Jun 14, 2022 | Carson City, coins, dollar, errors, grading, GSA, Morgan

Life can be confusing. One of those confusions is when people do something for reasons that are not obvious. Then when the people were asked why they did not offer any answers.

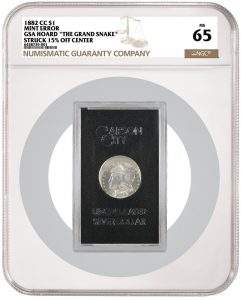

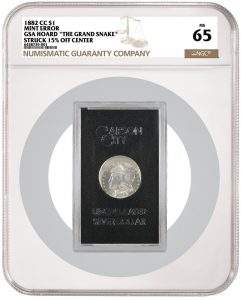

1882-CC GSA “Grand Snake Morgan Dollar Struck 15% Off Center graded NGC MS 65 (Image courtesy of NGC)

The coin is fascinating in that it looks stunning, survived for so long to be part of the GSA Hoard, and the original owner purchased the coin for $30 in 1972. But that is not what makes this coin a curiosity.

Rather than NGC applying the tamper-evident label that NGC wraps around the GSA holder, NGC placed the entire GSA holder in one of their Mega Holders.

According to NGC’s website, the Mega Holder can hold a coin as large as 180 mm (about 7-inches) in diameter and 28 mm (about 1.1-inches) thick. The NGC holder appears to be three times the size of the GSA holder.

Understandably, a collector would send a coin of this significance to NGC for authentication and grading. But why did NGC have to slab the entire GSA holder? The coin is 38.1 mm in diameter (less than 1-inch) and is in a holder for a coin seven times its size. The coin, which should be the central focus, appears lost.

I tried to ask NGC about their decision to slab the entire GSA holder, and the response I received referred me back to the article that does not discuss the decision. There must be a reason other than “this is what the client wanted.” Even if NGC does not want to answer the question, I want to see the coin in person.

Jun 12, 2022 | cents, coins, news

1943-S Steel Cent

Copper was a crucial element in making bullets for the war efforts. With the production of war materials increasing, congress and the U.S. Mint thought that striking the cent using another metal would help. After testing different materials in 1942, the U.S. Mint selected a zinc-coated steel planchet. In 1943, the U.S. Mint produced 1,093,838,670 steel cents between the three mints.

The coins were not well received by the public. Their size and lighter weight caused many people to confuse the steel cent with the dime. The zinc coating would wear as the coin circulated, allowing rust to form on the steel.

With over 1 billion coins struck, there are plenty of opportunities to collect steel cents. At the time, some people saved rolls, and others put the coins aside because they did not like to use them. They can be purchased online or from many dealers.

When looking for steel cents for a collection, look for a coin that continues to show its zinc color. The zinc will be a semi-bright silvery color that does not have a very shiny look. Grey-looking and dark grey coins have been handled and should be less expensive.

Nice examples of Steel Cents are not expensive. With over 680 million struck in Philadelphia, uncirculated examples of those coins cost $2.50 – $3.00. There were over 210 million struck in Denver, uncirculated 1943-D steel cents will sell for $3.25 – $4.00. There were fewer steel cents struck in San Francisco. Over 190 million struck, uncirculated 1943-S coins cost $5.00 – 6.50.

When buying coins for your collection, be careful with coins that look shinier than others. These coins may be reprocessed Steel Cents. Reprocessed steel cents are real coins but have a new coating of polished zinc. While they are pretty coins, numismatists consider these coins damaged and advise not collecting them if you are looking for value.

Rather than continuing to use the steel planchet, the U.S. Mint used copper recovered from the spent shell casing used for ammunition. The shell casing came from the training fields in the United States and not from the battlefields.

In 1944 and 1945, spent ammunition provided the copper used to strike Lincoln Cents. These coins are known as shotgun case cents and are darker than other copper coins because the smelting process could not remove all of the impurities from the ammunition.

There are famous 1943 Lincoln Cents struck on copper planchets, and 1944 cents struck on steel. These are rare coins and not as readily available.

The 1943 Steel Cent is the only circulating coin ever produced by the United States Mint that does not contain copper. Collecting a complete three-coin set adds a historic coin to your collection at an affordable price.

And now the news…

June 6, 2022

Prague, Czech Republic – A rare ten-ducat coin dating from the 17th century sold for more than 10 million Czech crowns (about €4 million) at an auction held in Prague on Saturday. The ten-ducat coin was minted in Prague during the reign of Frederick the Great in the early 17th century.

→ Read more at

kafkadesk.org

June 7, 2022

Hyderabad: Security Printing and Minting Corporation of India Limited (SPMCIL) is organising Azadi Ka Amrit Mahotsav celebrations from June 6 to 13 in all its units. As a part of the celebrations, India Government Mint, Hyderabad, is inaugurating the coin museum at Saifabad Mint on June 7.

→ Read more at

thehansindia.com

June 7, 2022

Centuries-old shipwrecks complete with gold coin treasure have been discovered off Colombia. According to officials, Colombian naval officials conducting underwater monitoring of the long-sunken San Jose galleon discovered two other historical shipwrecks nearby.

→ Read more at

presstv.ir

June 8, 2022

A SELLER on eBay recently had some luck with his coin collection – selling it for nearly $3,500. The collection featured Lincoln steel pennies that mostly bared the 1943 dates, according to the seller.

→ Read more at

the-sun.com

June 10, 2022

The U.S. Mint released the first quarters featuring Wilma Mankiller, who was the first woman named Chief of the Cherokee Nation.

→ Read more at

poncacitynow.com

Jun 7, 2022 | auction, coins, grading

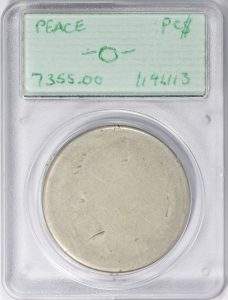

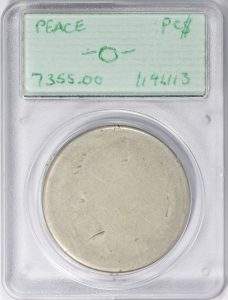

Peace Dollar with PCGS Prototype Handwritten Label

(Image courtesy of Great Collections)

That curiosity in history had me searching for the auction of a significant piece of numismatic history. An article appeared at Coin Week reporting that a sample PCGS Type 1 holder with a handwritten label was up for auction at Great Collections.

According to the auction description, it is a prototype holder for a very worn Peace dollar to show how a coin with a worn date could be certified by PCGS. The handwritten label was produced in 1989 or 1990, with PCGS confirming the label’s authenticity.

The label is a demonstration of the growing pains experienced by PCGS. By 1989, PCGS was three years old and experienced an exception to its established procedures. Long before low-ball collecting, what does a company do with a low-grade coin?

The prototype holder with a coin that would likely grade PO-1 today is an artifact of numismatic history. Aside from its historical significance, it is just a cool item. The price as this is being written is $5,050. The auction ends Sunday, June 19, 2022, at 06:38 PM Pacific Time. Get your bids in!

EDITED: I am not the owner/seller of this slab and I am not a bidder in this auction. I was accused of shilling this auction by a reader via an email. It is featured here because I thought it was something interesting and, quite frankly, cool. I have no association with Great Collections except as a satisfied customer.

May 24, 2022 | coins, commemorative, legislative

World War II Memorial from the Washington Monument

Without noticeable prompting or any other reason, the Senate Banking Committee discharged the Greatest Generation Memorial Act (S. 1596) and was passed by unanimous consent by the Senate.

If passed, the bill will require the minting of up to 50,000 $5 gold coins, 400,000 $1 silver coins, and 750,000 clad half-dollar coins in commemoration of the National World War II Memorial in Washington.

At the end of the sale, the Treasury will pay all surcharges ($35 per gold coin, $10 per silver dollar, and $5 per clad half-dollar) to the Friends of the National World War II Memorial to help maintain the memorial.

The Senate sent the bill to the House of Representatives, where it is being held at the desk because it was a bill not introduced by the majority party.

S. 1596: Greatest Generation Memorial Act

Summary: This bill directs the Department of the Treasury to mint and issue up to 50,000 $5 coins, 400,000 $1 silver coins, and 750,000 half-dollar clad coins in commemoration of the National World War II Memorial in the District of Columbia. The design of the coins shall be emblematic of the memorial and the service and sacrifice of American soldiers and civilians during World War II. All surcharges received from the sale of such coins shall be paid to the Friends of the National World War II Memorial to support the National Park Service in maintaining and repairing the memorial, and for educational and commemorative programs.

Introduced in Senate — May 12, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — May 12, 2021

Senate Committee on Banking, Housing, and Urban Affairs discharged by Unanimous Consent. — May 16, 2022

Passed Senate with an amendment by Unanimous Consent. (text of amendment in the nature of a substitute: CR S2515-2516) — May 16, 2022

Measure laid before Senate by unanimous consent. — May 16, 2022

Message on Senate action sent to the House. — May 17, 2022

May 23, 2022 | coins, news

Sorry… we are one day late for many reasons including just being tired. More to come.

One of the cans found as part of the Saddle Ridge Gold Coin Hoard

Of course, the metal detectorists are looking for treasures. Few save any of the coins they find. They will consign the coins to an auction and collect the payment. The coins will end up in the hands of collectors and museums that will enjoy them for years to come.

I have never been interested in exploring with a metal detector. In the United States, most finds are limited to the 200-300 years. Detectorists find belt buckles, watches, rings, some coins, and other items dropped along the way. But nothing compares to finding coins from over 1,000 years ago or medieval coins from 500 years ago.

These unburied coins are sometimes the only record of history. Recently, a hoard revealed a problem with inflation during the Roman Empire that taught historians about ancient economics.

I am not saying that there are no exciting finds in the United States. The Saddle Ridge Gold Hoard is a recent example, but the finds in England and the rest of Europe can change our knowledge of history.

I do not know if I will be able to go to Europe to see if I can find a treasure, but it is interesting to watch from afar.

And now the news…

May 13, 2022

One of only three known gold examples of the “Eid Mar” aureus A small but potent piece of history is up for sale in Zurich this month, when Numismatica Ars Classica offers one of only three known examples of the “Eid Mar” aureus, celebrating the “liberation” of Rome after the bloody assassination of the dictator Julius Caesar on the Ides of March in 44BC.

→ Read more at

ft.com

May 18, 2022

Britain’s Royal Mint unveiled a special new commemorative rainbow-colored 50 pence coin on Wednesday as a tribute to celebrate the 50th anniversary of the Pride UK movement. The coin, designed by east London artist and LGBTQ activist Dominique Holmes, uses state-of-the-art printing technology to emboss it with the colors of the Pride progress flag.

→ Read more at

nbcnews.com

May 20, 2022

When it comes to buying silver , coins are one of the most popular places to start. A coin collector or investor who is used to buying gold may like the idea of taking that same investment strategy and applying it to silver.

→ Read more at

menafn.com

May 20, 2022

About 1,800 antique coins, jewellery and stamps, pottery plates with inscriptions, and an ancient bronze figurine were seized this week at the home of a resident of the city of Modi’in in the centre of the country, the Israel Antiquities Authority (IAA) announced Thursday.

→ Read more at

jwire.com.au

May 9, 2022 | books, coins, education, poll

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

As I was thinking about sharing my experiences, I wondered where most people learned about their collectibles. But the resources I had are different than those available today. Even the way we take in and understand knowledge is different. I thought it would be interesting to ask the numismatic community how they learn about collecting.

So let’s ask the question:

Loading ...

May 8, 2022 | coins, commentary, news

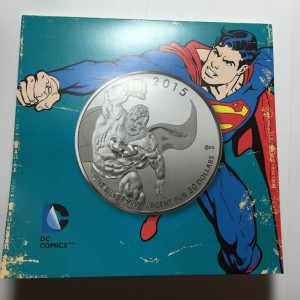

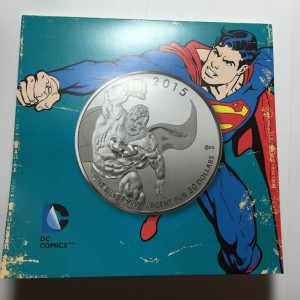

Reverse of the Royal Canadian Mint 2015 Superman $20 for $20 coin featuring “The Man of Steel”

After reading yesterday’s blog post, the comics dealer asked me how to become a coin dealer to sell comics-themed coins.

My reader knows that the comics industry is exploding and that the publishers are dabbling in non-fungible tokens (NFT) to see if they can extend the market. Those skeptical of the NFT market are looking for alternatives. A comics dealer that expanded to other publications, toys, and other collectibles understands that extending his market with coins will be profitable.

Walk into any hobby shop and see how every hobby has evolved. Comics, sports, and antiques have seen a rise in collecting, and all have seen the benefit of cross-collecting. A sports dealer is also selling comics and other collectibles with sports themes. Comics dealers are collectible cards and souvenirs from the ComicCons, the same as the sports dealers are selling game tickets.

Coin dealers extend their business into metals and jewelry, and their stores look the same as they did 10 years ago. The dealers may be making a living, but it is not expanding the hobby. But is it their job to expand the hobby or make a living? Unfortunately, this attitude is typical with the dealers trying to set ANA policy and is not helping the hobby’s growth.

And now the news…

May 4, 2022

The most successful artistic design of the Croatian national side of the €1 coin has been selected, the Croatian National Bank (HNB) said in a press release.

→ Read more at

croatiaweek.com

May 5, 2022

Found in Switzerland, some of the buried Roman coins were minted during a time of relative political stability, between 332 and 335 C.E.

→ Read more at

smithsonianmag.com

May 7, 2022 | coins, commentary

Cover with the 2015 $20 Canada Superman coin

Free Comic Book Day is more than an effort to get people into the stores to buy comics. The publisher will take the opportunity to tweak a story, start a new story arc, or introduce new characters. They spend a few pages in the free comic book to enhance their stories or introduce new characters. The free comic book may also have an existing story that can summarize the story to convince readers to start reading the series.

Free Comic Book Day is more than a giveaway day. It is a marketing tool for the story writers to interact with the readers and get them attracted to the stories. The publishers and store owners use the giveaway to keep current customers interested and lure in new customers.

Although the publishers will introduce many new stories and characters, almost 90-percent will not last more than a few issues. The publishers know this and are willing to try whatever it takes to ensure that the readers come back for more. Once the readers are hooked, the publishers extend the brand into movies and other collectibles where collectors can purchase the merchandise anywhere.

The comic book industry accomplishes more in one day than the numismatic industry accomplishes in one week. Considering how ubiquitous money is in society, It is any wonder that we can raise new collectors.

2016 Canada Batman v Superman: Dawn of Justice $20 silver coin

There is nothing wrong with comics and the comics culture. Comics readers love their characters, especially the superheroes, that they extend their buying beyond the comic book. Why not invite them into your shop to add comic book character coins to their collection.

You may not find coins with Superman, Batman, Captain America, or Spider-man exciting coins, but they are legal tender coins made of silver or gold that excite this crowd. Contact the publishers and see if you can source material to supplement the coins. It could create a partnership that could benefit both collectibles.

It might not be selling rare proof-like Morgans, but it will get people in your shop to look at your other inventory. Maybe they will see the Buffalo nickels and think those Type 1 coins are so cool that they might start a collection.

I have an idea… on Free Comic Book Day, the numismatic community can work with Marvel and DC to create a brass token that would be available to the collecting public. Some to the coin store, get the token for free. Let the publishers work on tokens and medals associated with their comics and sell them through coin stores. Then the coin stores can contact the New Zealand Mint or the Royal Canadian Mint to purchase a supply of comic book character coins and join the fun.

May 6, 2022 | coins, quarter

The current quarter in the American Women Quarters Program honors Dr. Sally Ride. These coins are showing up in change in an increasing number, with several landing in my pocket this week.

The current quarter in the American Women Quarters Program honors Dr. Sally Ride. These coins are showing up in change in an increasing number, with several landing in my pocket this week.

Dr. Ride was a physicist, astronaut, educator, and the first American woman to rocket into space aboard the Space Shuttle Challenger in 1983. At 32, Ride was also the youngest American in space.

On STS-41G in 1984, also on the Challenger, Ride was joined by Dr. Kathryn Sullivan, a geologist, making it the first space mission with two female crew members.

Following her retirement from NASA, Ride and Tam O’Shaughnessy teamed up to write science books for young people. They also started an educational company to inspire young people, especially girls, in science, technology, engineering, and math (STEM).

Ride received many honors during her life, including induction into the Astronaut Hall of Fame, National Women’s Hall of Fame, and Aviation Hall of Fame.

The reserve depicts Dr. Sally Ride next to a window on the space shuttle. It was designed by Elana Hagler of the Artistic Infusion Program and sculpted by U.S. Mint Medallic Artist Phebe Hemphill.

Apr 24, 2022 | coin design, coins, news

I am sponsoring

GOLD memberships for new and renewing memebers of the American Numismatic Association. This is a limited-time offer to celebrate

National Coin Week and the 131st anniversary of the American Numismatic Association. The offer expires on April 25, 2022. Call (800) 514-2646 or visit

info.money.org/ncw-2022-barman to take advantage of this offer. Be sure to apply code

NCW22SB at checkout!

National Coin Week wraps up this weekend, celebrating coin designs. One thing that has been constant throughout the 21st century is changing coin designs. It started with the 50 State Quarters program and has affected every circulating coin except the half-dollar and the dime.

National Coin Week wraps up this weekend, celebrating coin designs. One thing that has been constant throughout the 21st century is changing coin designs. It started with the 50 State Quarters program and has affected every circulating coin except the half-dollar and the dime.

Although the design has lasted more than 25 years, it is not likely that the Treasury Department will change the design. The story of the JFK assassination continues to resonate with a significant sector of the population, and Kennedy’s popularity remains.

Franklin D. Roosevelt’s appearance on the dime is different. Roosevelt helped create the March of Dimes, and following his death, Congress decided that adding his portrait to the dime was the best way to honor the late president. Since its release in 1946, the dime’s design has not changed.

The Roosevelt Dime is the smallest coin produced by the U.S. Mint. Changes to the design may not display as well. When John Sinnock designed the coin’s reverse, the similarity with the Mercury dime was not a coincidence. Aside from the symbolism, the U.S. Mint knows the design will strike well on a small planchet.

While the ability to strike the designs continues to be a concern, modern technology could help produce a suitable design. The problem is, what would make an appropriate design?

Until someone in Congress proposes a bill to change the dime’s design, it will remain the longest-running design on U.S. coins.

And now the news…

April 17, 2022

“The Romans had been used to extremely fine silver coinage, so they may well have lost confidence in the denarius when it ceased to be pure,” Matthew Ponting, one of the archaeologists involved in the research, said in a media statement.

→ Read more at

mining.com

April 17, 2022

An approximate amount of $1 has been received. The U.S. economy is estimated to grow by $5 trillion over the next five years. Coins with physical characteristics. The 11th quarter accounts for about 80% of this value. A billion-dollar note is $100 worth 5 billion. 70 percent of new bills are written to replace older notes as they go out of circulation each year.

→ Read more at

malaysiandigest.com

April 18, 2022

Nearly 1,300 priceless 4th-century AD Roman coins, all in a pot, were found in September 2021 near Bubendorf, Basel County, Switzerland by amateur archaeologist volunteer, Daniel Ludin.

→ Read more at

ancient-origins.net

April 20, 2022

A family's new truffle-hunting puppy is already worth its weight in gold after digging up 15 sovereign coins worth £6,000 on its first walk.

→ Read more at

dailymail.co.uk

April 22, 2022

Out on his daily constitutional, a dog in Poland unexpectedly struck gold, or rather, silver.

→ Read more at

ancient-origins.net

→ Read more at

→ Read more at

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.

I am getting ready to open the next chapter of my life, and I was thinking about how I can leverage my knowledge and experience to enhance the collecting community. As an experienced collector of all types and a dealer in areas other than numismatics, I learned a lot about collectors and their habits that could benefit a general audience.