May 1, 2020 | gold, investment, markets

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

On Monday, Bloomberg News published an article that suggested otherwise. The article notes that retail buyers of gold are paying up to $135 per ounce above spot prices. An analyst interview for the article said, “There has never been a time for American Gold Eagles at this premium level.”

A call to a trusted source explained the differences in the reporting.

Last year, gold hit a low of $1,269 per troy ounce. With good economic indicators, investors thought that the prices would continue to fall. The market did not see value in buying a declining asset. Sellers were hoarding their stock until prices became more favorable.

The lack of buying, especially by retail investors, left dealers with a lot of inventory. With inventory building, dealers did not buy additional coins from the U.S. Mint’s dealers. As the prices rose, sellers started to sell their gold coins adding to the inventory.

Then came the coronavirus pandemic.

Markets hate uncertainty. The coronavirus pandemic has made uncertainty the only certainty. Not knowing where to turn, many sources are reporting significant gold sales. Where the reports differ is the source of the gold.

Although sources confirm that physical bullion and warrants are producing the highest volumes, they say it is because the investors cannot find enough bullion coins to satisfy market demands. The markets adjusted.

The demand increased when the U.S. Mint temporarily closed the West Point Mint. While the reaction did not rise to panic-like levels, retail gold buyers sought bullion coins, primarily American Gold Eagles, with greater urgency.

Professional investors are buying bullion and other gold products, including classic United States gold coins. The retail demand for American Gold Eagle coins has driven up the price. As the price for Eagles rises, it has driven up the cost of other bullion coins, including the Canadian Maple Leaf and Krugerrand.

When considering the purchase of gold coins, keep the spread in mind. If you purchase gold coins with a $150 premium over spot, to ensure that your investment generates a return, the bid price has to raise $150 plus whatever premiums dealers place on the coins. It might require the price of gold to rise $200-255 per troy ounce to break even.

Investors thought that the supply would ease with the Royal Canadian Mint resuming processing of bullion. However, in the beginning, the Royal Canadian Mint will produce large gold bars to satisfy orders from central banks so they can settle on accounts. They will also be striking silver Maple Leaf bullion coins.

Some reports suggest that most of the early production of silver coins will stay in Canada.

After discussing the markets with three different analysts, the only certainty is uncertainty. Each had an opinion that differed from each other but agreed that someone is going to make money.

Apr 27, 2020 | gold, investment, markets, news, silver

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

While investors are turning to gold as the equity markets are less than stable, reports that bullion and bullion-related warrants are outselling all coin offerings. Even though the West Point Mint briefly paused coin production, the markets have not felt the impact.

Silver prices are faring as well as gold. The area that silver is gaining strength is in the industrial markets. Driving the price is the demand for electronics. The primary use of silver is in the braising that ensures the connections between the chips are secure and with the production of LEDs.

Industrial silver is in more demand than industrial gold. As Asian electronics production begins to ramp up, some investors feel that there may be a temporary shortage of silver. One analyst suggested that silver prices could climb to $18 per ounce. Silver is currently $15.26 per troy ounce.

On the other hand, the reports of economic contraction have suggested that bullion prices will collapse. If this is the case, then there will be more to worry about than the market price of bullion.

And now the news…

April 22, 2020

People have been collecting coins for about as long as coins have been made. That’s a passion that has endured for centuries, since roughly 600 to 800 BC. Coin collecting is a worthwhile hobby and can sometimes be a financially savvy investment.

→ Read more at

washtimesherald.com

April 23, 2020

Gold coin demand makes up a small part of total demand, and thus doesn’t have much impact on the gold price. Demand for gold coins must be seen as a retail sentiment indicator.

→ Read more at

seekingalpha.com

April 25, 2020

Copper is well documented for its impressive antibacterial properties. Even Ancient Egyptians used bronze filings (an alloy of copper and tin) from their freshly sharpened swords to treat their wounds.

→ Read more at

iflscience.com

April 25, 2020

What's True The reverse of a U.S. quarter issued in 2020 honoring the National Park of American Samoa features a pair of fruit bats.

→ Read more at

snopes.com

Apr 5, 2020 | bullion, gold, markets, news, silver

I know it is difficult to turn away from the news. It is like watching an automobile accident in slow motion. Every day it seems like there is something else. Unfortunately, this is true about the precious metals market.

Europe, which appears to be taking the closings and stay-at-home orders better than the United States, is trying to figure out what will happen to the economy after everything reopens. That is wreaking havoc with the market.

In one story, Germany is beginning to buy gold in preparation for future spending while institutions in Italy are selling gold to stay afloat. While African mines continue to bring metals to the market, investors are buying gold as a hedge for an uncertain future.

In the last 30-days, the price of gold has bounced back almost to pre-market shaking announcements about COVID-19 in the United States. Other metals have not been as active. According to a source, the only thing keeping the price of silver somewhat stable is its industrial use.

Coins and other collectibles that are sensitive to the precious metals market will begin to see a disparity in prices. Common gold coins whose price is tied to the metals market will rise. Silver coins will likely not move on the metals market.

During a conversation with a professional metals trader, I asked what is next for the market. A person who usually has an answer said that he did not know. He said that most traders are not trying to predict the market but react to whatever happens. One of the problems is that the computer models are wrong. In many cases, firms have halted automated metals trading. He said that the situation is so fluid that some of the computer models were buying from themselves.

If you watch the business news on cable television, you will hear a different opinion from every guest. I plan to use the advice given to me: prepare for the worst and turn off the television.

And now the news…

April 1, 2020

On that day, men shall fling away, To the flying foxes and the bats, The idols of silver And the idols of gold Which they made for worshiping. Isaiah 2:20

→ Read more at

breakingisraelnews.com

April 2, 2020

When people are worried about the future they turn to gold to protect their savings. That’s rarely been more true than today.

→ Read more at

finance.yahoo.com

April 2, 2020

I estimate that the Germans own 9000 tonnes in private gold-nearly as much gold as the French and Italians have combined. The World Gold Council (WGC) states there are roughly 198,000 tonnes of gold above ground, of which 35,000 tonnes is held by central banks.

→ Read more at

seekingalpha.com

April 3, 2020

Polish archaeologists have uncovered a treasure trove of Roman denarii coins. They date from the first and the second century BC, and they probably belonged to a member of a Germanic people who lived in the area at the time.

→ Read more at

ancient-origins.net

April 3, 2020

While removing the floor of the church in Obišovce near Košice, the foundations of the old church were uncovered. After this discovery, the archaeological company Triglav conducted research that took place at the beginning of February 2020, the Regional Monuments Board Košice reported.

→ Read more at

spectator.sme.sk

Jun 30, 2019 | bullion, economy, gold, investment, markets, news

Price of Gold for the 2nd Quarter of 2019

(Chart courtesy of GoldSeek.com)

With the price of gold opening at $1,279.00 on January 2, 2019, it saw some bumps in its price but has largely averaged a modest gain until the price closed at $1,271.15 on May 21. Then it started to climb and climb rapidly by market standards. On Friday, June 28, the end of the second fiscal quarter, gold closed at $1,409.00. The rise is a 10.8-percent gain since May 21.

Gold is considered a safe bet for investors. It is a way of investing in cash or cash equivalence. Investors buying gold will purchase bullion, gold bullion coins like the American Eagle, or shares in a fund that maintains large stores of gold. There are many types of funds and ways to purchase shares in these funds, but it is not the same as owning the physical gold. Most reports are claiming that investors are interested in purchasing physical gold with bullion coins being the preference.

Investors make money by investing with what they consider a manageable amount of risk. If the risk pays off, they can make a lot of money. The risks that fail must be made up elsewhere. Investors diversify their portfolios to mitigate these risks. However, if the institutional and large investors are moving their monies to safe harbors, like gold, they sense a problem.

This relatively sharp jump in the price of gold is being driven by the major investors who are worried about the future of the U.S. economy. They see the various trade wars being detrimental to the economy. One economist said that the recent hike in soybean tariffs to China is going to have long term effects long after this president leaves office.

Although the United States is no longer an agrarian economy, agriculture plays a significant role in the country’s economic health. Upsetting that role that agriculture plays will cause long-term damage to the economy. The soybean tariffs are believed to be the driver that is scaring investors.

You may ask how are soybeans causing gold to rise?

As part of foreign policy in Africa, the government has been supplying countries with the proper climate the means to grow soybeans. It was a way to make the countries self-sufficient by helping create an economy. In many cases, the United States did not follow through on commitments to help with the infrastructure that is needed to create access to the markets. Countries needed irrigation and road improvements. Rather than helping with the upgrades, the United States government concentrated on the military aspects of these country’s problems. A policy of one-problem-at-a-time.

For at least 15 years, China has ignored the military issues and began to supply the money, supplies, and labor to fix the infrastructure. The Chinese government helped build irrigation systems, roads, and provided transportation to build these economies with the promise that China would buy their products.

Although there was significant Chinese investment in Africa, it was still cheaper to buy soybeans from the United States. That situation changed with the 25-percent tariffs placed on soybean exports. The tariffs raised the price of U.S. soybeans beyond what the Chinese would pay to the African exporters. Now China is importing soybeans from Africa while U.S. farmers are provided allegedly short-term subsidies from the federal government.

Now that the infrastructure is in place for China to import soybeans from Africa, the costs have reduced and is projected to have the long-term effect of lowering the U.S. market for soybeans in China. One economist said privately that even if the tariffs were reduced to pre-trade war levels, it might not make it economically viable for China to buy as much from the United States as it did in the past.

Institutional investors see the loss in revenue from China, the increased deficit in providing welfare to soybean farmers, and the danger of the business not returning to the United States. They also see the reduction of tariffs to Russia for wheat and that Russia is also looking to African and South American countries for wheat sources. The competition is making trade prices drop and is making it look like agriculture trade is in trouble.

If exports of United States agriculture are in trouble, then it will hurt the economy. With the uncertainty added to the risk profile investors and fund managers have to manage, they have turned to gold as the natural, safe harbor.

The rise in gold prices always helps numismatics. It helps boost the prices of gold and, by association, other rare coins. However, if the gold prices go up because of economic stress, it will not matter what happens to numismatic prices. Fewer people will be in the market to buy coins.

And now the news…

June 26, 2019

Gold is a hedge against financial risk, and coins offer convenience.  → Read more at marketwatch.com

→ Read more at marketwatch.com

June 26, 2019

COIN collectors can now get their hands on a Toy Story 4 50p piece – but you can’t use it in shops. The commemorative coin features popular character Woody in colour with the cowboyR…  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

Jan 7, 2019 | commentary, gold, news

Sorry for the one day delay, it was a busy weekend!

The important news is not being reported in the numismatic press nor by those who are supposed to watch over the industry. The important news is the government shutdown and its potential effects on the economy as a whole.

The important news is not being reported in the numismatic press nor by those who are supposed to watch over the industry. The important news is the government shutdown and its potential effects on the economy as a whole.

Market performance is like a disease. When one part gets infected the rest of the organism will follow. The part the economic organism that is getting infected is the Washington, DC area. Home to 15 companies in the Fortune 500 including government-sponsored Fannie Mae and Freddie Mac, The Washington Post is reporting that 174,800 people have been furloughed in the Washington, DC-area because of the shutdown.

When that many people are not getting paid they are not spending money and the economy gets stagnant. When a region as significant in size becomes stagnant, it is only a matter of time before it spreads to other areas including those where the federal government has the most impact including Alaska, Montana, and New Mexico. Farming states could also feel the impact since the U.S. Department of Agriculture is closed and cannot process subsidy (welfare) checks for farmers hurt by the trade war with China, potentially affecting the price of food.

Since the markets do not like uncertainty, investors tend to seek refuge in precious metals, primarily gold and silver. The problem is that there is so much news that timing the markets has given the market watchers whiplash as the uncertainty seems to force the professional investors (gamblers) to treat the market like they are playing the hokie-pokey: a little bit in, a little bit out, panic a little and shake all about the next news cycle.

The dollar is strong but that is because the Federal Reserve did not raise rates in December. While that averted a panic, the Fed may not be able to hold back if the shutdown continues and puts inflationary pressure on the economy.

With news cycles that could change at the drop of a Tweet, it does not make sense to try to time the market. However, if the price of gold climbing as a result of those in the equity markets looking for a safer haven, you may want to tell your representatives in Congress to work to end this shutdown. Although some would love to see $2,000 per ounce gold prices, it could negatively impact the economy and your ability to collect.

And now the news…

December 31, 2018

Have you ever wondered what happened to all the old, round £1 coins after they were removed from circulation? We just found out  → Read more at mirror.co.uk

→ Read more at mirror.co.uk

December 31, 2018

Chain restaurants Sweetgreen and Dig Inn in the US have already stopped accepting cash. Starbucks and UK pubs are also moving towards card and contactless.  → Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

January 1, 2019

U.S. Mint sales of American Eagle gold and silver coins dropped to their lowest …  → Read more at reuters.com

→ Read more at reuters.com

January 2, 2019

Editor's Note: Kitco News has officially launched Outlook 2019 – Rush To Safety – the definitive reference for precious metals investors for the new year. We chose this year's theme as financial markets face growing uncertainty.  → Read more at kitco.com

→ Read more at kitco.com

January 3, 2019

PolicÃa Nacional has issued a warning after a rise in reported cases of members of the public receiving the wrong currency in their change. Instead of being handed back euros, unsuspecting holidaymakers and expats are being short-changed with coins of much lower value compared to the euro.  → Read more at express.co.uk

→ Read more at express.co.uk

January 5, 2019

KIND-hearted shopkeepers are helping an Inverness youngster with her coin collecting hobby by setting aside specially-minted versions of 50p and £2 coins produced to commemorate historic occasions. A Girl Guides centenary 50p sparked the interest of Cradlehall Primary’s Isla Macdonald, who now has 40 special 50p coins and 30 differently designed £2 coins.  → Read more at inverness-courier.co.uk

→ Read more at inverness-courier.co.uk

Nov 18, 2018 | coins, commentary, gold

Vahid Mazloumin is seen appearing in court for the first time on charges of manipulating the currency market. He was later sentenced to death, in Tehran, Iran. September 8, 2018.Tasnim News Agency /Handout via REUTERS (via ChannelNews Asia)

The charges stem from a new round of sanction by the United States that has Iranians hoarding gold and looking for other safe investments. To serve that market, Mazloumin and his associates began to trade in gold coins and bullion.

Up until the sanctions, Iran did not have many restrictions on the trading of gold and other bullion but found itself in another financial crisis. The Iranian central bank is reporting a reduction of reserves and those with the means to purchase gold have been doing so at a rate higher than in the past.

According to many reports, Mazloumin was caught with non-Iranian coins and bullion including bars made by Swiss and German companies. Amongst the charges included trading in gold American Eagle coins and Krugerrands. As part of this defense, Mazloumin claimed that the coins were imported before the ban.

What is troublesome is that the collecting and investing communities have been silent on the execution of someone whose actions were made retroactively illegal by a panicking government. It is a more extreme version of blaming the collector for the financial crisis, such as the United States did in 1964 over silver coinage.

Although someone will inevitably ask if condemnation will do anything, just remember how an industry condemned the actions in Turkey and the United States over actions against journalists. Communities that do not stand up for itself run the risk of allowing governments to run roughshod over them at their convenience.

Therefore, I CONDEMN IN THE STRONGEST POSSIBLE TERMS THE STATE-SPONSORED MURDER OF A COIN DEALER IN IRAN!

I urge the rest of the numismatic and investment industries to join me before someone comes for you!

And now the news…

November 12, 2018

Coins from 1930s donated during "Fill the Boot" fundraiser.  → Read more at spectrumlocalnews.com

→ Read more at spectrumlocalnews.com

November 12, 2018

DHAKA, Nov. 12 (Xinhua) — Shelves and cases in the money museum in Dhaka, capital of Bangladesh, are filled to the brim with coins and currencies from the barter era to modern times, with the displays attracting many visitors.  → Read more at xinhuanet.com

→ Read more at xinhuanet.com

November 12, 2018

A local fire department wants the public's help in making the Holidays special for members of The Armed Forces.  → Read more at fourstateshomepage.com

→ Read more at fourstateshomepage.com

November 14, 2018

These coins both endangered and saved Optatius Buyssens's life, as he fought as a soldier during World War One  → Read more at bbc.com

→ Read more at bbc.com

November 14, 2018

SARATOGA SPRINGS, N.Y. – BOCES Career & Technical Education culinary students hosted a recent Kiwanis Club luncheon where prominent numismatist Anthony Swiatek discussed old coins and currency, which might be worth a great deal more than their owners realize.  → Read more at saratogian.com

→ Read more at saratogian.com

November 14, 2018

Iran has executed two men convicted of manipulating coin and currency markets. Vahid Mazloumin and Mohammad Ismail Ghasemi were hanged on Wednesday after they were found guilty of manipulating coin and hard currency markets through illegal and unauthorized deals, Iranian Students’ News Agency (ISNA) reported.  → Read more at newsweek.com

→ Read more at newsweek.com

November 14, 2018

On November 14 the national Bank put into circulation four commemorative coins of irregular shape. This reports the press service of the regulator on the official page in Facebook, writes the Chronicle.info with reference to epravda.com.ua.  → Read more at bobrtimes.com

→ Read more at bobrtimes.com

Sep 19, 2018 | bullion, coins, Eagles, gold, US Mint

Want more information about American Eagle Coins?

The Coin Collectors Handbook: American Eagle Coins has more information and is fully illustrated. Read more →

here;

This is second article of a 4 part series:

During the debate of the law that created the American Silver Eagle program, the gold mining interests began to lobby congress to pass a bill to allow the U.S. Mint to mint bullion coins using gold mined in the United States. A few months later, congress passed the Gold Bullion Coin Act of 1985 that created the American Eagle Gold Bullion Program.

The key provisions of the Gold Bullion Coin Act are that the gold used in the coins be purchased from United States mining sources at prevailing market value and that the coins would be produced using 22-karat gold. It was decided to produce the using 22-karat gold to allow the U.S. Mint to compete with the Krugerrand, which was produced using 22-karat gold.

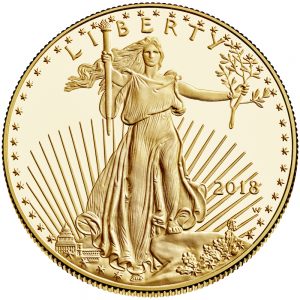

American Gold Eagle Design

The obverse of the coin used the design of the $20 Double Eagle coin designed by Augusts Saint-Gaudens. This design is considered by many the most beautiful of all coins produced by the U.S. Mint.

The reverse features a male bald eagle carrying an olive branch flying above a nest containing a female eagle and her hatchlings. It was designed by Miley Frances Busiek.

-

-

-

Reverse of the 2018 American Gold Eagle Proof coin feating the design my Miley Busieck

American Gold Eagle Coins are offered in four different sizes with each size being of different legal tender face value. The different coins are as follows:

- One ounce American Gold Eagle: $50 face value, is 1.287 inches (32 mm) in diameter, contains one troy ounce of gold and weighs 1.0909 troy ounces,

- One-half ounce American Gold Eagle: $25 face value, is 1.063 inches (27 mm) in diameter, contains 0.5000 troy ounce of gold and weighs 0.5455 troy ounce,

- One-quarter ounce American Gold Eagle: $10 face value, is 0.866 inch (22 mm) in diameter, contains 0.2500 troy ounce of gold and weighs 0.2727 troy ounce,

- One-tenth ounce American Gold Eagle: $5 face value, is 0.650 inch (16.5 mm) in diameter, contains 0.1000 troy ounce of gold and weighs 0.1091 troy ounce.

All coins are struck with reeded edges.

Each coin is made from 22-karat gold. The composition is comprised of 91.67% gold, 3% silver, and 5.33% copper. The coins are produced so that each size contains its stated weight in pure gold. This means that the coins are heavier than their pure gold weight to account for the silver and copper.

Bullion American Gold Eagle Coins

The American Gold Eagle program produces bullion and collectible coins. The bullion coins can be stuck at any branch mint but does not have a mintmark. Bullion coins are sold in bulk to special dealers who then sell it to retailers. They are struck for the investment market.

Although some people do collect bullion coins they are not produced or marketed for the collector market. As with other investments, American Gold Eagle bullion coins are subject to taxes when sold. Please consult your financial advisor or tax professional for the tax implications for your situation.

It is important to note that there have been attempts to determine where the bullion coins have been struck. Collectors have tried to use shipping records from the U.S. Mint, shipping labels, and other means to try to investigate the origin of the coins. Although some believe that these methods have identified some coins, the U.S. Mint has said that the shipping records that are being relied upon are not correct and do not reliably show the branch mint of origin.

Collector American Gold Eagle Coins

Collector coins are produced and sold by the U.S. Mint in specialty packaging directly to the public. Collectors can purchase new coins directly from the U.S. Mint and find these coins online. Collector American Gold Eagle coins are produced only as proof coins.

American Gold Eagle Poof coins are sold individually or in a four-coin set. The coins sold by the U.S. Mint are stored in a specially made capsule and that capsule is placed in a special folder-like packaging. The folders are distributed in a brown box with a Certificate of Authenticity.

OGP vs. GRADED

2018-W American Gold Eagle Proof in Original Government Package

Collector American Gold Eagle coins may have been removed from its original government package in order to be sent to a third-party grading service for grading. Most of the time, the original government package may have been discarded. Some dealers will sell the package without the coin for a few dollars, but for collectors of graded coins, this is not a priority.

1999-W Bullion Eagles Struck with Unfinished Proof Dies

In 1999, there was an incredible demand for gold bullion. In the rush to produce $5 one-tenth ounce and $10 one-quarter ounce bullion coins to satisfy market demand, the West Point Mint mistakenly struck coins using unfinished dies made that were supposed to be for proof coins.

These dies were considered unfinished because they did not receive their final finishing treatment that would be used for proof coins.

As a result, about 4,000-6,000 American Gold Eagle 1999 bullion coins were struck with the "W" mintmark and the higher relief of proof coins. Since most of these coins may be in bullion holdings, experts are not sure how rare these coins may be. However, few have been seen for sale on the secondary market.

SPECIAL SETS

Tenth Anniversary American Eagle Set

As part of the celebration of the 10th anniversary of the American Eagle program, the U.S. Mint created the 10th Anniversary American Eagle set. The set contained a four 1995-W American Gold Eagle Proof coins (one-tenth, one-quarter, one-half, and one troy ounce coins) and a 1995-W American Silver Eagle proof coin. This set is significant for the 1995-W American Silver Eagle proof coin since it was not made available to collectors not buying the set.

Most of the sets have been split up to take advantage of the fluctuating metal prices and the rarity of the 1995-W American Silver Eagle. Finding the entire set with the American Gold Eagle coins and the American Silver Eagle Proof coin in the original government package can set you back $8,000 and higher.

Twentieth Anniversary American Eagle Set

To celebrate the 20th anniversary of the American Eagle bullion program, the U.S. Mint issued two different using gold coins in celebration.

The American Gold Eagle three-coin 20th Anniversary Set contained three coins: a 2006-W Proof Gold Eagle, a 2006-W Uncirculated Gold Eagle, and a 2006-W Reverse Proof Gold Eagle.

The 2006-W American Gold Eagle Reverse Proof was unique to the 20th Anniversary set. The raised design elements of the coin are mirrored and the background fields are frosted. This is the reverse of the typical cameo proof finish. Because of this, many of these sets were broken up and the coins encapsulated in third-party grading service holders.

A second 20th Anniversary Set included a one-ounce 2006-W American Gold Eagle Uncirculated coin and 2006-W American Silver Eagle Uncirculated coin. Both coins were treated giving them a burnished finish. Since both coins were available to be purchased individually with over 19,000 produced, it is easier to find a set in its original government packaging.

Annual Collector Coins and Sets

During the course of the American Gold Eagle Program, the U.S. Mint has offered proof coins for the collector they sold directly through their sales channels. Collectors could purchase each coin individually in a presentation case or all four coins as a set.

When searching for American Gold Eagle Proof coins on eBay, be careful not to buy a lot with just the original government package (OGP) and no coins. It is common for collectors to remove the coins from the OGP and send them to a third-party grading service for encapsulation. Collectors and dealers will try to sell the OGP without the coins for people who have the coins but not the package.

The OGP without the coins have no collector value.

Starting in 2006, the U.S. Mint has offered an uncirculated American Silver Eagle coins struck on specially burnished gold blanks. The burnishing gives the coin a satin finish that distinguishes this version from the bullion coin. These coins were offered from 2006-2008 and 2011 to present. Because of the increased demand for the gold bullion coins in 2009 and 2010, the U.S. Mint did not produce burnished collector coins so that the blanks can be used for fulfilling the bullion demand.

Similar to the proof collector coins, many of these coins were removed from their OGP and encapsulated by third-party grading services. The warning about sellers offering the OGP for sale without coins applies for the uncirculated burnished coins.

Rolls and the Monster Box

When the U.S. Mint sells bullion coins to their authorized resellers, the coins are packaged in 20-coin hard plastic rolls and 25 rolls are placed in a specially designed box that contains 500 troy ounces of silver. Rolls are topped with red caps and the boxes storing the rolls are red.

Although you may be able to find rolls and monster boxes of American Gold Eagle for sale, the price will be commensurate with the price of the coins. However, some dealers have tried to sell the boxes to anyone interested.

In our next installment, we look at the American Platinum Eagles.

Jun 17, 2018 | coins, foreign, gold, news

Thomas Rawlins Oxford Crown coin that minted in 1644. Only 100 of these coins were produced under the reign of Charles I.

(Image courtesy of The Sun.)

Workers cleaning out the cellar in an abandoned home in Brittany, a northwest region in France, discovered a shell-shaped container that rattled when shaken. Inside the container were 600 Belgian gold coins dated 1870. The obverse of the coins had the portrait of Leopold II, then the reigning monarch of Belgium.

Local media reported that the coins could be worth 100,000 euros or about $116,000 at the current exchange rate.

As reigning monarch in Belgium, as democratic reforms were sweeping through Europe, Leopold II had little power except to expand his empire. He did so by using explorer Henry Morton Stanley to help him lay claim to the Congo. Leopold was a harsh ruler in the Congo as he depleted the country of its two major resources: ivory and rubber. After, gaining a fortune Leopold basically went on a spending spree.

By 1908, Leopold was forced to give up control of the Congo to be managed as a legitimate Belgium colony. Belguim Congo gained independence in 1960 and became the Republic of the Congo.

There have been several hoards of Belgium gold coins from the Leopold II era that has been driving down the price of all coins. Add that European history does not portray him well makes his reign very unpopular.

The other find was by a woman in Hull, or more properly, Kingston upon Hull in the United Kingdom. She was cleaning out her loft and found a coin collection she inherited from her grandfather. She offered the coins to her children but they declined, believing the coins were junk.

Wanting to know more, she went to get the coins appraised and found that she had a Thomas Rawlins Oxford Crown coin that minted in 1644. Only 100 of these coins were produced under the reign of Charles I. It has an estimated value of £100,00 ($132,729 at the current exchange rate).

The lesson we should learn is to find those old boxes, containers, tins, or anything else that was given to you by a relative and do not assume it is junk. Have them appraised because you never know what you might find!

And now the news…

June 10, 2018

©Belga Demolition workers in the French town of Pont-Aven in Brittany have uncovered a fortune in Belgian gold coins worth €100,000. The coins date back to 1870, and show the notorious king Leopold II on the reverse.  → Read more at brusselstimes.com

→ Read more at brusselstimes.com

June 11, 2018

French gendarmes say workers paid to demolish an uninhabited house in Brittany made an unexpected discovery in the cellar — 600 gold coins. The Pont-Aven gendarmerie said the workers discovered the coins after rattling a mysterious, shell-shaped container.  → Read more at abc.net.au

→ Read more at abc.net.au

June 12, 2018

Liza Minnelli famously sang about the role of money in the award-winning Broadway play Cabaret, saying “Money makes the world go round.” Oscar Wilde cleverly wrote about it, as well, stating “When I was young, I used to think that money was the most important thing in life. Now that I am old, I know it is.”  → Read more at jasper52.com

→ Read more at jasper52.com

June 13, 2018

LOS ANGELES (Reuters) – A one of a kind 18th century gold coin bearing the likeness of the first U.S. President, George Washington, is expected to fetch more than $1 million when it goes up for auction in August, auctioneers said on Wednesday.  → Read more at in.reuters.com

→ Read more at in.reuters.com

June 13, 2018

A GRANDMOTHER found a rare 17th century coin worth £100,000 in a box of junk she was about to dump. The 69-year-old from Hull was clearing out her loft when she discovered the Thomas Rawlins Oxford Crown coin, minted in 1644.  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

June 13, 2018

The South African Reserve Bank (SARB) has released the designs of its commemorative banknotes and coins for Nelson Mandela’s birth centenary, ahead of the launch on July 13. The central bank on Wednesday issued a statement indicating that test packs of the commemorative notes were made available to the cash industry to make preparations for cash processing, cash dispensing machines and ticket machines, among other things.  → Read more at fin24.com

→ Read more at fin24.com

June 16, 2018

Family Fortunes: A sniper shot and seriously wounded him in east Belfast in 1922  → Read more at irishtimes.com

→ Read more at irishtimes.com

June 16, 2018

A one of a kind 18th century gold coin bearing the likeness of the first U.S. President, George Washington, is expected to fetch more than $1 million when it goes up for auction in August, auctioneers said on Wednesday.  → Read more at reuters.com

→ Read more at reuters.com

Jun 1, 2018 | coin design, coins, gold, legislative

Although it is not really a numismatic-related bill, the Saint-Gaudens National Historical Park Redesignation Act appears to be on track for passage in the Senate.

Essentially, the bill redesignates the Saint-Gaudens National Historic Site, Augustus Saint-Gaudens’ former home in New Hampshire, as the “Saint-Gaudens National Historical Park.” The change is significant in that it changes the funding for the staffing and maintenance of the site. It also will keep the site accessible for tourism.

Augustus Saint-Gaudens is known as the artist who co-conspired with President Theodore Roosevelt in his “pet crime” to redesign United States coinage. Before his death in 1907, Saint-Gaudens provided the design for the $20 Double Eagle and $10 Eagle gold coinage.

Saint-Gaudens’ legacy did continue after his death by his students Adolph A. Weinman, designer of the Walking Liberty half-dollar and Mercury dime, and James Earle Fraser, designer of the Buffalo Nickel.

S. 2863: National Law Enforcement Museum Commemorative Coin Act

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — May 16, 2018

H.R. 965: Saint-Gaudens National Historical Park Redesignation Act

Summary: (Sec. 2) This bill redesignates the Saint-Gaudens National Historic Site, in New Hampshire, as the "Saint-Gaudens National Historical Park."

Referred to the House Committee on Natural Resources. — Feb 7, 2017

Placed on the Union Calendar, Calendar No. 197. — Aug 25, 2017

Reported (Amended) by the Committee on Natural Resources. H. Rept. 115-277. — Aug 25, 2017

Mr. Thompson (PA) moved to suspend the rules and pass the bill, as amended. — Oct 2, 2017

Considered under suspension of the rules. — Oct 2, 2017

DEBATE – The House proceeded with forty minutes of debate on H.R. 965. — Oct 2, 2017

At the conclusion of debate, the Yeas and Nays were demanded and ordered. Pursuant to the provisions of clause 8, rule XX, the Chair announced that further proceedings on the motion would be postponed. — Oct 2, 2017

Considered as unfinished business. — Oct 2, 2017

On motion to suspend the rules and pass the bill, as amended Agreed to by the Yeas and Nays: (2/3 required): 401 – 0 (Roll no. 545). — Oct 2, 2017

Motion to reconsider laid on the table Agreed to without objection. — Oct 2, 2017

Received in the Senate and Read twice and referred to the Committee on Energy and Natural Resources. — Oct 3, 2017

Committee on Energy and Natural Resources. Ordered to be reported without amendment favorably. — May 17, 2018

Jun 1, 2018 | coins, commentary, gold, US Mint

One of the ten 1933 Saint-Gaudens $20 Double Eagle gold coins from the Longbord Hoard confiscated by the U.S. Mint

Coin World reported that the previous owner, who wishes to stay anonymous, turned in the coin because he did not want to be caught with the coin that federal courts ruled was stolen government property. Department of the Treasury and U.S. Mint officials have been instructed by the Department of Justice not to go into any further details about the case.

Since it has been assumed that 25 of these coins were taken from the Philadelphia Mint, that leaves four left at large.

According to Coin World, “The Secret Service still has on its books a directive to seize any extant 1933 double eagles as stolen government property.” However, other coins, patterns, and fantasy pieces including the five 1913 Liberty Head Nickels and the 1974 Lincoln Cent trial strike made from aluminum are still in private hands.

As long as this bogus double standard remains the policy of the federal government, we will likely never know whether the rumored 1964 Peace Dollars are real.

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor. As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen. → Read more at

→ Read more at