Jul 7, 2015 | ANA, news, video

American Numismatic Association Executive Director Kim Kiick announced the official election results. Since the president and vice president ran unopposed, these offices are as follows:

American Numismatic Association Executive Director Kim Kiick announced the official election results. Since the president and vice president ran unopposed, these offices are as follows:

President:

Jeff Garrett (Lexington, KY)

Vice President:

Gary Adkins (Minneapolis, MN)

For the Board of Governors, there were four incumbents running who were re-elected. Of the three other seats vacated by Gary Adkins (who became Vice President), Scott Rottinghaus, Jeff Swindling and Laura Sperber (who did not seek re-election), one is making a return to the Board of Governors, the current president rejoins the Board, and the board adds one new member. The ANA Board of Governors is as follows:

Board of Governors:

Col. Steve Ellsworth, Ret. (Clifton, VA) – 3,705 votes

Dr. Donald H. Kagin (Tiburon, CA) – 3,451 votes

Walter Ostromecki Jr. (Encino, CA) – 3,319 votes

Dr. Ralph Ross (Sugar Land, TX) – 3,222 votes

Greg Lyon (St. Louis, MO) – 2,982 votes

Thomas A. Mulvaney (Lexington, KY) – 2,746 votes

Paul Montgomery (Oklahoma City, OK) – 2,407 votes

The candidates that were not elected are as follows:

- Brian Hendelson (Bridgewater, NJ) – 2,221 votes

- Christopher Marchase (Colorado Springs, CO) – 2,006 votes

- Oded Paz (Arco, ID) – 1,950 votes

- Richard Jozefiak (Madison, AL) – 1,872 votes

- Steve D’Ippolito (Peyton, CO) – 1,844 votes

In the event that any of the new board members cannot serve, the next-highest vote-getter will fill that seat for the rest of the two-year term.

The new board members will be sworn-in at the annual ANA Banquet on Friday, Aug. 14, at the World’s Fair of Money in Rosemont, Ill. Garrett will become the Association’s 59th president, succeeding current President Walter Ostromecki.

COMMENTARY: All men and only one minority. No wonder hobby participation is shrinking. Only the investors and speculators are fueling the top end. Sure, there may be some kids, but there is no outreach to girls and minorities making it appear that the hobby is not welcoming. I hope this is something that can be addressed sooner rather than later!

Finally, if you want to see the announcement, you can watch it here:

Jun 18, 2015 | BEP, currency, Federal Reserve, news

The current $10 Federal Reserve Note featuring Alexander Hamilton

The new note is scheduled for release in the year 2020, which coincides with the passage of the 19th Amendment that declared:

The right of citizens of the United States to vote shall not be denied or abridged by the United States or by any State on account of sex.

According to the Treasury Department, the $10 note was selected to be redesigned to add Advanced Counterfeit Deterrence (ACD) based on their study of counterfeiting activity. This decision was made by the ACD Steering Committee, an inter-agency group that monitors a number of factors that go into the maintenance of U.S. currency. One of the factors includes the ongoing discussion of features that will help increase accessibility for the visually impaired as part of the court mandated Meaningful Access Program. Treasury reports that the new note “will include a tactile feature that increases accessibility for the visually impaired.”

The last time Treasury changed the portrait on U.S. currency was in 1928 when Andrew Jackson replaced Grover Cleveland on the $20 notes. Alexander Hamilton first appeared on the $10 note in 1923 when his portrait replace Andrew Jackson’s. Although the portraits have been redesigned, the same men have appeared on U.S. currency during small-sized note era (since 1928).

Series 1886 $1 Silver Certificate featuring Martha Washington (Fr #217)

Lew is asking the public to provide suggestions as to whom should be the new face on the $10 note. She should be a woman “who was a champion for our inclusive democracy,” according to the Treasury statement. You can submit comments on their new website thenew10.treasury.gov or make your suggestion on social media using the hashtag #TheNew10.

You can also visit the Bureau of Engraving and Printing in Fort Worth on June 24 and meeting with United States Treasurer Rosie Rios and Bureau of Engraving and Printing Director Len Olijar to give them your ideas. A similar event will be held at the Bureau of Engraving and Printing in Washington, D.C. on July 15. You can find more information on the BEP website.

Mockup of the $20 note featuring Harriet Tubman

Politico notes:

In fact, Hamilton shared his bed with more than one woman – making him one of the first subjects of a political sex scandal.

While his wife, Elizabeth, and kids were staying with relatives, Hamilton began an affair with a young woman named Maria Reynolds in 1791. He was secretary of the Treasury at the time, and Reynolds and her husband started extorting money from Hamilton. Hamilton eventually confessed to the affair in full detail in a pamphlet that also featured letters between him and his mistress.

Interestingly, according to Bloomberg news, “The $10 bill is the third least-circulated among the seven major denominations, accounting for 5.2 percent of 36.4 billion notes in use at the end of last year.” The $100 note is the most circulated of all U.S. currency notes.

Image of the current $10 note courtesy of the Bureau of Engraving and Printing

Image of the Series 1886 $1 Silver Certificate courtesy of Wikimedia Commons

Mockup of Harriet Tubman on the $20 note courtesy of Women on 20s

Jun 14, 2015 | coins, fun, news, technology, web

When I discussed the American Numismatic Association election, I noted that my posting has been more sporadic because of a business I started. This will continue at least for the next few months.

However, if you are looking for different types of coin news and information, I invite you to follow me on Twitter. You can find me @coinsblog. For those of you not familiar with Twitter, it is a social media site where users post information using 140 characters or less. This makes it difficult to post long diatribes of extensive notes. What it is good for is to post short messages with a link to longer stories.

However, if you are looking for different types of coin news and information, I invite you to follow me on Twitter. You can find me @coinsblog. For those of you not familiar with Twitter, it is a social media site where users post information using 140 characters or less. This makes it difficult to post long diatribes of extensive notes. What it is good for is to post short messages with a link to longer stories.

Those who either follow my Twitter feed on the web, using their favorite app, or the the box on the sidebar of this page will note that I will post links to coin, currency, and bullion-related stories from around the web. These stories are not from the usual set of numismatic-related websites like CoinNews.net, CoinWeek, Coin World, Numismatic News, etc. I figure that many of you would read these sites without my prompting. If you are not reading the articles on those sites, here is my endorsement for all of them. I read them all regularly.

Items I do post are from other news sources from around the web. Most of the articles are from media outlets but there are some financial blogs that make it into the mix.

The stories I post are about coins that have been about issued or planned to be issued coins and currency; news about bullion; some economic news that will affect circulating coins and currency; stories about shows where ever they appear; stories about collectors and collecting; or anything else that catches my eye.

The stories that end up in my Twitter stream are “hand selected.” This means I have a few saved searches and I periodically read through them looking for something interesting. Sometimes there are a lot of stories on one topic, such as the recent stories about France being upset with Belgium for striking a Waterloo commemorative. Other times it could be serious but amusing items like Zimbabwe phasing out its inflation currency at the rate of on U.S. dollar for ever Z$35 Quadrillion (that’s Z$35,000,000,000,000,000 or Z$35 thousand million) of inflation currency.

Similarly, I will post interesting pictures I find onto Pinterest. Pinterest is social media for pictures. Pictures are pinned to Pinterest like a bulletin board. You can follow those who pin on Pinterest (pinners) or their individual pin boards. I keep a few boards on Pinterest that I pin to as I look at the various articles. I try to pin something different than the usual coins. Most comes from the articles I find as I search for news stories.

Unless I find something different, most of the items from the news I post to my “In The News” board. One of my popular boards is “Coin & Currency Art” where I post items made from coins or currency or items made to look like coins and currency (that are not or intended to be counterfeit). If you like looking at interesting items, you might want to join Pinterest and start to follow many of the numismatic-related pinners already on the site.

I will try to finish some posts I started shortly. Until then, stay tuned and watch social media for my take on the on-going news.

May 29, 2015 | ANA, commentary, news

By now, American Numismatic Association members should have received their paper ballot or the email saying the electronic ballot is available.

By now, American Numismatic Association members should have received their paper ballot or the email saying the electronic ballot is available.

Now is the time for all good members to vote for the sake of the association.

Thankfully, the state of the ANA is calmer than in the past. Finances are stable, lawsuits have been settled, upheaval in Colorado Springs has settled, and the ANA has a technology platform it could be proud of. I happy to have been a part of the technology upgrade process that made a liar out of a current member of the Board of Governors.

Both Tom Hallenbeck and Walt Ostromecki have done well as the last two presidents leading the ANA out of its problems. What I know about Jeff Garrett, the ANA should be in good hands. But that does not mean the rest of the Board of Governors can be ignored. As we have seen, there are good reasons to choose wisely.

Endorsements

Jeff Garrett is running unopposed for president and Gary Adkins is unopposed for vice president. Both are good people and will provide great leadership for the ANA. While I have no objections to either holding these respective offices, I wish they did have some competition. It has been a while since there have been choices for these offices.

Since the ANA Board of Governors includes the two executive offices and seven governors, it is my preference to see a turnover where new people have a significant presence over members who are being re-elected or have been governors in the past. New people come with new ideas. Keeping the ideas fresh with a tie to the past is the best way to go.

With Garrett and Adkins running unopposed from the current board, I will only endorse one member of the current board for re-election. To continue with the current leadership, I am endorsing Tom Mulvaney to return as Governors.

There are a lot of reasons to endorse every member who is not a governor for the four other positions. Each has their strengths, weaknesses, positives, and negatives. But when looking at the list of candidates, three jump out at me with different backgrounds who I think would be good to have as a member of the Board of Governors. These people are (in alphabetical order): Steve D’Ippolito, Richard Jozefiak, and Oded Paz. I have either met all three or met people who have wonderful things to say about them. All are worthy of an endorsement.

Christopher Marchase will be my last endorsement. I have not met Mr. Marchase and all I know of him comes from his online statement. But his online statement begins, “I believe the future of the ANA is the millennials and the young numismatists…” then talks about expanding the ANA online presence and expanding its technology. As a member of the Technology Committee, I am in violent agreement with everything he said in his first paragraph. How I could not endorse someone like this!

As you noticed, I did not endorse seven Board of Governor candidates. Although I filled out a complete ballot, I do not feel strongly in favor or against the other candidates.

Why I did not run again

Over the last three years working with the Technical Committee, I have learned a lot about how the ANA works and think I could make a difference. But as my regular readers have noticed, the amount of writing has declined. This is because I started a new business, Having-Fun Collectibles. Having-Fun is all about having fun collecting. We deal in collectibles of all types—all the fun items that remind you of yesterday. Having-Fun is on eBay and The Antique Center in Historic Savage Mill (Savage, Maryland). Starting a business takes a lot of effort and requires my personal attention that prevents me from committing the time necessary to be an effective Governor.

I am also proud of the work that the ANA Technical Committee has done in moving the ANA forward with using technology to create more outreach opportunities. The upgrade and moving forward of technology in support of the ANA’s mission was my primary platform. Now that the platform is there, the priority should change to expanding programs using the technology to create outreach to younger collectors.

The ANA continues to have issues that have yet to be addressed including personnel matters, highlighted by the transition of five executive directors in 15 years, and two lawsuits with the second recently settled. The next board must address these issues and ensure a level of management that may still be lacking.

I will continue to write about my numismatic experiences here and hope to return as an active member as soon as business allows.

May 28, 2015 | coins, Federal Reserve, news, US Mint

In an early morning press release, the U.S. Mint announced that they would be going from a two-shift operation to a three-shift operation citing increased production requirements for circulating coins.

In an early morning press release, the U.S. Mint announced that they would be going from a two-shift operation to a three-shift operation citing increased production requirements for circulating coins.

The main job of the U.S. Mint is to supply circulating coinage to the Federal Reserve banks. These Federal Reserve branch banks then circulate the coins to member banks and distributors where they will eventually enter daily commerce. As part of their operations, the Federal Reserve will order coins from the U.S. Mint to supplement the money supply and provide the a forecast for the next 12-months. In order to meet the production requirements, the U.S. Mint uses the forecast to adjust their operations.

During the downturn in the economy, the U.S. Mint adjusted to a 4-day, 10 hours per shift schedule. Halting production so that the machines do not run on Friday saved money by lowering the electricity requirements and allowed for a broader maintenance program. Along with the schedule adjustments, the U.S. Mint instituted production efficiencies that have lead to lower costs. The result has been a an increase in seigniorage for the agency even during the downturn in the economy and the rising cost of base metals that have lead to debates over coin composition.

With this move, the U.S. Mint is likely going back to a 5-day, 8 hours per shift schedule. This will make the U.S. Mint a 24-hour operation again. It also means that they will have to hire people to work at the world’s largest coin factories in Philadelphia and Denver. The U.S. Mint anticipate that an additional 46 people will be hired in Philadelphia and 40 in Denver. They will be hiring quickly since they want to be up and running with their third shift by the mid-June to July timeframe.

If you are interested in working for the U.S. Mint, the positions will be posted on the federal government’s jobs website usajobs.gov. You can also visit the U.S. Mint’s online careers page to learn more about working for the U.S. Mint.

Apr 18, 2015 | coins, gold, legal, news, US Mint

The ten 1933 Saint-Gaudens Double Eagles confiscated by the government from Joan Lanbord, daughter of Israel Switt.

The original suit was filed in the U.S. District Court in Philadelphia by Barry H. Berke on behalf of Joan Langbord, the surviving daughter of jeweler Israel Switt, and her sons Roy and David. Berke is no stranger to these types of law suits. He represented the plaintiffs in the case that resulted in the sale of the Farouk coin in 2002. In July 2011, the jury returned a verdict declaring the coins to be government property.

1974-D Aluminum Cent (J2151)

This case is different since it is further along and about what was to be a circulating coin.

The ruling, written by Judge Marjorie O. Rendell,† centers around the government’s use of Civil Asset Forfeiture Reform Act of 2000 (CAFRA). CAFRA was passed as a “eact[ion] to public outcry over the government’s too-zealous pursuit of civil and criminal forfeiture” and as an “effort to deter government overreaching.” The government said that the Langbords did not file their suit within the 90-day time period. However, the ruling says that it does not imply because “Congress has specifically enumerated theft or embezzlement of government property as one of the crimes to which CAFRA applies.” Since the government called the assets stolen and then ignored the Langbords’ claim for the government to return the coins, they did not prove that the assets were embezzled and CAFRA does not apply.

In the areas where CAFRA did apply, the government did not respond to the Langbords’ request for return of the assets within the 90-days required by law. “The Langbords are correct in urging that we reject these arguments. The Government was required either to return their property or to institute a judicial civil forfeiture proceeding within 90 days of the Langbords’ submission of a seized asset claim.”

The three judge panel concluded “he Langbords are entitled to the return of the Double Eagles.” The appeal overturns the lower court’s ruling and the Appeals Court “will remand for the District Court to order the Government to return the Double Eagles to the Langbords.”

This may not be the end of the story. The government can ask for a temporary stay of the order in order to file an appeal. At that point the government attorneys can either appeal the ruling by the three-judge panel to the full Appellate Court (a full 9 judge panel) or directly to the Supreme Court.

My opinion: considering how the government has behaved throughout the saga of these coins, I think they will try to appeal this ruling to the full Third Circuit. It drags the case out longer and allows the government to put its considerable heft against the the Langbords. I do not think the government will settle this suit in a similar manner that the King Farouk coin was settled. However, if I understand the procedures correctly, the Langbords can claim that the case has significant public interest and ask for it to be heard by the Supreme Court. The Supreme Court then will decide to hear the case or let it be heard by the Third Circuit first. Regardless, I think the next stop is the Supreme Court where the most fascinating story in U.S. numismatics will be settled.

Or will it?

† Judge Rendell was appointed by President Bill Clinton in 1997. She was also the First Lady of Pennsylvania during the term of her then husband

Ed Rendell (2003-2011). The Rendells have since “

amicably separated.”

Image of the 10 Double Eagles courtesy of the U.S. Mint.

Image of the Aluminum cent originally from the Smithsonian Institute.

Apr 17, 2015 | BEP, coin design, currency, dollar, Federal Reserve, news

During the course of searching for information, I stumbled upon the website for Women on 20s. It is a site dedicated to replacing the image of President Andrew Jackson with a woman by 2020. The group has targeted the $20 Federal Reserve Note to be replaced 2020 because it is the 100th anniversary of the passage of the 19th Amendment that granted women the right to vote.

During the course of searching for information, I stumbled upon the website for Women on 20s. It is a site dedicated to replacing the image of President Andrew Jackson with a woman by 2020. The group has targeted the $20 Federal Reserve Note to be replaced 2020 because it is the 100th anniversary of the passage of the 19th Amendment that granted women the right to vote.

Jackson is being targeted because as we look back through the long lens of history, he was not exactly a model person judging by today’s standards. During the War of 1812, Jackson led U.S. Army troops against native tribes working with the British against the United States to regain the lands taken following the colonies’ independence. It was said that Jackson’s troops were brutal against the native tribes on his orders, killing them rather than taking prisoners.

After beating back the British in the Battle of New Orleans, Jackson declared martial law in New Orleans and used his troops to enforce martial law. Aside from having a magistrate arrested who sided with a newspaper reporter writing who was arrested for writing negatively about his rule, he had members of the local militia who sided with the British executed without trial and went on to use it as propaganda to allegedly maintain order.

As president, Jackson’s policies to relocated native tribes lead to the Indian Removal Act that codified his policies. This lead to the “Trail of Tears” that forced the relocation of Cherokee, Muscogee, Seminole, Chickasaw, and Choctaw nations from their ancestral homelands in the southeast to an area west of the Mississippi River that had been designated as Indian Territory. It is considered the most violent and brutal act against the native tribes in United States history.

To have Jackson’s portrait on the United States central banks’ currency is also a bit ironic. Jackson was against the concept of a central bank and refused to renew the charter of the Second Bank of the United States and vetoed the bill to continue its charter. After winning election in 1833, Jackson withdrew all of the country’s funds from the bank limiting the bank’s ability to conduct business. He gave power to local banks to lend money and issued the Specie Circular, an executive order requiring government transaction be done in gold and silver coin (specie).

Poster issued by the Whig Party blaming Jackson for the Panic of 1837

The Women on 20s organization does not believe that this should be the legacy honored on U.S. currency. But if we look into the history of all of the men on U.S. currency, there are aspects of their pasts and personal lives that would make some blush, including Benjamin Franklin’s common law wife and illegitimate son.

Women on 20s do recognize that suffragette Susan B. Anthony did appear on a one dollar coin but the coin failed because of its confusion with the quarter. They also recognize that Sacagawea, the Shoshone guide to Meriwether Lewis and William Clark, appears on the current one-dollar coin. Aside from the 2003 Alabama State Quarter, no other woman has appeared on circulating coinage (they do not count commemorative issues). Since neither dollar coin has circulated well and since the Alabama quarter was a temporary issue, the organization believes a better tribute is warranted.

Women on 20s do recognize that suffragette Susan B. Anthony did appear on a one dollar coin but the coin failed because of its confusion with the quarter. They also recognize that Sacagawea, the Shoshone guide to Meriwether Lewis and William Clark, appears on the current one-dollar coin. Aside from the 2003 Alabama State Quarter, no other woman has appeared on circulating coinage (they do not count commemorative issues). Since neither dollar coin has circulated well and since the Alabama quarter was a temporary issue, the organization believes a better tribute is warranted.

In what looks like an addendum to their argument, they mention that a portrait of Martha Washington appeared on the Series 1886 (Fr. #215) and 1891 (Fr. # 223) $1 Silver Certificates. Both Martha and George Washington appeared on the reverse of $1 Series 1896 Educational Series note (Fr. #224).

To decide who they will try to lobby to appear on the $20 note, the organization started with 15 candidates. Voters were asked to select thee of the 15 candidates in this preliminary round. The top vote-getters will be subject to another final voting round.

2012 First Spouse coin featuring Alice Paul

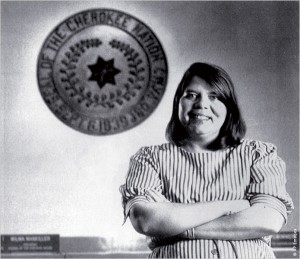

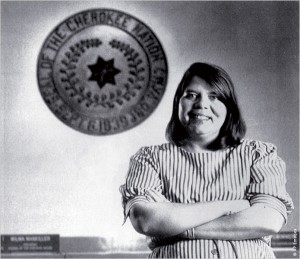

Women on 20s reported that 256,659 people had cast ballots when the first round ended on April 5, 2015. They reported that Eleanor Roosevelt, Harriet Tubman and Rosa Parks were named by as many as half of the voters as one of their top three. They added Wilma Mankiller to the final ballot. Mankiller, the first female Chief of the Cherokee Nation and the first female to be a chief of a native nation, was added because of a claimed “strong public sentiment that people should have the choice of a Native American to replace Andrew Jackson.”

Wilma Mankiller, the first female principal chief of the Cherokee Nation

Voting is open at the time this is being written. There is no closing date listed on their website.

Since congress does not control the design of the currency, Women on 20s will have to convince the Federal Reserve to change the design of the $20 Federal Reserve Note. If the Federal Reserve, whose chair is Janet Yellen, agrees to the change, they will work with the Bureau of Engraving and Printing for the design and the U.S. Secret Service to ensure that the appropriate anti-counterfeiting measures are included.

Design changes to any Federal Reserve Note can take 3-5 years to complete.

NOTE: I contacted the Women on 20s organization for comments via email. That email has not been returned at the time of writing this article. If they answer my questions, I will publish them in a follow up post.

Image of the $20 FRN and Whig Party poster courtesy of Wikimedia Commons.

Coin images courtesy of the U.S. Mint

Image of Wilma Mankiller courtesy of the

Native American Encyclopedia.

Apr 10, 2015 | cents, coin design, coins, economy, news, US Mint

The U.S. Mint has sent out a press alert saying that CBS Sunday Morning will air two segments this Sunday, April 12th, that may be of interest to collectors. The first segment will focus on the artists and engravers in Philadelphia and the role they play in the coin-making process. The segment will also look at some of the Philadelphia Mint’s history.

The U.S. Mint has sent out a press alert saying that CBS Sunday Morning will air two segments this Sunday, April 12th, that may be of interest to collectors. The first segment will focus on the artists and engravers in Philadelphia and the role they play in the coin-making process. The segment will also look at some of the Philadelphia Mint’s history.

A second segment will look at the penny and the debate about whether or not it should be eliminated.

Anthony Mason

CBS Sunday Morning is usually hosted by Charles Osgood and airs at 9 am Eastern Time. Check your local listings to see when it airs in your region.

Apr 4, 2015 | coins, commentary, markets, news, other

Click on graphic to see full survey

One of the problems I had with writing about this is that I did not know what to say. While it was fun to participate, what can I add to the survey? Rather than just reporting, I decided I would share my answers with some commentary.

Question #1: What is your favorite individual coin?

My answer: 1955 Double Die Obverse Lincoln cent

Prior to the appearance of the 1955 DDO Lincoln cent, there was almost no interest in error coins or that coins with errors can be collectible. After the discovery of the 1955 DDO, it was a number of years before error collecting was considered acceptable—I found a 1960 referenced to “spoiled 1955 pennies.” It is a historic coin in that it is the only coin that can be pointed to that started a type of collecting. That is what makes it so cool!

Question #2: What is your favorite coin series?

My answer: Peace dollars

I love the design of the Peace dollar. The image of Liberty on the front is, in my opinion, the one of the best images on U.S. coins. For collectors, it is the one set of silver coins that may be the most affordable for average collectors with the 1928 and 1938-S being the most expensive. It is also the only complete set of silver coins I own.

Question #3: What coin is most overpriced on the market right now?

My answer: Any coin in a slab with a CAC sticker

I have previously written of my dislike for CAC and how I feel they are practicing market manipulation. There are too many people willing to blindly accept CAC as an authority and some cannot explain why. While that CAC may have helped force PCGS and NGC to improve their processes, I have seen coins with CAC stickers I just did not like.

Question #4: What are some examples of undervalued coins?

My answer: Almost any commemorative coin

I should have clarified this answer to say that almost any modern commemorative coin. There are many commemoratives that did not sell well and not worth much more than their bullion value and a small numismatic premium. Even though they were not popular, they do have artistic value. A dedicated collector could put together a nice collection of modern commemorative coins for not a lot of money.

Question #5: What is the hardest coin to locate and purchase in the US?

My answer: A solid, mid-grade Liberty Head nickel

While most of the people taking the survey left this question blank, I was thinking about my own experiences. Not including rare coins, it is not that difficult to find key and semi-key dates. But if you really want to search for coins that are not easy to find, try to put together a set of extra-fine to almost uncirculated Liberty Head nickels. You can find a lot of lower grade nickels and higher grade nickels. Finding these solid mid-grade nickels can be more difficult than finding a 1913-S Type 2 Buffalo nickel.

Question #6: Do you think the penny will ever be phased out? If so, what year?

My answer: No. Never.

Although I am not in favor of eliminating the one-cent coin, I do not think it will ever be eliminated because of the dysfunction of congress. Congress would not be able to come to any consensus and neither side of the aisle does not have the intestinal fortitude to make a stand one-way or another.

Question #7: What President deserves to be on a coin/bill that hasn’t previously been featured?

My answer: Not counting the presidential dollars, Theodore Roosevelt

In this political climate, I knew what the dominant answer would be. Rather than thinking about the political, I was considering what president had the single largest impact on U.S. coinage. No other president had the impact on coin design than Theodore Roosevelt. While his “pet crime” was directly responsible for the designs by Bela Lyon Pratt, Augustus Saint-Gaudens, and Victor D. Brenner, it was the seed he planted for the renaissance of coin design. Remember that James Earle Fraser and Adolph A. Weinman were Saint-Gaudens’ students and added notable coin designs of their own.

Question #8: Do you think the US will ever introduce a brand new denomination?

My answer: No.

For the same reason that congress would never be able to vote on legislation to eliminate the one-cent coin, the same dysfunction will prevent new denominations from every being created.

Question #9: Which of the following phased out coins/bills do you think the US will begin minting in the near future?

- Kennedy Half dollar

- Susan B Anthony silver dollar coin

- Sacagawea dollar coin

- Two dollar bill

- None

My answer:

All items in the list are being produced except for the Susie B’s. There is no correlating law to authorize the U.S. Mint to produce the Susie B thus it could never be produced unless congress changes the laws. Kennedy halves and Sac dollars are being produced for the collector markets, but there are correlating laws to allow them to be produced. Authorization is codified in 31 U.S. Code § 5112.The $2 Federal Reserve Note is different in that the law (

12 U.S. Code § 411) authorizes the Federal Reserve to determine what notes are produced. The way the law is written, the Bureau of Engraving and Printing is not as regulated as the U.S. Mint. The only legal consideration is that the Fed could only have notes produced based on the denominations codified in

12 U.S. Code § 418. The law does not say these denominations have to be produced. Section 411 lets the Fed decide. In 1969, the Fed decided to stop producing large denomination currency. By the Fed’s definition, large denominations are FRNs larger than $100. Currently, the $2 FRN is being produced. The Fed does not order many and the rest are produced for the collectors market.

Yes, that was my answer and I’m sticking to it!

Question #10: If you didn’t collect coins, what would you collect?

My answer: Cars, sports memorabilia, lapel pins

In reverse order, I do collect lapel pins from situations meaningful to me. I have a collection that includes past professional activities, interests, places I have visited, and more. While I have some sports memorabilia, I am jealous of the collections I have seen of people who just pickup items as they go along. Of course those people are like Penny Marshall who have a phenomenal collection but also has access.

When I mention cars, I am not talking about a Jay Leno-like collection, but I wouldn’t mind his collection. I am just looking for a few cars to have some fun with. While I own a

1974 Plymouth Gold Duster with a 225 cu. in. Slant 6 engine (memories of my youth), I want other classics. A few great examples come to mind like a 1959 Cadillac convertible in red (Eldorado or Series 62, I don’t care which), a 1968-70 Dodge Charger R/T with the 426 Hemi engine in Plum Crazy purple, and a 1930s 4-door car to create a hotrod (yes, I know 2-doors are more popular, but I have an interesting idea). Every so often I see

movie or television-related cars that come up for sale that I think would be cool to own.

But I digress. While I am looking for a token with a cut-out “Q” as part of its design (it does not have to be a transportation token since none were made like that), you can

check out the survey and compare my answers with those from the other experts.

Infographic courtesy of International Precious Metals.

Mar 21, 2015 | bullion, gold, markets, news, palladium, platinum, US Mint

Last day at the London Fix market

The move to an electronic system followed the revelation that in June 2012 an employee of Barclays Bank manipulated the gold fixing process. Unfortunately, it was not an isolated incident. When Barclays was investigated, it was revealed that there were such system and control failures that members of the bank had been manipulating gold prices since they started hosting the market. In May 2014, the Financial Control Authority, the British equivalent Commodity Futures Trading Commission, fined Barclays £26 million for not properly managing the market.

What made the old system susceptible to manipulation was that it was still widely a human controlled process with bidding arbitrarily controlled behind then scenes. Even as the market moved toward a more technological approach, it was as if the technology was being used as the proxy with a human still doing the arbitration. Think of it as if the computers would provide the bidding but there was still an human auctioneer managing the bids.

The new market is electronically run and monitored in cooperation with the LBMA. Rather than a single source being responsible for all of the benchmark prices, the LBMA Gold price auctions are held twice daily by the ICE Benchmark Administration (IBA) at 10:30 AM and 3:00 PM London time in U.S. dollars. IBA is an independent subsidiary of the Intercontinental Exchange (ICE) responsible for the end-to-end administration of benchmark prices. They do not buy or sell commodities but manage the transactions and setting rates based on market forces.

To further diversify the market, the LBMA Silver price auction is operated by the CME Group, a Chicago-based market maker, and administered by Thompson Reuters. The London Metals Exchange administers the platinum and palladium price market. Silver auctions are held once per day at noon London time.

Proponents of the new market system touts its stronger oversight and detailed audit trail capabilities to support the new regulations as making this market more trustworthy than the previous system. Detractors wonder if the new electronic system could create market inequities that was seen in U.S. markets with programmed trading.

News reports suggest that the new market operated without problems on its opening day. In fact, the market saw a rise in all metals by the afternoon auction.

Snapshot of the bullion market on March 20, 2015 (static image, will not update)

Since the U.S. Mint sets its price based on the London market, they sent the following note to Authorized Purchases of bullion products on March 18, 2015:

This is to inform you that on Friday, March 20, 2015 the U.S. Mint will start using the LBMA Gold Price (PM) to price and settle all of its gold bullion coin orders. The new gold price replaces the London Gold Fix and will be managed by the ICE Benchmark Administration (IBA). We do not anticipate any transition issues. Moving forward all gold bullion transactions with the United States Mint will utilize the new LBMA Gold Price (PM) in place of the (PM) London Gold Fix.

While the move will make the markets more transparent and possibly open it to more participants, it is uncertain how this will affect the price of metals in the long term. For that, my crystal ball does not compute!

London Metals Exchange market images courtesy of

Mining.comLondon gold price snapshot courtesy of

Kitco.

American Numismatic Association Executive Director Kim Kiick announced the official election results. Since the president and vice president ran unopposed, these offices are as follows:

American Numismatic Association Executive Director Kim Kiick announced the official election results. Since the president and vice president ran unopposed, these offices are as follows:

By now,

By now,  In an early morning press release, the

In an early morning press release, the

During the course of searching for information, I stumbled upon the website for

During the course of searching for information, I stumbled upon the website for