Nov 20, 2016 | bullion, coin design, coins, gold, US Mint

In 1916, the U.S. Mint began to circulate three iconic coin designs that remain favorites amongst collectors. To celebrate, the U.S. Mint issued 24-karat gold centennial versions of the Mercury Dime, Standing Liberty Quarter, and Walking Liberty Half-Dollar. The designs of the coins are the same as their century-old counterparts except the gold specification was added. Earlier this month, the U.S. Mint released the 2016-W Walking Liberty Half-Dollar 24-karat gold coin to complete the series.

-

-

2016-W Mercury Centennial Gold Dime

-

-

2016-W Standing Liberty Centennial Gold Quarter

-

-

2016-W Walking Liberty Centennial Gold Half-Dollar

With the release of the gold Walking Liberty Half-Dollar, every coin design that was part of President Theodore Roosevelt’s “pet crime” that has gone out of circulation, except the Bela Lyon Pratt quarter and half-eagles and the Saint-Gaudens $10 eagle, have been reproduced at least once. Only Victor D. Brenner’s Lincoln Head Cent design remains in circulation even though the reverse has been redesigned a few times.

Isn’t it time we move on?

Let’s forget the legal limitations placed on the U.S. Mint that only allows them to do a tribute like this in gold even though the original coins were struck in silver, how many collectors are really interested in buying these coins? How many can afford these coins?

Judging by the listings for online auctions and dealers that specialize in modern precious metals, it seems that the alleged sellout of the gold Mercury Dime was because of speculation. While there will always be some opportunists in any market, the appearance of the churn in that market feels more like people looking to make money rather than collect, especially since its $209 issue price is more affordable.

Now, both the Standing Liberty and Walking Liberty gold coins are still available. With the limited availability, why aren’t collectors buying these coins?

Aside from the cost of a gold coin, how many younger collectors or even those that are a part of Generation X have any connection to those coins? It is possible we Baby Boomers have seen these coins in circulation, even sparingly. I was able to find Mercury dimes and Buffalo nickels as late as the very early 1970s before they were all removed from circulation. My interest in collecting started when I found Indian Head cents in pocket change.

I am not saying that these designs are unworthy of a tribute. As a collective, they are arguably the most iconic designs of U.S. coinage. But what many consider the best of the best will live on as part of the American Eagle, Buffalo 24-karat, and the soon-to-be palladium bullion programs.

Isn’t it time we move on?

-

-

American Silver Eagle Proof

-

-

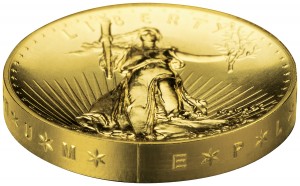

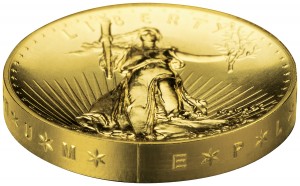

2009 Ultra High Relief Double Eagle Gold Coin

-

-

2013-W American Buffalo gold reverse proof obverse

Sales of mint and proof sets are down. Sales of commemorative coins are not meeting expectations where only a few have been sellouts. And the only modern coin that has seen any respect from the Baby Boomer and older collecting community was the 2014 50th Anniversary Kennedy Half Dollar gold coin.

It is time we move on.

The 115th congress will be sworn into office on January 3, 2017. Giving the congress time to get settled including my representative who will be entering his first term in the House, I will write to him to propose a that a silver program similar to the 24-karat gold program be created. Maybe, if coins are offered in silver, a more affordable metal, we can use those coins to generate additional interest in collecting.

It may not be much, but it is a start!

Coin images courtesy of the U.S. Mint.

Aug 23, 2016 | coins, gold, legal, news, US Mint

One of the ten 1933 Saint-Gaudens $20 Double Eagle gold coins from the Longbord Hoard confiscated by the U.S. Mint

This is a case that has been ongoing for ten years following the “discovery” of ten 1933 Saint-Gaudens $20 gold Double Eagle coins by Joan Langbord, the daughter of Philadelphia jeweler Israel Switt. Following the auction in 2002 of the only legal Double Eagle for a single coin record of $7,590,020 (since broken), Langbord claims that she found ten 1933 Double Eagles in a safe deposit box where Switt stored the coins.

Langbord reported the find to the Mint to “attempt to reach an amicable resolution of any issues that might be raised.” When Langbord gave the coins to the Mint to be authenticated, the Mint confiscated the coins. Langbord retained Barry H. Berke, the attorney who represented the plaintiffs in the case that resulted in the sale of the King Farouk coin.

-

-

-

-

Reverse of the iconic 1933 Saint Gaudens

$20 Double Eagle gold coin

After adding her sons Roy and David as plaintiffs to protect the property since Joan is elderly, the case is finally heard in July 2011. The court handed down an unanimous decision against the Langbords. The coins are moved to the United States Bullion Depository at Fort Knox, Kentucky.

Langbords appeal the trail to the Third Circuit where a three-judge panel vacated the forfeiture and order the government to return the coins.

The government appeals and asks that the return order be vacated in order to appeal the decision. Rather, the Chief Judge of the Third Circuit will stay the order and ruled that the appeal will be en banc, meaning that the appeal will be heard before the entire bench of judges.

In this round the government did not file in the proper time-frame and the Longboards appealed all rulings. The Third Circuit order the return of the coins but the government appealed the ruling again.

On August 1, 2016, in a 9-3 vote, a full Third Circuit panel of judges ruled that they agreed with the government who argued that forfeiture laws were not applicable because the coins were already U.S. property and could only be surrendered. The majority also ruled against granting a new trial noting that the errors of the 2011 trial were harmless even though a previous three-judge panel ruled differently.

In writing the dissenting opinion, Judge Majorie Rendell said that the majority based its opinion “mainly on its buy-in to the Government’s audacity—the Government’s say—so that it owned the 1933 Double Eagles and had no intention of forfeiting them.” She noted that the Civil Asset Forfeiture Reform Act was designed to prevent the government from forcefully seizing civilian property and that the ruling sets an “incorrect and dangerous precedent.”

A part of the government’s argument that is disturbing is that the they claim the Langbords are “the family of a thief” and should not benefit. Switt was never charged or convicted of a crime. While there is significant circumstantial evidence that Switt was the private seller of the coins and probably worked with the Mint’s cashier, his role has not been legally proven in any of the cases regarding any of the Double Eagle coins. Although this sounds like a legal arm-twist, it is important not only for this case but for any possible case the government can levy against any citizen. It is not right, fair, or legal and a violation of rights.

Berk told Reuters, “The Langbord family fully intends to seek review by the Supreme Court of the important issue of the unbridled power of the government to take and keep a citizen’s property.”

It is likely that the case will be filed to the U.S. Supreme Court for hearing in its next session beginning in October. Hopefully by then a ninth justice will be seated before hearing this case.

Image courtesy of U.S. Mint

Apr 24, 2016 | coins, gold, US Mint

As luck would have it, the day I published my post about my predicted price of the 2016 Mercury Dime Centennial Gold Coin, the U.S. Mint published their prices for all of the centennial celebration coins in the Federal Register. Typical of the way the government does things, the table is too cluttered. As a service to my readers I reproduced the table in a more human-readable form.

As luck would have it, the day I published my post about my predicted price of the 2016 Mercury Dime Centennial Gold Coin, the U.S. Mint published their prices for all of the centennial celebration coins in the Federal Register. Typical of the way the government does things, the table is too cluttered. As a service to my readers I reproduced the table in a more human-readable form.

Price is based on the average price of gold based on the afternoon price of gold as set by the London Bullion Market Association (LBMA). The U.S. Mint uses a Thursday-to-Wednesday week for the average which means that it is highly likely that the Standing Liberty and Walking Liberty gold coins will also be released on a Thursday.

I will add a link to this table under the Collector’s Reference on the menubar for your future reference.

| LBMA Gold Price weekly average |

Mercury Dime Centennial Gold Coin (1/10 ounce) |

Standing Liberty Centennial Gold Coin (¼ ounce) |

Walking Liberty Centennial Gold Coin (½ ounce) |

| $950.00 to $999.99 |

$180.00 |

$397.50 |

$740.00 |

| $1,000.00 to $1,049.99 |

185.00 |

410.00 |

765.00 |

| $1,050.00 to $1,099.99 |

190.00 |

422.50 |

790.00 |

| $1,100.00 to $1,149.99 |

195.00 |

435.00 |

815.00 |

| $1,150.00 to $1,199.99 |

200.00 |

447.50 |

840.00 |

| $1,200.00 to $1,249.99 |

205.00 |

460.00 |

865.00 |

| $1,250.00 to $1,299.99 |

210.00 |

472.50 |

890.00 |

| $1,300.00 to $1,349.99 |

215.00 |

485.00 |

915.00 |

| $1,350.00 to $1,399.99 |

220.00 |

497.50 |

940.00 |

| $1,400.00 to $1,449.99 |

225.00 |

510.00 |

965.00 |

| $1,450.00 to $1,499.99 |

230.00 |

522.50 |

990.00 |

Image courtesy of the U.S. Mint.

Apr 22, 2016 | commentary, gold, US Mint

Obverse of the Mercury Dime 2016 Centennial Gold Coin

Although I was in a meeting, I tried to purchase this coin using the U.S. Mint app on the iPhone. Basically, the U.S. Mint app on the iPhone does nothing more than distill the mobile version of the U.S. Mint website on the iPhone. Since the app was not working properly, I opened Safari and tried to use the website directly. By the time I was able to get the system to respond, the coin sold out.

Even though the U.S. Mint revamped the website, hired a new integrator, and added more capacity to the communications lines that lead to the server, the website failed to be able to handle the requests. The U.S. Mint hired a new contractor to make these improvements but still cannot get it right. Their website is not programmed to handle the crush of a popular product.

As someone who has worked in the government for many years, we usually have to undergo a review of recent events to learn about what went wrong in order to fix the problems for next time. These reviews look at every aspect of the process and recommend changes. It appears that if the U.S. Mint performed these after action reviews they did not learn their lessons from past mistakes.

Now is the time for the U.S. Mint to get out of the e-commerce business and hire a company that understands how to manage peak volumes. Services like Amazon and eBay have figured out how to manage users flooding their systems. I am sure that sales related to the U.S. Mint would not approach the traffic that comes on shopping holidays like Cyber Monday.

Does Ticketmaster sell e-commerce solutions? The software they use that adds you to a queue to wait until you can order because the system has been flooded. In the cases when I used Ticketmaster or Live Nation, their sister site, to buy tickets to popular shows, I was forced to wait on the virtual line before being able to purchase tickets.

Regardless of the model the U.S. Mint uses, they must do something. Either they need to figure it out or maybe a discussion with the Treasury Office of Inspector General may be worth the effort.

NOTE: The U.S. Mint sent a note to the media saying that they would have a statement regarding the sellout on Friday (today). At the time of this writing the U.S. Mint has not released a statement.

Apr 15, 2016 | bullion, coin design, coins, gold, US Mint

If you read my Baltimore show report, you might have noticed that I included images of the Mercury Dime 2016 Centennial Gold Coin. According to the U.S. Mint, the coin is scheduled to go on sale on April 21, 2016 at noon Eastern Time.

Obverse of the soon to be released Mercury Dime 2016 Centennial Gold Coin

Reverse of the soon to be released Mercury Dime 2016 Centennial Gold Coin

With a mintage limit of 125,000 and struck in West Point, the coin will be struck on a 24-karat (.999 pure) gold planchet. It will differ from the original Mercury Dime in that it will be dated 2016. On the reverse the coin will have the “W” mintmark since it will be struck in West Point, include “AU 24K” and “1/10 OZ.” to note that the coin will contain one-tenth ounce of gold. Otherwise, it looks exactly like Adolph A. Weinman’s design that was used from 1916 through 1945.

At 16.50 mm in diameter, the gold coin will be a little smaller than the 17.91 mm silver dime. The gold coin will be heavier (3.11 g) than the original that was made from 90-percent silver (0.7234 troy ounces).

To make this coin, the U.S. Mint is exploiting a loophole in the law that authorized the American Buffalo 24-Karat Bullion Gold Coins program (31 U.S.C. § 5112(q)). According to the law, after the first year of issue (2007), the Secretary can change the design of the coin as long as the design is reviewed by the Commission of Fine Arts and Citizens Coinage Advisory Committee. The U.S. Mint used this law to authorize the 2009 Ultra High Relief coin and the fifty year celebration of the Kennedy half dollar in 2014 with the dual date.

The original Winged Liberty “ Mercury” Dime was a silver coin produced as a result President Theodore Roosevelt’s “pet crime” where he thought U.S. coin design was hideous. Weinman was Augustus Saint-Gaudens’ student who is credited with finishing the work on Saint-Gaudens coin designs after the master sculpture’s death. It was not one of Weinman’s favorite works but it is beloved by collectors.

As a collector who has an almost complete collection of Mercury dime (missing the 1916-D), I was skeptical about the visual appeal of the coin in gold. When I open the folder, I see 30 years of silver coins. Since I try to keep my collection at extra fine (XF) or better, you can get used to seeing that beautiful silver color. When I saw the gold coin in a size that is close to the original dime in the presentation box at the Whitman Expo, I thought it made for a beautiful tribute.

Pricing of the coin will depend on the London Bullion Market Association (LBMA) afternoon price of gold on Wednesday, April 20. That number will be plugged into their pricing grid to determine the opening price of the coin. For example, the LBMA PM price of gold on April 14 is $1,233.85 per troy ounce. If this was the basis of the opening price, we would look up in the table for the price range $1,200.00 to $1,249.99. Since this is an uncirculated business strike coin struck under the American Buffalo act, the table shows that the coin would open at $194.00.

Using my example, this would give the coin a $70.61 or 36-percent numismatic premium over the spot price, which also takes into account U.S. Mint production costs (materials, labor, packaging, etc.).

If the LBMA PM price goes over $1,250 then the opening price of the coin will be $199.00. Being under $200.00 may give the market a psychological boost that may promote quicker sales. Then again, if the price of gold dips below $1,200.00, the coin will open at $189.00.

Putting on my prognosticator’s hat, I predict that the price of gold will go up enough that the opening price will be $199.00.

NOTE: I am just a blogger making a prediction. If you want a better market analysis, ask a professional advisor. They may have a more informed opinion, but we are all just throwing ideas up against the wall trying to figure out what will stick!

Jan 15, 2016 | coins, commemorative, gold, silver, US Mint

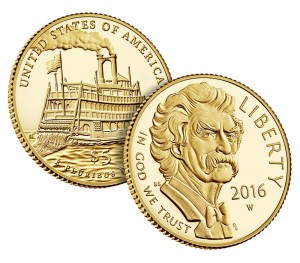

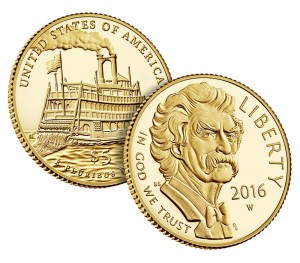

2016 Mark Twain Commemorative Silver Dollar

Originally, both the press release and apparently the COA from the U.S. Mint announced that the reverse design included Jim and Huck from the Adventures of Tom Sawyer. This error seemed to pass a lot of people who read the books, including me. Jim, who was Miss Watson’s slave who befriended Huckleberry Finn, appeared in the Adventures of Huckleberry Finn. Oops!

Apparently, someone forgot to proof read everything and the COAs were printed with the same information. Rather than distribute the wrong COA, which would have been interesting, the U.S. Mint had them reprinted. Citing an inventory issue, they delayed the sale of the silver dollar. It was not the inventory of coins that was the problem. It was the inventory of the complete package including the COA that caused the delay.

Packaging errors usually do not bring a premium. While they can be amusing, collectors have treated packaging errors as a nuisance. This would have been a fun error to keep around.

As an aside, I noticed that the 2016-W Mark Twain $5 Gold Proof Coin is listed as “Currently Unavailable” on the U.S. Mint’s website. The uncirculated coin is still available. Although there is a mintage limit of 100,000 gold coins regardless of strike type, there is no indication if this is the result of a sell out or a lack of inventory. Stay tuned.

2016-W Mark Twain $5 Commemorative Gold Coin

Images courtesy of the U.S. Mint.

Dec 22, 2015 | bullion, coins, gold, legislative, news

Over the last few years, congress has had this habit of waiting to the last minute to vote on legislation. When they do, they load up this legislation with seemingly unrelated stuff that it is no wonder their ratings are in the single digits.

2010 Somalia Sports Cars — Not the type of numismatic transportation we are talking about.

Title LXXIII of what is now Public Law 114-94 is short but has a big impact on the future for collectors. Rather than try to digest it all here, I will spend the next few days discussing the impacts. Starting with the technical corrections as part of Section 73001.

Technical corrections to a law is the process where congress votes on the wording changes that either clarifies or changes the limits of a law. It is written in a way that tells theOffice of the Law Revision Counsel, the editor of the United States Code (federal law), how to correct the law. In the case of the these corrections, it is instructing the Law Revision Counsel to edit the law (31 U.S.C. § 5112) that defines all the specification for U.S. coinage.

Today we begin with:

Title 31, United States Code, is amended —

(1) in section 5112 —

(A) in subsection (q) —

(i) by striking paragraphs (3) and (8); and

(ii) by redesignating paragraphs (4), (5), (6), and (7) as paragraphs (3), (4), (5), and (6), respectively;

2013-W American Buffalo gold reverse proof obverse

Removing the CFA and CCAC from design decisions may be a good idea when producing coins based on classic design. However, if the U.S. Mint abuses this provision, there is no doubt that congress will yell, scream, call the U.S. Mint bad names, and put the provision back in the law.

The change also removes any limits on mintages of 24-karat gold bullion coins allowing the U.S. Mint to produce as many to meet market demands. It will also allow the U.S. Mint to limit mintages on 24-karat gold bullion coins without asking for permission. This change just codifies current practice.

The change also removes any limits on mintages of 24-karat gold bullion coins allowing the U.S. Mint to produce as many to meet market demands. It will also allow the U.S. Mint to limit mintages on 24-karat gold bullion coins without asking for permission. This change just codifies current practice.

This first correction also removes paragraph (8) that requires protective covering, such as capsules for the coins. This will allow the U.S. Mint to package these coins for bulk sale as bullion coins adding to the potential for higher sales of gold coins. Although there has been no comment from the U.S. Mint, it is doubtful that they would sell collector versions of these coins in substandard packaging. That has not been their policy.

All that from just a few lines. Stay tuned because tomorrow we learn that congress actually did something right, for a change!

Image of the 50th Anniversary Gold Kennedy Half Dollar courtesy of the U.S. Mint.

Nov 24, 2015 | bullion, Eagles, gold, silver, US Mint

As we wind down to the end of the year, the U.S. Mint has been announcing their end of the year production availability for 2015 American Eagle bullion coins. Starting with the announcement on November 14, 2015 that the quarter ounce $10 gold American Eagle bullion coin has sold out and no more will be produced. For 2015, the U.S. Mint has sold 39,500 ounces of quarter ounce American Eagle bullion coin representing 158,000 coins. This represents a 33-percent increase from 2014.

As we wind down to the end of the year, the U.S. Mint has been announcing their end of the year production availability for 2015 American Eagle bullion coins. Starting with the announcement on November 14, 2015 that the quarter ounce $10 gold American Eagle bullion coin has sold out and no more will be produced. For 2015, the U.S. Mint has sold 39,500 ounces of quarter ounce American Eagle bullion coin representing 158,000 coins. This represents a 33-percent increase from 2014.

A few days later on November 18, the U.S. Mint announced that the one-tenth ounce American Eagle gold bullion coin has been sold out. For the year, the U.S. Mint produced 980,000 of the one-tenth ounce gold American Eagle proof coins representing 98,000 ounces of gold. This year’s production is a bit more than 73-percent increase over the 565,000 coins struck in 2014.

UPDATE: In a 4:35 PM note (24-Nov-15), the U.S. Mint has announced that the one-ounce gold American Eagle bullion coin has sold out! Orders for 2016 bullion coins will begin on January 11, 2016.

The day after announcing that they will be restricting the production of the American Silver Eagle bullion coins to 1 million coins per week, the U.S. Mint announced that they will continue to produce the coins through the week of December 7, 2015. They anticipate that this will cover their full weekly allocation through Monday, December 14, 2015.

With the price of silver dropping, the U.S. Mint has produced 42,929,500 American Silver Eagle bullion coins to this point. Considering the allocation of 1 million coins per week with four weeks left of sales, the final total of silver coins should be between 46-47 million coins. This would be an increase over last year’s record of 44,006,000.

American Silver Eagle bullion coin image courtesy of the U.S. Mint.

Aug 26, 2015 | bullion, coins, commentary, gold, investment, silver, US Mint

Reference price of metals for this post (does not update)

Watching the price of gold has been interesting. Since the release of the 2014 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin when the price of gold was set based on the $1,290.50 spot price, the trend of gold prices has been to go lower. Gold spot hit a low almost one year to the day of the release of the Kennedy gold coin on August 5, 2015 at $1,085.10. It has taken three weeks to bounce back a little.

Gold Chart for August to date (does not update)

I call silver the precious metal for the masses. Aside from being less expensive it is still considered a valuable commodity. Aside from the aesthetics of the color (I love the look of chrome on cars) you can really see a great design on a larger silver coin than a gold coin for a lower cost. For example, I like the look of the larger Silver Panda over the yellow gold Panda—and it is cheaper!

While my interest is more of aesthetics and the costs between purchasing the different types of coins, you can get into a situation where the composition determines the price of a coin. After all, the most expensive coin to sell at auction was a 1794 Flowing Hair silver dollar with a rare die variety. For a non-precious metal coin, you can always look at the 1913 Liberty Head Nickels whose composition is 75-percent copper and 25-percent nickel. Sales of these coins have averaged around $3-5 million in the last few auctions.

Rare and key date coins notwithstanding, more people can afford silver than gold. As a result, we have seen a rise in the collecting of silver non-circulated legal tender (NCLT) coins. Although I am not a fan of many of these designs, the various mints creating them would stop if there was not a market for them. Since this is what people are buying, the mints are striking.

To some degree, the price of silver may be inconsequential to the cost of some of these NCLT sets. Coins like the Looney Tunes and DC Comics sets from the Royal Canadian Mint; Star Wars, Disney, and Dr. Who sets from the New Zealand Mint are priced to include royalties that will have to be paid to their respective copyright holders.

-

-

Royal Canadian Mint’s $100 Looney Tunes 14-karat Reverse

-

-

Could this Looney Tunes Silver Kilo coin be on your list?

Then there are the countries of Somalia, Niue, Tuvalu, and the Marshall Islands that do have their own mints but license their names or contract other mints to strike coins for them. Even though these coins may not require licensing fees, many are made with popular themes to entice collectors to purchase them. Seigniorage then goes to both the mint striking the coins and the general treasuries of country whose name is on the coin.

-

-

2007 Somalia Motorcycle Coins

-

-

2010 Somalia Sports Cars

Most mints will float the price of their bullion coins to reflect market forces but not the price of NCLT coins. Even the U.S. Mint does not adjust the price of commemorative coins if the price of the metals drops.

While there are collectors that view their collection in terms of its value and others collecting as an investment of those of us who collect for the sake of collecting, the dropping of metals prices can be seen as an opportunity to buy some nice collectibles cheaper than otherwise. However, never underestimate the greed of some of these mints and the companies that sign agreements with them that will keep your prices high.

I wonder how these coins will fare on the aftermarket in the future?

Image Credits

- Charts courtesy of Kitco.

- Looney Tunes coin images courtesy of the Royal Canadian Mint.

- Somalia motorcycle and sports car coins from author’s personal collection.

Aug 6, 2015 | coins, commentary, fun, gold, history, US Mint

The other day I walked into the office of a big-shot producer and pitched a story for a movie that had the possibilities of a sequel. Here is the story I pitched:

The other day I walked into the office of a big-shot producer and pitched a story for a movie that had the possibilities of a sequel. Here is the story I pitched:

Our story opens in Philadelphia where the

U.S. Mint is striking 445,500 double eagle coins bearing the design by Augustus Saint-Gaudens.

Flash to Washington where President Franklin D. Roosevelt signs Executive Order 6102 that banned the private use of gold for currency.

Transition back to Philadelphia where a shadowy figure, presumably the U.S. Mint’s cashier, is locking the doors of the coin room but is clearly clanking coins in his pocket.

Watch as the cashier grabs his coat, hat, a small bag and leaves the Mint. He walks to the Philadelphia’s diamond district where he knocks on the backdoor of jeweler Israel Switt. Switt opens the door and the two men talk. Switt hands the cashier a bag and the cashier hands the bag he was carrying to Switt then leaves.

Fast forward to 1944. An emissary for King Farouk of Egypt is meeting with someone at the State Department to obtain permission to export a 1933 double eagle to Egypt for his vast collection. Not knowing whom to call, the State Department worker calls the Smithsonian who verifies the coin that leads to an export permit.

Next, a series of investigations and stories about the seizing of 10 double eagle coins that the Secret Service says should not have left the U.S. Mint. This part of the story goes to 1952.

Scene is the famous Waldorf-Astoria Hotel in New York in 1996. British coin dealer Stephen Fenton is attempting to buy a 1933 double eagle when the Secret Service interrupts the transaction and arrests him.

Attorney Barry Berke helps get Fenton out of jail and begins to build a case against the government. The defense claims that King Farouk of Egypt legally exported the coin. Some court drama and negotiations lead to charges against Fenton being dropped but the coin not returned to Fenton.

The scene is Federal Court in Manhattan where Berke is negotiating a settlement with federal attorneys. Finally, in July 2001, both sides agree that the coin would become federal property and sold at auction. The Fenton and the government would split the proceeds of the auction. The government required the buyer pay an extra $20 to officially monetize the coin.

Flash to the World Trade Center where the coin is removed from a safe and transferred to the government.

Brief pause for a scene about the destruction of the World Trade Center.

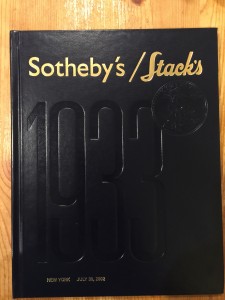

Fade to Southeby’s Auction on July 30, 2002 where the coin sells for $6.6 million plus a 15-percent buyer’s premium. After the auction Stephen Fenton received $3.3 million. Another $3.3 million was deposited in the federal treasury. Southeby’s and their auction partner Stack’s earned $990,000. The president of Southeby’s will pull $20 out of his pocket and hand it to the government’s representative to monetize the coin.

New scene is in a dark basement in Philadelphia. Joan Langbord, Israel Switt’s surviving daughter, will be opening boxes as if she was looking for something. Soon she would find a bag with ten 1933 Saint-Gaudens double eagle coins.

Langbord contacts the U.S. Mint and hands the coins over for authentication. In July 2005 they determine the coins are real and confiscates them.

Langboad contacts Berke to help recover the coins.

First trial occurs in July 2011, which leads to a unanimous decision against Langbord who was joined by her sons in the lawsuit. The elderly Langbord did this to protect the family’s interest.

Scene changes to the transfer of the ten coins to the Bullion Depository at Fort Knox, Kentucky.

Langbord appeals and a three-judge panel will vacate the forfeiture and order the government to return the coins.

The government appeals and asks that the return order be vacated in order to appeal the decision. Rather, the Chief Judge of the Third Circuit will stay the order and ruled that the appeal will be en banc, meaning that the appeal will be heard before the entire bench of judges this year.

Fade to the image of the ten coins in Fort Knox with the lettering “To be continued…” overlaying the screen.

The producer found the story so unbelievable that he threw me out of his office.

Just goes to prove that reality is weirder than fiction!

As luck would have it, the day I published

As luck would have it, the day I published

The other day I walked into the office of a big-shot producer and pitched a story for a movie that had the possibilities of a sequel. Here is the story I pitched:

The other day I walked into the office of a big-shot producer and pitched a story for a movie that had the possibilities of a sequel. Here is the story I pitched: