Who is Stuart Weitzman

Weitzman continued to design shoes with unique designs and materials not used before. He was creating one-of-a-kind designs for stars to wear on the red carpet. Top stars and models consider Stuard Weitzman shoes the must-have accessory to any designer outfit.

Weitzman collected stamps as a child. As he collected, Weitzman became fascinated with very rare stamps. Although his collection is modest in size, it consists of two rarest stamps, the only surviving British Guiana One-Cent Magenta stamp and the 1918 24-Cent Inverted Jenny Plate Block stamps. Sotheby’s will be selling both stamps in an auction on June 8, 2021.

As part of the auction announcement, Sotheby’s revealed that Weitzman was also selling the only 1933 Saint Gaudens Double Eagle gold coin that is legal to own. It is the first time the identity of the coin’s owner is publicly known.

Stuart Weitzman was the winning bidder of the Sotheby/Stack’s auction held on July 30, 2002, held at the Sotheby’s headquarters in New York City. When the hammer fell, Weitzman anonymously purchased the coin for $6.6 million plus a 15-percent buyer’s premium. Sotheby’s famously paid the $20 face value to the U.S. Mint to monetize the coin. The final sale price was $7,590,020. At the time, it was almost twice the previous record paid for a coin.

Although there are other one-of-a-kind coins, none have the same story as the 1933 Farouk-Fenton Double Eagle. It is a unique story that could only be born out of the circumstances of the Great Depression and the documented corruption at the Philadelphia Mint.

The coin and stamps will be on public view by appointment at Sotheby’s in New York until March 17 and June 5-7.

The Double Eagle and British Guiana stamp carries a pre-auction estimate of $10-15 million. The Inverted Jenny is estimated to be worth $5-7 million.

I expect the sale of the coin will break the record for the price of a single coin. The coin is likely to sell for more than $12 million, including the buyer’s premium.

Auction preview video courtesy of Sotheby’s

Native American dollars are under appreciated

Through 2008, the reverse featured a soaring eagle by U.S. Mint sculptor-engraver Thomas D. Rogers. Starting in 2009, the reverse was changed as part of the Native American $1 Coin Act (Pub.L. 100-82) signed into law by President George W. Bush. Under the law, the reverse of the one dollar coin “shall depict images celebrating the important contributions made by Indian tribes and individual Native Americans to the development of the United States and the history of the United States.”

The act also moved the E PLURIBUS UNUM and the date to the edge of the coin.

While dollar coins have not been popular and even have undergone unneccesary scorn, the images and artwork going into these coins are amongst the best produced by the U.S. Mint. In 2009, the subject was the Three Sisters of Agriculture depicting a Native American woman planting seeds in a field populated with corn, beans and squash. It shows how the Native Americans understood the concept of crop rotation long before the Europeans did. But the design by U.S. Mint sculptor-engraver Norman E. Nemeth is nothing less than fine art on a coin.

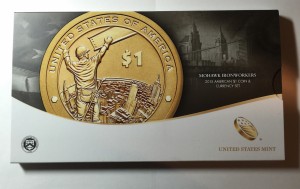

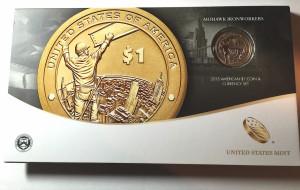

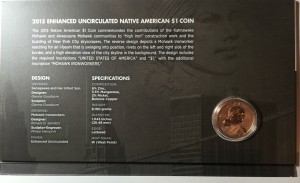

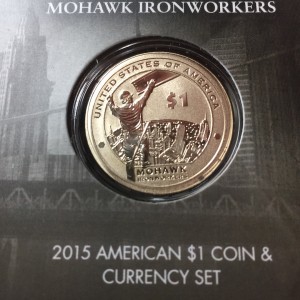

For 2015, the reverse commemorates the Kahnawake and Akwesane Mohawk ironworkers who contributed to the building of New York City skyscrapers. The deisgn by artist Ronald D. Sanders and engraved by U.S. Mint sculptor-engraver Phoebe Hemphill is nothing less than fine art touting the talents of both artists.

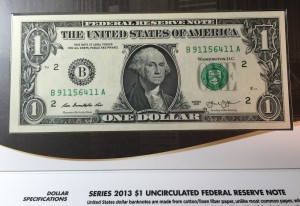

This year, the U.S. Mint issued the American $1 Coin and Currency Set containing a $1 Federal Reserve Note from the Federal Reserve Bank of New York with a serial number beginning with “911” and an Enhanced Uncirculated 2015-W Native American dollar coin with the Mohawk Ironworker’s reverse. Originally, I bought this set for the dollar note because of its tie to New York but the enhanced uncirculated dollar coin makes this a fantastic collectible.

There are some great designs that the U.S. Mint has issued as “Enhanced Uncirculated.” To add the textures to the coins, the dies are polished and enhanced with lasers and wire brushes. In my opinion, these are better than the colored coins because they are part of the design and not the printing of pictures on the coin. I will have more thoughts on the enhanced uncirculated coins at another time.

CCAC posts HELP WANTED Ad

Are you a numismatist with training, education or experience? Do you want to be part of the decisions making process in the design of new coins and medals? Can you do this with no compensation, minimal reimbursement, and make decisions with people looking and criticizing your decisions? Then do I have a job for you!

Are you a numismatist with training, education or experience? Do you want to be part of the decisions making process in the design of new coins and medals? Can you do this with no compensation, minimal reimbursement, and make decisions with people looking and criticizing your decisions? Then do I have a job for you!

The Citizens Coinage Advisory Committee is looking for a member who is specially qualified in numismatics to fill one of its 11 seats. As one of the 11 members, you will provide one of the many inputs on themes and designs for circulating and bullion coinage, commemorative coins, Congressional Gold Medals, and other medals produced by the U.S. Mint. The other inputs will be the Commission of Fine Arts and the special interest organizations that has the ear of the decision makers including whomever is running the U.S. Mint and the Secretary of the Treasury.

Appointments to the CCAC are for four-year term and are classified as Special Government Employees who are subject to conflict of interest laws and ethics regulations. At the end of the four-year term you can be re-appointed as long as your application is approved.

If you want to be considered to be part of this sausage making process, should submit a resume, along with a cover letter, detailing specific educational credentials, skills, talents, and experience. Applications may be submitted by email to info@ccac.gov, by fax to 202-756-6525, or by snail mail to: United States Mint, 801 9th Street NW, Washington, DC 20220, Attn: Greg Weinman. Submissions must be postmarked no later than Friday, October 9, 2015.

I wouldn’t swallow this pill

Weighing in at 1.25 grams, containing .900 silver (1.125 grams of silver), and measuring 10 millimeters in diameter, the coin nicknamed the Panama Pill is smaller than the silver three-cent piece, which was 14 millimeters in diameter, and the small gold dollar (Type 1) that was produced from 1849 through 1886. The gold dollar weighed 1.67 grams and was 15 millimeters in diameter.

Although there are smaller coins, such as the 9.09 millimeter Maximillian coin struck by the Mexico City Mint, this is the smallest ever produced by the U.S. Mint.

After Panama gained its independence in 1904, the new government made the decision to convert its monetary systems from the Columbian peso the balboa. Named in honor of the Spanish explorer Vasco Nunez de Balboa, the balboa would be subdivided into 100 centesimos to use for commerce. But Panama faced a similar problem that the United States faced over 100 years earlier. Since commerce was based on the Spanish Milled Dollar, which was 8 Reales, it was common for the coinage to be divided by 8 rather than 10. Simply, if something cost 1 Reale, referred to as 1 bit for when the milled dollar was physically cut for smaller denominations, a direct conversion would mean that an equivalent to the bit would be 12½ centesimos.

The United States solved this problem by striking the half-cent coin. Panama opted to strike a 2½ centesimos coin that would be paired with the 5, 10, 25, and 50 centesimos coins, all produced by the U.S. Mint. Rather than continually produce these coins until the bureaucracy caught up with commerce as was the case in the United States, Panama ordered 400,000 of these coins. The Panamanian people adapted to the new currency system, making this a one-year type coin.

During our monthly coin club meeting some members bring coins and boxes of foreign coins for other members to pick though. I went to the table where a member brought a box of loose foreign coins and someone found the Panama Pill in the box. Having never seen one before, when the searcher passed on the coin, I took the opportunity to purchase it.

Just for fun, I searched for the next smallest coin in the box. This found a 1963 Sweden 10 ore coin. It is 50-percent larger than the Panama Pill at 15 millimeters but is only slightly heavier at 1.4 grams. The difference is that the Pill was made of silver and the 10 ore is copper-nickel.Having time to search a box of foreign coins can be a lot of fun. Things you read about in history books, read in the newspapers years ago, and nice designs can be found on many foreign coins. Even though the Eurozone uses a common currency with a country specific reverse, there is nothing like some of the coins that the individual countries produced before creating a common currency.

In that light, our top story of the night, Generalissimo Francisco Franco is still dead.

Good night and have a pleasant tomorrow.

Summary of August 2015 coin-related legislation

Usually, I open the month with a report on the coin-related legislation from last month. In August, congress went on their summer vacation and did not work on any legislation. There are many who think that given the way congress has done little to nothing over the last few years, this may have been a good thing. When congress returns after Labor Day, there is work on their schedules. While I expect the same level of non-work as before their vacation, there are the issues that have a high probability of being worked on.

Usually, I open the month with a report on the coin-related legislation from last month. In August, congress went on their summer vacation and did not work on any legislation. There are many who think that given the way congress has done little to nothing over the last few years, this may have been a good thing. When congress returns after Labor Day, there is work on their schedules. While I expect the same level of non-work as before their vacation, there are the issues that have a high probability of being worked on.

H.R. 2722: Breast Cancer Awareness Commemorative Coin Act

- 2018 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 400,000 silver $1 coins with $10 surcharge

- 750,000 clad half-dollars with $5 surcharge

- Surcharge paid to Breast Cancer Research Foundation for the purpose of furthering breast cancer research

Track this bill at https://www.govtrack.us/congress/bills/114/hr2722

Aside that this would be a swan-song for an a long-serving representative that is retiring, even after the argument about who should receive the money the concept is popular in congress. It is likely to pass the Senate either as a formality or under a suspension of the rules with only a voice vote taken. If there are any votes against this bill, it will be from the senators who have said that they are against using commemorative coins as a fundraising mechanism (see H.R. 3097).

H.R. 1698: Bullion and Collectible Coin Production Efficiency and Cost Savings Act

Track this bill at https://www.govtrack.us/congress/bills/114/hr1698

Back in February, I wrote that congress was being lazy and that as members and their staffs were writing commemorative coin acts, they were copying from old legislation. While this makes it easy for them to deal with, the U.S. Mint has asked that this be changed to save money. Time and again, congress has been told that the U.S. Mint could save money if they standardized gold coins to 24-karat coins and silver to at least .999 fine quality. Aside from making the coins more attractive to more buyers including investors, the U.S. Mint does not have to pay more for someone to “dirty” the metals to create planchets that contain 90-percent of the metals.

This bill should be easy for congress to deal with. It does not spend any taxpayer money and has the ability to add money to the General Treasury. Since H.R. 1698 has passed the House under suspension of the rule (voice vote), it should not have problems in the Senate.

An issue that is likely to be raised that has been a part of a lot of bills is the elimination of the paper $1 note. This came up again when Sen. John McCain (R-AZ) was unequivocal about seeing the $1 note retired in favor of a coin. McCain has supported this type of legislation in the past but his going out of the way to emphasize this as an issue makes it interesting. As one of the oldest members of congress, his opinion is a minority of those of his generation. Surveys have shown there is a clear generational divide as to who supports this measure. When, the Baby Boomers (those born before 1964) and those older are overwhelmingly not in favor of eliminating the the paper note. The GenXers, those born 1965-1980, are almost evenly divided while the Millenials, those born since 1980, do not care because they are mostly tied to their credit and debit cards.

For the longest time, the Massachusetts delegation have held these types of bills back. This is because the Dalton, Massachusetts based Crane & Co., the maker of currency paper, has been the exclusive currency paper supplier to the Bureau of Engraving and Printing since 1879. Although Elizabeth Warren (D-MA) has become a more powerful figure in the Senate, she does not have the gravitas of a previous holder of that seat, the late Sen. Ted Kennedy (D). Additionally, with John Kerry now the Secretary of State and other changes in the House, like the retiring of Barney Frank (D-MA), the Massachusetts delegation does not have the same power as it once had. The only power the Senators have would be to filibuster any measure that would eliminate the $1 note. Whether they will do this remains to be seen.

Making cents of the metals market

Watching the price of gold has been interesting. Since the release of the 2014 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin when the price of gold was set based on the $1,290.50 spot price, the trend of gold prices has been to go lower. Gold spot hit a low almost one year to the day of the release of the Kennedy gold coin on August 5, 2015 at $1,085.10. It has taken three weeks to bounce back a little.

I call silver the precious metal for the masses. Aside from being less expensive it is still considered a valuable commodity. Aside from the aesthetics of the color (I love the look of chrome on cars) you can really see a great design on a larger silver coin than a gold coin for a lower cost. For example, I like the look of the larger Silver Panda over the yellow gold Panda—and it is cheaper!

While my interest is more of aesthetics and the costs between purchasing the different types of coins, you can get into a situation where the composition determines the price of a coin. After all, the most expensive coin to sell at auction was a 1794 Flowing Hair silver dollar with a rare die variety. For a non-precious metal coin, you can always look at the 1913 Liberty Head Nickels whose composition is 75-percent copper and 25-percent nickel. Sales of these coins have averaged around $3-5 million in the last few auctions.

Rare and key date coins notwithstanding, more people can afford silver than gold. As a result, we have seen a rise in the collecting of silver non-circulated legal tender (NCLT) coins. Although I am not a fan of many of these designs, the various mints creating them would stop if there was not a market for them. Since this is what people are buying, the mints are striking.

To some degree, the price of silver may be inconsequential to the cost of some of these NCLT sets. Coins like the Looney Tunes and DC Comics sets from the Royal Canadian Mint; Star Wars, Disney, and Dr. Who sets from the New Zealand Mint are priced to include royalties that will have to be paid to their respective copyright holders.

- Royal Canadian Mint’s $100 Looney Tunes 14-karat Reverse

- Could this Looney Tunes Silver Kilo coin be on your list?

Then there are the countries of Somalia, Niue, Tuvalu, and the Marshall Islands that do have their own mints but license their names or contract other mints to strike coins for them. Even though these coins may not require licensing fees, many are made with popular themes to entice collectors to purchase them. Seigniorage then goes to both the mint striking the coins and the general treasuries of country whose name is on the coin.

- 2007 Somalia Motorcycle Coins

- 2010 Somalia Sports Cars

Most mints will float the price of their bullion coins to reflect market forces but not the price of NCLT coins. Even the U.S. Mint does not adjust the price of commemorative coins if the price of the metals drops.

While there are collectors that view their collection in terms of its value and others collecting as an investment of those of us who collect for the sake of collecting, the dropping of metals prices can be seen as an opportunity to buy some nice collectibles cheaper than otherwise. However, never underestimate the greed of some of these mints and the companies that sign agreements with them that will keep your prices high.

I wonder how these coins will fare on the aftermarket in the future?

- Charts courtesy of Kitco.

- Looney Tunes coin images courtesy of the Royal Canadian Mint.

- Somalia motorcycle and sports car coins from author’s personal collection.