Sep 22, 2019 | commentary, economy, news

While perusing the news sources looking for numismatic-related news in the general media, I am noticing that there is an increase in crimes involving coin dealers. Between robberies or scams against dealers, the escalation of crime is noticeable and concerning.

While perusing the news sources looking for numismatic-related news in the general media, I am noticing that there is an increase in crimes involving coin dealers. Between robberies or scams against dealers, the escalation of crime is noticeable and concerning.

Any business that handles money is a potential target for criminals. Even with the policies of dropping excess cash into time-locked safes, criminals will rob any store where they can easily take a few dollars.

What makes robberies from coin dealers concerning is that these types of crimes increase when the criminals are looking for a more significant take when their economic situation appears to be getting worse.

Although the markets may be up and the unemployment numbers are low, the indications are that the economy has some soft spots that should be concerning to everyone. The number of people taking contingent and alternative employment arrangement, sometimes called the gig economy, has risen in the last year. The Bureau of Labor Statistics reports that much of the rise in the gig economy is being used to supplement regular income.

In the last month, silver has been a rise of nearly $2 since the beginning of August. Even though silver has dropped to $17.88 from a $19.30 high in September, economic indicators suggest that global affairs will prevent the price from falling. These investors will be affected by a potential oil crisis following the bombing of Saudia Arabian oil fields and the trade war caused by tariffs.

Gold has been relatively flat over the last few months although up for the year. As an investment instrument, gold is favored by large and institutional investors. What is preventing their rise is that on a larger scale, they are not as worried by global affairs. The investments they are involved with are not as affected by a potential oil crisis and a Chinese trade war. Many have isolated themselves from these issues.

The concern is that the split in the economic effect will cause those at the lower ends to try to find some relief by turning to crime. A stolen American Gold Eagle coin has the potential to yield a better return than robbing a convenience store.

As some dealers are pushing the sales of gold, think about what they are saying about the economy.

And now the news…

September 12, 2019

OYSTER BAY, NY — A Fort Salonga coin dealer has been accused in a $330,000 coin consignment and sales scheme in which he bilked several coin dealers and private collectors out of money, gold and collectible coins under the guise of legitimate coin deals, prosecutors said.  → Read more at patch.com

→ Read more at patch.com

September 13, 2019

Photographer: Ted Aljibe/AFP via Getty Images Congestion and constant flooding in the Philippine capital are prompting the central bank to move its mint away from the city. Bangko Sentral ng Pilipinas signed a deal Friday to relocate its production facility for coins and bank notes to New Clark City, a former U.S. air base where the government is building a back-up capital.  → Read more at bloomberg.com

→ Read more at bloomberg.com

September 16, 2019

Julien Perrotte stood in front of the representative at his local bank last week, unsure he properly understood what she was telling him. He was carrying about $800 worth of coins, sorted and rolled, that he had collected over the past year.  → Read more at cbc.ca

→ Read more at cbc.ca

September 17, 2019

September 18, 2019 – Sibenik was the first city in Croatia to mint its own money during the Venetian period. Today, the city has released a new sweet souvenir in its honor. HRTurizam writes that back in 1485, the Venice Council of Nine approved the minting and use of Sibenik's coins – known as the bagatin, which was a means of payment in the city for more than two centuries.  → Read more at total-croatia-news.com

→ Read more at total-croatia-news.com

September 17, 2019

Break-in happened Aug. 30 in Silver Spring Montgomery County police released surveillance video Tuesday of a man stealing what they estimate to be $6,500 in property from a downtown Silver Spring rare-coin store on Aug.  → Read more at bethesdamagazine.com

→ Read more at bethesdamagazine.com

September 17, 2019

More and more people are swapping cash for contactless payments – which means fewer coins are being made. That means the Royal Mint, the company which produces coins for the UK, don't make as many anymore.  → Read more at bbc.co.uk

→ Read more at bbc.co.uk

Jun 30, 2019 | bullion, economy, gold, investment, markets, news

Price of Gold for the 2nd Quarter of 2019

(Chart courtesy of GoldSeek.com)

With the price of gold opening at $1,279.00 on January 2, 2019, it saw some bumps in its price but has largely averaged a modest gain until the price closed at $1,271.15 on May 21. Then it started to climb and climb rapidly by market standards. On Friday, June 28, the end of the second fiscal quarter, gold closed at $1,409.00. The rise is a 10.8-percent gain since May 21.

Gold is considered a safe bet for investors. It is a way of investing in cash or cash equivalence. Investors buying gold will purchase bullion, gold bullion coins like the American Eagle, or shares in a fund that maintains large stores of gold. There are many types of funds and ways to purchase shares in these funds, but it is not the same as owning the physical gold. Most reports are claiming that investors are interested in purchasing physical gold with bullion coins being the preference.

Investors make money by investing with what they consider a manageable amount of risk. If the risk pays off, they can make a lot of money. The risks that fail must be made up elsewhere. Investors diversify their portfolios to mitigate these risks. However, if the institutional and large investors are moving their monies to safe harbors, like gold, they sense a problem.

This relatively sharp jump in the price of gold is being driven by the major investors who are worried about the future of the U.S. economy. They see the various trade wars being detrimental to the economy. One economist said that the recent hike in soybean tariffs to China is going to have long term effects long after this president leaves office.

Although the United States is no longer an agrarian economy, agriculture plays a significant role in the country’s economic health. Upsetting that role that agriculture plays will cause long-term damage to the economy. The soybean tariffs are believed to be the driver that is scaring investors.

You may ask how are soybeans causing gold to rise?

As part of foreign policy in Africa, the government has been supplying countries with the proper climate the means to grow soybeans. It was a way to make the countries self-sufficient by helping create an economy. In many cases, the United States did not follow through on commitments to help with the infrastructure that is needed to create access to the markets. Countries needed irrigation and road improvements. Rather than helping with the upgrades, the United States government concentrated on the military aspects of these country’s problems. A policy of one-problem-at-a-time.

For at least 15 years, China has ignored the military issues and began to supply the money, supplies, and labor to fix the infrastructure. The Chinese government helped build irrigation systems, roads, and provided transportation to build these economies with the promise that China would buy their products.

Although there was significant Chinese investment in Africa, it was still cheaper to buy soybeans from the United States. That situation changed with the 25-percent tariffs placed on soybean exports. The tariffs raised the price of U.S. soybeans beyond what the Chinese would pay to the African exporters. Now China is importing soybeans from Africa while U.S. farmers are provided allegedly short-term subsidies from the federal government.

Now that the infrastructure is in place for China to import soybeans from Africa, the costs have reduced and is projected to have the long-term effect of lowering the U.S. market for soybeans in China. One economist said privately that even if the tariffs were reduced to pre-trade war levels, it might not make it economically viable for China to buy as much from the United States as it did in the past.

Institutional investors see the loss in revenue from China, the increased deficit in providing welfare to soybean farmers, and the danger of the business not returning to the United States. They also see the reduction of tariffs to Russia for wheat and that Russia is also looking to African and South American countries for wheat sources. The competition is making trade prices drop and is making it look like agriculture trade is in trouble.

If exports of United States agriculture are in trouble, then it will hurt the economy. With the uncertainty added to the risk profile investors and fund managers have to manage, they have turned to gold as the natural, safe harbor.

The rise in gold prices always helps numismatics. It helps boost the prices of gold and, by association, other rare coins. However, if the gold prices go up because of economic stress, it will not matter what happens to numismatic prices. Fewer people will be in the market to buy coins.

And now the news…

June 26, 2019

Gold is a hedge against financial risk, and coins offer convenience.  → Read more at marketwatch.com

→ Read more at marketwatch.com

June 26, 2019

COIN collectors can now get their hands on a Toy Story 4 50p piece – but you can’t use it in shops. The commemorative coin features popular character Woody in colour with the cowboyR…  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

Jun 3, 2018 | commentary, dollar, economy, investment, markets, policy

Zimbabwe’s 2009 $100 trillion hyperinflation note

In the news this week was a story about the Reserve Bank of Zimbabwe touting the adoption of Chinese currency for general use in the country as circulating currency.

Zimbabwe’s economy has seen wild swings between massive inflation and significant economic stagnation that has caused currency fluctuations so bad that the country has given up managing its own currency. The economic problems have created a hyperinflation currency with notes printed with denominations as high as 100 Trillion Zimbabwean Dollars. So many of these notes were printed that any collector can buy them for $5-10 each.

Because of trade restrictions, Zimbabweans turned to United States currency smuggled from outside of the country. The supply of United States currency was so limited that some had begun the practice of cleaning the paper because people were carrying their currency in their underwear and new notes were difficult to come by.

Following negotiations with the United States, the RBZ was able to obtain new currency notes and offered an exchange to its residents. But that is where the negotiations ended. Upon the change of administrations, the current Department of the Treasury stopped negotiating with Zimbabwe and other African nations to introduce additional trade in United States dollars.

As the United States began to abandon these countries, the Chinese stepped in. The Chinese government has been negotiating with these countries and have made several inroads, especially in Africa. Zimbabwe is just the latest to announce that they could adopt the Yuan as their currency.

Although Zimbabwe is not an influential economy, it expands the Chinese economic base in Africa. By chipping away at the United States economic influence, it reduces the impact of the dollar on the continent that could have an effect on numismatics.

Africa continues to have the largest deposits of precious metals. Southern African regions have the world’s most active gold, silver, and platinum mines that if the United States loses influence in the region could have a negative effect on worldwide precious metals prices.

It is not a matter of the golden rule, “He who has the gold rules,” it is a matter of who controls the flow of gold from those mines. If the Chinese control the economic engine that runs those mines, they can use that influence to make or break the markets as they see fit. The ripple effect could not only bring higher precious metals prices but worldwide economic instability.

History has taught us that market manipulating does not work except if the manipulators have a backup plan. In this case, the Chinese are using their treasury as the backup plan. They are amassing economic power that could manipulate markets to the point that would cause prices to rise.

Currently, precious metals prices are set by arrangement with the London Bullion Market Association (LBMA) based on the daily auction prices in London. This is known as the London Fix Price. The market uses United States dollars for its pricing. However, if the dollar loses its economic power because the Chinese are controlling the markets where the metals are mined, it will affect the cost of everything.

In the short term, economic factors will affect the price of bullion being produced by the U.S. Mint since those prices are based on LBMA price averages. Collectors and investors will be hit first. After that, it would be a short time before economic instability hits everyone else.

And now the news…

May 27, 2018

If you visit Stones River National Battlefield and Cemetery, you'll likely see coins on the top of many tombstones. According to park workers, the small mementos are a way some choose to pay their respects to the fallen soldier, and each kind of coin has a different meaning.  → Read more at newschannel5.com

→ Read more at newschannel5.com

May 27, 2018

In this edition of East Idaho Newsmakers, Nate Eaton speaks with Randy’L Teton. Teton is a Fort Hall native and is featured on the US Sacagawea dollar gold coin. She is the only living person to currently appear on a United States coin. During their conversation, Teton shares the fascinating story of how she ended …  → Read more at eastidahonews.com

→ Read more at eastidahonews.com

May 28, 2018

TOKYO (Jiji Press) — The Finance Ministry said Friday that it will issue a silver coin to commemorate the 150th anniversary of the 1868 start of the country’s Meiji period, which ended in 1912.  → Read more at the-japan-news.com

→ Read more at the-japan-news.com

May 29, 2018

Ahmed Mohamed Fahmy Yousef has spent the last academic year at the University of Colorado conducting research on learning technologies and instructional design in computer science education.  → Read more at dailycamera.com

→ Read more at dailycamera.com

May 29, 2018

Tawanda Musarurwa, Harare Bureau The adoption of Renmimbi/Yuan as a reserve currency, will help the country repay loans and grants from China, the Reserve Bank of Zimbabwe has said.  → Read more at chronicle.co.zw

→ Read more at chronicle.co.zw

June 1, 2018

Archaeologists in Egypt have unearthed a 2,200-year-old gold coin depicting the ancient King Ptolemy III, an ancestor of the famed Cleopatra.  → Read more at foxnews.com

→ Read more at foxnews.com

June 1, 2018

An ancient Egyptian coin discovered in far north Queensland has researchers questioning how it got there.  → Read more at abc.net.au

→ Read more at abc.net.au

June 3, 2018

The Royal Canadian Mint unveiled their first-ever panda-themed coin at the Calgary Zoo.  → Read more at thestar.com

→ Read more at thestar.com

Aug 6, 2016 | economy, history, tokens

For as long as there has been money or commerce, there has been some form of credit. Whether it was borrowing a few coins until the next payday or today’s credit cards, credit has been a fuel of economic development for quite some time. The financial industry is built on credit and charging customers to borrow money and spread the payments out over time. By some estimates the average household owes over $16,000 in credit card debt.

The United States was founded on credit. During the founding of the country currency had been limited to coins with an intrinsic value based on their gold, silver or copper content. As the King of England tried to tax the colonies to pay for the wars in Europe, the colonies looked for ways of financing their own governments to provide services. they issued paper notes. These notes functioned as currency but actually were bills of credit, short-term public loans to the government. For the first time, the money had no intrinsic value but was valued at the rate issued by the government of the colony in payment of debt. Every time the colonial government would need money, they would authorize the printing of a specified quantity and denomination of notes that it would use to pay creditors. The emission laws also included a tax that would used to repay the bill of credit and the promised interest.

Later, the era we now refer to as Obsolete Banknotes (or Broken Banknotes), were currency issued by banks under permission of the Department of the Treasury that were supposed to be backed by the assets of the issuing bank. Banks were supposed to be able to back at least 90-percent of the value of the notes with hard currency. But the banks were not honest with the Treasury Department, issued more currency than assets, and many went out of business because they could not cover the value of the notes issued.

Credit run amok has been the cause of nearly every major market downturn in history including the most recent dire recession that began in 2008.

The concept of institutionalizing consumer debt was first written about in Looking Backward, 2000 to 1887 by Edward Bellamy. Bellamy, a writer from Massachusetts, wrote about Julian West, a young American who falls into a deep, hypnotic sleep and wakes up in the year 2000. As part of West’s experience, Bellamy describes purchases being made using a credit card. Bellamy’s credit card was limited to the amount on deposit. The description is more like a debit or secured credit card of today. After the book became popular, the concept of consumer credit began to be institutionalized.

Hotels and other higher-end retailers were first. They would create medals or tokens that could be carried in the pocket or have a hole to include them on a keychain. Much like the Colgate tokens previously written about, the use of metal tags and tokens began at the beginning of the 20th century and was stopped by the War War II efforts.

Credit tokens were nondescript items with the name of the establishment and the user’s account number which lead to a number of problems. Since the account number was engraved into the tag, it was up to the cashier to write down the account number. Mistakes would lead to unpaid bills. A later improvement was to include raised letters that could be rubbed onto the paper using a pencil or carbon paper in order to record the number correctly, a feature that would be added to the plastic charge plate before the invention of the magnetic strip.

These tokens did not include the customer’s name. Although many can be mailed to the company so that the keys could be returned to the original owner, thieves would keep the tokens and use them. Stores would later have to produce lists of invalid or stolen charge numbers to verify the sale at the register. In the day before computers, this was a time consuming task.

Stores continue to think the risks are worth dealing with since credit purchases appear to be more popular than cash-based purchases.

One of the early adopters of credit purchases was Abraham & Straus, Inc. Founded in 1865 by Abraham Abraham in Brooklyn, the store was operated on Fulton Street as a small clothing outlet until its later flagship store was built closer to downtown Brooklyn in 1883. As part of expanding the store and funding the move, Abraham received funding from Nathan and Isidore Straus. When the company reopened at 422 Fulton Street the was renamed Abraham & Straus, the name that was used until its closing in 1995.

-

-

A&S Charge Token with account number

-

-

If found return it to A&S in Brooklyn!

Known as A&S throughout the New York metropolitan area, it was a little more upscale from other discount stores of the time. Although the stores expanded as far as the Philadelphia region, it would not see the same success as the New York-area stores. A&S was a favorite amongst the burgeoning middle class of the post-World War II Baby Boomer generation especially for women’s clothes. I have a lot of memories waiting outside of the A&S with my father at the Green Acres Mall in Valley Stream, NY as my (late) mother would go shopping in A&S. And the family car, a black 1963 Chevy Impala with red interior, did not include air conditioning!

Apparently, I survived those shopping trips along with my recent find an on old A&S credit token. While searching through a cigar box of old tokens, I found this pre-World War II item. Aside from bringing back the memories, and reminder of the hot days waiting for my mother to try on nearly every dress in the store, I though this would be a perfect addition to my collection of New York numismatic memorabilia.

Remember, you do not have to collect coins to have fun with numismatics!

NOTE: Electronic versions of

Looking Backward, 2000 to 1887 by Edward Bellamy can be downloaded from

Project Gutenberg.

Jun 22, 2016 | Britain, economy, markets, medals, news

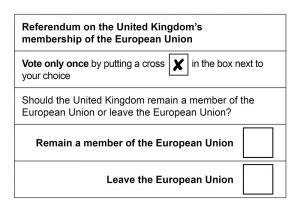

While there is enough going on with U.S. politics to make one’s head spin, on Thursday, June 23 the United Kingdom will hold a nationwide vote on whether the U.K. should leave the European Union. The last time the U.K. held a referendum on joining the E.U. was in 1975, which predates the modern European Union. It is called “Brexit,” a portmanteau of the term “Britain Exit,” as in should Britain exit the E.U.?

The European Union was formed after World War II in various forms in an attempt to collectively rebuild Europe by integrating their resources. The first formal attempt was the Treaty of Rome in 1957 signed by Belgium, France, Italy, Luxembourg, the Netherlands and West Germany to create the European Economic Community (EEC) and established a customs union. What we know today as the European Union was established when the Maastricht Treaty became effective in 1993.

As part of the integration under the E.U. is the common currency known as the Euro. First distributed in 1999 with 14 participating nations, now includes 19 of the 28 nations plus the Vatican, Monaco, and San Marino who are not formally members of the E.U. The United Kingdom (England, Northern Ireland, Scotland, and Whales) continues to use the pound sterling, sometimes referred to the Great Britain Pound. Ireland, sovereign from the United Kingdom, uses the euro.

British Prime Minister David Cameron

Interestingly, many of the arguments for leaving the E.U. are similar to those being applied by the apparent nominee for the Republican Party in the United States while those campaigning to remain in the E.U. are similar to the apparent Democratic Party nominee. It just goes to prove that regardless of which side of the pond you live, politics is polarizing.

For those of us Yanks who want to learn more, BBC News has published a good overview with links to more in-depth that you can click here to read it, if interested.

So why is this significant for a coin collector’s blog? We do look at economic matters affecting collecting including those whose collection are being put together for speculation including the purchase of bullion-based numismatics. Also, the outcome could not only affect the world economic system but could also have an impact for those who collect foreign coins.

If the U.K. votes to remain in the E.U. then the status quo remains. The British will go back to their partisan politics and scratch their heads over the U.S.’s partisan politics known as the 2016 presidential election. Markets that have tightened in anticipation of what Brexit may mean could see this as a temporary reprieve.

If the U.K. votes to leave the E.U. the markets may not like it and the economy can go into a freefall. Markets do not like uncertainty and a vote for the U.K. to leave the E.U. would bring about the uncertainty of “what happens next?” and “now what?” Business leaders, who are largely in favor of remaining the in E.U., has noted that it makes it easier for them to move money, people and products around the world. What happens when those doors are closed?

As we have seen when economies are uncertain, markets react by selling off speculative assets, like stocks, and running to safer investments like trustworthy bonds and precious metals. In the last three weeks in the run up to Brexit, gold is up $56 (4.6-percent) in the last three weeks and silver is up $1.41 (8.8-percent). Both are off their annual highs set on June 16 when published polls are suggesting that Stay has a lead greater than the margin of error over Leave.

-

-

June gold prices through June 22

-

-

June silver prices through June 22

NOTE: Charts do not update

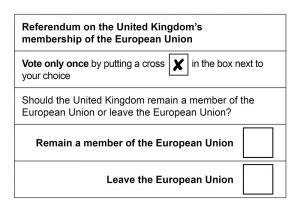

Sample of the ballot that will be used for the EU Referendum “Brexit” vote

Market watchers can watch what happens to the Tokyo Nikkei 225 market index and Hong Kong’s Hang Seng Index. Both are the major indexes in the Asia/Pacific region and will be around their midday trading sessions on Friday.

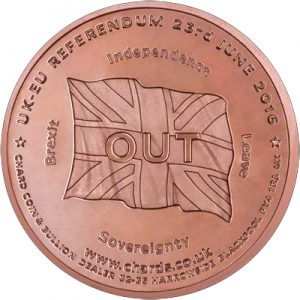

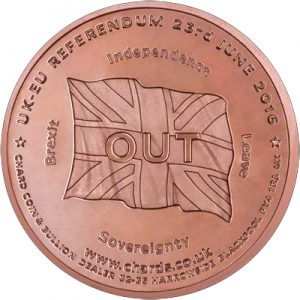

Collectors looking for something numismatic to add to their collection might want to consider the In/Out UK EU Referendum Medallion produced by Chard(1964), a British metals dealer. These copper medals were produced for the Britons who were undecided. Flip the medal before you vote to decide whether to remain or leave. The Remain side has the E.U. flag surrounded by “Remain,” “Better Together,” “United,” and “Stronger in Europe.” The Leave side has the British Union Jack with “Brexit,” “Independence,” “Leave,” and “Sovereignty.”

Medals are 31mm in diameter and weighs 14 grams. They come in pure copper or Abyssinian Gold, a type of brass made of 90-percent copper and 10-percent zinc that has a gold-like color. They can be purchased for £2.95 each ($4.33 at the current exchange rate) plus shipping (estimated at £6.00 or $8.80) directly from Chard’s website.

-

-

Chard Brexit Medal “In” side

-

-

Chard Brexit Medal “Out” side

Credits

- Brexit combined flags image: Credit Philippe Wojazer/Reuters via the New York Times.

- Image of PM Cameron is an official photo downloaded from Wikipedia.

- Static metals graphs courtesy of Kitco.

- Referendum Ballot image courtesy of Wikipedia.

- Brexit Medal images courtesy of Chard.

Mar 9, 2016 | bullion, coins, commentary, Eagles, economy, silver

What began as an English proverb as “March comes in like a lion and goes out like a lamb” may become a relic of history. Aside from the weather implications the markets are experiencing a lion-like robustness that even has the governors and branch presidents of the Federal Reserve issuing conflicting statements about the future of interest rates.

What began as an English proverb as “March comes in like a lion and goes out like a lamb” may become a relic of history. Aside from the weather implications the markets are experiencing a lion-like robustness that even has the governors and branch presidents of the Federal Reserve issuing conflicting statements about the future of interest rates.

While the professionals are attempting to figure out what the economic numbers are saying, one thing is clear that the U.S. Mint is on pace to break its 2015 sales for American Silver Eagle bullion coins. March opens with the U.S. Mint announcing that it has another 1 million silver coins ready for sale. This is the fifth time in 2016 that the U.S. Mint has made this type of announcement.

Year to date, gold prices are up about 17-percent and silver prices are up 11-percent. This has not stopped the buying of bullion coins. One Canadian dealer recently informed me that they sold out of a specific silver issue from the Royal Canadian Mint because of high demand, especially from the United States.

This is reaching beyond collectors. While the numismatic world was focused on Dallas for the National Money Show, my business kept me in the D.C. area as a vendor at one of the largest antiques shows in the mid-Atlantic region. Although coins are a very minor part of the show, some dealers that were selling silver coins had high volumes of sales. One dealer reported that he sold out of the 30 American Silver Eagle bullion coins graded MS-70 by the middle of the show’s second day.

An informal poll of attendees to the National Money Show suggests similar sales performances.

Even though there may be areas of the economy that has not caught up to the current economic trends, it is difficult to find an analyst or pundit that does not believe that the current trends will end in the short term.

It is likely that March will go out like a raging bull, even if I could not find a one-armed economist to disagree!

Nov 18, 2015 | BEP, cents, coins, commentary, currency, dollar, economy, Federal Reserve, US Mint

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Series 1935 $1 FRN Reverse Early Design

Every so often an article is written, usually by the political elite, about ending lower denomination coins for many reasons including the high cost of mintage or the inconvenience of their existence. Others point to rise of non-cash transactions and the rise of digitally created currencies as the future.

Those of us who work in areas outside the larger commercial world has experience with a cash economy that is not tied to economic status. One of those is the numismatics industry. While many dealers will take credit cards, and will pass along the fees along to the customer, many dealers have said that most of their off-line business is a cash-based business. While larger purchases are done using checks, most will leave shows with more hard currency than other types of payments.

1909-VDB Lincoln Cent

There are people who are leery of using credit and debit cards for every transaction. We use cash to limit our exposure. In this connected world, the credit and debit card leaves a digital breadcrumb that is available to be hacked. I cannot tell you how many times I watched people in local convenience stores punch in their codes in a matter I could see them and then leave their receipts behind. This could be used to steal your money and your debit cards are not covered the same as credit cards. But the public does not see this.

A week does not go by without a report of the hacking of personal information that should not be made public. Unfortunately, it is getting to be like rain on the hot-tin roof, after a while the sound blends into the background.

According to the Federal Reserve, there was approximately $1.39 trillion in circulation as of September 30, 2015, of which $1.34 trillion was in Federal Reserve notes. That represents a lot of money that would have to be accounted for if we were to go into a cashless society. It would take a significant effort that would not make for good public policy.

The calls to make changes to change are beginning to drone on as background noise like rain on a hot-tin roof.

Jul 8, 2015 | coins, currency, economy, foreign, news

Greece 1€ coin depicts an owl, copied from an ancient Athenian 4 drachma coin (ca. 5th century BCE)

Collecting numismatic items from distressed times can present an interesting challenge. While we have heard about Hard Times Tokens being a popular collectible, sales tax tokens produced during the Great Depression so that people could pay the exact fractions of a tax on low-value purchases.

Two of the more recent examples of numismatics based on distressed economic conditions are the Zimbabwe hyperinflation currency and the State of California’s Registered Warrants (IOUs). Although both have different origins from the Greek crisis, both show different ways of handling the situation.

When a country controls its own currency, it can manage that currency to maintain its value. In the United States, that is done by the Federal Reserve. It uses many programs from buying debt from its member banks to setting what it calls the Discount Rate, the rate that its member banks can borrow overnight to meet its liquidity requirements. In Zimbabwe, the central bank did not have the business and circulation in order to make this type of policy work because of the strife caused by wars and other ugliness. Their only choice was the print more money. The more money printed, the less it is worth. The less the money is worth the more it takes to buy daily goods and services. This result is that the more money that is added to the economy the higher inflation goes.

Zimbabwe’s 2009 $100 trillion hyperinflation note

California was a different story. It was a self-made crisis of politics in 2009 between the Republican Governor Arnold Schwarzenegger and the Democratic-controlled legislature. Since neither side could agree on a budget, Schwarzenegger declared a fiscal emergency and ordered the printing of IOUs to pay for state debts.

California Registered Warrant

A friend who was living in California at the time was issued an IOU for a small personal tax refund. Rather than be burdened with the rigors of cashing the warrant, the paper is now part of his collection. However, since the warrants were addressed to specific people, it is not likely that these items will be immediately collectible. Many years from now it is probable that these warrants will be a curious collectible like the old Series E or War Bonds.

Greece does not control its own currency nor does it have any potential backing to issue warrants. Since Greece has not been seen as creditworthy, it cannot issue bonds at any interest rate because the markets are not interesting in buying Greek debt. Unless a deal can be struck with the rest of the European Union, Greece may not have a choice but exit the pact that uses the Euro as the common currency.

Exiting the Euro will bring back the Greek drachma.

2000 Greece 20 Drachma coin features Dionysios Solomos, a poet and author of the Greek national anthem.

Before you search your ten pound bag of foreign coins looking for pre-Euro drachma, it is likely that Greece will keep those coins demonetized and not recognize them as official currency. If Greece wants to be able to control the amount of currency in circulation, then they will have to issue new coins and notes.

If Greece goes this route, experts are saying that the Greek government will allow the Euro to circulate alongside whatever is added to the market. Some people think it may take over a year to strike enough coins and print enough notes to be able to remove the Euro from circulation.

What will Greece do in the interim? Does the Greece Central Bank issue warrants like California did? If so, will the warrants become something that would become a collectible?

10,000 drachma note issued by the Bank of Greece in 1995 features the image of Dr. George Papanicolaou, inventor of the Pap smear

Image Credits

- Greek 1€ coin courtesy of EuroCoins.co.uk.

- California Warrant courtesy of MyMoneyBlog.com

- Zimbabwe $100 trillion note courtesy of Wikimedia Commons.

- 20 drachma coin courtesy of Numista.

- 10,000 drachma note courtesy of the Bank of Greece.

Apr 10, 2015 | cents, coin design, coins, economy, news, US Mint

The U.S. Mint has sent out a press alert saying that CBS Sunday Morning will air two segments this Sunday, April 12th, that may be of interest to collectors. The first segment will focus on the artists and engravers in Philadelphia and the role they play in the coin-making process. The segment will also look at some of the Philadelphia Mint’s history.

The U.S. Mint has sent out a press alert saying that CBS Sunday Morning will air two segments this Sunday, April 12th, that may be of interest to collectors. The first segment will focus on the artists and engravers in Philadelphia and the role they play in the coin-making process. The segment will also look at some of the Philadelphia Mint’s history.

A second segment will look at the penny and the debate about whether or not it should be eliminated.

Anthony Mason

CBS Sunday Morning is usually hosted by Charles Osgood and airs at 9 am Eastern Time. Check your local listings to see when it airs in your region.

Sep 28, 2012 | BEP, coins, currency, economy, Federal Reserve, legislative, policy, US Mint

Those of us here in the Washington, DC area who work with or for the Federal Government knows that this week is the home stretch to the end of the fiscal year. Many of us who work for the government are not directly involved with the political infighting that makes the national news. Federal employees are prohibited to be involved with politics by law and contractors usually have employer policies that limit their political activities.

One thing we worry about is the funding issues that have not been resolved. Although the news reported that congress has passed a continuing resolution to fund the government for six months, what the reports did not say is that the continuing funding are only at the levels negotiated last year which rolled back funding to Fiscal Year 2007 (FY07) levels. FY07 dollars do not have the same buying power as today’s dollars and the amount of work required by the laws passed by congress have increased.

You might have heard about the budget “sequestration.” Sequestration is the mechanism that was instituted as part of the Budget Control Act of 2011 to force congress to negotiate a budget or automatic, across the board cuts totaling $1.2 trillion will go into effect on January 1, 2013. Sequestration has made a lot of people in the DC area nervous because it will cause contractors to cut jobs. In fact, with the uncertainty of sequestration, large contractors, like Lockheed-Martin, are providing 90 day layoff notices they are required to give employees when defense and other security-related contracts are ended early.

For the money manufacturing operations under the Department of the Treasury, there should not be any problems from sequestration because the U.S. Mint and the Bureau of Engraving and Printing are profitable agencies that uses their profits for operations. If there are shortfalls in providing funding for operations, the Secretary of the Treasury is allowed to withdraw funds from the Public Enterprise Funds (the accounts where the profits are deposited).

Problems remain for both agencies. The most significant of the issues are the problems with printing the new $100 Federal Reserve Notes. BEP continues to report that the new notes have folding issues that have delayed their release for two years. Inquiries by numismatic industry news outlets have reported that the problems are still under investigation and that no new release date has been set.

The U.S. Mint recently reported striking problems with the First Spouse Gold Coins. Apparently, the design caused metal flow problems in trial strikes that caused delays in releasing the coins. While the U.S. Mint has said they rectified the problems, the coins have not been issued.

In addition to the coining problems, the U.S. Mint also suspended its attempt to update its technology infrastructure. After receiving the responses from a formal Request For Information (RFI), the U.S. Mint pulled back on its attempt to update its infrastructure and online ordering services to re-examine the requirements and the business processes that would be part of that contract. The U.S. Mint press office said that they had no further information other than what has been published. They did confirm that the RFI responses will not be released because they contain proprietary information that is protected from public release.

It is difficult to know whether the federal budget situation will effect the U.S. Mint and BEP or whether the attempt to reduce costs in order to ensure they do not access more money from their respective Public Enterprise Funds. This is because money in excess of budgeted operations plus a reserve must be withdrawn from these Public Enterprise Funds and deposited in to the general treasury accounts at the discretion of the Secretary of the Treasury (31 U.S.C. § 5136 for the U.S. Mint and 31 U.S.C. § 5142 for the BEP). It is reasonable to question the management of these funds in the light of the federal budget situation.

Right now, the way the BEP and the Federal Reserve has handled the situation with the new $100 note suggests there is more to that issue than meets the eye. Nether the BEP or the Fed are answering question and the BEP did not issue an annual report for 2011 which would have to report on the production of the $100 notes. Inquiries to the BEP were returned with a reply that the report “is not ready.”

The annual reports for both these bureaus will make for interesting reading, if the BEP produces one for 2012.

While perusing the news sources looking for numismatic-related news in the general media, I am noticing that there is an increase in crimes involving coin dealers. Between robberies or scams against dealers, the escalation of crime is noticeable and concerning.

While perusing the news sources looking for numismatic-related news in the general media, I am noticing that there is an increase in crimes involving coin dealers. Between robberies or scams against dealers, the escalation of crime is noticeable and concerning. → Read more at patch.com

→ Read more at patch.com → Read more at bloomberg.com

→ Read more at bloomberg.com → Read more at cbc.ca

→ Read more at cbc.ca → Read more at total-croatia-news.com

→ Read more at total-croatia-news.com → Read more at bethesdamagazine.com

→ Read more at bethesdamagazine.com → Read more at bbc.co.uk

→ Read more at bbc.co.uk

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.