2024 Commemorative Coin Programs are Set

The Greatest Generation Commemorative Coin Act (H.R. 1057) was introduced last year by Rep. Marcy Kaptur (D-OH) to create a 2024 commemorative coin to raise money to care for the World War II memorial in Washington, D.C.

The commemorative program will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits to 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the Friends of the National World War II Memorial will receive $9.5 million for maintenance and educational purposes.

H.R. 1057: Greatest Generation Commemorative Coin Act

Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) was introduced last year by Rep. Gregory Meeks (D-NY) to create a commemorative coin program to raise money to support museums remembering the legacy of Harriet Tubman.

The commemorative program will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits tp\o 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, will receive $9.5 million ($4.625 million each) for maintenance and educational purposes.

H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

These are the only two numismatic-related bills passed by the 117th Congress.

Early Registration for the WFM Ends Today!

Are you going to the World’s Fair of Money this year?

Are you going to the World’s Fair of Money this year?

If you are, early registration ends TODAY, July 15, 2022.

If you register early, the ANA will mail your registration information so that you do not have to wait in long queues to register at the show. You can also purchase the convention medal, convention bar for those who collect the bars from each WFM they attend, and holders for those starting a new collection.

With life turning back towards normal, this show should have more opportunities to learn, see, and buy than last year. Although I did not attend last year’s WFM, the fact that the number of bourse tables available has returned to previous levels suggests that it has a making of an exciting experience.

There continues to be a problem with COVID, but not to the levels of the past. Some will be wearing masks, including me. Please be respectful of the mask wearers, and we can show that the numismatic community cares about each other and is supportive and friendly to everyone.

Are you going to the World's Fair of Money

Total Voters: 17

DO NOT BUY COINS FROM A FACEBOOK AD!

DO NOT BUY COINS FROM A FACEBOOK AD!

DO NOT BUY COINS FROM A FACEBOOK AD!

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China who advertised on Facebook.

Nearly every email I receive starts with the writer seeing an ad on Facebook and bought the coins advertised. The coins are always advertised below melt value and up to 75-percent off the published market guides.

A few weeks ago, the Anti-Counterfeiting Educational Foundation (ACEFonline.org) said they are helping an “investor” who bought counterfeit coins based on an ad he saw on Facebook. The investor paid $499 for what he thought would be 50 American Silver Eagles and $499 for an American Gold Eagle.

He is another scammed collector who bought coins from a Facebook ad.

Some legitimate dealers use Facebook to promote their stores. There are Facebook groups dedicated to buying and selling amongst members. These groups are self-policed and have no significant problems. However, we cannot say this about many of Facebook’s advertised content.

How to Identify Legitimate Sellers from the Scammers

Facebook provides clues on how to identify advertisers’ potential legitimacy. First, all advertised content is marked ”Sponsored.” Look below the company’s name; instead of the date, the post is ’Sponsored.’ If it is just a timeline post that the writer stuffed with keywords to game the system and get you to notice the content, it is likely not legitimate.

Look for the check next to the company’s name for Facebook’s verification. A company that has submitted to Facebook’s process for verification is likely safe. For example, the advertisement below for Moden Coin Mart shows a verified company with sponsored content. Modern Coin Mart is a good company with fair prices and will sell a quality product and should not be dismissed because they advertise on Facebook.

The following is an advertisement from BullionMax. BullionMax has not submitted its company information to Facebook’s verification process and does not show the blue check. But they are a company selling bullion. However, BullionMax is a company in that grey area between having a reputation that could pass a verification process and selling products at a premium price using advertising bordering on deceptive.

For a sanity check, I will search for the dealers in the Professional Numismatic Guild (png.memberclicks.net/find-a-png-dealer) and the Accredited Precious Metals Dealers (apmddealers.org/apmd-dealers) databases of members. If the dealer is not in either of those directories, I will avoid purchasing from them based on an online advertisement. Modern Coin Mart has employees that are PNG Members, and BullionMax does not.

For the record, I am not affiliated with Modern Coin Mart except as a satisfied customer.

Then you find ads that use the images of shiny coins to get you to click on their site. Sites like this pretend to be search engines but lead you to scam sites, and they get a kickback from the scammers for every click they generate.

If you see these ads or any other, click on the three-dot menu at the top of the post and select “Report ad” from the pulldown menu. It will send a message to a human at Facebook to inform them that the ad is attempting to scam people.

Caveat emptor.

Weekly World Numismatic News for July 10, 2022

This past week, I had an email conversation with a reader and collector from the United Kingdom that started with a conversation about the Women on Quarters and Innovative Dollar programs. In one of the emails, I was asked why the dollar coin was not generating interest.

This past week, I had an email conversation with a reader and collector from the United Kingdom that started with a conversation about the Women on Quarters and Innovative Dollar programs. In one of the emails, I was asked why the dollar coin was not generating interest.

The simple answer is that the dollar coin does not circulate.

My correspondent asked why the United States strikes a circulating coin that does not circulate? My response, “because it is the law, ” did not satisfy my correspondent because the U.S. also prints a paper dollar. Why do both?

Good question. Why does the United States do both?

There are several reasons, but the main driver is politics. For many years, Ted Kennedy, the powerful senator from Massachusetts, protected the interest of Crane and Company, the manufacturer of U.S. currency paper. On the other side, politicians interested in manipulating people against the government convinced them taking the paper dollar away would weigh them down.

In response, my friend from across the pond said it did not make sense while pointing out that many countries successfully dropped paper for coinage.

The arguments become a religious war whenever the paper versus coin discussion surfaces. I had no answers as to why. Some day, we may resolve this debate, but it is not going to happen today.

And now the news…

→ Read more at venturejolt.com

→ Read more at venturejolt.com

→ Read more at collectspace.com

→ Read more at collectspace.com

Independence Day 2022

The decision to go to war to confirm independence was not something the English colonies in the New World took likely. After many years of trying to convince King George III, and over the objection of Benjamin Franklin, Thomas Jefferson began to author what was effectively a declaration of war.

The decision to go to war to confirm independence was not something the English colonies in the New World took likely. After many years of trying to convince King George III, and over the objection of Benjamin Franklin, Thomas Jefferson began to author what was effectively a declaration of war.

To convince Franklin and other skeptics to support the fight for independence, Jefferson presented the preamble of what would become the beginning of the Declaration of Independence to the Continental Congress. It passed on May 15, 1776.

As a result, the Continental Congress appointed a “Committee of Five” to draft a declaration. Committee members were John Adams of Massachusetts, Benjamin Franklin of Pennsylvania, Thomas Jefferson of Virginia, Robert R. Livingston of New York, and Roger Sherman of Connecticut. They completed the draft on June 28, 1776.

The Continental Congress debated the draft on July 1-2, 1776. New York and South Carolina were still holdouts, and the two Deleware representatives were deadlocked. This led to the historical ride of Caesar Rodney, who rode 80 miles to Philadelphia to vote in favor of independence.

The Continental Congress debated the draft on July 1-2, 1776. New York and South Carolina were still holdouts, and the two Deleware representatives were deadlocked. This led to the historical ride of Caesar Rodney, who rode 80 miles to Philadelphia to vote in favor of independence.

After Thomas Jefferson made the final agreed upon corrections to the document, the Continental Congress approved the draft on July 4, 1776, with 12 votes. Only New York abstained since they did not have the authority of their government.

The final signatures were added on August 2, 1776. Since New York approved the resolution of independence on July 10, the New York delegation is included among the signatures.

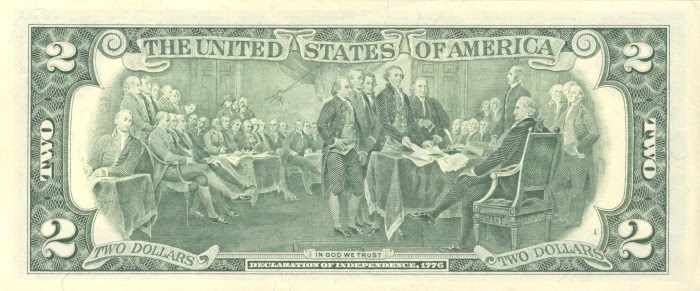

Reverse of the Series 1976 $2 Federal Reserve Note features an engraved modified reproduction of the painting The Declaration of Independence by John Trumbull.

Although we celebrated the nation’s birth in 1776, the new country was not recognized until 1783, when the two nations signed the Treaty of Paris.

Weekly World Numismatic News for July 3, 2022

As I returned from two weeks off, I noticed that the Anti-Counterfeiting Educational Foundation (ACEF) warned about Chinese counterfeits using the example of a gentleman in Texas who was scammed by buying counterfeits.

According to the report, “Oliver” paid $1,000 for counterfeit coins. As part of the order, Oliver paid $499 for an American Gold Eagle that the U.S. Mint sold for $1,950. He paid $499 for 50 alleged American Silver Eagles that would have been worth $40 each and received fakes.

If Oliver had done a little due diligence, he would not have been scammed out of $1,000. Sure, he will work with his credit card company to recover his money, but that may be $1,000 that the credit card company has to absorb. The credit card company will try to recover the money from the scammer, but the process will cost money.

Remember, credit card companies do not absorb these losses. They will raise service charges and interest rates to compensate for the losses. Oliver might be made whole, but we will all pay for his lapse of judgment.

Before you purchase these alleged “good deals,” please remember my rules:

- NO LEGITIMATE DEALER IS SELLING BULLION COINS FOR BELOW THE SPOT PRICE!

- IF THE DEAL IS TOO GOOD TO BE TRUE, IT LIKELY IS NOT A GOOD DEAL!

- IF THE DEALER DOES NOT IDENTIFY THEMSELVES ON THEIR WEBSITE, THEY ARE LIKELY HIDING SOMETHING!

Check the “About” or “Contact” page. If there is no address, then they are hiding. If the address is in China or the Middle East, they will sell you counterfeit merchandise. If there is an address, go to Google Maps and see what is really at the address. - IF THERE ARE ANY QUESTIONS, THEN DO NOT PURCHASE THE COINS!

There is no harm in asking for help. Talk to a dealer. If you do not know a dealer, reach out to an expert affiliated with the Accredited Precious Metals Dealer program (www.APMDdealers.org) or the Professional Numismatists Guild (www.PNGdealers.org). Or ask me! Using my background as a (now retired) information security specialist, I can tell you if I think a scammer created the website.

Please! Please! Please! Do not give these scammers your credit card information. You will be ripped off, and they will likely steal your credit card information, leading to other problems.

And now the news…

→ Read more at therecord.com

→ Read more at therecord.com

→ Read more at bbc.com

→ Read more at bbc.com

→ Read more at afterdawn.com

→ Read more at afterdawn.com