Top 5 Numismatic Stories of 2021

The last two years have been a wild ride. Anyone who predicted what would have happened should be picking lottery numbers. For the rest of us, the predictable (i.e., the U.S. Mint) became unpredictable. The positives had a lot of negatives and what used to be extraordinary is now ordinary.

Without further ado, here are the top five numismatic stories for 2021.

5. Return of the coins shows

It isn’t easy to have any retrospective of 2021 without acknowledging how COVID-19 has affected the industry. At the beginning of 2021, there were cancelations of shows and other events. As the vaccines became more available and the infection rates declined, the shows returned.

It isn’t easy to have any retrospective of 2021 without acknowledging how COVID-19 has affected the industry. At the beginning of 2021, there were cancelations of shows and other events. As the vaccines became more available and the infection rates declined, the shows returned.

Smaller shows found hotels willing to lease larger rooms to allow the setup of a socially distance bourse. Like the World’s Fair of Money, Larger shows changed to provide for social distancing and limiting contact. Collectors that attended these shows called them a success. Still, the reports may be more emotional satisfaction after a year off.

Coins shows are adapting to an alleged new normal, and collectors are happy to get what they can. While it makes collectors happy, the looming threat of new variants may slow down the shows at the start of 2022.

4. The Positives and Negatives of the U.S. Mint

The U.S. Mint is the source of the items we collect and the biggest frustration experienced by the community. On the one hand, the manufacturing business of the U.S. Mint made it the biggest success story of 2021. Compared to the rest of the manufacturing sector, the U.S. Mint has been running in overdrive since mid-2020. The only manufacturer of United States coinage has produced more money than any three mints in the world combined.Even with the COVID issues, the U.S. Mint could produce the coins required by law, including the 2021 Morgan and Peace Dollars. Unfortunately, selling these coins revealed collectors’ frustrations with the U.S. Mint.

The U.S. Mint’s online order processing system may work without product release. Still, a major product release causes the system to fail. The product release was a perfect storm of a limited supply and a high collector demand. The result exposed how PFSWeb, the U.S. Mint’s contractor, created a system that could not handle the rush.

The U.S. Mint became more communicative with the numismatic press. During this communication, it was clear that Director David Ryder wanted to talk more about the successes. Unfortunately, the failures of the ordering system overshadowed any success. Ryder resigned as Director effective October 1, 2021.

The e-commerce system at the U.S. Mint is broken and needs to be replaced. Unfortunately, the open communications from the U.S. Mint indicate that they are planning to install a bandaid to cover up the system’s problems. Unless the U.S. Mint and PFSWeb make major changes to their online order system, the issues will continue into 2022.

3. 2021 Morgan and Peace Dollars

Numismatists know that 2021 marked the end of the Morgan Dollar series and the introduction of the Peace Dollar. Morgan Dollars may be the most collected coin in U.S. numismatics. The Peace Dollar was the coin promoted by former ANA President Faran Zerbe with support from the ANA. In 1921, the U.S. Mint produced both coins. What better way to celebrate the centennial is by creating tributes to both coins.

Numismatists know that 2021 marked the end of the Morgan Dollar series and the introduction of the Peace Dollar. Morgan Dollars may be the most collected coin in U.S. numismatics. The Peace Dollar was the coin promoted by former ANA President Faran Zerbe with support from the ANA. In 1921, the U.S. Mint produced both coins. What better way to celebrate the centennial is by creating tributes to both coins.

The tribute idea was popular by collectors suggesting that it would be a high-demand product. But the U.S. Mint found a way to destroy the movement. In a series of missteps, the U.S. Mint allowed its lawyers to restrict their ability to do its job. As a result, the U.S. Mint could not purchase enough planchets to satisfy collector demand.

It is difficult to call the program a success given its problems. But the coins were a sellout, and they continue to do well on the secondary market. The U.S. Mint announced that the program will continue in 2022, and hopefully, it will go better than the 2021 releases.

2. Million Dollar Coins No Longer a Surprise

1804 Class I Original Draped Bust dollar, PCGS Proof-68 and the finest known of its kind, acquired for a client by GreatCollections for $7.68 million. (Photo credit: Professional Coin Grading Service.)

The numismatic market is very active, and the price increase of significant rarities results from the active market. Although the market favors United States coins, the collectors extend their collections to coins made elsewhere. Of the ten-million-dollar coins sold in 2021, four were not U.S. coins.

Here are the coins that sold for more than $1 million in 2021:

| Sale Price | Coin Sold | Date Sold |

|---|---|---|

| $18,900,000 | 1933 Saint-Gaudens Double Eagle (King Farouk provenance) | June 8, 2021 |

| $9,360,000 | 1787 Brasher Doubloon – EB on Wing (ex: Stickney-Ellsworth-Garrett-Partrick) | January 21, 2021 |

| $8,400,000 | 1822 Half Eagle (ex: Pogue) | March 25, 2021 |

| $7,680,000 | 1804 Bust Dollar – Class I (one of 15 known) | August 18, 2021 |

| $5,280,000 | 1804 $10 Proof Eagle (Finest of Three known) | January 20, 2021 |

| $4,750,000 | 1907 Saint-Gaudens Ultra High Relief Double Eagle | April 6, 2021 |

| $2,640,000 | 1825 Russia Ruble Pattern with would-be Emperor Constantine | April 6, 2021 |

| $2,280,000 | 1928 China Pattern Dollar featuring the warlord Zhang Zuolin | April 6, 2021 |

| $2,280,000 | 1937 Edward VIII 5 Pounds Pattern (one of six known) | March 26, 2021 |

| $2,160,000 | 1928 China Pattern “Mukden Tiger” Dollar (one of ten known) | December 11, 2021 |

1. The Double Eagle That Flies Higher

Farouk-Fenton 1933 Saint-Gaudens $20 Double Eagle was sold by Sotheby’s for $18,872,250 in a June 2021 auction. (Picture Credit: PCGS)

Since that sale, several coins sold for more.

On June 8, 2021, Sotheby’s auctioned the Stuart Weitzman Collection, including rare Inverted Jenny Plate Block and the British Guiana One-Cent Black on Magenta stamps. The coin sold for a record $18,872,250.

It answers the question, “What is a coin worth?” What are you willing to pay for it?

Suffrage Centennial Commem passes the Senate

Congress may be filling out the 2020 commemorative coin calendar with the Senate passing the Women’s Suffrage Centennial Commemorative Coin Act (S. 1235). If passed by the House, the bill would require the U.S. Mint to issue a one dollar silver coin to commemorate women suffrage activists in 2020.

Congress may be filling out the 2020 commemorative coin calendar with the Senate passing the Women’s Suffrage Centennial Commemorative Coin Act (S. 1235). If passed by the House, the bill would require the U.S. Mint to issue a one dollar silver coin to commemorate women suffrage activists in 2020.

S. 1235: Women’s Suffrage Centennial Commemorative Coin Act

On August 18, 1920, Tennessee became the 36th state to ratify the 19th Amendment to the U.S. Constitution. Since there were 48 states in the union, 36 represented the three-quarters necessary to ratify the amendment.

S. 1235 was introduced in the Senate by Sen. Marsha Blackburn from Tennessee.

According to the bill the design of the coin is supposed to “contain motifs that honor Susan B. Anthony, Elizabeth Cady Stanton, Carrie Chapman Catt, Harriet Tubman, Mary Church Terrell, Alice Paul, Lide Meriwether, Ida B. Wells, and other suffrage activists of the late 19th century and early 20th centuries.” That is a lot of people to try to fit on a 1½-inch coin.

As with almost every other commemorative coin bill, the silver dollar will have a $10 surcharge. The surcharge will go to the Smithsonian Institution’s American Women’s History Initiative.

This bill does not mention mintage limits. It is possible to become the most produced commemorative coin of the modern era.

Next, the bill is sent to the House of Representatives for their vote.

May 2019 Numismatic Legislation Review

The legislative review is back after taking a month hiatus since there was nothing to report for April.

The legislative review is back after taking a month hiatus since there was nothing to report for April.

Legislation introduced in May is a bit different than others in that only one bill directly affects the section of the law that governs the U.S. Mint (Subchapter III of chapter 51 of title 31, United States Code). Let’s look at each of legislation submitted in May.

S. 1300: National Law Enforcement Museum Commemorative Coin Act

The National Law Enforcement Museum Commemorative Coin Act is a typical three-coin commemorative coin legislation ($5 gold, $1 silver, half-dollar clad) to raise money for a cause. If passed, this law will pay the surcharges to National Law Enforcement Officers Memorial Fund.

H.R. 2559: Gold Reserve Transparency Act of 2019

The Gold Reserve Transparency Act of 2019 calls for a complete assay, inventory, and audit of gold reserves held by the federal government. The proposed law requires that the location of all gold is documented “including any gold in ‘deep storage,'” the security of those places, and any transactions of that gold.

If enacted, the Comptroller General of the United States do this audit for the past 15 years and have it completed within 12 months and every five years. The law would require the complete audit to be made public with the only exception of the physical security issues.

COMMENTARY: Given the nature of the economy and a lot of other factors are the gold holds that important? The Federal Reserve reports that the M1 money supply is over $3.7 trillion and the M2 is over $14.5 trillion. Think of the M1 as cash used in commerce. The M2 represents all money, including those in savings, securities, or may have circulating restrictions. Even if the government were to account for every grain of gold as reported an in U.S. Mint’s annual reports, that would represent less than 1-percent of the M1.

Gold holdings are irrelevant to the strength of the United States economy. Maintaining the M1 supply is more critical because it is a measure of activity. Economists fear wild tariffs since it will have a direct effect on the M1 money supply. Changes to the M1 will alter the demand for the products produced by the U.S. Mint and Bureau of Engraving and Printing.

H.R. 2558: To define the dollar as a fixed weight of gold.

H.R. 2558 would require the Secretary of the Treasury “define the dollar in terms of a fixed weight of gold, based on that day’s closing market price of gold” and allow Federal Reserve Notes to be exchangeable for gold at that statutory rate.

COMMENTARY: This is a backhanded attempt to return the United States to the gold standard without the sufficient backing of gold that will support this effort. With the money supply being over $14 trillion, trying to match the amount of gold at market value to every U.S. dollar would cause a devaluation of the currency that it would not be economically viable to do business in or with the United States.

Further, the market price of gold is set by private banks, metals dealers, mining companies, and other financial companies from all over the world through the London Bullion Market Association (LBMA). Given the makeup of their membership, this bill will allow this market that includes people from Bahrain, China, Switzerland, Russia, and other countries where the United States may have disputes to have direct influence over the strength of the U.S. dollar.

The introduction of a bill like this makes for good talking points for a constituency that is ignorant of the ramifications of this law. It is not sound policy given the nature of the markets.

H.R. 2630: Cash Always Should be Honored Act

The Cash Always Should be Honored (CASH) Act states that “It shall be unlawful for any physical retail establishment to refuse to accept legal tender as payment for any products or services offered for sale by such physical retail establishment.” The bill allows exemptions for online and telephone-based transactions.

COMMENTARY: Although I believe in the power of spending the products of the U.S. Mint and Bureau of Engraving and Printing over using electronic means, it should not be the government’s place to tell anyone how to conduct business.

Another short-sighted bill that does not consider the modern economy because it does not consider changes to the concept of a physical retail establishment. For example, what about mobile-based commerce? Would the rideshare companies be required to take cash? What about the plumber who comes to fix your sink? What about the food truck where you might buy lunch?

For the numismatists, how would this affect dealers at a coin show? Will you be required to carry around a wad of currency to buy coins? Would there be a distinction between the dealer who only sells at shows versus a dealer with a shop who travels to shows?

It is another bill that looks better as part of talking points than its effects on the real economy.

H.R. 2650: Payment Choice Act of 2019

This Payment Choice Act of 2019 is similar to the CASH Act in that it will prohibit any business from refusing “to accept United States legal tender of cash as payment for goods or services,” post signs saying that the establishment will not accept cash, or charge a higher price for paying in cash. The bill exempts “any goods or services sold to the public by telephone, mail, or internet.”

COMMENTARY: See the commentary for the CASH Act, above.

Weekly World Numismatic News for June 2, 2019

The most interesting news of the week was not printed by a media outlet but by the Government Printing Office. On May 23, 2019, the GPO published an entry in the Federal Register saying that the U.S. Mint has priced the Pride of Two Nations Limited Edition Two-Coin Set at $139.95.

The most interesting news of the week was not printed by a media outlet but by the Government Printing Office. On May 23, 2019, the GPO published an entry in the Federal Register saying that the U.S. Mint has priced the Pride of Two Nations Limited Edition Two-Coin Set at $139.95.

Which two nations? Of course, if this is coming from the U.S. Mint, one of the countries is the United States. However, several reports claim that the second nation is Canada.

According to a source, the set will include a proof one-ounce American Silver Eagle coin and a proof one-ounce silver Canada Maple Leaf with a unique privy mark. There was no further information as to what the privy mark will be.

Production will be limited to 250,000 sets, according to the source.

The coins will be packaged and marketed by the U.S. Mint. The Royal Canadian Mint will also take orders for the set that will be fulfilled by the logistics contractor working for the U.S. Mint.

The source did not have information about the packaging.

The set will go on sale at the beginning of the World’s Fair of Money via Internet and telephone ordering only. Falling under the category that we can no longer have nice things, the U.S. Mint’s reticence to open sales at shows is a result of the fiasco that occurred when they released the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof coin at that year’s World’s Fair of Money.

Of course, no dealer was penalized by the American Numismatic Association for disrupting the World’s Fair of Money or setting the conditions that disrupted the distription outside of the Denver Mint.

And now the news…

ST. GEORGE — Glen Canyon National Recreation Area’s investigation of centuries-old Spanish coins that were turned into the park has provisionally concluded the coins are authentic. However, according to a news release from the National Park Service, the two small coins were probably part of a modern coin collection, perhaps accidentally or intentionally dropped by a visitor to Lake Powell.  → Read more at stgeorgeutah.com

→ Read more at stgeorgeutah.com

Editor's note: This story has been updated to include the newest mock-up of the Harriet Tubman currency from the advocacy group Women on 20s. WASHINGTON – The Trump administration says it needs until 2028 to release a new $20 bill featuring abolitionist hero Harriet Tubman.  → Read more at usatoday.com

→ Read more at usatoday.com

The coins and a silver ingot, believed to be worth £500,000, were seized in Durham and Lancashire.  → Read more at bbc.com

→ Read more at bbc.com

Is the current 1p piece the least valuable British coin since the currency was unified in 1707?  → Read more at bbc.com

→ Read more at bbc.com

POLL: Where are all the W mint quarters?

W is more than the 23rd letter of the Latin-based alphabet. While it is the chemical symbol for tungsten and used as an abbreviation for watt, in numismatics, it is an elusive mintmark found on only by a few dedicated hunters.

W is more than the 23rd letter of the Latin-based alphabet. While it is the chemical symbol for tungsten and used as an abbreviation for watt, in numismatics, it is an elusive mintmark found on only by a few dedicated hunters.

With 2 million quarters produced by for each of the five National Parks Quarters issued in 2019, it represents from 0.5 to 1-percent of the total production for each coin. Yet being in the shadows of the nation’s capital and running a business that sees a lot of cash, the only W mint quarters I have found were shown to me by a customer asking about them.

Most of the reports of W mintmark quarter finds have been from roll hunters. They buy rolls from the bank and search. But I have searched the rolls I buy for the shop and not found any W mintmark quarters.

I might offer a bounty for someone bringing one into my shop. I am not sure what I have to trade. I have a roll of 40-percent silver half-dollars I used to give to children when they come in and show an interested in coin collecting. That might be a fair trade!

How about you?

Memorial Day 2019

The first recorded organized public recognition of the war dead occurred on May 1, 1865, in Charleston, South Carolina. On that day, Freedmen (freed southern slaves) celebrated the service of the 257 Union soldiers buried at the Washington Race Course (now Hampton Park). They labeled the gravesite “Martyrs of the Race Course.” African Americans continued that tradition and named the celebration Decoration Day.

The first recorded organized public recognition of the war dead occurred on May 1, 1865, in Charleston, South Carolina. On that day, Freedmen (freed southern slaves) celebrated the service of the 257 Union soldiers buried at the Washington Race Course (now Hampton Park). They labeled the gravesite “Martyrs of the Race Course.” African Americans continued that tradition and named the celebration Decoration Day.

Memorial Day took on national significance following World War I when the nation began to recognize all those who gave the ultimate sacrifice during all conflicts. By the end of World War II, most of the celebrations were renamed to Memorial Day. Memorial Day did not become an official holiday until 1967 with the passage of the Uniform Holidays Act (sometimes referred to as the Monday Holiday Bill). Under the law, Memorial Day was set to the last Monday in May, changing it from the traditional May 30th.

The modern Memorial Day is a holiday celebrating the lives of those sacrificed in defense of the United States and its ideals at home and abroad. Today, we honor the memories of those who paid the ultimate sacrifice, from the days of the revolution to the conflicts in around the world, so that I have the freedom to write this blog and you can read and share it amongst your friends.

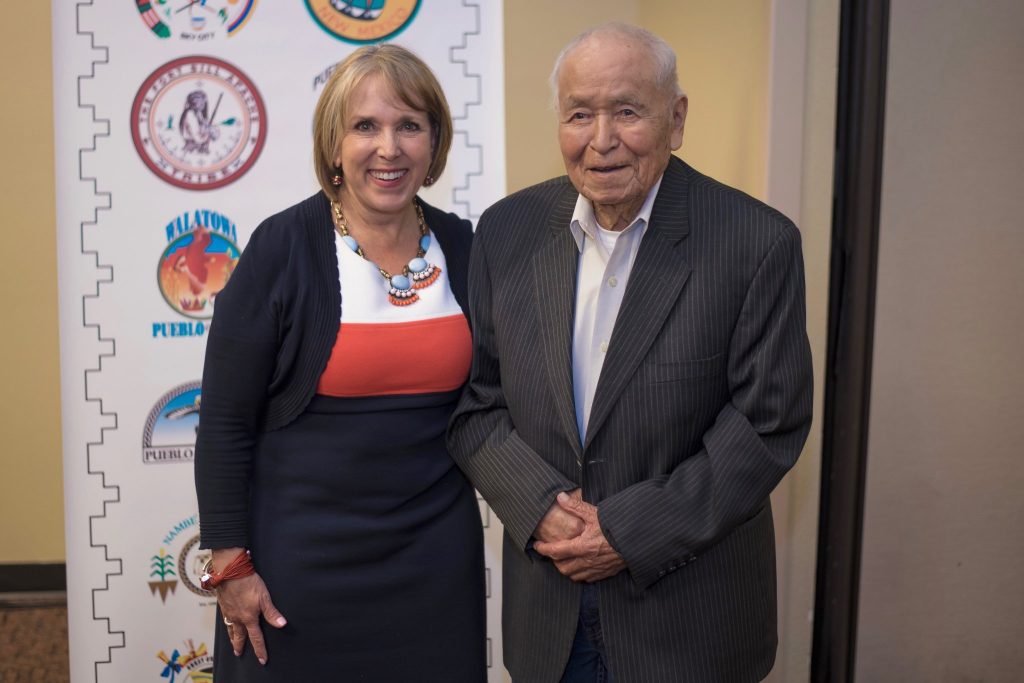

SPECIAL REMEMBRANCE: New Mexico Sen. John D. Pinto, a former World War II Navajo Code Talker, died on Friday, May 24, 2019. Pinto was one of the 400 native Navajo people who learned the code based on the Navajo language. It was used to communicate among the troops in the Pacific Theater during World War II. After the war, Pinto became a teacher and then a state senator in 1977. He was 94.

IMAGE: New Mexico Gov. Michelle Lujan Grisham and Sen. John D. Pinto (via Twitter)