A while ago, I received the following question from a reader:

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

The American Silver Eagle Program was the result of the Reagan Administration wanting to sell the silver that was part of the Defense National Stockpile to balance the budget. Originally, the plan was to auction the bullion. After intense lobbying by the mining industry warning that such an auction would damage their industry, the concept was changed to selling the silver as coinage.

Changing the sales to coinage allowed for market diversification. Rather than a few people attempting to corner the market at an auction, selling coins on the open market allows more people to have access to the silver as an investment vehicle.

As codified in Title II of the Statue of Liberty-Ellis Island Commemorative Coin Act (Public Law 99-61, 99 Stat. 113), the “Liberty Coin Act” defines the program as we know it today including the phrase “The coins issued under this title shall be legal tender as provided in section 5103 of title 31, United States Code.”

As a legal tender item, the coin’s basic value has the backing of the full faith and credit of the United States government. Regardless of what happens in politics and world events, the coin will be worth at least its face value. Being minted by the U.S. Mint is a guarantee of quality that is recognized around the world making worth its weight in silver plus a numismatic premium.

Coins are perceived by the market as being more desirable than medals. Medals have no monetary value except as an art object. When it comes to investments, they do not hold a value similar to that of a legal tender coin. This is because medals are not guaranteed by the United States government, a key factor in determining its aftermarket value.

Once the coin has been sold by the U.S. Mint, its value is determined by various market forces. For more on how coins are priced, see my two-part explanation: Part I and Part II.

Why do American Silver Eagles have a One Dollar face value? Because the law (31 U.S.C. Sect. 5112(e)(4)) sets this as a requirement.

Why are the coins worth more than their face value? Because the law (31 U.S.C. Sect. 5112(f)(1)) says that “The Secretary shall sell the coins minted under subsection (e) to the public at a price equal to the market value of the bullion at the time of sale, plus the cost of minting, marketing, and distributing such coins (including labor, materials, dies, use of machinery, and promotional and overhead expenses).”

Can you spend the American Silver Eagle as any other legal tender coin? In the United States, you can use any legal tender coin in commerce at its face value. This means that if you can find someone to accept an American Silver Eagle, it is worth one dollar in commerce. However, it would be foolish to trade one-ounce of silver for one dollar of goods and services.

Commemorative Coins

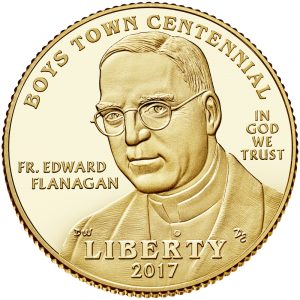

Commemorative programs are different in that the authorizing laws add a surcharge to the price of the coin to raise money for some organization. Using the 2017 Boys Town Centennial Commemorative Coin Program (Public Law 114-30) as an example, Rep. Jeff Fortenberry (R-NE) introduced a bill (H.R. 893 in the 114th Congress) to celebrate the centennial anniversary of Boys Town. As with all other commemorative bills, the bill specified the number, type, composition, and denomination of each coin.

For example, the law says that the U.S. Mint will issue no more than 50,000 $5 gold coins that weighs 8.359 grams, have a diameter of 0.850 inches, and contains 90-percent gold. The law also has design requirements including being “emblematic of the 100 years of Boys Town.” The sale price of the coin will have “a price equal to the sum of” “the face value of the coins; and, the cost of designing and issuing the coins (including labor, materials, dies, use of machinery, overhead expenses, marketing, and shipping).”As with other commemorative, the coins will include a surcharge. Each gold coin will include a $35 surcharge, $10 for a silver dollar, and $5 for each clad half-dollar coin. When the program is over, the surcharges “shall be paid to Boys Town to carry out Boys Town’s cause of caring for and assisting children and families in underserved communities across America.”

The 2017 Boys Town Centennial Uncirculated $5 Gold Commemorative Coin is selling for $400.45 and the proof coin is selling for $405.45 suggesting that the process of producing a proof coin costs the U.S. Mint $5 more than the uncirculated coin.

What goes into the price of the coin? After the face value of $5, there is a $35 surcharge added that will be paid to Boys Town, there is the cost of the metals used. Here is a workup of the cost of the gold planchet using current melt values:

| Metal | Percentage | Weight (g) | Metals Base Rate | Price (g) | Metal Value |

|---|---|---|---|---|---|

| Gold | 90% | 7.523 | 1259.00/toz | 40.48 | $ 304.52 |

| Silver | 6% | 5.015 | 16.57/toz | 0.53 | 0.27 |

| Copper | 4% | 3.344 | 2.83/pound | 0.006 | 0.00 |

| Total metal value | $ 304.79 | ||||

Even though the melt value of the coin is $304.79, there is a service charge the U.S. Mint has to pay the company that creates the planchets. Thus, before the labor, dies, use of machinery, overhead expenses, and marketing is calculated into the price, the coin will cost $344.79 even though the legal tender face value of the coin is $5.

Taking it a step further, the average profit the U.S. Mint makes from gold commemorative coins is 8-percent (based on the 2015 Annual Report). If they are charging $400.45 for the uncirculated gold coin, the coin costs $368.41 to manufacture, $373.41 for the proof version.

Why collect these coins?

Why not?!

American Silver Eagle bullion coins were created for the investment market even though the authorizing law saw the benefit of allowing the U.S. Mint to sell a collector version. All of the Eagle coins are sold for investment or because people want to collect them for their own reasons. Some collect the collector version as an investment.

Commemorative coins are collected for their design or the buyer’s affinity for the subject and to support the cause which is being sponsored by the sale of the coin. Some collect commemorative coins like others collect series of coins.

Even though modern commemorative coins are sold for more than their face value, that does not mean they are not worth collecting. After all, can you buy a Morgan Dollar, Peace Dollar, Walking Liberty Half-Dollar, or a Buffalo Nickel for its face value?

Collecting bullion, commemorative, and other non-circulating legal tender (NCLT) coins is a matter of choice. If you choose to collect these coins, know that they will be worth more than their face value. And while they are legal tender coins, they are not meant for circulation. They are collectibles.

If you like these collectibles, enjoy your collection. Along with coins produced for circulation, I own American Silver Eagle coins, commemoratives, and other NCLT because I like them.

Some of the NCLT coins in my collection

- 2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

- 2015 March of Dimes Commemorative Proof set

- 2014 National Baseball Hall of Fame commemorative proof dollar graded by PCGS PR70

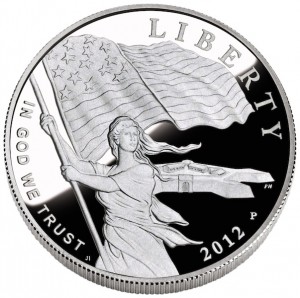

- 2012 Star-Spangled Banner Silver Commemorative Obverse depicts Lady Liberty waving the 15-star, 15-stripe Star-Spangled Banner flag with Fort McHenry in the background. Designed by Joel Iskowitz and engraved by Phebe Hemphill.

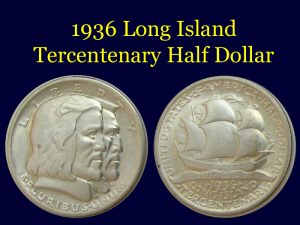

- 1936 Long Island Tercentenary Half Dollar

- Reverse of the 2016 Chinese Silver Panda coin

- 2006 Canada silver $5 Breast Cancer Commemorative Coin

- 2007 Somalia Motorcycle Coins

- 2010 Somalia Sports Cars