Basketball Hall of Fame Commem Unveiled

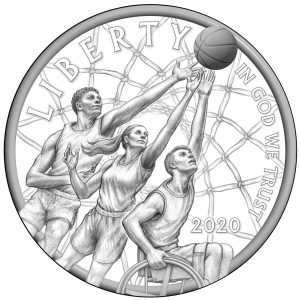

During a ceremony at the Naismith Memorial Basketball Hall of Fame in Springfield, Massachusetts on September 6, the U.S. Mint unveiled the design for the 2020 Hall of Fame commemorative coin.

The obverse of the coin, designed by Artistic Infusion Program artist Pheobe Hemphill, has an image looking down into the net from the rim. Superimposed on above the rim are three players: a man, woman, and wheelchair player, reaching for a ball.

The design is something that represents the Basketball Hall of Fame. As opposed to Halls of Fame from other sports, the Basketball Hall of Fame honors the best basketball players from any arena, not just from the professional leagues.

The reverse of the curved coin, designed by Artistic Infusion Program artist Justin Kunz, the image of a basketball as it is about to drop into the basket. While using the image of a ball is similar to what the U.S. Mint used for the 2014 Baseball Hall of Fame Commemorative Coin, this one is a little different. For this commemorative coin, the ball does not take up the entire side, leaving a distinct rim around the ball. Also, the ball will be on the concave side of the coin.

Line drawings of coin designs do not provide the perspective of the final product, making it difficult to judge. The design unveiled in Springfield appears to have a lot of potentials. Let’s hope that the final product can be just as nice.

Although U.S. Mint Director David Ryder once mentioned something about selective coloring on this coin, there has been no formal announcement from the U.S. Mint.

A video of the ceremony is available on the NBA’s website.

UGS Sues for Respect

When a company with the popularity of eBay sets an exclusive policy that says a seller cannot list a coin as certified unless it is one of a perceived top-tier grading service, it was only a matter of time before they would be sued.

It is being reported that eBay, the American Numismatic Association, the Professional Numismatics Guild, and the company of ANA President Barry Stuppler are being sued in the Eastern District of New York alleging anti-competive conduct.

The primary defendant is a company called Universal Grading Service of New Jersey. Others have ownership association with the company.

The case was filed in late August with a conference scheduled to be heard in January. The suit claims that a conspiracy exists between the defendants against small grading companies. According to the complaint, the plaintiffs are saying that eBay’s listing policy “limits the flow of goods in commerce.”

It is expected that the plaintiff will ask for class-action status.

One of the first questions would be whether New York is the proper jurisdiction for this suit. None of the organizations or officers are located in New York. Filing in New York may have been a strategic move since the court is known to be business friendly with a bias to opening markets. But without clear jurisdiction, it can be speculated that this case will be dismissed on those grounds.

Another issue is whether a non-government entity has the legal right to restrict how their site is used. Although I am not an attorney, I seem to recall similar cases where the commercial entity can restrict access to their services.

Interestingly, while UGS chooses to fight in court, Dominion Grading Service, which was formed out of the ashes of PCI, has chosen to let the market decide. DGS wants to earn respect rather than suing for it. That may be a better way to go.

A New Take on Coin Jewelry

I was visiting the site for the New York Public Library looking to see what government records they have that would show information about my family when I decided to click the link for the The Library Shop. I wanted to find out what souvenirs could be found in a library gift shop, other than bookmarks.

It was surprising to find a section for Jewelry. While visiting the site, I clicked on the section for rings and paged through the section to find very interesting coin rings. Rather than the smooth, flat rings, like I wrote about in the past, you can see the design inside and out. It is almost as if the ring was folded over and formed.

It was surprising to find a section for Jewelry. While visiting the site, I clicked on the section for rings and paged through the section to find very interesting coin rings. Rather than the smooth, flat rings, like I wrote about in the past, you can see the design inside and out. It is almost as if the ring was folded over and formed.

Coin rings are custom made and can be made from a Walking Liberty Half Dollar, New York State Quarter, Mercury Dime, and Morgan Dollar. The listing says that the coins require 1-2 weeks and can be made in sizes of up size 12 for the dime and quarter, size 14 for the half and dollar coins.

I may buy myself an early holiday present!

Image courtesy of The Library Shop at the New York Public Library

Confusion With Investing in Coins

There have been reports of the coin market continues to grow as the economy is falling. One measure is the PCGS3000 index that is based on a sample of 3,000 coins. Looking at the graph (see the right side of the page), the trend (blue) line continues upward. In fact, there is no downward place on the line. A trend graph would give an indication that the market is very hot and trending upward. But is that the case for the entire market?

The PCGS3000 is supposed to be a representative sample of the coin market. But like the Dow Jones Industrial Average, it is not a complete view of the market since there are other segments that have reacted differently. One area that is more sensitive to the movement of the market is the Generic Gold Index (right). This index looks at what many consider common date gold and gold bullion coins where the coins are worth their metal value plus a nominal numismatic premium. The graph shows a volatility that can be traced to the market value of gold.

The PCGS3000 is supposed to be a representative sample of the coin market. But like the Dow Jones Industrial Average, it is not a complete view of the market since there are other segments that have reacted differently. One area that is more sensitive to the movement of the market is the Generic Gold Index (right). This index looks at what many consider common date gold and gold bullion coins where the coins are worth their metal value plus a nominal numismatic premium. The graph shows a volatility that can be traced to the market value of gold.

Gold is a volatile market. When I thought that rare and proof gold would be a better choice, I found that the Mint State Rare Gold and Proof Gold indices seem to be affected by the price of gold. While there may be individual coins that perform better than others, the market itself seems to belie the trend of the PCGS3000 index.

The idea from this article came when a friend asked me they should buy if they wanted to invest using coins. My friend heard that the US Mint was having problems producing gold coins and wanted to know what to do. Since I am a collector and not an investor, I had to do some research.

Researching market trends is not easy. Online price guides do not provide the historical data to make an analysis. Gold dealers are quick to tout the investment in gold and how great of an investment option it is. But I was suspicious. After all, if even rare coins are affected by the gold market, maybe gold is not the best of investments.

I started to click on the links for the other graphs at the PCGS site and stumbled upon the Morgan and Peace Dollar Index (right). I have heard some dealers say that this market was moving, but I thought that was wishful thinking. But the graph shows that in the last year, the trend is upward. This was very interesting until I looked at the 10 year graph for Morgan and Peace Dollars.

I started to click on the links for the other graphs at the PCGS site and stumbled upon the Morgan and Peace Dollar Index (right). I have heard some dealers say that this market was moving, but I thought that was wishful thinking. But the graph shows that in the last year, the trend is upward. This was very interesting until I looked at the 10 year graph for Morgan and Peace Dollars.

My first impression was that the graph would overlay the trends in the economy with the exception of the downward trend during the technology bubble.

I was not sure what to tell my friend. I mentioned the Morgan and Peace Dollar market as a potential investment area. I also told the story of the GSA Morgan Dollars and their worth to collectors. I suggested high grade Morgan Dollars and later date, high grade Peace Dollars. I even discussed finding various die varieties that gets some collectors excited.

Although I was having fun clicking through vamworld.com, my friend was looking for something to invest in to either preserve a investment or to make money. I finally relented and suggested reading Profitable Coin Collecting by David Ganz. It seems to be the type of book that investors may find interesting.

While it is nice to see my collection is worth more than I purchased it, I am not collecting Morgan or Peace dollars because they are or will be worth more than when I purchased them.

Graphs courtesy of PCGS.

Should the US Mint Be Privatized

A weeks ago, an article appeared on the numismaster.com site, and subsequently in the October 6, 2008 edition of Numismatic News. The article, Get Government Out of Coin Manufacture said:

Coin dealers and collectors are still reeling from the U.S. Mint’s announcement that it had run out of American Eagle gold coins. But what ought to surprise every American isn’t that a government agency came up short. It’s that the U.S. government should be making little metal discs at all.

Today, a counterpoint was posted. In Hamilton was Right in Creating U.S. Mint, the author concludes:

The U.S. Mint is the world’s largest manufacturer of coinage. They are subject to market conditions that have to be managed, as would any manufacturer. Maybe the manufacturer’s board of directors (Congress) and it shareholders (the taxpayers) should question how the managers are doing their jobs. Making them accountable will fix more issues than ignoring 216 years of history.

I may be biased, but the author of the second article has it right. We should hold the management of the US Mint responsible for the problems they have experienced. If you have a difference of opinion from either of the authors, feel free to leave a comment here.

Canada’s One Cent Problem

Apparently, the United States is not the only country with a cost problem of its lowest denomination coin. In Canada, the press obtained notes from meetings with the Bank of Canada under the Access to Information Act (a similar law to the US Freedom of Information Act) that shows the Canadian cent costs more than one-cent to produce.

The Canadian cent weighs 2.35 grams and is made from .940 steel, .045 copper, and .015 nickel whose costs are subject to market conditions as any other item made from metals. As the economy changes, not only do the costs of materials change, but the costs of doing business changes. While the Royal Canadian Mint has said that the cent costs .008 to produce, reports based on the newly released documents show that the claim is based on the cost of metals and not production costs.

Accounting for labor and transportation costs from December, 2007, when the report was written, it is estimated that the Canadian cent costs an estimated 1.5-cents to produce. Some Canadian politicians are up in arms over the costs and want to “do something” about this without considering that seignorage from other coins more than covers the cost.

It is interesting to hear that other countries are having the same problems as we are here in the United States.