Mar 19, 2016 | cash, fun, news

Monopoly Ultimate Banking, a cashless version of the famous board game.

At the 2016 New York Toy Fair, Hasbro announced that it will release an “update” the famedMonopoly game creating the Monopoly Ultimate Banking Game where the cash has been eliminated for electronic bank cards. The bank is now a hand-held unit that will scan the bank cards to make transactions.

As part of the game, the bank card is used to pay rent, taxes from the cards, and buy property. The new property cards will now have bar codes for the players to scan in order to make the purchase or mortgage their property.

This version of Monopoly will still have Chance cards. Previews suggest that the Community Chest cards have been eliminated. Chance cards will now allow for market crashes, fluctuations in rent, and other “real life” scenarios faced in the modern age.

Hasbro does have an Electronic Banking edition that uses a similar hand-held device. A Hasbro representative said that the Electronic Banking edition is the traditional Monopoly game using the bank card technology. It does not have the ability to scan property cards for transactions and requires more manual input than will be allowed for the Ultimate Banking Game.

Recently, the advocates for a cashless society or one that uses a limited amount of physical currency have been on their virtual soapboxes trying to find every reason to eliminate cash. One story that appeared on the CNBC website reported about a San Francisco-area restauranteur who tried to accept only credit cards had to reverse the decision because of backlash from customers.

There are segments of our culture who do not trust banks. There are industries that work better when the transactions are made in cash. There are some of us who do not like the electronic trail non-cash transactions create. These are only some of the reason cash will continue to live on.

Hasbro said that the Monopoly Ultimate Banking Game will be released later this summer. My only question is will it support house rules like double payment for landing on Go or having the taxes paid to the Free Parking pool for the next player that lands there?

Feb 25, 2016 | cash, currency, dollar, errors, news, policy

The latest attack on the money in your pocket is the talk about eliminating the highest denomination banknotes. This discussion was intensified in the political policy world with the article by Lawrence Summers that appeared in The Washington Post. Summers is a professor at Harvard and had once been the Secretary of the Treasury and Director of the White House’s National Economic Council.

Summers cites a paper by Peter Sands of Harvard and students that claims to make a compelling case to stop issuing high denomination notes and possibly withdraw them from circulation because of its use in crime and corruption.

Crime is mostly a cash-based enterprise. Criminals do not use gold, checks, or credit cards. As those of us who use cash over other payment types understand, cash is more anonymous. Cash transactions can be used to perform untraceable transaction that could be used to evade taxes. Criminals use cash to avoid law enforcement and terrorists use cash to fund their activities outside of the monitoring of financial transactions. In fact, Sands notes that these criminals have nicknamed the €500 note the “Bin Laden.”

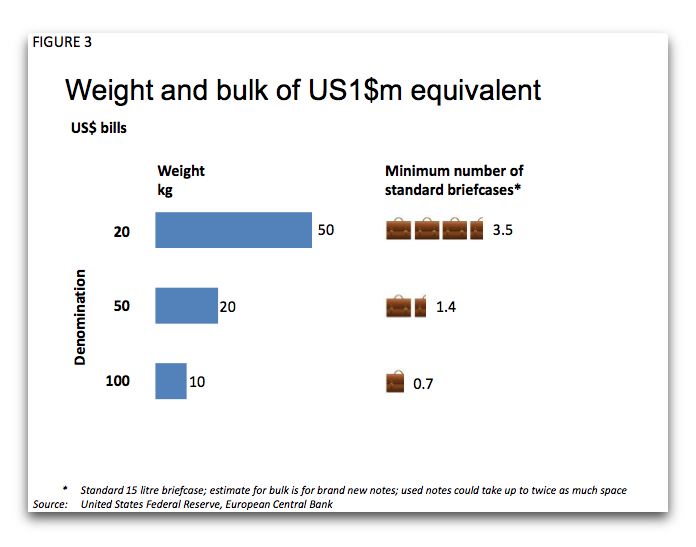

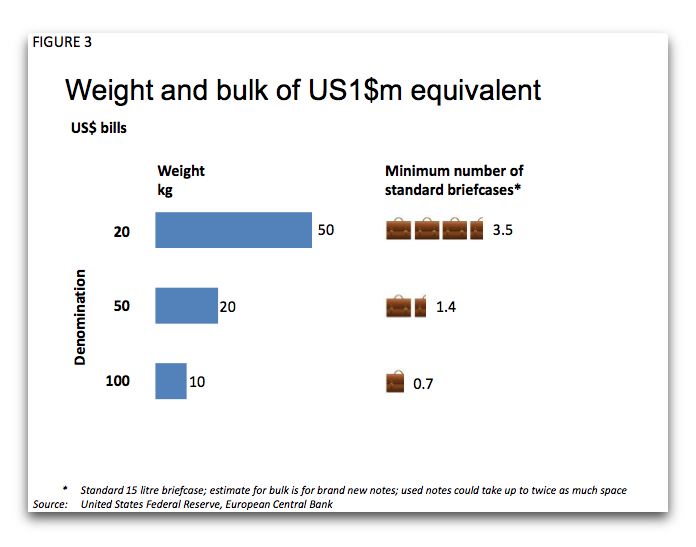

In order to carry out cash-based transactions is the ability to carry the cash. Sands’ paper and Summers’ article both say that lower denomination currency will make it difficult to carry large volumes of currency in order to make these transactions. Considering the weight of United States currency, carrying $1 million worth of $100 Federal Reserve Notes would weigh about 10 kilograms (22.0462 pounds). Using a 15 liters (just under 4 gallons) as the “standard” briefcase capacity, you could carry $1 million in 0.7 cases.

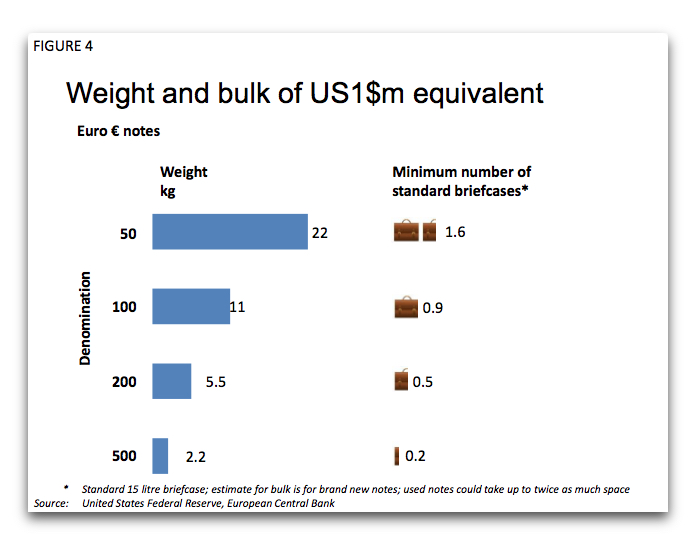

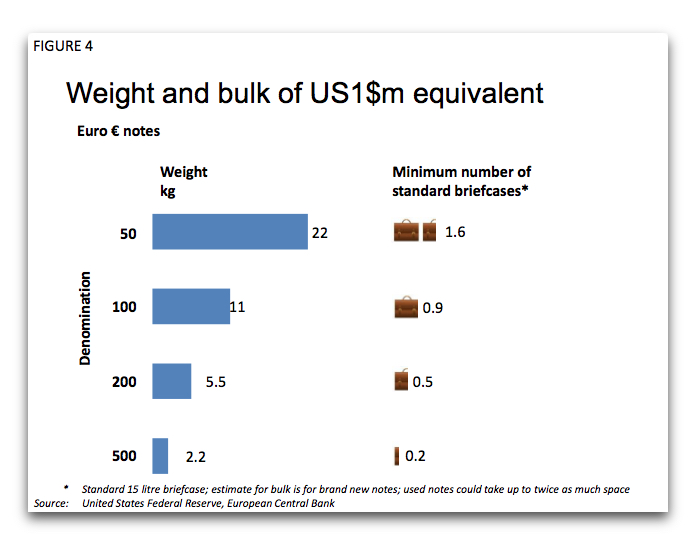

As a comparison, $1 million worth of $50 Federal Reserve Notes would require 1.4 briefcases and 3.5 briefcases when using $20 notes. If the $1 million was being paid using €500 notes, it would weigh 2.2 kilograms or about 4.85 pounds that takes up a quarter of a briefcase.

Comparison of the weight of the equivalent of $1 million using U.S. Federal Reserve Notes

Comparison of the weight of the equivalent of $1 million using euro currency

Sands says:

By eliminating high denomination, high value notes we would make life harder for those pursuing tax evasion, financial crime, terrorist finance and corruption. Without being able to use high denomination notes, those engaged in illicit activities – the “bad guys” of our title – would face higher costs and greater risks of detection. Eliminating high denomination notes would disrupt their “business models”.

Summers agrees with Sands and even suggests that the baseline currencies, specifically the dollar and the euro, should “stop issuing notes worth more than say $50 or $100.” Both consider demonetizing these high denomination notes a step in the right direction.

$207 Million in $100 notes seized as part of a drug raid in 2007

In the world of policy analysis there is the concept of the three-legged stool. The first leg is to identify the policy, which is what Sands’ paper does. Next would be to translate the policy idea into something that could be used as the basis for a law. The final step is something to drive the policy to be considered by the lawmakers in order to do something with the policy.

This is how the one cent coin went from being 95-percent copper to being copper-covered zinc. There was the idea to change the composition of the coin in order to save money. After the idea, there was the research and the law writing that went into changing the composition. As part of that second-leg exercise was the creation of the 1974 aluminum cent pattern. Finally, by 1982, the costs were so out of line that it became the driver that forced action.

Although the article and report has been well discussed as part of the financial press it is not likely to be acted on in the near future. It is only the first leg. It will take time before this stool gets its two other legs.

Images were copied from the report “Making it Harder for the Bad Guys: The Case for Eliminating High Denomination Notes,” by Peter Sands, et. al.

Jan 24, 2016 | BEP, cash, coins, currency, education, US Mint

Marriner S. Eccles Building where the Federal Reserve Board is located

The process begins when the Federal Reserve places their annual order with the U.S. Mint for coins and the Bureau of Engraving and Printing for currency. Like any organization that deals with inventory, the Federal Reserve will estimate its order based on a projection of demand.

Inventory management for the Federal Reserve requires them to know how much currency is in circulation, how much will be required based on world-wide economic factors, and what would be required to replace the current currency supply. Since the Federal Reserve ships U.S. currency world wide, especially the $100 Federal Reserve Notes, someone has to project what the world is going to demand based on economic factors that it has no participation in.

Life Expectancy of U.S. Currency

| Denomination of Bill |

Life Expectancy (Years) |

| $ 1 |

5.9 |

| $ 5 |

4.9 |

| $10 |

4.2 |

| $20 |

7.7 |

| $50 |

3.7 |

| $100 |

15 |

Not only does the Federal Reserve has to track the amount of money in circulation but they also have to account for the different denominations in order to replace torn and worn notes. For instance, it was once estimated that 90-percent of the order for $1 Federal Reserve Notes were delivered to replace worn notes in circulation.

Once the order is placed by the Federal Reserve, the U.S. Mint and the Bureau of Engraving and Printing work to fulfill that order. The U.S. Mint strikes the coins and has they placed in one-ton ballistic bags for delivery. The Bureau of Engraving and Printing bundles the currency in packs. Multiple packs make a brick. Bricks are then piled on pallets that are used for delivery.

From Philadelphia and Denver, the coin bags are loaded onto secured trucks and transferred to the Federal Reserve for distribution. A similar transfer happens at the Bureau of Engraving and Printing in Washington and Fort Worth where the pallets are shipped to the Federal Reserve.

Although there may be a few warehouses and other distribution processes involved, the coins and currency are shipped to one of 26 “cash rooms” around the country based on need. These cash rooms are special warehouses operated by the Federal Reserve branch that store the physical currency before being distributed to the member banks.

Federal Reserve Bank of New York

Before currency can enter circulation, a member bank places an order with the Federal Reserve. It is then delivered to them from the closest cash room with the appropriate inventory necessary to fulfill the order.

Your personal bank is like the corner store in the ordering system. When the shelves are bare or threatening to go bare, they order the inventory of currency they need. The corner bank just do not order money from the Federal Reserve. Banking companies work on behalf of their branches to manage inventory. The big bank may have their own cash management operations that help ensure that they not only have the appropriate amount of currency available but they do not have too much in storage. Like product inventories, idle money is not good for business.

Federal Reserve Bank of Richmond Baltimore Coin Storage

Federal Reserve Bank of Atlanta Cash Operations

Many banks hire logistics companies to help with the flow of their currency inventory. These companies are the ones driving the armored trucks you see around town that delivers currency on order. While these logistic companies are registered currency distribution services and have permits to pick up inventory from the Federal Reserve cash rooms on behalf of the member banks, they also provide storage and delivery services.

Although your corner bank has a vault, each banking company limits the amount of currency they keep on site because of security concerns. When they need additional currency or have an excess that needs to be stored, they call the logistics company to physically move the inventory.

Four of the largest cash logistics companies

Depending on how fast the currency is needed to circulate by your corner bank, existing currency can circulate through the logistics processing center long before the new inventory is placed into circulation.

During the recent downturn in the economy, the banks’ inventories of coins increased as people emptied jars, jugs, and bottles of coins for necessities. As the coins were returned to the bank the inventories rose beyond what they needed for circulation reducing the requirement for the banks to order more coins from the Federal Reserve. This is why it was not surprising that many people did not see current year coins until as early as April.

It is more difficult to gauge when currency reaches circulation unless there is a change in the series designation. The Series of a note is the date followed by a letter indicating that there is a change, usually to the autograph of the Treasurer or the Secretary of the Treasury. Although there is no rule, the Series date changes with an administration and the letter is added and changes as the autographs changes. Sometimes, the series date changes with the design of the currency. These are recent conventions and not the rule. All printing and design decisions are made by the Federal Reserve, Bureau of Engraving and Printing, and the U.S. Secret Service as a team.

If you want to know when the 2016 coins will reach circulation, the answer is “I don’t know.” Considering the economy is in better shape than in years past, money continues to circulate, and the U.S. Mint has produced more coins in a single year than any other in its history, if you have not seen a 2016 coin in your pocket change soon, then my best guess will be in mid-February—if the weather holds up!

Credits

- Eccles Building image courtesy of the Federal Reserve.

- Federal Reserve Bank of New York building courtesy of the Federal Reserve Bank of New York.

- Image of the Federal Reserve Bank Baltimore Coin Room courtesy of NPR.

- Image of the Atlanta Federal Reserve Bank Cash Operations courtesy of Glassdoor.com.

- Armored vehicle image courtesy of Prinéa.

Jan 10, 2016 | cash, coins, currency, Federal Reserve, policy

Could the call to end the 1p and 2p coins in the UK have an effect in the US?

Not necessarily the end of money but the end of physical currency.

With all the talk about ending the production of low value coins, whether it is the one-cent coin here in the United States, or the one or two pence coins in Great Britain, there seems to be movement to reduce the dependence of coinage.

Amongst the examples cited by those looking to make these changes are Canada, who ended the production of their one-cent coin in 2012, and Sweden, where physical currency makes up 3-percent of the economy.

Could the DC Metro’s Smartrip Card be the future of a cashless society?

But could a cashless society work in the United States?

A key measure of the power of an economy is the Gross Domestic Product, the total cost of goods and services produced by the economy. As of 2012, the most recent statistics available, Sweden’s GDP is $184.8 billion (converted to US dollar equivalent) versus $1.56 trillion for the United States—eight times the Swedish economy. Sweden’s economy ranks 28th and the U.S. 2nd only behind the combined European Union.

For the record, China’s 2012 GDP, third on the list, was $8.36 trillion, just over half of the U.S. GDP.

The United States makes more money, spends more money, trades more money, and has more economic impact than any other country in the world.

The first problem with trying to replicate what Sweden is doing is one of scale. The United States has the single largest economy in the world. While the European Union has a larger GDP, it is made up of cooperating countries with their own sovereign interests. While some might say that it is the same as the 50 states, the federal structure of a single republic versus several cooperating republics of Europe makes like the equivalent of swallowing the ocean in one gulp versus several gulps controlled by cooperating governments in Europe. Even when European governments do not cooperate, they can individually work better than what has been going on in the United States.

Another key indicator is the poverty rate. It is important to consider those in poverty because they usually do not have the resources to participate in the advanced structures of society. People living in poverty do not have access to credit regardless of where they live, even if they do have some access to the technologies that support cashless access. Although companies are giving away smartphones in many poverty stricken areas, those customers continue to have problems paying their bills. These are the people who rely on cash.

What may account for Sweden’s low use of cash is their low percentage of its citizens in poverty. With a poverty rate of 3.97-percent, this may account for the 3-percent average currency usage. Poverty in the United States is 5-times more than Sweden at 20.59-percent. While this in itself may not be a definitive indicator, it could explain why there is a vocal opposition of anti-poverty groups when discussion turn to eliminating the cent or a cashless society.

Those who preach a cashless society and point to Sweden also fails to consider one factor that only few countries have faces: the United States has probably one of the most diverse populations. Current politics notwithstanding, the United States has historically been more open to immigration than most other nations. Sweden, while a wonderful place, has a lesser and more homogenous population. Swedes are rightfully proud of themselves, their heritage, and history and has a culture more conducive to working together.

When was the last time that we saw the United States all together? Even after the attacks of September 11, 2001, there were segments of the population that has called it a hoax and said that the government bombed itself to press an agenda.

1853 Braided Hair Half Cent Obverse – The last lowest denomination coin eliminated by the congress.

In 2015, the U.S. Mint and Bureau of Engraving and Printing produced more coins and currency than ever. Both government agencies produce their main products because it was ordered by the Federal Reserve, the central banking organization of the United States. Even though paper currency may be exported, most coins are circulated in the United States for domestic use.

If there is any indication that the United States is moving to a cashless society, then why is currency production at its highest in history?

Interestingly, 2015 was the 50th Anniversary of clad, non-silver coinage except for the half-dollar that was produced with 40-percent silver until 1969. To this day there are people to decry the use of fiat money.

Regardless of what pundits say, the United States economy is more broad, diverse, and not as easy to control as in Sweden. If the United States ever gets to the point where it can support a cashless society, it might not be during the lifetime of anyone reading this today. These pundits do not see beyond their caramel macchiatos to understand the Real World.

Keep collecting this coins. Your great grandchildren may enjoy them but their grandchildren may find them interesting curiosities.

Dec 22, 2014 | BEP, cash, currency, Federal Reserve, video

Last week, the Bureau of Engraving and Printing announced that the Federal Reserve had ordered the printing of 7.2 million Federal Reserve Notes for Fiscal Year 2015. This represents over $188 billion in currency.

Last week, the Bureau of Engraving and Printing announced that the Federal Reserve had ordered the printing of 7.2 million Federal Reserve Notes for Fiscal Year 2015. This represents over $188 billion in currency.

According to the Federal Reserve, the number of notes they order depends on the predicted growth in demand and the predicted number of notes that have to be destroyed because they are not usable any more. Both growth and demand are predicted to include world-wide usage of the United States Federal Reserve Note as it is the standard currency for many transaction. In addition to the demand and destruction is the predicted replacement of the old $100 Federal Reserve Note with the new note that has more advanced currency features. While the Federal Reserve will not recall the old $100 notes, they are removing them from circulation as they arrive back into the Federal Reserve system.

The following table is how the Federal Reserve says they broke down their order for 2015:

| Denomination |

Number of Notes |

Dollar Value |

| $1 |

2,451,200,000 |

$2,451,200,000 |

| $2 |

32,000,000 |

$64,000,000 |

| $5 |

755,200,000 |

$3,776,000,000 |

| $10 |

627,200,000 |

$6,272,000,000 |

| $20 |

1,868,800,000 |

$37,376,000,000 |

| $50 |

220,800,000 |

$11,040,000,000 |

| $100 |

1,276,800,000 |

$127,680,000,000 |

| Total |

7,232,000,000 |

$188,659,200,000 |

Included with the order are the notes that the Bureau of Engraving and Printing will sell to collectors. These are the same notes that collectors can purchase online at moneyfactorystore.gov and when the Bureau of Engraving and Printing attends shows.

As part of the announcement, the Federal Reserve released a video explaining how they decide the amount of currency to order.

[videojs mp4=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.mp4″ ogg=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.ogg” poster=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.jpg”]

Video courtesy of the Federal Reserve and the Bureau of Engraving and Printing

Apr 18, 2014 | cash, dollar, pocket change, US Mint

Earlier this week I drove up north to Long Island to spend holidays with relatives. Taking these rides reminds me that we do not live forever. While the family has been expanded with children, the number of relatives at the seder is lower than it was just 10 years ago and these trips are punctuated with trips to the cemetery.

2014 coins found in change during a recent drive to New York

During one of our necessary stops, I was handed some change and noticed that the dimes looked a bit shinier than usual. Quickly zeroing in on the date I saw the “2014” date. After searching all over the Washington, D.C. area for 2014 coins, I find my first somewhere on the road in New Jersey.

Later that evening I emptied my pocket to see what else I could find. In addition to the dime, there was a 2014-P nickel and a surprise.

In 1979, the Susan B. Anthony dollar was released to much fanfare. It was the first “small” dollar coin and was the first U.S. coin to feature a real woman. Prior to the famed suffragette being featured on a coin, the image was that of Lady Liberty in some form. Even the Indian Head cent was not an Indian but Liberty in a native headdress.

But those of us who watch the experiment first hand soon discovered that the coin was too close in size with a quarter. In fact, the color, and reeded edges saw the Susie B. consistently being mistaken for quarters.

Almost as instantly as they appeared, the coins disappeared. Even as the public was willing to try the new coins, the rejection was almost as quick. After three years of production, the coins found a home in Las Vegas where they were used in slot machines. So many coins went unused following their last production in 1981 that was mainly for collectors, production picked up in 1999 after orders for additional coins were made from the vending machine and Las Vegas gaming industry.

The ’79 Susie B. that I received in change that was probably mistaken for a quarter.

I suspect that someone who previously visited that roadside oasis (how’s that for a description of a rest stop along the New Jersey Turnpike), used one of the vending machines, then spent the dollar thinking it was a quarter. The coin sat in the tray in the cash register until it was time to provide change for my purchase. The cashier, not paying attention to what she was doing, counted the requisite number of coins from the quarter section of the draw. In a rush, I just saw what was the right size coin and dropped it into my pocket on my way back out of the building.

Starting in 2000, the dollar was changed to not only honor Sacagawea but magnesium was added to the metal mix to give the coins a golden color. The color and making the edge smooth made it less possible that the coin would be mistaken for a quarter. Unfortunately, the memory of the failed Susie B. lingers among a significant segment of the population in a way that kept a similar push with the modern Presidential dollars from being successful.

But in this case, finding a Susan B. Anthony dollar made my day!

Jun 25, 2013 | Canada, cash, cents, coins

I am back after taking two weeks off for a little travel. As part of my ventures I spent some time in Canada. My wife, whose family is from the French-speaking areas of Quebec, had me trail along while she visited relatives. Even though I cannot speak French (très peu or “very little” is my response to when I was asked) I did have a good time. My wife’s relatives are good people and it would be interesting to see some of them come to the United States to visit.

While I was in Canada I decided that it would be interesting to buy rolls of one dollar (Loonies) and two dollar (Toonies) coins and see what I can find. The process was very interesting. First, I had to find a teller who could help me in English and accept U.S. currency. Thankfully, my wife had business at a local bank and the banker she worked with introduced me to a teller I could work with.

As I was introduced to the teller, I decided to buy two rolls of Loonies and Toonies. I thought this would be a good idea since these rolls may not have many coins. After all, rolls of U.S. dollars has 25 coins and the half dollars have 40 coins. I was surprised to learn that both the one and two dollar Canadian coins contain 50 coins! Playing it cool, I pretended I was not surprised and decided that purchasing 100 of each coin would be more fun to go through.

The rolls that were handed to me were clear plastic with locking tabs to hold the coins in place. Opening the roll is as easy as pulling apart the tabs. It does not require banging the rolls on the counter or tearing apart paper. While I did not open the roll all of the way, I was able to press the tabs closed to keep the rolls together.

Since I was paying for the rolls using U.S. currency, the bank used the current exchange rate for the conversion. With an exchange rate of a fraction over 98-cents per Canadian dollar, the two rolls cost less than $150 in U.S. currency. This presented a problem trying to pay with coins. Thankfully, my wife had some Canadian currency and paid for part of the transaction and added the C$5.00 fee since I was not a customer. What was more interesting was that without one-cent coins in circulation, the change had to be rounded. In this case, the change was rounded up!

After I walked out of the bank I began to wonder how the bank balances its books? Having worked on computer systems that supports accounting with all of the auditing capabilities and the ability to balance many accounts at once, what happens when the balances do not match? Do the banks track the plus-or-minus cents in order to make the books balance?

While in Canada I had to continue with my usual coffee habit and found myself at a Tim Hortons. For the United States audience not in the northeast where there are Tim Hortons franchises, Tim Hortons was founded in 1964 by Miles “Tim” Horton, a hockey player and entrepreneur, in Ontario as a donut shop. Although Horton died as a result of a 1974 automobile accident, his namesake restaurant is the largest fast-food chain in Canada. When I am asked to describe Tim Hortons I say that it is similar to Dunkin Donuts but with a better system and better coffee. When purchasing coffee at the Tim Hortons and paid using cash, the store worker would enter the amount of money I handed over and the electronic cash register calculated the change. On the screen it noted the change and how much would be actually dispensed without the one-cent coins. When I made a $1.78 purchase and handed the cashier a toonie, the cash registers said I was owed 20-cents in change.

Even though these transactions were in my favor, I had mixed feelings about the situation. I could have paid the exact amount using a credit card, but I am not comfortable using my credit card for small transactions.

Canadians seem to be comfortable, or at least accepting, with the elimination of the one-cent coin. I noticed they are comfortable with the one and two dollar coins. In fact, I liked having the coins from change while purchasing my coffee or other items while in Canada.

I am not sure that eliminating the one-cent coin or the paper dollar is ever going to happen in the United States, but if Canadians can adapt then I do not see why we should not be able to!

Oct 13, 2012 | cash, dollar, fun, video

Now that it has been three weeks since the autumnal equinox, the kind folks at the National Weather Service has issued a freeze warning for the Washington, D.C. area almost ending most outdoor activities. Aside from finding new coats for the dogs and their human parents and looking for a good charity which to donate the old coats, it is time to look for something to do indoors.

Being a blog about numismatics, I went on a search to find something a little different that the whole family could do when I stumbled on a YouTube video teaching the watcher “How to Make an Origami Dollar Ring.” It’s fun, functional, and costs only one dollar per ring.

Interestingly, the host of the video starts with showing how to use plain paper if you do not have a U.S. one dollar note. All it takes is using ordinary paper that is cut down to 15.5 cm in length and 6 cm in width. It is better to use metric measurements so that you can cut the sheet to the right size. Another advantage of using plain paper is that you can print anything on it prior to folding.

Here is the video to teach you what to do:

If you want to make your own ring using plain paper, I created a template based on the video’s instructions. The advantage of using the templates is that you can create your own design. After I folded my own dollar, I decided to make my own design based on the theme to this blog. Here are my results:

-

-

Origami Ring made using a $1 Federal Reserve Note

-

-

Origami Ring made using the the template colors of the Coin Collectors Blog

If you want to make your own ring, I created templates with lines showing the basic folds. I am including a blank template for you to create your own design and the template I used to make the Blog ring. Click on the link for the format you want and it will automatically download the file for you.

NOTE: When you click on the link above, your browser may open the file using the appropriate application on your computer. How this works depends on the browser you use and how you have it configured.

Nov 10, 2010 | cash, coins, pocket change

The question of paper versus plastic is answered every time we go to pay for a purchase. Up until this year, you can perform an Internet search and find many articles and blog postings about how the use of credit cards and electronic payment systems will make the U.S. Mint and the Bureau of Engraving and Printing obsolete.

Many of those articles were written during allegedly good times when credit was easier to obtain with high credit lines and low monthly payments. Then we had a credit crisis caused by many things including our proclivity to take out the credit card for purchases. The credit market changed and most of us who had many credit cards are down to a few whether by choice or otherwise. Now, it appears that credit purchases are down and cash is king once again.

A new report says that while credit card payments have either stayed even, as in the case with American Express, or declines as in the case with Visa and MasterCard, the use of cash and debit cards have risen.

Consumer spending is up 2.2-percent this year with credit card transactions being down 1.2-percent. Debit card purchases is up 15-percent with the rest of the increase being cash. With the new credit card protection law allowing merchants to give a discount for using cash, small retailers have been starting to offer discounts while larger chains are discussing their next move in this area.

Are we really leading to an all-plastic economy? Both the U.S. Mint and the Bureau of Engraving and Printing are reporting higher production numbers for 2010 than they did in 2009. Discounting the striking of half-dollars and dollar coins, the U.S. Mint’s production is up almost 30-percent. Although the statistics from the BEP are not fully available, BEP Commissioner Larry Felix testified to the House Subcommittee on Domestic Monetary Policy and Technology that production is up from 2009.

For those of us who collect coins or notes, whether they are modern or classic, it is good to know that the U.S. Mint and the BEP will continue to produce products to feed our collecting habit. And that is something to be thankful for heading into this holiday season.

Aug 29, 2010 | BEP, cash, commentary, economy, US Mint

“Cash is expensive, we need to be using it less.”

This self-serving quote was made by Steve Perry, executive vice president of Visa Europe, in an article that appeared in the Telegraph in the United Kingdom. To justify this statement Perry says that supermarkets in the UK are introducing cashback, a program to promote the use of credit and debit cards over cash because cash is more expensive to handle.

It may be the case in the UK that cash is more expensive to handle, but in the United States, we are seeing consumers and some small businesses moving in the opposite direction. This past week, credit reporting agencies and the credit card companies reported that the average credit card debt has fallen to its lowest point since 2002. Delinquency rates fell by 17-percent to the lowest point since the start of the current recession. Americans are buying fewer items on credit and using what income they have to pay off credit card debt.

With the economy in a stall, the U.S. Mint exceeded its 2009 output in July 2010. And even before the August Federal Open Market Committee meeting, it was speculated that the Federal Reserve would order more paper notes from the Bureau of Engraving and Printing. Since the FMOC meeting, Federal Reserve Chairman Ben Bernanke said that the Fed will do whatever it takes to stimulate the economy.

Aside from the economy another factor turning people away from credit cards is the environment created by the banks prior to the implementation of the Credit Card Accountability Responsibility and Disclosure Act of 2009 (Public Law No. 111-24 [TXT] [PDF]), also know and the Card Act. Between the bill’s passage and recent enactment, the banks have been raising fees on consumers and businesses in order to make up for what they saw as a potential loss of income. Rather than make it better for the consumers in the spirit of the Card Act, the banks showed their bald-faced greed making the using of credit cards more expensive than cash.

Even though Canada is debating on eliminating its 1-cent coin and others are pushing credit card technology onto the smart phone, small businesses are looking to save the cost of credit card handling by offering a discount for paying with cash. Credit card processing costs from three to five percent per transaction plus account fees. Some small businesses are offering their customers a discount of their credit card processing fee if they pay in cash.

Receiving a discount for paying using cash is not a new idea. There was a time, before the Card Act, when gas stations used to offer one price for cash purchases and another for credit card purchases. However, the convenience of using credit cards at the gas pump made this option unattractive. Even though the costs for using credit cards have been added to the price of gas, the elimination of this dual pricing was welcome. Recently, some independently owned stations have been offering a discount for using cash or for using the company’s credit card. The psychology of receiving a discount may make dual pricing more palatable in this environment.

As people are pulling away from credit cards, small businesses are looking to cut costs by offering discounts for paying with cash, and even with the rise in savings rates, it appears that the report of cash’s eventual demise appears to be greatly exaggerated. For numismatists, this means that our hobby will continue to grow with new, fresh material for years to come. And considering the bad economic news, this is good news. Happy collecting!

Last week, the

Last week, the