Dec 31, 2013 | coin design, coins, commemorative, US Mint

For the first time ever, the U.S. Mint will be producing a coin that is not flat. The curved coin is of the 2014 National Baseball Hall of Fame Commemorative Coin.

The National Baseball Hall of Fame Commemorative Coin Act (Public Law 112-152 [PDF]) celebrates the 75th Anniversary of the National Baseball Hall of Fame in Cooperstown, New York. The three-coin commemorative program consisting of a $5 gold coin (50,000 maximum mintage), $1 silver coin (400,000 maximum), and a clad half-dollar (750,000 maximum) struck as uncirculated coins or as proofs.

The bill required an open competition for a common obverse design “emblematic of the game of baseball.” During the government shutdown this past October, the U.S. Mint posted the announcement on their website that the winning design was submitted by Cassie McFarland of San Luis Obispo, California.

McFarland told reporters that she stumbled upon the competition while researching coins for another art project. McFarland found the U.S. Mint’s call for design two days before the deadline and submitted a drawing. Her drawing was based on an old baseball glove belonging to a relative.

Cassie McFarland

U.S. Mint Sculptor-Engraver Don Everhart will do the engraving of McFarland’s winning design. Everhart created the reverse design.

Surcharges will be $35 per gold coin, $10 per silver coin, and $5 for the clad half-dollar to be paid to the National Baseball Hall of Fame for their continuing operations. If all the coins sell out, the Hall of Fame will receive $9.5 million for ongoing operations.

Given that the selection of Coin of the Year tends to favor gimmicks (to explained in a future post), it would not be surprising that this coin wins COTY when it is considered at the end of 2015.

In the mean time, it will be interesting to see this coin in hand as this is the #1 numismatic-related story as selected by the board of the Coin Collectors Blog!

Curved coin animation courtesy of the U.S. Mint.

Dec 30, 2013 | auction, coins

As a follow-up to #2 Records have been broken in the Coin Collectors Blog Top 10 countdown, the Professional Numismatists Guild published a “State of the Industry” report that included the list of 12 U.S. coins that sold for over $1 million. One was a private sale while the others were sold at auction.

As a follow-up to #2 Records have been broken in the Coin Collectors Blog Top 10 countdown, the Professional Numismatists Guild published a “State of the Industry” report that included the list of 12 U.S. coins that sold for over $1 million. One was a private sale while the others were sold at auction.

The eleven most valuable U.S. coins purchased by winning bidders at auctions in 2013 were as follows:

- 1794 Flowing Hair silver dollar, $10,016,875 (Stack’s Bowers Galleries)

- 1804 Type I silver dollar, $3,877,500 (Heritage Auctions)

- 1913 Liberty Head nickel, $3,172,500 (Heritage Auctions)

- 1880 Coiled Hair gold $4 denomination Stella, $2,574,000 (Bonhams)

- 1796 silver quarter-dollar, $1,527,500 (Heritage Auctions)

- 1792 silver half disme (early spelling of dime) $1,410,000 (Heritage Auctions)

- 1796 silver dollar, $1,175,000 (Heritage Auctions)

- 1783 Nova Constellatio Quint Type II, $1,175,000 (Heritage Auctions)

- 1852 Augustus Humbert $10 gold coin, $1,057,500 (Heritage Auctions)

- 1792 half disme, $1,145,625 (Stack’s Bowers Galleries)

- 1879 Coiled Hair gold $4 Stella, $1,041,300 (Bonhams)

The 12th U.S. rare coin that sold for more than a $1 million in 2013 was an 1894 San Francisco Mint dime that sold for over $2 million in a private sale conducted by David Lawrence Rare Coins.

A PNG survey of auction houses showed that they sold a total of $392.8 million in U.S. rare coins in public auctions in 2013. Based on the PNG survey, the sales scoreboard is as follows:

- Heritage Auctions, $236.5 million

- Spectrum Group International (Stack’s Bowers Galleries and Teletrade), $105 million

- Goldberg Coins & Collectibles, $21.1 million

- Bonhams, $13.5 million

- Legend-Morphy Rare Coins, $7.2 million

- David Lawrence Rare Coins, $5.5 million

- Scotsman, $2.8 million

- Krueger & Krueger, $1.2 million

All prices include the buyer’s premium, if any.

This survey did not include paper money or world coins. It would be interesting to see the impact of the currency and world coin market alongside the U.S. coin market.

Dec 30, 2013 | auction, coins, currency

This past year saw the high-end market get even higher with the auction of significant rarities bringing in significant prices.

1794 Flowing Hair Silver Dollar sold for a record $10,016,875 to Legend Numismatics

Legend Numismatics’ Laura Sperber took control of the bidding when she invigorated bidding that stalled at $5.5 million when she bit $8,525,000. She called it “shock and awe.” Sperber said that she knew that a $10 million coin would create a huge buzz for the industry and went on to predict that a coin would sell for $25 million before the end of the decade.

1913 Walton Specimen Liberty Head Nickel sold for $3,172,500 on April 25, 2013 to Jeff Garrett of Lexington, Kentucky and Larry Lee of Panama City, Florida.

At the 2003 World’s Fair of Money in Baltimore, a conclave of experts examined the coins for hours, debated, and determined that the coin was real. One of those involved in the marathon meeting was Jeff Garrett, the current Vice President of the American Numismatic Association.

Nearly ten years later, the coin was auctioned for the first time. Graded PR63 by PCGS, the coin sold for $3,172,500 to Jeff Garrett and his business partner Larry Lee.

Silver dollar known as “The King of Coins” has sold for more than $3.8 million.

Maybe the discovery of the 1933 Double Eagle coins may have the 1804 dollar beat, but only one version of that coin is legal to own. There are 15 known coins dated 1804 even though they were struck later. In 1834, eight dollar coins were struck with the 1804 date to include in a special set created as a gift for the King of Siam. The set was presented to the King by President Andrew Jackson during trade missions to the Middle East and Asia.

It is known as “The King of Coins.”

The coin is designated as The Mickley-Hawn-Queller Class I Original 1804 Dollar, graded PR62 by PCGS, sold for $3,877,500 to an anonymous bidder.

1796 25C MS67+ NGC. CAC. B-2, R.3. Ex: “Col.” E.H.R. Green. The finest certified 1796 quarter.

In case you were curious, according to the Bureau of Labor Statistics Inflation Calculator, $100 in 1931 has the same buying power at $1,533.35 today. Conversely, the $1.5 million sale price is equivalent to $99,618.57 in 1931.

The coin was sold as part of the November 13, 2013 “16 Selections from the Eric P. Newman Collection Part II Signature Auction” held in New York. Proceeds from the sale goes to support the Eric P. Newman Numismatic Education Society.

1891 Marcy $1,000 silver certificate (PMG VF25) sells for $2,600,000 by Stacks-Bowers in a private sale.

The note was graded VF25 by Paper Money Guaranty.

The note was sold as part of a collection of more than 85 large-size Silver Certificates that are the finest ever put together. Five notes were sold as part of this transaction. The other 80 went for sale at the 2013 World’s Fair of Money.

Can you imagine what would happen if the Langboard Hoard of 1933 Double Eagles ever make it to the auction block?

Image Credits:

- 1794 Flowing Hair Dollar and 1891 $1000 Silver Certificate images courtesy of Stack’s Bowers Galleries

- 1913 Walton Liberty Head Nickel, 1804 Dollar, and 1796 Quarter dollar images courtesy of Heritage Auctions

Dec 29, 2013 | Canada, coins, counterfeit, legislative, RCM

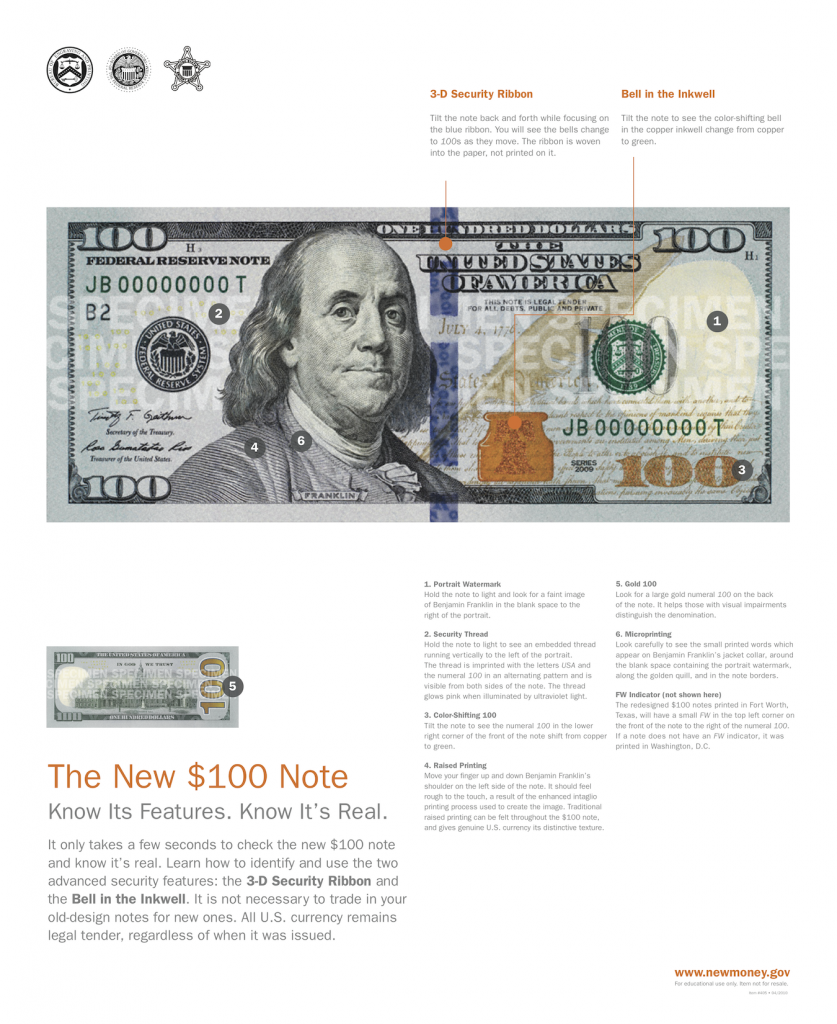

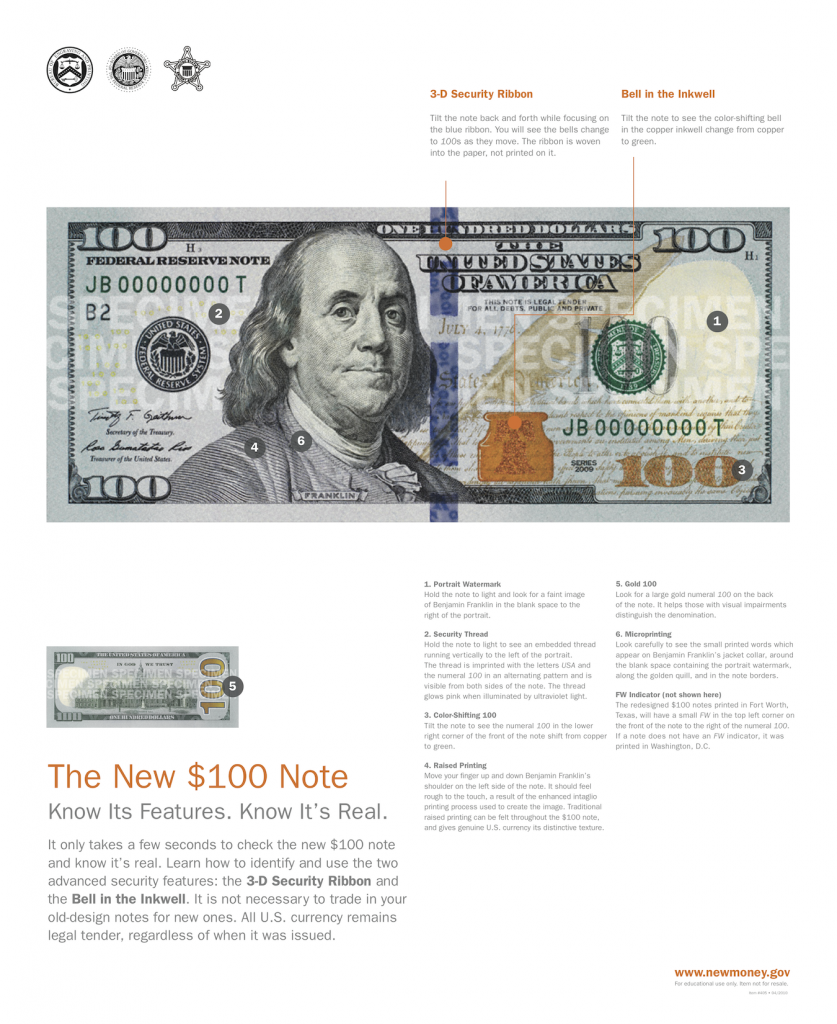

Counterfeiting coins and currency has been a problem for both the government and the numismatic industry. Government has shown it will go to extensive lengths in order to change the $100 note in order to stop currency counterfeiting. In fact, currency has had a long history of trying to fight currency counterfeiting.

For collectors of United States coins, there is a problems with the counterfeiting of classic coins primarily from China. In China, it is legal to reproduce obsolete

An example of a Morgan Dollar cut in half to match a date with a mintmark to have the coin appear something it is not. Coin was in a counterfeit PCGS slab and caught by one of their graders.

Those who create counterfeit coins are not making “tributes,” as has been the stance of the Chinese government. They are reproducing rarities and trying to pass them as real coins. In some cases, these counterfeiters are even trying reproduce the third-party grading service slabs in order to get them past scrutiny.

In the United States, Industry Council for Tangible Assets and the Gold & Silver Political Action Committee has been working to have congress update the Hobby Protection Act (15 U.S.C §§ 2101-2106) to provide for more protection to the buyer. Aside from strengthening the requirement to have copies appropriately marked and marketed, it allows for duped buyers and the government to take action against the resellers. Currently, the Hobby Protection Act only allows for action against the manufacturers and not anyone else in the supply chain. By opening the supply chain to prosecution it is hoped that it will choke off the supply.

This past August, the House of Representatives passed the Collectible Coin Protection Act on a unanimous voice vote.

PCGS representatives showed Congressmen counterfeit U.S. coins in counterfeit PCGS holders during their recent meetings in Washington, DC. (Photo courtesy of PCGS.)

Collectible coins are not the only problem. Great Britain has been having problems since the issue of new £1 coins entering circulation starting in 2010. Even though arrests have been made, there remains an undetermined amount of counterfeit coins in circulation.

Last summer, counterfeiters were arrested in Greece and Turkey for producing fake 2 Euro coins. These counterfeits look very similar to the standard 2 Euro coin with the standard Greece reverse. A real 2 Euro coin is a bi-metalic coin that does not separate. The counterfeits will separate and are lighter than the real version.

In Canada, the Royal Canadian Mint has changed the Loonie and Toonie to include micro engraving to thwart counterfeiters. The RCM has also changed the composition of the coins which will help them last longer.

Counterfeit coins and currency will continue to be a problem. Every change, no matter how small, is not only good for the economy, it is good for the hobby.

-

-

The new technology used by the Royal Canadian Mint to protect the Loonie ($)

-

-

The new technology used by the Royal Canadian Mint to protect the Toonie (C$2)

Dec 28, 2013 | ANA, Baltimore, commentary, other, shows

In a move that continues to be unexplained for reasons to be rumored to be grounded in personal issues rather than sound reason, American Numismatic Association Executive Director Jeff Shevlin was fired by the Board of Governors. Based on both public and not so public information regarding this firing, I believe that the ANA Board of Governors made a colossal mistake that proves that the Board is not up to the task of properly running the organization.

ANA Executive Director Kimberly Kiick

In a move to try to avoid controversy at the National Money Show in May, the Board rushed in to appoint longtime employee Kim Kiick as Executive Director. While her past experiences with the ANA questions as to whether the ANA made the best choice, her performance since her appointment shows that my opinion could be proven wrong. Time will tell.

Kathy McFadden, Executive Director of the Industry Council for Tangible Assets

Moving forward, Kathy McFadden was hired as Executive Director. McFadden has spent 18 years leading two different region associations of mechanical contractors with experience in legislative advocacy, public education, finances, public relations, etc. I had met McFadden for all of two-minutes at the Whitman Expo in November and look forward to working with her in my role with the Gold & Silver Political Action Committee.

David Crenshaw, Chief Operating Office of the Industry Council for Tangible Assets

Crenshaw leaves a good property for Lori Kraft who was named the Expo’s new general manager by Whitman.

The ANA’s changes were shrouded with turmoil and the ICTA changes are a celebration for an organization that is thriving. Certainly an interesting juxtaposition.

Dec 27, 2013 | coins, Eagles, gold, silver, US Mint

The collecting public has been enamored with the American Silver Eagle reverse proof. By making the fields look matte and the effigy of Adolph A. Weinman’s Walking Liberty design in a stunning mirror finish, the coin has become a favorite with collectors. Prior to this year, the U.S. Mint produced the American Silver Eagle for the 2006 20th Anniversary Silver Eagle set, 2011 25th Anniversary Silver Eagle set, and the 2012 75th Anniversary of the San Francisco Mint set.

This year, the reverse proof was included in the “2013 American Eagle West Point Two-Coin Set.” The coins were struck as the U.S. Mint branch facility in West Point, New York. The coins feature the “W” mintmark.

Included with the reverse proof coins was a coin that the U.S. Mint called “enhanced uncirculated.” While it looks like a proof coin, the enhanced portion are the selective frosting of elements. Introduced earlier this year, the new laser frosting technique allows the U.S. Mint to selectively apply the frosting texture to areas of the dies in a matter that leaves fine details of the coins. For the enhanced American Silver Eagles, the selective frosting leaves the folds of Miss Liberty’s skirt mirrored and is used to show off the flag she is holding. Weinman’s Walking Liberty image is one of the best designs every to appear on a U.S. coin. Enhancing it in this manner just makes it pop in a way Weinman could never imagine.

-

-

2013-W American Silver Eagle reverse proof

-

-

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

-

-

2013-W American Silver Eagle enhanced uncirculated coin

In a recent conversation with Acting Mint Director Richard Peterson, he said that the U.S. Mint’s most successful coin launch in recent history was the American Buffalo reverse proof coin. The coin was first offered for sale at the World’s Fair of Money this past August, the U.S. Mint did not have enough inventory in order to meet the demand.

-

-

2013-W American Buffalo gold reverse proof obverse

-

-

Reverse of the 2013-W American Buffalo gold reverse proof

-

-

1913 Buffalo Nickel Type 1 Reverse

The 24 karat gold coin that was first issued in 2006 featuring the 1913 Type 1 Buffalo Nickel, was issued to celebrate the 100th anniversary of the design by James Earle Fraser. Fraser, who had a reputation as being a finicky artist, would likely be happy to see his Type 1 Buffalo nickel design as a gold reverse proof coin. Black Diamond never looked so good!

Although it has not been announced, Peterson suggested that the Kennedy half dollar may see an enhancement. Since 2014 will be the 50th anniversary of the Kennedy Half Dollar, expect the U.S. Mint to do something for this anniversary. It would not be a surprise to see a set with reverse proof and enhanced uncirculated coins.

Using the enhanced uncirculated treatment, if a 2014-S coin paid tribute to the Bicentennial reverse, can you imagine how good that would look?

Dec 26, 2013 | Canada, currency, Federal Reserve

With the fanfare of a hard cough, the Federal Reserve released new new $100 Federal Reserve Notes on Tuesday, October 8, 2013 in the middle of the government shutdown. The launch is three years in the making following of folding problems during production at the Bureau of Engraving and Printing.

With the fanfare of a hard cough, the Federal Reserve released new new $100 Federal Reserve Notes on Tuesday, October 8, 2013 in the middle of the government shutdown. The launch is three years in the making following of folding problems during production at the Bureau of Engraving and Printing.

Earlier on 2013, a Freedom of Information request forced the government to release information as to the problems the BEP was experiencing. The BEP released images along with the report (OIG-12-038 [PDF]) from the Treasury Office of the Inspector General heavily criticizing the BEP for mismanaging the delay. The published response from the BEP was to apologize promising to do better.

As the U.S. Secret Service, Bureau of Engraving and Printing, and Federal Reserve scramble to deal with paper currency, some countries are abandoning cotton rag bond paper for polymer notes.

The polymer “paper” was developed by the Reserve Bank of Australia to enhance the durability of the notes and to incorporate security features not possible with paper or rag-based paper. RBA has been distributing polymer notes since 1992. While the polymer substrate costs little more and the production is only marginally more expensive, the benefit will come from the reduction in counterfeiting and the durability of the note. Polymer will last three-to-six times longer than rag-based paper.

Canada’s $5 Polymer banknote was issued on Nov 7, 2013

The Bank of England announced that they were going to transition to polymer currency notes. The research performed by the Bank of England can be used as a basis for the Federal Reserve to begin its own study.

Although polymer notes may be a better idea, the BEP’s long time ties to Crane & Co. along with politics from Massachusetts will prevent the United States from considering polymer as a viable option. Ironically, there is an indication that the prices of the paper may not be as low as possible. After many yeas of Crand & Co. saying that they are heavy recyclers of cotton, specifically cotton from old denim jeans, we learned that Crane has been sourcing cotton from “beyond the waste stream.” In other words, no more blue jean recycling.

Crane claims the problem is skinny jeans—the pants that many of us should not be wearing! In order to make the clothes tight but comfortable, manufacturers are adding spandex to the fabric so they appear tighter. Spandex and other synthetic fibers cannot be used to make currency because it degrades the strength of the paper. The process to remove the spandex or other “contaminants” is too expensive to be viable.

The United States has tried to use non-paper for currency in the past. In the 1980s, the American Banknote Company worked to Dupont to use its Tyvek polyethylene fiber sheets for currency. Tyvek has had a lot of uses including liners used around insulation during construction and envelopes. It is a strong material that can last much longer than paper. After a number of problems, use of Tyvek was discontinued.

As with the dollar coin, the long memory of the Tyvek failure is a significant detractor to the possibility of just researching the possible move. To paraphrase Thomas Edison, we did not fail in producing currency with plastic, we learned ways of how not to do it! It appears to be unlikely that the United States will be producing polymer notes any time soon.

Last week I went to my local bank asking if they could order the new $100 note from the Federal Reserve. Following two currency deliveries I was told that the notes were not available in the supply chain that supplies my bank in the Maryland suburbs of Washington, DC. Another order was placed with the hopes that they will be available before the end of this year.

Information from the Bureau of Engraving and Printing as to how to use the new note’s security features to ensure it is not a counterfeit.

Image of new $100 note and counterfeit detection info courtesy of the Bureau of Engraving and Printing.

Image of the Canadian $5 polymer note courtesy of the Bank of Canada.

Dec 25, 2013 | base metals, cents, coins, commentary, dollar, Federal Reserve, gold, history, Morgan, Peace, silver, US Mint

Two discussions that transcended numismatics is what to do about the one dollar coin and common one-cent coin. Both coins cause different problems depending on who is doing the arguing. I find it amazing that the logic that is used to support the argument is not used consistently.

Dollar coins have been around since the beginning of the republic. In fact, the coin that currently holds the record for being the most expensive coin sold at auction is a 1794 Flowing Hair dollar. The coin is reported to be amongst the first dollar coins minted at the newly created Mint was bought by Legend Numismatics for more than $10 million. Laura Sperber, one of the principals of Legend Numismatics, was quoted as saying that she was prepared to bid higher for the coin.

If that is not enough to show how important the dollar coin has been in our history, there is always the 1804 Bust dollar, also known as “The King of Coins.” The U.S. Mint ceased to strike dollar coins in 1804 because of hoarding when the price of silver rose. The dollars that were struck in 1804 were struck using dies dated 1803 and are indistinguishable from the coins struck in 1803. The U.S. Mint continued to strike “minor coinage” to encourage circulation.

In 1834, eight dollar coins were struck with the 1804 date to include in a special set created as a gift for the King of Siam (the area known today as Thailand). One coin was included in the set, one was retained by the U.S. Mint for its collection that is now part of the National Numismatic Collection at the Smithsonian National Museum of American History, and the six others were kept as souvenirs by Mint officials and eventually landed in private collections. Between 1858 and 1860 seven more specimens were surreptitiously by U.S. Mint employee Theodore Eckfelt. It is alleged that Eckfelt created 15 coins. Six are in private collection, one is now part of the National Numismatic Collection and the others were reported to be destroyed when seized by the government.

The Coinage Act of 1873, known as “The Crime of ’73,” ended the free coining of silver and put the United States strictly on the gold standard until the western states where silver was being mined became upset. Two weeks later, congress passed the Bland-Allison Act to required the Department of the Treasury to buy the excess silver and use it to strike the Morgan Dollar. Morgan dollars, especially those struck at the branch mint in Carson City, Nevada are popular with collectors because of their ties to the days of the old west. Collectors can find quite a few nice examples of Morgan and the Peace dollars that were struck from 1921 through 1938 because many did not circulate. These coins were held as backing to silver certificates in circulation and did not get released to the general public until the GSA Hoard sales that begin in the 1960s.

Such a colorful history also has a downside that is used as fodder against the dollar. After ending the production of the Peace dollar in 1938, no dollars were struck until 1964 when the U.S. Mint struck 316,076 1964-D Peace dollars in May 1965. The coins were never put into circulation and the entire population of 1964-D Peace dollar were allegedly destroyed. There have been reports that some Peace dollars were struck using base metals (copper-nickel clad) as experimental pieces in 1970 in anticipation of the approval of the Eisenhower dollar. The same reports also presume these coins have been destroyed.

The Eisenhower dollar was not well received because of its size. The 38mm coin was seen as too big for modern commerce and with the exception of dollars struck with the special bicentennial reverse in 1975 and 1976, most coins did not circulate.

The Susan B. Anthony dollar coin was introduced in 1979 with much fanfare for being the first coin to honor a woman. The coin was a failure because it was confused with a quarter

Since the introduction of the Sacagawea dollar in 2000, the dollar coin’s size has remained the same but with the addition of manganese has a golden color to be visually different from other coins. For the visually impaired, the reeding was removed from the edges. Today, the Presidential $1 coins and the Native American $1 Coins have edge lettering that keeps it tactically different from the quarter dollar. However, people continue to bring up the Susan B. Anthony dollar as a reason not to use dollar coins.

Historically, dollar coins has been more popular in the western regions of the United States where the east prefers paper. Financial centers and big city government prefers paper for its alleged ease of handling. When circulated side-by-side, the public tends to choose paper over coin.

When we look around the world for examples of how to handle this situation, we find that the United States is the only country where the unit currency is available in both paper and coin. Other countries did not give people a choice. Rather, their governments made a decision based on overall economic benefits of using a coin with a predicted 30-year lifespan over paper currency that can last 18-24 months in circulation. Instead of the argument being of practical economics where every other country and the European Union have put on their proverbial long pants and made a decision that is in their best economic interest, factions in the United States comes up with mind boggling arguments of alleging that taking the paper dollar away is akin to taking away our freedom.

Obverse of the 2013-S Lincoln proof cent. Lincoln’s portrait, designed by Victor D. Brenner in 1909, is the longest running design of any United States coin.

The United States has a history of using its currency to boost the economic status of its citizens, aside from the various silver laws and the laws that eventually took the United States off the gold and silver standards, the creation of the half-cent was made because of the economic status of its citizens. Following Alexander Hamilton’s Treasury Secretrary’s report to congress “On the Establishment of a Mint,” Secretary of State Thomas Jefferson had another idea. Jefferson thought it would be better to tie subsidiary coins tied to the actual usage of the 8 reales coin. At the time, rather than worry about subsidiary coinage, people would cut the coin into pieces. A milled dollar cut in half was a half-dollar. That half-dollar cut in half was a quarter-dollar and the quarter-dollar cut in half was called a bit.

The bit was the basic unit of commerce since prices were based on the bit. Of course this was not a perfect solution. It was difficult to cut the quarter-dollars in half with great consistency which created problems when the bit was too small, called a short bit. Sometimes, short bits were supplemented with English pennies that were allowed to circulate in the colonies.

As an aside, this is where the nickname “two bits” for a quarter came from.

Jefferson felt that in order to convert the people from bit economy to a decimal economy, the half-cent was necessary to have 12½ cents be used instead of a bit without causing problems during conversion from allowing foreign currency to circulate as legal tender until the new Mint can produce enough coinage for commerce.

The half-cent would come into focus in the 1850s when the cost to produce the United State’s copper coins was nearly double their face value. In 1856, the Mint produced the first of the small cents, the Flying Eagle small cent, and produced 700 samples to convince congress to change to the small cent. As part of the discussion was the elimination of foreign currency from circulation making the U.S. Mint the sole supplier of coins.

There is no record of outcry from the public on the elimination of the half-cent. Its elimination came four years after the Coinage Act of 1853 that created the one-dollar and double eagle gold coins in response to the discovery of gold in North Carolina, Georgia, and California. The gold rush caused a prosperity and inflation that not only made the half-cent irrelevant but not something on the public’s mint. In that light, the Mint and congress felt that it just outlived its usefulness and would not be necessary with the elimination of foreign currency from circulation.

More controversy was generated in 1857 over the demonetizing foreign coins in the United States than the elimination of the half-cent. While the half-cent continued to circulate, it was estimated that one-third of the coins being circulated were foreign, primarily reales from Mexico. Redemption programs did not go smoothly, but in the end foreign coins were taken out of the market and the American people adapted and it could be said we prospered as a nation.

Like the 1850s, the last seven years have found that the cost of the copper used to make the one-cent coin has increased to more than the coin’s value. Combined with the labor and manufacturing costs, it costs the U.S. Mint between 1.6 and 1.8 cents for each copper-coated zinc cent struck. Although people argue that the cent is not needed and is barely useful, the U.S. Mint reports that 65-percent of its production are for one-cent coins that are ordered by the Federal Reserve to be circulated in commerce.

Eliminating the cent has caused controversy from those concerned with the economic welfare of the less fortunate. Many are using the same arguments that Jefferson made in 1791 to create the half-cent in order to keep the one-cent coin in circulation while others point to what other countries are doing. Canada is currently the country with the largest economy to eliminate its lowest denomination coin. Proponents of eliminating the cent point to Canada’s rocky success (withdrawal of the cent had been delayed twice) as an example of how the United States can handle the situation.

Canadian 1-dollar and 2-dollar coins. The 1-dollar coin is called a Loonie because its reverse depicts a common loon. “Toonie” is a play on the Loonie nickname.

Suggesting that if the United States follows Canada’s lead in the elimination of the cent, should the United States follow Canada’s lead and eliminate the one- and two-dollar Federal Reserve Notes in favor of one- and two-dollar coins?

This debate will continue until someone decides to act like an adult and make a definitive policy decision—especially when the Fed publishes a “working paper” that cherry picks facts to support a specific viewpoint.

Image of the Susan B. Anthony dollar and Lincoln cent courtesy of the U.S. Mint.

Image of the Canadian Loonie and Toonie courtesy of

Noticias Montreal.

Dec 24, 2013 | ANA, commentary

Nearly two months into the nomination process for American Numismatic Association Board of Governors, I decided to throw my proverbial hat in the ring and run for the ANA Board of Governors. Even though I lost, it was a humbling experience and I appreciate those who supported my candidacy. I continue to believe in the issues I campaigned on and will continue to work to improve the ANA in whatever way I can.

Nearly two months into the nomination process for American Numismatic Association Board of Governors, I decided to throw my proverbial hat in the ring and run for the ANA Board of Governors. Even though I lost, it was a humbling experience and I appreciate those who supported my candidacy. I continue to believe in the issues I campaigned on and will continue to work to improve the ANA in whatever way I can.

I continue to work with the Technology Committee helping the ANA modernize its technological presence.

I have not decided whether I will try again in 2015. However, I will renew the domain names I bought (vote4scott.info and vote4scott.org) because I think they are just too cool to let go back into the wild world of domain naming.

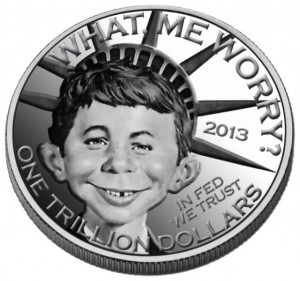

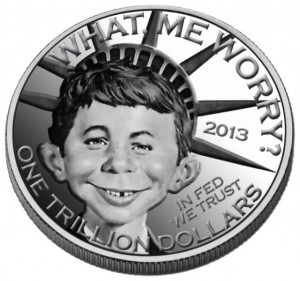

Dec 23, 2013 | celebration, coins, commentary, Federal Reserve, platinum, US Mint

If there was a countdown of the idiocy of the punditocracy of this country, the discussion over the $1 Trillion platinum coin would be the number 1 story. As I previously explained, which it is feasible for the U.S. Mint to strike a $1 Trillion coin, the question remains, “Who will buy the coin?” In order for the U.S. Mint to gain from the seigniorage that would come from minting and selling this coin.

If the coin is has to be paid for by a depositor before it can become legal tender, who will buy a $1 Trillion coin?

How could the coin be used to reduce the debt? If the coin is just deposited with the Federal Reserve, there will be a $1 Trillion liability on the government’s balance sheet. In order to make the books balance, the Department of Treasury would have to sell debt bonds to make up the difference and that would add $1 Trillion to the national debt.

If the coin is bought by the Federal Reserve, then the Fed will have to pay $1 Trillion to the U.S. Mint for the coin reducing its overall working capital by $1 Trillion. Paying for a $1 Trillion that could not be used will just transfer the debt from the general treasury to the Federal Reserve. Since the Federal Reserve is in charge of managing the country’s money supply, the net effect will be to reduce the money supply by $1 Trillion that will cause the economy to shrink—any time you artificially remove money from the economy it will shrink which will also weaken the buying power of the U.S. dollar.

Transferring the debt away from the general fund might look good on paper but the effect will shrink the economy and cause more problems than even considering the constitutionality of doing this.

The bottom line is that regardless of what the U.S. Mint sells, there has to be a buyer. If there is no buyer then all the government would do is transfer balances from one balance sheet to another without any net gain.

Dallas-based Heritage Auctions, held a mock contest on Facebook for the public to design a potential $1 trillion coin. The concept of a coin was even a joke to the folks at Heritage whose mockup included famed Mad Magazine “pitchman” Alfred E. Newman.