Dec 5, 2009 | RCM, Royal Mint, US Mint, web

Progress and experience is a good thing. It helps us learn about ourselves and how other perceive us. In the world of competing for business in numismatics, progress and experience helps those who sell coins and offer services improve how they communicate to us, their customers and constituents. Today, we are going to look at the websites that those of us who live part of our lives online visit for our numismatic fix.

Earlier this year, the Royal Canadian Mint updated their website. Prior to their current update, their site was written using Adobe Flash in a way that felt limiting to someone who visited the site to browse. The updated site has a more exciting look, fresher colors, and is better for those of us who like to browse. And speaking of browsers, this version does not use Flash in the same way as the old site. Your experience will be faster and more responsive than the previous RCM design. It is clear that experience has allowed the RCM to progress to a new design.

Not long ago, The Royal Mint updated their website. Although The Royal Mint did not need an update, they chose to change the basic theme and go with a simple design with a black background. It give the site a regal look, which is in tune with The Royal Mint’s vision of itself as one of the world’s oldest mint. However, navigation of this site is a bit quirky. There appears to be extra clicks required to find products and while the look is nice, every page has an image on top that distracts from the presentation by pushing to coins down. This image may only be a minor annoyance, but an annoyance nonetheless.

Here in the United States, there have been changes in the website for the Bureau of Engraving and Printing. The bureau with one of the best domain names (www.moneyfactory.gov) appears to have hired website designers that have graduated from Web Design 101. The site is is clean and professional looking with easier navigation making it easier to find information about the BEP. From the front page, the site is about the bureau and its functions. Sure, the last major even of the BEP is the redesign of the $5 Federal Reserve Note in 2007, but it allows the BEP to highlight its limited accomplishments.

With the new design, the BEP has created a new store front with its own domain name: www.moneyfactorystore.gov. The new store is easier to navigate and find products. The categories have been cleaned up, the unavailable products have been removed, and the premium series can be purchased by series or individual Federal Reserve banks. Buying individual premium products by Federal Reserve Bank was not possible with the old website.

Moving away from the government, the Professional Coin Grading Service has redesigned its website again. This time, rather than rely on the black and gold theme of their logo, PCGS is using a lighter blue theme to highlight their service. While this design is better than their previous designs, it is not without issue. For example, there is something about the front page layout that bothers me. The banner is too large, there is too much space between the banner and the page contents, and menus at below the main content are too low. If the PCGS web designers can lower the height of the banner, close up that extra space, the lower menus will move up on the page and not feel as if they are an after thought. Making these fixes could change the A- design into a solid Grade A design.

Of course the one website that is in dire need of updating continues to have the same design since 2000. The US Mint should update their web presence, especially their online catalog.

Nov 17, 2009 | cents, coin design, US Mint, video

With “Real Life” delaying the completion of my proposal to Reform US Currency, I wanted to take a brief moment to talk about the November 12th launch of the last of the 2009 Lincoln Bicentennial One Cent coins honoring Abraham Lincoln’s presidency.

With “Real Life” delaying the completion of my proposal to Reform US Currency, I wanted to take a brief moment to talk about the November 12th launch of the last of the 2009 Lincoln Bicentennial One Cent coins honoring Abraham Lincoln’s presidency.

The reverse design is an image of the US Capitol as it appeared on March 3, 1861 when Lincoln was inaugurated for the first time. With the Civil War imminent, Lincoln was asked whether the government should stop the construction so that the money would be used for the war effort. Lincoln was ever mindful of trying to keep the promise of the union said that the dome’s completion would enforce that view—making it an appropriate design for the last of this series. The reverse was designed by Susan Gamble and sculpted Joseph Menna.

In addition to the launch of the final 2009 reverse design, the design for the 2010 Lincoln Cent was introduced. The reverse of next year’s coin features a Union shield. In the context of symbolism, the union shield is an emblem symbolizing a national union fitting of the theme calling for the reverse to be “emblematic of President Lincoln’s preservation of the United States of America as a single and united country” as required by Public Law 109-145. Although this is not the first time a union shield has been depicted on US coinage, this is an interesting choice that I will discuss in the future. However, given the history of the Lincoln Cent, this will be the design for the next 50 years!

In addition to the launch of the final 2009 reverse design, the design for the 2010 Lincoln Cent was introduced. The reverse of next year’s coin features a Union shield. In the context of symbolism, the union shield is an emblem symbolizing a national union fitting of the theme calling for the reverse to be “emblematic of President Lincoln’s preservation of the United States of America as a single and united country” as required by Public Law 109-145. Although this is not the first time a union shield has been depicted on US coinage, this is an interesting choice that I will discuss in the future. However, given the history of the Lincoln Cent, this will be the design for the next 50 years!

If you missed the launch, you can see some of the ceremony, the crowd, the designs, and part of the exchange in the following B-Roll video from the US Mint:

Coin images courtesy of the US Mint

B-Roll video from NewsInfusion

Nov 9, 2009 | bullion, foreign, gold, silver, US Mint

My motivation for recommending the restructuring of the US Mint was when they announced that proof silver and gold American Eagle coins will not be produced in 2009. The logic of the decision in the context of what we know of the US Mint’s operations was unpalatable.

Restructuring the bullion program is to first acknowledge that it is a profit center for the US Mint. Its sole purpose is the buy precious metals and create bullion coins for sale at a significant profit. In the 2008 Annual Report, the profit on bullion issues was 22-percent over all costs, more than circulating currency or commemorative coins.

The anchor of the bullion program are the American Eagles, which has been the most successful bullion program since its inception in 1986. The program started with silver and gold American Eagles. Platinum bullion Eagles were first struck in 1997. American Silver Eagle coins are one troy ounce of 99.9-percent pure silver. American Gold Eagles contain 22-karat (91.67-percet) of gold balanced with silver and copper struck in 1/10 ($5), ¼ ($10), ½ ($25), and one ($50) troy ounces. American Platinum Eagles are struck using 99.95-percent platinum in 1/10 ($10), ¼ ($25), ½ ($50), and one ($100) troy ounces. This program will not change and the US Mint will continue striking coins to meet the demand.

Under the current law, it is not required that the US Mint strike proof versions of these bullion coins. This restructuring will change this to require a minimum mintage of these coins. For the future, the US Mint will strike proof coins to meet the demand with a maximum number in ounces of metals used. For this policy, it is proposed that 1 million troy ounces of silver be used for proof coins meaning the production will be limited to 1 million coins. Gold will be limited to 500,000 troy ounces of gold across all sizes. Finally, platinum will be limited to 100,000 troy ounces in proof coins.

I am not proposing changes to the 24-karat (.999 fine) Gold Buffalo program.

To complete the transformation, the First Spouse program will be transfered to bullion issues and continue using the same rules as it does today.

This year, the US Mint introduced the 2009 Ultra High Relief Coin. This coin brings to life the Augustus Saint-Gaudens proposed high relief design for his $20 Double Eagle design that 1909 technology could not create. The coin has been praised for its beauty and should be a future Coin of the Year candidate.

The concept of creating special bullion coins like the Ultra High Relief coin is something that a new bullion program can do. The US Mint, with direction from the CCAC acting as the US Mint’s Board of Directors can authorize new bullion coins that will allow the US Mint to create new collectibles that could be marketed to a wider audience. In addition to special strikes, the new bullion program can include coins with privy marks, special reverses, enameled coins, even coins made from multiple materials.

Examples of what could be accomplished can be seen in the 2007 Coin of the Year and 2008 Coin of the Year candidates. Although there are wonderful single metal coins, there are some wonderful coins using other design elements. In fact, the the 2009 Coin of the Year award was given to the 2007 Mongolia Wolverine coin with diamonds for eyes that is very intriguing when seen in hand!

It is not my intent to tun the US Mint into the non-circulating legal tender (NCLT) producer like the Royal Canadian Mint who is known to produce a large number of bullion-related issues. The CCAC should limit the introduction of bullion issues to a few a year and limit the number of coins that could be produced for each type. But if the US Mint can find influence in more areas than classic US coinage to produce beautiful collectibles using bullion metals.

Before I forget, these coins are bullion collectibles sold as a profit for the US Mint. They are not commemorative coins and not subject to the fundraising considerations proposed for commemorative coins.

Although the US Mint has been the focus of this series, we cannot reform America’s currency without considering paper money. Next, I will look at the Bureau of Engraving and Printing and what to do with Federal Reserve Notes.

Nov 6, 2009 | coins, commemorative, policy, US Mint

As part of the restructuring of the US Mint, the area of commemorative coins have to be a significant concern. With both the classic and modern commemoratives, congress could not help itself by using commemorative coins as a form of fundraising for pet causes. While some of the beneficiaries of the funds are worthy, others have caused significant controversy. Additionally, there were commemorative programs that have lost money for the US Mint causing more losses than what has been seen in the cent and nickel.

The first reform in commemorative coinage would be that no commemorative would be struck for the sole purpose of raising money for any organization. Regardless of how worthy the organization may be, the association of the commemorative with fundraising taints the process. Thus, this proposed reform recommends that no commemorative coin may be proposed with the purpose of fundraising.

Once the commemorative coin has been approved, related groups may petition congress to attach their organization to the commemorative for fundraising purposes. If congress approves, the organization will be paid for the profits beyond the cost of manufacturing, packing, and distribution of the coin. The US Mint must be able to recover their costs before any money is distributed to the approved organization. Payments will be made quarterly after the US Mint has broken-even. As part of this plan, the US Mint holds back 5-percent of the dispersal in order cover future expenses. When the sales of the commemorative coins are complete, the US Mint’s costs will be recalculated and the remainder will be paid to the approved organization.

Before choosing an organization for fundraising, the commemorative coin must be selected. Since congress has bungled this over the years, congress should no longer select topics or how the program is to run. As part of the reformed commemorative coin laws, the congress sets parameters for how commemorative programs and leaves the decisions to the Citizens Coinage Advisory Committee. When the CCAC makes their selection, the process will be limited to something of national interest. It may be something relating to history (e.g., War of 1812), the anniversary of a government institution or program, someone of national historical significance, or a building of national importance (e.g., the Capital Building, White House). The commemorative must be something representative of the national interest.

All commemoratives will be proof strikes. There seems to be no purpose to uncirculated commemorative coins nor is there a purpose for clad commemorative. Commemorative programs may contain up to four coins with the priority being $1 silver, $10 gold, half-dollar silver, and $5 gold. In this scenario, if the commemorative program is to only have three coins, then the $5 gold coins would not be used. If the commemorative is used for a fundraiser, the US Mint will add a $5 premium for the half-dollar, $10 premium for the dollar, $25 premium for the $5 gold coin, and the $35 premium for the $10 coin.

Because it may be impossible for the egos in congress to remove themselves from the commemorative process, the law should allow that they be given the ability to vote in one commemorative program per year. As opposed to their current practice, a congressional commemorative program may specify everything except the design and where the coins will be struck. The design will be created by the CCAC and the US Mint engravers to match the theme of the program and the branch mint used to strike the coins will be selected by the US Mint in a manner to make efficient use of the facilities.

As part of the transition, any commemorative program passed by congress prior to the restructuring will be issued as required by the enacted law. However, those commemoratives will count against the one program that congress is allocated per year.

Fixing the commemorative coin program is a combination of making it relevant and removing the fundraising aspect of the programs. With the compromise of allowing congress one commemorative program a year and giving them the ability to add a controlled fundraising aspect after the fact, this should prevent commemorative coins from becoming irrelevant.

The restructuring continues next with the bullion programs.

Nov 5, 2009 | coin design, coins, policy, US Mint

Now that the US Mint has been reorganized, it is time to strengthen the product line. The US Mint’s primary product are the circulating coins that are sold to the Federal Reserve. At this moment, there should be no changes to the required denominations and composition. Although there have been recent issues with the rise in the costs of zinc and nickel that affected the seignorage of the one and five cent coins, the US Mint produces enough coins in other denominations to mitigate those losses. Business calls selling a product at or below it manufacture price is called a loss leader. As long as the US Mint is meeting its obligations to the Federal Reserve, it is not a problem for the US Mint to downgrade the cent and nickel to loss leader status.

Numismatists are most vocal over the design of the coinage and the number of rotating series that drives up the costs to collectors. In order to add sanity to the process, there must be some rules. Thus, under this reorganization, no coin design is to last more than 25 years. The coin design can refer either to the obverse, reverse, or both, but something must be changed. This means the end of the 50 year design pattern given to the Lincoln Cent. Once the new design is settled in 2010, it must be changed by 2035. At that point, the CCAC and the US Mint will decide to redesign the entire coin or, once again, replace the reverse only.

Under this rule, the dime and half-dollar are due for design updates.

This proposal does not change the elements that are required on the coin. As described in 31 U.S.C. §5112(d)(1), “United States coins shall have the inscription ‘In God We Trust’. The obverse side of each coin shall have the inscription ‘Liberty’. The reverse side of each coin shall have the inscriptions ‘United States of America’ and ‘E Pluribus Unum’ and a designation of the value of the coin.” All other rules about design in that paragraph would be eliminated under this plan.

If the US Mint creates circulating commemoratives, there should be no more than two programs in place. One program can be a multi-coin commemorative, like the Presidential $1 Coins, and the other an annual series, such as the Native American $1 Coins. Any more than that becomes too much where the US Mint apparently cannot maintain the levels of manufacturing necessary to satisfy demands for their products. Once the circulating commemorative series is completed, the coin will undergo a final design change for the year after the program’s conclusion and remain that way for 25 years. An exemption to this rule will be to maintain the America the Beautiful Quarters Program as part of the transition.

And no more circulating commemoratives of the same coin. Either have the Presidential $1 Coin or the Native American $1 Coin, not both!

The US Mint will maintain the annual coin programs for all circulating coins. Mint Set will remain coins that have come from business strike production lines and proof coins will continue to use specially treated planchets as they do today. Additionally, the US Mint will continue to produce the Silver Proof Set except that the one-cent coins will be struck in an alloy of 95-percent copper.

Finally, it is time to make the one-dollar coin worth striking. The only way to do this is to stop producing the one-dollar Federal Reserve Note. The United States is the only “First World” country that continues to produce its unit currency in paper form. Even as the $1 FRN continues to be produced, some countries are eliminating more lower denominations to save on costs. It is time for the United States to do the same. In fact, the United States should also eliminate the $2 note.

At the end of the series, there will be an article about the paper currency and the Bureau of Engraving and Printing.

There are relatively few changes necessary for circulating coins. In the next article, we will look at the commemorative coin program.

Nov 4, 2009 | policy, US Mint

Yesterday, I called for reform in the coinage laws to remove congress from the operations of the US Mint. Before talking about coinage, the first act of reformation is a reorganization of the system. When a business is failing, the first thing they do is to reorganize. This is the purpose behind Chapter 11 of the Bankruptcy laws.

The first step to reorganization is that congress must change the coinage laws (31 U.S.C. §5112) to divide the coinage types into the four relevant types: circulating coinage, bullion, commemorative coins, and medals. Making this distinction between coinage types will clean up the laws, reduce the confusion, and make it easier for the US Mint to understand the policies it is required to implement. A byproduct of making the laws easier to understand would help the public with understanding the responsibilities of the US Mint.

Next would be to change the organizational of the US Mint. It is unfortunate that the previous administration chose to appoint a political hack as the director. Rather than being a good manager to lead the US Mint through a slow period, the current director has shown that it needs more than a political appointee to run the US Mint. Thus, the US Mint needs a Board of Directors.

The Board of Directors would be responsible for ensuring that the US Mint would maintain policies, properly managed production issues, and assisted with the design of the coinage. The Board would be the first line of defense to ensure that the US Mint is living up to its responsibilities to both its commercial client, the Federal Reserve, and the collecting community. This Board would be responsible for contacting the Treasury Inspector General or the Government Accountability Office to investigate issues with the US Mint.

To create a Board of Directors, congress would have to look no further than the current Citizens Coinage Advisory Committee. Since its inception in 2003, the CCAC was supposed to be on the front-end of the design process. Instead, the lawyers at the US Mint defined the CCAC’s role as being virtually in competition with the US Commission of Fine Arts when it comes to coin design. It is time for that to end and give the CCAC a more significant role in the process.

Under this proposal, the CCAC would be the ultimate arbitrator of everything that goes into the coin design. While I will discuss this role in the context of coin types, this means that congress will cease deciding what is to be depicted on the coins. The CCAC will be the arbitrator of this process. While this concept is new in the United States, this is the role played by similar organizations that work with the Canadian Royal Mint, Great Britian’s Royal Mint, and other worldwide mint. It is time for the United States to catch up with the rest of the world in this regard.

With the expanded role of the CCAC, the role of the CFA to be the arbitrator of the final design will not end. However, rather than be in competition, the CCAC and CFA will work together on the final design.

As part of the CCAC’s role as the US Mint’s Board of Directors, the US Mint Director and the directors of each branch mint would have an ex-officio seat on the Board and be required to provide monthly production reports and quarterly operating reports (similar to SEC Form 10-Q) for review by the CCAC. All reports would then be published by the US Mint and made available electronically via the US Mint’s website. Similarly, notes from the CCAC, including design considerations, would be made available through the CCAC’s currently useless website.

If the CCAC is to take on a more significant role in operating the US Mint, it is reasonable that they should receive a stipend. The stipend would be paid out of the Public Enterprise Fund and counted as an operating expense of the US Mint.

Speaking of accounting, as part of this reorganization, the US Mint would be required to produce their quarterly and annual reports that is in full compliance with the Federal Accounting Standards Advisory Board. Annual reports must be audited by an accredited accounting firm while it would be optional for quarterly reports to be audited.

Funding for the US Mint and its operations will be proposed by the Director and approved by the CCAC. The approved budget will be provided to the Secretary of the Treasury and submitted to congress for their final approval. The budget for the US Mint must be withdrawn exclusively from the United States Mint Public Enterprise Fund (31 U.S.C. §5136). If the Public Enterprise Fund does not have enough money sufficient to fund US Mint operations, the Secretary of the Treasury must approve the transfer of money from the general fund to the Public Enterprise Fund.

The only substantive change to the operations of the US Mint Public Enterprise Fund is how the excess money is handled. Although the wording is not clear, it appears that a reserve of “6.2415 percent of the nominal value of the coins minted” is required and that all excess is transferred to the general fund. For the reorganized US Mint, the reserve in the public enterprise fund would be 10-percent of the bureau’s total budget rounded up to the next million dollars. Also, to hedge against the problems congress creates with their annual budget battles, the budget approved by the Secretary will go into effect on October 1. During the budget process, the excess from the Public Enterprise Fund will remain in the fund until congress passes the budget.

While we are cleaning up the laws, congress needs to remove the Numismatic Public Enterprise Fund (31 U.S.C. §5134). The law that created the US Mint Public Enterprise Fund supersedes this law and is unnecessary to remain on the books.

The final aspect of the reorganization is to alter the laws that requires all metals to be purchased from United States mines and other sources. Through a labyrinth of laws, the copper, nickel, zinc, and manganese used for US circulating coinage and silver, gold, and platinum for bullion coins must be bought from US sources at the prevailing price. In other words, the US Mint cannot negotiate for discounts on the purpose of these metals as any large manufacturer would do. By doing this, congress is providing a subsidy (welfare) to the mining industries who have stemmed losses by selling to the US government. While politics will protect those mining interests, congress can authorize the US Mint to purchase coining metals from non-US sources when US sources cannot maintain sufficient supplies.

Now that the US Mint has been reorganized, the next installment will discuss improving circulating coinage.

Nov 3, 2009 | coins, US Mint

The Congress shall have power… To coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures;

Since the ratification of the United States Constitution in 1788, congress has interpreted their Article I, Section 8 right to coin money beyond this sentence. Since the Coinage Act of 1792, congress has been heavily involved in the design of US coinage even to the point of providing exact design details.

In recent years, it appears that congress that too worried about their legacy in US coinage than their legislative legacy. The modern problem began with the success of the 50 State Quarters program. While this was a novel idea that was worth doing, congress has destroyed the novelty by making the start of the 21st century the decade of the rotating design. In this decade, congress approved the Westward Journey Nickels, Presidential Dollar, DC and US Territories Quarters, Native American $1 Coins, Lincoln Bicentennial One Cent, and the America the Beautiful Quarters programs that will begin next year. Making matters worse, the dollar coin programs have mintage requirements that the US Mint has confirmed that there is a surplus of dollars that have not been sold to collectors or the Federal Reserve.

Commemorative coins have had mixed results. What numismatists call classic commemoratives suffered from issue overload where congress authorized commemorative coins to raise money for any pet project. When congress reauthorized commemorative coins for 1982, it appeared that they learned the lessons from past mistakes by limiting the number of programs authorized. That was until congress authorized programs with multiple coin options, like the 1989 Congress Bicentennial, 1991 Mount Rushmore Golden Anniversary, and 1992 XXV Olympiad commemoratives, causing collector fatigue in the market.

After commemorative programs started showing losses, the General Accounting Office (now called the Government Accountability Office) investigated how to fix the commemorative coin program. In GAO report GGD-96-113 [PDF], U.S. Mint: Commemorative Coins Could Be More Profitable, they noted failures in the commemorative coin programs were because of over production, bad choices of subject, and the production of too many commemoratives. Subsequently, congress authorized the 32-coin Atlanta Olympic Commemorative Coin Program that lost money for the US Mint. As a result, congress codified the recommended limits on commemoratives which they have held to ever since.

With complaints coming from many directions, congress has regularly abused its constitutional powers to the point that collectors are threatening to turn away from future US Mint’s offerings. This will hurt the future commemorative market as well as the dollar coin market since collectors are the majority purchasers of these coins.

It is time to reform the coinage laws.

Even though the constitution says that congress has the authority to coin money it does not say that they have to the ability to design money or run the US Mint. Since the Coinage Act of 1792, congress has transferred the operation of the US Mint to the executive branch. But for over 200 years, congress continues to try to run the Mint from the halls of the capital so that whenever congress has asserted itself in the coining process the results have lead to failure. It is time to remove congress from the process. Congress continues to have a role in defining the denominations, metal types, and other specifications (see 31 U.S.C. §5112(a) through (c)), but what goes on the coins, how they are made, and where they are made should be removed from congressional tinkering.

Over the next week, I will look at how to improve the administration of the coining process by breaking the discussion up into four categories: circulating coinage, bullion, commemorative coins, and medals. But first, we must reorganize the US Mint to become a better operating entity. The next article will look at a reorganization proposal.

Oct 21, 2009 | US Mint

Jay Johnson, who served as the 36th Director of the US Mint, died of an apparent heart attack on Saturday, October 17. He was 66 years old.

Johnson, a Wisconsin native, was a television commentator turned politician. He was elected to one term congressman from Wisconsin’s 8th District in 1996. In 1999, Johnson was nominated as Director of the US Mint by President Bill Clinton. He served a Mint Director from May 2000 to August 2001. Succeeding Philip Diehl as Mint Director, Johnson managed the bureau during the height of production. Diehl and Johnson were able to maintain high production levels of American Eagle coins while starting the 50 State Quarters program. Coin production in 2001 continues to hold the record for most coins struck by the Mint.

After serving as Mint Director, Johnson remained in the Washington, DC metropolitan area and continued to work in numismatics. He formed Jay Johnson Coins and Consulting to work with investment banks and brokerages on investing in coins. Recently, Johnson worked for Goldline International and appeared on television as a spokesman.

Johnson is survived by his wife, JoLee, and two stepchildren.

Oct 19, 2009 | bullion, Eagles, gold, silver, US Mint

I am sure you heard that the US Mint has announced that they will not produce American Eagle gold and silver proof coins “[because] of unprecedented demand for American Eagle Gold and Silver Bullion Coins.” Is there really an unprecedented demand?

What We Should Have Learned

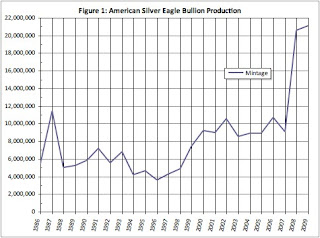

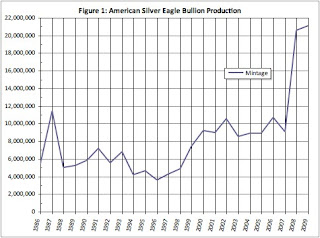

In an analysis posted here last April, production totals for 2008 showed that the US Mint experienced an extraordinary increase in demand for American Silver Eagle bullion coins striking over 20 million ounces of silver for the first time. This was a 128-percent increase over the 2007 production and almost twice as large as 2006, the second highest production total.

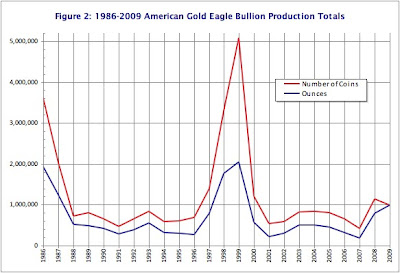

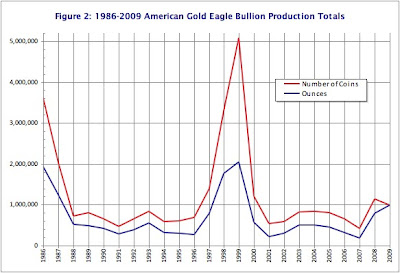

Gold production totals revealed a different story. There was an unprecedented demand in 1998-1999 where the number of American Gold Eagle coins and the ounces of gold used has not been matched by the US Mint. In addition to striking over 5 million coins using over 2 million ounces of gold, the US Mint also struck over 4.4 million 50 State Quarters in the program’s first year of issue. The production of 1.1 million coins using 788,500 ounces of gold was only a bit above average but the most in the 21st century.

Since the start of the current economic crisis that experts say began in December 2007, it was clear that the US Mint was unprepared when investors turned to purchasing American Eagle coins looking for safe investments. In fact, the US Mint admitted that the US Mint knew they were experiencing shortages as early as June 2008. By October, the US Mint had to announce that there is a shortage of bullion because the US Mint could not purchase enough material at market prices to meet the demand. After a year, the US Mint announced that “the United States is lifting the allocation process,” ending the rationing of bullion issues.

Whoever said no news is good news has never met the politicians running the US Mint.

Where We Stand Today

With the announcement by the US Mint, I downloaded the 2009 bullion production totals and added it to the previous analysis to see if there has been an unprecedented demand.

If the demand for silver in 2008 was any indication, it would be matched or exceeded by the demand in 2009. Through the first week in October, the US Mint has struck over 21 million one-ounce American Silver Eagle bullion coins. That is more coins than the 20.5 million struck in 2008. Figure 1 shows that if the trend continues, 2009 will exceed all silver production totals for American Silver Eagle coins.

Click image to enlarge

Click image to enlargeAlthough there was a dip in the monthly production for September (see Figure 2), trends show that American Silver Eagle coins struck in the fourth quarter (the first quarter of the fiscal year) can outpace production in earlier in the year. It is possible that the US Mint could produce another 10 million silver coins by the end of the year, especially if collectors plan to buy bullion coins to fill in the whole made by the 2009 discontinuance of the proof coin.

Click image to enlarge

Click image to enlargeGold Glitters, But…

Although production for the 2009 American Gold Eagle is outpacing production for 2008, this cannot be said about gold. While gold will surpass last year’s production totals, the US Mint will not produce the amount of coins or strike the amount of gold that they did in 1998 and 1999 (see Figure 3). And while the US Mint may strike more than the 1.3 million coins that marked 1997, they will do so by striking only one-ounce coins.

Click image to enlarge

Click image to enlargeEven with the production increases in 2009, the combined unit production of the gold and silver American Eagle coins will be less than it was a decade ago.

So What Is The Mint Doing?

At the end of April, it was reported that US Mint ceased production of nickels and dimes that would last for six months because of the reduced demand from the Federal Reserve. They continued the production of other coins with changing designs, such as the Bicentennial Lincoln Cent, DC & Territories Quarters, and Presidential Dollars. Recent reports show that the US Mint has not continued striking nickels and dimes while producing fewer quarters than any series since the start of the 50 States Quarter program began in 1999.

The Philadelphia Mint has also ceased production of Kennedy Half Dollars. In fact, Denver has out produced Philadelphia by 26.5 million coins.

As part of the announcement of the temporary cessation of production, the US Mint said that workers will participate in a six-month productivity maintenance program and capital maintenance in order to keep the rank-and-file workers employed.

According to the US Mint’s Annual Reports, American Eagle coins are struck at both Philadelphia and West Point. Bullion issues do not include mint marks making it difficult for collectors to determine where the coins were struck.

If there are idle coin presses at the Philadelphia Mint and employees not working on the production of business strikes, why has management not allocated the appropriate resources to meet the demand for bullion as well as the demand for collector American Eagle coins?

Between 1998 and 2001, the US Mint was running at full production including the new 50 State Quarters and was able to meet the bullion and collector demand for American Eagle coins. In fact, between the two years, the US Mint was producing half-dollars for regular circulation and changed the production of dollars from the Susan B. Anthony dollars to the Sacagawea design. Even with the economic slowdown, the US Mint produced a record number of coins in 2001.

With coin presses silent and the lack of sell outs for this year’s commemorative coins, why can’t the US Mint keep up with the investor and collector demand for American Eagles?

It Does Not Make Sense

Even though there was a coin shortage in the mid-1960s, production at the US Mint exceeds what it is today. In order to find production totals as low as they are this year, we would have to look over 50 years ago when the Philadelphia Mint was in its third building and only producing five types of coins with no commemoratives.

Today, the Philadelphia Mint is in a larger building with more state of the art equipment. The same facility that helped produce record numbers of coins less than ten years ago while striking bullion that included platinum American Eagle coins.

The only answer is the incompetence of the US Mint’s management.

It is very clear that the leadership of Director Edmund Moy and Deputy Director Andrew Brunhart must be questioned. Moy was a patronage appointee who has no experience managing a manufacturing operation or in any other type of position where workflow and resource management is critical. Brunhart, who was hired for his “expertise in organizational change,” appears to be changing the US Mint the same way he changed the Washington Suburban Sanitary Commission (WSSC), for the worse.

I know that the country has issues that may be more important than who is running the US Mint. But the US Mint is a profit center for the federal government and those profits (seignorage) are being hurt by its leadership’s inability to manage its resources properly. Therefore, it is time that President Obama set aside a few moments to replace these political hacks before they destroy one of America’s oldest bureau.

Will You Help?

If you are a collector, investor, or have an interest in seeing the US Mint successfully carry out its mission, I ask that you write a letter (addressed to 1600 Pennsylvania Ave NW, Washington, DC 20500-0001), send an email, or go to the White House website contact form and tell President Obama that Director Moy and Deputy Director Brunhart are damaging this venerable institution.

Hopefully, we can convince the President to act now before US Mint management tries something insipid, like blame collectors for their problems as they tried to do in the mid-1960s.

Oct 2, 2009 | CCAC, US Mint

Yesterday, the US Mint has announced that they are seeking applicants for two openings to the Citizens Coinage Advisory Committee (CCAC). The CCAC advises the Secretary of the Treasury and the Director of the US Mint as to the design of numismatic products produced by the US Mint. CCAC’s recommendations are submitted to the US Commission of Fine Arts (CFA) for final decision.

“The CCAC is composed of 11 members: one specially qualified in numismatic collection curation; one specially qualified in the medallic arts or sculpture; one specially qualified in American history; one specially qualified in numismatics; three individuals representing the interests of the general public; and four individuals recommended by the Leadership of both the House of Representatives and Senate. CCAC members serve terms of four years and are Special Government Employees; therefore, they are subject to various applicable conflict of interest laws and ethics regulations.”

In this announcement, four year appointments are for the representative specially qualified in American history and one who is a specialist in medallic art. Interested parties should send a cover letter, a resumé or curriculum vitae outlining relevant experience, and an indication of which position is being applied for to the US Mint by fax to 202-756-6525, or by mail to the United States Mint, 801 9th Street NW, Washington, DC 20220, Attn: Greg Weinman. Applications must be postmarked no later than November 13, 2009.