Apr 27, 2020 | gold, investment, markets, news, silver

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

While investors are turning to gold as the equity markets are less than stable, reports that bullion and bullion-related warrants are outselling all coin offerings. Even though the West Point Mint briefly paused coin production, the markets have not felt the impact.

Silver prices are faring as well as gold. The area that silver is gaining strength is in the industrial markets. Driving the price is the demand for electronics. The primary use of silver is in the braising that ensures the connections between the chips are secure and with the production of LEDs.

Industrial silver is in more demand than industrial gold. As Asian electronics production begins to ramp up, some investors feel that there may be a temporary shortage of silver. One analyst suggested that silver prices could climb to $18 per ounce. Silver is currently $15.26 per troy ounce.

On the other hand, the reports of economic contraction have suggested that bullion prices will collapse. If this is the case, then there will be more to worry about than the market price of bullion.

And now the news…

April 22, 2020

People have been collecting coins for about as long as coins have been made. That’s a passion that has endured for centuries, since roughly 600 to 800 BC. Coin collecting is a worthwhile hobby and can sometimes be a financially savvy investment.

→ Read more at

washtimesherald.com

April 23, 2020

Gold coin demand makes up a small part of total demand, and thus doesn’t have much impact on the gold price. Demand for gold coins must be seen as a retail sentiment indicator.

→ Read more at

seekingalpha.com

April 25, 2020

Copper is well documented for its impressive antibacterial properties. Even Ancient Egyptians used bronze filings (an alloy of copper and tin) from their freshly sharpened swords to treat their wounds.

→ Read more at

iflscience.com

April 25, 2020

What's True The reverse of a U.S. quarter issued in 2020 honoring the National Park of American Samoa features a pair of fruit bats.

→ Read more at

snopes.com

Apr 19, 2020 | dollar, news

Glenna Goodacre, the designer of the Sacagawea Dollar and world-renown sculptor, died at her home in Santa Fe, New Mexico of natural causes. She was 80 years old.

Amongst her better-known works include the Vietnam Women’s Memorial on the National Mall in Washington, DC. Goodacre also created the 8-foot standing portrait of President Ronald W. Reagan at the Reagan Library in Simi Valley, California.

The unveiling of the Sacagawea Dollar design at the White House with (L-R) irst Lady Hillary Clinton, Sacagawea Model Randy’L He-dow Teton, and Designer Glenna Goodacre.

Numismatists know Goodacre for the design of the Sacagawea Dollar. Since there are no images of Sacagawea, the Shoshone guide of the Lewis and Clark expedition, Goodacre found Randy’L He-Dow Teton, a member of the Shoshone-Cree tribe, to be her model. The resulting profile of Sacagawea in three-quarter view and her infant son, Jean Baptiste Charbonneau, carried on her back has been produced for 20 years.

In 2018, Goodacre donated several plaster and bronze casts of the coin that was used to test the design and show the relief of the coin. There is also a plaster cast with an alternate version without her baby on her back.

As Dennis Tucker wrote in her memory, “The numismatic community joins Glenna Goodacre’s family, friends, and many fans in mourning her loss and celebrating her art.”

And now the news…

April 14, 2020

SANTA FE, N.M. (AP) — Renowned sculptor and painter Glenna Goodacre, who created the Vietnam Women’s Memorial on the National Mall in Washington, D.C, has died. She was 80.

→ Read more at

huffpost.com

April 14, 2020

She discovered the rare 22-carat, 16th century Henry VII Fine Gold Angel coin A single mum struck gold when she unearthed a 500-year-old coin worth £2,500 in her back garden. Amanda Johnston, 48, was bored at home in the appropriately named Portsmouth suburb of Moneyfields when she grabbed her son George's metal detector and set to work looking for treasure.

→ Read more at

dailymail.co.uk

April 15, 2020

(Bloomberg) — The clamor for retail investors to get hold of precious-metals coins is about to get more urgent.

→ Read more at

finance.yahoo.com

April 16, 2020

(Kitco News) – Bullion investors shouldn’t expect to see a drop in premiums anytime soon as the supply crunch for gold and silver coins continues to grow, according to Peter Hug, global trading director for Kitco Metals.

→ Read more at

kitco.com

April 16, 2020

Gold saw its price soar over 1.5% notching its highest increase in more than seven years earlier this week, as investors moved towards the precious metal’s traditional safe-haven focus on fears of an extended recession and gloomy corporate earnings.

→ Read more at

irishexaminer.com

April 18, 2020

Jeb Robinson is on the hunt for the SS Benmacdhui A diver aged 84 and his old team – the youngest in his 70s – are kitting up to find treasure on the bed of the North Sea. Jeb Robinson will show there’s life in the old seadog yet as he searches the SS Benmacdhui.

→ Read more at

mirror.co.uk

Apr 5, 2020 | bullion, gold, markets, news, silver

I know it is difficult to turn away from the news. It is like watching an automobile accident in slow motion. Every day it seems like there is something else. Unfortunately, this is true about the precious metals market.

Europe, which appears to be taking the closings and stay-at-home orders better than the United States, is trying to figure out what will happen to the economy after everything reopens. That is wreaking havoc with the market.

In one story, Germany is beginning to buy gold in preparation for future spending while institutions in Italy are selling gold to stay afloat. While African mines continue to bring metals to the market, investors are buying gold as a hedge for an uncertain future.

In the last 30-days, the price of gold has bounced back almost to pre-market shaking announcements about COVID-19 in the United States. Other metals have not been as active. According to a source, the only thing keeping the price of silver somewhat stable is its industrial use.

Coins and other collectibles that are sensitive to the precious metals market will begin to see a disparity in prices. Common gold coins whose price is tied to the metals market will rise. Silver coins will likely not move on the metals market.

During a conversation with a professional metals trader, I asked what is next for the market. A person who usually has an answer said that he did not know. He said that most traders are not trying to predict the market but react to whatever happens. One of the problems is that the computer models are wrong. In many cases, firms have halted automated metals trading. He said that the situation is so fluid that some of the computer models were buying from themselves.

If you watch the business news on cable television, you will hear a different opinion from every guest. I plan to use the advice given to me: prepare for the worst and turn off the television.

And now the news…

April 1, 2020

On that day, men shall fling away, To the flying foxes and the bats, The idols of silver And the idols of gold Which they made for worshiping. Isaiah 2:20

→ Read more at

breakingisraelnews.com

April 2, 2020

When people are worried about the future they turn to gold to protect their savings. That’s rarely been more true than today.

→ Read more at

finance.yahoo.com

April 2, 2020

I estimate that the Germans own 9000 tonnes in private gold-nearly as much gold as the French and Italians have combined. The World Gold Council (WGC) states there are roughly 198,000 tonnes of gold above ground, of which 35,000 tonnes is held by central banks.

→ Read more at

seekingalpha.com

April 3, 2020

Polish archaeologists have uncovered a treasure trove of Roman denarii coins. They date from the first and the second century BC, and they probably belonged to a member of a Germanic people who lived in the area at the time.

→ Read more at

ancient-origins.net

April 3, 2020

While removing the floor of the church in Obišovce near Košice, the foundations of the old church were uncovered. After this discovery, the archaeological company Triglav conducted research that took place at the beginning of February 2020, the Regional Monuments Board Košice reported.

→ Read more at

spectator.sme.sk

Apr 1, 2020 | news, policy, silver

As part of an action-filled month, there was one numismatic-related bill introduced in congress. Rep. Andy Barr (R-KY) introduced the 1921 Silver Dollar Coin Anniversary Act (H.R. 6192) to allow the U.S. Mint to strike tributes to the 1921 Morgan and Peace Dollars.

As part of an action-filled month, there was one numismatic-related bill introduced in congress. Rep. Andy Barr (R-KY) introduced the 1921 Silver Dollar Coin Anniversary Act (H.R. 6192) to allow the U.S. Mint to strike tributes to the 1921 Morgan and Peace Dollars.

H.R. 6192 is a replacement for the 1921 Silver Dollar Commemorative Coin Act (H.R. 3757). That bill will die in committee because two commemorative coin bills are already the law. The Christa McAuliffe Commemorative Coin Act of 2019 (Public Law No. 116-65) and the National Law Enforcement Museum Commemorative Coin Act (as part of Public Law No. 116-94) will appear in 2021.

The new bill is different in that it is not a commemorative coin bill. It was introduced is a bullion bill, which means that the government will keep all of the seigniorage. It would have been nice to have a commemorative bill that would raise money for the ANA.

The bill also does not have an end date. If passed, the U.S. Mint can strike bullion Morgan and Peace silver dollars starting in 2021 and into eternity. Although reports claim that the U.S. Mint “does not currently have any intention of creating an ongoing program and issuing coins after 2021,” does not mean they will not change their mind.

The only change I would recommend is to amend the bill to be like the 24-karat gold bullion bill. Allow the U.S. Mint to use the Morgan and Peace dollar designs the first year but allow the U.S. Mint to come up with new designs every year. Consider how much more successful the 2017 Centennial Coins would have been if they were struck in silver.

H.R. 6192: 1921 Silver Dollar Coin Anniversary Act

Introduced in House — Mar 11, 2020

Referred to the House Committee on Financial Services. — Mar 11, 2020

Mar 29, 2020 | bullion, news, policy

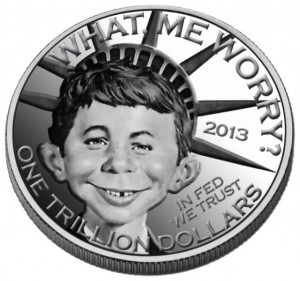

In 2013, Heritage Auctions asked the public to suggest names and and designs for the mythical $1 trillion coin. This was one of the proposals.

This time, the scheme was cooked up by Rep. Rashida Tlaib (D-MI), a freshman member of Congress. Apparently, Tlaib read that the Federal Reserve has more than a $2 trillion surplus. Rather than allow the Fed to use it to sure up financial systems in a crisis, she wants to transfer the money out of the semi-autonomous agency and put it in the general treasury to fund her version of a stimulus.

It is not the first time in the last ten years this idea came up. Back in late 2012, conservative pundits pushed Congress to do the same thing. The drumbeat for this idea became so loud that cooler heads finally prevailed, and the jokes about how to design such a coin quickly faded into history.

Tlaib is trying to learn from history by proposing that not only should the coins be struck but transferred to the Federal Reserve. By removing the $2 trillion liability from the Treasury Department’s books, it places the debt on the Federal Reserve.

If we were to ignore the law (31 U.S.C. §5136) will require the U.S. Mint to deposit the money int into the United States Mint Public Enterprise Fund, the costs of striking these coins including the design and administration is required to be deducted from the $2 trillion. It is a small percentage of the total, but it counts.

Then there is the question of operating capital. What will the Federal Reserve do if it needs the money to keep banks open during this crisis? By taking its operating capital, the Federal Reserve will have to raise money on a market that will become more restrictive when the United States central bank cannot perform. One analyst said it would be like tying the Fed’s arms and throwing them into the deep end of the pool. Everyone will panic, jump in to save them, and will drown.

To make the ensuing chaos even worse, to prevent the bank failures and to prop up the bank-related insurance programs, like the Federal Deposit Insurance Corporation (FDIC), Treasury will have to get very creative to fund the insurance program. Like they did in the late 1980s during the Savings and Loan fiasco, the Treasury had to sell bonds and bills to make the depositors whole. Back then, the economy was better, and there were willing buyers. Today, if the coronavirus crisis continues and worldwide investors become spooked because the Fed failed to help, the costs of that paper (interest rate) will skyrocket.

When the government borrows money on the open market at high interest rates, the payment for just the interest (servicing the debt) becomes part of the national debt.

Take two platinum coins and give them a face value of $1 trillion each. Make the Federal Reserve buy these coins. The result will be a ripple of actions disrupting everything, like when a stone is thrown in the middle of a calm lake.

There was a time when freshman members of Congress were pushed to the background and told to shut up and learn. It was to allow them to learn from more senior members and to prevent them from saying and doing stupid things. Maybe Congress should go back to that practice.

And now the news…

March 23, 2020

Two styles of silver coins at the Perth Mint. Photographer: Carla Gottgens/Bloomberg

→ Read more at

bloomberg.com

March 24, 2020

The fifth auction of coins from the legendary D. Brent Pogue Collection skyrocketed to a total of more than $15 million at Stack’s Bowers Galleries in Santa Ana last week.

→ Read more at

news.justcollecting.com

March 25, 2020

Stock market crash safety sought by concerned investors is coming in the form of shiny precious metals that include gleaming gold and silver coins. Even though stock market drops usually coincide with a price hike in gold and silver, both equities and precious metals soared on March 24 when the Dow Jones Industrial Average jumped 11.37%, or 2,112.98 points, to reach 20,685.04 for its biggest percentage gain since March 1933 and its largest point rise ever.

→ Read more at

stockinvestor.com

March 27, 2020

— A proposal to land the Apollo lunar module on the reverse side of a new $1 coin has been waved off by the committees reviewing the design.

The historic moon lander was among the three subjects considered for New York's dollar in the U.S.

→ Read more at

collectspace.com

March 27, 2020

Sales of retail gold coins are revealing just how desperate investors are to find a safe haven. People have always been willing to shell out more for retail coins than gold sold in the spot market. But that premium has more than doubled — and at times quadrupled — over the past two weeks as investors seek a safe place to park their cash in the face of global market turmoil.

→ Read more at

bloomberg.com

March 28, 2020

The frenzy to buy physical gold is driving demand for well-known coins like the Krugerrand, Maple Leaf, or American Eagle. A Swiss-issued coin is one of the few still to be had. The market for physical gold has dried up after four Swiss refineries were forced to shut due to the coronavirus, as finews.com reported on Tuesday.

→ Read more at

finews.com

Mar 23, 2020 | currency, news

As the COVID-19 crisis expands, news outlets have been asking how life will change once we medical science can catchup and conquer this disease. Numismatically, there is a question as to whether the currency will survive.

As the COVID-19 crisis expands, news outlets have been asking how life will change once we medical science can catchup and conquer this disease. Numismatically, there is a question as to whether the currency will survive.

There has been concern about spreading the virus on our currency. According to the Associated Press, “Experts say cash does carry a risk of transmitting the virus, but the risk from cash so far is small compared with other transmission routes.”

Is it possible that a virus-contaminated banknote could transmit the virus? Scientists are not sure. Even considering the studies that show currency could be as dirty as your smartphone, there is no definitive answer.

“It’s not impossible that there might be traces of virus on dollar bills but if you wash your hands it should provide adequate protections, you shouldn’t need anything else,” said Julie Fischer, a professor at the Center for Global Health Science and Society at Georgetown University, on C-SPAN according to the AP.

While countries like South Korea and Poland have withdrawn paper money and has gone as far as burning it, banks in the United States are reporting the opposite effect. Fear has led some customers to make substantial cash withdrawals at banks and ATMs. Some banks are raising withdrawal limits.

The run on the bank is similar to the experiences in 2001 following the attacks of 9/11. Banks reported that customers were withdrawing cash at a higher rate than before the alleged Y2K crisis. Although reports have not reached that level, it is possible to exceed the 2001-2002 withdrawals if the COVID-19 crisis continues for very long.

The Bureau of Engraving and Printing publishes its production numbers monthly. It will be interesting to see if they had to increase production in March to meet increased demand. It proves that cash is still king, and the thoughts of a cashless society can be put away for a while.

And now the news…

March 15, 2020

Precious metals sellers never let a good crisis go to waste, using people’s fears of market turmoil to convince them to invest in an asset like gold or silver coins. These investments may seem safe, but some sellers price their coins at double their actual value, and that can leave the investor poorer.

→ Read more at

qz.com

March 19, 2020

NEW YORK (AP) — In a world suffering a pandemic, cash is no longer king. A growing number of businesses and individuals worldwide have stopped using banknotes in fear that physical currency,…

→ Read more at

apnews.com

March 21, 2020

Why You Should Invest in the $5 Gold Coin Commodities / Gold & Silver 2020 Mar 20, 2020 – 03:34 PM GMT

→ Read more at

marketoracle.co.uk

March 21, 2020

Roman relic: The coin is one of a record number of treasures ( )

→ Read more at

standard.co.uk

Mar 16, 2020 | coins, news, nickels

Following Saturday’s article, an article appeared in my newsfeed with tips on how to start building a collection of Buffalo Nickels.

CNN interviewed noted numismatist Charles Morgan. The article is a good synopsis of collecting Buffalo Nickels.

Buffalo nickels are a favorite of a lot of people. Designed by James Earle Fraser, the Buffalo Nickel was struck by the U.S. Mint from 1913 to 1987. The obverse of the coin features a Native American that Fraser said was a composite design of three chiefs, and the reverse is a buffalo that Fraser said was modeled after Black Diamond, an American bison he found at the Bronx Zoo. Both claims by Fraser have been controversial since several American Indian Chiefs claimed to have been Fraser’s model, and Black Diamond lived at the Central Park Zoo. In either case, it is a beautiful coin and an excellent entry to collecting.

Buffalo nickels are very available coins with a few exceptions. Beautiful examples with full dates and at least three-quarters of the buffalo’s horn still visible are available at reasonable prices.

For someone starting a Buffalo nickel collection, you might want to consider starting with a date and type set. Going this route would spare the beginning collector from trying to find the Type 2 1913-D and 1913-S coins, which can be expensive.

If you complete the goal of the date and type set, then try to fill in the rest of the coins to create the full date and mintmark set.

Another idea is to use the Buffalo nickel as the basis to collect other coins with buffaloes as part of the design. In 2011, I presented a Herd of Buffaloes type collection. Maybe it can be something to do while riding out the current situation.

Maybe, if we can attract new collectors using an article from CNN, we can encourage them to write more.

And now the news…

March 6, 2020

The five extremely rare Islamic coins dating from the 7th century AD Image Credit: Dubai: As a UAE exhibition – Coins of Islam: History Revealed – with a display of 300 coins is proving to be a big draw at the Sheikh Zayed Grand Mosque Centre in Abu Dhabi, five rare coins are making big news globally because they offer a historic narrative of Islamic coinage, dating back to the 7th century or the dawn of Hijri (Islamic calendar).

→ Read more at

gulfnews.com

March 10, 2020

Some of the coins and pins made by Brad Brown, owner of B2 Promotions. HERMITAGE – When people ask Brad Brown what he does for a living, he isn’t sure what to tell them.

→ Read more at

meadvilletribune.com

March 11, 2020

A rare 1,300- year-old coin featuring the face of an unknown Saxon King sells for ₤48,000 after the proprietor invested 3 years attempting to verify its historic relevance.

→ Read more at

theunionjournal.com

March 14, 2020

Written by Forrest Brown, CNN Whether an entry point for budding neophytes or the domain of studied numismatists, buffalo nickels hold a fascinating place in the world of coin collecting. For the uninitiated, buffalo nickels are copper-nickel 5-cent pieces produced by the US Mint in the first half of the 20th century.

→ Read more at

cnn.com

Mar 14, 2020 | news

Now that the rollercoaster ride of this past week has pulled into the station, let us off, and is preparing for next week’s run, we can step back and assess our next move.

Now that the rollercoaster ride of this past week has pulled into the station, let us off, and is preparing for next week’s run, we can step back and assess our next move.

With the announcement of canceling of sports tournaments to the restriction on large gatherings and the declaration of states of emergency has caused everyone to rethink their short-term schedule. In numismatics, the canceling of the NCAA Men’s Basketball Tournament, dubbed March Madness, forced PCGS to cancel a launch they had scheduled with the Naismith Basketball Hall of Fame. PCGS was going to offer specially slabbed Hall of Fame commemorative coins as part of the coin’s launch.

Shortly after Maryland Governor Larry Hogan declared a state of emergency in Maryland, Whitman canceled the March expo scheduled for the Baltimore Convention Center. Stack’s Bowers Galleries, the official auctioneer of the Whitman Expo, will move their auction to their California offices and hold the auction online.

A few of the small local shows have sent notices that their shows will go on as scheduled. These are shows that are held in local meeting halls, hotel ballrooms, or other smaller facilities. Many times, the dealers outnumber the patrons. These shows will likely not exceed the 250 person limit expressed by the state of emergency.

Although the COVID-19 virus pandemic is something to worry about, we can get past the fears by following the common sense approach promoted by the Center for Disease Control and Prevention (CDC).

According to the CDC and the National Institute of Health (NIH), the only way the virus spreads is person-to-person through respiratory droplets. The virus does not live on surfaces that long. If everyone maintains the proper precautions, there should be no problem handling numismatic items. Dealers should take care in how they present their wares and their interaction with the public.

Collectors going to shows must also take precautions. If you are not feeling well, do not attend the show. Do not rub your face and then touch the merchandise. Wear gloves if you do not feel comfortable.

And please wash your hands!

Because of the way we do things, handwashing is one of the most effective measures to control the spread of many of our health issues, including COVID-19.

To put the importance of handwashing into perspective, the concept of basic sterilization did not exist during the Civil War. This lead to the rampant death of soldiers to infectious diseases, many of epidemic proportions. About two-thirds of the 660,000 deaths were because of infections. That number could have been much less if the doctors just washed their hands.

When you go to the smaller coin show, wash your hands before entering. Clean your hands frequently with a sanitizer that contains at least 60-percent alcohol. If you have alcohol preps, you can use those to wipe your hands then apply hand lotion to prevent your hands from drying out.

If you touch a lot of items, you should wash your hands in between. Wash them before diving into that junk box and after you are finished.

And do not touch your face!

We all have these habits that involve touching our face, hair, or other parts of our head. I know these habits are tough to change. As a member of the Society of Bearded Numismatists, I am regularly rubbing or scratching the area under my chin. I have been forcing myself to stop.

If you do not feel well or are uncomforatble, stay home.

The situation may cause temporary changes, but that does not mean cowering in the corner. Use the time to your advantage. Catch up reading those numismatic books on your show. Update your collection’s catalog. Organize new purchases.

You can organize family time around numismatics. Talking about coins and their history is better than watching everyone else panic on social media.

Mar 9, 2020 | commentary, news, shows

Much of the news this week was by media outlets announcing local coin shows.

Much of the news this week was by media outlets announcing local coin shows.

While the big shows are delightful, local coin shows can be more fun. Smaller shows do not attract the type of crowd that you will see in a larger venue, like a convention center. Fewer people go to these local shows making it a more relaxed atmosphere.

Behind the tables at these shows are local dealers, some who may not be able to afford to set up at national shows. These are your neighbors. They are the ones you can go to for information and help you find that hard to find or intriguing coin.

The relaxed atmosphere of the small show makes it an excellent time to talk with everyone about collecting.

I will try to visit the Whitman Baltimore Expo in two weeks and the World’s Fair of Money in August. Between now and then, you might find me a few local shows in Maryland and Northern Virginia. Go check out a local show. You’ll be glad you did!

And now the news…

March 3, 2020

Maurice Jackson of Proven and Probable sits down with Andy Schectman, president of Miles Franklin Precious Metals Investments, to talk about ways to invest in precious metals. Maurice Jackson: Today we will discuss the merits of owning government minted coins versus private minted coins.

→ Read more at

streetwisereports.com

March 6, 2020

A hoard of coins has been uncovered at a famous temple in southern India. Hundreds of gold coins were unearthed in a pot that could date back over a millennium, to when this area was part of the mighty Chola dynasty .

→ Read more at

ancient-origins.net

March 6, 2020

POMEROY — The Meigs County Library in Pomeroy was the venue for a coin show presented by the OH-Kan Coin Club on Saturday which featured Bob Graham’s coin collection and some of his recent photo acquisitions.

→ Read more at

mydailytribune.com

Mar 1, 2020 | coins, news

Show of hands: how many of you have found an old coin only to think it was a reproduction?

As an avid junk box diver at flea markets, antique shows, and other venues, I regularly come across reproductions of old coins made of various materials. The most common are brass and pewter.

In 2018, someone found a pewter coin that resembles a Continental Currency dollar in the same design as the Fugio Cent. After consulting a dealer, the coin was sent to Professional Coin Grading Service for authentication.

PCGS determined that it was a period created coin. They graded it MS-62.

1776 Pewter Continental Dollar, PCGS MS-62

(Image courtesy of PCGS)

It is not clear where the coin was made. Some experts say that it was a pattern made in Philadelphia. Others speculate that it was made in England as a satire piece to mock the newly formed country.

The problem is that PCGS does not describe the criteria that they used to determine the coin is authentic. Neither their public news article or the PCGS Coin Fact entry does not provide details of what makes this a genuine coin. With all due respect to PCGS, I have learned the hardway: trust but verify!

https://www.pcgs.com/news/pcgs-paris-office-certifies-1776-continental-dollar?gid=47

https://www.pcgs.com/coinfacts/coin/1776-1-curency-pewter/794

Someday, I hope to find something similar in one of my junk box dives. But I hope PCGS would help the community by publishing what to look for when junk box diving. I would not mind sending a proper find for authentication, but I do not want to pay for a service if it is not necessary.

And now the news…

February 24, 2020

The Carson City Mint operated from 1870 until it stopped producing coins in 1893, and was finally closed entirely in 1933. The historic building remained unoccupied until 1941, when it was selected to be the site for the Nevada State Museum.

→ Read more at

mesquitelocalnews.com

February 25, 2020

PHILADELPHIA — Julius Erving and fellow basketball hall-of-famer Sheryl Swoopes struck fear in the opposition on the court. On Tuesday, they struck coins at the U.S. Mint in Philadelphia, unveiling a special commemorative coin expected to raise as much as $10 million for Springfield’s Naismith Memorial Basketball Hall of Fame.

→ Read more at

masslive.com

February 25, 2020

A Pennsylvania appeals court has overturned a judge order that required a convicted thief to pay nearly $87,000 for stealing a collection of rare coins. Should a convicted thief who stole a batch of rare collectible coins from his former employer have to pay nearly $87,000 in restitution for the crime?

→ Read more at

pennlive.com

February 27, 2020

NewsRegionBaltimore City Actions Posted: 6:19 PM, Feb 24, 2020

→ Read more at

wmar2news.com

February 29, 2020

WABASSO, Fla. (WPTV/CNN) – A group of friends in Florida loves to look for buried treasure and last week they found a trove of silver coins that are 300-years old. The skies are overcast and rain's moving closer to the beaches along Hutchinson Island while people seek cover, but it's the perfect time to dig for treasure in the sand.

→ Read more at

mysuncoast.com

February 29, 2020

A RARE 1776 continental dollar bought at a French flea market for 56 cents is now worth a stunning $100,000. The anonymous buyer picked up the rare coin in June 2018, thinking it was just a piece of junk, but it turned out the coin was a rare treasure printed in the year of American independence.

→ Read more at

thesun.co.uk

February 29, 2020

"The large coin had letters similar to the Arabic language on it while the smaller coins had Hindu gods on them," a source who was present at the site tells TNM. It was close to 10 am on Wednesday morning and workers at the Jambukeswar Akilandeshwari in temple were clearing a space behind the Prasanna Pulaiyar sannidhi.

→ Read more at

thenewsminute.com

February 29, 2020

Treasure hunter Jonah Martinez, 43, of Port St. Lucie, found 22 Spanish coins from a 1715 shipwreck at Turtle Trail beach access on Friday, Feb.

→ Read more at

tcpalm.com

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen. → Read more at washtimesherald.com

→ Read more at washtimesherald.com

→ Read more at seekingalpha.com

→ Read more at seekingalpha.com

→ Read more at iflscience.com

→ Read more at iflscience.com

→ Read more at snopes.com

→ Read more at snopes.com

As part of an action-filled month, there was one numismatic-related bill introduced in congress. Rep. Andy Barr (R-KY) introduced the 1921 Silver Dollar Coin Anniversary Act (

As part of an action-filled month, there was one numismatic-related bill introduced in congress. Rep. Andy Barr (R-KY) introduced the 1921 Silver Dollar Coin Anniversary Act (

As the COVID-19 crisis expands, news outlets have been asking how life will change once we medical science can catchup and conquer this disease. Numismatically, there is a question as to whether the currency will survive.

As the COVID-19 crisis expands, news outlets have been asking how life will change once we medical science can catchup and conquer this disease. Numismatically, there is a question as to whether the currency will survive.