Dec 23, 2015 | coins, legislative, news, silver, US Mint

In our short saga of How the Congress Turns (our stomachs), we are going to look at the next and last provision of how the “Fixing America’s Surface Transportation Act” or the “FAST Act” (H.R. 22) will impact collectors. Returning to Title LXXIII, Section 73001 we find:

In our short saga of How the Congress Turns (our stomachs), we are going to look at the next and last provision of how the “Fixing America’s Surface Transportation Act” or the “FAST Act” (H.R. 22) will impact collectors. Returning to Title LXXIII, Section 73001 we find:

Title 31, United States Code, is amended —

(1) in section 5112 —

. . .

(B) in subsection (t)(6)(B), by striking 90 percent silver and 10 percent copper and inserting not less than 90 percent silver; and

. . .

(2) in section 5132(a)(2)(B)(i), by striking 90 percent silver and 10 percent copper and inserting not less than 90 percent silver.

The result of the corrections is to change the requirement to strike silver coins with a composition that contains 90-percent silver, to the requirement that the coins must contain at a minimum 90-percent silver. By making these changes, it allows the U.S. Mint to use pure silver planchets to strike coins.

The U.S. Mint has been asking congress to end the practice of requiring silver coins to be 90-percent silver. Earlier, it was learned that pure silver planchets would be cheaper to produce than to find the few suppliers who would create “dirtied” blanks.

Congress finally listened (for a change).

The change in the law happens in two parts. Paragraph (B) makes the change for the balance of the America the Beautiful Quarters Program including the 5-ounce bullion coin. Section (2) changes the Administrative part of the code (31 U.S.C. § 5132(a)(2)(B)(i)) that covers all other coins. A problem with the way these corrections were written it does not affect commemorative coin programs unless the U.S. Mint’s general counsel feels that this law covers all coins. While the U.S. Mint is likely to interpret the law the way that benefits them, the wording does not cover commemoratives.

The change in the law happens in two parts. Paragraph (B) makes the change for the balance of the America the Beautiful Quarters Program including the 5-ounce bullion coin. Section (2) changes the Administrative part of the code (31 U.S.C. § 5132(a)(2)(B)(i)) that covers all other coins. A problem with the way these corrections were written it does not affect commemorative coin programs unless the U.S. Mint’s general counsel feels that this law covers all coins. While the U.S. Mint is likely to interpret the law the way that benefits them, the wording does not cover commemoratives.

Missing from these corrections the similar language for gold coins. Unless the U.S. Mint will interpret the gold coin changes as permission to change the commemorative coin programs, gold coins will remain 90-percent gold.

As I write this I am reminded about famous quote by the first Chancellor of Germany Otto von Bismarck: “Laws, like sausages, cease to inspire respect in proportion as we know how they are made.”

Next, we introduce another collectible that congress has mandated to be produced by the U.S. Mint.

Mount Rushmore quarter image courtesy of the U.S. Mint.

Dec 22, 2015 | bullion, coins, gold, legislative, news

Over the last few years, congress has had this habit of waiting to the last minute to vote on legislation. When they do, they load up this legislation with seemingly unrelated stuff that it is no wonder their ratings are in the single digits.

2010 Somalia Sports Cars — Not the type of numismatic transportation we are talking about.

Title LXXIII of what is now Public Law 114-94 is short but has a big impact on the future for collectors. Rather than try to digest it all here, I will spend the next few days discussing the impacts. Starting with the technical corrections as part of Section 73001.

Technical corrections to a law is the process where congress votes on the wording changes that either clarifies or changes the limits of a law. It is written in a way that tells theOffice of the Law Revision Counsel, the editor of the United States Code (federal law), how to correct the law. In the case of the these corrections, it is instructing the Law Revision Counsel to edit the law (31 U.S.C. § 5112) that defines all the specification for U.S. coinage.

Today we begin with:

Title 31, United States Code, is amended —

(1) in section 5112 —

(A) in subsection (q) —

(i) by striking paragraphs (3) and (8); and

(ii) by redesignating paragraphs (4), (5), (6), and (7) as paragraphs (3), (4), (5), and (6), respectively;

2013-W American Buffalo gold reverse proof obverse

Removing the CFA and CCAC from design decisions may be a good idea when producing coins based on classic design. However, if the U.S. Mint abuses this provision, there is no doubt that congress will yell, scream, call the U.S. Mint bad names, and put the provision back in the law.

The change also removes any limits on mintages of 24-karat gold bullion coins allowing the U.S. Mint to produce as many to meet market demands. It will also allow the U.S. Mint to limit mintages on 24-karat gold bullion coins without asking for permission. This change just codifies current practice.

The change also removes any limits on mintages of 24-karat gold bullion coins allowing the U.S. Mint to produce as many to meet market demands. It will also allow the U.S. Mint to limit mintages on 24-karat gold bullion coins without asking for permission. This change just codifies current practice.

This first correction also removes paragraph (8) that requires protective covering, such as capsules for the coins. This will allow the U.S. Mint to package these coins for bulk sale as bullion coins adding to the potential for higher sales of gold coins. Although there has been no comment from the U.S. Mint, it is doubtful that they would sell collector versions of these coins in substandard packaging. That has not been their policy.

All that from just a few lines. Stay tuned because tomorrow we learn that congress actually did something right, for a change!

Image of the 50th Anniversary Gold Kennedy Half Dollar courtesy of the U.S. Mint.

Dec 18, 2015 | commentary, grading, news, other

Exonumia are numismatic items that are items that represent money or something of value that is not considered legal tender coin or currency. When originally coined in 1960 by the founder of the Token and Medals Society (TAMS) Russell Rulau, the intent was to describe tokens, medals, and scrip. Over the course of time, other items have been added to exonumia category including some award medals and empherma like cancelled checks.

NGC John Mercanti Signature Label sample

Earlier this week, Numismatic Guaranty Corporation (NGC) announced that John Mercanti, the former 12th Chief Engraver of the U.S. Mint, has agreed to individually hand sign certification labels exclusively for NGC. Mercanti will autograph labels for coins bearing his design.

Last week, NGC announced that they struck a deal with Edmund C. Moy, the 38th Director of the U.S. Mint and currently the last full-time director, to autograph labels.

1982-S Washington Half with Elizabeth Jones Signature

In addition to signature labels, NGC has a primary brown label and lables for First Releases, Early Releases, Detailed Grade, 100 Greatest Modern Coins, Top 50 Most Popular Coins, and many others. Not to be outdone, the Professional Coin Grading Service (PCGS) has its own labels for First Strike, U.S. Marshals Service commemorative and 50th Anniversary Kennedy Half Dollar.

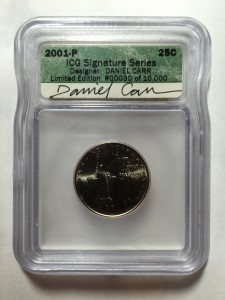

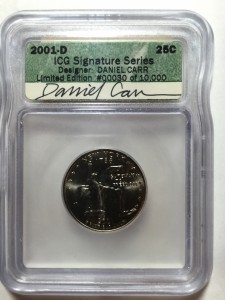

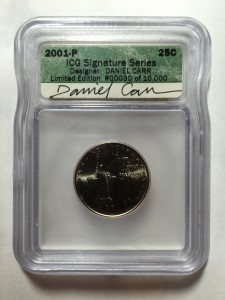

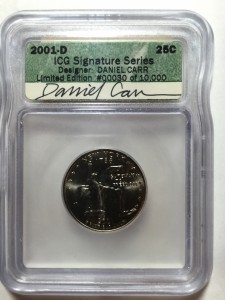

Even Independent Coin Graders (ICG) has been in the label business. Aside from their various label options, they also issued an autographed series as part of the 50 States Quarters program including the New York quarter designed by artist Daniel Carr that is part of my New York Hometown collection.

2001-P New York quarter with Daniel Carr’s autograph on ICG label

2001-D New York quarter with Daniel Carr’s autograph on ICG label

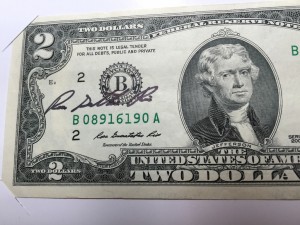

Autographs are not just limited to labels. Since becoming Treasurer of the United States, Rosie Rios has been a fixture at many numismatic events autographing Federal Reserve Notes that has her printed signature. Since Rios is a prolific signer, Rosie Dollars, as she as called them, are so common that her signed notes are not worth much more than face value.

Series 2009 Federal Reserve Note autographed by Treasurer of the U.S. Rosa Gumataotao Rios

Collecting numismatic-related souvenirs are not just limited to autographs, which also appear in books. Collectibles include show programs, badges, buttons, ribbons, tags, and other souvenirs related to shows, clubs, and other collecting endeavors.

Autographed slabs, money, books, programs, and other items that are collected because they are numismatic-related but not real numismatic items can be fun collectibles. As an effort to me more inclusive with all aspects of collecting items related to numismatics, it needs a name. Marketing folks will tell you that a good name helps promote your product.

I have an idea. We can call these collectibles numismentos. Numismento is a portmanteau of numismatic + memento.

For example, let’s say you have a collection of programs from the World’s Fair of Money shows you have attended? That would be a numismento. Are you a collector of the labels from the third-party grading services or their sample slabs? You are collecting numismentos. Collecting nametags, buttons, or other items from shows? These are also numismentos!

Numismentos. Numismentos are collectibles that demonstrate the culture of numismatics but are not numismatic items.

Happy numismentos collecting!

NGC Signature Series Holder images courtesy of NGC.

Other images are the property of the author.

Dec 15, 2015 | coins, news, US Mint

With the growing importance of electronic commerce especially for new products that sell out online with greater efficiency than even telephone order, the U.S. Mint has announced that it will be discontinuing all mail order processing at the end of the current fiscal year, on September 30, 2016.

With the growing importance of electronic commerce especially for new products that sell out online with greater efficiency than even telephone order, the U.S. Mint has announced that it will be discontinuing all mail order processing at the end of the current fiscal year, on September 30, 2016.

According to the statement released by the U.S. Mint, “The reality of the digital environment means that paper orders placed through the mail are increasingly not accepted as inventory is depleted quickly through online and telephone channels in real time. This is especially true for high-demand products with limited mintages. By eliminating mail orders and encouraging all customers to shop online or by phone, the Mint will be offering more ordering consistency and eliminating those hard copy orders that take longer to receive, process and fulfill.”

While existing order forms will be accepted until the deadline, catalogs and other U.S. Mint advertising material will no longer include paper order forms. Order forms received after September 30, 2016 will be returned with instructions to place the order using the online catalog or by calling (800) USA-MINT (872-6468).

There will be some people upset by this move, but considering the direction of online retail services and the reduction in cost to serve the broader market, the few people that might feel they are being excluded will be inconsequential. Dealers and the secondary market will pick up the business the U.S. Mint is expected to lose.

As with any change, the U.S. Mint will not make everyone happy. Some may point out the previous failures in their online ordering process while others might even say that telephone ordering should also be reduced without realizing that the U.S. Mint’s customer service representatives use a similar version of the website to place an order.

For those who use smartphones, the U.S. Mint does have an app that can be used to place orders. I have used the app (and should write a review) but it might be better to ignore the app and directly use the website.

2011 American Silver Eagle 25th Anniversary Set

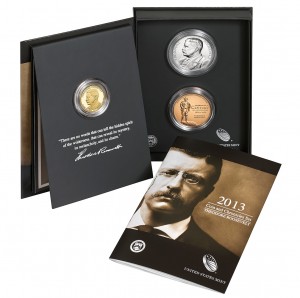

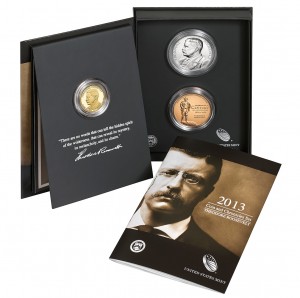

2013 Theodore Roosevelt Coin and Chronicles Set

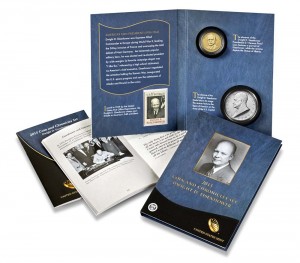

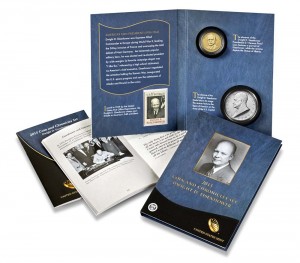

2015 Dwight D. Eisenhower Coin & Chronicles Set

Nov 13, 2015 | coins, commentary, counterfeit, news

The counterfeit quarter-ounce Krugerrand in a counterfeit NGC holder that was purchased in Fullerton, California.

The biggest threat to the numismatics industry is not the lack of participation by younger people, women, or people of color, all of which are problems, the threat that counterfeits pose will drive away potential collector and investors. Anyone that collects scarce or rare coins should be very concerned about counterfeits.

Industry heavyweight Dwight Manley issued a statement after his company was fooled by a counterfeit Krugerrand in a counterfeit third-party grading service holder. Here is the statement:

Beware of Frighteningly Deceptive Counterfeits

Statement By Dwight Manley

Prominent rare coin dealer and collector Dwight Manley, owner of Fullerton Coins & Stamps in Fullerton, California and Managing Partner of the California Gold Marketing Group, who assisted a quarter-century ago in breaking up a counterfeit coin and counterfeit holder scheme, has issued the following statement.

“A frighteningly deceptive counterfeit has been encountered, and the world needs to be told about it. We recently realized that a 2005-dated quarter-ounce South African Krugerrand labeled NGC Proof 70 is not only a counterfeit coin, it is housed in a counterfeit Numismatic Guaranty Corporation holder that has the same certification number on the label as a genuine 2005 PF 70 one-quarter ounce Krugerrand listed in the NGC data base.”

“The fake was purchased on October 23, 2015 by a knowledgeable employee of Fullerton Coins & Stamps over the counter from a semi-regular customer. Before making the purchase, the employee checked the NGC website to see if the certification number and coin description matched. They did: cert number 3676849-006.”

“I recently examined the coin, and it just didn’t look quite right. I did a side-by-side, inch-by-inch comparison between the encapsulated coin the store purchased and the obverse and reverse photos on the NGC website. The reproduction of the NGC hologram on the fake is almost dead on the same; however, there is one distinct difference between fake and genuine on the left side of the front insert label. On the fake coin, the circle in the NGC logo (an encircled balance scale) goes almost entirely around the P in the grade PF 70. On the genuine coin’s label, the P is outside the logo circle.”

“An amazing amount of effort obviously went into creating a fake coin and a fake holder with a cert number and description that match a genuine coin. I’ve notified NGC, but in the meantime, I caution collectors and dealers to watch out for any similar, deceitful and dangerous counterfeits.”

Oct 29, 2015 | administrative, coins, fun, news, personal

Sometime in 2005 I began to search the Internet for information about coins. The two major publications, Coin World and Numismatic News, were not quite fully engaged online at that time. There were other online services but there was not something that would be the voice of a collector. Chat boards are nice but they are fractured. I wanted to have a conversation with the community.

Sometime in 2005 I began to search the Internet for information about coins. The two major publications, Coin World and Numismatic News, were not quite fully engaged online at that time. There were other online services but there was not something that would be the voice of a collector. Chat boards are nice but they are fractured. I wanted to have a conversation with the community.

Although I have a technical background, I did not know how to create and run a blog. After doing some research I discovered Blogger, Google’s blogging platform. After playing with the administration and learning how to create a blog post, I wrote my first post on October 29, 2005.

In my first post, I said that the coins I like include “Adolph A. Weinman’s Walking Liberty Half-Dollar and Liberty Head “Mercury” Dime, James Earl Fraser’s Buffalo Nickel, Augustus Saint-Gaudens’ $20 Double Eagle, and Bela Lyon Pratt $5 Half-Eagle.” Not much has changed except for my interest in exonumia, especially those pieces with ties to New York City, and the addition of Canadian coins to my collection

The blog has changed, or I would like to think it has evolved over the years. The biggest change was moving away from Blogger to my own domain. As part of the move I decided to create a logo using the allegedly non-existent 1964-D Peace Dollar, and I now participate social media specifically Twitter and Pinterest. What has not changed is the amazed and humbling experience I feel when I look at the server logs to see that more than 1,000 people read my posts—even with the recent slowdown in writing.

To all my readers, past, present and future, THANK YOU for being part of my numismatic adventure!

Stay tune… more to come!

Oct 22, 2015 | coins, markets, news, values

Earlier this year, Shane Downing, editor and publisher of the Coin Dealer Newsletter, better known and “The Greysheet” died of colon cancer on Jun 18, 2015. Shane became publisher following the death of his father, Ron Downing, in 1997.

Earlier this year, Shane Downing, editor and publisher of the Coin Dealer Newsletter, better known and “The Greysheet” died of colon cancer on Jun 18, 2015. Shane became publisher following the death of his father, Ron Downing, in 1997.

The Downings have been running The Greysheet since 1884 when Ron and Shane’s grandmother Pauline Miladin purchase the publication from its original owners.

The Downings expanded the publication to include quarterly supplements, The Currency Dealer Newsletter (Greensheet) for currency, Certified Coin Dealer Newsletter (Bluesheet) for certified coins, and special monthly supplements highlighting specific coins. In recent years, CDN has been available online as a PDF file in a program they call CDNi.

Early last month it was announced that an ownership group led by John Fiegenbaum, formerly president of David Lawrence Rare Coins (DLRC), has purchased CDN Publishing. The ownership group includes Steve Halprin and Steve Ivy, co-founders of Heritage Auctions; Mark Salzberg, Chairman of Numismatic Guaranty Corporation; Steve Eichenbaum, CEO of the Certified Collectibles Group, the parent company of NGC. Fiegenbaum has retired from DLRC to dedicate his time to running CDN with the assurance that CDN will remain an independent entity. The other owners will remain in their current positions.

John Feigenbaum receives 2014 Abe Kosoff Founder’s Award from the Professional Numismatic Guild

CDN will be moving from California to the east coast. Although the press release does not specify the location, it is likely that CDN will be located in Virginia Beach, Virginia where Fiegenbaum has been running DLRC for over 30 years.

One of the benefits of Fiegenbaum running CDN would be to improve online access to their publications. Under Fiegenbaum, DLRC has moved from mail and phone bid auctions to a successful online auction system. Their auction website is very user friendly and getting better as they receive feedback from users. DLRC’s website rivals that of Heritage Auctions, led by Halprin and Ivy, for ease of use and accessibility to the auction items. This is a powerful backing for better electronic access.

Using the resources of NGC and Heritage Auctions, CDN could produce an online almanac of coinage including history and prices that would rival anything currently available. Making it accessible to collectors and dealers on both a free and paid basis could keep CDN viable for many years to come. Such a service could even surpass the every-ten-year effort by CoinWorld and the multi-volume effort by Whitman Publishing.

While running DLRC, Feigenbaum has shown how embracing the Internet could benefit his company and the collecting community. If he can embrace electronic publishing by bringing existing resources to the Internet and look for expansion with specialty collectors, CDN could become the go-to resource for people interested in learning all about their collections by making it more accessible to the emerging market of Gen X’ers and Millennials. That would benefit the numismatic community more than phonebook sized volumes of dead trees or glossy pages with pretty red covers.

Image of The Greysheet cover courtesy of CDN Publications.

Image of John Feigenbaum courtesy of David Lawrence Rare Coins.

Aug 5, 2015 | coins, commemorative, gold, legislative, news, platinum, policy, US Mint

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

During the period from about 20 days prior to the height of Sirius to 20 days following, Canis Major would only appear with the sunrise and sunset. Because ancient Romans thought Sirius contributed to the heat and humidity, this period would be called the Dog Days.

Today’s society has attached many meanings to the Dog Days of Summer. In baseball, it is the jockeying for position to get ready for the pennant races. Football begins training camps, politicians warm up to run for office (sometimes a year early), and the temperatures are rising with the east getting too wet and the west not getting wet enough.

These contrasts illustrate a congress that sometimes looks like they are really trying to do something and then really trying to put the “fun” in dysfunctional!

In July, it looks like congress really tried to do some work. Here are the coin-related legislative actions from our from our representatives on Capitol Hill:

It’s the law!

H.R. 893: Boys Town Centennial Commemorative Coin Act

Sponsor: Rep. Jeff Fortenberry (R-NE)

• Introduced: February 11, 2015

• Signed by the President: July 6, 2015

• Public Law 114-30

• Summary:

- 2017 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 350,000 silver $1 coins with $10 surcharge

- 300,000 clad half-dollars with $5 surcharge

- Surcharge paid to Boys Town

Read the details of this law at https://www.govtrack.us/congress/bills/114/hr893

Passed the House

H.R. 2722: Breast Cancer Awareness Commemorative Coin Act

Sponsor: Rep. Carolyn Maloney (D-NY)

• Introduced: June 10, 2015

• Passed the House: July 15, 2015

• Received by the Senate: July 16, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

• Summary:

- 2018 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 400,000 silver $1 coins with $10 surcharge

- 750,000 clad half-dollars with $5 surcharge

- Surcharge paid to Breast Cancer Research Foundation for the purpose of furthering breast cancer research

Track this bill at https://www.govtrack.us/congress/bills/114/hr2722

Commemorative Coin Legislation Introduced

H.R. 2980: Mayflower Commemorative Coin Act

Sponsor: Rep. Bill Foster (D-IL)

• Introduced: July 8, 2015

• Referred to the House Committee on Financial Services

• Summary:

- 2020 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 100,000 silver $1 coins with $10 surcharge

- Surcharge paid to General Society of Mayflower Descendants for educational purposes.

Track this bill at https://www.govtrack.us/congress/bills/114/hr2980

S. 1715: Mayflower Commemorative Coin Act

Sponsor: Sen. John Hoeven (R-ND)

• Introduced: July 8, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

• Summary: see H.R. 2980, above

Track this bill at https://www.govtrack.us/congress/bills/114/s1715

H.R. 2978: Thirteenth Amendment Commemorative Coin Act

Sponsor: Rep. Danny Davis (D-IL)

• Introduced: Jul 8, 2015

• Referred to the House Committee on Financial Services

• Summary:

- 2015 Commemorative program

- 250,000 $50 bi-metallic (gold & platinum) with $10 surcharge

- 250,000 $20 gold coins with $10 surcharge

- 500,000 silver $1 coins with $10 surcharge

- Surcharge paid to Smithsonian National Museum of African American History and Culture.

Track this bill at https://www.govtrack.us/congress/bills/114/hr2978

Other coin-related legislation

H.R. 3097: Commemorative Coins Reform Act of 2015

Sponsor: Rep. Justin Amash (R-MI)

• Introduced: Jul 16, 2015

• Referred to the House Committee on Financial Services

• Summary: If passed, this bill will prohibit payment of surcharges from commemorative coins to organizations outside of the federal government.

Track this bill at https://www.govtrack.us/congress/bills/114/hr3097

H.R. 3300: To reduce waste and implement cost savings and revenue enhancement for the Federal Government.

Sponsor: Rep. Robert Pittenger (R-NC)

• Introduced: Jul 29, 2015

• Referred to many committees including the House Committee on Financial Services

Track this bill at https://www.govtrack.us/congress/bills/114/hr3300

Jul 11, 2015 | news, policy, US Mint

Rhett Jeppson

In January, Treasurer of the United States Rosie Rios Principal Deputy Director announce the appointment of Jeppson as the Principal Deputy Director. In that role, Jeppson is responsible for the day-to-day operation of the bureau.

This is President Obama’s second attempt at nominating a director for the U.S. Mint. In September 2012, Obama tried to nominate Bibiana Boerio to the position. The former Chief Financial Officer of Ford Motor Credit and Managing Director of Jaguar Cars Ltd, then a subsidiary of Ford, did not receive consideration from the Senate before the 112th congress adjourned for the last time.

The U.S. Mint has not had a permanent director in 54 months, since Edmund Moy resigned in January 2011. Since Moy’s departure, Deputy Director Richard Peterson has been capably running the world’s largest coin manufacturing agency. Peterson returned to the position of Deputy Director for Manufacturing and Quality on Jeppson’s appointment.

Since the Director of the U.S. Mint is an appointed position, the U.S. Senate has the power of “Advice and Consent” on the nominations to head departments. Until this do-less-than-nothing congress gets around to doing their job, Jeppson will continue to manage the U.S. Mint as a federal executive employee but without the Director’s title.

Jeppson’s biography in the President’s announcement was as follows:

Matthew Rhett Jeppson, Nominee for Director of the Mint, Department of the Treasury

Matthew Rhett Jeppson is the Principal Deputy Director of the Mint, a position he has held since January 2015. Mr. Jeppson was Associate Administrator in the Office of Veterans Business Development at the Small Business Administration (SBA) from 2012 to 2015 and also served as the Acting Chief Operating Officer of SBA from 2014 to 2015. From 2010 to 2012, he was Lead Crisis Response Planner at U.S. European Command. Mr. Jeppson served as Deputy Director of Operations for U.S. Forces Afghanistan from 2009 to 2010. From 2004 to 2008, he was Chief of Joint National Training Capability and European Engagements Lead at the United States Special Operations Command and served as Counter-Terrorism Planner and Chief of Current Operations for Marine Forces Europe from 2001 to 2003. Mr. Jeppson was Director of State Purchasing and Special Assistant to the Secretary at the Department of Business and Professional Regulation of the State of Florida from 1999 to 2003, and he served as Operations and Exercise Officer at Special Operations Command Central from 1995 to 1999. He was Vice President of E. Mark Jeppson, Inc. from 1992 to 1994. He also served as Principal Battalion Staff Officer, 81mm Mortar Platoon Commander, Rifle Company Executive Officer, and Rifle Platoon Commander in the 1st Marine Division from 1989 to 1991. Mr. Jeppson received a B.A. from the University of Florida.

Jeppson image courtesy of the U.S. Mint.

Jul 8, 2015 | coins, currency, economy, foreign, news

Greece 1€ coin depicts an owl, copied from an ancient Athenian 4 drachma coin (ca. 5th century BCE)

Collecting numismatic items from distressed times can present an interesting challenge. While we have heard about Hard Times Tokens being a popular collectible, sales tax tokens produced during the Great Depression so that people could pay the exact fractions of a tax on low-value purchases.

Two of the more recent examples of numismatics based on distressed economic conditions are the Zimbabwe hyperinflation currency and the State of California’s Registered Warrants (IOUs). Although both have different origins from the Greek crisis, both show different ways of handling the situation.

When a country controls its own currency, it can manage that currency to maintain its value. In the United States, that is done by the Federal Reserve. It uses many programs from buying debt from its member banks to setting what it calls the Discount Rate, the rate that its member banks can borrow overnight to meet its liquidity requirements. In Zimbabwe, the central bank did not have the business and circulation in order to make this type of policy work because of the strife caused by wars and other ugliness. Their only choice was the print more money. The more money printed, the less it is worth. The less the money is worth the more it takes to buy daily goods and services. This result is that the more money that is added to the economy the higher inflation goes.

Zimbabwe’s 2009 $100 trillion hyperinflation note

California was a different story. It was a self-made crisis of politics in 2009 between the Republican Governor Arnold Schwarzenegger and the Democratic-controlled legislature. Since neither side could agree on a budget, Schwarzenegger declared a fiscal emergency and ordered the printing of IOUs to pay for state debts.

California Registered Warrant

A friend who was living in California at the time was issued an IOU for a small personal tax refund. Rather than be burdened with the rigors of cashing the warrant, the paper is now part of his collection. However, since the warrants were addressed to specific people, it is not likely that these items will be immediately collectible. Many years from now it is probable that these warrants will be a curious collectible like the old Series E or War Bonds.

Greece does not control its own currency nor does it have any potential backing to issue warrants. Since Greece has not been seen as creditworthy, it cannot issue bonds at any interest rate because the markets are not interesting in buying Greek debt. Unless a deal can be struck with the rest of the European Union, Greece may not have a choice but exit the pact that uses the Euro as the common currency.

Exiting the Euro will bring back the Greek drachma.

2000 Greece 20 Drachma coin features Dionysios Solomos, a poet and author of the Greek national anthem.

Before you search your ten pound bag of foreign coins looking for pre-Euro drachma, it is likely that Greece will keep those coins demonetized and not recognize them as official currency. If Greece wants to be able to control the amount of currency in circulation, then they will have to issue new coins and notes.

If Greece goes this route, experts are saying that the Greek government will allow the Euro to circulate alongside whatever is added to the market. Some people think it may take over a year to strike enough coins and print enough notes to be able to remove the Euro from circulation.

What will Greece do in the interim? Does the Greece Central Bank issue warrants like California did? If so, will the warrants become something that would become a collectible?

10,000 drachma note issued by the Bank of Greece in 1995 features the image of Dr. George Papanicolaou, inventor of the Pap smear

Image Credits

- Greek 1€ coin courtesy of EuroCoins.co.uk.

- California Warrant courtesy of MyMoneyBlog.com

- Zimbabwe $100 trillion note courtesy of Wikimedia Commons.

- 20 drachma coin courtesy of Numista.

- 10,000 drachma note courtesy of the Bank of Greece.

In our short saga of How the Congress Turns (our stomachs), we are going to look at the next and last provision of how the “Fixing America’s Surface Transportation Act” or the “FAST Act” (H.R. 22) will impact collectors. Returning to Title LXXIII, Section 73001 we find:

In our short saga of How the Congress Turns (our stomachs), we are going to look at the next and last provision of how the “Fixing America’s Surface Transportation Act” or the “FAST Act” (H.R. 22) will impact collectors. Returning to Title LXXIII, Section 73001 we find: The change in the law happens in two parts. Paragraph (B) makes the change for the balance of the America the Beautiful Quarters Program including the 5-ounce bullion coin. Section (2) changes the Administrative part of the code (31 U.S.C. § 5132(a)(2)(B)(i)) that covers all other coins. A problem with the way these corrections were written it does not affect commemorative coin programs unless the U.S. Mint’s general counsel feels that this law covers all coins. While the U.S. Mint is likely to interpret the law the way that benefits them, the wording does not cover commemoratives.

The change in the law happens in two parts. Paragraph (B) makes the change for the balance of the America the Beautiful Quarters Program including the 5-ounce bullion coin. Section (2) changes the Administrative part of the code (31 U.S.C. § 5132(a)(2)(B)(i)) that covers all other coins. A problem with the way these corrections were written it does not affect commemorative coin programs unless the U.S. Mint’s general counsel feels that this law covers all coins. While the U.S. Mint is likely to interpret the law the way that benefits them, the wording does not cover commemoratives.

Sometime in 2005 I began to search the Internet for information about coins. The two major publications,

Sometime in 2005 I began to search the Internet for information about coins. The two major publications,  Earlier this year,

Earlier this year,

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).