Jul 7, 2013 | BEP, currency, Federal Reserve, policy

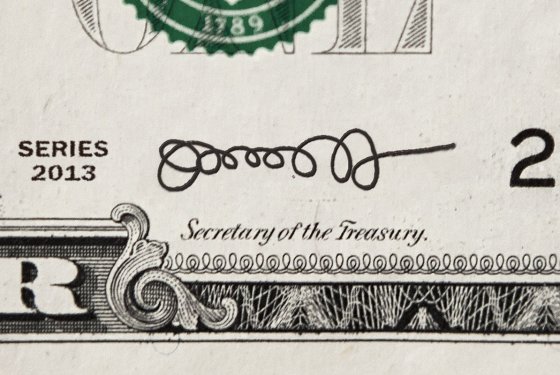

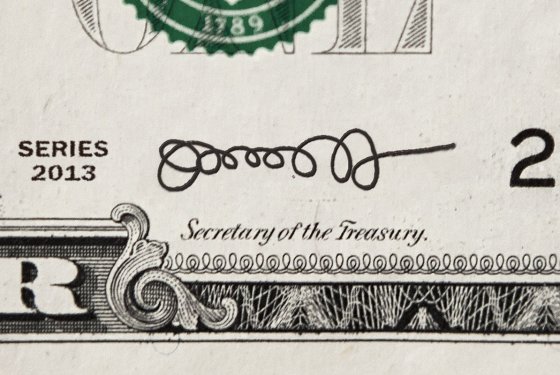

In one of those news items from while I was away, Secretary of the Treasury Jacob J. “Jack” Lew put pen to official paper and provided an autograph that will appear on United States Federal Reserve Note. Treasury reports that Lew’s signature will first appear on Series 2013 five-dollar notes that will be issued this fall. No plans were announced for other denominations.

In one of those news items from while I was away, Secretary of the Treasury Jacob J. “Jack” Lew put pen to official paper and provided an autograph that will appear on United States Federal Reserve Note. Treasury reports that Lew’s signature will first appear on Series 2013 five-dollar notes that will be issued this fall. No plans were announced for other denominations.

Lew, whose autograph has been called “lewpty” and been compared to the decorative icing on a Hostess cupcake, made a promise to the president that he would do better with his penmanship. During his confirmation hearing, Lew told Sen. Max Baucus (D-MT), Chairman of the Senate Finance Committee, that he promised the president he would do better. This did not satisfy those with an ironic sense for the different when a petition appeared on the White House website to “Save the Lewpty-Lew.”

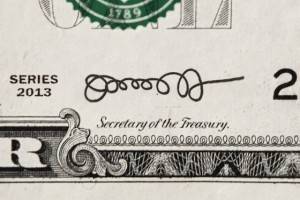

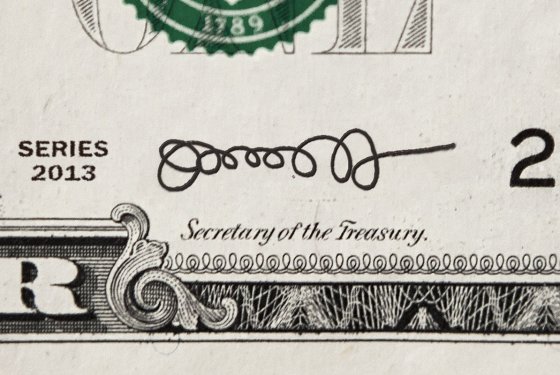

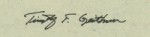

Mock-up of how Treasury Secretary Jack Lew’s autograph will appear on the Series 2013 $5 Federal Reserve Note in the Fall.

Remember as you were growing up spending time with a piece of paper practicing your signature? I wonder if Lew was doing this in his spare time?

While Lew’s autograph lost many of his infamous lewpts at least he did not go to the extreme that of predecessor, Tim Geithner. Geithner’s autograph was very readable and lacked character. At least Lew kept some of his lewpts. It will make for interesting conversations for currency collectors in the future as they examine the autographs on their collectibles.

Images courtesy of the U.S. Department of the Treasury.

May 10, 2013 | ANA, auction, coins, currency, shows

It was a rainy day in the Crescent City but that only mattered when I tried to leave my hotel to go to the convention center. Thanks to Michael Weir, the Director of First Impression at the Hilton Garden Inn, a group of three show attendees including myself, were able to get to the convention center without being rained on. Mr. Weir gave us door-to-door service dropping us off under an overhang.

Before I continue, let me give the New Orleans visitors bureau fodder by recommending the city for your next vacation. No matter when I have come here, the people of New Orleans have been accommodating, courteous, and fun. And when you are away from home, having fun is the most important part of a visit!

After stopping to speak with ICTA’s Director Elloise Ullman, I picked up a cup of coffee before walking down to Hall G. Before entering Hall G, I went upstairs to the meeting rooms where I found I missed a talk on so-called dollars because I started to schmooze outside of the hall.

My first stop this morning was to see Steve Roach, the Editor of Coin World. We had a nice conversation where we talked about everything from the upcoming American Numismatic Association Board elections to the production of Coin World Next, their weekly publication that concentrates on one topic.

After a lively conversation with Steve and Tom Mulvaney, who is best known as the instructor of the coin photography class with the ANA Summer Seminar. Tom’s work can be seen all over the numismatic industry. Some day I will be able to take the time off to go to Summer Seminar to take his class.

I wanted to tour the bourse floor but decided to finish touring the exhibits I did not finish. While in the exhibits area I ran into Hollie Weiland, counsel for the ANA. She then introduced me to Beth Papiano. This became an interesting conversation following the criticism I wrote about her. We did talk about what I wrote and why. Hopefully, I will have another opportunity to speak with Beth again and maybe I can understand more about what happened.

Lunch was a little hole-in-the-wall poboy place where I had fried oysters before returning to the convention center to try to do more looking around and meeting people. First, I had to go back to the exhibits and see what I missed. My favorite was the Travancore Chuckram Count Counting Boards. It was an exhibit of these metal boards that were used to count small coins. These are mainly form countries in southwest Asia. There were a lot more involved with this exhibit. Hopefully, I will have a chance to spend time carefully reading the text to learn more. Otherwise, I hope the exhibitor will display it again in Chicago.

At 2 o’clock it was time for the open Board meeting. After a delay because some of the governors were caught in traffic, the meeting proceeded with thunderstorms booming in the background. I do not know if that was a message, but considering the controversies of the past few weeks, there may have been something prophetic about the scene.

But the meeting started with an interesting “ritual.” ANA Past President Barry Stuppler invited his “spiritual advisor” Zar, a Voodoo Priest, to bless, spiritually cleanse, and add good luck to Kim Kiick on her appointment as executive director. Upon the end of the “ceremony,” someone in the crowd commented that this should have been done 10 years ago—referencing the problems with executive directors over the last 10 years.

I will comment about the meeting at another time, but one of the central discussions was the ANA’s web presence and the security of the technical infrastructure. I am glad to hear that the board is taking the move to expand the ANA’s technology seriously. Yes, there was skepticism and references to age-specific issues, it does not appear that the current board will hold back progress. There still needs a few more technologically aware members of the board, which is why I am running for the board.

After the meeting, it was back to the bourse floor to shake a few more hands before going to a reception for Rep. Steve Scalise (R-LA). Rep. Scalise from Lousiana’s first district and succeeded Bobby Jindal after Jindal became governor. Scalise co-sponsored newly introduced H.R. 1849, Collectible Coin Protection Act. This is the same bill that was introduced last year.

Finally, a walk down the hall to the Stacks-Bowers auction to watch the bidding on the various auction lots. Since most of the lots were out of my price range, I watched the action. The few items I could have afforded, I decided not to be a buyer. Some of those coins were hammered at a price higher than I expected. I would have dropped out before the top bids.

After being exhausted from a long day, I availed myself of the dinner service at the auction including the coffee. Meet a few people outside of the auction room came back the hotel. I did call my wife only to listen to one of my neurotic dogs bark at the thunderstorms throughout our conversation.

Tomorrow is the last day of the show and my last day on the floor. The candidate forum will be at 12 noon Central Time. I heard that the ANA arranged to have the two-hour forum broadcast on the Internet. I urge ANA members to watch the forum. If they have a way for you to ask questions, please try to do so! It is your ANA and you have to let the Board of Governors know how you feel.

I will be flying home after the candidates forum and arrive in the Washington, DC area very late. I will have a third-day update sometime on Sunday.

May 9, 2013 | ANA, coins, currency, shows

Hello from New Orleans: The Crescent City; The Big Easy; NOLA; N’awlins; the self-proclaimed America’s Most Interesting City; and home of the 2013 National Money Show.

After an early start and a change in planes in Atlanta, I made to Louis Armstrong International Airport. How could you not want to go to a place where the airport is named after the great Louis Armstrong! Oh yea!

I just checked into my hotel, freshened up a bit, and giving the phone a chance to charge so I can take pictures in the convention center. While waiting, I created a board on Pinterest where I will be posting those pictures. You can also follow me on Twitter where I will tweet and even post some images.

Of course, I will write an evening wrap-up. So keep your browser pointed here for what happens in New Orleans.

Remember, Saturday is the candidates forum for those running for the American Numismatic Association Board of Governors. I will be there along with the 15 other candidates including the president and Vice President candidates that are running unapposed.

Finally, at some point I have to make it to Café du Monde in the French Market for a café au lait. Going is a personal tradition that dates back to my first trip to New Orleans in 1980.

Time to go to the convention center!

May 7, 2013 | coins, currency, Federal Reserve, financial documents

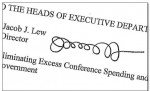

Although new currency with the autograph of Secretary of the Treasury Jacob “Jack” Lew have yet to be issued, Treasury documents signed by Lew have been seen with a new autograph.

Although new currency with the autograph of Secretary of the Treasury Jacob “Jack” Lew have yet to be issued, Treasury documents signed by Lew have been seen with a new autograph.

During his confirmation hearings, it was reported that Lew told Sen. Max Baucus (D-Montana) that he made to the president “to make at least one letter legible.” It looks like he has made more than one letter legible based on the image broadcast by MSNBC.

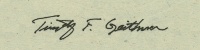

Lew is not the only Treasury Secretary to change his autograph. Timothy Geithner did the same on his appointment. When asked about his autograph, Geithner said, “Well, I think on the dollar bill I had to write something where people could read my name. That’s the rationale.”

-

-

Tim Geithner’s autograph before becoming Treasury Secretary.

-

-

Tim Geithner’s signature as it appears on U.S. currency

Not every autograph on U.S. currency could be considered legible. You can see all of the autographs on small size currency (since 1928) on this page at uspapermoney.info.

I wish Lew kept his lewpts!

A mock-up of what Jack Lew’s original signature would look like on a one-dollar note

Jack Lew autograph examples courtesy of MSNBC.

Tim Geithner autograph examples courtesy of American Public Media

Apr 24, 2013 | BEP, currency, Federal Reserve, news, video

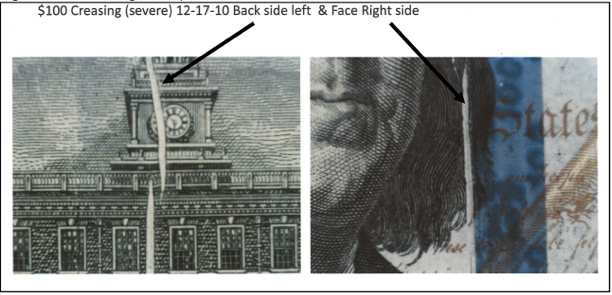

Earlier today, the Federal Reserve issued a press release announcing that the redesigned $100 Federal Reserve Note will be issued on October 8, 2013.

Earlier today, the Federal Reserve issued a press release announcing that the redesigned $100 Federal Reserve Note will be issued on October 8, 2013.

The redesign of the $100 note was announced with a press release that was to be held on April 21, 2010 at the Department of the Treasury Cash Room with all of the usual suspects: then Secretary of the Treasury Timothy Geithner, Chairman of the Board of Governors of the Federal Reserve System Ben Bernanke, Treasurer of the United States Rosie Rios, and the since retired Director of the United States Secret Service Mark Sullivan.

The date of the announcement, the Bureau of Engraving and Printing and Federal Reserve announced that Chairman of the Federal Reserve Board Ben S. Bernanke said, “When the new design $100 note is issued on February 10, 2011, the approximately 6.5 billion older design $100s already in circulation will remain legal tender.”

Throughout the summer of 2010, the BEP and Federal Reserve released a lot of training and education materials in anticipation of the release of the new notes.

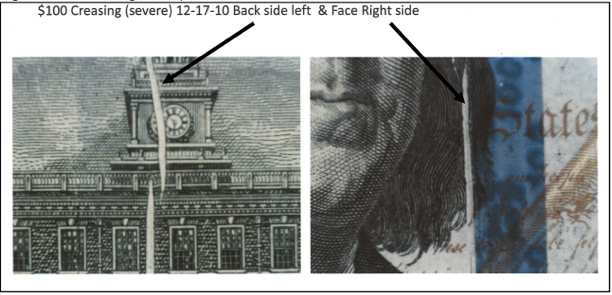

Everything seemed to be going well until October 1, 2010 when the Federal Reserve “announced a delay in the issue date of the redesigned $100 note.” The Federal Reserve and BEP said that there was a problem with creasing of the paper during the printing process. That was the last we heard from the Federal Reserve until today’s announcement.

Magnified images of the creasing showing up on the new $100 notes.

In the mean time, the Treasury Office of the Inspector General issued a report (OIG-12-038 [PDF]) that said the BEP did not handle this process properly. The report said:

We consider the delayed introduction of the NexGen $100 note to be a production failure that potentially could have been avoided and has already resulted in increased costs. We found that BEP did not (1) perform necessary and required testing to resolve technical problems before starting full production of the NexGen $100 note, (2) implement comprehensive project management for the NexGen $100 note program, and (3) adequately complete a comprehensive cost-benefit analysis for the disposition of the approximately 1.4 billion finished NexGen $100 notes already printed but not accepted by FRB. [Federal Reserve Board]

After the report noted that the BEP basic responded by saying that they were sorry and are looking into it, the OIG caved and said that even though the BEP was bad, the corrective actions “are responsive to our recommendations.”

Then nothing. No follow up by the OIG or the Government Accountability Office. In fact, we have not heard from the GAO since their 2005 report suggesting whether a second supplier of currency paper is needed (see GAO-05-368).

Of course it is easy for the BEP to say that Crane & Co., the Dalton, Massachusetts company that has been the exclusive currency paper supplier since 1879, because it would be easy to justify. Some of the arguments against finding a second supplier includes the cost of entering the market and the established relationship with Crane who the BEP allows to “own” the innovations paid with taxpayer money. There was also the case of having two of the most powerful senators, Ted Kennedy and John Kerry, there to protect Crane. Neither are the senators from Massachusetts today.

While the BEP has been struggling with rag-bond paper, countries have been moving to using polymer “paper.”. The polymer “paper” was developed by the Reserve Bank of Australia to enhance the durability of the notes and to incorporate security features not possible with paper or rag-based paper. RBA has been distributing polymer notes since 1992. While the polymer substrate costs little more and the production is only marginally more expensive, the benefit will come from the reduction in counterfeiting and the durability of the note. Polymer will last three-to-six times longer than rag-based paper.

The Bank of Canada has reissued its C$100, C$50, and C$20 notes using the polymer paper and will issue the new C$5 and C$10 notes later this year.

Switching to polymer notes, especially for higher denominations, would be a better decision. It will reduce counterfeiting and reduce the costs over the lifetime of the note. And there is no law that would prevent the Federal Reserve from using the polymer paper.

Considering the Bureau of Engraving and Printing’s previous performance with the $100 notes, this should not be consider the time to celebrate. Especially since a pre-solicitation notice asking for information about purchasing a Single Note Inspection System is still open at FedBizOpps.gov and the BEP has not issued a request for proposal (RFP) to purchase such a system. Let’s wait for the BEP to deliver the notes to the Federal Reserve for distribution before considering this a success.

While waiting, enjoy this video announcement narrated by Federal Reserve Deputy Associate Director Michael Lambert about the new release date.

Images courtesy of the Bureau of Engraving and Printing.

Video courtesy of the Federal Reserve.

Apr 2, 2013 | BEP, coins, currency, dollar, Federal Reserve, fun, US Mint

Based on some responses in my Twitter feed and via email, a number of people forgot what day it was and did not read yesterday’s post carefully.

To understand the post’s true condition, you have to consider the following:

- The Chairman of the Federal Reserve is Ben S. Bernanke. His first name is really Ben, not Benjamin.

- The law requires the Federal Reserve to distribute the one-dollar note. Only congress can vote to stop producing the note.

- The Acting Director of the U.S. Mint is Richard A. Peterson, not Pederson.

- Seignorage is deposited in the Public Enterprise Fund. No, the leaving out of the “d” in the original post was not a typo because I was having fun!

- The Director of the Bureau of Engraving and Printing is Larry Felix. I do not know a Larry Felinks. Maybe he is a long lost cousin of the director?

- The company that supplies currency paper to the BEP is “Crane and Company.” The Sandhill Crane Company does not exist, but there is a bird called the sandhill crane. There is also a blue crane, but I am reasonably sure that there is no such person as Violet “Blue” Crane; or at least there is not one associated with Crane and Company. Maybe there is a Blue Crane working for Sandhill Crane? There is a joke in there that can use “Whooping Crane” which I will leave as an exercise to the reader!

- Finally, when was the last time you heard the Fed Chairman concerned with coin collectors? The last line was added to emphasize the date.

In other words:

Besides, who is giving a blogger an exclusive story that does not appear elsewhere? Like the Orson Well’s broadcast of The War of the Worlds, all you had to do is change the channel (or check another source).

That was fun!

Now back to our regular numismatic content.

Feb 27, 2013 | coins, currency, fun, policy

The 75th Secretary of the Treasury Jacob “Jack” Lew

The White House release a statement from the president following the confirmation of his former Chief of Staff saying “here is no one more qualified for this position than Jack.”

Aside from being in charge of the department that includes the U.S. Mint and the Bureau of Engraving and Printing, currency collectors now get to look forward to the addition of Lew’s “Lewpty” autograph on United States currency. When Lew was nominated to succeed Tim Geithner, it was joked that Lew’s autograph resembled a series of loops or the icing decoration on the Hostess Cupcake. There was even a petition on the White House website to “Save the Lewpty-Lew” autograph on U.S. currency (the petition ended and can no longer be found on the White House’s website).

Given the realities of the Treasury and our current economics, we wish Jack Lew well in his new position. We also hope he does not follow through on the promise he told Sen. Max Baucus (D-Montana) he made to the president “to make at least one letter legible.”

Please Mr. Secretary, Save the Lewpty Lew!

A mock-up of what Jack Lew’s signature would look like on a one-dollar note

Credits

- Picture of Jack Lew courtesy of Wikipedia.

- Dollar Bill mock-up with Lew’s Loops courtesy of New York Magazine.

Jan 20, 2013 | Baltimore, cents, coins, currency

Although I am a proponent of the virtual world and want to see numismatics expand virtually, there is something to be said about going to a local coin show. You know the type, one that is held in a large meeting room at a local hotel where 40-50 tables are setup attended by local dealers and people in the area. Sometimes, it could be more interesting than a larger show.

Earlier today, I had the pleasure of going to the Baltimore Area Numismatic Coalition (BANC) Show at a hotel in Timonium, Maryland. BANC is coalition of the Baltimore Coin Club, Catonsville Coin Club, and the Maryland Token & Medal Society who works together to put on a local quarterly show to bring together people in the Baltimore area and numismatists that may be visiting.

My visit to the BANC Show came about because the Maryland State Numismatic Association (MSNA) held a Board of Directors meeting after the show closed. Since I am Vice President of MSNA, I drove from the metro Washington region to northwest Baltimore a little early to do a little early shopping before the meeting.

Smaller shows do not attract the type of crowd that you will see in a larger venue, like a convention center. Fewer people go to these local shows making it a more relaxed atmosphere. You also see many of the local dealers, the men and (some) women who you want to get to know better because these are the people who can really help you put together your collection. And since the crowds are more relaxed, there is time to talk with those dealers and even catch up with pther collectors you may know.

Another advantage of being at a local show is to be able to talk with people who just come to the show because they have an interest. At this show, I was introduced to a woman who initially had a question about purchasing coins directly from the U.S. Mint at their facilities in the District of Columbia. What then happened is that you get an enthusiastic collector (me) and someone who wants to talk about collecting together and it turned into a wonderful conversation.

While I forgot to ask her name, I did give her the address to this blog. If you are the woman I spoke with, I hope you enjoyed our conversation as much as I did and hope it inspired you to expand your collecting pursuits. Also, we spoke about my write up about negotiating for coins. It was part of my two-part series “How Are Coins Priced.” You can read Part I first then Part II where the section on negotiating is included.

How can I go to a coin show without buying something?! Today, I kept with my New York collectibles and found a Bureau of Engraving and Printing folder with a Series 2003 $2 Single Star Note from the Federal Reserve Bank of New York. For those not familiar with the concept of Star Notes, the best short description is from the Bureau of Engraving and Printing:

When an imperfect note is detected during the manufacturing process after the serial number has been overprinted, it must be replaced with a new note. A “star” note is used to replace the imperfect note. Reusing that exact serial number to replace the imperfect note is costly and time consuming. The “star” note has its own special serial number followed by a star in place of a suffix letter. The serial number of the imperfect note that was removed is not used again in the same numbering sequence.

The other purchase was an 1830 Matron Head large cent that looks like it was dipped a long time ago and has re-toned. Although I prefer original surfaces, it is a good looking coin for its age and condition. Since I am passively working on a large cent year set (no varieties), it will fill a hole in that book. Too bad the dealer did not have other large cents to fill the holes since the price was right. But other coins were either too vigorously cleaned or had some corrosion.

-

-

Folder for the Series 2003 $2 Single Star Note from the Federal Reserve Bank of New York

-

-

Series 2003 $2 Star Note from the Federal Reserve Bank of New York. Rosario Marin/John Snow signatures.

-

-

1830 Matron Head Large Cent

-

-

1830 Matron Head Large Cent reverse

If you want to find a local show, you can find one at the calendar at NumisMaster.com or the Events page at CoinWorld.com. Go forth and enjoy a local show!

Jan 12, 2013 | currency, fun

With the announced retirement of Secretary of the Treasury Timothy F. Geithner, President Barack Obama nominated his Jacob Joseph “Jack” Lew, his current Chief of Staff, to be the next Secretary.

Tim Geithner’s signature as it appears on U.S. currency

Should Lew be confirmed by the Senate, which is very likely, he will provide his signature to the engravers at the BEP so that it would replace Geithner’s. Based on past practices, the new Lew-Rios notes would become Series 2009A.

The Lewpty Signature of Jacob “Jack” Lew

This is not Jack Lew’s signature on a Hostess Cupcake

After hearing how Geithner changed his signature when providing the BEP with currency samples, there are some that want Lew not to change his autograph and have the “Lewpty Lew” appear on United States currency. Between now and February 8, 2013, there is a petition on the White House website to Save the Lewpty-Lew and have Jack Lew’s autograph loops appear on U.S. currency.

If you would like for Jack Lew to add his loops to U.S. currency and not try to make it legible, you can weigh in and sign the petition on the White House website!

A mock-up of what Jack Lew’s signature would look like on a one-dollar note

Credits

- Image of Tim Geithner’s signature on currency courtesy of Wikipedia.

- Jack Lew’s signature courtesy of Slate.

- Hostess Cupcake image courtesy of Wikipedia.

- Dollar Bill mock-up with Lew’s Loops courtesy of New York Magazine.

Dec 27, 2012 | base metals, BEP, bicentennial, bullion, coins, commemorative, copper, currency, dollar, Euro, Federal Reserve, First Spouse, gold, halves, legislative, nclt, news, nickels, policy, silver, US Mint

We end numismatic 2012 almost the same way as we began, discussing what to do about the one-dollar coins. The over production lead to a quite a number of bills introduced in congress to try to fix the perceived problem but none ever made it to a hearing, let alone out of a hearing. Rather, the U.S. Mint hired Current Technologies Corp. (CTC) to perform an alternative metals study required by congress.

When the U.S. Mint finally published the report and a summary they made a recommendation to study the problems further because they could not find suitable alternatives to the current alloys used. While reading the summary gives the impression that the request is reasonable, the full 400-page report describes the extensive testing and analysis that the U.S. Mint and CTC performed leaving the reader curious as to why they were unable to come to some sort of conclusion—except that there is no “perfect” solution. This is a story that will continue into 2013 and be on the agenda for the 113th congress when it is seated on January 3, 2013.

The other part of the discussion is whether or not to end the production of the one-dollar Federal Reserve Note. It was the last hearing before the House Financial Services subcommittee on Domestic Monetary Policy and Technology for Rep. Ron Paul (R-TX) and the 112th congress that will certainly carry over into 2013.

This does not mean the Bureau of Engraving and Printing is without its controversy. In order to comply with the court order as part of American Council for the Blind v. Paulson (No. 07-5063; D.C. Cir. May 20, 2008 [PDF]) and the subsequent injunction (No. 02-0864 (JR); D.C. Cir. October 3, 2008 [PDF]), the BEP has been working to provide “Meaningful Access” to United States currency.

Secretary of the Treasury Timothy F. Geithner approved the methods that will be used to assist the blind and visually impaired to U.S. currency on May 31, 2011. In addition to examining tactile features, high contrast printing, and currency readers, the BEP issued a Request for Information for additional information to implement their plan. The BEP will be participating at stakeholder organization meetings to socialize and refine their plans. There will probably be few announcements before the conventions of the National Federation of the Blind and American Council of the Blind this summer.

Another building controversy from the BEP is whether the redesigned $100 notes will find its way into circulation. Introduced in April 2010, full production has been delayed because of folding during the printing process. The situation has to be so severe that the BEP has not announced a new release date and delayed releasing the 2011 CFO Report [PDF] to the end of Fiscal Year 2012 while finding a way to bury the scope and costs of the delays. Will the redesigned $100 Federal Reserve Note be issued in 2013? Stay tuned!

Staying with currency issues, there should be a new series of notes when a new Secretary of the Treasury is appointed. It is known that the current Secretary Timothy F. Geithner wants to pursue other options. If the BEP follows its past practice, notes with the new Secretary of the Treasury’s signature would be Series 2009A notes. There have been no reports as to whether Treasurer Rosie Rios will continue in her position.

As for other products, the BEP will continue to issue specially packaged notes using serial numbers that are either lucky numbers (i.e., “777”) or ones that begin with “2013” as part of their premium products. Of course they will continue to issue their sets of uncut currency.

Another carry over from 2012 will be whether the U.S. Mint will issue palladium coins that were authorized by the American Eagle Palladium Bullion Coin Act of 2010 (Public Law No: 111-303 [Text] [PDF]). The law requires that the U.S. Mint study of the viability of issuing palladium bullion coins under the Act. That report was due to congress on December 14, 2012 but has not been made public at this time.

Bibiana Boerio was nominated to be the Director of the U.S. Mint.

Other than the higher prices for silver products, the U.S. Mint should not generate controversies for its 2013 coin offerings. There will be no changes for the cent, nickel, dime, and half dollar with the half dollar only being struck for collectors since it has not been needed for circulation since 2002. These coins will be seen in uncirculated and proof sets with silver versions for the silver sets.

For the sets with the changing designs, the reverse of the 2013 America the Beautiful Quarters Program will honor:

There has been no confirmation from the U.S. Mint whether they will strike San Francisco “S” Mint quarters for the collector community as they did in 2012.

The 2013 Presidential $1 Coins ends the 19th century and begins the 20th century with some of the more interesting Presidents of the United States in history:

If we honor the Presidents we have to honor their spouses. In 2013, the First Spouse Gold Coins will honor:

- Ida McKinley

- Edith Roosevelt

- Helen Taft

- Ellen Wilson (died 1914)

- Edith Wilson (married Woodrow Wilson 1915)

The U.S. Mint has not released designs for these coins at the time of this writing.

2013 Native American Dollar Reverse Design

Congress has authorized two commemorative coin programs for 2013:

American Eagle coin programs will continue with the bullion, collector uncirculated, and proof coins for both the silver and gold. The American Eagle Platinum bullion coin will continue to use its regular reverse while the American Eagle Platinum Proof will continue with the Preamble Series. The Preamble Series is a six year program to commemorate the core concepts of the American democracy as outline in the preamble of the U.S. constitution. For 2013, the reverse will be emblematic of the principle “To Promote the General Welfare.” The U.S. Mint has not issued a design at this time.

Currently, there are no announced special products or sets using American Eagle coins and no announced plan for special strikings such as reverse proofs or “S” mint marks.

Finally, we cannot forget the American Buffalo 24-Karat Gold Coins that will be available as an uncirculated coin for the bullion/investor market and a proof coin for collectors.

And I bet you thought that 2013 would be a mundane numismatic year!

In one of those news items from while I was away, Secretary of the Treasury Jacob J. “Jack” Lew put pen to official paper and provided an autograph that will appear on United States Federal Reserve Note. Treasury reports that Lew’s signature will first appear on Series 2013 five-dollar notes that will be issued this fall. No plans were announced for other denominations.

In one of those news items from while I was away, Secretary of the Treasury Jacob J. “Jack” Lew put pen to official paper and provided an autograph that will appear on United States Federal Reserve Note. Treasury reports that Lew’s signature will first appear on Series 2013 five-dollar notes that will be issued this fall. No plans were announced for other denominations.