What is wrong with the U.S. Mint… this time.

In this final installment of my look at the U.S. Mint’s current problems, I will translate the expletives I wrote in the margins of my notes into an editorial about what I learned.

The impression left by the U.S. Mint officials I spoke with is that the lawyers had more say over policy than the appointed director or the career executives. When questioned as to why the U.S. Mint did not implement additional cybersecurity measures against Internet robots, the answer was that the lawyers prevented a sound business decision.

The impression left by the U.S. Mint officials I spoke with is that the lawyers had more say over policy than the appointed director or the career executives. When questioned as to why the U.S. Mint did not implement additional cybersecurity measures against Internet robots, the answer was that the lawyers prevented a sound business decision.

I do not know why the lawyers prevented the U.S. Mint from implementing appropriate cybersecurity controls to prevent Internet robots and other abuses. Whatever the reason, it caused the U.S. Mint to violate the Federal Information Security Management Act (FISMA). Ignorance of FISMA put the U.S. Mint’s cybersecurity in jeopardy during a time when the Internet is becoming more dangerous.

When I used to work as an information security contractor for the U.S. government, including with Treasury bureaus, agencies would work in anticipation of the passage of relevant laws. When I worked for the IRS, another Treasury bureau, the lawyers and analysts would work on the implementation requirements for the new law. They drafted everything from new forms to planning for the programming necessary to implement the new law. Other agencies did the same. If the lawyers prevented the U.S. Mint from anticipating the passage of a law, then the lawyers are overanalyzing the law. It is called being pedantic.

Where was the U.S. Mint management? The lawyers are supposed to provide advice. They are not supposed to be the final answer. Even though the U.S. Mint did not have a permanent director until David Ryder was confirmed by the Senate, someone was in charge. Why is that person not held responsible for the problems?

What has David Ryder been doing since his confirmation in April 2018? During his confirmation hearing, Ryder spoke about his experience with the security of coinage. Why is he not concerned about the security of the U.S. Mint’s cyber assets?Has Ryder even worked on the security of U.S. coinage? Criminals are duping the collecting public by peddling counterfeit American Silver Eagles. Why has the U.S. Mint not implemented security features in the American Eagle program? If the security of the physical currency is Ryder’s specialty, why has he not implemented it to protect the public?

This is not Ryder’s first rodeo. He was appointed the U.S. Mint director in 1992 by President George H.W. Bush. Ryder should understand how the government works. But his performance during his current appointment and the decisions he has made have the numismatic public questioning his competence.

When someone writes a critical opinion piece, they should provide possible solutions. In this case, I am not sure that any suggestion would work. The U.S. Mint does not listen to the collecting public. When they feign interest, the people who try to be responsive move along with the political winds, and new appointees ignore the lessons of the past under the guise of “Not invented here.”

A common problem among political appointees is that they come into any job thinking they know better than career appointees. It causes them to ignore the past and rediscover previous mistakes. I spent a career fixing the security problems caused by mistakes made by appointees.

I wonder if a civilian advisory board would help the U.S. Mint? The board would consist of experts in numismatics and government processes. But it will give the bureau someone to blame if something goes wrong because if I learned nothing else from my 25 years working for the government, career executives and appointees are collectively risk-averse.

POLL: The 225th Anniversary Enhanced Uncirculated Coin Set

It has been a while since I did a poll and was curious how readers feel about the upcoming 225th Anniversary Enhanced Uncirculated Coin Set.

If you have not heard, the U.S. Mint announced that they will produce a set of enhanced uncirculated coin featuring all of the coin releases for this year in a package similar to that used for their proof sets. Enhanced Uncirculated coins are struck using dies that have been specially laser etched to use levels of frosting to give the designs a more in-depth look.

An advantage of the enhanced uncirculated process is the ability to selectively apply the frosting to the die. One of the coins where this had a real dramatic effect was the 2013-W American Silver Eagle. The enhanced uncirculated American Silver Eagle was only sold as part of the 25th Anniversary set.

- 2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

- 2013-W American Silver Eagle enhanced uncirculated coin

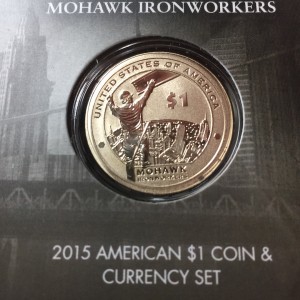

- 2015-W Native American Dollar Enhanced Uncirculated Reverse celebrating the Mohawk Iron Workers

- Reverse of the 2015-W Enhanced Uncirculated Native American Dollar

- Obverse of the 2015-W Enhanced Uncirculated Native American Dollar from the 2015 $1 Set

According to information currently available, the coins will be struck on the same planchets as what is used for business strikes.

No price has been set, but the 2017-S Silver Proof set costs $47.95 and the non-silver 2017-S Proof set is selling for $26.95. To be complete, the 2017 Uncirculated set that contains 20 coins, one of each type from both the Philadelphia and Denver Mints is selling for $20.95.

If I had to guess, I think the 225th Anniversary Enhanced Uncirculated Coin Set will sell somewhere between $28.95 and $32.95.

That being said, will you buy one a set?

Are you planning to buy the 225th Anniversary Enhanced Uncirculated Coin Set?

Total Voters: 68

A lesson in how not to compare grading services

Every so often I will read something and even though I agree with the premise and possibly the hypothesis, I disagree with the method. This is what happened when I read “How do late ANACS slabs stack up with modern PCGS?” This article by Michael Bugeja at Coin Update is not the first of its type on that site but is the latest of what I consider using faulty data to prove a hypothesis.

I submitted comments about my problems to the article. Since whoever is moderating comments has chosen not to publish them, I am using my own platform to call them out on this.

In Bugeja’s showdown of old ANACS versus new PCGS, he found six coins, which is where I begin to have problems. With a potential sample size of thousands or even millions of coins, six coins is a rounding error. And not only did he use six coins but from different dates, mints (Philadelphia and San Francisco), and grades. Anyone who has any knowledge of the scientific method knows that he has just introduced too many variables that will allow anyone to argue about the differences in the metals, machinery, and environmental factors.

The next problem with the experiment is that he uses damaged coins. Every coin Bugjea used was toned. Toning of the coin is a chemical reaction with the metals that cause a change in the original metal that makes it different from the original minted coin. While some consider toning acceptable, it represents a chemical change to the surface making it damaged.

How does one compare one damage to another? Do we know how these coins were damaged? Did the conditions that caused the toning of coin change the surface differently than the other? Did the damage caused by the environmental factors change? How do we know that the old ANACS holders were not sealed well enough to prevent changes in the toning from when they were originally graded?

I will not argue whether something happened to the coin that could have caused damage when it was cracked out of the original ANACS holder. Since there are so many questions about the coins, we can leave this argument off the table. I do hope Bugeja reported the serial number to ANACS so that their population reports can be appropriately adjusted.

Even if the test was to be limited because of the potential cost. A proper test would be to find six coins from the same year and the same mint that were not toned (or damaged). All six coins should be around the same grade or even a grade lower that it would be possible to pass for the higher grade. Once you have taken the variables away then you can test and determine the probability of proving or disproving the hypothesis.

Bugjea concludes that the early ANACS graders were more generous based on information that is so flawed that if that article was sent to a peer-reviewed journal it would be rejected.

He then goes on to warn, “Bid cautiously on early ANACS coins.” How about you bid cautiously on any coin you are not sure about. There are problems with coins in every holder and there are gems found with coins in every holder. Just because a coin is graded does not make it worth the plastic it is encased on.

The ONLY statement in the article I agree with is “Rely on your grading acumen rather than the age of the holder.” In fact, I would rephrase it to “Rely on your grading acumen rather than the holder.”

Translated: BUY THE COIN, NOT THE HOLDER!

- 1937-D 3-Legged Buffalo Nickel

- 1942/1 Mercury Dime

- 1955 DDO Lincoln Cent

New ANA President and Board

The American Numismatic Association announced today that Gary Adkins will be the associations 60th President. Gary will take office during the World’s Fair of Money.

The American Numismatic Association announced today that Gary Adkins will be the associations 60th President. Gary will take office during the World’s Fair of Money.

Adkins won with 62-percent of the vote.

Don Kagin, who ran unopposed, will be the next Vice President.

With seven available position for the Board of Governors and eight candidates, only Adam Crum was not elected. Crum was a newcomer to the ANA election process and was one of my choices for that reason. He needs to stay engaged and try again in the future. The ANA needs new people and new perspectives.

The election for ANA President was really the only consequential race and I am pleased with the outcome. I wish the new leadership luck and will support them in whatever way I can.

By the way, I think that at least one of the Board of Governors will reach his term limit of five terms for the next election cycle. I hope that this may convince more people to run for the Board of Governors during the next election in 2019. If not, run anyway. The ANA needs new voices and new ideas from all members of the hobby!

HAPPY INDEPENDENCE DAY

Jovita Carranza Sworn in as 44th Treasurer

Treasury Secretary Steven Mnuchin, right, administer the oath of office to Jovita Carranza, left, as the 44th Treasurer of the U.S., Monday, June 19, 2017, at the Treasury Department in Washington. Jovita Carranza’s daughter Klaudene Carranze, holds the Bible and her goddaughter Lily Hobbs stands second from right. (Carolyn Kaster/Associated Press)

Since the appointment of Georgia Neese Clark by President Harry S. Truman in 1949, there have been 16 women appointed as Treasurer of the United States. Carranza is the seventh Latina to hold the job and the fourth straight since the appointment of Rosario Marin in 2001 by President George W. Bush.

Carranza will oversee the Bureau of Engraving and Printing and U.S. Mint. Since there have been problems reported with Cabinet secretaries getting senior officials to be accepted by the head of the presidential personnel office, the current structure at the U.S. Mint will stay in place. Carranza will take an active role overseeing the mint until a director is appointed.