Aug 29, 2018 | coins, commentary, counterfeit, ethics, foreign

A regular reader was upset about the appearance of hypocrisy at the

World’s Fair of Money. On one hand there was a lot of talk about counterfeit collectibles from China. On the other hand, there was a lot of hoopla over the Panda with special designs and privy marks honoring the World’s Fair of Money. In this episode of “LOOK BACK,” I update what

I wrote in February 2014 about China and counterfeits.

Front of a counterfeit 2012-dated American Eagle $50 denomination one-ounce gold bullion coin. (Photo courtesy of Numismatic Guaranty Corporation.)

Every coin minted by the U.S. Mint is legal tender and are legally an instrument of the government. Although the Trade dollar was demonetized in 1876, it was remonetized as part of the Coinage Act of 1965 making it legal tender (31 U.S.C. § 5103) for trade in the United States. This means that it is legal to spend an 1873 Trade Dollar for $1 of goods and services even though the coin is worth more than its face value.

To protect its currency, the United States has anti-counterfeiting laws that makes it illegal to counterfeit the nation’s money and use in commerce. For collectible coins and currency congress passed and has since updated the the Hobby Protection Act (15 U.S.C. § 2101 et. seq.). These laws protect the money supply when it is a collectible and not an instrument of commerce.

In the United States, laws are cumulative. Once passed, they remain the law until repealed or declared unconstitutional by the courts. This is not the way in many other countries. In many countries, when a new government takes power they are given the authority to rewrite the laws. It is expected to happen within authoritarian governments but it is common in many parliamentary democracies.

The People’s Republic of China has been run by the Communist Party since 1949. Their rules and laws have changed significantly when the Communist Party came into power. One of their first rules was to demonetize the money produced by the Republic of Chin and issued renminbi, the “people’s currency.”

Since then, it has been the practice of the chairman of the Communist Party to demonetize non-current issues of coins and currency as part of their economic control policies. Based on the current Chinese economic system, all coins struck since 1955, the first issued under the current government, are legal tender. Currency printed since 1999, the fifth series is the only legal tender notes. Any other coin or currency note has been demonetized.

Under Chinese anti-counterfeiting laws, it is illegal to duplicate any legal tender coin or currency note for any reason. However, since coinage from previous regimes is no longer legal tender, it is legal to strike coins with those designs. Chinese laws do not recognize the collection of these coins as a market to protect.

An example of a Morgan Dollar cut in half to match a date with a mintmark to have the coin appear something it is not. Coin was in a counterfeit PCGS slab and caught by one of their graders.

Chinese law does not recognize the perpetual legal tender status of every coin issued. Chinese law also recognizes that counterfeiting current issues of other countries is also illegal because someone could try to use the coin in commerce where it is legal to use foreign currency. This means that in China, it would be illegal to reproduce a presidential dollar or Washington quarter, but producing Morgan dollars or a set of 1921 Walking Liberty half-dollars is legal in China because these are coins no longer issued in the United States.

When China is asked to assist the United States to stop the counterfeiting of coins, China does not recognize that its people are doing anything wrong. The coins are no longer being made, they are not in circulation, and their laws allow people to make copies of these coins. The only laws that China has regarding collectibles are laws protecting antiquities and cultural properties. This means that you cannot duplicate a Ming Dynasty vase and try to pass it off as real but it is legal to reproduce a Rembrandt masterpiece since he is not Chinese and his work was not made in China.

A trade attorney that was originally consulted for this article confirmed that when it comes to these issues, Chinese law is very protectionist. The claim is that they follow their laws consistently regardless of outside circumstances and they refuse to make exceptions citing the complication with enforcing their laws in a country with a population of more than 1.3 billion people.

PCGS representatives showed Congressmen counterfeit U.S. coins in counterfeit PCGS holders during their recent meetings in Washington, DC. (Photo courtesy of PCGS.)

The Chinese government has no incentive to help the United States or any other country fight counterfeiting in what is perceived by the Chinese as a small market problem. To put the resources necessary into what looks like a petty crime for selling inexpensive, non-circulating duplicate coins that are within Chinese law to manufacture is considered not worth their resources.

While there is anecdotal evidence that the Chinese government knows about the counterfeit trades and some officials informally support the efforts because they get kickbacks, official Chinese policy denies there is a problem.

A lot has been written about the nature of the relationship between the United States and China since President Richard Nixon’s trip to China in 1972. Neither side trusts each other nor does neither side believe each other. Today, the United States decries the Chinese for buying too much of our debt, allegations of spying, industrial espionage, and cyber crimes. The Chinese say that the United States is trying to bully the world and that these naysayers are making up the stories to scare the world into following them. The United States talks about civil rights violations within the Chinese border and the Chinese government tells the United States to mind its own business.

The greater opening of markets between the country and the increase in popularity of bullion coins has made the Chinese Panda a popular coin amongst collectors and investors. Those of us who buy these coins know that even with the production increases since 2010 new issues continue to command a premium greater than other bullion coins.

While the Chinese are happy to sell coins and be the factory to the United States, there remains an underlying tone of political and commercial hostility between the nations. A trade attorney said that the Chinese would rather keep the relationship to business between the countries that the United States should stay out of China’s domestic policy. It was explained that the Chinese central government was upset over how the United States passed judgment over companies in their high tech electronic manufacturing sector because these companies are doing better and are safer than other Chinese manufacturers. To the Chinese government, it is not a problem if a few workers die for whatever reason. There is an ample supply from the population to keep the plants running.

These are the values of the Chinese government. Whether you agree with them or not, Communist Party officials will resent anyone telling them how to manage their domestic affairs. They want advice about how to treat their citizens as much as the United States wants similar advice from China.

There is no incentive for China to stop the manufacture of counterfeit collectible coins.

It is not against Chinese law for these people to manufacture coins that are no longer in production. Chinese people who are manufacturing these coins are working in China and many employ other people. It means there are fewer people relying on assistance the Chinese government provides. Since they now have incomes, it provides revenues for the tax coffers.

When a United States trade representatives negotiate with their Chinese counterparts, it gives the Chinese a chance to lecture the United States how they resolved the counterfeiting issues which leads to a discussion on currency handling and management, which is a sore subject in the United States since the United States questions Chinese monetary policies.

A portion of the exhibit of confiscated counterfeits on special loan from the Department of Homeland Security displayed at the 2018 World’s Fair of Money® by ICTA/ACTF.

Finally, it gives China a measure of moral superiority against the United States. After all, China figured out a way to prevent the impact of counterfeiting of older currency, why can’t the United States do the same?

China has no incentive to help the United States to solve a problem that they perceive does not exist. It is up to the United States to resolve these issues. This is why the industry promoted the Collectible Coin Protection Act (Public Law No: 113-288) so that law enforcement has an additional tool to use to help prosecute handlers of counterfeit coins in the United States.

You can read the original article

here.

Aug 2, 2018 | coins, dollar, errors, ethics, scams, US Mint, varieties

This week’s LOOK BACK is my take at the stir made over the positioning of the edge letters on the newly struck George Washington Dollar coins in 2007.

If you search the online auction sites, you will find less than honest sellers trying to sell variations in the positioning of edge lettering of the new George Washington Dollars errors or varieties. Letters that are pointed up, or the top of the letters towards the obverse, are considered “normal” by these sellers. Letters that are pointed downward, or the top of the letters closer to the reverse of the coin, have been called errors or varieties. They are neither.

Exasperating the issue is that one third-party grading service added a designation to their labels with the orientation of the edge lettering.

-

-

According to one third-party grading service, Presidential Dollars With The Tops The

Edge Lettering Facing the Reverse Are Designated As “Position A.”

-

-

Those With The Tops Of Their Letters Facing The Obverse Are “Position B.”

An accepted definition of a variety “is any variation in the normal design of a given coin, usually caused by errors in the preparation or maintenance of the coin dies.” They are also errors caused in the striking process. But these definitions do not account for the differences in the orientation. The problem is that after the planchets are struck into coins by the high-speed coining machines, they are mechanically collected and fed into a machine that will press the lettering into the edge of the coins.

The machine that adds the edge lettering uses a three-part collar to impress the incuse lettering does this without regard to position. not only could the edge lettering face any direction, but the lettering can appear at any position along the edge. The U.S. Mint confirms this by saying that because of “the minting process used on the circulating coins, the edge-incused inscription positions will vary with each coin.”

Since the Mint is saying that the process can vary, these variations are normal for the design. Since these are normal variations, they are not numismatic varieties or errors. Thus, the coins with variations of orientation edge lettering are not worth the premiums being sought online. They are worth their face value of $1.

There have been errors found with the edge lettering. The most infamous has been called the “Godless Dollars” for coins missing their edge lettering and the motto “In God We Trust.” Most of these coins were minted in Philadelphia and discovered in Florida. Others have found doubling of edge letters and what looks like breaks in the three-part collars where letters have moved out of place. These are legitimate errors and worth a premium above face value. Orientation variations of the edge lettering are not errors.

If you want to consider these varieties, please save your money and visit your local bank. You can purchase these coins for face value without shipping and handling fees. If you purchase a 25-coin roll, you can spend the coins you do not want since they are legal tender.

The original article can be read

here.

Apr 13, 2018 | coins, commentary, ethics

EPA Administrator Scott Pruitt

Scott Pruitt, the 14th Administrator of the Environmental Protection Agency, has decided that rather than saving taxpayer money, he will spend additional money to have the EPA redesign the challenge coin that he uses on behalf of the EPA.

According to the New York Times, Pruitt wants to make the challenge coin bigger and to delete the EPA logo. According to a retired career EPA employee, it appears that Pruitt wants the coin to be all about him and not the agency.

The reverse side of the E.P.A. challenge coin conceived under Administrator Lisa P. Jackson, left, and the face of the coin issued when Gina McCarthy led the agency. (Photo Credit: Ron Slotkin/The New York Times)

“These coins represent the agency,” said Ronald Slotkin, who served as the director of the E.P.A.’s multimedia office. “But Pruitt wanted his coin to be bigger than everyone else’s and he wanted it in a way that represented him.”

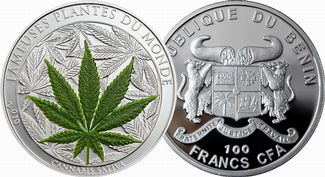

It is reported that Pruitt does not like the agency seal because (brace yourself) he felt it looks like a marijuana leaf!

-

-

Official logo of the United States Environmental Protection Agency

-

-

Leaf of the cannabis sativa plant

Pruitt is not the first agency head to extend his ego to challenge coins. Last fall, Interior Secretary Ryan Zinke commissioned his own challenge coin. At the time, it was thought to be the only Cabinet-level official to have his own challenge coin.

In order to create a new challenge coin, the manufacturer must create new dies. Making new dies does have a cost, as opposed to either using an existing die or having an existing design reworked. According to the website of Challenge Coins Plus, the company The New York Times story said was involved with making other challenge coins for the EPA, if Pruitt wants a 2.5-inch coin, the mold fees are $100 per side ($200 for both sides). Once the molds are made, 2-sided colored coins are $5.57 each for 2,000 coins ($11,140) without customizations such as custom edges and capsules.

However, Pruitt is not stopping with challenge coins. He has ordered pens, notebooks, and leather binders to exclude the logo and replaced with his name in a larger font. All at an additional charge to taxpayers.

At least when the U.S. Mint fails, it does not cost the taxpayers any money since the U.S. Mint’s operations are paid by the seignorage and not from the general treasury.

Sep 14, 2017 | ethics, news

Secretary of the Treasury Steven T. Mnuchin seems to think his position with the government affords him perquisites to be paid by the taxpayers.

Last June, Mnuchin married actress Louise Linton at the Andrew W. Mellon Auditorium located near the National Mall. Vice President Pence officiated the ceremony.

Louise Linton and Treasury Secretary Steve Mnuchin are pictured during their honeymoon in Edinburgh, Scotland, Aug. 5, 2017. (Alan Simpson Photography/Splash News)

According to ABC News, an Air Force spokesperson said that a U.S. Air Force jet could cost roughly $25,000 per hour for an international flight. Domestic travel is estimated between $10,000 and $15,000 per hour.

A request for the jet was requested in writing by the Secretary’s office but later deemed unnecessary following a review by Treasury Department officials.

The Department of Treasury Office of the Inspector General (OIG) has acknowledged to ABC that it has opened an official inquiry into this request. This investigation is in addition to the investigation the OIG is making into his trip to Kentucky.

The Treasury Department is also being sued by a public interest research group because the department has not responded to their Freedom of Information Act request.

Mnuchin becomes the first Treasury Secretary since Andrew W. Mellon to be actively investigated for wrongdoing while serving as Secretary.

For reference, articles of impeachment were introduced in the House of Representatives to remove Mellon from office in January 1932. Hearings were held in the House Judiciary Committee. Before the committee voted on the articles of impeachment, Mellon was appointed as the Ambassador to the Court of St. James (the formal name of the Ambassador to the United Kingdom). He resigned as Treasury Secretary and served as an ambassador for a year before retiring to private life.

Mnuchin has not commented on the situation.

Image courtesy of Alan Simpson Photography/Splash News via

ABC News.

Sep 12, 2017 | ethics, news

Louise Linton’s Instagram post that prompted the initial inquiry by the watchdog group.

On August 23, CREW filed a Freedom of Information Act (FOIA) request to obtain department records of the trip. They said that Treasury has not responded.

“We filed an expedited FOIA request because Americans deserve more information to determine whether there has been misuse of government resources,” CREW Executive Director Noah Bookbinder said. “We’re suing because the government has so far failed even to respond.”

A report has noted that a Treasury spokesperson confirmed that Mnuchin reimbursed the government for Linton’s travel expenses

[pdf-embedder url=”http://coinsblog.ws/wp-content/uploads/2017/09/CREWvTreasury.pdf” title=”CREW v Treasury”]

Jul 25, 2017 | commentary, ethics, grading

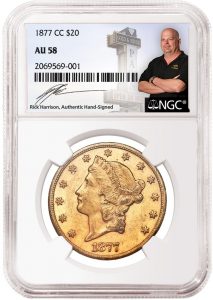

Sample NGC Holder with Rick Harrison signature label

I defended NGC’s position to produce the numismento not because I am interested in purchasing a slab with Harrison’s autograph, but because I do not see a problem with having it as part of the hobby. There are other issues that the hobby should attend to rather than worry about a reality television star and pawn shop owner signing slab labels.

However, my online correspondent, who I will keep anonymous but can respond to this post with an identification, was against the slab not because it will hurt the hobby but because of hidden meanings. When pressed on the real issue, my correspondent brought up a story of an elderly couple being taken advantage of by a company with an alleged A+ Better Business Bureau rating (although there have been questions raised about the Better Business Bureau’s ratings practice). The couple bought coins at a significantly inflated price with promises of a future gain only to learn that the coins were not worth what was promised.

About “The Coin Show”

The Coin Show is a podcast that is periodically produced by Mike Nottelmann and Matt Dinger. Matt owns Lost Dutchman Rare Coins in Indianapolis and is sadly not a fan of modern coins. If you are looking for a numismatic-related podcast, I would recommend The Coin Show. There are enough back episodes to keep you occupied until they produce their next show.

Unfortunately, this type of practice is not only pervasive in numismatics but there are all types of schemes where elderly are sold goods and services under fraudulent circumstances. Whether it is inflated prices of gold, the deflated prices of the hotel room gold buyers or the sets of State Quarters that are not worth thousands, these hucksters represent a problem that should be addressed.

Rather, my correspondent took the frustration of the situation on NGC and Harrison because Harrison does not represent the industry. He represents the pawn industry which does not have a high favorability rating.

My correspondent’s anger is misplaced. Rather than embrace the opportunity to use these slabs as a teaching moment and work with the industry to better educate the public, the response was to complain that this was not good for the industry because of what it allegedly represents. It is looking at the problems through a narrow prism, which is worse for the hobby than a stupid autographed slab. The perceived problems are not because a reality television star signs a slab label, the problem is that this industry has not properly represented itself and allowed those with less than moral character ruin things for everyone. The industry has let itself be denigrated by not properly getting out its message and allowing others to define the message. Industry Council for Tangible Assets (ICTA) has worked hard for the benefit of the industry the issues move faster than ICTA can keep up.

With the dysfunction in Washington lobbying efforts are turning to the state capitals where they can have a significant impact with less of a spotlight. ICTA needs help in nearly every state including California where my correspondent is from. Rather than kvetching on Facebook, I wish my correspondent and others would pick up a phone and join the battle.

Conflating the signing of slabs to the problems of an industry is myopic. If you want to fix the business problems then get look beyond the autograph to the real problems. Although I have never met NGC Chairman Mark Salzberg, his well-deserved reputation leads one to believe that he would not do anything detrimental to the business of numismatics, something he has dedicated his life to.

Unfortunately, I have a feeling that if someone walked into the shop that my correspondent owns and asked to buy the slab autographed by Rick Harrison, the business would find a way to allow the free market to reign and sell the customer what they asked for.

Feb 8, 2017 | coins, commentary, ethics, grading

There’s a revolution brewing in the numismatics markets that is being fed by its own successes causing its own failures.

There’s a revolution brewing in the numismatics markets that is being fed by its own successes causing its own failures.

The first salvo was fired by the Professional Numismatic Guild and Industry Council for Tangible Assets in 2006 when they jointly performed their own survey. One of the results was that PNG and ICTA were sued by a few of the services whose services were deemed unacceptable.

Following the report, the services not named Numismatic Guarantee Corporation and Professional Coin Grading Service went into turmoil. PCI went out of business around the time the J.T. Stanton left the company. James Taylor bought ANACS from Anderson Press and move the company to Englewood, Colorado. Taylor raided graders from Independent Coin Grading Company. As a result, ICG moved to Tampa, Florida.

In the meantime, most of those companies rated “Unacceptable” in the PNG-ICTA report either went out of business or have been marginalized to the point of irrelevance.

Next was the creation of the Certified Acceptance Corporation as a grader of the graders. As I have explained in the past, although a fourth-party or validation service might be helpful, the CAC is not an independent organization providing the service. The company trades on its inside information in what it calls “market-making.” This type of arbitrage activity would be illegal in the securities industry but has given a false sense of security in the numismatics world.

Now there are rumblings again and this time there are a few significant people doing the talking.

For the last six month, noted numismatist and author Q. David Bowers has written several stories for Coin World that has been both critical of the coin grading business and the complexity of the grading system. Although Bowers recognizes that there are advantages to third-party grading there has been changes and not for the better.

In other words, third-party grading and authentication is good for the hobby but the services have problems.

Could you tell the difference if they were not in the holders?

-

-

2016 American Silver Eagle graded MS-69 by NGC

-

-

2016 American Silver Eagle graded MS-70 by NGC

Following NGC’s change in its registry rules to no longer allow coins graded by PCGS in their sponsored registry sets, NGC Chairman Mark Salzberg publishes an analysis on what he claims is the decline in PCGS-graded coins. In his analysis, Salzberg looks at the prices realized from auction sales of certain PCGS coins over time and compares them to PCGS population reports for those coins.

Through a set of charts that resemble the supply-and-demand curves, it is unsure if the charts prove anything. If Salzberg is trying to say that PCGS is practicing grade inflation, known as gradeflation, then he could prove that with the changes in the grading for many modern coins. However, comparing the population report (supply) of a classic coin like the 1912-S Liberty Nickel, may not be valid without looking at other factors, such as the population report of lower grades declining. Also, Salzberg only uses the prices realize from auctions held by Heritage Auctions and not a survey of the industry as a whole.

Does PCGS practice gradeflation? Can we also ask does NGC practice gradeflation? And we do not know how these services fare with CAC who keeps its raw data hidden from the public while using it to increase the value of the coins it examines.

Dave Bowers provides good insight into the problems with coin grading without trying to overburden the reader with statistics even with the suggestion that dealers may overly emphasize grade differences and not the aesthetics of the coin.

Bowers is not the only one complaining about grading, last September, Rick Snow wrote an article on the CDN Publishing Blog suggesting grading be adjusted to a 15-point technical scale without the qualifying notations such as “”Full Head” or “Full Bands.”

The numismatics industry has put too much trust in these grading services without oversight. When oversight was tried by industry representative organizations, the companies that did not like the results litigated rather than fix their problems causing the attempt at oversight to be eliminated. Then a validation service appears to only turn out to be something they are using to manipulate the markets in their favor.

Is this coin worth less because it is is in an ICG holder?

Rather than implicitly trusting these companies, collectors and investors may want to start questioning all of these companies about their practices. Otherwise, you may find that coin you paid MS-70 prices for is really not worth more than an MS-68, which was a better looking, to begin with!

PNG-ICTA 2006 Grading Service Survey

Read their 2006 press release below or on Scribd.

Oct 25, 2014 | coins, commentary, ethics, grading

Fans of coins encased in plastic with special labels who also are baseball fans must be ecstatic that Fans of coins encased in plastic with special labels who also are baseball fans must be ecstatic that Numismatic Guarantee Corporation and Major League Baseball agreed to an exclusive deal that will allow NGC to reproduce team names, logos, and stadiums on labels used in NGC slabs.

Fans of coins encased in plastic with special labels who also are baseball fans must be ecstatic that Fans of coins encased in plastic with special labels who also are baseball fans must be ecstatic that Numismatic Guarantee Corporation and Major League Baseball agreed to an exclusive deal that will allow NGC to reproduce team names, logos, and stadiums on labels used in NGC slabs.

NGC announced that they will “encapsulate the National Baseball Hall of Fame commemoratives and other legal tender coins with attractive certification labels that feature a range of popular MLB trademarks.” Aside from the Major League Baseball logo, the logos of the 30 clubs, and stadium images, it will also include logos of All-Star Game and those used for post season.

NGC says this is gives their customers “an exciting new opportunity to combine their passions for the sport and the hobby.” What it gives is NGC a new area for marketing and to extract money from the market.

I understand that NGC is a business and has owners that are concerned about the business generating revenues. But what this will do is increase their revenues at the risk of some of the protections they claim is good for the hobby by encouraging cracking slabs, thus making the population reports even less reliable than they are today.

Let’s consider that I am one of those odd people that happens to collect the coin but it happens to be in a slab to ensure that it is genuine and the grade is something agreeable. This is a really nice coin and it fits in with my collection. But the coin happens to be in a slab with the logo of the New York Yankees. I hate the Yankees. I despise the Yankees. I have hated the Yankees ever since my father, the Brooklyn Dodgers fan, taught me to say “Let’s Go Mets!”

Unlike the fans of plastic, I really consider the coin encased in the slab. It is possible that I may like a coin even with the consequence that the label inside that slab has a decoration I am allergic to. If I decide that the coin is worth purchasing even if I ignore the label, I will buy the coin, but that label will have to go. There is no question that when I bring the coin home, the slab will be cracked, the coin removed, and the label finding its way to an appropriate disposal fitting of my opinion of that team.

Once cracked out of the slab, I could send it back to NGC and just have them re-grade the coin an put it in a plain slab. I could send it to Professional Coin Grading Service to see if they will give me a more solid grade. If it is a Morgan dollar I can ask ANACS to attribute the VAM. I could also ust keep it as a raw coin. Since the vast majority of my collection is not slabbed, this is not a problem. Besides, I know it is genuine because NGC slabbed it and I could submit it later if I need it slabbed again for resale.

Frankly, how many people actually save the labels and report their crack outs to the grading services? In the few cases when I have cracked coins out of its plastic tomb, I have not reported the cracked out coin to NGC. They have been cracked out of the slabs from multiple companies and submitted to NGC at a time I was working on a registry set. I believe this will encourage cracking out of the slab and make the population reports less reliable than they are today.

Not only will this affect the grading service population reports but it could affect coins with Certified Acceptance Corporation stickers. My hatred of the Yankees will not have me think twice about cracking that plastic just because the CAC or anyone else put a sticker on the slab. If I am not telling NGC I obliterated their label, I am not reporting it to CAC either—especially since I am not exactly a fan of CAC.

I do not begrudge NGC for doing what they need to do to earn a living. But they need to explain how these gimmicks align with their uncompromising standards and a commitment to integrity. Just admit that these gimmicks are being used to improve revenues and that everything else is window dressing. I would respect the honesty.

Image courtesy of NGC.

Aug 13, 2014 | ANA, coins, commemorative, commentary, ethics, gold, shows, US Mint

From the raw video of people dashing across the street at the Denver Mint

The media reported that those waiting for to purchase the coins were not collectors. Most were being paid by dealers to be on the line in order to get around the U.S. Mint purchasing limits. As part of their attempt to game the system, these dealers put collectors and the general public in danger by handing large amount of cash to needy people who did not conduct themselves in a manner that is consistent with the ANA Code of Ethics. Since those behaving badly were being paid by the dealers, they are representatives of the dealers, making the dealers responsible for the action of those they employ.

In case those dealers have forgotten, according to the ANA Code of Ethics:

As a member of the American Numismatic Association, I agree to comply with the following standards of conduct:

- To conduct myself so as to bring no reproach or discredit to the Association, or impair the prestige of the membership therein.

This applies directly to the dealers whose action caused problems at the World’s Fair of Money. Since sales of the coin were made at the U.S. Mint’s booth on the bourse floor, this is a case where the dealers who participated in this discredited the Association by creating an environment that potentially jeopardized the security of the show. By putting the security in jeopardy and bringing this negative publicity to the World’s Fair of Money, the participating dealers impaired the prestige of the membership especially when they had to put the U.S. Mint and the ANA Executive Director in the position to have to act as a parent to dealers acting like impetuous children.

- To base all of my dealings on the highest plane of justice, fairness and morality, and to refrain from making false statements as to the condition of a coin or as to any other matter.

Although the launch of the 2014 National Baseball Hall of Fame commemorative coin during the Whitman Baltimore Expo was a success, there was a feeling that the sales format did not give collectors a chance to purchase the coin. In order to promote the broader sales of the coin, the U.S. Mint adjusted its sales requirement to limit over-the-counter sales in order to give more collectors the opportunity to purchase the new Kennedy gold coin. How could the U.S. Mint or the ANA know that the sales of a coin that does not have any mintage limits would cause problems when the sales of a commemorative coin with mintage limits went without significant issue?

Unfortunately, the intent of the U.S. Mint was impeded by some dealer’s plane of justice by their action. By immorally trying to get around the U.S. Mint’s sales limits by using questionable methods to unfairly stack the line against the collector, the dealers were making false statements to a government entity, and thus the public it represents, as to their eligibility to purchase the coin.

The appalling images provided by Denver television news (see below) of the behavior of those described as homeless on behalf of the dealers trying to get around the sales limits not only is not only unjust to legitimate purchasers and immoral, but as ANA members discredits themselves as ANA members.

Therefore, I am accusing ALL of the ANA members who hired these people that acted on their behalf of the ANA dealers with violation of the ANA Code of Ethics. The ANA Board of Governors must take action to restore the organization’s credibility by suspending those involved as per the ANA Bylaws!

Images of the shameful display caused by ethically challenged and greedy dealers courtesy of

ABC 7News Denver.

Apr 23, 2013 | ancient, coins, ethics, foreign, history, news, policy

While the State Department’s Cultural Advisory Committee (CPAC) continues to kowtow the the whims of foreign government looking to use the Convention on Cultural Property Implementation Act (CPIA; 19 U.S.C. §§ 2601 et seq.) as some sort of virtual tool to attack the United States, little seems to be said by the foreign archeological supporters when a Paris court ruled for a French auction house allowing them to sell Native American artifacts.

The case involves the sale of 70 artifacts from Arizona’s Hopi Tribe by the Paris auction house Néret-Minet. Hopi tribe members and historians believe that the items were illegally obtained. Representatives from Néret-Minet claim that the items were purchased legally from a collector in the United States.

A visitor looks at antique tribal masks revered as sacred ritual artifacts by a Native American tribe in Arizona which are displayed at an auction house in Paris April 11, 2013. (REUTERS/John Schults)

Following the ruling, Néret-Minet went ahead with the auction. According to The New York Times, the auction generated $1.2 million in sales (with buyer’s premiums). Five of the 70 items did not sell and not sold for less than their estimated value.

According to The New York Times:

Before starting, the auctioneer, Gilles Néret-Minet, told the crowd that the sale had been found by a judge to be perfectly legal, and that the objects were no longer sacred but had become “important works of art.” He added, “In France you cannot just up and seize the property of a person that is lawfully his.”

So let me get this straight, religious objects that are allegedly protected by the same treaties as ancient coins and United States law can be sold as “art objects” while foreign governments confront a dealer on a bourse floor while the State Department does little to protect collectors and those who have legitimate claims?

If France can do this with items of religious and cultural significance to the Hopi tribe, then will happen to the coin collecting hobby? I know some people can take their hobby seriously, but it is not religion. Most countries already have examples of the coins in question, so why are additional examples “culturally significant.” Remember, it was reported that when a dealer was approached in Baltimore by representatives of a foreign government, they were only interested in the more expensive coins and not the common coins from the same country with a lesser value.

The State Department is not doing enough to protect the American people, whether it is to protect what is really culturally significant items like the artifacts from the Hopi tribe or the abuse of international law as demonstrated by the actions of the State Department’s CPAC and the confrontation in Baltimore. This is something that must be addressed by the president!

Please take action!

I renew my request that all of my readers to go to http://wh.gov/MD2O and sign the petition. Share it on social media. I made it easy—just see the widget at the top of the right column. Petitions require 100,000 signatures in order to be answered by the White House. So far there are five signatures (THANK YOU!). Let’s see if we can motivate the coin collecting community to add more before you will not be able to own any foreign coin older than 100 years old!

A French supporter of the Indian cause, who refused to give his name, left, holds a flag of the American Indian Movement and an American exchange student, member of the Arizona’s Hopi tribe, Bo Lomahquahu, right, stand outside of the Druout’s auction house to protest the auction of Native American Hopi tribe masks in Paris, Friday, April 12, 2013. A contested auction of dozens of Native American tribal masks went ahead Friday afternoon following a Paris court ruling, in spite of appeals for a delay by the Hopi tribe, its supporters including actor Robert Redford, and the U.S. government. (AP Photo/Michel Euler)