Sep 20, 2018 | bullion, coins, Eagles, platinum, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is third article of a 4 part series:

The Platinum American Eagle coins were an addition to the American Eagle bullion program to satisfy the needs of the domestic platinum mining industry. Work to create the program began in 1995 with Platinum Guild International Executive Director Jacques Luben working with Director of the United States Mint Philip N. Diehl and American Numismatic Association President David L. Ganz to pursue the appropriate legislation.

As with a lot of legislation, it was added to an omnibus appropriations bill (Public Law 104-208 in Title V) passed on September 30, 1996. Since the bill was necessary to keep the government functioning, it was signed by President Bill Clinton that same day.

The first platinum coins were issued in 1997.

Platinum American Eagle coins are the only bullion coins struck by the U.S. Mint that use a different reverse design for the proof coins than the uncirculated bullion coins. The reverse of the proof coins featured different themes that have largely gone unnoticed by collectors. Beginning in 2018, the Preamble to the Declaration of Independence series will introduce all new designs for both the obverse and reverse of the proof coin.

American Platinum Eagle Design

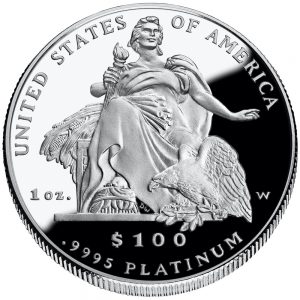

The obverse design of the American Platinum Eagle features a front-facing view of the Statue of Liberty from the shoulders designed by John Mercanti. Mercanti also designed the obverse of the 1986 Statue of Liberty Commemorative Silver Dollar.

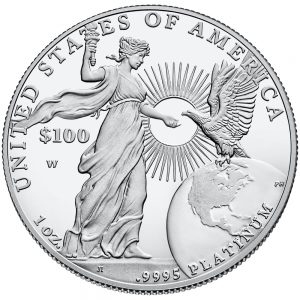

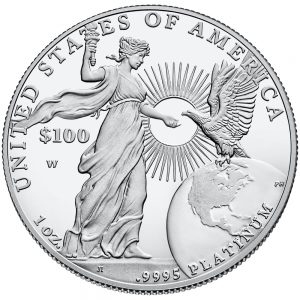

The reverse features a bald eagle soaring above the earth with a rising sun in the background. It was designed by Thomas D. Rodgers Sr. The reverse also includes the weight of the coin and its denomination.

-

-

Obverse of the American Platinum Eagle coin was designed by John Mercanti

-

-

Reverse of the original American Platinum Eagle and still used on the bullion coins was designed by Thomas D. Rodgers Sr.

The reverse designs of the proof coins were by different artists and discussed below.

American Platinum Eagle Coins are offered in four different sizes with each size being of different legal tender face value. The different coins are as follows:

- One-ounce American Platinum Eagle: $100 face value, is 32.7 mm in diameter, contains one troy ounce of platinum and weighs 1.0005 troy ounces,

- One-half ounce American Platinum Eagle: $50 face value, is 27 mm in diameter, contains 0.5000 troy ounce of platinum and weighs 0.5003 troy ounce,

- One-quarter ounce American Platinum Eagle: $25 face value, is 22 mm in diameter, contains 0.2500 troy ounce of platinum and weighs 0.2501 troy ounce,

- One-tenth ounce American Platinum Eagle: $10 face value, is 16.5 mm in diameter, contains 0.1000 troy ounce of platinum and weighs 0.1001 troy ounce.

All coins are struck with reeded edges.

Each coin is made from .9995 platinum. The composition is comprised of 99.95% platinum and 0.05% of an unspecified metal, likely copper. American Platinum Eagle coins are produced so that each size contains its stated weight in pure platinum. This means that the coins are heavier than their pure platinum weight to account for the other metals in the alloy.

Bullion American Platinum Eagle Coins

The American Platinum Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but does not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins there are not produced for the collector market. As with other investments, American Platinum Eagle bullion coins are subject to taxes when sold and may be held in Individual Retirement accounts. Please consult your financial advisor or tax professional for the tax implications for your situation.

Bullion coins of all four weights were struck from 1997-2008. Beginning in 2014, the U.S. Mint has only struck the one-ounce $100 American Platinum Eagle for the bullion market.

Collector American Platinum Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Platinum Eagle are different from other coins in the American Eagle series in that every year they are produced the U.S. Mint struck them in different designs and are only available as proof strikes.

In addition to the changing designs, the U.S. Mint sold uncirculated coins with a burnished (satin) finish using the design of the business (bullion) coins were struck 2006-2008 at West Point in all four weights.

The collector American Platinum Eagle may be one of the most under-appreciated series of coins produced by the U.S. Mint. Since its introduction in 1997, the U.S. Mint has produced four series of proof coins with the reverse honoring different aspects of the nation with plans for two more beginning in 2018 and 2021.

What distinguishes these coins are the well-executed reverse designs that few get to see or pay attention. It may be difficult for the average collector to consider collecting these coins because of the price of platinum has been either on par or higher than the price of gold. Also, platinum is not as well regarded as gold or silver as a precious metal causing it to be overlooked.

Following the proof coins issued in 1997 with the design used on the bullion coin, the reverse design has featured the following themes:

- Vistas of Liberty Reverse Designs (1998-2003):

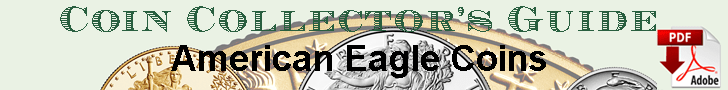

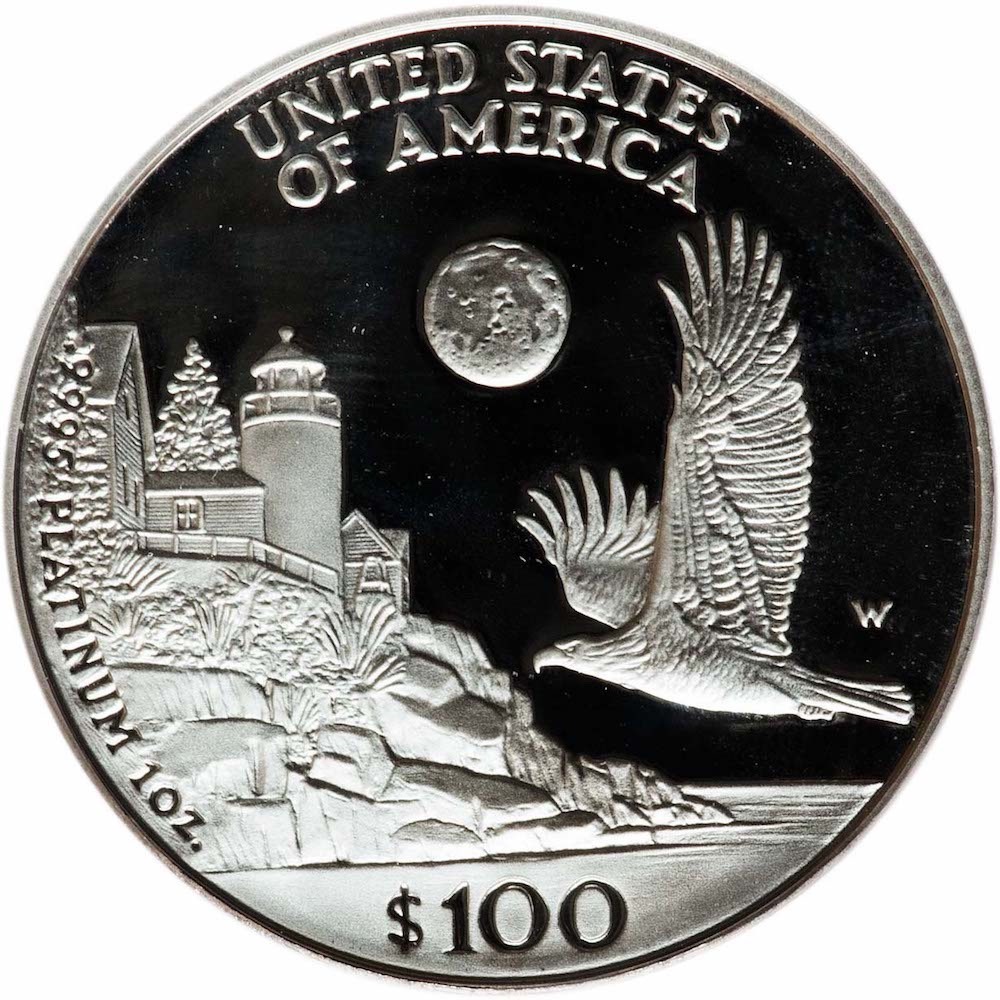

- 1998 Eagle Over New England

- 1999 Eagle Above Southeastern Wetlands

- 2000 Eagle Above America’s Heartland

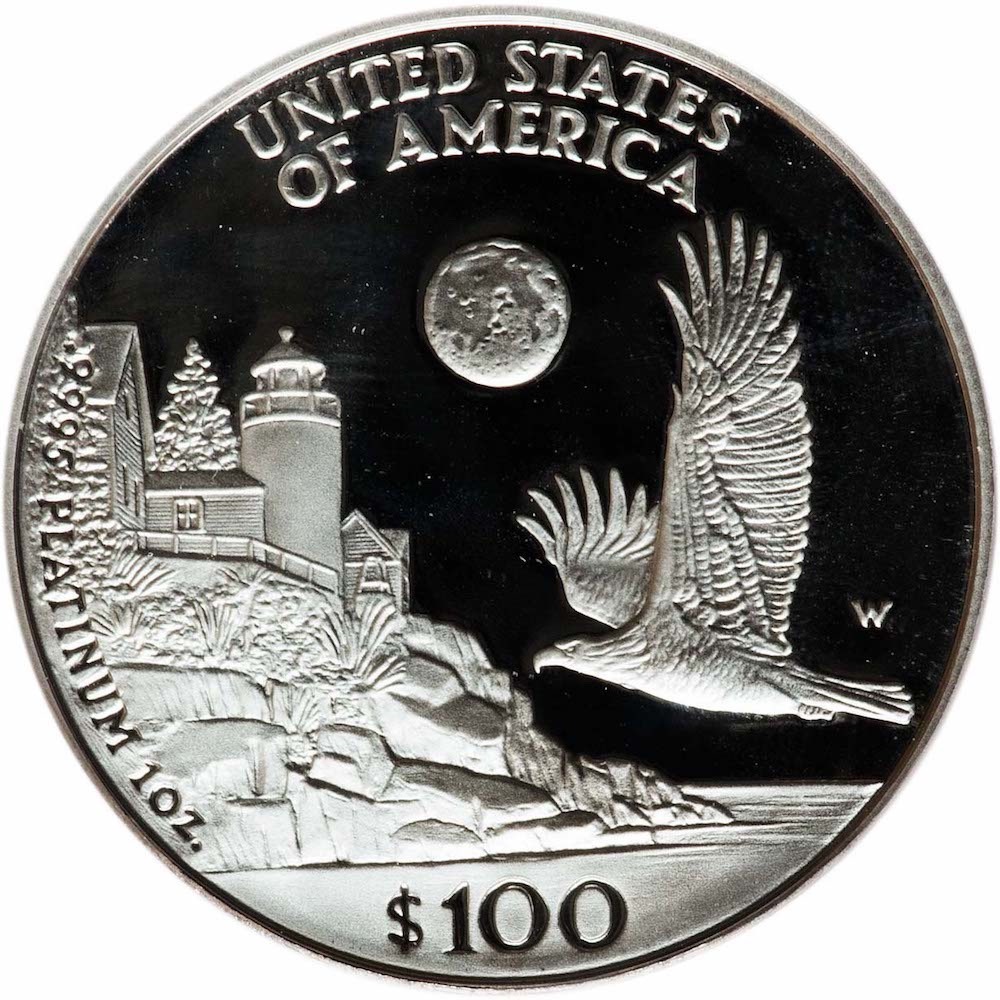

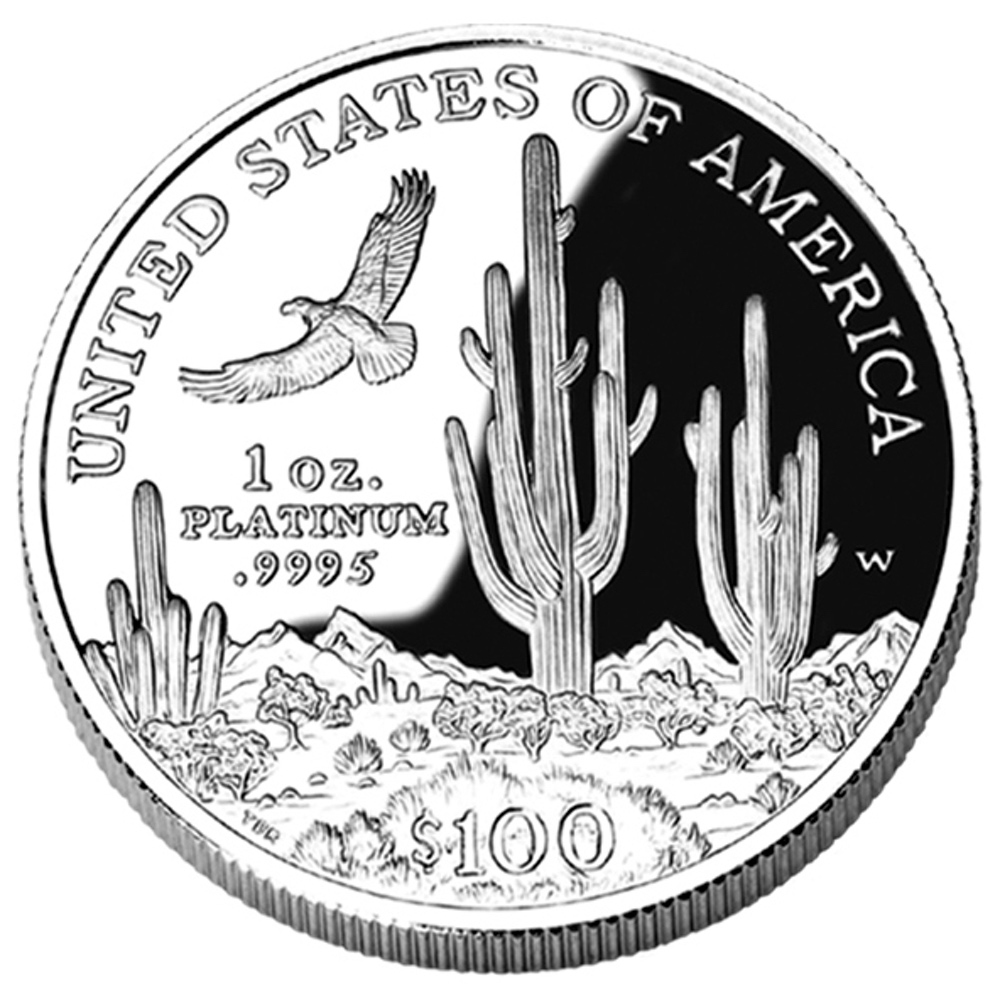

- 2001 Eagle Above America’s Southwest

- 2002 Eagle Fishing in America’s Northwest

- 2003 Eagle Perched on Rocky Mountain Pine Branch

-

-

1998 Eagle Over New England

-

-

1999 Eagle Above Southeastern Wetlands

-

-

2000 Eagle Above America’s Heartland

-

-

2001 Eagle Above America’s Southwest

-

-

2002 Eagle Fishing in America’s Northwest

-

-

2003 Eagle Perched on Rocky Mountain Pine Branch

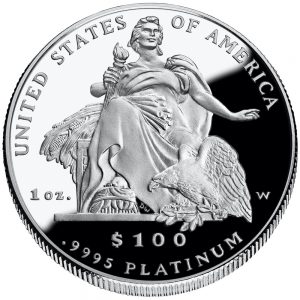

- 2004 Proof reverse design: Daniel Chester French’s “America” that sits before the U.S. Customs House in New York City.

- 2005 Proof reverse Design: Heraldic Eagle

-

-

2004 Daniel Chester French’s “America” that sits before the U.S. Customs House in New York City

-

-

2005 Heraldic Eagle

- Branches of Government Series:

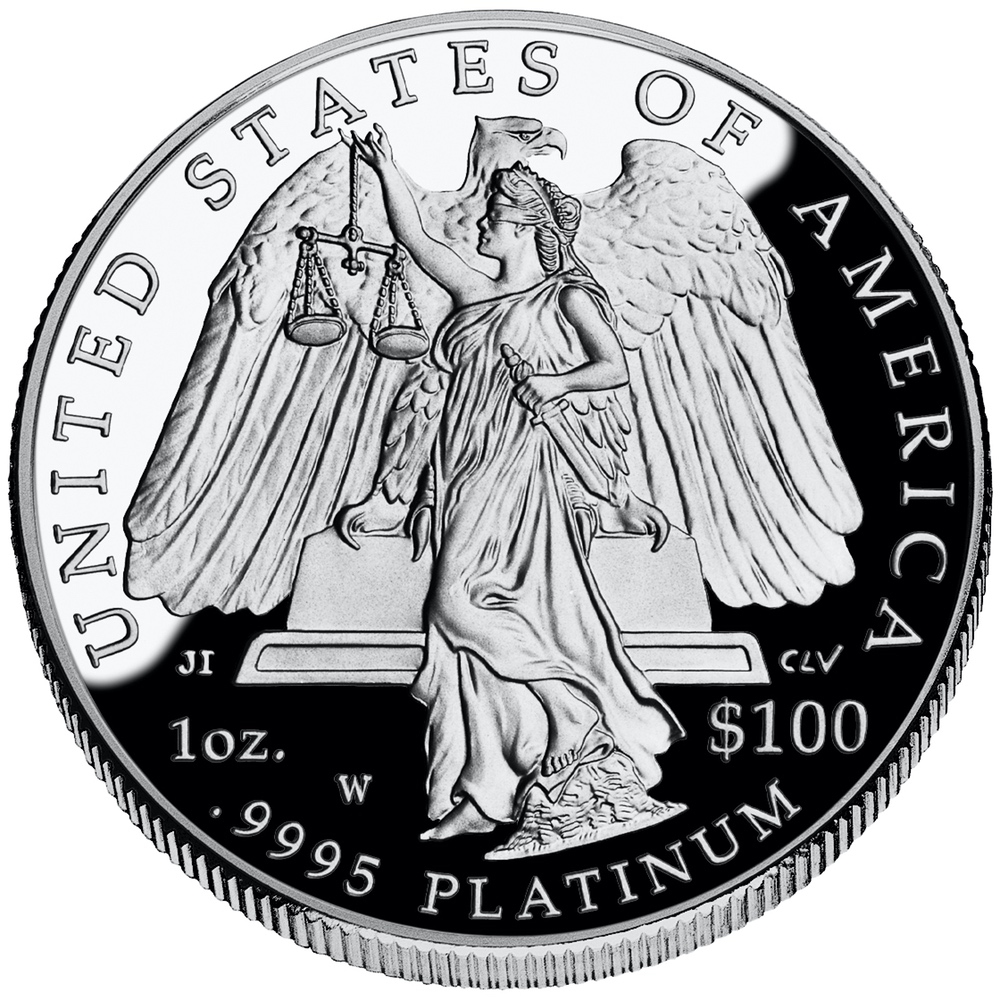

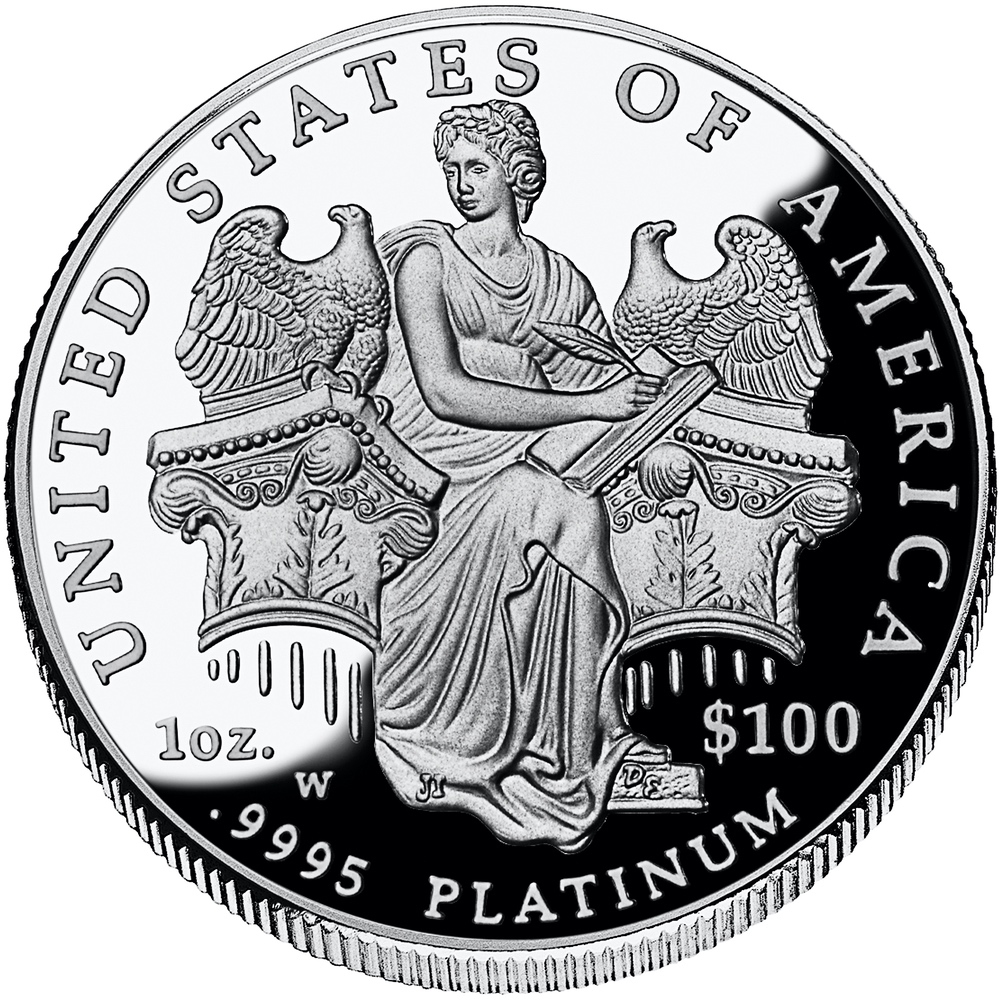

- 2006 “Legislative Muse” representing Legislative Branch

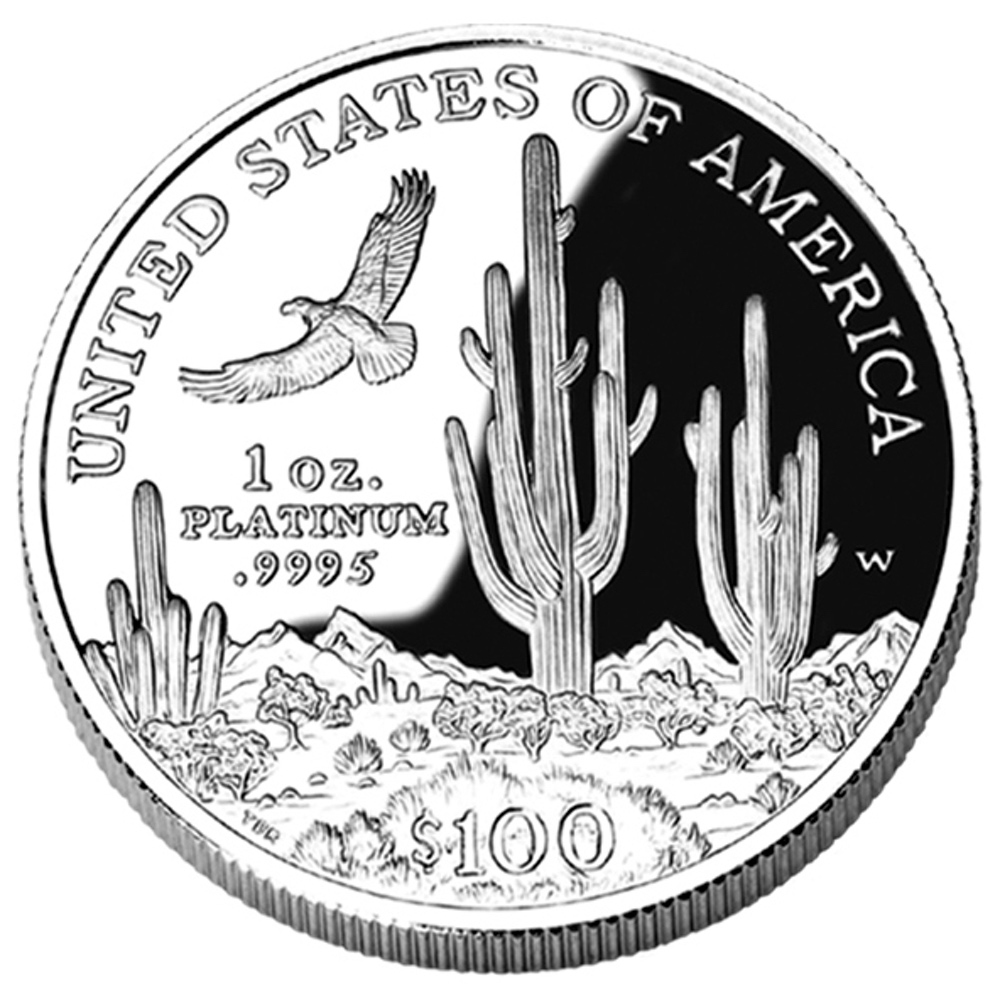

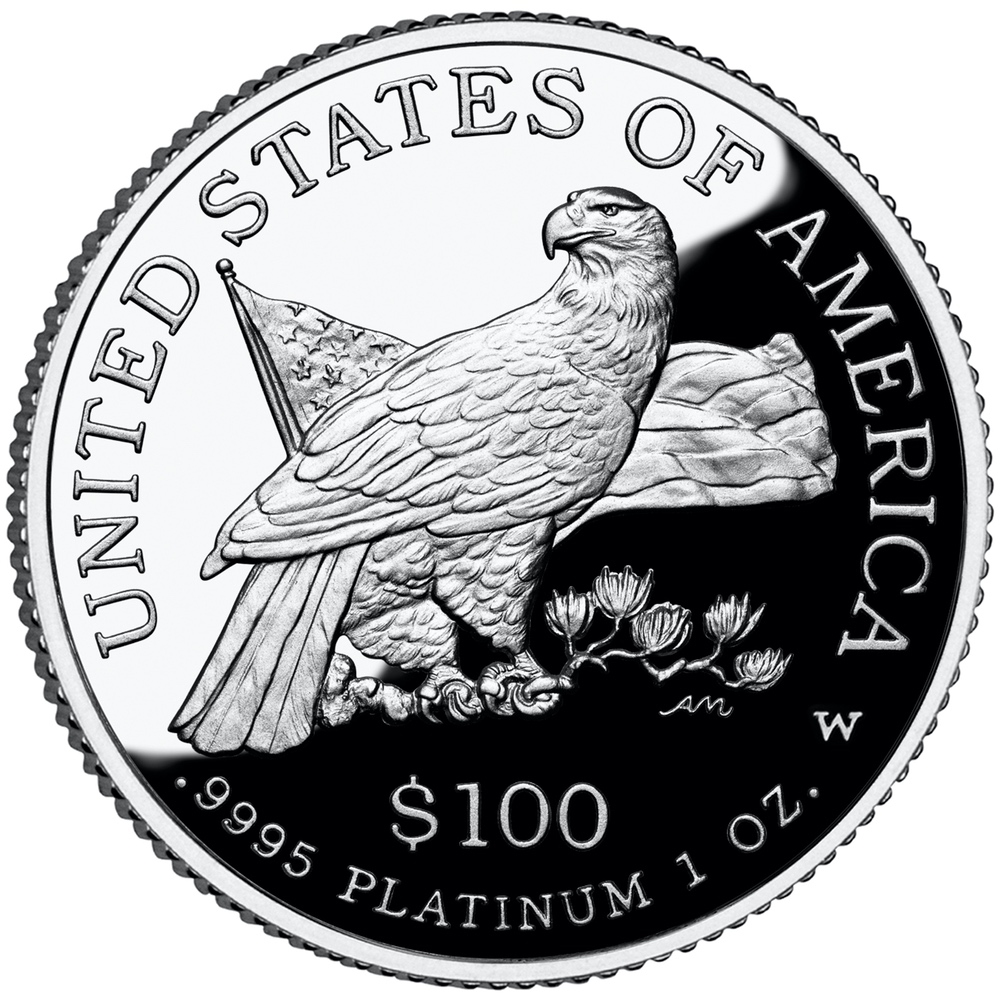

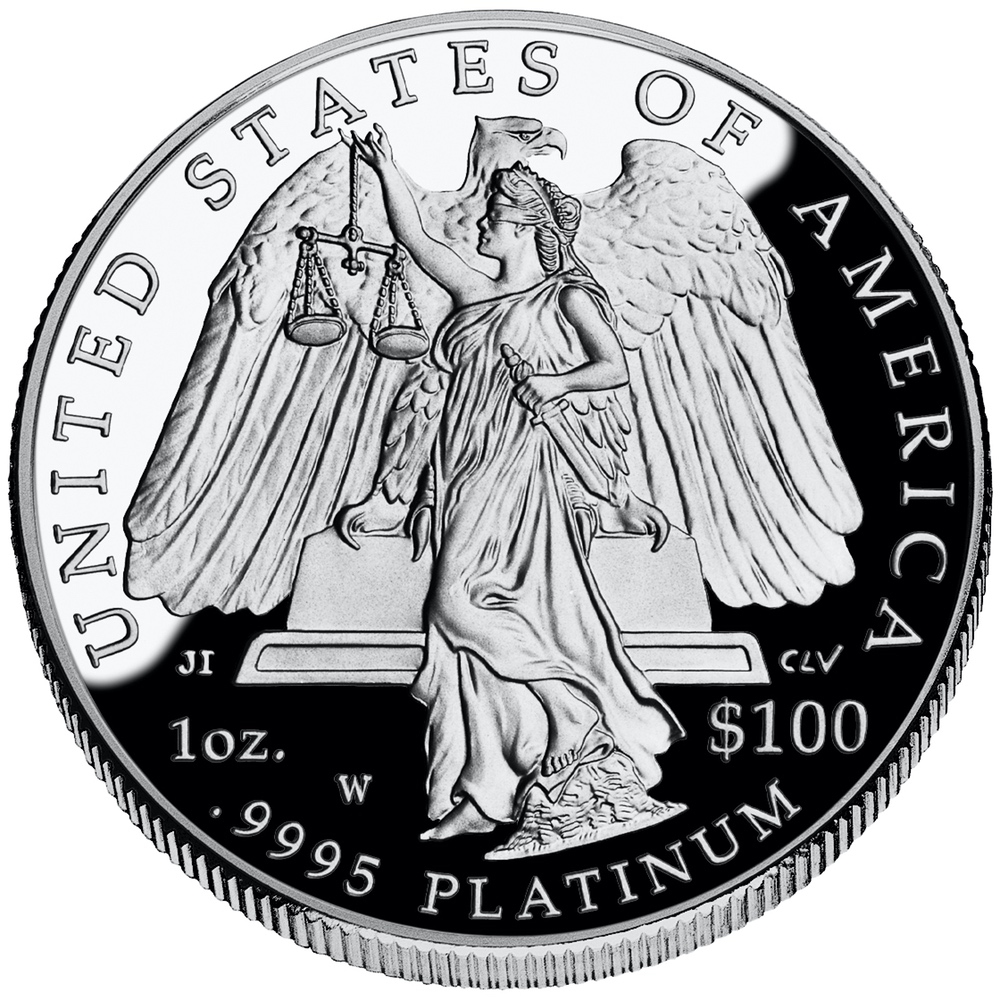

- 2007 “American Bald Eagle” representing Executive Branch

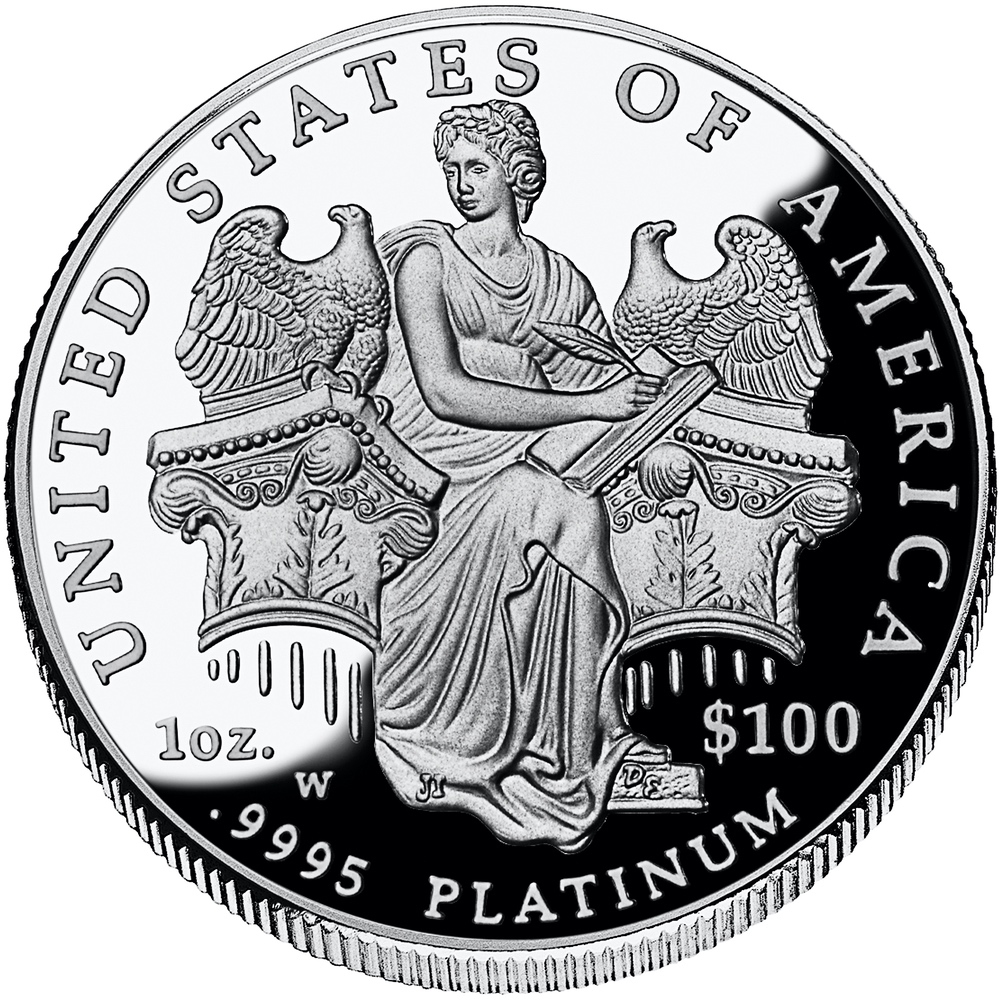

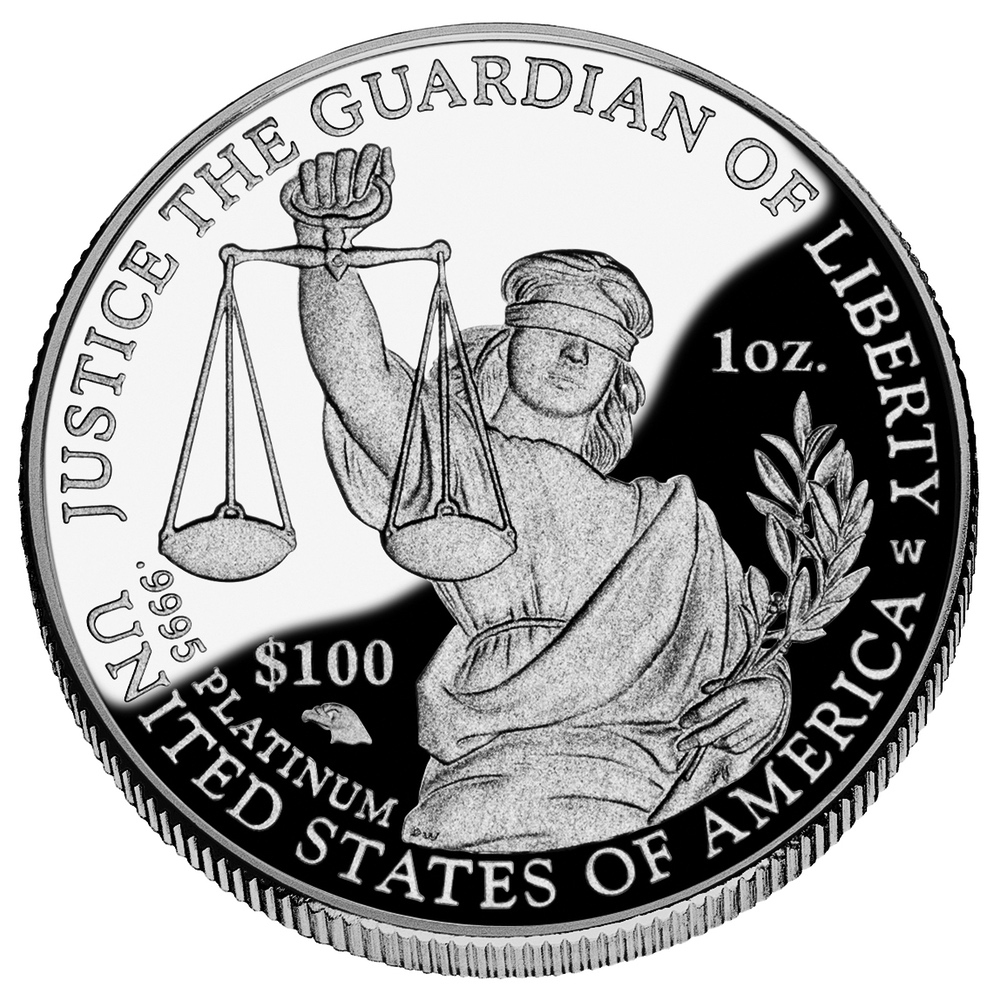

- 2008 “Lady Justice” representing Judicial Branch

-

-

2006 “Legislative Muse” representing Legislative Branch

-

-

2007 “American Bald Eagle” representing Executive Branch

-

-

2008 “Lady Justice” representing Judicial Branch

- Preamble Series (2009–2014):

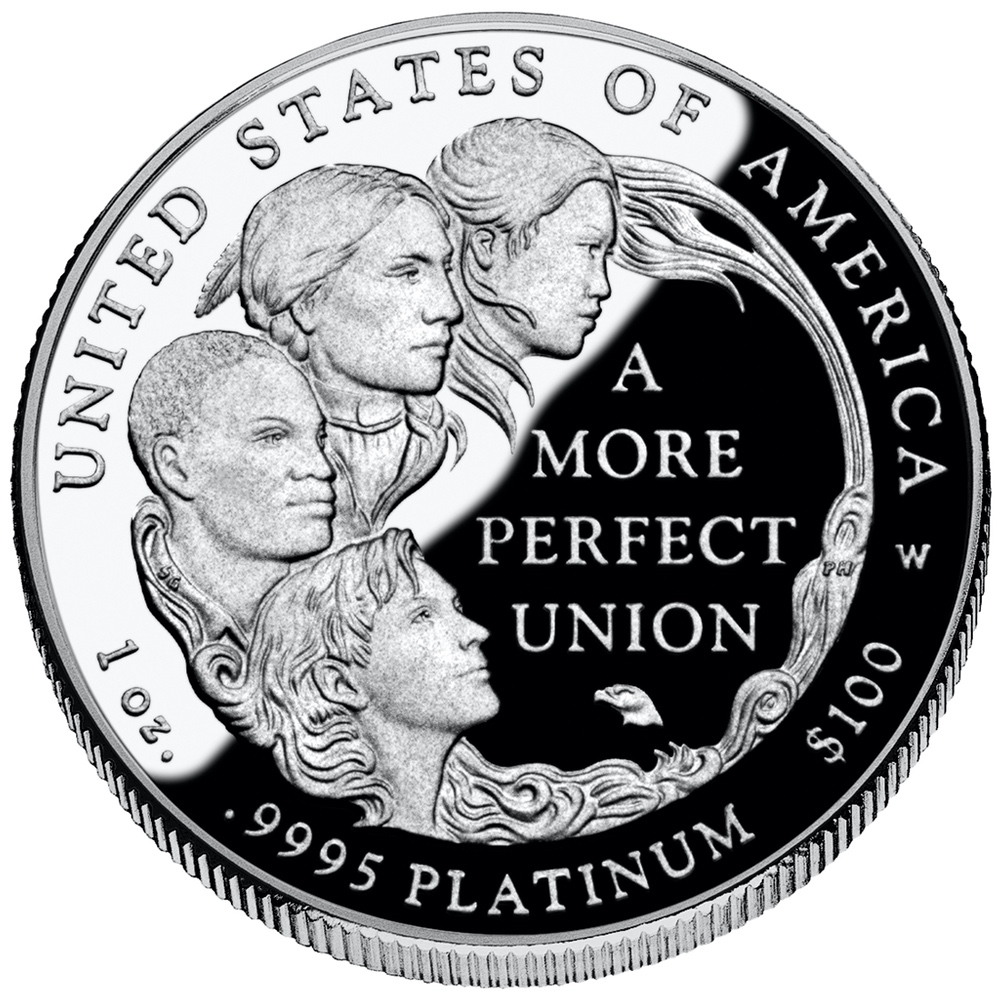

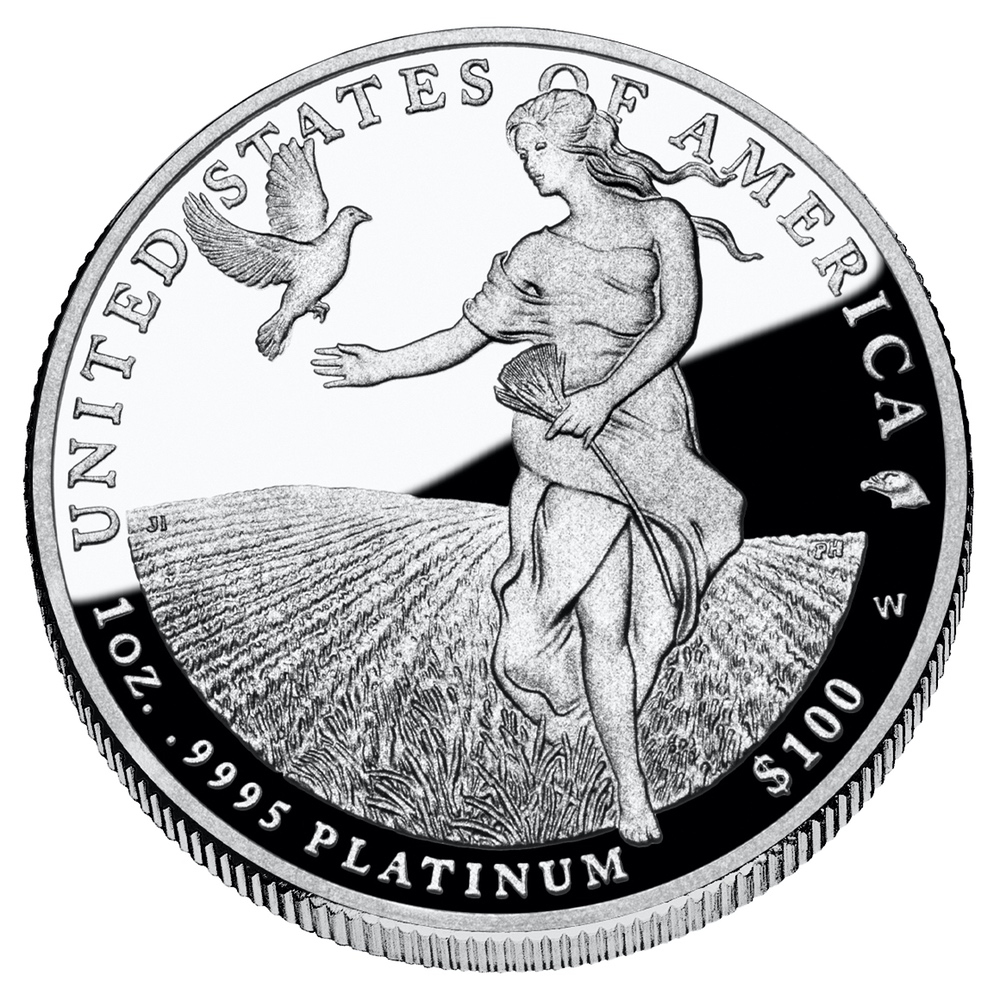

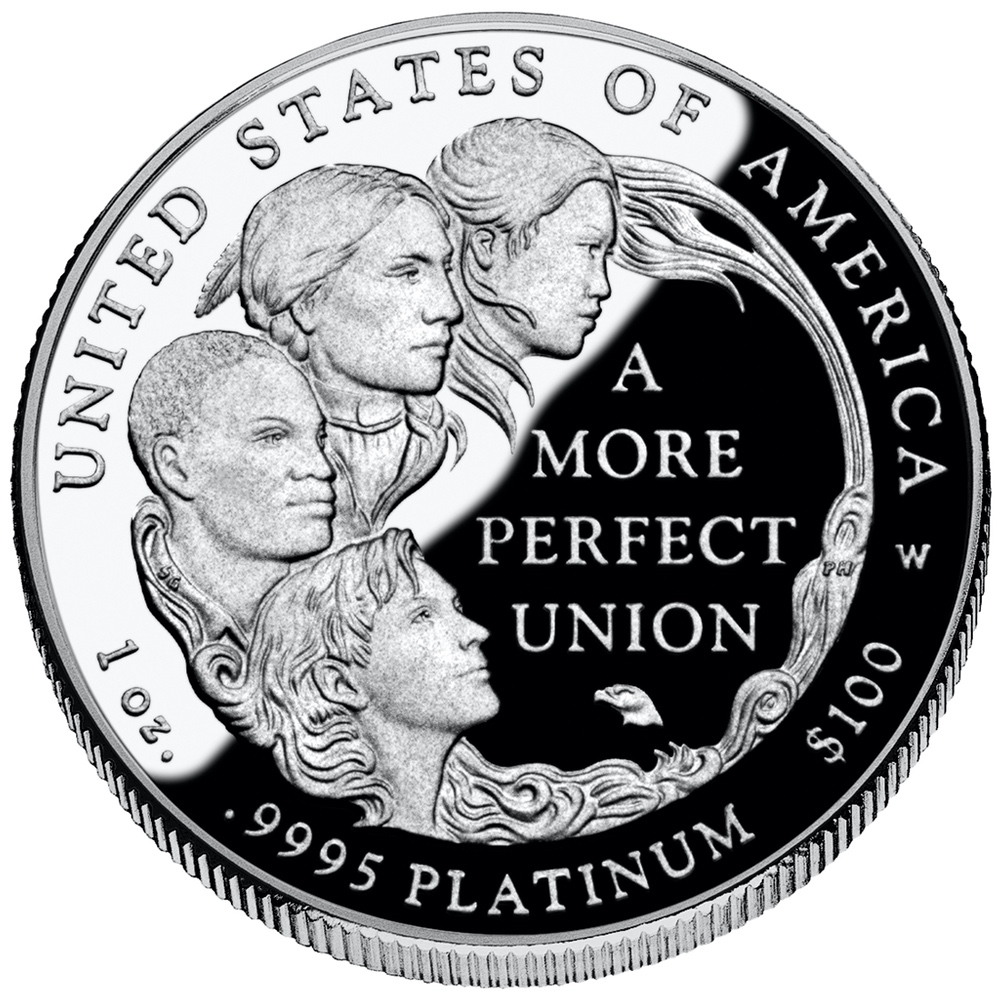

- 2009 “To Form a More Perfect Union”

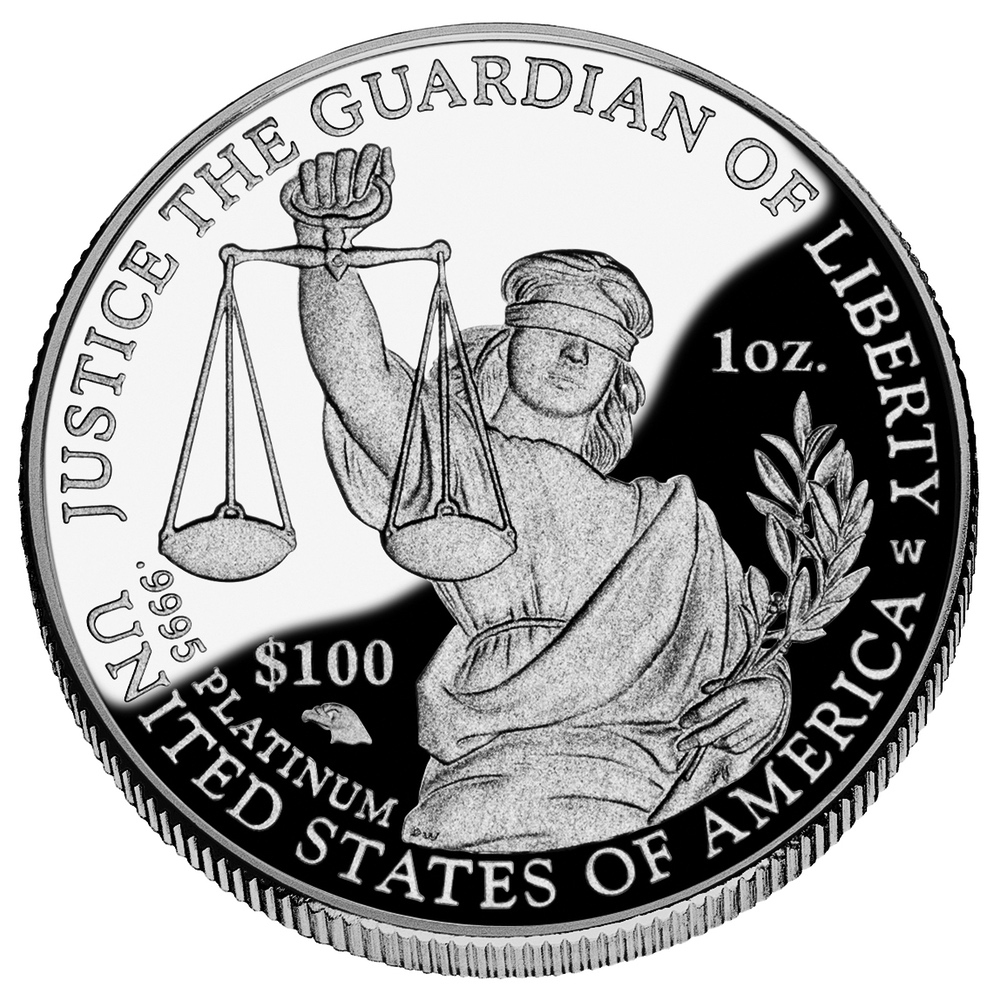

- 2010 “To Establish Justice”

- 2011 “To Insure Domestic Tranquility”

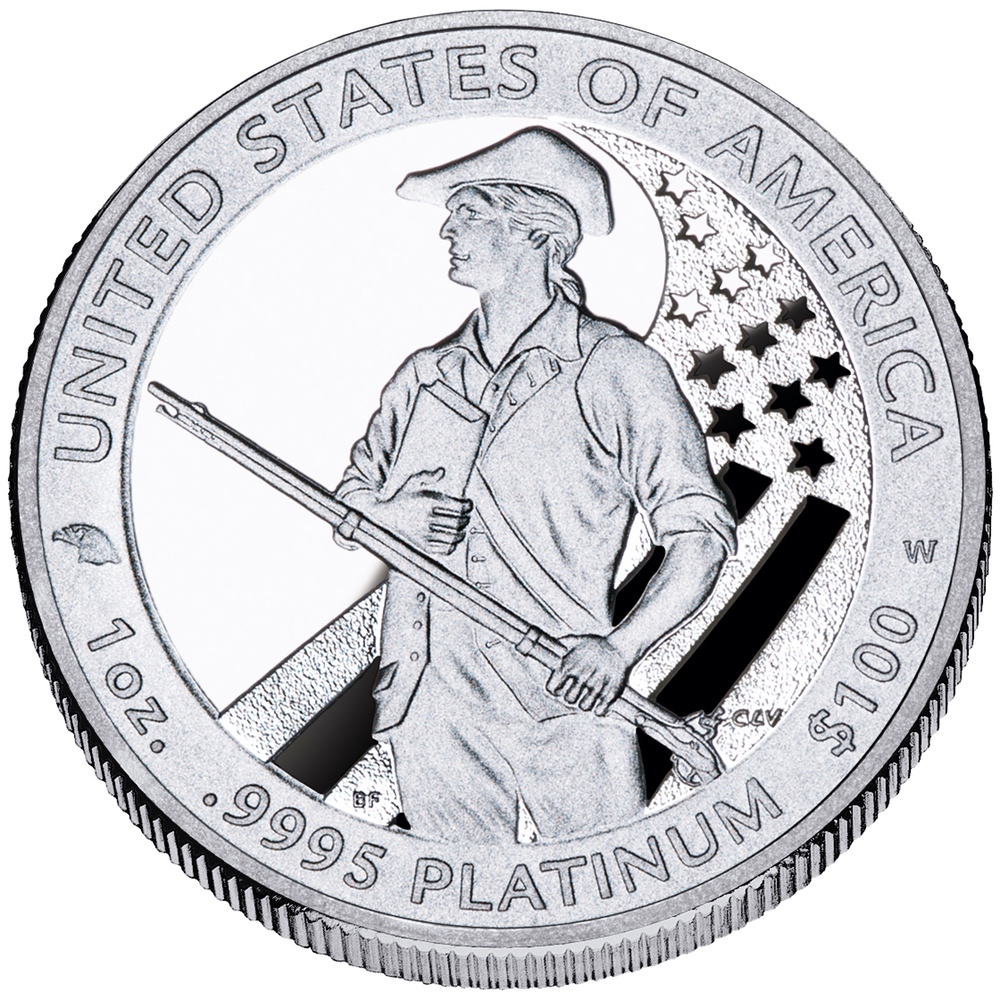

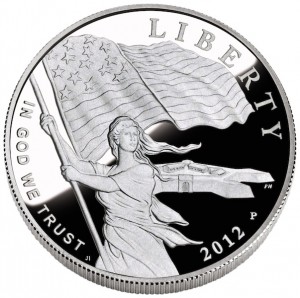

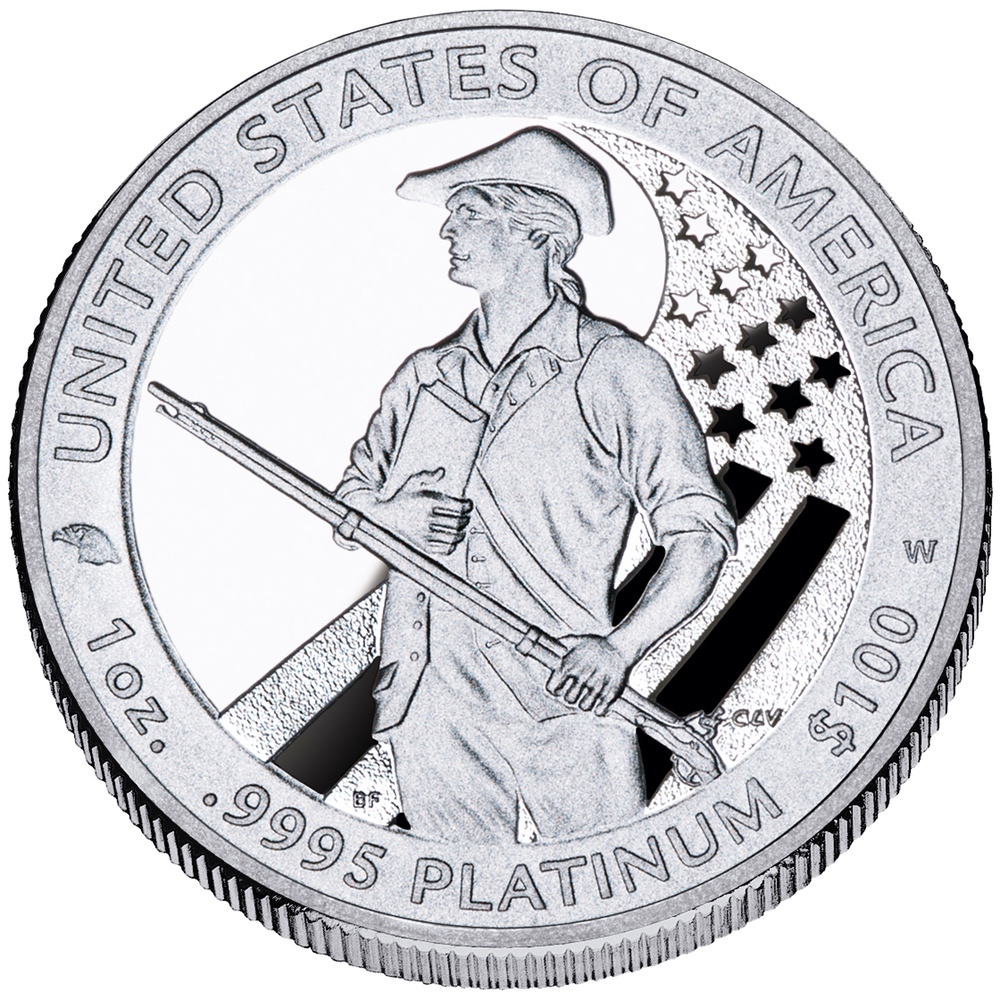

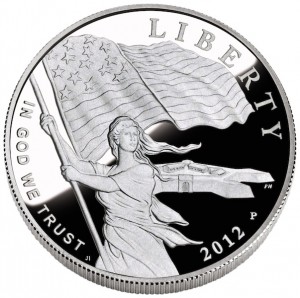

- 2012 “To Provide for the Common Defence”

- 2013 “To Promote the General Welfare”

- 2014 “To Secure the Blessings of Liberty to Ourselves and our Posterity”

-

-

2009 “To Form a More Perfect Union”

-

-

2010 “To Establish Justice”

-

-

2011 “To Insure Domestic Tranquility”

-

-

2012 “To Provide for the Common Defence”

-

-

2013 “To Promote the General Welfare”

-

-

2014 “To Secure the Blessings of Liberty to Ourselves and our Posterity”

- Nations Core Values (2015-2016):

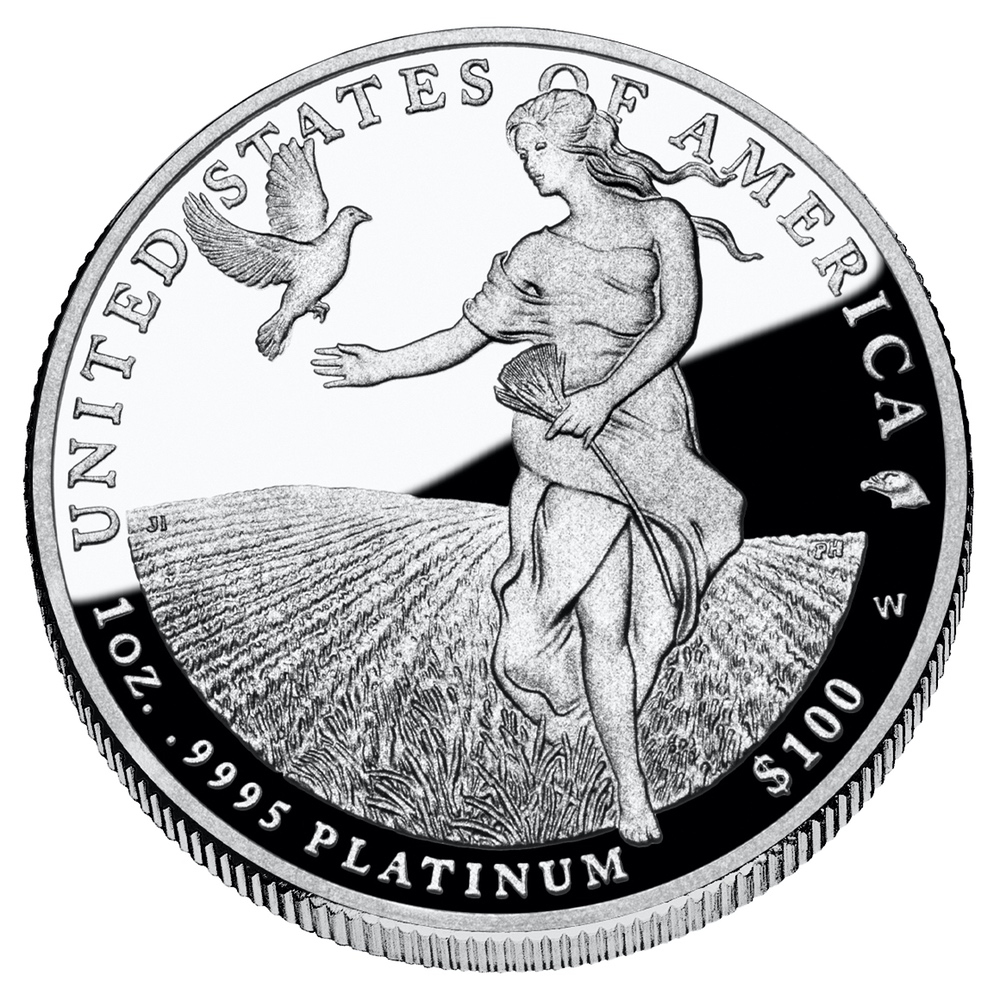

- 2015 “Liberty Nurtures Freedom”

- 2016 “Liberty and Freedom”

-

-

2015 “Liberty Nurtures Freedom”

-

-

2016 “Liberty and Freedom”

- 2017 depicted the original reverse designed by Thomas D. Rodgers Sr.

Beginning in 2018, the U.S. Mint will introduce two themes that will feature new obverse designs with a new common reverse with the following themes:

- 2018-2020 Preamble to the Declaration of Independence Series

- 2018 “Life”

- 2019 “Liberty”

- 2020 “Pursuit of Happiness”

-

-

Obverse of the 2018-W American Platinum Eagle Proof coin “Life.”

-

-

For the Declaration of Independence Series beginning in 2018, the common reverse designed by Patricia Lucas-Morris of the Artistic Infusion Program.

- 2021-2025 Five Freedoms Guaranteed Under the First Amendment Series

- 2021 “Freedom of Religion,”

- 2022 “Freedom of Speech,”

- 2023 “Freedom of the Press,”

- 2024 “Freedom to assemble peaceably,”

- 2025 “Freedom to Petition the Government for a Redress of Grievances.”

Tenth Anniversary American Platinum Eagle Set

As part of the Tenth Anniversary of the American Platinum Eagle, the U.S. Mint issued a special set to celebrate this milestone. The set featured two one-half ounce platinum proof coins using the American Bald Eagle design representing Executive Branch by Thomas Cleveland and was struck at the West Point Mint. One was struck as a standard proof with mirrored fields and frosted designs. The other was struck as a reverse proof with mirrored designs and frosted fields.

The set was announced November 2007 and scheduled to go on sale in mid-December. and remain on sale until December 31, 2008, with several interruptions.

During the sale, the price of platinum greatly fluctuated. At one point the price of platinum was greater than the price of the set. The U.S. Mint had suspended the sale of the coins in February 2008. They were priced higher when they were offered for sale again a month later. Sales were suspended again when the price of platinum fell dramatically. When the coins were brought back for sale, their final price was less than the set’s initial offer price.

Although the U.S. Mint set a maximum mintage of 30,000 sets, the final sales figure showed they sold 19,583 sets.

2007 “Frosted Freedom” Variety

For a very low production series that is handled differently than other coins, it is unusual for there to be a variety or error. In 2011, the Numismatic Guarantee Corporation announced that they certified a variety that was given the name “Frosted Freedom.”

On the proof strike of the 2007 American Platinum Eagle coin with the bald eagle design to celebrate the executive branch of the government, there is a shield in front of the eagle’s breast. Draped across the shield is a ribbon with the word “FREEDOM”. On the coins issued in 2007, the incuse word “FREEDOM” has the same mirrored finish as found on the coin’s fields. On the variety found by NGC, the word appears frosted with the same finish found on the coin’s raised devices.

In a statement by the U.S. Mint, these coins were pre-production strikes that had been inadvertently released into the production stream. They were struck to verify the look of the coin.

According to the U.S, Mint, the total number of “Frosted Freedom” coins potentially distributed to collectors includes 12 one-ounce coins, 21 half-ounce coins, and 21 quarter-ounce coins. As this is being written, only two one-ounce, one half-ounce, and one quarter-ounce coin have been certified by the major grading services.

In our next installment, we look at the American Palladium Eagles.

Sep 19, 2018 | bullion, coins, Eagles, gold, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is second article of a 4 part series:

During the debate of the law that created the American Silver Eagle program, the gold mining interests began to lobby congress to pass a bill to allow the U.S. Mint to mint bullion coins using gold mined in the United States. A few months later, congress passed the Gold Bullion Coin Act of 1985 that created the American Eagle Gold Bullion Program.

The key provisions of the Gold Bullion Coin Act are that the gold used in the coins be purchased from United States mining sources at prevailing market value and that the coins would be produced using 22-karat gold. It was decided to produce the using 22-karat gold to allow the U.S. Mint to compete with the Krugerrand, which was produced using 22-karat gold.

American Gold Eagle Design

The obverse of the coin used the design of the $20 Double Eagle coin designed by Augusts Saint-Gaudens. This design is considered by many the most beautiful of all coins produced by the U.S. Mint.

The reverse features a male bald eagle carrying an olive branch flying above a nest containing a female eagle and her hatchlings. It was designed by Miley Frances Busiek.

-

-

-

Reverse of the 2018 American Gold Eagle Proof coin feating the design my Miley Busieck

American Gold Eagle Coins are offered in four different sizes with each size being of different legal tender face value. The different coins are as follows:

- One ounce American Gold Eagle: $50 face value, is 1.287 inches (32 mm) in diameter, contains one troy ounce of gold and weighs 1.0909 troy ounces,

- One-half ounce American Gold Eagle: $25 face value, is 1.063 inches (27 mm) in diameter, contains 0.5000 troy ounce of gold and weighs 0.5455 troy ounce,

- One-quarter ounce American Gold Eagle: $10 face value, is 0.866 inch (22 mm) in diameter, contains 0.2500 troy ounce of gold and weighs 0.2727 troy ounce,

- One-tenth ounce American Gold Eagle: $5 face value, is 0.650 inch (16.5 mm) in diameter, contains 0.1000 troy ounce of gold and weighs 0.1091 troy ounce.

All coins are struck with reeded edges.

Each coin is made from 22-karat gold. The composition is comprised of 91.67% gold, 3% silver, and 5.33% copper. The coins are produced so that each size contains its stated weight in pure gold. This means that the coins are heavier than their pure gold weight to account for the silver and copper.

Bullion American Gold Eagle Coins

The American Gold Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but does not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins they are not produced or marketed for the collector market. As with other investments, American Gold Eagle bullion coins are subject to taxes when sold. Please consult your financial advisor or tax professional for the tax implications for your situation.

It is important to note that there have been attempts to determine where the bullion coins have been struck. Collectors have tried to use shipping records from the U.S. Mint, shipping labels, and other means to try to investigate the origin of the coins. Although some believe that these methods have identified some coins, the U.S. Mint has said that the shipping records that are being relied upon are not correct and do not reliably show the branch mint of origin.

Collector American Gold Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Gold Eagle coins are produced only as proof coins.

American Gold Eagle Poof coins are sold individually or in a four-coin set. The coins sold by the U.S. Mint are stored in a specially made capsule and that capsule is placed in a special folder-like packaging. The folders are distributed in a brown box with a Certificate of Authenticity.

OGP vs. GRADED

2018-W American Gold Eagle Proof in Original Government Package

Collector American Gold Eagle coins may have been removed from its original government package in order to be sent to a third-party grading service for grading. Most of the time, the original government package may have been discarded. Some dealers will sell the package without the coin for a few dollars, but for collectors of graded coins, this is not a priority.

1999-W Bullion Eagles Struck with Unfinished Proof Dies

In 1999, there was an incredible demand for gold bullion. In the rush to produce $5 one-tenth ounce and $10 one-quarter ounce bullion coins to satisfy market demand, the West Point Mint mistakenly struck coins using unfinished dies made that were supposed to be for proof coins.

These dies were considered unfinished because they did not receive their final finishing treatment that would be used for proof coins.

As a result, about 4,000-6,000 American Gold Eagle 1999 bullion coins were struck with the "W" mintmark and the higher relief of proof coins. Since most of these coins may be in bullion holdings, experts are not sure how rare these coins may be. However, few have been seen for sale on the secondary market.

SPECIAL SETS

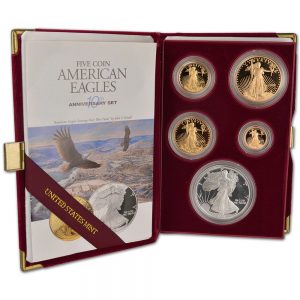

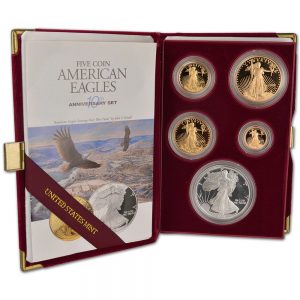

Tenth Anniversary American Eagle Set

As part of the celebration of the 10th anniversary of the American Eagle program, the U.S. Mint created the 10th Anniversary American Eagle set. The set contained a four 1995-W American Gold Eagle Proof coins (one-tenth, one-quarter, one-half, and one troy ounce coins) and a 1995-W American Silver Eagle proof coin. This set is significant for the 1995-W American Silver Eagle proof coin since it was not made available to collectors not buying the set.

Most of the sets have been split up to take advantage of the fluctuating metal prices and the rarity of the 1995-W American Silver Eagle. Finding the entire set with the American Gold Eagle coins and the American Silver Eagle Proof coin in the original government package can set you back $8,000 and higher.

Twentieth Anniversary American Eagle Set

To celebrate the 20th anniversary of the American Eagle bullion program, the U.S. Mint issued two different using gold coins in celebration.

The American Gold Eagle three-coin 20th Anniversary Set contained three coins: a 2006-W Proof Gold Eagle, a 2006-W Uncirculated Gold Eagle, and a 2006-W Reverse Proof Gold Eagle.

The 2006-W American Gold Eagle Reverse Proof was unique to the 20th Anniversary set. The raised design elements of the coin are mirrored and the background fields are frosted. This is the reverse of the typical cameo proof finish. Because of this, many of these sets were broken up and the coins encapsulated in third-party grading service holders.

A second 20th Anniversary Set included a one-ounce 2006-W American Gold Eagle Uncirculated coin and 2006-W American Silver Eagle Uncirculated coin. Both coins were treated giving them a burnished finish. Since both coins were available to be purchased individually with over 19,000 produced, it is easier to find a set in its original government packaging.

Annual Collector Coins and Sets

During the course of the American Gold Eagle Program, the U.S. Mint has offered proof coins for the collector they sold directly through their sales channels. Collectors could purchase each coin individually in a presentation case or all four coins as a set.

When searching for American Gold Eagle Proof coins on eBay, be careful not to buy a lot with just the original government package (OGP) and no coins. It is common for collectors to remove the coins from the OGP and send them to a third-party grading service for encapsulation. Collectors and dealers will try to sell the OGP without the coins for people who have the coins but not the package.

The OGP without the coins have no collector value.

Starting in 2006, the U.S. Mint has offered an uncirculated American Silver Eagle coins struck on specially burnished gold blanks. The burnishing gives the coin a satin finish that distinguishes this version from the bullion coin. These coins were offered from 2006-2008 and 2011 to present. Because of the increased demand for the gold bullion coins in 2009 and 2010, the U.S. Mint did not produce burnished collector coins so that the blanks can be used for fulfilling the bullion demand.

Similar to the proof collector coins, many of these coins were removed from their OGP and encapsulated by third-party grading services. The warning about sellers offering the OGP for sale without coins applies for the uncirculated burnished coins.

Rolls and the Monster Box

When the U.S. Mint sells bullion coins to their authorized resellers, the coins are packaged in 20-coin hard plastic rolls and 25 rolls are placed in a specially designed box that contains 500 troy ounces of silver. Rolls are topped with red caps and the boxes storing the rolls are red.

Although you may be able to find rolls and monster boxes of American Gold Eagle for sale, the price will be commensurate with the price of the coins. However, some dealers have tried to sell the boxes to anyone interested.

In our next installment, we look at the American Platinum Eagles.

Sep 18, 2018 | bullion, coins, Eagles, silver, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is first article of a 4 part series:

EDITOR’S NOTE: This post was updated on May 11, 2020. Please read the new version → here.

The American Silver Eagle program was created to provide a way for the United States government to sell off silver that was saved in the Defense National Stockpile. Following the Coinage Act of 1965 that removed silver United States coinage the amount of silver being used was building up a supply that far exceeded the needs for the national stockpile.

Following several years of discussion that almost led to the bulk auction and sale of the silver, it was decided to use the silver to create a silver investment coin. The program was so successful that when the Defense National Stockpile was depleted in 2002, the original law was changed to continue the program by purchasing silver from U.S.-based mines at market prices to be used for future production.

American Silver Eagle Design

The obverse of the coin is the much-beloved design of that was used on the Walking Liberty Half-Dollar coin from 1916 to 1947. It was designed by Adolph A. Weinman, a former student of Augustus Saint-Gaudens.

The reverse features a heraldic eagle using a design by John Mercanti who would become the 12th Chief Engraver of the U.S. Mint. Mercanti engraved both sides of the coin that including copying Weinman’s original design.

Each coin contains one troy ounce (31.103 grams) of .999 fine silver with the balance of copper. American Silver Eagle coins are 40.6 mm (1.598 inches) in diameter and 2.98 mm (0.1173 inches) thick with reeded edges. The coins are assigned a face value of $1.00 to give them legal tender status.

-

-

-

2018-W American Silver Eagle Proof reverse

Bullion American Silver Eagle Coins

The American Silver Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but does not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins there are not produced for the collector market. As with other investments, American Silver Eagle bullion coins are subject to taxes when sold. Please consult your financial advisor or tax professional for the tax implications for your situation.

It is important to note that there have been attempts to determine where the bullion coins have been struck. Collectors have tried to use shipping records from the U.S. Mint, shipping labels, and other means to try to investigate the origin of the coins. Although some believe that these methods have identified some coins, the U.S. Mint has said that the shipping records that are being relied upon are not correct and do not reliably show the branch mint of origin.

Collector American Silver Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Silver Eagle coins are produced as proof and uncirculated coins.

The U.S. Mint sells American Silver Eagle proof coins in a specially made capsule and that capsule is placed in a blue velvet-covered case. The case was distributed in a blue box with a Certificate of Authenticity.

Beginning in 2006, the U.S. Mint has produced an uncirculated, business strike coin for the collector market. Most uncirculated American Silver Eagle collector coins are struck in West Point and bear the “W” mintmark. Following striking, the coins are then burnished, a process by treating the surface with fine particles to give the surface a smooth, satin finish. Collector versions of the American Silver Eagle are also placed in a capsule for sale to the public. Packaging has varied from year to year including special collectibles.

When looking for collector American Silver Eagle coins, note that the American Silver Eagle proof coin was not struck in 2009 and the uncirculated burnished coins were not struck in 2009-2010. These years were skipped because the demand for bullion American Silver Eagle coins became higher than the available supply of silver planchets. To satisfy the demand, the U.S. Mint decided not to produce these collector coins.

OGP vs. GRADED

2018-W American Silver Eagle Proof in Original Government Package

Collector American Silver Eagle coins may have been removed from its original government package in order to be sent to a third-party grading service for grading. Most of the time, the original government package may have been discarded. Some dealers will sell the package without the coin for a few dollars, but for collectors of graded coins, this is not a priority.

2007 Reverse Variety

In 2008, the U.S. Mint updated the reverse dies of the American Silver Eagle giving it a slightly different appearance. The reverse die was only supposed to be used on collector American Silver Eagle coins in 2008 before being used for bullion coins in 2009.

However, as a result of the human factor required with operating the minting equipment at the West Point Mint, the reverse dies that were used for the 2007 American Silver Eagle coins were mated with 2008 collector coins creating a new variety for collectors. This is known as a 2008-W Silver Eagle Reverse of 2007 Variety.

The 1995-W

Tenth Anniversary American Eagle Set

Most of the sets have been split up to take advantage of the fluctuating metal prices. The gold coins have been sold while the gold prices rose since 1995, but the limited availability has caused the 1995-W American Silver Eagle to rise significantly on the secondary market. Cost to purchase this coin averages about $5,000, depending on the grade. Finding the entire set with the American Gold Eagle coins in their original government package can set you back $8,000 and higher.

Special Sets

In 1993, the U.S. Mint offered The Philadelphia Set, which was issued to commemorate the 200th anniversary of the striking of the first official U.S. coins at the Philadelphia Mint. This special set included each of the Proof American Gold and Silver Eagles struck at the Philadelphia Mint and containing the “P” mint mark. The 1993-P Proof Silver Eagle was included in the set along with the one-half ounce, one-quarter ounce, and one-tenth ounce 1993-P Proof Gold Eagles. Also included was a silver Philadelphia Bicentennial Medal, which specially produced for this numismatic product.

To mark the launch of the new American Platinum Eagle bullion and collector coin series, the US Mint offered the 1997 Impressions of Liberty Set. This set contained the one ounce 1997-W Proof Platinum Eagle, one ounce 1997-W Proof Gold Eagle, and one ounce 1997-P Proof Silver Eagle. Adding some special allure to the set, production was limited to just 5,000 units, which were individually numbered. The serial number for each set was engraved on a brass plate affixed to the wooden display case.

In 2004, the U.S. Mint worked with the United Kingdom’s Royal Mint to create a numismatic product containing the silver bullion coins from each country. The Legacies of Freedom Set contained one 2003 American Silver Eagle bullion coin and one 2002 British Silver Britannia bullion coin. The two coins were placed in special packaging which highlighted the importance of the two national icons.

To celebrate the 150th anniversary of the founding of the Bureau of Engraving and Printing and the 220th anniversary of the United States Mint the two bureaus joined together to release the 2012 Making American History Coin and Currency Set. The set contained a 2012-S American Silver Eagle Proof coin and a $5 note with a serial number beginning in “150”.

As part of the 2016 Ronald Reagan Coin and Chronicles Set the U.S. Mint included a 2016 Proof American Silver Eagle along with a 2016 Ronald Reagan Presidential reverse proof dollar, and a Nancy Reagan Bronze Medal. To complete the set, it included a presidential portrait produced by the Bureau of Engraving and Printing and an informational booklet.

Annual Sets

To extend the product line, the U.S. Mint began to create special annual issue sets to entice people to collect U.S. Mint products. The first annual set containing an American Silver Eagle coin was the Annual Uncirculated Dollar Coin Set. First offered in 2007, the set includes the issued uncirculated Presidential dollar coins, an uncirculated Native American dollar coin, and an uncirculated American Silver Eagle. Since the Presidential Dollar Program ended in 2016, it is unclear whether the U.S. Mint will issue the set in 2017.

Since 2012, the U.S. Mint has been producing the Limited Edition Silver Proof Set that contains 90% silver versions of the year’s five America the Beautiful Quarters, Kennedy Half Dollar, and Roosevelt Dime, along with the standard annual Proof American Silver Eagle. Sets are limited to 50,000 units annually.

Starting in 2013, the U.S. Mint has been producing the Congratulations Set as part of a new line of products targeted towards gift giving occasions. The This set included the standard annual Proof Silver Eagle within specially designed packaging which allowed a personalized message to be written the recipient.

Anniversary Sets

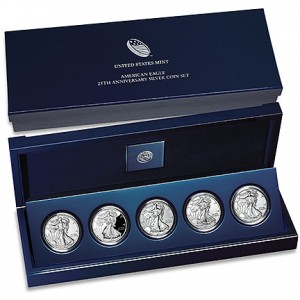

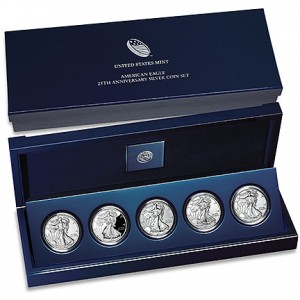

2011 American Silver Eagle 25th Anniversary Set

The Anniversary sets issued are as follows:

- 1995 American Eagle 10th Anniversary Set included a 1995-W American Silver Eagle Proof coin and four American Gold Eagle coins.

- 2006 20th Anniversary American Silver Eagle Set was a special three-coin box set included a 2006-W American Silver Eagle with a burnished (satin) finish, a 2006-W American Silver Eagle Proof coin, and a 2006-P American Silver Eagle Reverse Proof coin.

- 2011 25th Anniversary American Silver Eagle Set was a five-coin box set that contained five different coins. The U.S. Mint produced only 100,000 sets that sold out within the first 10 minutes they were offered online. This extremely popular set is averaging $800 on the secondary market in the original government package. The set includes the following coins:

- 2011-W (West Point) American Silver Eagle Uncirculated coin

- 2011-S (San Francisco) American Silver Eagle Uncirculated coin

- 2011-W (West Point) American Silver Eagle Proof coin

- 2011-P (Philadelphia) American Silver Eagle Reverse Proof coin

- 2011 (no mintmark) American Silver Eagle Bullion coin

- 2012 American Eagle San Francisco Two Coin Silver Proof Set was issued to celebrate the 75th anniversary of the current San Francisco Mint. The set included a 2012-S American Silver Eagle Proof coin and a 2012-S American Silver Eagle Reverse Proof Coin.

- 2013 West Point American Silver Eagle Set was issued to celebrate the 75th anniversary of the facility in West Point, New York. The set included a 2013-W American Silver Eagle Reverse Proof coin and a 2013-W American Silver Eagle Enhanced Uncirculated coin. This was a popular set since it was the first appearance of the Enhanced Uncirculated finishing process.

Although the U.S. Mint did not issue a set to celebrate the 30th Anniversary of the American Silver Eagle in 2016, the collector issues of the coins were issued with special edge lettering. Rather than the edge being reeded it was smooth with “30TH ANNIVERSARY” struck into the edge. Both the proof and burnished uncirculated coins were produced at West Point include the “W” mintmark and the edge lettering.

Rolls and the Green Monster Box

When the U.S. Mint sells bullion coins to their authorized resellers, the coins are packaged in 20-coin hard plastic rolls and 25 rolls are placed in a specially designed box that contains 500 troy ounces of silver. Because the box is green in color and sealed by the U.S. Mint, the package is nicknamed the Green Monster Box.

Resellers sell Green Monster Boxes with the intent of selling to investors. They also sell complete rolls from the Monster Box.

Sealed Green Monster Boxes have the benefit of being unsearched and unhandled since leaving the U.S. Mint. Additionally, the cost per coin is usually the lowest available since the coins are being purchased in bulk. These boxes are usually offered for sale by bullion dealers at a small premium over the current market (spot) price of silver.

In the next installment, we look at the American Gold Eagle coins.

All images courtesy of the U.S. Mint unless otherwise noted.

Dec 23, 2017 | bullion, exonumia, silver

One way to make collecting more fun is to combine interests. One of the members of my local coin club loves cats and has always had one around his house. To help enhance his collecting experience, he collects coins, medals, and tokens with images of cats.

One way to make collecting more fun is to combine interests. One of the members of my local coin club loves cats and has always had one around his house. To help enhance his collecting experience, he collects coins, medals, and tokens with images of cats.

I recently learned that the family of another club member was from Rhodesia. He is working on a collection of Rhodesian coins from before they became Zimbabwe.

Just to complete a thought, a friend’s family came to the United States and 1876 from Eastern Europe. After he traced his family’s history and their path to the United States, he collects coins that were struck in 1876 from the countries his family stopped in during their trip.

My interest is cars. I love the muscle cars of my youth, particular the Mopar muscle. But I love all of the older cars. I think that their designs through the muscle car era had depth and style. Other than the 1959 Cadillac with the biggest fins ever produced in Detroit, I find the Art Deco look of the pre-war cars very appealing.

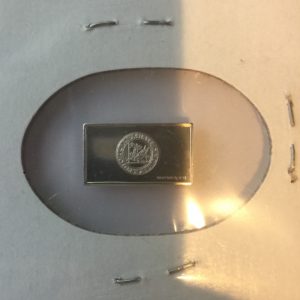

Recently, I was able to add to my cars and numismatics collection by finding one gram silver ingots with images of vintage cars.

While searching online auctions looking for holiday-related one grams silver ingots to use as gifts, I stumbled across a seller with about two dozen of the ingots with images of classic cars including an 1879 Benz, largely considered the first commercially available automobile. I systematically placed a minimum bid on each of the ingots and decided not to pay any more than one dollar per ingot. When the auctions were over, I won 16 of the 24 that were for sale.

When they arrived, I examined them closely looking for something to indicate who might have made them. Aside from the image of the automobile on the front and the manufacturer on the reverse, there is a sequence number and a copyright that says “476” on the bottom right. The numbers are so small that I needed a 16x loupe to see them.

Each ingot contains 1 gram of .999 silver. At the current price of $16.99 per Troy ounce, each ingot contains 55-cents worth of silver. Since I paid 99-cents for each ingot I think I did pretty well on this deal. They will fit nicely with my Somalia classic cars and motorcycle coins.

If anyone has information as to who created these ingots, please comment below or contact me with the information.

Sep 27, 2017 | bullion, coins, palladium, US Mint

Quick update for those interested in the new Palladium Bullion Coin that was sold to authorized purchasers on Monday.

The U.S. Mint added a link for the Palladium Bullion Coin to the American Eagle Coin Program web page. The web page provides scaled image of the coin and the design information.

If you want to find an authorized seller, the U.S. Mint has a web page to let you find one based on your location.

Rather than using the images that were reviewed by the Citizens Coinage Advisory Committee, the U.S. Mint also posted full-sized color pictures of the coins.

-

-

2017 American Palladium Eagle One Ounce Bullion Coin Obverse using the Mercury Dime design by Adolph A. Weinman

-

-

2017 American Palladium Eagle One Ounce Bullion Coin Reverse using the design 1907 American Institute of Architects (AIA) Gold Medal reverse by Adolph A. Weinman

A quick check of online auctions shows that the American Palladium Eagle coin is averaging $1,100 per coin when buying one graded and encapsulated coin or $1,080 when buying an ungraded coin. Multiple coin lots are averaging between $1,070 and $1,080 each.

As I type this, the current price of palladium is $928.73. Dealers are paying 6.25 percent over the spot price (approximately $986.79) plus shipping costs. Graded coins also incur fees paid to the third-party grading service.

Images courtesy of the U.S. Mint.

Sep 24, 2017 | bullion, commentary, markets, news

On Monday, the U.S. Mint will begin selling palladium bullion coins to authorized purchasers. The opening price will probably be $976.44 per coin, which is 6.25-percent over the spot price of $919 per troy ounce.

On Monday, the U.S. Mint will begin selling palladium bullion coins to authorized purchasers. The opening price will probably be $976.44 per coin, which is 6.25-percent over the spot price of $919 per troy ounce.

Metal prices have not followed a path that market watchers are familiar with. Platinum is usually more expensive per troy ounce than gold but has been less while palladium usually tracks at half of the price of gold.

With all of the turmoil in the world, the price of gold is relatively flat with spikes for various activities in the news. But an investor who bought at the beginning of the year “complains” that the price is up only 12-percent for the year despite fundamentals that suggest a larger gain. Recent events have caused the price to jump, but one investor told me that gold is a safe bet but it is not a good bet if you are looking to make money.

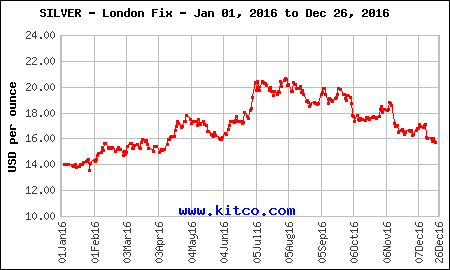

A dealer that sells silver has called the market schizophrenic. There are swings in the prices that defy market logic. With stricter regulation, higher demand, and flat production growth, the price of silver should be climbing. But it is relatively flat for the year with a 6.4-percent grown.

Some are even suggesting that the silver market is being manipulated.

I do not know if the market is being manipulated, but the experts are telling me that something is not right.

September 15, 2017

Even coin production mints make mistakes. If you have a coin that’s a product of one of these mistakes, it’s probably worth way more than face value. → Read more at rd.com

September 17, 2017

Summary There is considerable evidence that silver is subject to considerable manipulation. Revelations of manipulation from regulatory investigations and lawsuits in recent years have led to the introduction of stricter regulations and oversight. → Read more at seekingalpha.com

September 18, 2017

The second batch of commemorative coins minted for the funeral of His Majesty the late King Bhumibol Adulyadej have proved very popular after being available for reservations on Monday. Long queues were seen since early in the morning at designated venues nationwide. → Read more at nationmultimedia.com

September 23, 2017

HYDERABAD: Hyderabad of yore had carved a niche of its own in the spheres of culture, commerce, language and festivals. → Read more at timesofindia.indiatimes.com

Sep 19, 2017 | bullion, coins, Eagles, palladium, poll, US Mint

American Palladium Eagle mockup as presented to the Citizens Coinage Advisory Committee

After seven years since the law was passed (American Eagle Palladium Bullion Coin Act of 2010, Pub. L. 111-303), these coins Will begin their sale. There is no indication whether the U.S. Mint will offer collectable versions or just release the bullion coins.

The coin will have a $25 face value and require that “the obverse shall bear a high-relief likeness of the ‘Winged Liberty’ design used on the obverse of the so-called ‘Mercury dime’” making it yet another bullion coin that will feature a design from the early 20th century. For the reverse, the law says that the coin “shall bear a high-relief version of the reverse design of the 1907 American Institute of Architects medal.” Both the Mercury Dime and 1907 AIA medal designed by Adolph A. Weinman, whose Walking Liberty design is used on the American Silver Eagle coins.

No price has been announced but the current Price of Palladium is $911.63. As a reference the current spot price of metals are as follows:

Precious Metals Price Snapshot as of September 19, 2017

(This is a static chart—it does not update)

The U.S. Mint does not publish the bullion and bulk sale prices the way it does for collector coins but it is likely that these coins are sold to distributors at a premium over their spot price. I guess we will find out how much these coins will cost for investors and collectors purchase when they hit the market.

For today’s poll, are you going to buy one?

Loading ...

Jul 28, 2017 | bullion, coins, commemorative, commentary, legal, legislative, policy, US Mint

A while ago, I received the following question from a reader:

Why do coins that were made NOT for circulation, like Silver Eagles, Commemoratives Productions, etc have any value other than their face value? I do not see the value of collecting something that was never meant for circulation.

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

The American Silver Eagle Program was the result of the Reagan Administration wanting to sell the silver that was part of the Defense National Stockpile to balance the budget. Originally, the plan was to auction the bullion. After intense lobbying by the mining industry warning that such an auction would damage their industry, the concept was changed to selling the silver as coinage.

Changing the sales to coinage allowed for market diversification. Rather than a few people attempting to corner the market at an auction, selling coins on the open market allows more people to have access to the silver as an investment vehicle.

As codified in Title II of the Statue of Liberty-Ellis Island Commemorative Coin Act (Public Law 99-61, 99 Stat. 113), the “Liberty Coin Act” defines the program as we know it today including the phrase “The coins issued under this title shall be legal tender as provided in section 5103 of title 31, United States Code.”

As a legal tender item, the coin’s basic value has the backing of the full faith and credit of the United States government. Regardless of what happens in politics and world events, the coin will be worth at least its face value. Being minted by the U.S. Mint is a guarantee of quality that is recognized around the world making worth its weight in silver plus a numismatic premium.

Coins are perceived by the market as being more desirable than medals. Medals have no monetary value except as an art object. When it comes to investments, they do not hold a value similar to that of a legal tender coin. This is because medals are not guaranteed by the United States government, a key factor in determining its aftermarket value.

Once the coin has been sold by the U.S. Mint, its value is determined by various market forces. For more on how coins are priced, see my two-part explanation: Part I and Part II.

Why do American Silver Eagles have a One Dollar face value? Because the law (31 U.S.C. Sect. 5112(e)(4)) sets this as a requirement.

Why are the coins worth more than their face value? Because the law (31 U.S.C. Sect. 5112(f)(1)) says that “The Secretary shall sell the coins minted under subsection (e) to the public at a price equal to the market value of the bullion at the time of sale, plus the cost of minting, marketing, and distributing such coins (including labor, materials, dies, use of machinery, and promotional and overhead expenses).”

Can you spend the American Silver Eagle as any other legal tender coin? In the United States, you can use any legal tender coin in commerce at its face value. This means that if you can find someone to accept an American Silver Eagle, it is worth one dollar in commerce. However, it would be foolish to trade one-ounce of silver for one dollar of goods and services.

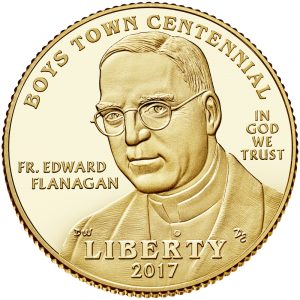

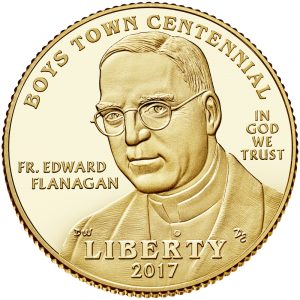

Commemorative Coins

Commemorative programs are different in that the authorizing laws add a surcharge to the price of the coin to raise money for some organization. Using the 2017 Boys Town Centennial Commemorative Coin Program (Public Law 114-30) as an example, Rep. Jeff Fortenberry (R-NE) introduced a bill (H.R. 893 in the 114th Congress) to celebrate the centennial anniversary of Boys Town. As with all other commemorative bills, the bill specified the number, type, composition, and denomination of each coin.

The Boys Town Centennial Commemorative coin features Fr. Edward Flanagan, founder of Boys Town

As with other commemorative, the coins will include a surcharge. Each gold coin will include a $35 surcharge, $10 for a silver dollar, and $5 for each clad half-dollar coin. When the program is over, the surcharges “shall be paid to Boys Town to carry out Boys Town’s cause of caring for and assisting children and families in underserved communities across America.”

The 2017 Boys Town Centennial Uncirculated $5 Gold Commemorative Coin is selling for $400.45 and the proof coin is selling for $405.45 suggesting that the process of producing a proof coin costs the U.S. Mint $5 more than the uncirculated coin.

What goes into the price of the coin? After the face value of $5, there is a $35 surcharge added that will be paid to Boys Town, there is the cost of the metals used. Here is a workup of the cost of the gold planchet using current melt values:

| Metal |

Percentage |

Weight (g) |

Metals Base Rate |

Price (g) |

Metal Value |

| Gold |

90% |

7.523 |

1259.00/toz |

40.48 |

$ 304.52 |

| Silver |

6% |

5.015 |

16.57/toz |

0.53 |

0.27 |

| Copper |

4% |

3.344 |

2.83/pound |

0.006 |

0.00 |

| Total metal value |

$ 304.79 |

Even though the melt value of the coin is $304.79, there is a service charge the U.S. Mint has to pay the company that creates the planchets. Thus, before the labor, dies, use of machinery, overhead expenses, and marketing is calculated into the price, the coin will cost $344.79 even though the legal tender face value of the coin is $5.

Taking it a step further, the average profit the U.S. Mint makes from gold commemorative coins is 8-percent (based on the 2015 Annual Report). If they are charging $400.45 for the uncirculated gold coin, the coin costs $368.41 to manufacture, $373.41 for the proof version.

Why collect these coins?

Why not?!

American Silver Eagle bullion coins were created for the investment market even though the authorizing law saw the benefit of allowing the U.S. Mint to sell a collector version. All of the Eagle coins are sold for investment or because people want to collect them for their own reasons. Some collect the collector version as an investment.

Commemorative coins are collected for their design or the buyer’s affinity for the subject and to support the cause which is being sponsored by the sale of the coin. Some collect commemorative coins like others collect series of coins.

Even though modern commemorative coins are sold for more than their face value, that does not mean they are not worth collecting. After all, can you buy a Morgan Dollar, Peace Dollar, Walking Liberty Half-Dollar, or a Buffalo Nickel for its face value?

Collecting bullion, commemorative, and other non-circulating legal tender (NCLT) coins is a matter of choice. If you choose to collect these coins, know that they will be worth more than their face value. And while they are legal tender coins, they are not meant for circulation. They are collectibles.

If you like these collectibles, enjoy your collection. Along with coins produced for circulation, I own American Silver Eagle coins, commemoratives, and other NCLT because I like them.

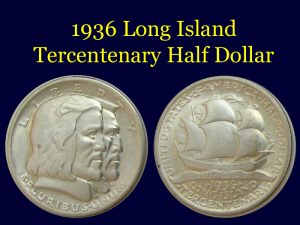

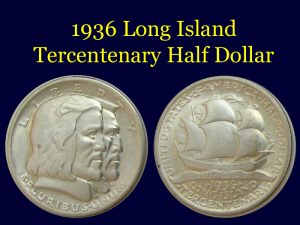

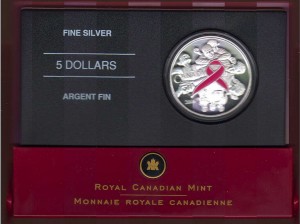

Some of the NCLT coins in my collection

-

-

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

-

-

2015 March of Dimes Commemorative Proof set

-

-

2014 National Baseball Hall of Fame commemorative proof dollar graded by PCGS PR70

-

-

2012 Star-Spangled Banner Silver Commemorative Obverse depicts Lady Liberty waving the 15-star, 15-stripe Star-Spangled Banner flag with Fort McHenry in the background. Designed by Joel Iskowitz and engraved by Phebe Hemphill.

-

-

1936 Long Island Tercentenary Half Dollar

-

-

Reverse of the 2016 Chinese Silver Panda coin

-

-

2006 Canada silver $5 Breast Cancer Commemorative Coin

-

-

2007 Somalia Motorcycle Coins

-

-

2010 Somalia Sports Cars

Boys Town commemorative coin image courtesy of the U.S. Mint.

Jan 9, 2017 | bullion, coins, commentary, Federal Reserve, investment, markets, news

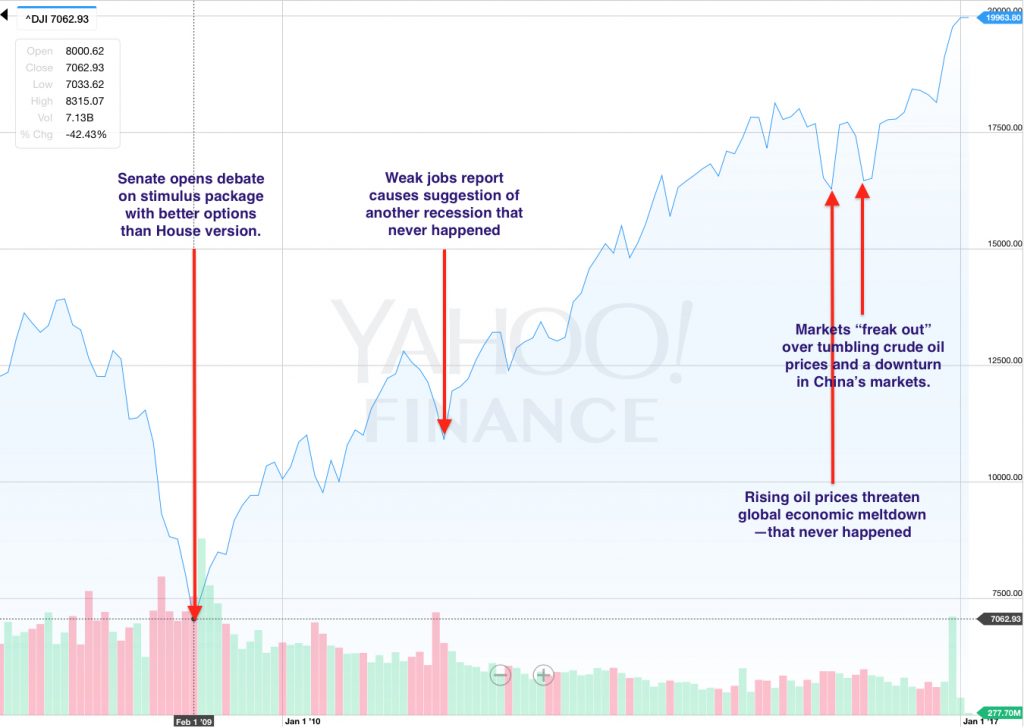

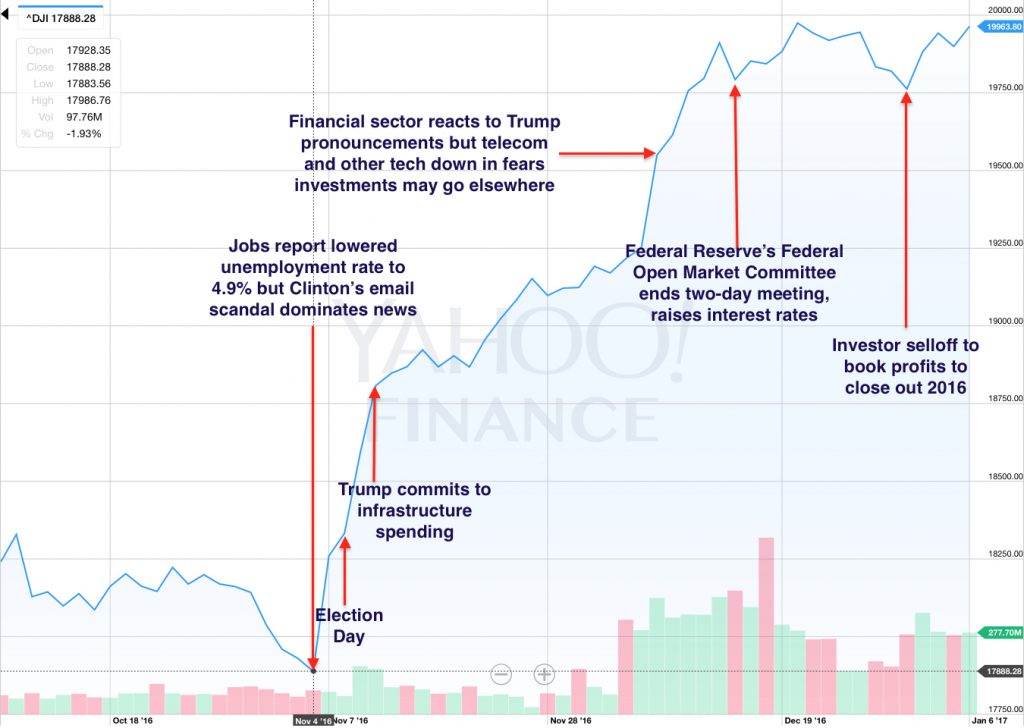

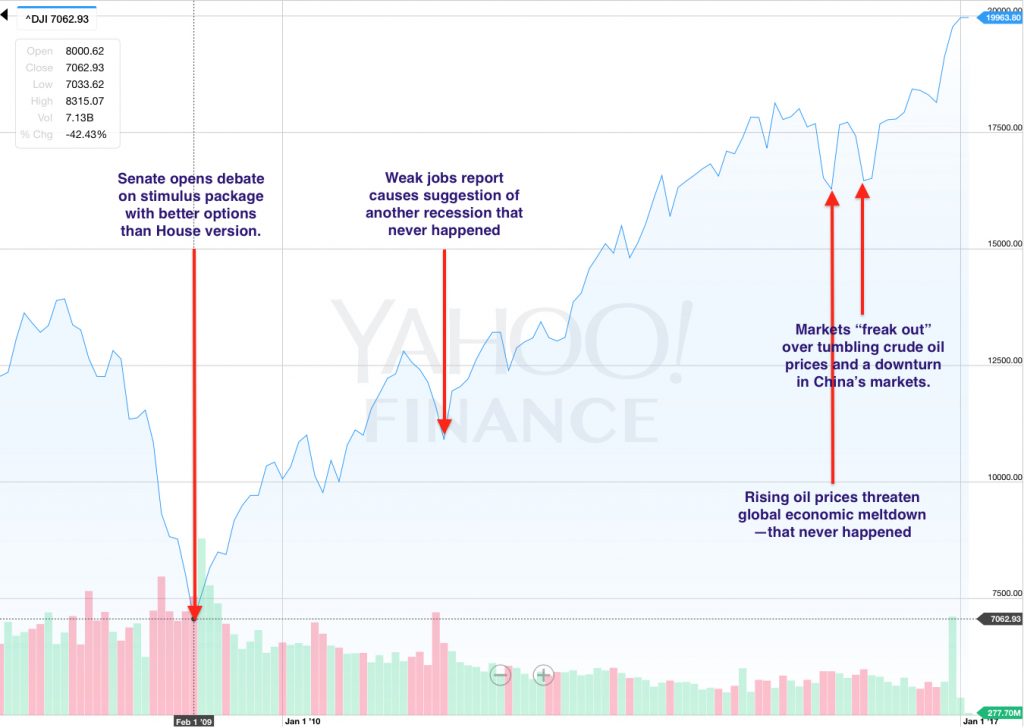

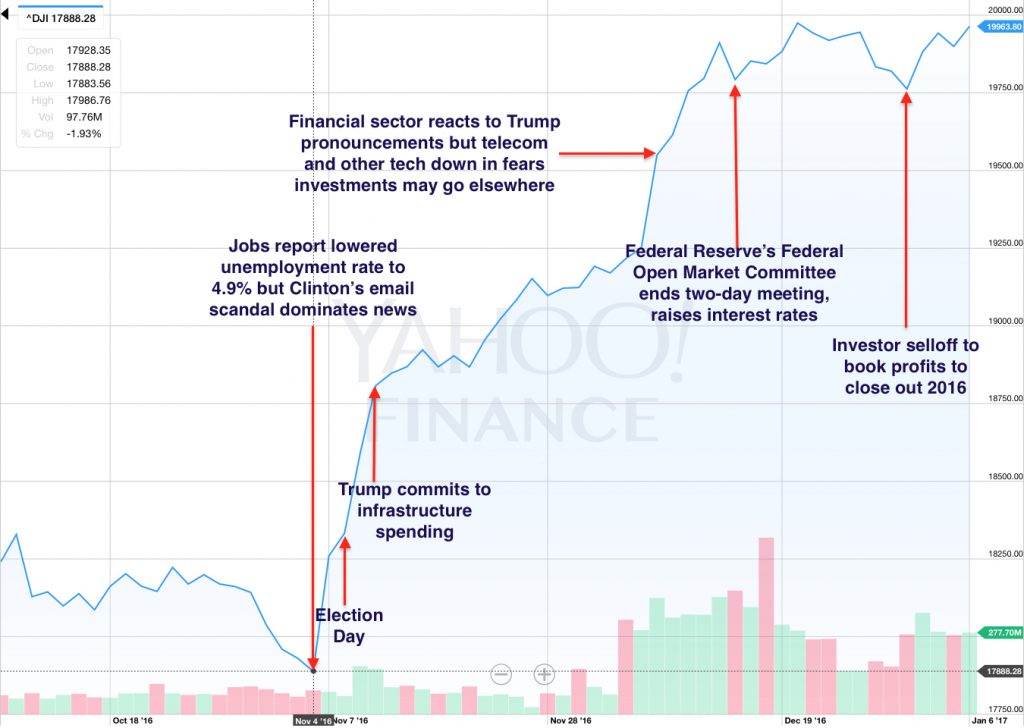

Since the election, there have been a number of stories about the “Trump Effect” on the markets. The narrative is that the economic bounce is tied specifically to the election of Trump.

The premise is that the market is reacting to the election of Donald Trump and is the direct cause for the change in the economic factors in the markets. Unfortunately, the narratives being promoted is shortsighted. Markets are not reacting to the election of Trump. The markets are reacting to the certainty that the election is settled.

Markets hate uncertainty. When there is uncertainty, the markets tend to react to everything and sometimes in an exaggerated manner. Fortunately, the economic indicators have been good and the markets have reacted accordingly with exaggeration.

How the markets have reacted to uncertainty in economic news

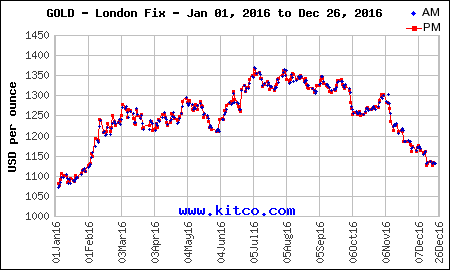

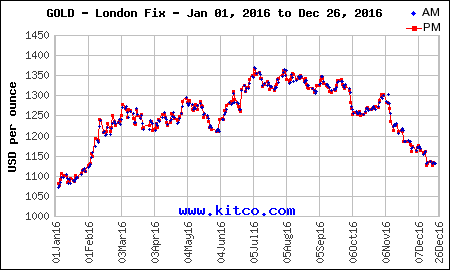

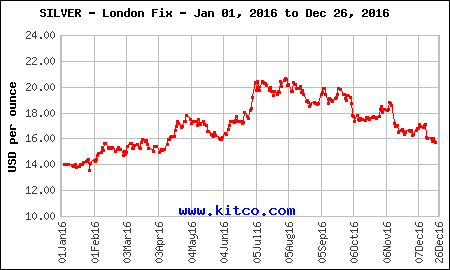

When looking at the collecting markets, whether it is numismatics or antiques, you can look at the precious metals markets as a key indicator. In basic terms, the price of precious metals is indirectly proportional to the strength of the markets and economy. It translates to if the economy is strong making investing less of a risk, then the precious metals markets will be weaker. it means there is more cash circulating creating discretionary income that buyers use to spend on non-essentials, like hobbies.

A strong market and economy means that investments in businesses are a better bet. Strong employment numbers and the movement of goods and services mean that there is money to be made by investing in business. If there are good investment opportunities, it does not make sense for investors to tie money up in precious metals.

Investment in metals makes sense when investing in their value is better than the expected rate of return on business investments. Once investors turn to precious metals, the price is based purely on supply and demand. Since the supply stream is relatively constant, demand mostly influences the price of metals. If the demand is high and the supply cannot keep up with the demand, the price will rise. What helps regulate the price is that there continues to be a supply but the demand has been known to outpace the supply.

The fact of the matter is that economic indicators have improved. Prices of metals have been steadily dropping since August as the investment in stocks been going up. Even before the election, the markets were in growth mode but skittish with uncertainty.

All the election brought was a certainty. Markets know who the next president will be, who will be in congress, and who will control the state houses. If markets hate uncertainty then the currency that fueled the rally was the removal of uncertainty.

After the week following the election, the markets leveled off with the next goal to figure out what the Federal Reserve would do. With the uncertainty surrounding the December Federal Open Market Committee (FOMC) meeting, the drive to record levels stalled. When the FOMC announced the increase in interest rates, rather than reacting negatively, the reactions was as if the markets were saying, “It’s about time.” with the uncertainty of what the FOMC would do, the markets reacted by climbing to record levels.

Market reactions to various news and economic events

In the meantime, the metals markets have been on a steady decline. Since the capital markets are providing a good return on investments, there is no incentive to invest in metals. Although people are buying, the fewer buyers are beating the prices down making bullion-based collectibles cheaper.

Gold free fall began on Election Day 2016

Silver downward trend started on Election Day

What does that have to do with higher end collectibles such as rare coins?

When capital markets are adding to the general wealth of the investor community, they will look for different places to invest their winnings. The new money will start to buy high-end items to supplement their other investments. This is why the collector market thrives during good economic times. Prices of fine art, prime real estate, collector cars, and even rare coins rise.

Rare coins have been resilient since the decline in markets. Rare coins became a safer bet and have attracted new investors which has bucked the trends of the past. This was not lost on the broader investing community who may be looking for diversity in their portfolios.

In review, the markets have been on a six-year rise as the economy has recovered from the Great Recession. Economic indicators are on an extended positive run. The election created certainty in the future of the government and the Federal Reserve created certainty when it raised interest rates. Since markets like certainty, the reaction is not because of the result of the election it is that the election is over.

Certainty is driving the markets, not the details of the results.

Credits

- Dow Jones Industrial Average charts courtesy of Yahoo! Finance.

- Gold and silver charts courtesy of Kitco.

Dec 7, 2016 | bullion, gold, US Mint, video

Gold storage at West Point in 1942 (screen grab)

Gold stored at West Point is called “working stock.” This is the gold that the U.S. Mint uses for striking coins. Depending on the demand, the gold you will see in the video will not be there in a year. It will be used for American Gold Eagles, gold commemoratives, and gold medals cast for congress and the president.

West Point has been called “The Fort Knox of Silver” because it is where the U.S. silver reserve is located. It is also the location for the working stock of silver used by the U.S. Mint. All of the U.S. Mint facilities have working stock of silver used to strike silver coinage. However, since most gold production is struck out of West Point and Philadelphia, most of the working stock of gold is in those facilities.

West Point is the primary manufacturer of gold bullion coins.

In the video at the 50-second mark, someone is weighing a bar of gold. He says the manufacturer claim is that it weighs 400.100 (troy ounces) but actually weighs 400.096. A gold bar weighing 400.096 troy ounces is 12.444 kilograms or 27.435 pounds. With the price of gold currently $1,176.60 per troy ounce (as this is being written), the melt value of that gold bar, which is .9999 fine looking at the stamp on the bar, is $470,752.95.

Video courtesy of the U.S. Mint.