Weekly World Numismatic News for June 12, 2022

Copper was a crucial element in making bullets for the war efforts. With the production of war materials increasing, congress and the U.S. Mint thought that striking the cent using another metal would help. After testing different materials in 1942, the U.S. Mint selected a zinc-coated steel planchet. In 1943, the U.S. Mint produced 1,093,838,670 steel cents between the three mints.

The coins were not well received by the public. Their size and lighter weight caused many people to confuse the steel cent with the dime. The zinc coating would wear as the coin circulated, allowing rust to form on the steel.

With over 1 billion coins struck, there are plenty of opportunities to collect steel cents. At the time, some people saved rolls, and others put the coins aside because they did not like to use them. They can be purchased online or from many dealers.

When looking for steel cents for a collection, look for a coin that continues to show its zinc color. The zinc will be a semi-bright silvery color that does not have a very shiny look. Grey-looking and dark grey coins have been handled and should be less expensive.

Nice examples of Steel Cents are not expensive. With over 680 million struck in Philadelphia, uncirculated examples of those coins cost $2.50 – $3.00. There were over 210 million struck in Denver, uncirculated 1943-D steel cents will sell for $3.25 – $4.00. There were fewer steel cents struck in San Francisco. Over 190 million struck, uncirculated 1943-S coins cost $5.00 – 6.50.

When buying coins for your collection, be careful with coins that look shinier than others. These coins may be reprocessed Steel Cents. Reprocessed steel cents are real coins but have a new coating of polished zinc. While they are pretty coins, numismatists consider these coins damaged and advise not collecting them if you are looking for value.

Rather than continuing to use the steel planchet, the U.S. Mint used copper recovered from the spent shell casing used for ammunition. The shell casing came from the training fields in the United States and not from the battlefields.

In 1944 and 1945, spent ammunition provided the copper used to strike Lincoln Cents. These coins are known as shotgun case cents and are darker than other copper coins because the smelting process could not remove all of the impurities from the ammunition.

There are famous 1943 Lincoln Cents struck on copper planchets, and 1944 cents struck on steel. These are rare coins and not as readily available.

The 1943 Steel Cent is the only circulating coin ever produced by the United States Mint that does not contain copper. Collecting a complete three-coin set adds a historic coin to your collection at an affordable price.

And now the news…

→ Read more at kafkadesk.org

→ Read more at kafkadesk.org

→ Read more at thehansindia.com

→ Read more at thehansindia.com

→ Read more at presstv.ir

→ Read more at presstv.ir

→ Read more at the-sun.com

→ Read more at the-sun.com

→ Read more at poncacitynow.com

→ Read more at poncacitynow.com

Weekly World Numismatic News for October 17, 2021

One of the reasons for the delay with the Weekly World Numismatic News is that I have been looking into a report of worldwide e-commerce issues under the radar.

One of the reasons for the delay with the Weekly World Numismatic News is that I have been looking into a report of worldwide e-commerce issues under the radar.

After ordering a box of flips and other storage products from a small company, a representative called to say that the transaction did not go through. According to the representative, overseas attackers are trying to hack shopping cart sites to steal merchandise and credit card information. Rather than attacking the entire site, the hackers are targeting individual shops. They are looking for sites that are not configured correctly.

During the telephone call, the representative said they turned off credit card verification and the system “throws the credit card away.” I know this vendor, but I am still not comfortable.

E-commerce is supposed to make purchasing goods and services more accessible. But when hackers are driving vendors to verify credit cards by telephone, it is not making e-commerce easy. Thankfully, I received an announcement for local shows. Maybe it’s time to spend money there.

By the way, a source told me that the Baltimore Convention Centre would be open when the Whitman Expo is scheduled in November.

And now the news…

→ Read more at stltoday.com

→ Read more at stltoday.com

→ Read more at kiro7.com

→ Read more at kiro7.com

Weekly World Numismatic News for October 10, 2021

The weekly numismatic news report is late for the same reason the U.S. Mint cannot run an ordering system. It seems that the dangers to online systems are growing.

The weekly numismatic news report is late for the same reason the U.S. Mint cannot run an ordering system. It seems that the dangers to online systems are growing.

Every week, I am receiving reports from collectors being scammed by Chinese counterfeiters. People are providing pointers to websites and other sellers that are pushing counterfeit coins. The most common coin is the American Silver Eagle.

Last week, the parent company of HiBid, one of the largest online auction platform after eBay, was struck with a ransomeware attack. HiBid was taken down Thursday, September 30 through Monday, October 4. To add insult to injury, HiBid crashed again on Sunday, October 10 because bidders overloaded their systems.

As I am looking for new business opportunities, several eBay sellers are also looking for alternate selling venues. They are complaining about how eBay has handled the conversion to charging sales tax collection. New programs do not include the small sellers. Although eBay has always preferred high-volume sellers, now they are adding programs to benefit those that sell high-value items. And some sellers are reporting driven crazy by eBay’s new payment system.

With all this happening, then how does one buy online? I have been buying from eBay. It has been a convenient way to find interesting out-of-print numismatic books and tokens from New York. My other buying venues have been the U.S. Mint, the Royal Mint, and Apmex.

Maybe it’s time to look for other purchase venues.

→ Read more at news.sky.com

→ Read more at news.sky.com

→ Read more at cphpost.dk

→ Read more at cphpost.dk

→ Read more at kentonline.co.uk

→ Read more at kentonline.co.uk

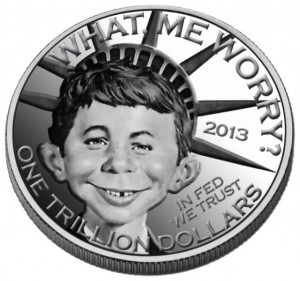

The $1 Trillion Coin Will NEVER Be Struck

(Image courtesy of Heritage Auctions)

Also turning up are all pundits, politicos, reporters, and sycophants explaining why the U.S. Mint should or should not strike the coin. The problem is that EVERYONE IS WRONG!

Let’s look at the FACTS.

FACT: Before a coin leaves the U.S. Mint, the purchaser must pay for the coin.

The Federal Reserve purchases business strike coins at face value. The money is deposited in the U.S. Mint’s Public Enterprise Fund.

Collectors pay for collector coins through the U.S. Mint’s retail and e-commerce operations. When the money is collected, they deposit the funds in the U.S. Mint’s Public Enterprise Fund.

FACT: The United States Mint has successfully argued in court that a coin is not legal tender until it is paid for.

After the U.S. Mint discovered the existence of several 1933 Double Eagle coins that were supposedly melted, the Secret Service investigated and seized several coins. Through the 1950s, government lawyers argued that the coins were government property since the coin was never monetized.

During the case of the Farouk-Fenton double eagle coin, the government used the same argument. Even though there was an export license for the coin issued to King Farouk of Egypt, the government maintained that the lack of monetization made the coin illegal.

As part of the $7,590,020 paid for the 1933 Double Eagle in 2002, $20 of the purchase price was paid to the U.S. Government to monetize the coin. When Sotheby’s sold the coin in June for $18,872,250, the coin came with a certificate from the U.S. Mint declaring its Legal Tender status.

If the U.S. Mint does not monetize a coin until someone or entity buys it, then how will striking a $1 trillion coin help anything?

Even as crazy as government generally accepted accounting principles (GAAP) may appear to the commercial market, Government GAAP still requires double-entry bookkeeping. In double-entry bookkeeping, if an asset is added to one part of the ledger, there must be a debit on another.

Forget the political arguments about the debt. When the government needs money, it sells bonds to finance its obligation. The bond is the created asset, as the coin. The asset is purchased, adding cash to the general treasury. In bookkeeping terms, an asset entry and an associated debit entry.

Who is going to buy the coin?

The Federal Reserve is not going to buy the coin. Bonds, warrants, and other investments have tangible returns. The investments have value and can be traded on the equity markets keeping the books balanced. What happens if $1 trillion is tied up in a non-investing asset?

If the Federal Reserve buys the coin, the general treasury may see a $1 trillion windfall, but the Federal Reserve will have $1 trillion less economic power. It is $1 trillion less in short-term loans to large financial institutions and quantitative easing that is keeping the economy in control.

If the Federal Reserve buys the $1 trillion coin, it will create a $1 trillion hole in the economy.

The U.S. Gross Domestic Product (GDP), the monetary value of all goods and services, is estimated at $22.675 trillion. Taking $1 trillion out of the economy will reduce the economy by 4.4-percent.

As the Great Recession of 2008 raged, the GDP lost 1-percent of its value by 2009. If a one percent drop caused the most significant economic calamity since the Great Depression, what will happen if the GDP contracts by more than 4-percent?

Of course, Congress can pass a law that changes how the U.S. Mint determines the legal tender status of coinage they manufacture. But the likelihood of that happening is about the same as the U.S. Mint striking a $1 trillion coin.

Numismatic Legislation Review: Catching Up

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

Regardless of the side of the aisle you follow, Congress is a very frustrating body. Members live in their own world, interested in what they can do to make them look better. When a citizen is interested in something that is not prominent in the daily news cycle, the response is cold or non-existent.

In the last few months, I tried to inquire about the scheduling of hearings in the Congressional committees regarding coin legislation. There were no answers.

For the last ten years, every Congress has promised to return to regular order. It seems that what we have now is regular order, meaning that coin-related legislation will not be heard until a holiday period or during the lame-duck session in 2022.

Welcome to the new regular order.

H.R. 4429: Semiquincentennial Commemorative Coin Act

- a designation of the value of the coin;

- an inscription of the years 1776-2026; and

- inscriptions of the words Liberty, In God We Trust, United States of America, and E Pluribus Unum.

Treasury may issue coins under this bill only during the period beginning on January 1, 2026, and ending on December 31, 2026. All sales of coins issued shall include a surcharge as prescribed by this bill. All surcharges received by Treasury from the sale of such coins shall be paid to the America 250 Foundation to fund the restoration, rehabilitation, and interpretation of units of the U.S. National Park System and its related areas, as a legacy of the semiquincentennial commemoration.

S. 2384: Semiquincentennial Commemorative Coin Act

H.R. 4703: Sultana Steamboat Disaster Commemorative Coin Act of 2021

H.R. 5232: Working Dog Commemorative Coin Act

H.R. 5472: To amend title 31, United States Code, to limit the face value of coins.

Weekly World Numismatic News for October 3, 2021

The Sun is searching eBay for interesting coins and hyping the prices as part of their U.S. Edition (Image courtesy of The U.S. Sun)

In the U.K. version of The Sun, someone watches eBay auctions and writes about whatever sells for more than face value. There are many stories about the extraordinary prices for the sale of 50 pence circulating commemoratives, error coins, and some demonetized the Royal Mint issues.

Now that The Sun is publishing for the United States market, an editor is watching eBay for the sale of U.S. coins. Although most of the stories have been about error coins, they have picked up on higher prices of classic coins. Almost all of their stories have been about what appears to be well-preserved ungraded coins. These are the type of coins that someone might find in a relative’s draw.

These columns have a lot of fans in the United Kingdom. It will be interesting to see if they catch on in the United States.

And now the news…

→ Read more at livescience.com

→ Read more at livescience.com

→ Read more at businesstech.co.za

→ Read more at businesstech.co.za

→ Read more at rcinet.ca

→ Read more at rcinet.ca

→ Read more at irishcentral.com

→ Read more at irishcentral.com

→ Read more at news.abs-cbn.com

→ Read more at news.abs-cbn.com