Weekly World Numismatic News for August 7, 2022

When my wife and I left today, we came home with a new family member. We welcomed Abe to our family four months after Tessa crossed the Rainbow Bridge.

When my wife and I left today, we came home with a new family member. We welcomed Abe to our family four months after Tessa crossed the Rainbow Bridge.

Rescuers found Abe Pugoda as a stray. The rescue organization said he was well behaved with many of the typical medical problems strays experience, and it appears that someone might have abandoned him.

One look at that face made it difficult to understand why someone would abandon Abe. He has a good disposition, moderate energy, and a sniffer that doesn’t stop. Abe is a Puggle, half pug, and half beagle. Doctors that examined him believe that he is 10 years old.

Abe has had an eventful first day in his new home. We know it will take time for us to become accustomed to each other. For us, we have another four-legged baby in the house and looking forward to having fun over the next few years together.

And now the news…

→ Read more at cbsnews.com

→ Read more at cbsnews.com

→ Read more at california18.com

→ Read more at california18.com

→ Read more at natureworldnews.com

→ Read more at natureworldnews.com

→ Read more at art-insider.com

→ Read more at art-insider.com

→ Read more at bbc.com

→ Read more at bbc.com

Two 2024 Commemorative Bills Pass the House

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

As part of the congressional charade of staying in session to prevent the appearance of adjournment, the House of Representatives cycled through some non-controversial legislation that included two that would authorize two 2024 commemorative coin programs.

National World War II Memorial Commemorative Coin Act (H.R. 1057) was introduced last year by Rep. Marcy Kaptur (D-OH) to create a 2024 commemorative coin to raise money to care for the memorial.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the Friends of the National World War II Memorial will receive $9.5 million for maintenance and educational purposes.

H.R. 1057: National World War II Memorial Commemorative Coin Act

Harriet Tubman Bicentennial Commemorative Coin Act (H.R. 1842) was introduced last year by Rep. Gregory Meeks (D-NY) to create a 2024 commemorative coin to raise money to support museums remembering the legacy of Harriet Tubman.

The National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 50,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars. The bill sets surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar.

If the program sells out, the National Underground Railroad Freedom Center in Cincinnati, Ohio, and The Harriet Tubman Home, Inc. in Auburn, New York, will receive $9.5 million ($4.625 million each) for maintenance and educational purposes.

H.R. 1842: Harriet Tubman Bicentennial Commemorative Coin Act

Newly Proposed Hotshot Commemorative Legislation

Last month, Rep. Paul Gosar (R-AZ) introduced a bill (H.R. 8244) to create a 2023 commemorative coin program to honor the Granite Mountain Hotshots.

Last month, Rep. Paul Gosar (R-AZ) introduced a bill (H.R. 8244) to create a 2023 commemorative coin program to honor the Granite Mountain Hotshots.

“Hotshots” are elite firefighters that specialize in the containment of wildfires. On June 28, 2013, lighting ignited the Yarnell Hill Fire on a ridge west of Yarnell, Arizona, and the fire spread rapidly. Firefighters from the Granite Mountain Interagency Hotshot Crew were deployed to assist with the containment of the fire. On June 30, 2013, 19 members of the Granite Mountain Hotshots died while attempting to contain the fire. Only one survived.

If passed, the commemorative set will include a $5 gold coin, silver dollar, and clad half-dollar. The bill sets mintage limits are 100,000 gold coins, 400,000 silver dollars, and 750,000 clad half-dollars.

The bill sets the surcharges at $35 for each of the $5 gold coins sold, $10 for each silver dollar, and $5 for each clad half-dollar. Proceeds will be paid to the Yarnell Fire District to help with wildfire prevention and wildfire education.

If the program sells out, the Yarnell Fire District will receive $11.25 million from the sale of the commemoratives.

H.R. 8244: Granite Mountain Hotshots Commemorative Coin Act

Weekly World Numismatic News for July 24, 2022

In the run-up to the World’s Fair of Money, several releases have announced the display of rarities and different collectibles relating to numismatics that will make an appearance. The announcement that excited me was the Brian Hendelson Collection of Presidential Appointment Documents.

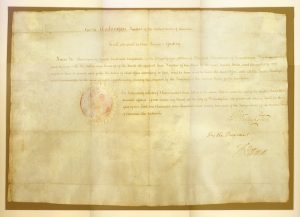

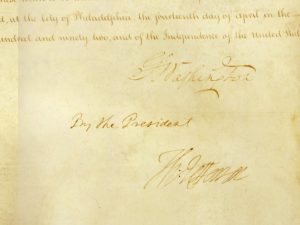

- Signed by George Washington as President and Thomas Jefferson as Secretary of State, this 1792 document appointed David Rittenhouse as the first Director of the United States Mint. (Photo courtesy of Brian Hendelson.)

One of the appeals of numismatics is the history coins and documents represent. The documents range from the document of George Washington’s appointing David Rittenhouse as the first Mint Director to President U.S. Grant’s appointment of Chauncy Noteware as Carson City Mint Director.

Historical documents can be as important as the coins because they represent the journey that led to the issuing of the coin. Although collectors would like to collect the 1907 Saint-Gaudens Double Eagle, I find the letters between Augustus Saint-Gaudens and Theodore Roosevelt more fascinating.

Most people will not geek out over historical documents, but I would love to see more original documents relating to numismatics. It would be an exhibition I would find fascinating and keep me off the bourse floor.

And now the news…

→ Read more at european-views.com

→ Read more at european-views.com

→ Read more at atlasobscura.com

→ Read more at atlasobscura.com

→ Read more at smithsonianmag.com

→ Read more at smithsonianmag.com

ANA Crowdfunds Its Technology Future

Earlier this month, the ANA emailed members to join the “Crowdfunding Drive to Improve Our Online Technology.” The email admitted the “pandemic taught us a lot about the importance of online learning and communication.” Thus, money is needed to “make much-needed website improvements to allow the ANA to take advantage of current technologies, resulting in a better online experience for ANA members and the collecting community.”

Earlier this month, the ANA emailed members to join the “Crowdfunding Drive to Improve Our Online Technology.” The email admitted the “pandemic taught us a lot about the importance of online learning and communication.” Thus, money is needed to “make much-needed website improvements to allow the ANA to take advantage of current technologies, resulting in a better online experience for ANA members and the collecting community.”

The email says that an anonymous donor will match all gifts.

I also thank the anonymous donor. I raise my coffee cup to you, and that’s a high honor from a coffee addict!

The ANA should not be in this situation. While there were failures before the pandemic put the ANA on the path to this failure, President Steve Ellsworth cemented the ANA’s fate because his bravado and ego got in the way of effectively running this organization.

Ellsworth dismissed the Technology Committee Chairperson in October 2019, and he did not replace the chair before the pandemic precautions caused the world to shut down. Ellsworth assigned Ron Oberth to work on ANA technology, who had no background in technology, and came up with unimaginative solutions and put the ANA behind other organizations who learned from the pandemic.

Although Ellsworth is out of office, he continues to be an ex-officio member of the Board of Governors. President Ron Ross has not demonstrated an understanding of the issue. Sources say that the loudest voice in the room is influencing Ross and that loudest voice belongs to Governor Ron Oberth. Oberth runs a successful numismatic company, but he does not know or understand technology, nor is he experienced in education that should guide the technology.

Ross and Oberth have not asked the ANA community to help. While they have listened to the ANA Headquarters staff, they have not listened to any other advisors with the experience necessary to lead the ANA into the future.

In other words, Ross and Oberth turned the Board of Governors into an insular club, and the rest of the membership was not welcome.

Both will deny their responsibility for the failures and ignore calls for their resignation. What you can do as a member is donate to the fund and add a note that the donation is conditional on the ANA assigning an independent committee to oversee the future of the technology policy. It was the model used by Presidents Walt Ostromecki, Jeff Garrett, and Gary Adkins to modernize the ANA technology infrastructure, and it should be the model in the future.

Weekly World Numismatic News for July 17, 2022

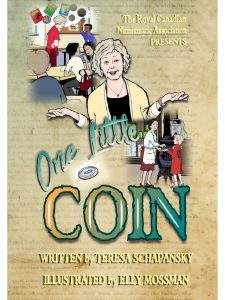

As the times change, traditional hobbies have to find new ways to reach a new audience. The Royal Canadian Numismatic Association (RCNA) tried something different and published a new children’s book.

As the times change, traditional hobbies have to find new ways to reach a new audience. The Royal Canadian Numismatic Association (RCNA) tried something different and published a new children’s book.

The RCNA teamed up with best-selling Canadian author Teresa Schapansky and award-winning artist Elly Mossman to produce a children’s book, One Little Coin. The book is about a child’s adventures in joining a coin club and what happens.

Here’s the publisher’s blurb:

The book includes “Miss Cassidy’s Guidebook,” a guide to coin collecting for young readers.

One Little Coin is written in English and in French as Une Petite Monnaie.

One Little Coin is written in English and in French as Une Petite Monnaie.

Book publishing is always a risk. A publisher once told me that less than 10-percent of the books they publish make a significant profit. The RCNA is taking a risk by publishing a children’s book in a society where parents opt for electronic entertainment.

I hope it works. If it does, I hope it inspires others to find new ways to reach collectors.

And now the news…

→ Read more at california18.com

→ Read more at california18.com

→ Read more at canadiancoinnews.com

→ Read more at canadiancoinnews.com

→ Read more at philstar.com

→ Read more at philstar.com

→ Read more at the-sun.com

→ Read more at the-sun.com