Nov 20, 2016 | bullion, coin design, coins, gold, US Mint

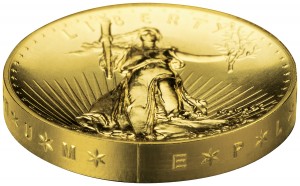

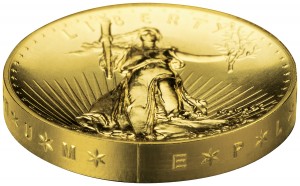

In 1916, the U.S. Mint began to circulate three iconic coin designs that remain favorites amongst collectors. To celebrate, the U.S. Mint issued 24-karat gold centennial versions of the Mercury Dime, Standing Liberty Quarter, and Walking Liberty Half-Dollar. The designs of the coins are the same as their century-old counterparts except the gold specification was added. Earlier this month, the U.S. Mint released the 2016-W Walking Liberty Half-Dollar 24-karat gold coin to complete the series.

-

-

2016-W Mercury Centennial Gold Dime

-

-

2016-W Standing Liberty Centennial Gold Quarter

-

-

2016-W Walking Liberty Centennial Gold Half-Dollar

With the release of the gold Walking Liberty Half-Dollar, every coin design that was part of President Theodore Roosevelt’s “pet crime” that has gone out of circulation, except the Bela Lyon Pratt quarter and half-eagles and the Saint-Gaudens $10 eagle, have been reproduced at least once. Only Victor D. Brenner’s Lincoln Head Cent design remains in circulation even though the reverse has been redesigned a few times.

Isn’t it time we move on?

Let’s forget the legal limitations placed on the U.S. Mint that only allows them to do a tribute like this in gold even though the original coins were struck in silver, how many collectors are really interested in buying these coins? How many can afford these coins?

Judging by the listings for online auctions and dealers that specialize in modern precious metals, it seems that the alleged sellout of the gold Mercury Dime was because of speculation. While there will always be some opportunists in any market, the appearance of the churn in that market feels more like people looking to make money rather than collect, especially since its $209 issue price is more affordable.

Now, both the Standing Liberty and Walking Liberty gold coins are still available. With the limited availability, why aren’t collectors buying these coins?

Aside from the cost of a gold coin, how many younger collectors or even those that are a part of Generation X have any connection to those coins? It is possible we Baby Boomers have seen these coins in circulation, even sparingly. I was able to find Mercury dimes and Buffalo nickels as late as the very early 1970s before they were all removed from circulation. My interest in collecting started when I found Indian Head cents in pocket change.

I am not saying that these designs are unworthy of a tribute. As a collective, they are arguably the most iconic designs of U.S. coinage. But what many consider the best of the best will live on as part of the American Eagle, Buffalo 24-karat, and the soon-to-be palladium bullion programs.

Isn’t it time we move on?

-

-

American Silver Eagle Proof

-

-

2009 Ultra High Relief Double Eagle Gold Coin

-

-

2013-W American Buffalo gold reverse proof obverse

Sales of mint and proof sets are down. Sales of commemorative coins are not meeting expectations where only a few have been sellouts. And the only modern coin that has seen any respect from the Baby Boomer and older collecting community was the 2014 50th Anniversary Kennedy Half Dollar gold coin.

It is time we move on.

The 115th congress will be sworn into office on January 3, 2017. Giving the congress time to get settled including my representative who will be entering his first term in the House, I will write to him to propose a that a silver program similar to the 24-karat gold program be created. Maybe, if coins are offered in silver, a more affordable metal, we can use those coins to generate additional interest in collecting.

It may not be much, but it is a start!

Coin images courtesy of the U.S. Mint.

Jun 16, 2016 | bullion, coins, Eagles, US Mint, video

American Silver Eagle Monster Box

Another of my guilty pleasures is How It’s Made on the Science Channel. How It’s Made is simply a show that will demonstrate how every day and other items are manufactured. I am fascinated by seeing the process of manufacturing. Some of the machines that are created to make our everyday items is fascinating. Take something simple as a pencil and think about how a company makes thousands over the course of a day and the non-standard machines required to do this.

The U.S. Mint infrequently posts videos about their coins, people and operations. What I find fascinating is the How It»s Made like videos that shows how they deal with the basic manufacturing process. In the latest video, the U.S. Mint shows how they package American Silver Eagle bullion coins into tubes for shipping to dealer.

The machine is called an Auto Tuber and can be found at the West Point branch mint where bullion coins are struck. After the coins are struck, they are laid flat on trays with the trays being stacked on a rack. From the rack, a machine takes one of the trays, places it next to the Auto Tuber, and pours the coins into the tracks. Using a suction cup fingers, the machine lifts the coins and places them into tube. The tubes are capped, weighed, packaged, inventoried, and sent for shipping.

At the end of the line is a human worker who picks up the packed green boxes you might have seen some dealers advertise for sale as “Monster Boxes” and places them on a pallet for shipping. That is where the one-minute journey ends.

BONUS VIDEO

Similar to the standard production videos is the proof set production video from the U.S. Mint in San Francisco that includes a similar machine that places the coins in the holders.

Credits

- Monster box image courtesy of Wikipedia.

- Videos courtesy of the U.S. Mint.

Apr 15, 2016 | bullion, coin design, coins, gold, US Mint

If you read my Baltimore show report, you might have noticed that I included images of the Mercury Dime 2016 Centennial Gold Coin. According to the U.S. Mint, the coin is scheduled to go on sale on April 21, 2016 at noon Eastern Time.

Obverse of the soon to be released Mercury Dime 2016 Centennial Gold Coin

Reverse of the soon to be released Mercury Dime 2016 Centennial Gold Coin

With a mintage limit of 125,000 and struck in West Point, the coin will be struck on a 24-karat (.999 pure) gold planchet. It will differ from the original Mercury Dime in that it will be dated 2016. On the reverse the coin will have the “W” mintmark since it will be struck in West Point, include “AU 24K” and “1/10 OZ.” to note that the coin will contain one-tenth ounce of gold. Otherwise, it looks exactly like Adolph A. Weinman’s design that was used from 1916 through 1945.

At 16.50 mm in diameter, the gold coin will be a little smaller than the 17.91 mm silver dime. The gold coin will be heavier (3.11 g) than the original that was made from 90-percent silver (0.7234 troy ounces).

To make this coin, the U.S. Mint is exploiting a loophole in the law that authorized the American Buffalo 24-Karat Bullion Gold Coins program (31 U.S.C. § 5112(q)). According to the law, after the first year of issue (2007), the Secretary can change the design of the coin as long as the design is reviewed by the Commission of Fine Arts and Citizens Coinage Advisory Committee. The U.S. Mint used this law to authorize the 2009 Ultra High Relief coin and the fifty year celebration of the Kennedy half dollar in 2014 with the dual date.

The original Winged Liberty “ Mercury” Dime was a silver coin produced as a result President Theodore Roosevelt’s “pet crime” where he thought U.S. coin design was hideous. Weinman was Augustus Saint-Gaudens’ student who is credited with finishing the work on Saint-Gaudens coin designs after the master sculpture’s death. It was not one of Weinman’s favorite works but it is beloved by collectors.

As a collector who has an almost complete collection of Mercury dime (missing the 1916-D), I was skeptical about the visual appeal of the coin in gold. When I open the folder, I see 30 years of silver coins. Since I try to keep my collection at extra fine (XF) or better, you can get used to seeing that beautiful silver color. When I saw the gold coin in a size that is close to the original dime in the presentation box at the Whitman Expo, I thought it made for a beautiful tribute.

Pricing of the coin will depend on the London Bullion Market Association (LBMA) afternoon price of gold on Wednesday, April 20. That number will be plugged into their pricing grid to determine the opening price of the coin. For example, the LBMA PM price of gold on April 14 is $1,233.85 per troy ounce. If this was the basis of the opening price, we would look up in the table for the price range $1,200.00 to $1,249.99. Since this is an uncirculated business strike coin struck under the American Buffalo act, the table shows that the coin would open at $194.00.

Using my example, this would give the coin a $70.61 or 36-percent numismatic premium over the spot price, which also takes into account U.S. Mint production costs (materials, labor, packaging, etc.).

If the LBMA PM price goes over $1,250 then the opening price of the coin will be $199.00. Being under $200.00 may give the market a psychological boost that may promote quicker sales. Then again, if the price of gold dips below $1,200.00, the coin will open at $189.00.

Putting on my prognosticator’s hat, I predict that the price of gold will go up enough that the opening price will be $199.00.

NOTE: I am just a blogger making a prediction. If you want a better market analysis, ask a professional advisor. They may have a more informed opinion, but we are all just throwing ideas up against the wall trying to figure out what will stick!

Mar 9, 2016 | bullion, coins, commentary, Eagles, economy, silver

What began as an English proverb as “March comes in like a lion and goes out like a lamb” may become a relic of history. Aside from the weather implications the markets are experiencing a lion-like robustness that even has the governors and branch presidents of the Federal Reserve issuing conflicting statements about the future of interest rates.

What began as an English proverb as “March comes in like a lion and goes out like a lamb” may become a relic of history. Aside from the weather implications the markets are experiencing a lion-like robustness that even has the governors and branch presidents of the Federal Reserve issuing conflicting statements about the future of interest rates.

While the professionals are attempting to figure out what the economic numbers are saying, one thing is clear that the U.S. Mint is on pace to break its 2015 sales for American Silver Eagle bullion coins. March opens with the U.S. Mint announcing that it has another 1 million silver coins ready for sale. This is the fifth time in 2016 that the U.S. Mint has made this type of announcement.

Year to date, gold prices are up about 17-percent and silver prices are up 11-percent. This has not stopped the buying of bullion coins. One Canadian dealer recently informed me that they sold out of a specific silver issue from the Royal Canadian Mint because of high demand, especially from the United States.

This is reaching beyond collectors. While the numismatic world was focused on Dallas for the National Money Show, my business kept me in the D.C. area as a vendor at one of the largest antiques shows in the mid-Atlantic region. Although coins are a very minor part of the show, some dealers that were selling silver coins had high volumes of sales. One dealer reported that he sold out of the 30 American Silver Eagle bullion coins graded MS-70 by the middle of the show’s second day.

An informal poll of attendees to the National Money Show suggests similar sales performances.

Even though there may be areas of the economy that has not caught up to the current economic trends, it is difficult to find an analyst or pundit that does not believe that the current trends will end in the short term.

It is likely that March will go out like a raging bull, even if I could not find a one-armed economist to disagree!

Dec 24, 2015 | bullion, coins, legislative, palladium, US Mint

Our final saga of How the Congress Turns (our stomachs), we will finish looking at the technical changes added to the “Fixing America’s Surface Transportation Act” or the “FAST Act” (H.R. 22) will impact collectors. Back to Title LXXIII, Section 73001 we find:

Title 31, United States Code, is amended —

(1) in section 5112 —

. . .

(C) in subsection (v) —

(i) in paragraph (1), by striking Subject to and all that follows through the Secretary shall and inserting The Secretary shall;

(ii) in paragraph (2)(A), by striking The Secretary and inserting To the greatest extent possible, the Secretary;

(iii) in paragraph (5), by inserting after may issue the following: collectible versions of; and

(iv) by striking paragraph (8);

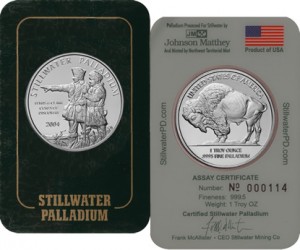

Remembering that technical changes instructs the Office of the Law Revision Counsel how to correct the law, to understand this change we have to look at the law (31 U.S.C. § 5112(v)) to find that this is a correction to the law about minting palladium bullion coins.

Palladium Nugget

The very first edit is to take away the wording that says to do the study and strike if there is a market to saying that palladium coins will be struck using as much palladium as can be found from United States sources. If there is a higher demand, the U.S. Mint can use sources outside of the U.S. to purchase palladium.

Finally, the last correction not only requires the U.S. Mint to strike palladium bullion coins but to also create collector versions.

-

-

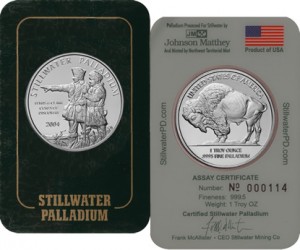

2004 Stillwater Palladium Rounds

-

-

2005 Canada Palladium Maple Leaf

Palladium is a soft silvery metal like platinum. It is lighter than platinum (atomic number 46 versus 78) and similar to silver (atomic number 47). It has similar uses as silver including in electronics, compounded catalysts, jewelry, and coins. Palladium commands a higher price than silver because it is less available but less expensive than platinum, which is more difficult to mine.

The primary source of palladium in the United States is the Stillwater Mine in Montana. The mines, which also provides the U.S. supply of platinum group metals (PGM), is owned and operated by the Stillwater Mining Company. The American Eagle Palladium Bullion Coin Act was introduced by Rep. Dennis “Denny” Rehberg (R), Montana’s only member in the House of Representatives.

The final entry will discuss how the transportation bill and bad timing will affect American Silver Eagle collectors.

Dec 22, 2015 | bullion, coins, gold, legislative, news

Over the last few years, congress has had this habit of waiting to the last minute to vote on legislation. When they do, they load up this legislation with seemingly unrelated stuff that it is no wonder their ratings are in the single digits.

2010 Somalia Sports Cars — Not the type of numismatic transportation we are talking about.

Title LXXIII of what is now Public Law 114-94 is short but has a big impact on the future for collectors. Rather than try to digest it all here, I will spend the next few days discussing the impacts. Starting with the technical corrections as part of Section 73001.

Technical corrections to a law is the process where congress votes on the wording changes that either clarifies or changes the limits of a law. It is written in a way that tells theOffice of the Law Revision Counsel, the editor of the United States Code (federal law), how to correct the law. In the case of the these corrections, it is instructing the Law Revision Counsel to edit the law (31 U.S.C. § 5112) that defines all the specification for U.S. coinage.

Today we begin with:

Title 31, United States Code, is amended —

(1) in section 5112 —

(A) in subsection (q) —

(i) by striking paragraphs (3) and (8); and

(ii) by redesignating paragraphs (4), (5), (6), and (7) as paragraphs (3), (4), (5), and (6), respectively;

2013-W American Buffalo gold reverse proof obverse

Removing the CFA and CCAC from design decisions may be a good idea when producing coins based on classic design. However, if the U.S. Mint abuses this provision, there is no doubt that congress will yell, scream, call the U.S. Mint bad names, and put the provision back in the law.

The change also removes any limits on mintages of 24-karat gold bullion coins allowing the U.S. Mint to produce as many to meet market demands. It will also allow the U.S. Mint to limit mintages on 24-karat gold bullion coins without asking for permission. This change just codifies current practice.

The change also removes any limits on mintages of 24-karat gold bullion coins allowing the U.S. Mint to produce as many to meet market demands. It will also allow the U.S. Mint to limit mintages on 24-karat gold bullion coins without asking for permission. This change just codifies current practice.

This first correction also removes paragraph (8) that requires protective covering, such as capsules for the coins. This will allow the U.S. Mint to package these coins for bulk sale as bullion coins adding to the potential for higher sales of gold coins. Although there has been no comment from the U.S. Mint, it is doubtful that they would sell collector versions of these coins in substandard packaging. That has not been their policy.

All that from just a few lines. Stay tuned because tomorrow we learn that congress actually did something right, for a change!

Image of the 50th Anniversary Gold Kennedy Half Dollar courtesy of the U.S. Mint.

Nov 24, 2015 | bullion, Eagles, gold, silver, US Mint

As we wind down to the end of the year, the U.S. Mint has been announcing their end of the year production availability for 2015 American Eagle bullion coins. Starting with the announcement on November 14, 2015 that the quarter ounce $10 gold American Eagle bullion coin has sold out and no more will be produced. For 2015, the U.S. Mint has sold 39,500 ounces of quarter ounce American Eagle bullion coin representing 158,000 coins. This represents a 33-percent increase from 2014.

As we wind down to the end of the year, the U.S. Mint has been announcing their end of the year production availability for 2015 American Eagle bullion coins. Starting with the announcement on November 14, 2015 that the quarter ounce $10 gold American Eagle bullion coin has sold out and no more will be produced. For 2015, the U.S. Mint has sold 39,500 ounces of quarter ounce American Eagle bullion coin representing 158,000 coins. This represents a 33-percent increase from 2014.

A few days later on November 18, the U.S. Mint announced that the one-tenth ounce American Eagle gold bullion coin has been sold out. For the year, the U.S. Mint produced 980,000 of the one-tenth ounce gold American Eagle proof coins representing 98,000 ounces of gold. This year’s production is a bit more than 73-percent increase over the 565,000 coins struck in 2014.

UPDATE: In a 4:35 PM note (24-Nov-15), the U.S. Mint has announced that the one-ounce gold American Eagle bullion coin has sold out! Orders for 2016 bullion coins will begin on January 11, 2016.

The day after announcing that they will be restricting the production of the American Silver Eagle bullion coins to 1 million coins per week, the U.S. Mint announced that they will continue to produce the coins through the week of December 7, 2015. They anticipate that this will cover their full weekly allocation through Monday, December 14, 2015.

With the price of silver dropping, the U.S. Mint has produced 42,929,500 American Silver Eagle bullion coins to this point. Considering the allocation of 1 million coins per week with four weeks left of sales, the final total of silver coins should be between 46-47 million coins. This would be an increase over last year’s record of 44,006,000.

American Silver Eagle bullion coin image courtesy of the U.S. Mint.

Oct 27, 2015 | Britain, bullion, coins, nclt, video

Royal Mint Striking Standards

As part of the article and video they discuss the differences between the three types of uncirculated commemorative coin finish: Proof, Brilliant Uncirculated, and Bullion. For the Royal Mint, proof are the highest standards followed by brilliant uncirculated then bullion.

While this may be intuitive to experienced collectors, novice and new collectors may be confused by the difference. The Royal Mint does a very good job at explaining the difference in a short, well produced video. It should be interesting to the beginning and expert collector to see how another mint does their work.

Image and video courtesy of the Royal Mint.

Oct 21, 2015 | bullion, Canada, coins, commemorative, silver

Obverse of the Royal Canadian Mint $20 for $20 silver coins

The advantage to directly buying coins from the RCM is that the exchange rate is very favorable for us Yanks. At the time of writing, C$1 is worth about 77-cents in U.S. currency making a C$20 purchase about $15.41 in the U.S. Another advantage of purchasing coins from the RCM than a dealer is avoiding the dealer markup. One U.S.-based dealer is selling the current $20 Bugs Bunny silver coin for $19.95 in U.S. currency.

For U.S. buyers who use credit cards to purchase coins on the RCM website, while your credit card will be charged in Canadian funds, your bank will charge you a conversion fee. Conversion fees are different between financial institutions and you should consult them for their rates.

Reverse of the Royal Canadian Mint $20 for $20 silver coin featuring Bugs Bunny

RCM’s $20 for $20 coins struck using 7.96 grams of silver. At 27 millimeters, it is comparable in size to the Canadian half-dollar (27.13 millimeters) and smaller than the U.S. half-dollar (30.61 millimeters). While a nice size, a coin containing 7.96 grams of silver is a little more than one-quarter of a troy ounce of the metal. With the cost of silver $15.92 per troy ounce (and the time of writing), the coin only contains $4.07 worth of silver ($5.25 in Canadian funds).

To put it another way, the silver value of the coin is 75-percent of its cost or 400-percent over its melt value!

Reverse of the Royal Canadian Mint $20 for $20 coin featuring “The Man of Steel”

Questioning the program’s worth aside, both the Bugs Bunny and Superman coins are very cool designs. Aside from being engraved coins (not colored pictures) and struck as specimen coins (similar to the U.S. Mint’s enhanced uncirculated strikes), it is just plain fun to have coins with the image of childhood interests.

For a little more than $30 including fees and shipping, I can get two silver coins with iconic designs. It is not about collecting for value. It is collecting for fun!

Weighing in at 1 kilogram of fine .999 silver, this enameled proof coin is does not cost $20! With a $250 face value, the Royal Canadian Mint is selling this coin for $2,350.95

($1,810.80 in the U.S. at the current exchange rate)

All images courtesy of the Royal Canadian Mint.

Aug 26, 2015 | bullion, coins, commentary, gold, investment, silver, US Mint

Reference price of metals for this post (does not update)

Watching the price of gold has been interesting. Since the release of the 2014 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin when the price of gold was set based on the $1,290.50 spot price, the trend of gold prices has been to go lower. Gold spot hit a low almost one year to the day of the release of the Kennedy gold coin on August 5, 2015 at $1,085.10. It has taken three weeks to bounce back a little.

Gold Chart for August to date (does not update)

I call silver the precious metal for the masses. Aside from being less expensive it is still considered a valuable commodity. Aside from the aesthetics of the color (I love the look of chrome on cars) you can really see a great design on a larger silver coin than a gold coin for a lower cost. For example, I like the look of the larger Silver Panda over the yellow gold Panda—and it is cheaper!

While my interest is more of aesthetics and the costs between purchasing the different types of coins, you can get into a situation where the composition determines the price of a coin. After all, the most expensive coin to sell at auction was a 1794 Flowing Hair silver dollar with a rare die variety. For a non-precious metal coin, you can always look at the 1913 Liberty Head Nickels whose composition is 75-percent copper and 25-percent nickel. Sales of these coins have averaged around $3-5 million in the last few auctions.

Rare and key date coins notwithstanding, more people can afford silver than gold. As a result, we have seen a rise in the collecting of silver non-circulated legal tender (NCLT) coins. Although I am not a fan of many of these designs, the various mints creating them would stop if there was not a market for them. Since this is what people are buying, the mints are striking.

To some degree, the price of silver may be inconsequential to the cost of some of these NCLT sets. Coins like the Looney Tunes and DC Comics sets from the Royal Canadian Mint; Star Wars, Disney, and Dr. Who sets from the New Zealand Mint are priced to include royalties that will have to be paid to their respective copyright holders.

-

-

Royal Canadian Mint’s $100 Looney Tunes 14-karat Reverse

-

-

Could this Looney Tunes Silver Kilo coin be on your list?

Then there are the countries of Somalia, Niue, Tuvalu, and the Marshall Islands that do have their own mints but license their names or contract other mints to strike coins for them. Even though these coins may not require licensing fees, many are made with popular themes to entice collectors to purchase them. Seigniorage then goes to both the mint striking the coins and the general treasuries of country whose name is on the coin.

-

-

2007 Somalia Motorcycle Coins

-

-

2010 Somalia Sports Cars

Most mints will float the price of their bullion coins to reflect market forces but not the price of NCLT coins. Even the U.S. Mint does not adjust the price of commemorative coins if the price of the metals drops.

While there are collectors that view their collection in terms of its value and others collecting as an investment of those of us who collect for the sake of collecting, the dropping of metals prices can be seen as an opportunity to buy some nice collectibles cheaper than otherwise. However, never underestimate the greed of some of these mints and the companies that sign agreements with them that will keep your prices high.

I wonder how these coins will fare on the aftermarket in the future?

Image Credits

- Charts courtesy of Kitco.

- Looney Tunes coin images courtesy of the Royal Canadian Mint.

- Somalia motorcycle and sports car coins from author’s personal collection.