U.S. Mint Talks About Their Website and Ordering System

The U.S. Mint held a press availability for members of the numismatic media this morning. There will be more to say about the information presented, but the following are some highlights that will interest the numismatic community.

The U.S. Mint held a press availability for members of the numismatic media this morning. There will be more to say about the information presented, but the following are some highlights that will interest the numismatic community.

Mint management noted that the U.S. Mint is the only sovereign mint with continuing bullion production during the pandemic. In addition to the bullion coin production, the U.S. Mint has produced more circulating coins than any other time.

The U.S. Mint continues operating at the highest level while maintaining safety and controls to protect the employees during the COVID-19 pandemic.

Although it is easy to criticize the U.S. Mint, it is commendable that the bureau continued production but manufacturing more products than ever in the last 18 months.

U.S. MINT DIRECTOR DAVID RYDER noted that sales at the U.S. Mint had been declining prior to his arrival. Part of the reason is that there was not a permanent director in almost nine years. Ryder saw his job as trying to expand the product line to increase interest in the numismatic process.

U.S. MINT ASSOCIATE DIRECTOR OF SALES AND MARKETING MATTHEW HOLBEN said that the U.S. Mint had faced unprecedented demand for its products during the “black swan event.” According to Holben, the U.S. Mint sold more proof American Silver Eagle Proof coins in under a half-hour than they sold in 2019.

The U.S. Mint has 18 dealers that are registered authorized purchasers of numismatic products. These 18 dealers can purchase up to 10-percent of the numismatic products before the public sale. They credit the reduction in attempts to use automated methods to order (BOTs) now that the dealers can determine their inventory.

U.S. MINT DEPUTY CHIEF MARKETING OFFICER KIRK GILLIS said that since the first 2021 Morgan Dollar release, the catalog website could process 217 peak orders per second, up from 96 peak orders per second.

Gillis reported that “up to 60% of the activity on the sites were BOTs” based on the drop in traffic demand since the May 24 launch of the 2021 Morgan Dollar products. He said that the U.S. Mint had implemented technology to reduce the impact of scripts and BOTs used to order products.

The U.S. Mint will explore pre-ordering and waiting room software similar to the processes used by the ticket purchasing systems. They are also looking into other rate-limiting technology.

Beyond the highlights, there are other issues to explore. Stay tuned!

- The website can process “217 peak orders per second, up from 96 peak orders per second.” It was originally reported as “270 orders per second, up from 90.”

- Clarified the 60% reduction in BOT activity as being since the May 24 launch of the initial Morgan Dollar products.

Happy Thanksgiving 2017

As part of his attempt to maintain the union, President Abraham Lincoln issued a proclamation that made Thanksgiving Day a national holiday in 1863.

After Lincoln’s proclamation, it was traditional to celebrate Thanksgiving on the last Thursday of November. In a move to increase the holiday shopping period to promote more spending, President Franklin D. Roosevelt pushed to have congress pass a law to move Thanksgiving earlier in the month. In December 1941, Roosevelt signed a bill that set Thanksgiving as the fourth Thursday in November.

Be thankful for your family.

Be thankful for our hobby.

Be thankful for everything.

Weekly Numismatic World News for November 19, 2017

Sometimes, I find it difficult to keep an open mind with some of the non-circulating legal tender (NCLT) coins that are on the market.

Some of the themes have started as interesting ideas have turned into blatant commercialism that I am not sure how to interpret its benefits to the hobby.

From superheroes to movie tie-ins to the cartoons, the themes are as varied as the grocery store shelves.

The latest NCLT that has me wondering about the future of the hobby is the 2018 Fiji Coca-Cola Bottle Cap-Shaped Dollar.

Yes, a Coca-Cola bottle cap-shaped coin with a face value of one Fijian dollar. The reverse of the coin is colored the famous Coca-Cola red with the script logo that is familiar to anyone who has passed by a Coca-Cola product. The obverse has the Fijian coat of arms, the date, and the specifications of the coin: 6 grams of .999 fine silver.

- 2018 Fiji Coca-Cola Bottle Cap-shaped coin (rendering)

- Packaging for the 2018 Fiji Coca-Cola Bottle Cap-shaped coin (rendering)

After looking at the specifications, the coin is 32.6 mm (1.283 inches) in diameter and I thought that the coins were going to be very thin.

Comparing the specification of this coin to pre-1965 United States coins that were made of .900 silver, the Washington quarter was made of 6.25 grams of silver and copper but was 24.3 mm (.957 inches) in diameter. The quarter is .25 grams heavier but 8.3 mm smaller. My caliper measured a 1960 uncirculated Washington quarter with a thickness of 1.75 mm.

Something closer is the size of the Kennedy half-dollar with a diameter of 30.6 mm (1.204) or 2 mm smaller than the Coco-Cola bottle cap coin. But the Kennedy half-dollar weighs 12.5 grams, more than double the Fijian coin.

To satisfy my curiosity, the caliper said that the uncirculated 1964 Kennedy half-dollar in my collection was 2.15 mm thick.

Not counting for the flare of the edges to resemble a bottle cap, the coin is probably 1 mm thick, less than the 1.35 mm of a 1955 Roosevelt dime I measured.

The coin is available for pre-order only from one company on eBay for $29.95 with free shipping. Expected shipping is on December 8, 2017.

The last time I checked, the listing reported that 1,481 of these coins were sold.

For the record, 6 grams of silver weighs .1929 troy ounces. With the price of silver currently at $17.31 per troy ounce, the coin contains $3.34 worth of silver.

If someone buys one of these coins, feel free to write a review. I will publish it here on the blog!

And now the news…

BRENTWOOD — When milestones are reached in the armed forces, servicemen and women often receive a challenge coin, creating solidarity with others who share the same accomplishment.  → Read more at fosters.com

→ Read more at fosters.com

A hoard of 21 Islamic gold dinars, 2,200 silver coins, and gold artifacts dating to the 12th century CE has been unearthed by archaeologists digging at the Abbey of Cluny, a former Benedictine monastery in Cluny, Saône-et-Loire, France.  → Read more at sci-news.com

→ Read more at sci-news.com

IF you've got one of these most sought-after 50p coins then you could be sitting on a tidy profit. The Sir Isaac Newton 50p coin was introduced into circulation in September and Brits are slowly starting to find it in their spare change.  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

An "exceptional and rare" medieval treasure trove including more than 2,200 gold and silver coins has been found in France in what has been called a "remarkable" discovery by archaeologists. It's the kind of discovery archaeologists dream of.  → Read more at thelocal.fr

→ Read more at thelocal.fr

It was just a strange old penny, a copper-nickel Indian Head minted in 1859, when the government was trying out different metals for one-cent pieces. A grandfather gave it to Eric Pfeiffer Newman in 1918, when he was 7, a little bonus for his nickel-a-week allowance.  → Read more at nytimes.com

→ Read more at nytimes.com

A metal detectorist has tracked down a rare gold coin from Richard III's reign near to the site of the Battle of Bosworth. The Half Angel is one of just a handful of such coins that have survived from the king's two-year reign.  → Read more at leicestermercury.co.uk

→ Read more at leicestermercury.co.uk

Archaeologists with the National Center for Scientific Research and other institutions in France revealed today that they have unearthed 2,200 silver deniers and oboles, 21 Islamic gold dinars, a very expensive gold signet ring and other objects made of gold from the Abbey of Cluny, located in the department of Saône-et-Loire.  → Read more at mining.com

→ Read more at mining.com

How the new tax bill will hurt numismatic businesses

The Industry Council for Tangible Assets (ICTA) issued an alert warning that a provision on the House of Representatives’s tax plan has the potential to hurt the numismatic industry and asked its members to contact their representatives to let them know of the issue.

The Industry Council for Tangible Assets (ICTA) issued an alert warning that a provision on the House of Representatives’s tax plan has the potential to hurt the numismatic industry and asked its members to contact their representatives to let them know of the issue.

Like many legislative actions, the bill was probably not targeted at the numismatic industry but at others where alleged abuses have allowed some to avoid paying taxes or reducing their tax burden. Some suggest that it is aimed at the burgeoning crypto-currency or Bitcoin economy.

In a bill that is supposed to be business-friendly, under Title III, Subtitle D (Reform of Business-Related Exclusions, Deductions, Etc.), Section. 3303 (Like-Kind Exchanges of Real Property) has an innocuous statement that says:

Section 1301(a)(1) refers to 26 U.S.C. §1301(a)(1) that currently says:

In plain English, this is the basis of the bartering economy. If I trade goods and services for goods and services, they are assumed to be a trade of even value and no taxes are paid on the transaction. The new bill (H.R. 1) will tax the barter economy.

In numismatic terms, a collector walks into to a coin shop with 10 Mercury dimes graded by one of the third-party grading services worth about $475 on the retail market. While talking to a dealer you see a nice 1928 Peace Dollar that he has marked $460 rather than selling the Mercury dimes for cash, you work out a trade with the dealer for the Peace Dollar. You make the trade and everyone is happy.

Under the current tax law, that is a “like kind” trade of items of value and not taxed as income.

If the bill that just passed the House is enacted, the dealer will be required to pay a tax on that that transaction.

The amount of the tax will be based on an interpretation of the law by the IRS which is where this could get very tricky.

If the dealer is taxed on the retail value of the trade, the dealer could be taxed on $15 of income if based on the dealer’s valuation of the transaction.

If the IRS requires the dealer to make a valuation based on prevailing market values, who sets those market values? Can the dealer use any price guide to determine the value of the coins? For example, if a price guide determines the Mercury dimes are worth $475 on the retail market as we assumed earlier, but the Peace dollar is worth $450 on one price guide but $480 on another, which guide does the dealer use? The dealer will either make $25 on the transaction, which is subject to taxation or lose $5 that will lower the dealer’s overall tax liability.

But the dealer does not buy at retail valuation. The cost of the inventory would be based on market values of the coins. Does the IRS allow the dealer to base the transaction on the “buy” cost of the coins? Based on the “buy” valuation the transaction may be closer to break-even.

The result will be more bookkeeping for the dealer and a tougher set of accounting rules when managing inventory. Managing inventory for a coin dealer is not like a regular retail store. Each coin is its only item and may be given its own identification (stock keeping unit, or SKU).

Most coin dealers are small businesses that are either sole proprietors or have a few employees. They either work at coin shows or have a few thousand square feet of retail space. Some are family operated business while others hire from the local community. Dealers make a living but it may not be enough to support the necessary change to their inventory management under the new tax law.

Eventually, this will make you, the collector, the loser.

First, it will eliminate the possibility of a trading because of the accounting problems. The dealer who has the Peace dollar in inventory that is not selling but can trade it for Mercury dimes that will sell quicker will not be able to happen. Of course, the dealer could buy the Mercury dimes for the same price as you buy the Peace dollars. The dealer could also be accused of a tax avoidance scheme which will make matters worse. Even if the accusation is not true, the IRS is notorious for treating these cases as “guilty until proven innocent.”

This can also drive dealers out of business.

If this drives small dealers out of business, then there will be no dealers to participate in local, small coin shows. With no dealers, those shows will end and so will your access to dealers to help you with your collection. With no smaller shows, you will have to travel further to find shows or will have lesser access to quality collectibles. Sure, you can purchase coins and currency online, but who will be there to answer questions? What happens if you are not happy with the purchase and you have to ship the coin back to the seller?

Ironically, the change proposed in H.R. 1 strengthens the trading of real estate and real property as “like kind” transaction.

This change in the tax law is not good for small business or the numismatic industry. Please contact your member of the House and Senators to let them know that the side effects of Title III Section 3303 will hurt the hobby we love!

If you do not know your member of Congress, you can call the Capitol switchboard operator at (202) 224-3121. They can transfer you to the appropriate representative.

If you are not sure what to say to the staffer who answers the phone, try the following:

Please call! Make your voice heard!

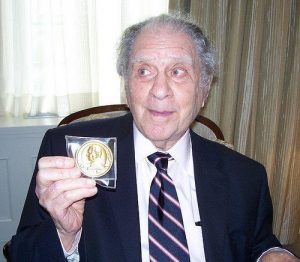

Eric P. Newman (1911-2017)

The following is the obituary scheduled to appear in the St. Louis Post-Dispatch.

Eric was a great lawyer, inventor, and historian, but he was best known as a numismatic collector and scholar, generous philanthropist, and inveterate traveler. He was a member of The Explorer’s Club and, with Evelyn, pioneered travel to every corner of the globe. Over the years, they enjoyed hosting family and friends both in St. Louis and at their homes in Jamaica, Martha’s Vineyard, and the bluffs of Alton, Illinois. Eric established the Newman Money Museum in St. Louis and authored over 100 books and articles, principally in the field of numismatics.

Both directly and through his role in the Eric P. & Evelyn E. Newman Foundation, the Eric P. Newman Numismatic Education Society, the Harry Edison Foundation, and the Edison Family Foundation, he helped in the creation of St. Louis institutions such as the Butterfly House, The Magic House, the Eric P. Newman Education Center at Washington University, and many of the concepts and events dreamed up by his wife Evelyn. Their marriage was an enduring and remarkable model of love, partnership, effectiveness, and concern for others.

The family wants to express its heartfelt thanks to Eric’s many compassionate caregivers. Per Eric’s wishes, there will be no funeral or memorial service. Any gift to your favorite charity would be a welcome tribute to his life. Messages of sympathy may be sent to EricNewmanFamily@gmail.com.

Weekly Numismatic World News for November 12, 2017

As I peruse the Interwebs for numismatic-related stories from non-numismatic sources, my searches are inundated with stories about Bitcoin, crypto-currencies, and blockchains. Most of the time, the stories are just noise given my objective to find information relevant to collectors including the issuance of circulating currencies and the impact of precious metals on the market.

As I peruse the Interwebs for numismatic-related stories from non-numismatic sources, my searches are inundated with stories about Bitcoin, crypto-currencies, and blockchains. Most of the time, the stories are just noise given my objective to find information relevant to collectors including the issuance of circulating currencies and the impact of precious metals on the market.

While there is some use of the technologies as an indicator of a store of something resembling wealth or as a new method of providing electronic transactions, the concept of inventing a currency out of thin air—or electronic bits—is something that may be more dangerous than the stock market.

Bitcoin, which is a type of crypto-currency, is traded using a blockchain, a technology that provides a mechanism for secured transactions between parties. Like the Federal Reserve Note, it is an invented currency whose value is in the eye of the beholder. The only difference between the Federal Reserve Note and crypto-currency is that the worth of the paper currency is backed by the full faith and credit of the United States government. Bitcoin has no backing, very little regulation, and could become as worthless as Enron stock as fast as it became worthless.

Although you may have issues with the way the federal government and the politicians have been conducting themselves, the government provides the backing to make sure that the currency you use has some representative value by law. It is called fiat money.

Crypto-currency not only has no intrinsic value, but it is not backed or supported by the government. It has no regulation and is worth what someone will provide in trade. The assignment of value to crypto-currency may be market driven but those who have seen the silver market of 1980, unregulated markets can cause significant problems.

The blockchains that protect the transactions are software creations. Software is what is used to provide the logic to the computer to do its job—or not do its job in the cases of Equifax, Target, Home Depot, the Office of Personnel Management, and any of the other servers you have heard attacked in the last few years.

Of course the most important thing to numismatists, crypto-currency has no presence in the physical world. You cannot create a collection of bitcoin since it really does not exist. And maybe that should be the question: if it does not have a physical form or a physical representation, is it really money?

And now the news…

The Stellarton Legion is now the proud recipient of a Nova Scotia Highlanders ceremonial unit coin. And Stellarton Legion president Jack Chaisson was on hand to take personal delivery of the coin from Lieutenant-Colonel Colin Todd at Pictou Legion, after attending the county Remembrance Day ceremony in town Sunday.  → Read more at ngnews.ca

→ Read more at ngnews.ca

The Royal Mint has released its official Remembrance Day coin ahead of commemorations on Saturday. Stephen Taylor, a graphic designer at the Royal Mint, said his artwork was inspired by the world-famous war poem 'In Flanders Fields' by John McCrae.  → Read more at standard.co.uk

→ Read more at standard.co.uk

The Perth Mint has released a world-first silver coin in the shape of a figure eight. Likely to be a hit with Chinese coin collectors and buyers, only 8888 of the 2oz, 99.99 per cent silver coins will be released at a recommended retail price of $218.  → Read more at thewest.com.au

→ Read more at thewest.com.au

Bruderer UK, which has nearly 50 years’ experience creating world renown precision high speed presses, has installed a state-of-the-art machine into the Royal Mint’s Llantrisant facility, giving the world famous institution additional speed, capacity and flexibility.  → Read more at expressandstar.com

→ Read more at expressandstar.com

Gold isn’t so shiny anymore. Globally, demand for the precious metal has fallen to its lowest level since late 2009, according to the World Gold Council. In the third quarter of 2017, demand for the haven asset was 915 metric tons, 9% lower than a year earlier.  → Read more at qz.com

→ Read more at qz.com

In January, 1999 Cassinelli Construction Co. was employed by Nevada State Public Works Department to remove a portion of Carolyn Street at the Nevada State Museum to construct a parking lot and build a small park facing Carson Street.  → Read more at elkodaily.com

→ Read more at elkodaily.com

Gold was once a common form of payment around the developed world, but after World War II the precious metal's influence began to wane. In 1971, when the United States finally put an end to the gold standard, the role of the yellow metal changed for good.  → Read more at fool.com

→ Read more at fool.com

The Thank-A-Vet cenotaph memorial coin set, created for local veterans and their families as a keepsake, has been completed with the minting of the final two coins and creation of a pine display box. – Sean Allen/Metroland  → Read more at brantnews.com

→ Read more at brantnews.com

The thing about money — we all need it. “Money bewitches people. They fret for it, and they sweat for it.  → Read more at royalgazette.com

→ Read more at royalgazette.com