Weekly World Numismatic News for October 3, 2021

The Sun is searching eBay for interesting coins and hyping the prices as part of their U.S. Edition (Image courtesy of The U.S. Sun)

In the U.K. version of The Sun, someone watches eBay auctions and writes about whatever sells for more than face value. There are many stories about the extraordinary prices for the sale of 50 pence circulating commemoratives, error coins, and some demonetized the Royal Mint issues.

Now that The Sun is publishing for the United States market, an editor is watching eBay for the sale of U.S. coins. Although most of the stories have been about error coins, they have picked up on higher prices of classic coins. Almost all of their stories have been about what appears to be well-preserved ungraded coins. These are the type of coins that someone might find in a relative’s draw.

These columns have a lot of fans in the United Kingdom. It will be interesting to see if they catch on in the United States.

And now the news…

→ Read more at livescience.com

→ Read more at livescience.com

→ Read more at businesstech.co.za

→ Read more at businesstech.co.za

→ Read more at rcinet.ca

→ Read more at rcinet.ca

→ Read more at irishcentral.com

→ Read more at irishcentral.com

→ Read more at news.abs-cbn.com

→ Read more at news.abs-cbn.com

Weekly World Numismatic Newsletter for April 15, 2018

The U.S. Mint has been without an appointed director since Edmund C. Moy resigned as the director effective on January 9, 2011, although he had vacated his office earlier. Moy’s term was to expire on September 5, 2011. He was one of the few officials from the George W. Bush administration to work under Barack Obama.

Moy will be remembered for the problems with the U.S. Mint’s website ablity to meet collector demand and the debacle over not having enough bullion planchets to meet demands of investors and collectors.

Ryder comes to the U.S. Mint after holding the position of Global Business Development Manager and Managing Director of Currency for Honeywell Authentication Technologies. As part of his work, Ryder worked with the Royal Mint during their development of the security technology that they are currently being used for the new one-pound coin.

During his confirmation, Ryder was asked about counterfeit technologies and how it could help in the United States. Although counterfeiting is a concern, current circulating coins are not the counterfeiter’s targets. For coins, the targets are the older collectible coins with an overwhelming target being Morgan and Trade dollars.

This is a return for Ryder who served as the 34th Director from September 1992 to November 1993 during the administration of President George H.W. Bush. His experience with running the U.S. Mint in the past and his work with Honeywell should help him be successful.

Welcome, Mr. Ryder and good luck!

And now the news…

Football fans were shocked to learn that Patriots tight end Rob Gronkowski is a coin collector. On Wednesday night ESPN Sports Business Reporter Darren Rovell tweeted a new detail about Gronkowski's $1million home being burglarized on February 5, the night the Patriots lost to the Philadelphia Eagles in Super Bowl LII.  → Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

To mark the 20th anniversary of Astana and the 25th anniversary of the national currency, the National Bank of Kazakhstan will issue a new series of commemorative coins. This is great news for numismatists of many countries.  → Read more at kazakh-tv.kz

→ Read more at kazakh-tv.kz

Bank tellers beware! A coin con man may be on a roll, warn North Vancouver RCMP – literally. The inventive fraudster recently bilked a bank in North Vancouver by cashing in what the teller believed were more than 45 toonies and leaving significantly lighter, pocketing $2,600 in bills.  → Read more at nsnews.com

→ Read more at nsnews.com

A junk dealer in Turkey returned 100 gold coins he found hidden away in an old stove, state run Anadolu news agency reported on Friday. Asir Ozturk, 36, has been making a living by collecting and selling junk materials in Burdur for the last 20 years, according to the report.  → Read more at thenews.com.pk

→ Read more at thenews.com.pk

In 1974, Reno stock investor and real estate man, Lavere Redfield, passed away at the age of 77 years. Lavere was born in Utah and his father died when Lavere  → Read more at elkodaily.com

→ Read more at elkodaily.com

When going picking, check the bookcase

When I go picking I look for the unusual. Whenever I walk into an estate sale or any other picking opportunity, I will find the most remote area and work from there. In most homes, I head for the basement and the garage. These are the places that people store things they did not want to throw out, It is where I find the most unusual items.

Lately, I have been finding that buying old books can be just as interesting. Aside from cultivating a small clientele of interested customers, I have found that people hide things in books, especially old books.

Not long ago I visited a difficult to find estate sale hoping to find something interesting. I did not find much but there were some books that had possibilities. At $2 each, I felt I could find a few gems.

Based on the type of books I found, the owner had a passion for European history. In addition to travel books and books about European influence on United States society, there was a two-volume set written in French.

My French is good enough to figure out that the books were published in 1899 Paris and were from the first printing of the first edition. For book collectors, once the book meets the condition test, these are the books they like. Since they were in good condition with nice covers I added them to my pile.

This past week I was going looking through the box of books. As I was cataloging them I will either scan the pages or fan them to see if I find something. Within these two volumes of French language books on European history, I found money.

I was a little surprised to see notes from the Central Bank of Egypt. Seven different Egyptian notes, mostly from the late 1980s. The face value of the notes totals 13 pounds.

- Obverse of the Egyptian banknotes found in a French language book about European history.

- Reverse of the Egyptian banknotes found in a French language book about European history.

Aside from being mostly in horrible condition, I do not recall any indication of books, magazines, or catalogs referencing Egypt of the Middle East or North Africa.

The best-looking note is a 25 piastre note (Pick #57a) but it looks water damaged. It was probably water damaged before being stored between the pages of the book since the book shows no effects from the storage.

Although the notes can be worth $5 for the 25 piastre note to $25 for the 5-pound note, that would be if they were in better condition. I am not sure the entire lot is worth $5!

The moral of this story is that if you go picking at estate sales, check the bookcase. You never know what might fall out when you fan the pages.

Add Scott Pruitt to the Challenge Coin ego list

Scott Pruitt, the 14th Administrator of the Environmental Protection Agency, has decided that rather than saving taxpayer money, he will spend additional money to have the EPA redesign the challenge coin that he uses on behalf of the EPA.

According to the New York Times, Pruitt wants to make the challenge coin bigger and to delete the EPA logo. According to a retired career EPA employee, it appears that Pruitt wants the coin to be all about him and not the agency.

The reverse side of the E.P.A. challenge coin conceived under Administrator Lisa P. Jackson, left, and the face of the coin issued when Gina McCarthy led the agency. (Photo Credit: Ron Slotkin/The New York Times)

“These coins represent the agency,” said Ronald Slotkin, who served as the director of the E.P.A.’s multimedia office. “But Pruitt wanted his coin to be bigger than everyone else’s and he wanted it in a way that represented him.”

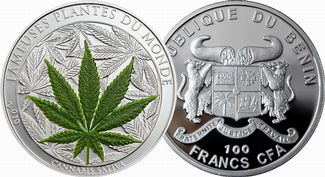

It is reported that Pruitt does not like the agency seal because (brace yourself) he felt it looks like a marijuana leaf!

- Official logo of the United States Environmental Protection Agency

- Leaf of the cannabis sativa plant

Pruitt is not the first agency head to extend his ego to challenge coins. Last fall, Interior Secretary Ryan Zinke commissioned his own challenge coin. At the time, it was thought to be the only Cabinet-level official to have his own challenge coin.

In order to create a new challenge coin, the manufacturer must create new dies. Making new dies does have a cost, as opposed to either using an existing die or having an existing design reworked. According to the website of Challenge Coins Plus, the company The New York Times story said was involved with making other challenge coins for the EPA, if Pruitt wants a 2.5-inch coin, the mold fees are $100 per side ($200 for both sides). Once the molds are made, 2-sided colored coins are $5.57 each for 2,000 coins ($11,140) without customizations such as custom edges and capsules.

However, Pruitt is not stopping with challenge coins. He has ordered pens, notebooks, and leather binders to exclude the logo and replaced with his name in a larger font. All at an additional charge to taxpayers.

At least when the U.S. Mint fails, it does not cost the taxpayers any money since the U.S. Mint’s operations are paid by the seignorage and not from the general treasury.

I guess Pruitt will not be collecting this 2010 Republic of Benin Marijuana Scented Coin!

Who is hurting the hobby?

I write this blog from the perspective of a collector. I champion the collector. I think that collectors are the most qualified to determine the direction of the hobby. The collector is the consumer and the consumer is almost always right.

When it comes to helping with the direction of the hobby dealers should also have a say. Their input is important. But they should be there to support the collector because without collectors the dealers have no business. Dealers should not be dictating the direction of the hobby.

Recently, I was listening to The Coin Show podcast hosted by Matt Dinger, a dealer in Indianapolis, and Mike Noodle, a collector that says he works in a coin shop (I think he said it was a part-time gig), and became very concerned when Matt said that the U.S. Mint was hurting the hobby.Regular listeners to The Coin Show knows that Matt is not a fan of modern coins and the products of the U.S. Mint. In fact, during the last show, he admitted to not carrying American Eagle coins because he does not want to support the U.S. Mint in damaging the hobby.

During the podcast, Mike came to the defense of U.S. Mint collectors but that defense was tempered when he said that collecting U.S. Mint products was for beginner collectors and that it was a way to start before the collector “graduate” to other collectibles.

I have questioned Matt and Mike in the past on Facebook but this time I felt their statements crossed a line. My regular readers know I can get hyperbolic but I try to remain respectful. As it happens on Facebook and anywhere else on the Internet, people cannot take the words at face value and have to read something into them.

This time I emphasized that not only do I collect U.S. Mint items but have not “graduated” to the type of collectibles Mike and Matt proclaim to be real collectibles. New readers can go through this blog and see how my collection can be classified as normal to eclectic.

After a lot of angry discussions (you will see a sample below) and some churlish responses from others (not Matt or Mike), I finally coaxed out the reasons for Matt’s hatred of modern U.S. Mint products. Unfortunately, it seems his reasons have more to do with the industry than the U.S. Mint.

According to Matt, the U.S. Mint is harming numismatics by selling annual sets like proof and mint sets at the prices they set. During the Facebook discussion, Matt and Sam Shafer, another Indianapolis-area dealer, said that they believe the U.S. Mint’s prices are too high.

From their perspective as dealers, they claim it is the U.S. Mint’s fault for the differences between the manufacturer’s suggested retail price the secondary market.

Using that logic, can I blame Chevrolet for the secondary market price of the 2014 Silverado I just purchased? If I tried, General Motors would laugh me under the tonneau cover of the truck! Yet, coin dealers are applauded for applying the same logic. This does not make sense.

How can you blame the manufacturer for the secondary market’s reaction?

Matt wrote, “I feel like the depreciation seen in modern sets is much more harmful to potential collectors or beginning collectors.”

I guess if General Motors followed that logic, they would stop making trucks!

But we are talking about collectibles. In that case, Topps, Fleer, and Upper Deck should stop producing baseball cards.

This is only an argument by dealers who would rather sell what they like and not take a broader view of the collecting market. In my new life, I am a collectibles and antiques dealer. The items I buy are either from the secondary market or I buy new items from manufacturers such as comic book and baseball card publishers.

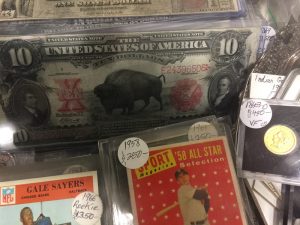

This 1901 $10 Dollar Lewis and Clark Bison note (Fr# 122) was sold by a dealer at an antiques show by a dealer not complaining about the collecting market.

The vast majority of dealers are very good and very reasonable. Many do understand the view of the collector and work with them. However, there is a subset of dealers that can be some of the most stubborn business people I know. They refuse to change with the market. Even if the market is not looking for their niche, they will not adapt to the market. Their mind is made up do not confuse them with facts.

They are also the most vocal in their opposition to market forces. Their usual retort is “you don’t understand, you’re not a dealer!”

With all due respect, I do not need to be a dealer to know that not changing with the times is doing more to hurt the hobby than the U.S. Mint is by doing its job.

Did you know that the Pobjoy Mint struck this coin under the authority of the British Virgin Islands. Is this good for the hobby? (Pobjoy Mint image)

The U.S. Mint does not offer dozens of non-circulating legal tender (NCLT) coins. U.S. Mint coins are struck and not painted. The U.S. Mint does not offer piedfort version of circulating coins or even coins guilt in gold or palladium. The U.S. Mint does not make deals with movie production companies, comic book publishers, or soft drink manufacturers to issue branded coins.

Every coin that the U.S. Mint offers for sale has an authorizing law limiting what they could produce. According to those laws, the U.S. Mint has to recover costs and is allowed to make a “reasonable” profit.

But what is reasonable? This is a question that has a lot of valid arguments on both sides. However, the U.S. Mint is subject to oversight by the Treasury Office of the Inspector General (OIG) and, occasionally, review by Congress’s Government Accountability Office (GAO). Neither oversight agency has produced a report saying that the U.S. Mint’s prices are unreasonable.

The U.S. Mint is selling what they manufacture at a price that the competent oversight agencies have not complained about. The only one complaining is by the dealers in the secondary market.

Why are these dealers complaining?

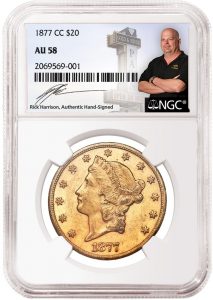

We get to the crux of the problem when Sam Shafer responds, “I would rather sell a customer a Morgan dollar than a set of glorified shiny pocket change.”

It does not take a rocket scientist to understand why a dealer would write that. A dealer makes more money selling Morgan dollars than modern coins. It is about business, not about what the U.S. Mint is doing. It is also a very reasonable response if the dealer would own up to the fact that it is about the impact to their business. Blaming the U.S. Mint is like crashing into a wall and blaming the wall for being there!

But Sam must have had some bad experiences: “How about you come down from your pedestal, put your loudspeaker up your rectum and work in a shop for a few years where you can witness the devastation of families first hand for a few years.”

This is a strong statement, even if you discount the placement of inanimate objects into bodily orifices they do not belong. What has the U.S. Mint done to cause “devastation?” The U.S. Mint sells products to those who want to buy them. You are not forced to buy from the U.S. Mint.

Sam continues, “While your [sic] at it maybe you can take up your glorious cause of finding homes for the 50 billon [sic] sets the government produced and bulk sold over the years to the collectors who assumed that 5 sets would better than 1.”

By Sam’s logic, it is the U.S. Mint’s fault that someone speculated and the investment did not pan out? Whose fault is that? Who told someone that buying these sets would be a good investment? Not the U.S. Mint! Where does the U.S. Mint say in any of its publications or website that coins make a solid investment? How could these speculators have come to this conclusion?

2018 Fiji Coca-Cola Bottle Cap-shaped coin is not a U.S. Mint product. It contains 6 grams of silver (about $3.20) and costs $29.95. Is this good for the hobby? (Modern Coin Mart image)

The U.S. Mint does not even acknowledge historical and aftermarket pricing for the items they manufacture.

The U.S. Mint sells collectible coins. They do not sell investments.

Over the years, I have received more complaints about dealers than allegedly worthless State Quarters or the U.S. Mint’s annual sets. But why are coins allegedly worthless?

Did the U.S Mint make claims that these one-time-only coins are really special and that they would be the greatest thing since sliced bread?

Did the U.S. Mint create rolls in sonically sealed plastic holders and tout them as the next great collectible?Did the U.S Mint create books, boards, folders, albums, maps, touting this as a once-in-a-lifetime way to collect?

All this came from the secondary market. Who runs the secondary market? DEALERS!

DEALERS set the values for the coins based on what they sell them for.

DEALERS take coins and entomb them in sonically sealed plastic holders saying that this is how you should be collecting. They tell you one encapsulating service is better than another and then make you pay different prices if you use a service they do not like even if the number assigned as a grade is the same on both pieces of plastic.

DEALERS have convinced an entire class of collectors that if they do not have a plastic holder with this new, whiz-bang label that their collection is not complete.

DEALERS have also complained about whose name and image have appeared on some of those labels.DEALERS genuflect when someone puts a shiny green sticker on a plastic holder as if it was blessed by some deity. They prostrate themselves if the plastic holder is granted that divine gold sticker! After preaching this gospel to their flock, you are considered a heretic if you question the validity of the sticker and the motives of the sticker maker.

While the U.S. Mint is not perfect, the problems with the numismatic market have not been created by a tightly regulated government bureau. The problems come from the secondary market whether they are overstating the values of these items or demeaning collectibles that they cannot make a hefty profit on.

Maybe it is time for dealers to look in the mirror and ask whether the U.S. Mint is hurting the hobby or maybe they are refusing to recognize the problem is right in front of them.

Weekly World Numismatic News for April 8, 2018

The Royal Canadian Mint has officially Jumped the Shark!

2018 Canada $20 coin commemorates the 1967 Falcon Lake alleged UFO incident. (Source: Royal Canadian Mint)

Popular usage has been those times when a show, company, or anyone does something so outlandish to attract attention that was once lost.

One might say that the Royal Canadian Mint might have jumped the shark in the past, but they have really outdone themselves this time. They issued a one-ounce silver, $20 face-value non-circulating legal tender (NCLT) coin to commemorate an alleged UFO sighting.

When it goes on sale, the will cost $129.95 ($101.69 USD).

Aside from being 6.22-times the spot price of silver, the design is printed on the egg-shaped planchet. There appears to be nothing about the coin that is struck.

I have heard some say that things the U.S. Mint is doing is bad for the hobby. Some have targeted the American Liberty 22th Anniversary Gold Coin as being over the top. Although I have a problem with the coins having a high premium over spot prices, the coin pales in comparison to the UFO and other lenticular coins being offered by the Royal Canadian Mint.

And now the news…

Sales in March of U.S. Mint American Eagle gold fell to their lowest for the month, and silver coins dropped to their lowest in 11 years, government data showed.  → Read more at cnbc.com

→ Read more at cnbc.com

Scientists are left wondering how the coins remained hidden for so long.  → Read more at newsweek.com

→ Read more at newsweek.com

A Long Island businessman who built a textile empire by peddling irregular sweaters at local flea markets thought he had a fool-proof way to boost his assets — invest in a pal’s coin business. Bad …  → Read more at nypost.com

→ Read more at nypost.com

The oval-shaped coin immortalizes Stefan Michalak’s experience in Whiteshell Provincial Park, more than 50 years ago in what became known as the Falcon Lake incident.  → Read more at thestar.com

→ Read more at thestar.com

The Royal Canadian Mint has released a new $20 coin to commemorate one of Canada's closest encounters with a UFO.  → Read more at ctvnews.ca

→ Read more at ctvnews.ca

Now that the nation has a $1.3 trillion budget, lawmakers can resume debate about whether to pinch pennies. The threat to do away with pennies and nickels  → Read more at newsherald.com

→ Read more at newsherald.com

A trove of bronze coins, the last remnants of an ancient Jewish revolt against the Roman Empire, have been discovered near the Temple Mount in Jerusalem.  → Read more at foxnews.com

→ Read more at foxnews.com

Medieval coins dating back 800 years have been unearthed in north Shropshire.  → Read more at shropshirestar.com

→ Read more at shropshirestar.com