Apr 27, 2009 | coins, gold, silver, US Mint

Last year, the US Mint has been under a lot of scrutiny for how they handled gold bullion sales. I tried to find any positive story for the US Mint’s handling of bullion coins. Regardless of the search string I fed into several search websites, I did not find any positive article. Even though the US Mint continues to have problems supplying bullion to the market, I began to wonder if there was a deeper reason that may explain the situation.

Starting with the hypothesis that the shortage of American Gold Eagle bullion coins was because of record high mintage demands, I started by collecting the mintage totals for all American Eagle bullion coins from the US Mint’s website. I am limiting my study to bullion coins because of the difference in striking, handling, and selling collectible versions. I am also not including Gold Buffaloes since they make up less than one-percent of the total number of gold coins produced by the US Mint.

The US Mint does not make downloading mintage data easy. While the numbers are nicely displayed on their website, they do not provide a way to easily import that number into a database or spreadsheet. Using my programming skills, I was able to download the HTML files and extract the numbers. It would be nice if the US Mint would provide a way to download the raw numbers.

Counting Gold Coins

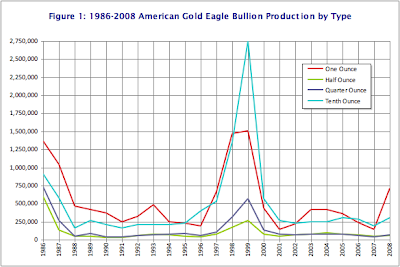

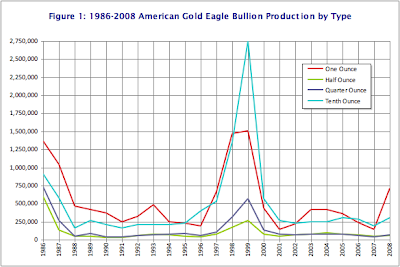

In 27 years of production the US Mint produced over 28.4 million American Gold Eagle bullion coins using over 15.1 million ounces of gold. Over 12 million, or 42.5-percent of the production has been one-ounce coins while more than 10.8 million, or 38-percent are in tenth-ounce coins. Half and quarter-ounce coins combined make up less than 20-percent of the total production of American Gold Eagles. Figure 1 graphs the sales of American Gold Eagle coins.

As with most new coin series, the first year of issue started strong then trailed off the next few years. Our graph in Figure 1 shows that significant changes started in 1998 and continued until 2000. This was the time of the Internet boom when companies were spending money on technology related projects when budgets swelled in fear of the dreaded Y2K Bug. Technology company sprung up like weeds with no business plan, went public with initial public offerings whose prices prompted then Federal Reserve Chairman Alan Greespan to call the run up irrational exuberance, only to crash by 2001.

The economy began to slow after Y2K fizzled but not that slow as the technology industry focused on the potential Leap Day Bug. Usually, every 100 years there will be no leap day on the last year of a century except every 400 years and the last year of a millennium. The threat of the Leap Day Bug continued technology spending but at a slower pace. The economy showed tentative strength through the end of the quarter before showing a slowdown as technology spending slowed.

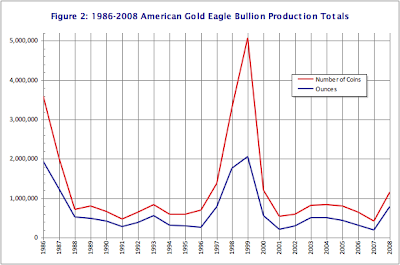

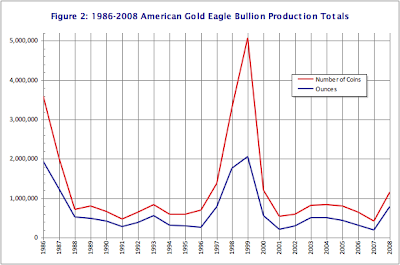

With all of the money entering the market, people were looking for areas for investment. Aside from the irrational exuberance, there were a significant number of investors looking to buy assets to hedge against potential tragedy. Since gold has always been a safe haven from potential disaster, the US Mint increased their production to meet the demand. From 1997 through 2000, the US Mint struck 10.9 million gold coins representing 5.16 million ounces of gold. Considering gold bullion coins are a generic investment, I thought it would be a good baseline to use the number of coins struck and the amount of gold used as a generic comparison from year to year. Figure 2 shows this comparative bullion production.

Graphs in Figures 1 and 2 illustrate that the US Mint produced a significant number of American Gold Eagle Bullion coins during the 1997-2000 economic run. At the time, the US Mint was under the leadership of Philip N. Diehl (1994-2000) and Jay Johnson (2000). Diehl and Johnson guided the US Mint in the production of 48-percent of all gold coins struck between 1986 and 2000. Although this does not take into consideration the total coin production at the US Mint, the time included the introduction of the 50 State Quarters program which caused a significant increase in the number of quarters produced.

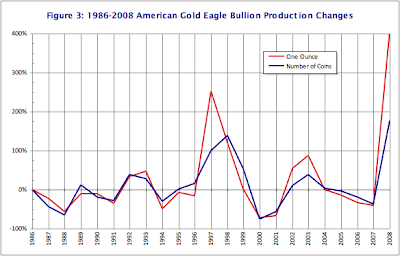

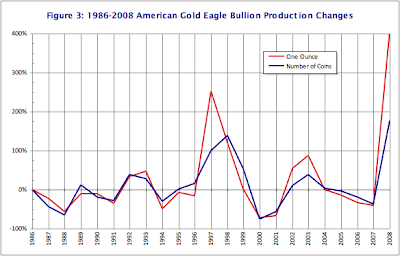

Both graphs show an uptick in production for 2008 where the US Mint reports that they struck over 1.14 million gold coins using 788,500 ounces of gold. This is comparable to the 2000 American Gold Eagle bullion production. But the increase may tell another story. I wanted to figure out what was the difference in production from year to year to see what that says. Figure 3 shows the percent change from year to year.

In 2008, the US Mint produced over 400-percent more gold coins than in 2007 using 178-percent more gold. Since the start of the American Gold Eagle bullion program, there has never been this significant of a change from year to year. But this change was for the year. Was this a steady increase or was there a immediate demand?

Assessing the Demand

Market watchers were greeted on September 8, 2007 with an editorial from the Wall Street Journal saying that 2008 would bring a recession. Citing the credit crunch that began that past July, the editorial said that “tighter credit conditions mean that the drag on the U.S. economy will soon spread beyond the housing sector to affect consumption and investment decisions.” By January 2008, it was reported that Goldman Sachs said that they “[believe] the housing slump and recent credit market turmoil will spill over into the broader economy this year.”

As a result, the spot price of gold rose to over $830 in December 2007, and almost to $930 by the end of January 2008.

According to the US Mint, their best sales month in 2007 was January with sales of 1,650 coins representing 1,208 ounces of gold. As the economy began to turn, the US Mint saw sales increase from 100 coins in September to 1,000 coins in October, and 1,350 in November. There was only a modest increase in sales to 1,400 coins in December 2007 as the US Mint was gearing up for 2008 production.

In January 2008, they reported selling 26,000 coins representing 23,650 ounces of gold. In one month, the US Mint exceeded the sales of gold bullion for all of 2007! Figure 4 graphs the gold bullion production for both 2007 and 2008.

But was this a steady increase or was the growth really a surprise?

Although there were reports we were in a recession, the Dow Jones Industrial Average was still over 12,000 points and gold had a once-per-month spike around $940 per ounce before dropping to $840 with an over $1,000 per ounce spike in March. Sales of American Gold Eagles averaged around 33,000 coins leading up to the summer. Compared to other years, these statistics are unremarkable for the US Mint.

By August, gold dropped to $780 for a brief period and the DJIA dropped to 11,000 points while the financial industry was starting to show significant weakness. Investors started to run for cover in July causing an increase in sales of American Gold Eagles by over 200-percent and an additional 72-percent in August. The rush to buy bullion was too much for the US Mint to handle causing the Mint to suspend bullion sales in mid-August. In September, the markets began to decline, banks and investment houses began to fail, the term “bailout” became prominent in our vocabularies, and the rush for gold strengthened.

We were given our “no kidding” moment when the National Bureau of Economic Research issued a report in December declaring we were in a recession for all of 2008.

Reaching Capacity

In the US Mint’s 2008 Annual Report, they allege that “Production capacity and the volume of precious metal blanks our suppliers can timely provide limit the number of bullion products the United States Mint can produce and sell.” However, the US Mint also noted that there was a decline in the number of business strikes sold as well as a decline in numismatic sales, including the drop in sales of the First Spouse gold coins. There are reports noting even lower production of business strikes this year.

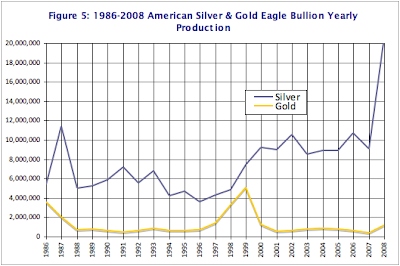

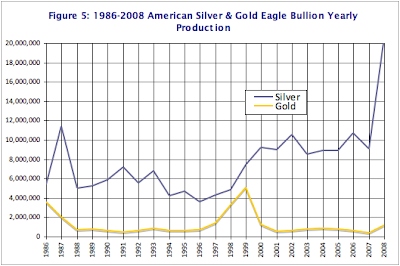

If the US Mint can be accused of modesty in any area it is their assessment of production capacity of bullion coins. According to reports, the US Mint knew that they were experiencing shortage of silver blanks as early as June. Apparently, the US Mint did not tell anyone that 2008 was their best sales year for American Silver Eagle bullion coins. In 2008, the US Mint struck over 20.5 million American Silver Eagle bullion coins. That is a 127-percent increase over 2007’s production and just under twice the previous record of 11.4 million coins in 1987. Figure 5 graphs the dramatic difference in silver production over that for gold.

With the exception of a brief dip in demand during February, production of American Silver Eagle bullion coins remained high as can be seen in Figure 6.

Although the US Mint does not advertise how many coins they can produce over any given period of time, it appears that a significant effort was placed into striking American Silver Eagles over their gold counterparts.

Why Silver Really is King

To understand why the US Mint prioritizes silver over gold is to dig into the how they operate, which is revealed in the 2008 Annual Report. Although the narrative in the report suggests that the net margin for gold is greater than silver, you have to dig deeper to understand the bigger picture.

According to 31 U.S.C. §5116 gold and silver purchased for coinage must be “mined from natural deposits in the United States, or in a territory or possession of the United States, within one year after the month in which the ore from which it is derived was mined.” Gold must be bought from the market at the “the average world price.” If the US Mint cannot purchase the necessary gold, “use gold from reserves held by the United States.” This means that in the event of a gold shortage, the US Mint can use the gold reserves held at Fort Knox to carry out the law.

Silver must also be purchase at the average costs on the world market. However, 31 U.S.C. §5111(b) allows the US Mint to maintain a Coinage Metal Fund to allow the Mint to “invest” in metals in order to maximize profits using dollar cost averaging.

In the FY2008 Annual Report, the US Mint discusses their “Hedging Fund” (Notes to Financial Statements Section 20. Hedging Program, p. 58) that it uses to trade silver shares with partners in order to raise additional capital. The report says that US Mint maintains custody of the silver while the trading occurs. This trading activity yielded $932,000 in profit for FY2008 and $1.3 million in FY2007.

There is no similar program for gold.

The silver trading program makes silver more profitable for the US Mint since they can make a profit by selling lease shares on their non-coinage inventory before making collecting the seigniorage when silver coins are sold.

But We Own A Lot of Gold

According the US Mint’s annual report, the United States is holding 245,262,897 ounces of gold at the United States Bullion Depository in Fort Knox, Kentucky. It has a statutory value of over $10.3 billion dollars (“42 and two-ninths dollars a fine troy ounce” according to 31 U.S.C. §5117(b)).

If there was a shortage of material and the law allows the US Mint to draw from deep storage to make up for the difference, then why did the Mint not withdraw gold to strike coins? Because 31 U.S.C. §5117(b) requires the transfer of gold to the Mint has to be approved by the Secretary of the Treasury, overseen by the Board of Governors of the Federal Reserve, and replaced at the statutory value of “42 and two-ninths dollars a fine troy ounce” when supplies become available. Given the current state of the market, the Mint would not be able to purchase gold for the statutory price $42.2222 fine troy ounce.

What Caused the Shortage

Evidence suggests that the higher demand for silver was a factor in the shortage. However, since the US Mint saw the demand for gold increase as the economy turned in December 2007, and since the US Mint does not keep a large working stock of gold, they were caught without the same safety net as they have with silver and was unable to catch up.

According to reports, the US Mint knew that they were experiencing shortages as early as June. By October, the US Mint announced a shortage of gold and platinum. With the prices rising and the worldwide demand increasing, the US Mint could not purchase enough material at market prices to meet the demand. In other words, the US Mint as unprepared for market demand.

Fixing the US Mint

In 1999, the US Mint announced that not only the Mint experienced increased demand for the American Gold Eagle but announced measures to ensure that the supply would keep up with the demand. In 2008, the US Mint did not adjust their business practices to keep up. Other than changing management at the US Mint, something must be done.

One idea is to change the law to allow the US Mint to have a Hedging Fund for gold. In this program, the US Mint would sell shares for gold in storage on the open market while holding on the physical metal. If the Mint could make an average of $1 million for silver, this would allow the US Mint to leverage stored gold in the same way they leverage stored silver.

In addition to creating a Hedging Fund for gold, the law should allow the US Mint to use the money earned in this program to purchase gold on the open market from any source in the event of a shortage, regardless of where mined. This will allow the US Mint to buy gold from any source to strike bullion coins and maintain their business.

I understand that there may be political implications for this proposal. But when the laws protecting US mining interests were first enacted in the 19th and early 20th centuries, the United States had an abundance of resources and congress passed laws to protect the mining companies, especially as consumer consumption saw a lot of metal leave our shores and not return. The market in the 21st century is more global and the amount of gold resources is not as it was in 1849. Precious metals are globally traded with markets centered in London or New York. It may be time to modernize the laws to allow the Mint to do its business without being held hostage to market forces.

Click on any graph to show larger versions.

Apr 19, 2009 | coins, counterfeit, grading, technology

I have been working with computers for over 30 years. During that time, I have watched computers evolve from room-sized systems to smart-phones that can fit in the palm of your hand. To make this point to people I talk with, I hold up my iPhone and tell them that it is more powerful than the IBM System/370 Model 158 that I used in college—using punch cards!

I was reminded how much technology has changed when I read the article The birth … and death of computerized grading. The article recalls the stories of how computers were supposed to revolutionize coin grading and how New York inventor Henry A. Merton received a patent for computerized coin grading.

Merton’s patent claimed that his system could electronically identify, distinguish, and grade coins based on imaging technology of the daya. Using this system, Merton founded what would eventually called CompuGrade. Starting with Morgan Dollars, CompuGrade would use decimalize grading, assigning partial points to a coin, such as MS 64.5.

Limitations of the technology doomed computer-assisted grading almost as quickly as it started.

Imaging technology has greatly improved in the last 20 years. When combined with x-ray, magnetic resonance imaging, and other electromagnetic technologies, computer imaging becomes an indispensable diagnostic tool. Have you ever been through an MRI and watched the computer reconstruct your internal anatomy from those images allowing for a virtual tour of your body? It is amazing technology.

Advances in biometrics that work on the physiological aspects of the body can now determine differences shown by the same person because of biological changes, such as the effect of aging on your hands. High performance imaging systems are being tested for facial recognition and other identification programs to help law enforcement. While this technology is not perfect, it has shown a lot of progress.

Biometrics uses a concept called pattern recognition. Pattern recognition uses previous knowledge or statistics to recognize or match patterns. Pattern recognition uses a scoring system to determine how close a match would be. A real world implementation can be found in Apple’s iPhoto ’09 application that includes a feature called Faces that helps organize photos by who is in the picture. Faces uses pattern recognition to recognize the people. Interestingly, while Apple’s documentation says that Faces works only on humans, users have reported that it can also recognize pets!

The same technologies could be used for grading coins. Since coins are more static than living beings, the computer can recognize the patterns and the scoring system could be translated into a grade for the coin or even find patterns, such as VAM varieties for Morgan Dollars.

Imaging technologies can be programmed to easily tell of a coin has be cleaned or dipped by noting how the light reflects off the surface. Think of how the computer can “look at” a coin and find the cartwheel effect or determine the fine lines that occur when a coin is cleaned or whizzed.

The article mentions that imaging can be used as a fingerprinting of coins to help in counterfeit detection. With Chinese counterfeiters becoming more sophisticated, computer imaging can be use to find these counterfeits. When a coin is determined to be a counterfeit, the die patterns can be saved in order to be used to find other counterfeits. Additionally, chromatography could be another technology to determine whether the gold or silver is from the period or contemporary.

Computers are great tools. Imaging technologies enhanced by computers can do wonderful things. To apply this technology to coin grading and analysis would be a fantastic addition to the industry. Can you imagine being able to take the technology to major shows and for a small fee, provide on sight diagnostics for coins before submitting them to the grading services? Too bad I do not have the money to invest in this. I believe it would be a great tool for the collecting and investing world.

Apr 12, 2009 | coins, web

Every so often I will surf the ‘Net to find new things on topics of interest. When I do this for numismatics, I find interesting sites that I bookmark for future blog posts. The problem is that the topics are not in the mainstream and not in my core interests. But they are intriguing enough for me to try to find an excuse to write about them. Today, I will write about three of these websites.

I wrote about a presentation at my local coin club about Hobo Nickels. I heard about Hobo Nickels before but did not know details but I learned more about these coins and the artists who are credited with creating them. Although I mentioned the Original Hobo Nickel Society, I wanted to take this opportunity to talk about their website. Although it can use a small does of aesthetics, web surfers are greeted with a montage of six Hobo Nickels on the front page. One area to check out are the Nickel Carver’s Showcase with pictures of modern artists and their work. There are three pages of great works so be sure to look at all of the pages. You may also want to see the OHNS Annual Hobo Tokens, which can be purchase from the Society.

Under the category of collect what you like is the collection of Holed Coins. These are not coins made with holes but coins that had holes drilled into them. Most of the time, these coins are used for jewelry or for adornments on clothing. One representative of a Holed Coin enthusiast is Holey Lovin’ by Douglas Thigpen. On the home page, Thigpen writes that he has “always been drawn to holed coins.” noting that “they are often procured for much less than non-holed examples.” Although the site looks sparse, the site can be easily navigated through the categories with pictures of various holed coins. You have to see the images of the two Carved Holed Coins where an 1875 Seated Liberty Dime and Gold Indian Dollar are carved into Love Tokens.

Rather than collecting coins, how about the slabs which they are housed. I am not talking about collecting for registry set but collecting sample slabs produced by the grading services. Cameron Kiefer, former Young Numismatist of the Year and grader for ICG, collects the sample slabs given out by the grading services to promote their services. Aside from the images of sample slabs from nearly every grading service that exists and used to exist, the site provides a visual history of grading services. The pages showing PCGS sample slabs and NGC sample slabs shows a fascinating evolution of their respective slabs.

While researching this post, I found a few other interesting websites. I will write about those in the future.

Apr 1, 2009 | Baltimore, coins, shows, tokens

If it was Saturday at the end of March, it was time to drive to Baltimore for the Whitman Baltimore Coin and Currency Expo. This show is a three-times-a-year ritual for the numismatic community centrally located on the eastern seaboard. For the last few years, the show has expanded to three large halls in the Baltimore Convention Center and made into a real numismatic happening by the people at Whitman. Whitman has done a good with the show and I hope their new venture into Philadelphia is successful. If there is one complaint, I wish they would use chairs without arms. Those of us with wide bottoms would appreciate this.

After completing errands, I left home at 11:30 and drove to Baltimore. Depending on traffic, the trip from home to parking near the Baltimore Convention Center can take an hour. I park near the convention center in the parking lot at the Sheraton Inner Harbor. I overpaid for parking and walked to the Convention Center.

Registration booths are expertly tended to by members of the Baltimore Coin Club. Sine many of the members are also members of the Maryland State Numismatic Association, it was nice to see friendly faces.

Once inside I started with my regulars. I wanted to talk with them to see how the show was going. The responses were mixed, but in the extremes. Some dealers said that they would not make the money they paid in fees and expenses for the weekend. Others said that the weekend could not be better.

Gold and silver seemed to be very hot. It was difficult to find 2009 Silver Eagles. I was able to find one from a dealer with three singles and two rolls left. Good date Morgan dollars were also selling well. One dealer said that early 20th Century commemoratives were also selling well.

There was a lot of gold. Gold was everywhere. Some dealers were advertising that they would buy scrap gold. I watched as a dealer bought scrap gold at spot less 5-percent. I also saw a dealer with one ounce gold eagles fanned across his case when I entered the hall and the pile was half the size two hours later.

At the show I met Sharon, a dealer from New York who travels with her husband nearly every weekend to shows. She was a fun person who convinced me to buy something I originally was not going to buy. Sharon mostly sells currency and said that the show was a disaster for her. Although she had some very nice National Banknotes, there seemed to be little interest in currency at this show. Sharon and her husband will be at the Dulles Coin & Currency Expo at the end of April. This year is the third annual show at Dulles. I will have to drop by.

Other currency dealers also said it was slow. I do not collect currency because of the costs involved, but I will browse their tables to look at the artwork of these wonderful notes. Currency dealers also love to talk about their products and I have learned a lot about economic history from their discussion of the notes. Nearly every currency dealer said that their sales were slow. Only one dealer gave me a shrug and said that it was “OK.”

Although I did not buy much, I continued my tradition to try to find something I consider “neat.” This show’s neat find did not cost anything. I was walking down the aisle and walked by the table for Abbott’s Coins. I forgot to ask who the dealer at the table was, he was not John Abbott, but he was handing out these copper-looking tokens. Looking at the token, there were the big letters “TUIT” on the front. I looked at the dealer and said, “I can’t take this. It means that I would have to get things done!” But it was so compelling, I had to take one.

Although I did not buy much, I continued my tradition to try to find something I consider “neat.” This show’s neat find did not cost anything. I was walking down the aisle and walked by the table for Abbott’s Coins. I forgot to ask who the dealer at the table was, he was not John Abbott, but he was handing out these copper-looking tokens. Looking at the token, there were the big letters “TUIT” on the front. I looked at the dealer and said, “I can’t take this. It means that I would have to get things done!” But it was so compelling, I had to take one.

Now that I have a “Round TUIT” I cannot complain that I will get things done when I get a Round TUIT. I have one. I guess it’s time time to get things done!

The June show will be bigger and will have a Sunday session. There will be speakers, club meetings, and more activities. It will be a real happening along with the usually buying and selling. If you are in the area, you have to attend this show. When you are done, remember that the Inner Harbor is right next door with shops and plenty of restaurants. If you want to bring your family and they are not interested in coins, send them to the National Aquarium while you check out the coins.

Mar 26, 2009 | coins, commemorative, US Mint

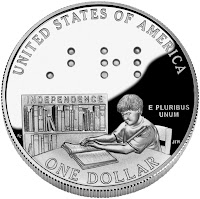

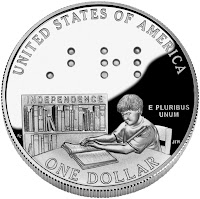

In a ceremony earlier today at the National Foundation for the Blind headquarters in Baltimore, US Mint Director Ed Moy and NFB President Marc Maurer introduced the nation’s first coin with readable braille. the 2009 Louis Braille Bicentennial Silver Dollar.

In a ceremony earlier today at the National Foundation for the Blind headquarters in Baltimore, US Mint Director Ed Moy and NFB President Marc Maurer introduced the nation’s first coin with readable braille. the 2009 Louis Braille Bicentennial Silver Dollar.

“For the first time in history, the United States has a coin with readable Braille,” Director Moy told the audience. “The 2009 Louis Braille Bicentennial Silver Dollar honors the developer of Braille, a tactile code that has been instrumental in the literacy and independence of the world’s blind people.”

Authorized by Public Law 109-247 (GPO: [Text] [PDF]), the Mint is limited to issuing 400,000 coins. The $10 surcharge, a maximum of $4 million, will be paid to the NFB to promote braille literacy. The NFB reports that the money will be used in its Jernigan Institute and Braille Literacy Campaign to double the number of school-age children reading braille by 2015.

Authorized by Public Law 109-247 (GPO: [Text] [PDF]), the Mint is limited to issuing 400,000 coins. The $10 surcharge, a maximum of $4 million, will be paid to the NFB to promote braille literacy. The NFB reports that the money will be used in its Jernigan Institute and Braille Literacy Campaign to double the number of school-age children reading braille by 2015.

According the the NFB:

An astounding 90 percent of blind people today are Braille illiterate. This would be viewed as a national outrage if the same crisis faced sighted individuals, and yet blind people continue to be deprived of the Braille education and resources they need to obtain jobs, pursue stimulating careers, and enjoy the same opportunities as sighted individuals. Further, Braille illiteracy is the leading contributor to a shocking 70 percent unemployment rate among 1.3 million blind Americans and it’s only going to get worse—70,000 people are losing their sight each year.

To help fund Braille literacy programs, the NFB has teamed with the U.S. Mint to issue the first coin ever to feature readable Braille. The Louis Braille Bicentennial Silver Dollar will be launched this Thursday, March 26, 2009 at the NFB’s headquarters in Baltimore, MD, after which the coin will be available for purchase…. Every coin sold will support Braille education nationwide and ensure that every blind American enjoys the same opportunities for success as sighted individuals.

The National Federation of the Blind is also publishing a report to the nation, titled “THE BRAILLE LITERACY CRISIS IN AMERICA: Facing the Truth, Reversing the Trend, Empowering the Blind.” The report, a comprehensive overview of the crisis and proposed solutions to reverse it, is currently under embargo until the launch day on March 26, when it will be posted online at www.nfb.org and www.braille.org.

I believe in supporting a good cause. If support also comes with a cool collectible, then it makes sense to buy. I hope this commemorative sells out!

Mar 24, 2009 | coins, fun, other

In January, 2007, there was a story about Department of Defense contractors inadvertently carrying a hollowed out Canadian dollar that contained Radio Frequency Identification (RFID) transmitters that could be used to track their movement. Allegedly, the coin was given to them in change by a third party. Later, Defense Security Services (DSS) issued a press release stating that the story was not true.

I thought it would be fun to find a spy coin and see what could be done with it.

Earlier on Monday, a friend sent a link to Think Geek, an online merchant that sells technology-related items specifically to the technologist market. While looking through the items I found a listing for Hollow Spy Coins. The coins are hollowed out quarters or half-dollars with enough room for a very small memory card. The coins are advertised to come with an unlocking ring and are “indistinguishable from regular coins when closed.”

Earlier on Monday, a friend sent a link to Think Geek, an online merchant that sells technology-related items specifically to the technologist market. While looking through the items I found a listing for Hollow Spy Coins. The coins are hollowed out quarters or half-dollars with enough room for a very small memory card. The coins are advertised to come with an unlocking ring and are “indistinguishable from regular coins when closed.”

Think Geek is selling the spy quarter for $20.99 and the half-dollar for $24.99.

If these coin are indistinguishable from regular coins, I would be afraid to carry the quarter for fear of accidentally spending it. But keeping the half-dollar as a pocket piece with some “secret” inside could be fun. I might buy one!

Image courtesy of ThinkGeek.com.

Mar 23, 2009 | ANA, coins, education, YN

A while ago, I heard from Donna Guthrie, teacher and children’s book author, who created a new website called Meet Me At the Corner. Meet Me At the Corner hosts kid-friendly videos about many topics of interest to kids. Kids are encouraged to produce a video about a topic of interest and submit them for the world to see. For those who need assistance, there is a video to explain how to make videos.

Donna wrote to me around Presidents Day to alert me about the new video about one kid’s visit to the Edward C. Rochette Money Museum located at the American Numismatic Association headquarters in Colorado Springs.

The video by Amanda tours the museum with and interviews ANA educator Rod Gillis. Amanda asks about coins, collecting, and the new Lincoln Cent issues. Amongst the tour during the video, Amanda is shown the two examples of the 1913 Liberty Head Nickel the ANA holds. Rod tells Amanda that one of the five known coins was sold last year for $4 million. Amanda does a great interview and probably does better than most adults!

Go to the site and watch the video. It is worth the time. When you are done, pass it along to a young numismatist for their enjoyment.

Mar 16, 2009 | coins, history

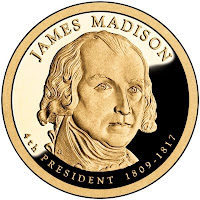

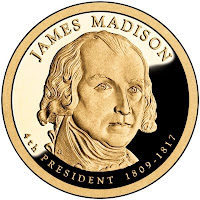

A friend sent an email note reminding me that today (March 16) is the 258th anniversary of James Madison’s birth and the 207th Anniversary of the founding of the United States Military Academy at West Point.

Madison, our 4th President, was the Commander-in-Chief during the War of 1812 and the victory over the British. He was a major contributor to the Federalist Papers and the framer of the Bill of Rights. Numismatically, the Madison Dollar was the last of the Presidential dollars issued in 2007.

Madison, our 4th President, was the Commander-in-Chief during the War of 1812 and the victory over the British. He was a major contributor to the Federalist Papers and the framer of the Bill of Rights. Numismatically, the Madison Dollar was the last of the Presidential dollars issued in 2007.

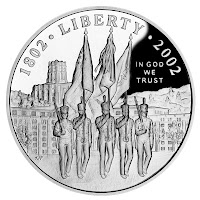

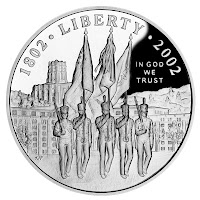

The United State Military Academy is the oldest of the service academies. West Point is considered the premier school of its type worldwide and its graduates includes war heroes, former presidents, and a famous college basketball coach. In 2002, the US Mint issued the West Point Bicentennial Dollar to commemorate 200 years of training our nation’s best.

The United State Military Academy is the oldest of the service academies. West Point is considered the premier school of its type worldwide and its graduates includes war heroes, former presidents, and a famous college basketball coach. In 2002, the US Mint issued the West Point Bicentennial Dollar to commemorate 200 years of training our nation’s best.

I mention this note because the friend who sent the note has a unique perspective on coin collection. He has taken the phrase “history in your hand” to heart and has built his collection around history represented by the coins. Rather than purchase albums to collect series of coins, he has three-ring binders with pages to present his collection in date order of significance.

Using 12 three-inch binders, date numbered tabs, and various mylar pages, he insert his collection into the area where there is the most significance. For example, he collected the 50 State Quarter coin covers and inserted them on the date corresponding to when the state was admitted into the union. His Presidential Dollar coin covers are stored based on the birth date of the president. In this system, March 16 has the James Madison dollar coin cover and the West Point Bicentennial commemorative.

It sounds unwieldy, but my friend has done a great job creating a collection that he uses to teach his children and their friends the significance of history and coinage. I will try to post pictures if he gives me permission.

The moral of this story is that there is no right way to collect coins. Collect what you like and how you like. If you slowed your collecting activities because of the economy, maybe you can come up with a new idea as to how to organize your collection.

Images courtesy of the US Mint.

Mar 14, 2009 | cents, coins, dollar, quarter

I went to my bank and branches of three other banks to look for rolls of Martin Van Buren dollars and Lincoln Birth and Early Childhood cents. I know that the William Henry Harrison dollars are the current issue, but I was not able to find Van Buren dollars when they were in active release.

One bank I went to had just emptied the cent bags from its coin counting machine. The teller showed me the three bags of cents that will be sent to their contractor to be counted and sent back to the Federal Reserve. They did have Harrison Dollars and some John Quincy Adams dollars, but no Van Burens. A teller in another bank showed me a box of cent rolls they just received from the Federal Reserve. All the rolls had mixed coins, no new cents.

I also asked for District of Columbia quarters. Only one bank had a roll.

I have heard that Lincoln cents have started to be found in pocket change west of the Rockies and DC Quarters in the northern midwest states. But friends living throughout the Northeast Corridor have not found any of these coins in change.

Last year, I found my first 2008 coin in mid-June. Other than the special distribution of dollars and quarters, I don’t expect to see 2009 coins until June or July.

Mar 14, 2009 | coins, dollar, education

After work, I decided to stop at a local coffee shop for a beverage. As I ordered my libation and noticed a $2 bill in the tip jar. The numismatist in me became excited. I reached in to take the note and replaced it with three William Henry Harrison dollars.

The barista watched carefully and noticed the gold-colored coins. She looked at me and asked why I was taking her money and leaving tokens. I pulled one out of the jar and showed her that it was a $1 coin. Apparently, it was the first time she had seen the dollar coin.

I told her about the Presidential Dollar Program and how they were honoring four presidents each year. She seemed interested and looked at the coin and asked who William Henry Harrison was.

If nothing else, the Presidential Dollar Program helped educate one high school student today!