep. Rodney Davis (R-IL)

Summary: This bill establishes the Route 66 Centennial Commission to honor Route 66 on the occasion of its centennial anniversary. The Department of Transportation shall prepare a plan on the preservation needs of Route 66.

Passed the House of Representatives — Feb 6, 2019

LAST ACTION: Received in the Senate and Read twice and referred to the Committee on Environment and Public Works. — Feb 7, 2019

- H.R. 7995: Coin Metal Modification Authorization and Cost Savings Act of 2020

Sponsor: Rep. Mark E. Amodei (R-NV)

Summary: This bill authorizes the United States Mint to modify the metallic composition of circulating coins (including by prescribing reasonable manufacturing tolerances with respect to those coins) if a study and analysis conducted by the Mint indicates that the modification will

- reduce costs incurred by the taxpayers;

- be seamless, which shall be determined by verifying that the coins will work interchangeably in most coin acceptors using electromagnetic signature technology; and

- have as minimal an adverse impact as possible on the public and stakeholders.

The Mint must notify Congress before making the modification and provide a justification for the modification.

Passed the House of Representatives with amendments — Dec 2, 2020

LAST ACTION: Received in the Senate and Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Dec 3, 2020

Passed by the Senate

The following bill was passed by the Senate but died in committee in the House of Representatives.

- S. 1235: Women’s Suffrage Centennial Commemorative Coin Act

Sponsor: Sen. Marsha Blackburn (R-TN)

Summary: (Sec. 3) This bill directs the Department of the Treasury to mint and issue up to 400,000 $1 silver coins that are emblematic of the women who played a vital role in rallying support for the 19th Amendment to the U.S. Constitution. (Sec. 5) Such coins may be issued during the period beginning on January 1, 2020, and ending on December 31, 2020. (Sec. 7) All surcharges received from the sales of such coins shall be paid to the American Women’s History Initiative of the Smithsonian Institution.

Passed the Senate with amendments — Jun 4, 2019

LAST ACTION: Held at the desk. — Jun 5, 2019

It is common for members in both chambers to submit the same bills on both sides of the capitol. These bills are usually non-controversial and increase the chances of passage. The version of the bill that gets passed depends on politics and timing. S. 1235 was superseded by H.R. 2423 that became Public Law No. 116-71.

Died In Committee

The following bills were introduced but were never acted upon. They are called bills that died in committee. If a member wants the 117th Congress to consider their bill, they are required to submit it again.

House of Representatives

- H.R. 61: Carson City Mint 150th Anniversary Commemorative Coin Act of 2019

- H.R. 500: Christa McAuliffe Commemorative Coin Act of 2019

- H.R. 636: Muhammad Ali Commemorative Coin Act

- H.R. 1089: Monetary Metals Tax Neutrality Act of 2019

- H.R. 1173: President George H.W. Bush and Barbara Bush Dollar Coin Act

- H.R. 1257: United States Coast Guard Commemorative Coin Act of 2019

- H.R. 1805: Tomb of the Unknown Soldier Centennial Commemorative Coin Act

- H.R. 1982: National Women’s Hall of Fame Commemorative Coin Act

- H.R. 2558: To define the dollar as a fixed weight of gold.

- H.R. 2559: Gold Reserve Transparency Act of 2019

- H.R. 2630: Cash Always Should be Honored Act

- H.R. 2650: Payment Choice Act of 2019

- H.R. 3155: 75th Anniversary of the End of World War II Commemorative Coin Act

- H.R. 3483: Integration of Baseball Commemorative Coin Act

- H.R. 3757: 1921 Silver Dollar Commemorative Coin Act

- H.R. 4332: Paul Laurence Dunbar Commemorative Coin Act

- H.R. 4681: National World War II Memorial Commemorative Coin Act

- H.R. 4940: Texas Ranger Division’s 200th Anniversary Commemorative Coin Act

- H.R. 5537: Conan Commemorative Coin Act

- H.R. 5873: Harriet Tubman Bicentennial Commemorative Coin Act

- H.R. 6555: United States Semiquincentennial Quarter Series Act

- H.R. 6923: Coronavirus Front-Line Responders Commemorative Coin Act

- H.R. 8242: National Women’s Hall of Fame Commemorative Coin Act of 2020

Senate

- S. 509: United States Coast Guard Commemorative Coin Act of 2019

- S. 639: Tomb of the Unknown Soldier Centennial Commemorative Coin Act

- S. 1300: National Law Enforcement Museum Commemorative Coin Act

- S. 1794: CENTS Act

- S. 1954: Integration of Baseball Commemorative Coin Act

- S. 2042: National Purple Heart Hall of Honor Commemorative Coin Act

- S. 2427: Women’s History and Nineteenth Amendment Centennial Quarter Dollar Coin Program Act

- S. 2815: National Purple Heart Honor Mission Commemorative Coin Act

- S. 4006: Coin Metal Modification Authorization and Cost Savings Act of 2020

- S. 4326: 1921 Silver Dollar Coin Anniversary Act

- S. 4663: Coin Metal Modification Authorization and Cost Savings Act of 2020

- S. 4730: Circulating Collectible Coin Redesign Act of 2020

If you like what you read, share, and show your support

Jan 18, 2021 | coin design, coins, dollar, halves, legislative, quarter, silver, US Mint

The president has signed the last numismatic-related bill this past week. On January 13, 2021, the president signed the Circulating Collectible Coin Redesign Act of 2020 (Public Law No. 116-330). It was the last possible day to sign the bill. If he did not sign it, the bill would be subjected to a pocket veto.

The president has signed the last numismatic-related bill this past week. On January 13, 2021, the president signed the Circulating Collectible Coin Redesign Act of 2020 (Public Law No. 116-330). It was the last possible day to sign the bill. If he did not sign it, the bill would be subjected to a pocket veto.

- H.R. 1923: Circulating Collectible Coin Redesign Act of 2020

Sponsor: Rep. Barbara Lee (D-CA)

LAST ACTION: Signed by the President and became Public Law No: 116-330. — Jan 13, 2021

The law will require the U.S. Mint to redesign the quarters’ reverse through 2030, starting in 2022.

Prominent American Women Quarters

For the quarters issued between 2022 and 2025, “The design on the reverse side of each quarter dollar issued under this subsection shall be emblematic of the accomplishments and contributions of one prominent woman of the United States.” The U.S. Mint will issue “up to” five quarters per year and confer with several groups to determine who receives the honor.

United States Semiquincentennial Coins

The United States will celebrate its seniquincentennial (250th Anniversary) on July 4, 2026. In celebration of the event, the law states that the U.S. Mint will issue the following coins:

- QUARTERS: 2026 quarters “with up to five different designs emblematic of the United States semiquincentennial.” One quarter must be design to be emblematic of the contribution of a woman or women.

- DOLLARS: orders the Mint to issue “$1 dollar coins with designs emblematic of the United States semiquincentennial.” These dollar coins will be issued in addition to the Native American and Innovation dollars.

Youth Sports Program

The law requires the U.S. Mint to celebrate youth sports with changes to the quarter and half-dollars to correspond to the Summer Olympic games of 2028 and the Winter games of 2030. This program will run from 2027 through 2030.

- QUARTERS: Up to five coins issued each year “shall be emblematic of one sport played by American youth.”

- HALF-DOLLARS: Up to five coins issued each year “emblematic of one Paralympic sport.”

- MEDALS: The law authorizes the U.S. Mint to create “medals with designs emblematic of the sport honored with the issuance of the coin.”

Medals for the 2028 Olympic Games in Los Angeles

The law authorizes the U.S. Mint “to design and manufacture medals for awarding at the 2028 Olympic Games in Los Angeles, California.” The law makes it the first time in the modern Olympics history that the U.S. Mint will create the games’ medals. Previously, the Olympic committees had a private vendor create the medals. According to the International Olympic Committee website, medals for the games played in the United States were created by the following:

| Year |

Games |

Location |

Minter of the Medals |

| 1904 |

Summer |

St. Louis |

Diege & Clust |

| 1932 |

Summer |

Los Angeles |

The Whitehead & Hoag Co. |

| 1932 |

Winter |

Lake Placid |

Robbins Company |

| 1960 |

Winter |

Squaw Valley |

Herff Jones |

| 1980 |

Winter |

Lake Placid |

Medallic Art Co. |

| 1984 |

Summer |

Los Angeles |

Jostens, Inc |

| 1996 |

Summer |

Atlanta |

Reed and Barton |

| 2002 |

Winter |

Salt Lake City |

O.C. Tanner |

Silver Bullion Coins

The new law allows the U.S. Mint to continue to make the five-ounce silver bullion coins that correspond to each of the quarter and half-dollar programs. Interestingly, the silver hockey-puck-sized coins appear to be popular and will continue to be available to collectors and investors.

Also added to the law is the ability to strike factional silver bullion coins with the same designs. It is uncertain if a half-ounce or quarter-ounce silver coin will sell, but we will find out.

Obverse of the Coins

George Washington will continue to appear on the obverse but “be designed in a manner, such as with incused inscriptions, so as to distinguish it from the obverse design used during the previous quarters program.”

The bill includes similar language for the image of John F. Kennedy on the 2026 Semiquincentennial half-dollar.

And now the news…

January 8, 2021

Coin collecting is viewed by many enthusiasts to be a form of modern day treasure hunting, as shops in South Beloit and Beloit continue to do well as collectors come seeking rare finds, or simply to make an investment in precious metals.

→ Read more at

beloitdailynews.com

January 11, 2021

The world’s finest Brasher Doubloon, the most legendary U.S gold coin ever produced, is heading for auction at Heritage this month. The 18th century coin is described as “arguably the world’s most famous numismatic rarity”, and is one of only seven examples known to exist.

→ Read more at

news.justcollecting.com

January 13, 2021

Ongoing excavations at a rural spot near the village of Újlengyel in central Hungary recently struck gold, both figuratively and literally. Archaeologists armed with powerful metal detectors found a buried treasure of approximately seven thousand silver and four medieval gold coins in Hungary, hidden centuries ago by unknown individuals.

→ Read more at

ancient-origins.net

January 14, 2021

Egypt: Archaeologists find coins with Cleopatra’s face on Thousands of objects including ancient coins, pottery and sculpture thousands of years old have been secured, the Israel Antiquities Authority (IAA) has confirmed.

→ Read more at

express.co.uk

If you like what you read, share, and show your support

Jan 11, 2021 | coins, legislative, quarter

My parents taught me that there is a time and place for everything. Even though a discussion about the current state of politics is relevant, a blog about numismatics is not the place for that discussion. Thus, anything I write about politics and public policy will focus on how it affects numismatics. I appreciate your understanding and your readership.

With the 116th Congress gaveled to a closed, the only numismatic-related bill left to watch is H.R. 1923, Circulating Collectible Coin Redesign Act of 2020. The House of Representatives agreed with the Senate’s amendment on December 31, 2020, and sent it to the White House on January 1, 2021. The president has until January 13, 2021, to sign the bill into law. If he does not sign the bill, it becomes the victim of a pocket veto.

With the 116th Congress gaveled to a closed, the only numismatic-related bill left to watch is H.R. 1923, Circulating Collectible Coin Redesign Act of 2020. The House of Representatives agreed with the Senate’s amendment on December 31, 2020, and sent it to the White House on January 1, 2021. The president has until January 13, 2021, to sign the bill into law. If he does not sign the bill, it becomes the victim of a pocket veto.

- H.R. 1923: Circulating Collectible Coin Redesign Act of 2020

Sponsor: Rep. Barbara Lee (D-CA)

Passed the House of Representatives — Sep 22, 2020

Passed the Senate with amendments — Dec 17, 2020

LAST ACTION: Presented to President. — Jan 1, 2021

For a description of what coinage is included in H.R. 1923, see the September 2020 Numismatic Legislation Review.

If you like what you read, share, and show your support

Jan 5, 2021 | coins, legislative, Morgan, Peace, silver

UPDATE (Jan 5, 2021, NOON): A message was transmitted to Congress that the president signed H.R. 6192 along with several other bills on his desk that were received on December 24, 2020.

Several readers asked about the timeline for the president’s signature on H.R. 6192, 1921 Silver Dollar Coin Anniversary Act, and whether he signed the bill.

Several readers asked about the timeline for the president’s signature on H.R. 6192, 1921 Silver Dollar Coin Anniversary Act, and whether he signed the bill.

- H.R. 6192: 1921 Silver Dollar Coin Anniversary Act

Sponsor: Rep. Andy Barr (R-KY)

Passed the House of Representatives — Sep 22, 2020

Passed the Senate with amendments — Dec 17, 2020

LAST ACTION: Presented to President. — Dec 24, 2020

According to the Government Printing Office, the United States government’s official publisher, H.R. 6192 was presented to the president on December 24, 2020. The U.S. Constitution, Article I, Section 7, Clause 2 says that the president has ten days to act. If the president does not sign the bill and Congress is in session, the bill becomes law without the president’s signature. If Congress adjourns during that ten-day period, an unsigned bill is vetoed, called a pocket veto.

Documents from the Justice Department notes that the ten-day period does not include Sunday. A follow-up call to the Justice Department noted that Christmas Day does not count as part of the ten days, but New Years Day counts. The Clerk of the House’s office confirmed this information.

The president has until Wednesday, January 6, 2021, to act on the bill. If he does not sign H.R. 6192 into law, it will be the victim of a pocket veto since the 116th Congress formally adjourned sine die (without a date) the morning of Sunday, January 3, 2021, as constitutionally required.

Since watching numismatic legislation has been a feature of the Coin Collectors Blog (since 2005), the White House Press Office would post bill signings on whitehouse.gov. Unfortunately, the current administration has provided uneven coverage of bill signings not in the news. The GPO will probably publish this news before the White House releases the information.

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

→ Read more at

→ Read more at