May 24, 2020 | advice, bullion, markets, news

When talking about markets, the central theme is that investors hate instability. Whether the conversation is with the professional market maker or the individual investor, there is much uncertainty in the current marketplace.

When talking about markets, the central theme is that investors hate instability. Whether the conversation is with the professional market maker or the individual investor, there is much uncertainty in the current marketplace.

When equity markets become unstable, investors run to cash or cash equivalents. Cash equivalents include investments like bonds, especially those issued by stable governments. The other investment they run to is precious metals.

Gold is the primary safe-haven for investors. As a society, we have given this mineral an intrinsic value and trade it for a premium. With the panic of the U.S. Mint closing the West Point Mint for a short time, investors started buying platinum. The most popular form to purchase these metals is in coins where we saw the South African Platinum Elephant coins sell out its 2,000 coin production.

With the markets scrambling, it has opened up the door to scammers trying to cash in on the panic buying. Scammers use tactics like selling overpriced and overhyped coins, counterfeits, and not delivering coins after purchasing.

These scams are not new. Last year, the Accredited Precious Metals Dealer (APMD) program warned against scammers as the prices jumped. Unfortunately, the problem has only become worse.

Please do not fall for these scams. If you have any questions, contact a reputable dealer from the APMD, Professional Numismatists Guild (PNG), Industry Council for Tangible Assets (ICTA), or the American Numismatic Association dealer directories. You will be glad you did!

And now the news…

May 18, 2020

Nervous investors have been pouring into the gold and silver markets over the past two months. Money Metals Exchange is proud to have helped almost 20,000 new customers with a precious metals purchase in recent weeks, many of whom came over from other dealers struggling with inventory shortages and ridiculous delivery delays.

→ Read more at

fxstreet.com

May 19, 2020

While the covid-19 pandemic has had a negative effect on the platinum market — including price, demand and supply — results for Q1 2020 show the net effect is less than feared, and the outlook for 2020 is better than expected, according the latest quarterly report by the World Platinum Investment Council (WPIC).

→ Read more at

mining.com

May 21, 2020

Investors seeking a haven from the economic turmoil created by the coronavirus pandemic are snapping up platinum coins engraved with African wildlife.

→ Read more at

ca.finance.yahoo.com

May 22, 2020

Kakinada: Cyclonic storm Amphan may have caused heavy damage in parts of Odisha and West Bengal, but the rains it brought in its wake helped unearth a treasure trove of silver coins of British India era in a village in north coastal Andhra.

→ Read more at

timesofindia.indiatimes.com

May 11, 2020 | bullion, coins, Eagles, silver, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is first article of a 4 part series:

NOTE: This is an updated article that was first published on September 18, 2018.

After the Coinage Act of 1965 removed silver from United States coinage, the federal government held the silver in the national stockpile. By the 1980s, the supply that far exceeded the needs of the national stockpile. Following several years of discussion that almost led to the bulk auction and sale of the silver, congress decided to use the silver to create a silver investment coin, the American Silver Eagle.

The American Silver Eagle program was so successful that following the depletion of the Defense National Stockpile in 2002, the original law was changed to continue the program by purchasing silver from U.S.-based mines at market prices to be used for future production.

American Silver Eagle Design

The obverse of the coin is the much-beloved design that was used on the Walking Liberty Half-Dollar coin from 1916 to 1947, designed by Adolph A. Weinman, a former student of Augustus Saint-Gaudens. The reverse features a heraldic eagle using a design by John Mercanti. Mercanti engraved both sides of the coin that including copying Weinman’s original design. Mercanti would later become the 12th Chief Engraver of the U.S. Mint.

| American Silver Eagle Specifications |

| Composition |

.999 Fine Silver |

| Weight |

One Troy Ounce (31.103 grams) |

| Diameter |

40.6 mm (1.598 inches) |

| Thickness |

2.98 mm (0.1173 inches) |

| Edge |

Reeded |

| Face Value |

$1.00 |

| Designers |

Adolph A. Weinman (obverse), John Mercanti (reverse) |

| Engraver |

John Mercanti |

Bullion American Silver Eagle Coins

The American Silver Eagle program produces bullion coins for the investment market and collectible versions of these coins. As bullion coins, the U.S. Mint tries to eliminate the factors that drive the price of collectible coins (mintage, rarity, and condition) by making each coin the same. The U.S. Mint strikes American Silver Eagle to meet the market demand and can be stuck at any branch mint. Bullion coins do not have a mintmark.

The U.S. Mint does not sell bullion coins directly to the public. They sell the coins to “Authorized Purchasers,” who then resell the coins to the market. Although the American Silver Eagle bullion coins are produced for the investment market, some people collect these coins.

As with other investments, American Silver Eagle bullion coins are subject to taxes when sold. Please consult with a financial advisor or tax professional for any tax implications.

Mint of Origin for Bullion Coins

The U.S. Mint branch facility in West Point, New York, has been the primary manufacturer of American Silver Eagle bullion coins. Over the years, the mint facilities in San Francisco and Philadelphia have supplemented production.

Following an investigation, researchers learned that the U.S. Mint struck American Silver Eagle bullion coins at San Francisco and Philadelphia from 2011-2017. Some have tried to use shipping records from the U.S. Mint, shipping labels, packaging materials, and other means to try to investigate the origin of the coins.

In 2015, the industry thought they understand how to tell which Mint struck the coins. According to a statement issued by the U.S. Mint in 2018, the Philadelphia Mint produced 79,640 bullion coins. However, 140 coins were “condemned” and not issued. They shipped 79,500 coins to West Point for distribution to authorized purchasers. Although the boxes contain labels and serial numbers, there was no attempt made to separate the coins by Mint. Further, the U.S. Mint acknowledges that they identified cases of duplicate labels and tracking numbers written on the box. The information creates a reasonable doubt as to determine the manufacturer of the coins.

The third-party grading services believe they identified strike characteristics of the 2015 bullion coins that occurred at the Philadelphia Mint. They have encased American Silver Eagle bullion coins with labels noting their Philadelphia pedigree with no additional evidence.

In 2020, the novel coronavirus (COVID-19) pandemic caused the U.S. Mint branch at West Point to close temporarily. In order to keep up with production, the U.S. Mint struck 240,000 bullion coins in Philadelphia.

The third-party grading services asked the U.S. Mint about the production of these coins. Rather than leave the industry guessing, the U.S. Mint identified which boxes contained American Silver Eagle bullion coins struck in Philadelphia. The grading services are noting the origin of the bullion coin on the label of their slab.

Unlike the 2015(-P) coins, the 2020(-P) coins have an identifiable trail that leaves little doubt to the origin of the coins.

Collector American Silver Eagle Coins

The U.S. Mint produces collector versions of the American Silver Eagle are sold directly to the public in specialty packaging. The U.S. Mint sells American Silver Eagle proof coins in a specially made capsule stored in a blue velvet-covered case in a blue box with a Certificate of Authenticity.

Beginning in 2006, the U.S. Mint has produced an uncirculated business strike coin for the collector market. Most uncirculated American Silver Eagle collector coins are struck in West Point and bear the “W” mintmark. Uncirculated coins are burnished, a process by treating the surface with fine particles to give the surface a smooth, satin finish. The U.S. Mint sells these coins in a capsule with packaging that varies from year to year.

The U.S. Mint has produced coins with reverse proof and enhanced uncirculated finishes. A reverse proof coin is when the elements show a mirror-like appearance and the fields have a matte finish.

In 2009, the U.S. Mint was unprepared for the financial collapse that increased the demand for silver bullion coins. So that the U.S. Mint could produce the coins to meet the investor demand, the U.S. Mint did not produce collector American Silver Eagle coins. Although the American Silver Eagle proof coin returned to the market in 2010, the U.S. Mint did not produce uncirculated burnished coins.

American Silver Eagle collector coins returned in 2011.

OGP vs. GRADED

2018-W American Silver Eagle Proof in Original Government Package

Collector American Silver Eagle coins can be purchased either in their original government package or graded. When searching for coins that are in their original government packaging on most online auction sites, it is recommended that you add “OGP” as part of the search.

Dealers and collectors will remove the collector American Silver Eagle coins from their original government package in order to submit them to a third-party grading service for grading. Collectors who prefer the encapsulated coins are not concerned with the package. Some dealers will sell the package without the coin for a few dollars, but for collectors of graded coins, this is not a priority.

2007 Reverse Variety

In 2008, the U.S. Mint updated the reverse dies of the American Silver Eagle, giving it a slightly different appearance. The reverse die was only supposed to be used on collector American Silver Eagle coins in 2008 before being used for bullion coins in 2009.

As a result of the human factor required with operating the minting equipment at the West Point Mint, the reverse dies used for the 2007 American Silver Eagle coins were mated with 2008 collector coins creating a new variety for collectors. These coins are known as a 2008-W Silver Eagle Reverse of 2007 Variety.

The 1995-W

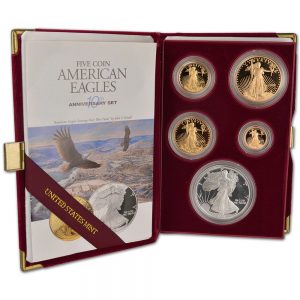

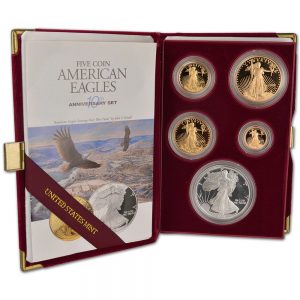

Tenth Anniversary American Eagle Set

In 1995, the U.S. Mint created the 10th Anniversary American Eagle set to celebrate the program’s decade. The set contained a 1995-W American Silver Eagle proof coin that was made available only to collectors buying the set. Collectors wanting to add the 1995-W American Silver Eagle proof coin to their collection had to purchase the entire five-coin set that included four American Gold Eagle proof coins ($5, $10, $25, and $50 gold American Eagles). The $999 price for the set helped limit the number of coins sold.

As gold prices have risen, collectors sold the gold coins separately. However, the limited availability has caused the 1995-W American Silver Eagle to rise significantly on the secondary market. Cost to purchase this coin averages about $5,000-6, depending on the grade and finding the entire set with the American Gold Eagle coins in their original government package averages over $8,000.

Special Sets

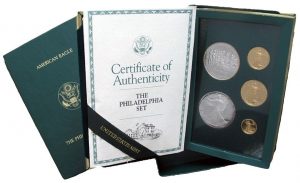

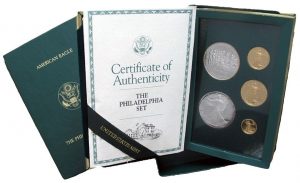

In 1993, the U.S. Mint offered The Philadelphia Set, which was issued to commemorate the 200th Anniversary of the striking of the first official U.S. coins at the Philadelphia Mint. This set included each of the Proof American Gold and Silver Eagles struck at the Philadelphia Mint and containing the “P” mintmark. The set included a 1993-P Proof Silver Eagle along with the one-half ounce, one-quarter ounce, and one-tenth ounce 1993-P Proof Gold Eagles. Also included was a silver Philadelphia Bicentennial Medal, which specially produced for this numismatic product.

In 1993, the U.S. Mint offered The Philadelphia Set, which was issued to commemorate the 200th Anniversary of the striking of the first official U.S. coins at the Philadelphia Mint. This set included each of the Proof American Gold and Silver Eagles struck at the Philadelphia Mint and containing the “P” mintmark. The set included a 1993-P Proof Silver Eagle along with the one-half ounce, one-quarter ounce, and one-tenth ounce 1993-P Proof Gold Eagles. Also included was a silver Philadelphia Bicentennial Medal, which specially produced for this numismatic product.

To mark the launch of the new American Platinum Eagle bullion and collector coin series, the U.S. Mint offered the 1997 Impressions of Liberty Set. This set contained the one ounce 1997-W Proof Platinum Eagle, one ounce 1997-W Proof Gold Eagle, and one ounce 1997-P Proof Silver Eagle. Production was limited to 5,000 individually numbered units. The serial number for each set was engraved on a brass plate affixed to the wooden display case.

In 2004, the U.S. Mint worked with the United Kingdom’s Royal Mint to create a numismatic product containing the silver bullion coins from each country. The Legacies of Freedom Set contained one 2003 American Silver Eagle bullion coin and one 2002 British Silver Britannia bullion coin. The special packaging highlighted the importance of the two national icons.

To celebrate the 150th Anniversary of the founding of the Bureau of Engraving and Printing and the 220th Anniversary of the United States Mint, the two bureaus joined together to release the 2012 Making American History Coin and Currency Set. The set contained a 2012-S American Silver Eagle Proof coin and a $5 note with a serial number beginning in “150.”

As part of the 2016 Ronald Reagan Coin and Chronicles Set the U.S. Mint included a 2016 Proof American Silver Eagle along with a 2016 Ronald Reagan Presidential reverse proof dollar, and a Nancy Reagan Bronze Medal. To complete the set, it included a presidential portrait produced by the Bureau of Engraving and Printing and an informational booklet about President Reagan.

In 2019, the U.S. Mint partnered with the Royal Canadian Mint to issue the Pride of Two Nations silver coin set. The set contained a reverse proof American Silver Eagle struck at West Point and a reverse proof Silver Maple Leaf struck at the Royal Canadian Mint’s facility in Ottawa, Ontario. Production was limited to 100,000 sets in the United States and 10,000 sets in Canada.

Later in 2019, the U.S. Mint released an Enhanced Reverse Proof coin struck at the San Francisco Mint. Its mintage limit of 30,000 coins is less than the number of 1995-W coins issued.

Annual Sets

To extend the product line, the U.S. Mint began to create special annual issue sets to entice people to collect U.S. Mint products. The first annual set containing an American Silver Eagle coin was the Annual Uncirculated Dollar Coin Set. First offered in 2007, the set includes the issued uncirculated Presidential dollar coins, an uncirculated Native American dollar coin, and an uncirculated American Silver Eagle. Since the Presidential Dollar Program ended in 2016, it is unclear whether the U.S. Mint will issue the set in 2017.

Since 2012, the U.S. Mint has been producing the Limited Edition Silver Proof Set that contains 90% silver versions of the year’s five America the Beautiful Quarters, Kennedy Half Dollar, and Roosevelt Dime, along with the standard annual Proof American Silver Eagle. Sets are limited to 50,000 units annually.

Starting in 2013, the U.S. Mint has been producing the Congratulations Set as part of a new line of products targeted towards gift-giving occasions. The set includes the standard annual Proof Silver Eagle within specially designed packaging that allows the gift giver to add a personalized message.

Anniversary Sets

2011 American Silver Eagle 25th Anniversary Set

Since the American Eagle Program has been one of the most successful programs in the history of the U.S. Mint, they have used its popularity to extend the product line. Aside from celebrating the anniversary of the program, the U.S. Mint has produced anniversary sets to celebrate Mint facilities.

The Anniversary sets issued are as follows:

- 1995 American Eagle 10th Anniversary Set included a 1995-W American Silver Eagle Proof coin and four American Gold Eagle coins.

- 2006 20th Anniversary American Silver Eagle Set was a special three-coin box set included a 2006-W American Silver Eagle with a burnished (satin) finish, a 2006-W American Silver Eagle Proof coin, and a 2006-P American Silver Eagle Reverse Proof coin.

- 2011 25th Anniversary American Silver Eagle Set was a five-coin box set that contained five different coins. The U.S. Mint produced only 100,000 sets that sold out within the first 10 minutes they were offered online. This extremely popular set is averaging $800 on the secondary market in the original government package. The set includes the following coins:

- 2011-W (West Point) American Silver Eagle Uncirculated coin

- 2011-S (San Francisco) American Silver Eagle Uncirculated coin

- 2011-W (West Point) American Silver Eagle Proof coin

- 2011-P (Philadelphia) American Silver Eagle Reverse Proof coin

- 2011 (no mintmark) American Silver Eagle Bullion coin

- 2012 American Eagle San Francisco Two Coin Silver Proof Set was issued to celebrate the 75th anniversary of the current San Francisco Mint. The set included a 2012-S American Silver Eagle Proof coin and a 2012-S American Silver Eagle Reverse Proof Coin.

- 2013 West Point American Silver Eagle Set was issued to celebrate the 75th anniversary of the facility in West Point, New York. The set included a 2013-W American Silver Eagle Reverse Proof coin and a 2013-W American Silver Eagle Enhanced Uncirculated coin. The set was instantly popular with collectors since it was the first appearance of the Enhanced Uncirculated finishing process.

Although the U.S. Mint did not issue a set to celebrate the 30th Anniversary of the American Silver Eagle in 2016, West Point struck proof and burnished uncirculated collector coins with edge lettering that read “30TH ANNIVERSARY.”

Rolls and the Green Monster Box

Bullion coins are packaged in 20-coin hard plastic rolls with 25 rolls packed in a specially designed green box that contains 500 troy ounces of silver. The U.S. Mint seals the box before shipping them to authorized purchasers. The term Green Monster Box refers to the green box with 500 silver coins.

Resellers sell Green Monster Boxes with the intent of selling to investors. Resellers also sell unopened rolls from the Monster Box.

Sealed Green Monster Boxes have the benefit of being unsearched and unhandled since leaving the U.S. Mint. These boxes are usually offered for sale by bullion dealers at a small premium over the current market (spot) price of silver. Unsealed Monster Boxes with the U.S. Mint’s labels intact can attest to the authenticity of the coins.

In the next installment, we look at the American Gold Eagle coins.

All images courtesy of the U.S. Mint unless otherwise noted.

May 10, 2020 | bullion, coins, Eagles, grading, markets, news, silver

Is it Sunday already?

Is it Sunday already?

This past week, the numismatic world was greeted with the news that the Philidelphia Mint struck a limited number of American Silver Eagle bullion coins to help fill the demand.

Most of the production of the American Silver Eagle bullion coins are in the West Point Mint. Sometimes, the San Francisco and Philadelphia Mints add capacity when necessary, with San Francisco being the priority. Since the West Point and San Francisco Mints temporarily closed because of the effects of COVID-19, Philadelphia picked up the slack.

The U.S. Mint produces all bullion coins without mintmarks. In most cases, it is impossible to tell which mint struck the coins. An exception is the 2015 (P) American Silver Eagles. Collectors and the grading services have been trying to figure out where the green monster boxes came from by examining the serial number and other clues. In 2015, Philadelphia struck just under 80,000 bullion coins. Those handling monster boxes noticed a difference in the packaging and quality.

According to the U.S. Mint, “Monster boxes of 2020 American Eagle Silver Bullion Coins minted in Philadelphia were affixed with a typed label containing the box tracking number; additionally, box tracking numbers were handwritten directly on the boxes. Box tracking numbers 400,000 through and including 400,479 were used on boxes of coins minted in Philadelphia.”

The 480 monster boxes translate into about 240,000 coins.

With that knowledge, the third-party grading services will add a special label noting that the coins were struck at Philidelphia only if the monster box sent for grading has the proper label and seal.

Of course, the price gougers are out in force. Most reputable companies are selling MS-70 graded “emergency” coins at around $250. That is about $200 over a “First Strike” or “Early Release” graded coins. One online seller is offering a pre-sale of the “emergency release” coins in MS-70 PCGS slabs with John Mercanti autographs for $595.

Coins graded MS-69 are selling for $75-80, which is $40-45 over other MS-69 graded coins.

Remember, if the listing says “pre-sale” it means that the seller does not have the coins in inventory.

And now the news…

May 6, 2020

With central banks spraying unprecedented amounts of printed money at the global economic system, it’s little wonder the gold price soared by 18% in the six weeks following the stockmarket meltdown. All the extra money sloshing around means the chances that consumer price inflation will take off and erode the value of your cash have risen sharply.

→ Read more at

theweek.co.uk

May 6, 2020

(Kitco News) – The last time the U.S. Mint sold this many platinum coins, President Bill Clinton was being tried by the U.S. Senate and Spongebob SquarePants was premiering on Nickelodeon. As of last month, the U.S. Mint said sales of the 1 oz platinum Eagle in 2020 reached 56,500 oz.

→ Read more at

kitco.com

May 8, 2020

A veritable gold mine of silver coins which had been hastily stashed inside a church in a ceramic jug hidden by a blind Polish priest over 300 years ago has been unearthed by workers removing rotting floorboards in the blind priest’s former church.

→ Read more at

thevintagenews.com

May 4, 2020 | bullion, commentary, counterfeit, news

This past week has been interesting for the precious metals markets. When the market seems like it will take off, prices modulate and lay flatter than a pancake. Predictions as what the markets will do are all over the place without a consensus answer from analysts.

This past week has been interesting for the precious metals markets. When the market seems like it will take off, prices modulate and lay flatter than a pancake. Predictions as what the markets will do are all over the place without a consensus answer from analysts.

It reminds me of the quote attributed to President Harry S. Truman, “Give me a one-handed Economist. All my economists say; ‘on one hand…,’ then ‘but on the other….’”

This past week, the Anti-Counterfeiting Educational Foundation (ACEF) weighed in with another problem in this market: COUNTERFEITING!

Counterfeiting is not a new problem. What makes the problem more pronounced is that with much of the country staying home and Internet usage increasing, the number of websites trying to scam people out of money has risen. ACEF has been monitoring the problem and has reported over 100 websites selling counterfeit coins and bullion to government enforcement agencies.

Many of these counterfeiters create slick websites. Not only is it easy to create professional-looking sites with modern tools, but it is easy to copy information from one website to another. Once the scammer has the information they want, it is easy to repurpose it to scam people. They also copy the text from legitimate websites, especially if English is not their first language. It is easier to steal the text than have to create their own.

- If the price is too good to be true, it is probably a scam. Check a site like kitco.com for the current Bid/Sell price. If the offer price is below the current Bid, be wary of the seller.

- Many scammers do not include real information about their location. Beware of the seller if they do not have a physical address. I know that there are exclusively online dealers that work from home but use post office boxes, so they do not publicize their home address. For those dealers, you will have to do more investigations. However, if the dealer is using a private postal box, you may want to avoid their offers. Private postal box services have fewer verification checks than the Post Office. Also, if something happens with a Post Office Box, you will have a stronger case when you complain to the Postal Inspection Service.

- Nearly everything said about addresses can apply to telephone numbers. Telephone numbers can be faked, rerouted, sent to a pay-as-you-go phone that some people call a “burner phone,” and so many more options. The problem also exists for toll-free telephone numbers but with an additional issue: when you call a toll-free telephone number, the owner of the number will get the phone number of the telephone you used to call. Since the recipient is paying for the call, they have the right to know where the call originated.

“But Scott,” you ask. “How do I figure out if this information is real?”

Let your favorite search engine be your friend.

Use your favorite search engine and type the address into the search bar. What information comes up for that address? Is the address a business? A private home? A private mailbox service?

Use an online map service that shows street views, like Google Maps. Search for the address found on the website. What can you learn from looking at the street view?

You can also enter the telephone number as a search term. In many cases, you will find one of the many “is it a scam” websites. These sites rely on users to enter data about their experiences with the telephone number. Click on a few to see what others have said about the telephone number in question.

With those essential tools, you should be able to avoid most scammers. Unfortunately, the professional scammers know their way around these issues. Then again, some of those scammers work out in the open. They run legally but use emotion, patriotic-sounding buzzwords, and extremist rhetoric to convince buyers to overpay for their products.

If you think you have been scammed or there is a question about a dealer, contact the ACEF (www.acefonline.org) and ask for assistance.

Finally, if you are in the market to buy precious metals, you should consider working with a member of the Accredited Precious Metals Dealer program (www.APMDdealers.org).

And now the news…

April 27, 2020

Retail investors can’t seem to get enough of gold during the coronavirus crisis, and they are willing to pay staggering amounts to get their hands on it. Consumers who want to buy gold coins typically have to pay more than the per-ounce prices quoted on financial markets in London and New York.

→ Read more at

bloomberg.com

April 29, 2020

Our guest column this week is a report on a study done by accessibility consulting and assistive technology firm BarrierBreak on the new currency coins launched by the Reserve Bank of India that claim to be accessible to people with visual impairments.

→ Read more at

newzhook.com

April 29, 2020

Australia’s largest gold refinery has ramped up production of one kilogram bars to ease the supply squeeze in the U.S. that helped propel a surge in the premium for New York futures.

→ Read more at

finance.yahoo.com

May 1, 2020

With central banks spraying unprecedented amounts of printed money at the global economic system, it’s little wonder the gold price soared by 18% in the six weeks following the stockmarket meltdown. All the extra money sloshing around means the chances that consumer price inflation will take off and erode the value of your cash have risen sharply.

→ Read more at

moneyweek.com

Apr 5, 2020 | bullion, gold, markets, news, silver

I know it is difficult to turn away from the news. It is like watching an automobile accident in slow motion. Every day it seems like there is something else. Unfortunately, this is true about the precious metals market.

Europe, which appears to be taking the closings and stay-at-home orders better than the United States, is trying to figure out what will happen to the economy after everything reopens. That is wreaking havoc with the market.

In one story, Germany is beginning to buy gold in preparation for future spending while institutions in Italy are selling gold to stay afloat. While African mines continue to bring metals to the market, investors are buying gold as a hedge for an uncertain future.

In the last 30-days, the price of gold has bounced back almost to pre-market shaking announcements about COVID-19 in the United States. Other metals have not been as active. According to a source, the only thing keeping the price of silver somewhat stable is its industrial use.

Coins and other collectibles that are sensitive to the precious metals market will begin to see a disparity in prices. Common gold coins whose price is tied to the metals market will rise. Silver coins will likely not move on the metals market.

During a conversation with a professional metals trader, I asked what is next for the market. A person who usually has an answer said that he did not know. He said that most traders are not trying to predict the market but react to whatever happens. One of the problems is that the computer models are wrong. In many cases, firms have halted automated metals trading. He said that the situation is so fluid that some of the computer models were buying from themselves.

If you watch the business news on cable television, you will hear a different opinion from every guest. I plan to use the advice given to me: prepare for the worst and turn off the television.

And now the news…

April 1, 2020

On that day, men shall fling away, To the flying foxes and the bats, The idols of silver And the idols of gold Which they made for worshiping. Isaiah 2:20

→ Read more at

breakingisraelnews.com

April 2, 2020

When people are worried about the future they turn to gold to protect their savings. That’s rarely been more true than today.

→ Read more at

finance.yahoo.com

April 2, 2020

I estimate that the Germans own 9000 tonnes in private gold-nearly as much gold as the French and Italians have combined. The World Gold Council (WGC) states there are roughly 198,000 tonnes of gold above ground, of which 35,000 tonnes is held by central banks.

→ Read more at

seekingalpha.com

April 3, 2020

Polish archaeologists have uncovered a treasure trove of Roman denarii coins. They date from the first and the second century BC, and they probably belonged to a member of a Germanic people who lived in the area at the time.

→ Read more at

ancient-origins.net

April 3, 2020

While removing the floor of the church in Obišovce near Košice, the foundations of the old church were uncovered. After this discovery, the archaeological company Triglav conducted research that took place at the beginning of February 2020, the Regional Monuments Board Košice reported.

→ Read more at

spectator.sme.sk

Mar 29, 2020 | bullion, news, policy

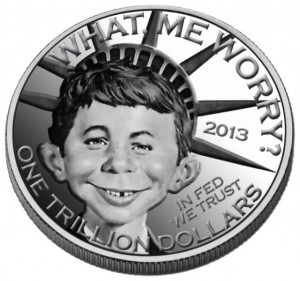

In 2013, Heritage Auctions asked the public to suggest names and and designs for the mythical $1 trillion coin. This was one of the proposals.

This time, the scheme was cooked up by Rep. Rashida Tlaib (D-MI), a freshman member of Congress. Apparently, Tlaib read that the Federal Reserve has more than a $2 trillion surplus. Rather than allow the Fed to use it to sure up financial systems in a crisis, she wants to transfer the money out of the semi-autonomous agency and put it in the general treasury to fund her version of a stimulus.

It is not the first time in the last ten years this idea came up. Back in late 2012, conservative pundits pushed Congress to do the same thing. The drumbeat for this idea became so loud that cooler heads finally prevailed, and the jokes about how to design such a coin quickly faded into history.

Tlaib is trying to learn from history by proposing that not only should the coins be struck but transferred to the Federal Reserve. By removing the $2 trillion liability from the Treasury Department’s books, it places the debt on the Federal Reserve.

If we were to ignore the law (31 U.S.C. §5136) will require the U.S. Mint to deposit the money int into the United States Mint Public Enterprise Fund, the costs of striking these coins including the design and administration is required to be deducted from the $2 trillion. It is a small percentage of the total, but it counts.

Then there is the question of operating capital. What will the Federal Reserve do if it needs the money to keep banks open during this crisis? By taking its operating capital, the Federal Reserve will have to raise money on a market that will become more restrictive when the United States central bank cannot perform. One analyst said it would be like tying the Fed’s arms and throwing them into the deep end of the pool. Everyone will panic, jump in to save them, and will drown.

To make the ensuing chaos even worse, to prevent the bank failures and to prop up the bank-related insurance programs, like the Federal Deposit Insurance Corporation (FDIC), Treasury will have to get very creative to fund the insurance program. Like they did in the late 1980s during the Savings and Loan fiasco, the Treasury had to sell bonds and bills to make the depositors whole. Back then, the economy was better, and there were willing buyers. Today, if the coronavirus crisis continues and worldwide investors become spooked because the Fed failed to help, the costs of that paper (interest rate) will skyrocket.

When the government borrows money on the open market at high interest rates, the payment for just the interest (servicing the debt) becomes part of the national debt.

Take two platinum coins and give them a face value of $1 trillion each. Make the Federal Reserve buy these coins. The result will be a ripple of actions disrupting everything, like when a stone is thrown in the middle of a calm lake.

There was a time when freshman members of Congress were pushed to the background and told to shut up and learn. It was to allow them to learn from more senior members and to prevent them from saying and doing stupid things. Maybe Congress should go back to that practice.

And now the news…

March 23, 2020

Two styles of silver coins at the Perth Mint. Photographer: Carla Gottgens/Bloomberg

→ Read more at

bloomberg.com

March 24, 2020

The fifth auction of coins from the legendary D. Brent Pogue Collection skyrocketed to a total of more than $15 million at Stack’s Bowers Galleries in Santa Ana last week.

→ Read more at

news.justcollecting.com

March 25, 2020

Stock market crash safety sought by concerned investors is coming in the form of shiny precious metals that include gleaming gold and silver coins. Even though stock market drops usually coincide with a price hike in gold and silver, both equities and precious metals soared on March 24 when the Dow Jones Industrial Average jumped 11.37%, or 2,112.98 points, to reach 20,685.04 for its biggest percentage gain since March 1933 and its largest point rise ever.

→ Read more at

stockinvestor.com

March 27, 2020

— A proposal to land the Apollo lunar module on the reverse side of a new $1 coin has been waved off by the committees reviewing the design.

The historic moon lander was among the three subjects considered for New York's dollar in the U.S.

→ Read more at

collectspace.com

March 27, 2020

Sales of retail gold coins are revealing just how desperate investors are to find a safe haven. People have always been willing to shell out more for retail coins than gold sold in the spot market. But that premium has more than doubled — and at times quadrupled — over the past two weeks as investors seek a safe place to park their cash in the face of global market turmoil.

→ Read more at

bloomberg.com

March 28, 2020

The frenzy to buy physical gold is driving demand for well-known coins like the Krugerrand, Maple Leaf, or American Eagle. A Swiss-issued coin is one of the few still to be had. The market for physical gold has dried up after four Swiss refineries were forced to shut due to the coronavirus, as finews.com reported on Tuesday.

→ Read more at

finews.com

Jul 29, 2019 | bullion, markets, news, silver

One of the indicators as to how the markets view the economy is the price of precious metals. When there is uncertainty in the markets, investors leave the equity markets and buy precious metals. When that happens, it will have an impact on most pre-1965 coins.

Marketwatch reported that silver hit a 13-month high about the same time Iran captured a Britsh tanker. Since then, the silver market leveled out with few signs of dropping. Silver is not selling for at the same level as seen during the economic crisis in as it approached 2011, there continues to be upward pressure on its price.

-

-

30-day Silver Chart (will not update—Courtesy of Kitco)

-

-

10-year Silver Chart (will not update—Courtesy of Kitco)

Silver investing is sometimes called the “poor man’s gold.” When the average investor is uncertain and looks for a safer investment, they will buy silver while the wealthier investors will buy gold. Palladium has emerged as the new investment vehicle for investors with means.

Gold has been more erratic with wild swings in both directions depending on the news of the day. A precious metals fund manager who manages several diverse portfolios called the divergence of the markets curious. There is not a clear explanation for the current rise of silver. If someone were trying to manipulate the market, the prices would climb faster. All she could tell was there were a lot of low-end investors buying into silver.

30-day Gold Chart (will not update—Courtesy of Kitco)

For numismatics, the rising price of silver can be problematics. As the price of silver rises, the value of your coins will increase. However, adding to your collection will cost more, especially on those collectible coins whose value is tied to the price of silver.

Those responsible for investing in these markets are beginning to worry. If investors are buying silver as a safe haven, there could be a feeling of a pending economic crisis. Only time will tell if they are right.

And now the news…

July 24, 2019

Present-day tenants of home owned by Jewish family before the Holocaust find jars containing 2,800 coins from as far back as the Roman Empire and as far away as India  → Read more at timesofisrael.com

→ Read more at timesofisrael.com

July 24, 2019

A hoard of Roman coins dating from the time of Queen Boudicca have been found by a metal detectorist in a field. What makes this find especially fascinating is that they may have been hidden there during one of the most interesting periods in Britain’s early history, the revolt against Rome led by the Celtic Queen Boudicca.  → Read more at thevintagenews.com

→ Read more at thevintagenews.com

July 24, 2019

Silver futures settle at a 13-month high on Monday, outpacing strength in gold, which saw prices eke out only a modest gain despite rising tensions between…  → Read more at marketwatch.com

→ Read more at marketwatch.com

Jun 30, 2019 | bullion, economy, gold, investment, markets, news

Price of Gold for the 2nd Quarter of 2019

(Chart courtesy of GoldSeek.com)

With the price of gold opening at $1,279.00 on January 2, 2019, it saw some bumps in its price but has largely averaged a modest gain until the price closed at $1,271.15 on May 21. Then it started to climb and climb rapidly by market standards. On Friday, June 28, the end of the second fiscal quarter, gold closed at $1,409.00. The rise is a 10.8-percent gain since May 21.

Gold is considered a safe bet for investors. It is a way of investing in cash or cash equivalence. Investors buying gold will purchase bullion, gold bullion coins like the American Eagle, or shares in a fund that maintains large stores of gold. There are many types of funds and ways to purchase shares in these funds, but it is not the same as owning the physical gold. Most reports are claiming that investors are interested in purchasing physical gold with bullion coins being the preference.

Investors make money by investing with what they consider a manageable amount of risk. If the risk pays off, they can make a lot of money. The risks that fail must be made up elsewhere. Investors diversify their portfolios to mitigate these risks. However, if the institutional and large investors are moving their monies to safe harbors, like gold, they sense a problem.

This relatively sharp jump in the price of gold is being driven by the major investors who are worried about the future of the U.S. economy. They see the various trade wars being detrimental to the economy. One economist said that the recent hike in soybean tariffs to China is going to have long term effects long after this president leaves office.

Although the United States is no longer an agrarian economy, agriculture plays a significant role in the country’s economic health. Upsetting that role that agriculture plays will cause long-term damage to the economy. The soybean tariffs are believed to be the driver that is scaring investors.

You may ask how are soybeans causing gold to rise?

As part of foreign policy in Africa, the government has been supplying countries with the proper climate the means to grow soybeans. It was a way to make the countries self-sufficient by helping create an economy. In many cases, the United States did not follow through on commitments to help with the infrastructure that is needed to create access to the markets. Countries needed irrigation and road improvements. Rather than helping with the upgrades, the United States government concentrated on the military aspects of these country’s problems. A policy of one-problem-at-a-time.

For at least 15 years, China has ignored the military issues and began to supply the money, supplies, and labor to fix the infrastructure. The Chinese government helped build irrigation systems, roads, and provided transportation to build these economies with the promise that China would buy their products.

Although there was significant Chinese investment in Africa, it was still cheaper to buy soybeans from the United States. That situation changed with the 25-percent tariffs placed on soybean exports. The tariffs raised the price of U.S. soybeans beyond what the Chinese would pay to the African exporters. Now China is importing soybeans from Africa while U.S. farmers are provided allegedly short-term subsidies from the federal government.

Now that the infrastructure is in place for China to import soybeans from Africa, the costs have reduced and is projected to have the long-term effect of lowering the U.S. market for soybeans in China. One economist said privately that even if the tariffs were reduced to pre-trade war levels, it might not make it economically viable for China to buy as much from the United States as it did in the past.

Institutional investors see the loss in revenue from China, the increased deficit in providing welfare to soybean farmers, and the danger of the business not returning to the United States. They also see the reduction of tariffs to Russia for wheat and that Russia is also looking to African and South American countries for wheat sources. The competition is making trade prices drop and is making it look like agriculture trade is in trouble.

If exports of United States agriculture are in trouble, then it will hurt the economy. With the uncertainty added to the risk profile investors and fund managers have to manage, they have turned to gold as the natural, safe harbor.

The rise in gold prices always helps numismatics. It helps boost the prices of gold and, by association, other rare coins. However, if the gold prices go up because of economic stress, it will not matter what happens to numismatic prices. Fewer people will be in the market to buy coins.

And now the news…

June 26, 2019

Gold is a hedge against financial risk, and coins offer convenience.  → Read more at marketwatch.com

→ Read more at marketwatch.com

June 26, 2019

COIN collectors can now get their hands on a Toy Story 4 50p piece – but you can’t use it in shops. The commemorative coin features popular character Woody in colour with the cowboyR…  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

Dec 2, 2018 | bullion, coins, foreign, markets, news, platinum

While watching the numismatic news that appears in non-numismatic sources, I noticed that regardless of the predictions of cashless societies taking over, there are a few countries with interest in coins for both commerce and collecting.

While watching the numismatic news that appears in non-numismatic sources, I noticed that regardless of the predictions of cashless societies taking over, there are a few countries with interest in coins for both commerce and collecting.

By far, the one country that seems to have an affinity for coins is India. The news consistently highlights collectors who have coin collections of all sizes and varieties. Whether it is someone who has collected old Indian coins dating back to the Britsh control of the country to someone that collects foreign coins from visitors, there seems to be a story about coin collectors in one of the many Indian news publications.

The other country I can count on for consistent numismatic-related stories is China. Aside from stories about coin shortages and how the poorer areas of the country are hoarding coins, Chinese collectors seem to gravitate toward precious metal coins. Interestingly, Chinese collectors seem to like silver coins even though investors are chasing gold. This is understandable since silver coins can be bigger and cost less.

Recently, it was reported that Chinese collectors are chasing platinum as an investment option. Reports are being circulated that Chinese markets are investing heavily in South African platinum mines allowing the production to increase. With the spot price of platinum ($802.00) lower than the spot prices of gold ($1,222.10) and palladium ($1,170.00), the growth of platinum investment options has grown. The Hang Seng ETF (exchange-traded funds) Index has noted a significant increase in the trading of platinum futures.

Several publications have asked if this means that China is attempting to corner the platinum market. Since I am not a financial analyst, I am not sure. As a numismatist, it is interesting to see that platinum has a growing interest in China.

And now the news…

November 15, 2018

Grab your metal detectors! We are seeking some of the most valuable treasures ever discovered. From buried treasures to sunken treasures, lying beneath villages, towns, cities, farms, riverbeds, and in…  → Read more at invest.usgoldbureau.com

→ Read more at invest.usgoldbureau.com

November 25, 2018

The National Bank of Romania (BNR) has issued several coins to mark the 100-year anniversary of Romania’s 1918 Union. They are a gold coin, a silver coin, and a brass collector coin for numismatic purposes, along with a brass commemorative circulation coin.  → Read more at romania-insider.com

→ Read more at romania-insider.com

November 26, 2018

Limited edition gold and silver coins commemorating the 70th anniversary of the first issuance of the renminbi (RMB) currency and establishment of China's central bank went on sale in China last Friday.  → Read more at gbtimes.com

→ Read more at gbtimes.com

November 26, 2018

The World Platinum Investment Council is pushing for new platinum products to lure Chinese investors into the metal, providing another source of demand for SA’s second-largest mineral export. Weibin Deng, China’s head at the council, which is financially backed by SA’s platinum producers to stimulate investment, outlined plans for coins, metal-backed exchange-traded funds (ETFs) and other products, targeting the country’s burgeoning middle class.  → Read more at businesslive.co.za

→ Read more at businesslive.co.za

November 26, 2018

The Celtic coins discovered in Slovakia were tetradrachms, which were the most precious coins available at the time. In the heart of Slovakia in Mošovce, archaeologists have unearthed 40 …  → Read more at inquisitr.com

→ Read more at inquisitr.com

November 27, 2018

Welcome back for Part II of our Most Valuable Treasure Discoveries series. Below is a continuation of some of the most remarkable treasures unearthed in recent history. The Staffordshire Hoard…  → Read more at invest.usgoldbureau.com

→ Read more at invest.usgoldbureau.com

November 28, 2018

THE CENTRAL Bank of Ireland has unveiled a special commemorative coin created to mark 100 years since Irish women won the right to vote.  → Read more at irishpost.com

→ Read more at irishpost.com

Sep 21, 2018 | bullion, coins, Eagles, palladium, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is last article of a 4 part series:

The American Palladium Eagle coin is the newest addition to the American Eagle program. The bill to create the program was introduced by Rep. Denny Rehberg (R-MT), the representative-at-large from Montana. Montana is home of the Stillwater Mining Company, the only producer of palladium in the United States. Stillwater also owns platinum mines that supply the U.S. Mint with platinum for American Eagle Bullion coins.

In the world of metal investing, palladium is behind gold, silver, and platinum in demand. Palladium is not as popular in the United States as it is in other countries. Palladium sells better than silver in Canada and Europe. It is rarer than gold, but a little more abundant than platinum but has the silky look of platinum while being almost as ductile as silver. Artists in Europe and Asia are beginning to use palladium instead of platinum for their higher-end designs.

The American Eagle Palladium Bullion Coin Act (Public Law 111-303) originally requested that the secretary study the feasibility of striking palladium coins and mint them if the study shows a market demand. Although the study showed that there is a market, it was not overwhelming. Based on the wording of the law, the U.S. Mint opted not to strike palladium coins.

In December 2015, Rehberg added an amendment to the Fixing America’s Surface Transportation Act or the FAST Act (Public Law 114-94, 129 STAT. 1875, see Title LXXXIII, Sect. 73001) that took away the U.S. Mint’s option. The first American Palladium Eagle bullion coins were struck in 2017.

Source of Metals

The law requires that the U.S. Mint purchase palladium from United States sources at market values. It allows the U.S. Mint to purchase palladium from other sources to meet market demands.

A difference between the authorizing law for the American Palladium Eagle and other coins in the American Eagle program is that there is no requirement for the U.S. Mint to produce proof coins. It will be up to the U.S. Mint to determine whether there is a collector demand and strike proof coins accordingly. How this differs from the rest of the American Eagle program will be tested the next time metals experience high investor demand.

The American Palladium Eagle Design

By law, the obverse of the American Palladium Eagle coin features a high-relief likeness of the “Winged Liberty” design used on the obverse of Mercury Dime. It is an acclaimed classical design as created by Adolph A. Weinman.

The law requires that the reverse used to bear a high-relief version of the reverse design of the 1907 American Institute of Architects medal. The AIA medal was also designed by Weinman. It is the first time that this design is featured on a legal tender coin.

-

-

Obverse features the Winged Liberty “Mercury” Dime design by Adolph A. Weinman

-

-

Reverse is the design used on the 1907 American Institute of Architects medal designed by Adolph A. Weinman

American Palladium Eagle coins are made from one troy ounce of .9995 palladium. The balance is copper. These coins are produced so that each coin states its weight and fineness and has a denomination of $25.

Bullion American Palladium Eagle Coins

The American Palladium Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but do not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins there are not produced for the collector market. As with other investments, American Palladium Eagle bullion coins are subject to taxes when sold and may be held in Individual Retirement accounts. Please consult your financial advisor or tax professional for the tax implications for your situation.

Collector American Palladium Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Palladium Eagle coins are produced only as proof coins.

The U.S. Mint began selling American Palladium Eagle Proof coins in 2018 with a limited production of 15,000 coins. The coins sold by the U.S. Mint are stored in a specially made capsule and that capsule is placed in a package similar to that used for other coins in the American Eagle program.

Since this program is new, there have been no special issues or the discovery of errors. As time passes, that will likely change.

When talking about markets, the central theme is that investors hate instability. Whether the conversation is with the professional market maker or the individual investor, there is much uncertainty in the current marketplace.

When talking about markets, the central theme is that investors hate instability. Whether the conversation is with the professional market maker or the individual investor, there is much uncertainty in the current marketplace. → Read more at fxstreet.com

→ Read more at fxstreet.com

→ Read more at mining.com

→ Read more at mining.com

→ Read more at ca.finance.yahoo.com

→ Read more at ca.finance.yahoo.com

→ Read more at timesofindia.indiatimes.com

→ Read more at timesofindia.indiatimes.com

This past week has been interesting for the precious metals markets. When the market seems like it will take off, prices modulate and lay flatter than a pancake. Predictions as what the markets will do are all over the place without a consensus answer from analysts.

This past week has been interesting for the precious metals markets. When the market seems like it will take off, prices modulate and lay flatter than a pancake. Predictions as what the markets will do are all over the place without a consensus answer from analysts.