Sep 13, 2017 | commentary, counterfeit, grading

On September 12, Apple opened the Steve Jobs Theater on their new campus in Cupertino with an announcement of new hardware. There was the new Apple Watch 3, Apple TV-4K, and two new iPhones.

On September 12, Apple opened the Steve Jobs Theater on their new campus in Cupertino with an announcement of new hardware. There was the new Apple Watch 3, Apple TV-4K, and two new iPhones.

Outside of the tech press, everyone is focused on the iPhone X, “X” for the Roman numeral 10, a marvel of engineering but will cost $1,000. Breaking that $1,000 barrier is a big thing because it makes the iPhone X the most expensive smartphone on the market.

But I see another story that can be more important to a lot of other markets than the price of the device. It is the technology that can be industry altering.

Both the iPhone 8 and iPhone X have dual-lens cameras that are designed to enhance the use of photography. The new cameras have larger sensors that pick up more pixels of information with a processor that can better process the image.

It is the image processing and the iPhone’s ability to use the detailed images to map the terrain, textures, and to use augmented reality (AR) to enhance what the camera sees.

An area where this technology can help numismatics is with computer-based grading.

Computer-based grading was first tried in 1991 using the technology of the day. While it was a good start, the technology was just not ready for the ability to grade coins.

Apple proved that the technology is ready to try again.

Human-based grading has led to an environment of mistrust amongst the grading services. It is the failure of humans to be consistent in grading that leads to religious-like arguments as to which grading service is better. These failures have led the creation of verification services to check up on the ability of grading services to do their job.

The ability for the imaging process to visualize and analyze thousands of polygons on an image, the way imaging technology visualizes the three-dimensional surface, in such a way to allow for real-time expression processing and rendering can be used to assess the surface of a coin.

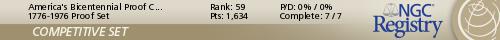

Another problem that can be resolved is the crack out game. Some people will crack coins out of their slabs to submit them to the grading services multiple times to play on the failure of humans to be consistent to try to have the coins graded higher. The information created based on the surface analysis of the coin will result in digital data that should be unique to each coin. Minute scratches and other environmental factors can help distinguish one coin from another in the same manner that there are subtle differences that can detect on identical twin from another.

Creating a digital signature for each coin will help prevent theft or help law enforcement use the information to track stolen items.

Imaging analysis can look at the surface to find alterations like the use of a chemical that would change the surface. Rather than using the “sniffing” technology that Professional Coin Grading Service has pioneered to find chemical additives, a surface analysis can detect chemical-based alterations to the surface.

Altered surface detection can also be used to detect unnatural toning. It will require teaching the imaging systems to detect the differences between natural and unnatural toning, but the long-term benefits to the hobby will be tremendous.

Device that could metallic analysis of a coin below the surface

In the short term, this will not put the third-party grading services out of business but it will change their business. They will not be grading and regrading coins. The computer will analyze the coin, provide the owner with a report, and that report will be consistent regardless of the imaging process used. Otherwise, the coin was altered and you would know about it.

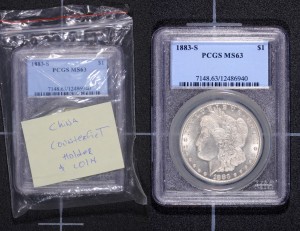

Counterfeit U.S. coins in counterfeit PCGS holders (Photo courtesy of PCGS.)

This technology will eliminate the verification services. There will no need for a human to verify the human-based grading. After all, the fourth-party verification process is artificially driving up the costs of collector coins because of blind trust placed in humans verifying humans.

Although I spent nearly all of my adult life in the technology industry, I am not for technology completely taking over all aspects of our lives. There is a level of trust in the hardware and software that must be earned to have me feel comfortable with things like self-driving cars or even maintaining personal information (see the recent Equifax breach).

However, I am for the use of technology where it can solve a problem. Technology can solve the problem of inconsistent grading. Technology can solve the problem of coin identification. Technology can solve the problems with counterfeiting. Why not use technology to increase the trust in the numismatic market by fixing these problems?

It is now time that technology was put to use in the numismatic and collecting industries in order to create a level of assurance for the collector that their item is genuine and the condition is what the collectible is being represented as.

Credits

- iPhone X image courtesy of Apple.

- Niton scanner image by the author.

- Counterfiet PCGS slabs courtesy of PCGS

Aug 15, 2017 | coins, education, grading

Over the last few weeks, I have been working on a few writing projects that include primers about collecting numismatics. While some of these articles have allowed me to repurpose blog posts, I have had to create some content not posted before.

Over the last few weeks, I have been working on a few writing projects that include primers about collecting numismatics. While some of these articles have allowed me to repurpose blog posts, I have had to create some content not posted before.

In the past, I posted a few including the series on small dollars and about Seated Liberty Dime Varieties. They were posted as regular articles because I thought they would be of general interest.

A few may not make for exciting reading but could be used as a reference for those interested. Last week, I added one of those articles rewritten for the blog and posted it under the Collector’s Reference menu.

“A Collector’s Guide to Understanding U.S. Coin Grading” is a simple overview of coin grading. It starts with a short narrative that explains the origin of coin grading and its standardization. It is not an extensive overview. It is just the basics to give a collector an idea of the evolution.

This is followed by three tables:

- Coin Grading Scale correlates the words with the expected grade that might be printed in an advertisement or on a grading service label along with a definition of what that grade means. These definitions were adapted from The Official American Numismatic Association Grading Standards for United States Coins edited by Kenneth Bressett. I own the 6th Edition but I am sure it has not changed much between then and the 7th Edition!

- Strike Quality is the attributes of a coin that signifies the strike and the wearing of the dies. Each of these designations begins with “Full” like “Full Bands” or “Full Steps.”

- Surface Quality is those grade attributes assigned to the quality of the coin’s fields. These are for proof coins designated as “Deep Cameo” or a business strike exhibiting “Proof Like” surfaces.

It ends with a section on a summary of the “eBay Coin Grading Policy.” There are aspects of their grading policy I did not know until I read eBay’s rules carefully.

If you find these types of write-ups helpful, let me know. I can convert some of the other guides into posts for the community.

Aug 9, 2017 | commentary, grading

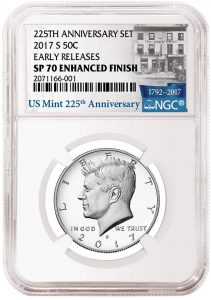

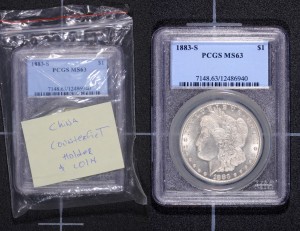

NGC slab featuring the U.S. Mint 225th Anniversary Label

Funny thing is that the outrage of putting a building that has been long demolished on the label of a slab is non-existent.

I wonder why?

I am not begrudging NGC for creating new labels for their products or anybody buying them. But the argument about the subject matter of one label versus another shows the hypocrisy by some of the people in this hobby.

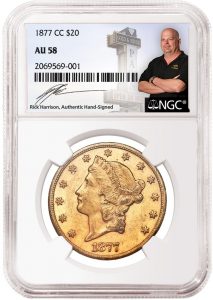

When NGC announced that reality television star Rick Harrison would be featured on an NGC label, the umbrage by some was deafening. Notes that I received about the Harrison numismentos were so profane that I had to force a few people to apologize under the threat that I would publish their uncensored words and email addresses!

Don’t I own slabs?

Yes, I own coins entombed in slabs. I own a modest registry set and higher priced coins (e.g., 1955 DDO) that I had encapsulated to protect my family if something should happen to me. The number of slabbed coins I own does not fit into two 20-slab cases. The vast majority of my collection is not slabbed.

It is not a secret that I am not a fan of slabs. To me, there is something antiseptic about a coin entombed in a slab.

It is also not a secret that I am not a fan of these special labels. They are a gimmick to make you buy the slab and not the coin.

I am not going to argue with anyone who likes the labels, slabs or anything I am against. No! If this is what drives you to collect, then have fun. I welcome those who enter the hobby to collect whatever they like.

HOWEVER, I am not a fan of inconsistent arguments. If you are in favor of these labels, then you have to take what you like with what you perceive as the bad. If you want NGC, Professional Coin Grading Service or any other grading service to use special labels, then you have to accept all of the labels these companies produce regardless of the subject.

I am not saying you have to add one to your collection. You can ignore the ones you do not like. But if you are in favor of the grading services creating the labels you like, then you have to accept the ones you do not like, too.

But don’t you own signed slabs?

Yes, I do. This is why I am not criticizing those who buy these items. It is not the label or autograph that bothers me. It is the hypocricy of the argument about who could or should autograph slab labels.

As an aside, NGC produced a label autographed by former U.S. Mint Director Edmund Moy. The same person who was in charge of the U.S. Mint when they were caught flat-footed when there was run on American Eagle coins, especially the silver coins. This caused the U.S. Mint to have to break the American Silver Eagle Proof series in 2009 because of his incompetent leadership.

If you are going to get upset that a reality television star was added to a label, I am going to call having a label that features an incompetent politician even worse for the hobby.

Of course, this does not include my feelings about the “Early Releases” and “First Strike” designations. These bogus designations are far worse for the hobby than who is featured on the label.

Slab image courtesy of

NGCJul 25, 2017 | commentary, ethics, grading

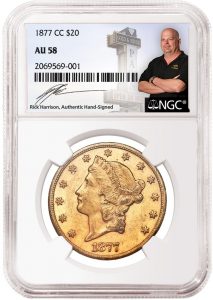

Sample NGC Holder with Rick Harrison signature label

I defended NGC’s position to produce the numismento not because I am interested in purchasing a slab with Harrison’s autograph, but because I do not see a problem with having it as part of the hobby. There are other issues that the hobby should attend to rather than worry about a reality television star and pawn shop owner signing slab labels.

However, my online correspondent, who I will keep anonymous but can respond to this post with an identification, was against the slab not because it will hurt the hobby but because of hidden meanings. When pressed on the real issue, my correspondent brought up a story of an elderly couple being taken advantage of by a company with an alleged A+ Better Business Bureau rating (although there have been questions raised about the Better Business Bureau’s ratings practice). The couple bought coins at a significantly inflated price with promises of a future gain only to learn that the coins were not worth what was promised.

About “The Coin Show”

The Coin Show is a podcast that is periodically produced by Mike Nottelmann and Matt Dinger. Matt owns Lost Dutchman Rare Coins in Indianapolis and is sadly not a fan of modern coins. If you are looking for a numismatic-related podcast, I would recommend The Coin Show. There are enough back episodes to keep you occupied until they produce their next show.

Unfortunately, this type of practice is not only pervasive in numismatics but there are all types of schemes where elderly are sold goods and services under fraudulent circumstances. Whether it is inflated prices of gold, the deflated prices of the hotel room gold buyers or the sets of State Quarters that are not worth thousands, these hucksters represent a problem that should be addressed.

Rather, my correspondent took the frustration of the situation on NGC and Harrison because Harrison does not represent the industry. He represents the pawn industry which does not have a high favorability rating.

My correspondent’s anger is misplaced. Rather than embrace the opportunity to use these slabs as a teaching moment and work with the industry to better educate the public, the response was to complain that this was not good for the industry because of what it allegedly represents. It is looking at the problems through a narrow prism, which is worse for the hobby than a stupid autographed slab. The perceived problems are not because a reality television star signs a slab label, the problem is that this industry has not properly represented itself and allowed those with less than moral character ruin things for everyone. The industry has let itself be denigrated by not properly getting out its message and allowing others to define the message. Industry Council for Tangible Assets (ICTA) has worked hard for the benefit of the industry the issues move faster than ICTA can keep up.

With the dysfunction in Washington lobbying efforts are turning to the state capitals where they can have a significant impact with less of a spotlight. ICTA needs help in nearly every state including California where my correspondent is from. Rather than kvetching on Facebook, I wish my correspondent and others would pick up a phone and join the battle.

Conflating the signing of slabs to the problems of an industry is myopic. If you want to fix the business problems then get look beyond the autograph to the real problems. Although I have never met NGC Chairman Mark Salzberg, his well-deserved reputation leads one to believe that he would not do anything detrimental to the business of numismatics, something he has dedicated his life to.

Unfortunately, I have a feeling that if someone walked into the shop that my correspondent owns and asked to buy the slab autographed by Rick Harrison, the business would find a way to allow the free market to reign and sell the customer what they asked for.

Jul 19, 2017 | coins, commentary, exonumia, grading

“Pawn Stars” Rick Harrison

I do not believe there should be a problem with this.

Previously, I wrote about something I called “numismentos,” mementos created from numismatic items. It was prompted when NGC announced they struck a deal with Edmund C. Moy, the 38th Director of the U.S. Mint and currently the last full-time director, to autograph labels. I also noted that NGC also had autograph deals with Elizabeth Jones and John Mercanti, the 11th and 12th Cheif Engravers of the U.S. Mint, respectively.

You can see the list of available NGC Signature Labels here.

But NGC is not the only one in this game. Professional Coin Grading Service has had similar promotions including Philip Diehl, another former Director of the U.S. Mint and a long list of Baseball Hall of Fame inductees who signed labels used in the encapsulation of the 2014 National Baseball Hall of Fame commemorative coins.

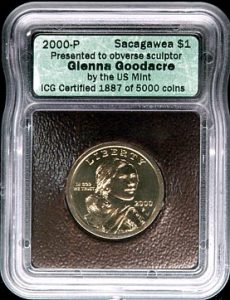

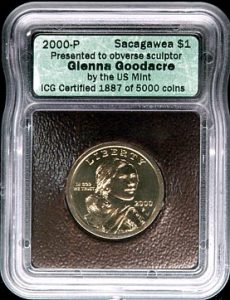

A Goodacre Dollar encapsulated by ICG

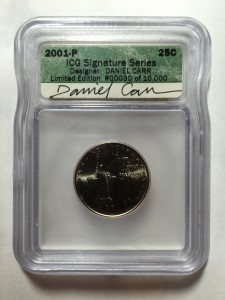

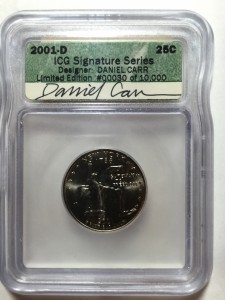

ICG also had some of the designers of the State Quarters autograph labels.

Does anyone else remember when the original PCI was still in business and they hired J.T. Stanton as company president and they had him autograph labels of coins he graded?

Although all of the grading services include special attribution for coins, NGC and PCGS have special labels that they use for certain coins.

In all cases, these grading services are creating these numismentos for customers interested in having the label be significant to their collection.

The only problem I have with the label designation is the “First Strike” or “First Strike” labels. There are questions as to the validity of these designations that causes an unnecessary premium to be added to these coins.

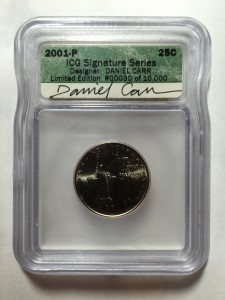

Besides, If I took any other stance, I could be accused of hypocrisy. In a few cases, I have purchased numismentos. My collection includes a pair of ICG holders with 2001-P and 2001-D New York State quarters autographed by designer David Carr that is part of my New York collection.

-

-

2000-P New York quarter with Daniel Carr’s autograph on ICG label

-

-

2000-D New York quarter with Daniel Carr’s autograph on ICG label

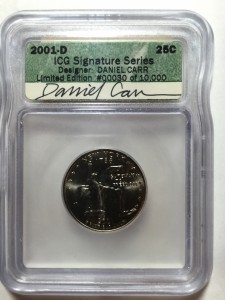

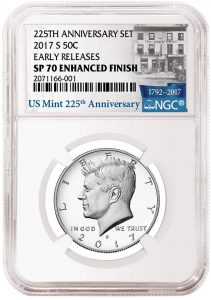

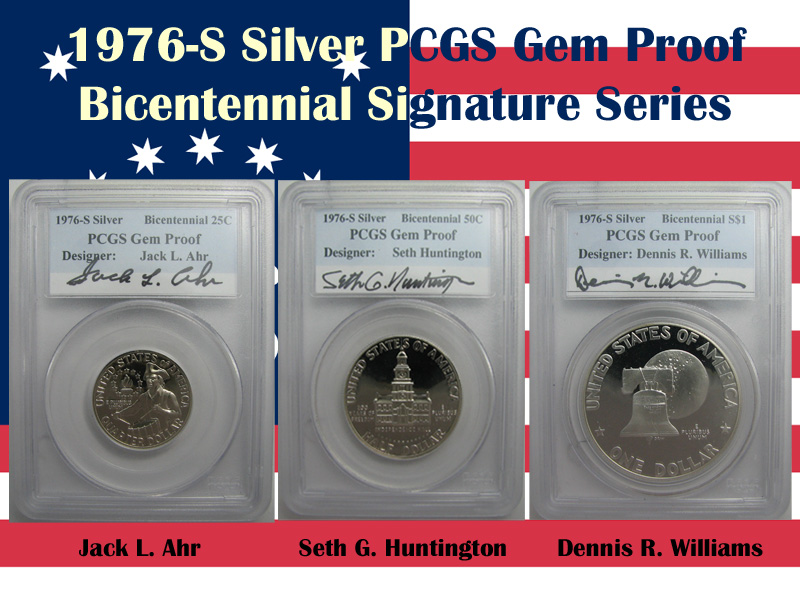

As part of my Bicentennial Collections, I own a Bicentennial PCGS Signature set. The set consists of the three proof coins with the special bicentennial reverse in PCGS slabs with the autographs of Jack L. Ahr, Seth Huntington, and Dennis R. Williams, the designer of the coins. There is a business strike version of this set but I find the proof coins more appealing.

1976-S Silver Proof Bicentennial Autograph Set

The only reason that there appears to be some umbrage taken with the autograph by Rick Harrison is that he is a relentless self-promoter whose style is not welcome by everyone. Harrison is not the first non-numismatic-related celebrity to autograph inserts but may be the most controversial to some people.

As I have previously suggested, we can call these types of numismatic-related collectibles numismentos. Numismento is a portmanteau of numismatic + memento.

I suggest the name to distinguish collecting the coins from collecting the slabs, show-related ephemera, buttons, or anything else that is not numismatics.

If collecting numismentos makes you happy? Enjoy yourself!

Jul 8, 2017 | coins, commentary, grading

Every so often I will read something and even though I agree with the premise and possibly the hypothesis, I disagree with the method. This is what happened when I read “How do late ANACS slabs stack up with modern PCGS?” This article by Michael Bugeja at Coin Update is not the first of its type on that site but is the latest of what I consider using faulty data to prove a hypothesis.

I submitted comments about my problems to the article. Since whoever is moderating comments has chosen not to publish them, I am using my own platform to call them out on this.

In Bugeja’s showdown of old ANACS versus new PCGS, he found six coins, which is where I begin to have problems. With a potential sample size of thousands or even millions of coins, six coins is a rounding error. And not only did he use six coins but from different dates, mints (Philadelphia and San Francisco), and grades. Anyone who has any knowledge of the scientific method knows that he has just introduced too many variables that will allow anyone to argue about the differences in the metals, machinery, and environmental factors.

The next problem with the experiment is that he uses damaged coins. Every coin Bugjea used was toned. Toning of the coin is a chemical reaction with the metals that cause a change in the original metal that makes it different from the original minted coin. While some consider toning acceptable, it represents a chemical change to the surface making it damaged.

How does one compare one damage to another? Do we know how these coins were damaged? Did the conditions that caused the toning of coin change the surface differently than the other? Did the damage caused by the environmental factors change? How do we know that the old ANACS holders were not sealed well enough to prevent changes in the toning from when they were originally graded?

I will not argue whether something happened to the coin that could have caused damage when it was cracked out of the original ANACS holder. Since there are so many questions about the coins, we can leave this argument off the table. I do hope Bugeja reported the serial number to ANACS so that their population reports can be appropriately adjusted.

Even if the test was to be limited because of the potential cost. A proper test would be to find six coins from the same year and the same mint that were not toned (or damaged). All six coins should be around the same grade or even a grade lower that it would be possible to pass for the higher grade. Once you have taken the variables away then you can test and determine the probability of proving or disproving the hypothesis.

Bugjea concludes that the early ANACS graders were more generous based on information that is so flawed that if that article was sent to a peer-reviewed journal it would be rejected.

He then goes on to warn, “Bid cautiously on early ANACS coins.” How about you bid cautiously on any coin you are not sure about. There are problems with coins in every holder and there are gems found with coins in every holder. Just because a coin is graded does not make it worth the plastic it is encased on.

The ONLY statement in the article I agree with is “Rely on your grading acumen rather than the age of the holder.” In fact, I would rephrase it to “Rely on your grading acumen rather than the holder.”

Translated: BUY THE COIN, NOT THE HOLDER!

Now tell me, does it really matter what holder these coins are in? These coins are so cool that a holder might detract from their beauty!

-

-

1937-D 3-Legged Buffalo Nickel

-

-

1942/1 Mercury Dime

-

-

1955 DDO Lincoln Cent

NOTE: I did not include images from the

original article because I do not have permission.

Feb 8, 2017 | coins, commentary, ethics, grading

There’s a revolution brewing in the numismatics markets that is being fed by its own successes causing its own failures.

There’s a revolution brewing in the numismatics markets that is being fed by its own successes causing its own failures.

The first salvo was fired by the Professional Numismatic Guild and Industry Council for Tangible Assets in 2006 when they jointly performed their own survey. One of the results was that PNG and ICTA were sued by a few of the services whose services were deemed unacceptable.

Following the report, the services not named Numismatic Guarantee Corporation and Professional Coin Grading Service went into turmoil. PCI went out of business around the time the J.T. Stanton left the company. James Taylor bought ANACS from Anderson Press and move the company to Englewood, Colorado. Taylor raided graders from Independent Coin Grading Company. As a result, ICG moved to Tampa, Florida.

In the meantime, most of those companies rated “Unacceptable” in the PNG-ICTA report either went out of business or have been marginalized to the point of irrelevance.

Next was the creation of the Certified Acceptance Corporation as a grader of the graders. As I have explained in the past, although a fourth-party or validation service might be helpful, the CAC is not an independent organization providing the service. The company trades on its inside information in what it calls “market-making.” This type of arbitrage activity would be illegal in the securities industry but has given a false sense of security in the numismatics world.

Now there are rumblings again and this time there are a few significant people doing the talking.

For the last six month, noted numismatist and author Q. David Bowers has written several stories for Coin World that has been both critical of the coin grading business and the complexity of the grading system. Although Bowers recognizes that there are advantages to third-party grading there has been changes and not for the better.

In other words, third-party grading and authentication is good for the hobby but the services have problems.

Could you tell the difference if they were not in the holders?

-

-

2016 American Silver Eagle graded MS-69 by NGC

-

-

2016 American Silver Eagle graded MS-70 by NGC

Following NGC’s change in its registry rules to no longer allow coins graded by PCGS in their sponsored registry sets, NGC Chairman Mark Salzberg publishes an analysis on what he claims is the decline in PCGS-graded coins. In his analysis, Salzberg looks at the prices realized from auction sales of certain PCGS coins over time and compares them to PCGS population reports for those coins.

Through a set of charts that resemble the supply-and-demand curves, it is unsure if the charts prove anything. If Salzberg is trying to say that PCGS is practicing grade inflation, known as gradeflation, then he could prove that with the changes in the grading for many modern coins. However, comparing the population report (supply) of a classic coin like the 1912-S Liberty Nickel, may not be valid without looking at other factors, such as the population report of lower grades declining. Also, Salzberg only uses the prices realize from auctions held by Heritage Auctions and not a survey of the industry as a whole.

Does PCGS practice gradeflation? Can we also ask does NGC practice gradeflation? And we do not know how these services fare with CAC who keeps its raw data hidden from the public while using it to increase the value of the coins it examines.

Dave Bowers provides good insight into the problems with coin grading without trying to overburden the reader with statistics even with the suggestion that dealers may overly emphasize grade differences and not the aesthetics of the coin.

Bowers is not the only one complaining about grading, last September, Rick Snow wrote an article on the CDN Publishing Blog suggesting grading be adjusted to a 15-point technical scale without the qualifying notations such as “”Full Head” or “Full Bands.”

The numismatics industry has put too much trust in these grading services without oversight. When oversight was tried by industry representative organizations, the companies that did not like the results litigated rather than fix their problems causing the attempt at oversight to be eliminated. Then a validation service appears to only turn out to be something they are using to manipulate the markets in their favor.

Is this coin worth less because it is is in an ICG holder?

Rather than implicitly trusting these companies, collectors and investors may want to start questioning all of these companies about their practices. Otherwise, you may find that coin you paid MS-70 prices for is really not worth more than an MS-68, which was a better looking, to begin with!

PNG-ICTA 2006 Grading Service Survey

Read their 2006 press release below or on Scribd.

Nov 18, 2016 | bicentennial, coins, grading, news

NGC Chairman Mark Salzberg

In the past, NGC would accept coins graded by Professional Coin Grading Service in the registry. They did this while PCGS only accepted their own coins. This created a lot of options for collectors. Many of the registry collectors have tried to use only NGC-graded coins as a source of pride. Others have been looking for the best coin for their sets.

I had started a few registry sets based on the 1975-76 Bicentennial coins. After a few years, I had stopped working on the set while other things took priority. Since I had not looked in a while, it appears that overall, I rank 4,653 with a total 12,050 points. While I know that the point values change based on population, I am not sure how this has changed. What has not changed is my America’s Bicentennial Celebration set, a 1776-1976 Clad Mint Set. According to NGC, the set is still ranked THIRD in this category with a score of 3,883 points.

During the last few years, I have divested many of the coins I purchased for registry sets except for the Bicentennial coinage.

As part of the change, Salzberg’s letter said that coins from “other services” that have been added prior to the change will be allowed to remain. In this case, the other services would be PCGS since it was the only service allowed in registry sets. Salzberg said that there will be no point deductions for those coins.

At 949 registry points, this coin scores the most points in the America’s Bicentennial Mint Registry Set

Unfortunately, I must have missed something because while looking at my sets, my 1776-1976 Silver Mint Set should be a top set but is made up of all PCGS coins. If PCGS coins are still allowed, then why are these coins not counted? Time to sent NGC a note and ask!

Frankly, I am surprised NGC has waited this long to make this change. As the quality of the coins and the number of people participating in registry sets have increased, NGC should have considered this move a few years ago. After all, PCGS does not accept NGC-certified coins in their registry.

In thinking about the competition between the two services, it is interesting that Salzberg noted that there will be some who will be upset “but I cannot continue to allow coins graded by companies whose standards do not match those of NGC.” Since the only non-NGC graded coins allowed in the sets are from PCGS, is this a commentary on PCGS?

Aside from questions that caused the formation of the Certified Acceptance Corporation as the “third-party grading service verifier,” or a fourth-party grading service, there have been some that claim PCGS has lowered their standards to grade more coins at higher grades to make their service more attractive. One dealer pointed out that it was once very rare to submit American Eagle bullion coins to PCGS and receive more than 5-percent graded as a 70 (perfect). Now, if at least 25-percent do not come back with a 70 grading he wonders if there was something wrong.

Another dealer pointed to high-profile online dealers who pre-sell 70 graded coins from both services. How do they know that the services are going to be able to supply these companies with the appropriate inventory? One said that they expect a certain number to come back with the perfect grade based on a percentage of what is submitted, noting that it is easier to predict.

I have no problems with registry set collecting, competition, or NGC only allow coins they graded in their competition. It is their Registry Service and they can set whatever rules they want. I now have to consider whether I want to try to cross-over the PCGS coins or buy new coins.

Image of Mark Salzberg courtesy of NGC.

Sep 12, 2016 | coins, commentary, grading

Over the last few years there have been many numismatic writers who have taken to their keyboards to complain about the state of coins grading. Aside from your intrepid blogger there was a series of articles that appeared in Coin World by Q. David Bowers. In his articles, Bowers notes that even though the American Numismatic Association grading standards have not changed in quite some time, coins in older holders usually are graded higher today than they were when originally graded.

Over the last few years there have been many numismatic writers who have taken to their keyboards to complain about the state of coins grading. Aside from your intrepid blogger there was a series of articles that appeared in Coin World by Q. David Bowers. In his articles, Bowers notes that even though the American Numismatic Association grading standards have not changed in quite some time, coins in older holders usually are graded higher today than they were when originally graded.

One area where this is hurting the hobby is when trying to buy coins using online auctions. In a less than scientific study, I have noticed that while looking for a specific coin that coin once graded by the Professional Coin Grading Service in their old green holders (OGH) tend to sell at a price half-way to what it would be if it was the next grade higher. Coins in older Numismatic Guarantee Corporation holders sell close to a similar price.

It is not known how many coins are cracked out of their holders and submitted to the grading services are submitted as raw coins. Most of these “crack out artists” do not turn in the labels for the grading services to adjust their population reports. Some coins could be counted several times by all of the major grading services while collectors fish for better grades.

Part of the problem is with the concept called market grading. Rather than looking at the coin and determine the technical state of preservation, the grading services take that grade and try to rank it within the market of similar coins. In the mean time, they participate in forums that teach technical grading without explaining market grading.

Could there be a better way? On the CDN Publishing Blog is a post by Rick Snow suggesting a different type of grading system based on a 15-point technical scale. Coins would be graded on a 0-5 scale for the condition of the planchet, state of the die as struck, and the strike. In this notation there would be no “Full Bands,” “Full Head,” or similar designations. Those coins would receive a strike score of 5. If that Jefferson nickel does not show all six steps, then the strike would be a 4. A final column would be a color designator with either a percentage of color loss from the original strike or RD (red), RB (red-brown), or BN (brown) for copper coins.

Rather than seeing a grade like XF, AU, or MS and trying to figure out why the coin received the grade, a coin would receive a grade like:

“Adjectival grade” (“Qualifier”: “Factor for Planchet”, “Factor for Die”, “Factor for Strike”, “Color Designation”).

As an example: Gem AU (13: 4, 4, 5, 10%)

The “Qualifier” would be the sum of the factors for the planchet, die, and strike.

It is an interesting idea especially for the current bullion coins. Honestly, can anyone really tell the difference between an American Silver Eagle graded MS69 versus one graded MS70? Yet, just because a grading service can allegedly tell the difference, there could be a two-to-three times difference in the price. However, I wonder if those coins were cracked out of their holders and resubmitted would they maintain their grades?

Could you tell the difference if they were not in the holders?

-

-

2016 American Silver Eagle graded MS-69 by NGC

-

-

2016 American Silver Eagle graded MS-70 by NGC

Although the grading services claim that they are doing what is best for the hobby, they are for-profit corporations that has to satisfy a market that seems to be more interested in the plastic and the label than the coin it holds. Even these verification services are for-profit corporations that has owners and investors to answer to. One is even into “market making” by doing arbitrage-like trading of its own stickered coins. This type of market making questions their independence because it appears that they are using their influence to drive up the price of those coins.

Would this type of grading be better for the hobby by providing the collector with more information? Is there an alternative that would fix the current system? Or is the current system just fine? Read the article on the CDN Publishing Blog and leave comments there and/or here!

Aug 21, 2016 | coins, grading, news

Artist’s conception of a 1964-D Peace dollar.

It started with the 1964-D Peace Dollar, a coin that was struck but never put into circulation and allegedly destroyed. PCGS, along with many others, believes that not every 1964-D Peace dollar was destroyed. The reward was offered in hopes that it would give someone the incentive to bring the coin out of hiding. However, given the current status of the 1933 Saint-Gaudens Double Eagles and the recent confiscation of the 1974-D Aluminum Lincoln cent, $10,000 is not a big enough incentive to risk losing this coin.

Earlier this month, PCGS announced the addition of four coins to their reward list. These four coins are as follows:

- 1873-S Seated Dollar: It was reported that 700 were minted but none have ever been seen. Some think these coins were melted as a result of the Mint Act of February 12, 1873 which ended the series in favor of the Trade Dollar.

- 1894-S Barber Dime: The U.S. Mint reported that only 24 were struck by only 13 have been discovered. One was found in circulation. This leaves 11 chances to claim a reward, if they still exist.

- 1841-O $5 Half Eagle: This was one of those coins where the U.S. Mint reported one thing and did another—or they were partying too much in New Orleans. Although they reported striking 8,350 of these coins in 1841, research shows that 8,300 of the coins were dated 1840. Could the other 50 be out there somewhere?

- 1849 Templeton Reid $25: Only one was ever known and was once part of the U.S. Mint Cabinet Collection. It was stolen in August 1858. Was it melted, as experts believe, or hiding in some unknown treasure trove?

-

-

1873 Seated Liberty Dollar – NGC PR62 – because there are no pictures of a real 1873-S dollar (Heritage Auctions)

-

-

1841-C Half Eagle — NGC AU55 because there are no images of a real 1841-O coin (Heritage Auctions)

-

-

Only 13 1894-S Barber Dimes have been accounted for (PCGS)

-

-

1849 Templeton Reid $25 was stolen from U.S. Mint Cabinet Collection (PCGS)

I wonder if there are any other coins that could be added to this list? Comment below if you have a thought.

Credits

- Seated Dollar and Half Eagle images courtesy of Heritage Auctions.

- Barber dime and Templeton Reid images courtesy of PCGS.

On September 12, Apple opened the Steve Jobs Theater on their new campus in Cupertino with an announcement of new hardware. There was the new Apple Watch 3, Apple TV-4K, and two new iPhones.

On September 12, Apple opened the Steve Jobs Theater on their new campus in Cupertino with an announcement of new hardware. There was the new Apple Watch 3, Apple TV-4K, and two new iPhones.