U.S. Mint and BEP Making American History

Earlier today, the U.S. Mint posted a video on its YouTube channel a video about the history of the 220 year history U.S. Mint and the 150 year history of the Bureau of Engraving and Printing. The video is hosted by Treasurer of the United States Rosie Rios.Here is a basic history of the United State’s money manufacturing organizations:

For reference, the official “birth date” for the U.S. Mint is April 2, 1792 when President George Washington signed the Coinage Act of 1792.

On February 25, 1863, President Abraham Lincoln signed the National Bank Act of 1863 that created a single currency standard for the United States where the notes would be backed by the United States Treasury and printed by the federal government. The result of this act lead to the establishment of the National Currency Bureau which was later rename to the Bureau of Engraving and Printing.

Keeping it Light Today

Before I begin with today’s post, to help the victims of Hurricane Sandy, I urge my readers to donate what they can to the American Red Cross. You can donate online or you can Text REDCROSS to 90999 to donate $10 to the Red Cross Disaster Relief fund. Charges will appear on your wireless bill, or be deducted from your prepaid balance.

Those of us in the D.C. metropolitan area dodged the wrath of Sandy for the most part. There are power outages, trees down, and flooding, but not to the extent north and east of here. It may take a day or two for what passes as normalcy to return to the area but we are in better shape than the coastal areas from the Delmarva Peninsula north to Connecticut and Rhode Island. I wish all of those in the effected areas well and hope their recovery goes as smoothly as possible.

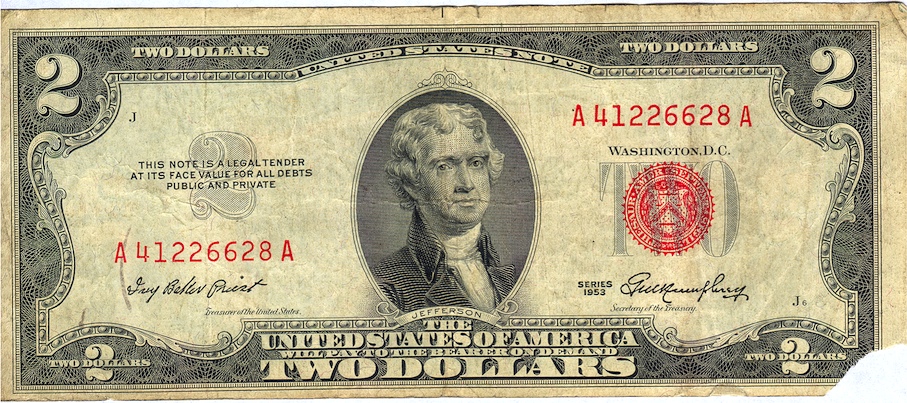

Today’s post is lighter than planned. I rather than do a 2012 version of the numismatic trick or treat as I did last year, I will show off a pocket change find was not found in pocket change and not even change, per se. At our last coin club meeting someone paid for their auction lots with this Series 1953 $2 Federal Reserve Note. Although it is not in good shape and there is a tear in the bottom corner, I decided to take it as part of payment for the lots I sold.

Priest Pictured with a hat of money when she announced her candidacy for treasurer of California (circa 1966)

Humphrey was the 55th Secretary of the Treasury serving during Eisenhower’s first term. It was reported that Humphrey gave up a $300,000 annual salary as president of the steel manufacturer M.A. Hanna Company to accept a Cabinet position that paid only $22,500. After retiring from government service, Humphrey returned to Hanna Company and later became chairman of National Steel Corporation.

Long time readers will remember that Priest was the mystery guest on the television game show “What’s my Line” that aired on August 29, 1954. If you forgot, you can go back and watch the video.

Aside from being a political leader in Utah and the 30th Treasurer of the United States, Priest is also the mother of Pat Priest who is better known for playing Marilyn Munster on the 1960’s sitcom “The Munsters.”

Pocket Change Find: Obverse of a Series 1953 $2 Federal Reserve Note signed by Treasurer Ivy Baker Priest and Secretary of the Treasury George M. Humphrey

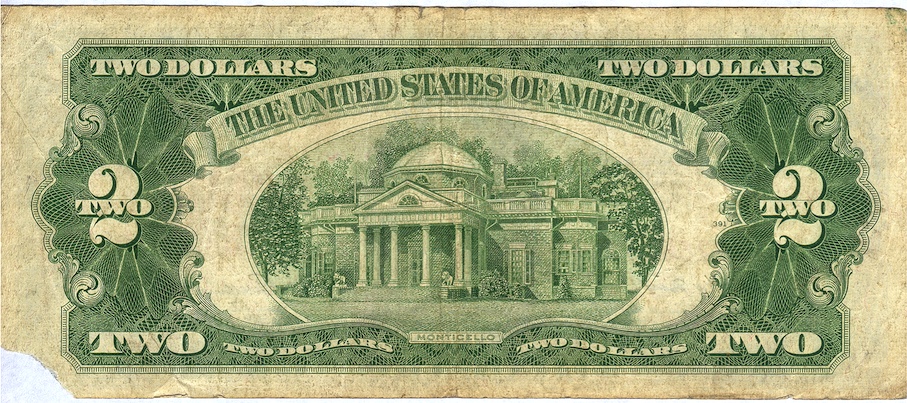

Pocket Change Find: Reverse of a Series 1953 $2 Federal Reserve Note featuring image of Jefferson’s Monticello.

Image of Ivy Baker Priest courtesy of findgrave.com.

U.S. Paper Money Still In Failed Dark Ages

Last year I asked why the United States would not consider using polymer notes after the Bank of Canada made their announcement that they will transition to using the polymer substrate. Not only are polymer notes very difficult to counterfeit, they last longer reducing printing costs and overhead to both the Bureau of Engraving and Printing and the Federal Reserve.

After it was announced that Spink of London will auction sheets of DuraNote trial printings from the Bank of Canada, BEP told CoinWorld that they printed as many as 40,000 sheets of Federal Reserve Notes using the DuraNote substrate.

DuraNote was a product of Mobil Chemical and AGRA Vadeko of Canada. Trials of DuraNote were not successful and the project was abandoned. Patents for DuraNote were sold following the Exxon-Mobil merger.

Around the same time, the Reserve Bank of Australia (RBA) developed a polymer substrate with a different formula that went into production in 1992. Since then, Australia has been successfully printing polymer notes.

In the mean time, there continues to be issues with folding of the paper specially designed for the new $100 Federal Reserve Note. Since the October 1, 2010 announcement by the Fed of the folding issue, the Fed and BEP has less than forthcoming on the status of the new note including the BEP withholding their annual report for fiscal year 2011 so they do not have to disclose how many of these notes they have in inventory.

The paper being used by the BEP is manufactured by Crane & Company who has had the exclusive contract with the BEP since 1879.

Where DuraNote failed RBA succeeded in creating a workable technology that is being adopted world wide. With the new $100 note having printing problems, why has the BEP not looked into the RBA polymer substrate for U.S. currency? Why does the Federal Reserve, BEP, and Secret Service cling to 19th and 20th century printing technologies in the 21st century? Or is this a matter of the influence being purchased [PDF] by Crane & Company in order to maintain its monopoly.

Maybe it is time for the Fed and the BEP to re-examine their commitment to paper and stop wasting time and money with failed technologies.

A Thought as the Government Ends Its Fiscal Year

Those of us here in the Washington, DC area who work with or for the Federal Government knows that this week is the home stretch to the end of the fiscal year. Many of us who work for the government are not directly involved with the political infighting that makes the national news. Federal employees are prohibited to be involved with politics by law and contractors usually have employer policies that limit their political activities.

One thing we worry about is the funding issues that have not been resolved. Although the news reported that congress has passed a continuing resolution to fund the government for six months, what the reports did not say is that the continuing funding are only at the levels negotiated last year which rolled back funding to Fiscal Year 2007 (FY07) levels. FY07 dollars do not have the same buying power as today’s dollars and the amount of work required by the laws passed by congress have increased.

You might have heard about the budget “sequestration.” Sequestration is the mechanism that was instituted as part of the Budget Control Act of 2011 to force congress to negotiate a budget or automatic, across the board cuts totaling $1.2 trillion will go into effect on January 1, 2013. Sequestration has made a lot of people in the DC area nervous because it will cause contractors to cut jobs. In fact, with the uncertainty of sequestration, large contractors, like Lockheed-Martin, are providing 90 day layoff notices they are required to give employees when defense and other security-related contracts are ended early.

For the money manufacturing operations under the Department of the Treasury, there should not be any problems from sequestration because the U.S. Mint and the Bureau of Engraving and Printing are profitable agencies that uses their profits for operations. If there are shortfalls in providing funding for operations, the Secretary of the Treasury is allowed to withdraw funds from the Public Enterprise Funds (the accounts where the profits are deposited).

Problems remain for both agencies. The most significant of the issues are the problems with printing the new $100 Federal Reserve Notes. BEP continues to report that the new notes have folding issues that have delayed their release for two years. Inquiries by numismatic industry news outlets have reported that the problems are still under investigation and that no new release date has been set.

The U.S. Mint recently reported striking problems with the First Spouse Gold Coins. Apparently, the design caused metal flow problems in trial strikes that caused delays in releasing the coins. While the U.S. Mint has said they rectified the problems, the coins have not been issued.

In addition to the coining problems, the U.S. Mint also suspended its attempt to update its technology infrastructure. After receiving the responses from a formal Request For Information (RFI), the U.S. Mint pulled back on its attempt to update its infrastructure and online ordering services to re-examine the requirements and the business processes that would be part of that contract. The U.S. Mint press office said that they had no further information other than what has been published. They did confirm that the RFI responses will not be released because they contain proprietary information that is protected from public release.

It is difficult to know whether the federal budget situation will effect the U.S. Mint and BEP or whether the attempt to reduce costs in order to ensure they do not access more money from their respective Public Enterprise Funds. This is because money in excess of budgeted operations plus a reserve must be withdrawn from these Public Enterprise Funds and deposited in to the general treasury accounts at the discretion of the Secretary of the Treasury (31 U.S.C. § 5136 for the U.S. Mint and 31 U.S.C. § 5142 for the BEP). It is reasonable to question the management of these funds in the light of the federal budget situation.

Right now, the way the BEP and the Federal Reserve has handled the situation with the new $100 note suggests there is more to that issue than meets the eye. Nether the BEP or the Fed are answering question and the BEP did not issue an annual report for 2011 which would have to report on the production of the $100 notes. Inquiries to the BEP were returned with a reply that the report “is not ready.”

The annual reports for both these bureaus will make for interesting reading, if the BEP produces one for 2012.

A Busy Friday at the WFM

Friday at the World’s Fair of Money was my shopping day. I spent a lot of time walking the bourse floor looking at the various tables thinking about my current goals.

I am working on a special set of currency that will be used for a future exhibit, so I made a beeline to a few currency dealers. I met Steve from Florida. He was formerly from northern New Jersey but moved to Florida a few years ago to get away from the rat race. I had a great time going through the currency at his table. When I explained what I was looking for, Steve was great in showing me items that would fit my theme.

All the dealers I visited were wonderful. I was even able to take a close look at a note I want but cannot afford. I love the $10 Buffalo note that was issued in 1901 (sorry, I forgot the Pick or FR number). The dealer I spoke with said that he would show it to me but I would have to give him the chance to sell me one when I was ready to buy. It was a deal I could not pass.

Now that I had some currency and some coins, I went on a trading binge. I was able to make some trades to upgrade some of the notes and pick up new ones. At one point I found a Morgan Dollar that I recognized was a significant variety in a slab that was unattributed. Even though I am far from being an expert in Morgan Dollar VAMs, I remember reading something about it during my travels. After a quick trip to the NGC table to verify what was in their unattributed slab, I found a dealer interested in VAMs and sold the coin at a nice profit.

So with that money, I was off to the Royal Canadian Mint booth to buy their Philadelphia souvenir set, a gift for my wife, and to other booths where negotiating is difficult to non-existent.

In the middle of the day, the good people at Krause Publications cut a cake celebrating their 60th Anniversary. Doing the honors was former Editor and Publish Cliff Mishler and the current Editor-in-Chief of Numismatic News Dave Harper. While I opted out of a piece of cake, I was given a special KP 60th Anniversary token and an S-Mint quarter as their special giveaway.

I did miss the announcement while shmoozing around the floor that United States Treasurer Rosie Rios was in the area between the U.S. Mint and the Bureau of Engraving and Printing booths autographing currency. Rather than keeping her head down and autographing currency, Treasurer Rios was smiling and engaging to the people getting autographs. It looked like she was genuinely enjoying meeting the people and signing their currency. I have read interviews with Treasurer Rios who said that she is humbled by the attention and enjoys meeting the people. Too bad I didn’t think about it earlier to get on line.

On Friday, I was told I forgot about the revival of the Society of Bearded (S.O.B.) Numismatists that was held on Thursday—and I would qualify as a member! I have to figure out how to join this group!

In the evening I attended the American Numismatic Association Banquet. I sat next to a very nice family and a couple from Lancaster County, Pennsylvania in town to volunteer at the show. I was also at the table with the YN Exhibit Award Winner Morgan Fatora. To say Morgan was happy would be an understatement.

Saturday is the last day. I am only staying part of the day before heading home. Continue to follow me on Twitter and the pictures on Pinterest for the short time I will be at the show.

New for Currency Collectors

Although my collection consists mostly of coins, I have been branching out into some areas of currency. Other than collecting Israeli currency, I am not sure what direction I want to go. Since 2007, the Bureau of Engraving and Printing has issued a yearly $2 Single Note Collection where each folder has a $2 note from each of the Federal Reserve branches and the serial number begins with the year, allowing for only 10,000 collectibles per Fed branch (YYYY0000-YYYY9999). This year, the Single Note is just being issued for the Federal Reserve Band of Kansas City. This is not good for someone who has only purchased the notes from the New York Fed.

This year represents the sesquicentennial of the Bureau of Engraving and Printing. Formed as a result of the National Currency Act, the Department of the Treasury opened the National Currency Bureau in a basement office of the Treasury Building on August 29, 1862 to cut and manage the fractional currency that was being printed for the government. With the passage of the National Bank Act of 1863 centralizing currency production with the federal government, the office became its own bureau with a mission to print currency and other security documents. The name was changed a few times before it was settled on the Bureau of Engraving and Printing.

The U.S. Mint and the BEP have combined to sell the Making American History Coin and Currency Set to celebrate the 150th anniversary of the BEP and 220th Anniversary of the U.S. Mint. The set will contain a 2012-S American Silver Eagle Proof coin and a Series 2009 $5 note from the Federal Reserve Bank of San Francisco with a “unique serial number” that begins with “150.”

Sales of the set will be handled by the U.S. Mint and scheduled to begin on August 7, 2012, at 12:00 Noon. Sets will cost $72.95 with no purchase or production limits announced. Considering that the serial number is eight digits long, the de facto limit will probably be 100,000 sets.

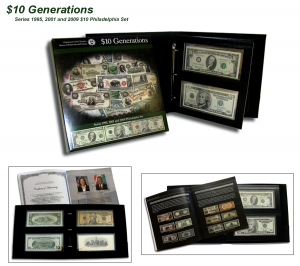

Limited edition, three-note set features Series 1995, 2001 and 2009 $10 notes, with matching low serial numbers, from the Federal Reserve Bank of Philadelphia.

BEP began printing the small-sized notes starting in 1928 with the Series 1929 notes. Since then, the basic designs had note changed until the re-design effort that began in 1996. The $1 Federal Reserve Note continues to use the design similar to that first circulated in 1929.

The set will be in a leatherette binder with the notes stored in acid-free polymer sleeve. Included in the set will be a commemorative print of Independence Hall with the Liberty Bell and “We the People” on the reverse. It will also include a booklet about the history of the $10 note since 1861.

Sales will begin on August 7, 2012. There will be a limit of 3,333 set priced at $149.95, $135 for purchasing ten or more with a 25 set purchase limit the first week.

Since August 7 is the first day of the World’s Fair of Money in Philadelphia, I wonder if the U.S. Mint and the Bureau of Engraving and Printing will have sets there for sale?

Significant Legislation Effecting Numismatics

There has been a lot of legislation passed by Congress that affects the coin and currency production in the United States. While some of it has been as mundane as changing the composition of coins or the approval of a commemorative coin, there are some that has had a significant impact on coin and currency production. Here is a list of those laws that had a major impact.

- Coinage Act of 1792

- The first coin-related law passed by congress and signed by President George Washington on April 2, 1792, establishes a mint, says that congress is the regulating authority of coins, and establishes the dollar as the unit of money. It made the United States one of the first countries to use a decimal system for currency and established legal tender laws. It is the foundation for the creation of the money production in the United States.

- Act of April 10, 1806

- This act regulates the legal tender value of foreign coins used in the United States.

- Act of April 21, 1806

- This act establishes the penalty for counterfeiting coins to be between three and five years of hard labor. Although there was no law regarding counterfeiting coins before this act, it was assumed that penalty was death because of the statements printed on colonial currency.

- Coinage Act of 1834

- This act changed the ratio of silver-to-gold weight from 15:1 that was established in the Coinage Act of 1792 to 16:1, setting the price of an ounce of gold to $20.67. This was done to strengthen the financial system after the Panic of 1833 and stem the tide of paper currency in favor of “hard money.” President Andrew Jackson signed this bill into law on June 27, 1834.

- Coinage Act of 1849

- Signed into law by President James K. Polk as one of his last acts as president on March 3, 1849, it established the use of gold for a $1 coin and the $20 gold double eagle coin. This act also refined the variances that were permissible for United States gold coinage. This act came largely because of the California Gold Rush.

- Coinage Act of 1857

- Signed into law by President Franklin Pierce February 21, 1857, this act repealed the legal tender status for foreign coins in the United States. It required the Treasury to exchange foreign coins at a market rate set by Treasury. This act discontinued the half-cent and reduced the size of the one-cent coin from 27mm (large cent) to the modern size of 19.05mm (small cent) that is still being used today.

- National Bank Act of 1863

- Originally known as the National Currency Act and signed into law by President Abraham Lincoln on February 25, 1863, it created a single currency standard for the United States where the notes would be backed by the United States Treasury and printed by the federal government. The result of this act lead to the establishment of the National Currency Bureau which was later rename to the Bureau of Engraving and Printing.

- Coinage Act of 1864

- This act changed the composition of the one-cent coin to bronze (0.95 copper, 0.05 tin and zinc) from 0.88 copper and 0.12 nickel. It authorized the minting of the two-cent coins with the motto “In God We Trust” to appear the first time on a United States coin. President Abraham Lincoln signed this act into law on April 22, 1864.

- Coinage Act of 1873

- Sometimes referred to as the “Crime of ’73,” demonetized silver and set the standard for gold as the backing of the national currency. This act placed the U.S. Mint under the jurisdiction of the Department of the Treasury and officially established four branch mints at Philadelphia, San Francisco, Carson City, and Denver. Two assay offices were established in New York and Boise City, Idaho. The act also ended the production of the half-dime, silver three-cent piece, and two-cent coin. President Ulysses S. Grant signed this act on February 12, 1873.

- Bland-Allison Act

- Named for Rep. Richard P Bland (D-MO) and Sen. William B. Allison (R-IA), the act required the Treasury Department to buy silver from western mines and put them into circulation as silver dollars. The act authorized the striking of the Morgan Dollar. President Rutherford B. Hayes vetoed the bill but congress overrode his veto on February 28, 1873.

- Sherman Silver Purchase Act

- Signed into law by President Benjamin Harrison on July 14, 1890 and named for Sen. John Sherman (R-OH), the law increased the amount of silver the government was required to purchase from western silver mines.

- Federal Reserve Act of 1913

- President Woodrow Wilson signed the Federal Reserve Act into law on December 23, 1913 that allowed the creation of the Federal Reserve System as the central bank of the United States. It also granted the Federal Reserve authority to issue Federal Reserve Notes and Federal Reserve Banknotes.

- Pittman Act

- Named for Sen. Key Pittman (D-NV) and signed into law by President Woodrow Wilson on April 23, 1918 authorized the conversion of up to 350 million silver dollars into bullion for sale or to be used to strike subsidiary coinage. The act required the government to buy all silver mined in the United States at a fixed price of $1 per ounce above market rate.

- Gold Reserve Act of 1934

- Even though Franklin D. Roosevelt as part of Executive Order 6102 ordered the withdrawal of gold from the economy on April 5, 1933, there was one challenge and one reissue of the executive order. Congress felt that the executive order needed codification and passed this act on January 30, 1934. Roosevelt signed the law the same day. The law withdrew all gold and gold certificates from circulation and outlawed most private possession of gold with the exception of some jewelry and collector coins. This act established the nominal price of gold to $35 per troy ounce.

- Public Law 84-851 (70 Stat. 732, H.J.Res. 396)

- On July 30, 1956, this law established the national motto of the United States to be “In God We Trust.” While the motto appeared on most coins of the time, the Bureau of Engraving and Printing phased it in on currency between 1957 and 1965.

- Coinage Act of 1965

- In response to the coin shortages caused by the rising silver prices, the act eliminated silver from circulating dimes, and quarters while reducing the amount of silver used to strike half-dollars from 90-percent to 40-percent for five years. After five years, the half-dollar would be struck using the same copper-nickel clad composition as the lower denominations. The act forbade the striking of silver dollars for five year ending an experiment with the striking of Peace Dollars in 1964. Finally, the act made all coins and currency produced in the United States and certain bank issues as legal tender–which reversed the 1876 demonetization of the Trade Dollar. Signed into law on July 23, 1965 by President Lyndon B. Johnson, it is seen as the dividing line between “classic” and “modern” coinage.

- Hobby Protection Act or 1973

- Signed into law by President Richard Nixon on November 29, 1973, this act requires that replica collectibles, including coins, be marked “plainly and permanently” with the word “COPY” to indicate that the item is not genuine. This act grants the Federal Trade Commission permission to take action against suppliers who violate this act.

- Statue of Liberty-Ellis Island Commemorative Coin Act—Title II: Liberty Coins

- Signed by President Ronald Reagan on July 9, 1985, Title II of this act allowed for the U.S. Mint to establish the American Eagle Silver Bullion Program.

- Gold Bullion Coin Act of 1985

- A few months after the passage of the act to allow for silver bullion coins, this act was enacted on December 17, 1985 that lead to the establishment of the American Eagle Gold Bullion Program.

- 50 States Commemorative Coin Program Act

- Considered one of the most significant act affecting circulating coinage since the Coinage Act of 1965, this act lead to the very successful 50 State Quarters Program. Section 4 of the act, named the “United States $1 Coin Act of 1997” changed the composition of the one dollar coin to be “golden in color” which lead to the creation of the Sacagawea “Golden” Dollar. President Bill Clinton signed this bill into law on December 1, 1997.

Art For Your Money

If you are not following me on Twitter or Pinterest you are missing some interesting extras that may not make it to the blog. While I can include Twitter updates on this page (see the right column), pins to Pinterest are a little more elusive unless I remember to click the box to post the pin to Twitter.

My newest pins on Pinterest came from the U.K.’s Daily Mail Online from a story about Evan Wondolowski, an artist who uses currency and coins to make portraits of politicians and celebrities. These portraits are made using shredded Federal Reserve Notes on newspaper. He make a portrait of President Obama using Lincoln Cents including 1943 Steel Cents.

Wondolowski is the Creative Director and co-owner of Mozaiks, and artist-based clothing company. His art can be see at his website The Art of E and usually depicts images of greed and politics.

Below are the images from the Daily Mail Online article. If you want to see the full images, visit Wondolowski’s online gallery.

If you are not on Pinterest and would like an invite so you join, drop me a note and if I have any invites I will send you one.

Numismatics Is More Than Coins

Although the dominant area of numismatics is the collection and study of legal tender coins, numismatics is more than just coins. Numismatic is the collecting and study of items used in the exchange for goods, resolve debts, and objects used to represent something of monetary value. This opens up numismatic collecting to a wide range of items and topics that could make “the hunt” to put together the collection as much fun as having the collection.

Exonumia

Exonumia is the study and collection of tokens, medals, or other coin-like objects that are not considered legal tender. Exonumia opens numismatics to a wide variety of topics that could not be satisfied by collecting coins alone. An example of exonumia is the collection of transportation tokens. You may be familiar with transportation tokens from your local bus or subway company who used to sell tokens to place into fare boxes. Others may have used tokens to more easily pay in the express lanes at bridges and tunnels. A person who collects transportation tokens is called a Vecturist. For more information on being a Vecturist, visit the website for the American Vecturist Association.

Token collecting can be the ultimate local numismatic collection. Aside from transportation tokens, some states and localities issued tax tokens in order to collect fractions of a cent in sales taxes to allow those trying to get by in during down economic times to stretch their money further. Some communities issued trade tokens that allowed those who used them to use them as cash at selected merchants. Some merchants issued trade tokens that were an early form of coupons that were traded as coupons are traded today.

While tokens are items used to represent monetary value, medals are used to honor, commemorate, or advertize. The U.S. Mint produces medals that honor people, presidents, and events. Medals produced by the U.S. Mint are those authorized by law as a national commemoration including the medal remembering the attacks of 9/11.

Commemorative medals are not limited to those produced by the U.S. Mint. State and local governments have also authorized the producing medals on their behalf that were produced by private mints. Many organizations also have created medals honoring members or people that have influenced the organization. Companies have produced medals to honor their place in the community or something about the company and their community.

Many medals have designs that can be more beautiful than on coins since they are not limited to governmental mandated details and their smaller production runs allows for more details to be added. Medals can be larger and thicker than coins and made in a higher relief than something that could be manufactured by a government mint.

Exonumia collecting also involves elongated and encased coins. You may have seen the machines in many areas where you pay 50-cents, give it one of your cents, turn the wheel and the cent comes out elongated with a pattern pressed into the coin. Elongated coins have been used as advertisements, calling cards, and as a souvenir.

Encased coins are coin encircled with a ring that has mostly been used as an advertisement. One side will call the coin a lucky coin or provide sage advice with the other side advertising a business. Another form of encased coins are encased stamps. Encased stamps were popular in the second half of the 19th century and used for trade during times when there were coin shortages.

Other exonumia includes badges, counter stamped coins, wooden money, credit cards, and casino tokens. Counter stamped coins are coins that have been circulated in foreign markets that were used in payment for goods. When the coin was accepted in the foreign market, the merchant would examine the coin and impress a counter stamp on the coin proclaiming the coin to be genuine based on their examination. Although coins were counter stamped in many areas of the world, it was prevalent in China where the coins were stamped with the Chinese characters representing the person who examined the coin. These Chinese symbols are commonly referred to as “chop marks.”

One type of counter stamped coins are stickered coins. Stickered coins were popular in the first half of the 20th century; they were used as an advertisement. Merchants would purchase stickers and apply them to their change so that as the coins circulated, the advertising would reach more people. Some stickered coins acted as a coupon to entice the holder to bring the coin into the shop and buy the merchandise.

Remember the saying, “Don’t take any wooden nickels?” If you are a wooden money collector, you want to find the wooden nickels and other wooden denominations. Wooden nickels found popularity in the 1930s as a currency replacement to offer money off for purchases or as advertisement. Wooden nickels are still being produced today mostly as an advertising mechanism.

We cannot end the discussion of exonumia without mentioning Love Tokens and Hobo Nickels. Love Tokens became popular in the late 19th century when someone, usually a man, would carve one side of a coin, turn it into a charm for a bracelet or necklace, and give it to his loved one. The designed are as varied as the artists who created them. Hobo Nickels are similar in that hobo artists would carve a design into a Buffalo Nickel to sell them as souvenirs. While there are contemporary Love Tokens and Hobo Nickels, collectors have an affection for the classic design that shows the emotion of the period.

Currency collecting, formally called notaphily, is the study and collection of banknotes or legally authorized paper money. Notes can be collected by topic, date or time period, country, paper type, serial number, and even replacement or Star Notes (specific to the United States). Some consider collecting checks part of notaphily. Collectors of older cancelled checks are usually interested in collecting them based on the issuing bank, time period, and the signature. For the history of currency and their collecting possibilities, see my previous article, “History of Currency and Collecting”.

Scripophily is the study and collection of stock and bond certificates. This is an interesting subset of numismatics because of the wide variety of items to collect. You can collect in the category of common stock, preferred stock, warrants, cumulative preferred stocks, bonds, zero-coupon bonds, and long term bonds. Scripophily can be collected by industry (telecom, automobile, aviation, etc.); autographs of the officers; or the type of vignettes that appear on the bonds.

Militaria: Honorable Collectibles

Collecting of military-related items may be considered part of exonumia but deserves its own mention. It is popular to collect military medals and awards given to members since the medals themselves are works of art. Families will save medals awarded to relatives and even create museum-like displays to honor or memorialize the loved one.

Militaria includes numismatic-related items that represent the various services. One of the growing areas of collectibles is Challenge Coins. A challenge coin is a small medal, usually no larger than 2-inches in diameter, with the insignia or emblem of the organization. Two-sided challenge coins may have the emblem of the service on the front and the back has the emblem of the division or other representative service. Challenge coins are traditionally given by a commander in recognition of special achievement or can be exchange as recognition for visiting an organization.

Over the last few years, civilian government agencies and non-government organizations (NGO) have started to create and issue challenge coins. Most of those agencies have ties to the military, but not all. Like their military counterparts, a manager or director can give challenge coins in recognition of special achievement or for visiting an organization.

Another area of military collectibles is Military Payment Certificates (MPC). MPC was a form of currency that was used to pay military personnel in foreign countries. MPC were first issued to troops in Europe after World War II in 1946 to provide a stable currency to help with commerce. MPC evolve from Allied Military Currency (AMC) to control the amounts of U.S. dollars circulating in the war zone and to prevent enemy forces from capturing dollars for their own gain. Prior to World War II, troops were paid in the currency of the country where they were based. With the ever moving fronts and the allies need to control the economies to defeat the Axis powers, AMC was issued to allow the military to control their value.

After the war, MPC replaced APC in order to control the currency and prevent the locals from hoarding U.S. dollars preventing the building of their own economies. When military officials discovered that too many notes were in the circulation, being hoarded, and thriving on the black market, series were demonetized and reissued to military personnel. Those holding MPC notes not in the military received nothing and were encouraged to circulate their own currency.

MPC were printed using lithography in various colors that changed for each series. From the end of World War II to the end of the Vietnam War there were 15 series printed with only 13 issued. Although the two unissued series were destroyed, some examples have been found in the collections of those involved with the MPC system. Amongst the 13 series that were issues, there are 94 recognized notes available for collectors. Most notes are very affordable and accessible to the interested collector.

Don Kagin: Our Nation’s First Circulating Currency: The Treasury Notes of the War of 1812

The Treasury Notes of the War of 1812

The fourth speaker in the Maryland State Numismatic Association (MSNA) annual Distinguished Lecturer series will be Dr. Donald Kagin, one of the country’s leading numismatists and numismatic researchers. Don was raised in a numismatic household. His father, Art Kagin, was also a respected numismatist. Numismatic education has been a top priority for both Don and his father throughout their careers.

The fourth speaker in the Maryland State Numismatic Association (MSNA) annual Distinguished Lecturer series will be Dr. Donald Kagin, one of the country’s leading numismatists and numismatic researchers. Don was raised in a numismatic household. His father, Art Kagin, was also a respected numismatist. Numismatic education has been a top priority for both Don and his father throughout their careers.

Don is widely recognized as the country’s leading authority on pioneer gold coins. He also has an exceptional numismatic education Don was awarded the first ever Bachelor of Arts degree in numismatics, this from Northwestern University, and holds the first (and only) Ph.D. in numismatics in the country which he earned at the Union Institute and University in Ohio. His Ph.D. major studies resulted in the book Private Gold Coins and Patterns of the United States, which won the Numismatic Literary Guild’s (NLG) Best Book of the Year award, and which remains the definitive reference on pioneer gold. His Ph.D. minor studies were on early American currency, and his chapter on the early notes of 1812, included in Friedberg’s authoritative study of American currency, is also still the definitive work in this area.

Don contributes to the Official Guide to United States Coins and the Coin and Currency Dealer Newsletter, which he founded. He regularly publishes articles in a number of leading periodicals including Money magazine, U.S. News and World Report, Barron’s, The Wall Street Journal, and The Numismatist. He has made several radio and television appearances. He received the American Numismatic Association’s (ANA) Heath Literary Award for several of his articles. As chairman of the American Money and Gold Rush Museum, he strongly contributed to the passage of a Congressional bill for the San Francisco Mint commemorative coins, the proceeds from which will go for the renovation of the historic old San Francisco Mint. Don served two terms on the ANA Board of Governors. He is also an expert numismatic investment advisor having written the book Donald Kagin’s Personal Guide to Rare Coin Investments, which won the NLG’s Best Investment Book of the Year award.

Don’s lecture is entitled “Our Nation’s First Circulating Currency: The Treasury Notes of the War of 1812.” It will be presented at 2:00 PM on Friday, June 29, 2012 in Room 301 of the Baltimore Convention Center during The Whitman Coin & Collectibles Expo. Don will also bring examples of the Treasury Notes from the time of the War of 1812.