Oct 6, 2021 | coins, Federal Reserve, policy, US Mint

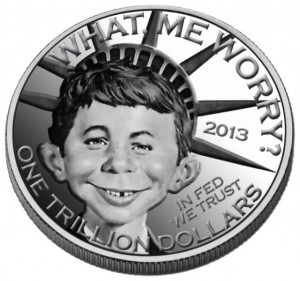

The $1 trillion coin concept turns up like a bad penny.

Also turning up are all pundits, politicos, reporters, and sycophants explaining why the U.S. Mint should or should not strike the coin. The problem is that EVERYONE IS WRONG!

Let’s look at the FACTS.

FACT: Before a coin leaves the U.S. Mint, the purchaser must pay for the coin.

The Federal Reserve purchases business strike coins at face value. The money is deposited in the U.S. Mint’s Public Enterprise Fund.

Collectors pay for collector coins through the U.S. Mint’s retail and e-commerce operations. When the money is collected, they deposit the funds in the U.S. Mint’s Public Enterprise Fund.

FACT: The United States Mint has successfully argued in court that a coin is not legal tender until it is paid for.

After the U.S. Mint discovered the existence of several 1933 Double Eagle coins that were supposedly melted, the Secret Service investigated and seized several coins. Through the 1950s, government lawyers argued that the coins were government property since the coin was never monetized.

During the case of the Farouk-Fenton double eagle coin, the government used the same argument. Even though there was an export license for the coin issued to King Farouk of Egypt, the government maintained that the lack of monetization made the coin illegal.

As part of the $7,590,020 paid for the 1933 Double Eagle in 2002, $20 of the purchase price was paid to the U.S. Government to monetize the coin. When Sotheby’s sold the coin in June for $18,872,250, the coin came with a certificate from the U.S. Mint declaring its Legal Tender status.

If the U.S. Mint does not monetize a coin until someone or entity buys it, then how will striking a $1 trillion coin help anything?

Even as crazy as government generally accepted accounting principles (GAAP) may appear to the commercial market, Government GAAP still requires double-entry bookkeeping. In double-entry bookkeeping, if an asset is added to one part of the ledger, there must be a debit on another.

Forget the political arguments about the debt. When the government needs money, it sells bonds to finance its obligation. The bond is the created asset, as the coin. The asset is purchased, adding cash to the general treasury. In bookkeeping terms, an asset entry and an associated debit entry.

Who is going to buy the coin?

The Federal Reserve is not going to buy the coin. Bonds, warrants, and other investments have tangible returns. The investments have value and can be traded on the equity markets keeping the books balanced. What happens if $1 trillion is tied up in a non-investing asset?

If the Federal Reserve buys the coin, the general treasury may see a $1 trillion windfall, but the Federal Reserve will have $1 trillion less economic power. It is $1 trillion less in short-term loans to large financial institutions and quantitative easing that is keeping the economy in control.

If the Federal Reserve buys the $1 trillion coin, it will create a $1 trillion hole in the economy.

The U.S. Gross Domestic Product (GDP), the monetary value of all goods and services, is estimated at $22.675 trillion. Taking $1 trillion out of the economy will reduce the economy by 4.4-percent.

As the Great Recession of 2008 raged, the GDP lost 1-percent of its value by 2009. If a one percent drop caused the most significant economic calamity since the Great Depression, what will happen if the GDP contracts by more than 4-percent?

Of course, Congress can pass a law that changes how the U.S. Mint determines the legal tender status of coinage they manufacture. But the likelihood of that happening is about the same as the U.S. Mint striking a $1 trillion coin.

Oct 4, 2021 | coins, commemorative, legislative

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

Regardless of the side of the aisle you follow, Congress is a very frustrating body. Members live in their own world, interested in what they can do to make them look better. When a citizen is interested in something that is not prominent in the daily news cycle, the response is cold or non-existent.

In the last few months, I tried to inquire about the scheduling of hearings in the Congressional committees regarding coin legislation. There were no answers.

For the last ten years, every Congress has promised to return to regular order. It seems that what we have now is regular order, meaning that coin-related legislation will not be heard until a holiday period or during the lame-duck session in 2022.

Welcome to the new regular order.

H.R. 4429: Semiquincentennial Commemorative Coin Act

Summary: This bill directs the Department of the Treasury to mint and issue $25.00 gold coins, $2.50 silver coins, 25 cent clad coins, and proof silver $2.50 coins in commemoration of the 250th anniversary of the establishment of the United States. The designs of the coins shall be emblematic of the semiquincentennial anniversary of the establishment of the United States of America and celebrate 250 years of our nation. On each coin there shall be

- a designation of the value of the coin;

- an inscription of the years 1776-2026; and

- inscriptions of the words Liberty, In God We Trust, United States of America, and E Pluribus Unum.

Treasury may issue coins under this bill only during the period beginning on January 1, 2026, and ending on December 31, 2026. All sales of coins issued shall include a surcharge as prescribed by this bill. All surcharges received by Treasury from the sale of such coins shall be paid to the America 250 Foundation to fund the restoration, rehabilitation, and interpretation of units of the U.S. National Park System and its related areas, as a legacy of the semiquincentennial commemoration.

Introduced in House — Jul 13, 2021

Referred to the House Committee on Financial Services. — Jul 13, 2021

S. 2384: Semiquincentennial Commemorative Coin Act

Introduced in Senate — Jul 20, 2021

Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. — Jul 20, 2021

H.R. 4703: Sultana Steamboat Disaster Commemorative Coin Act of 2021

Summary: This bill directs the Department of the Treasury to mint and issue $5 gold coins, $1 silver coins, and half-dollar clad coins in recognition and remembrance of the Sultana Steamboat explosion of 1865. The designs of the coins shall be emblematic of the historical significance of the Sultana disaster, with special recognition and remembrance given to the lives lost, including the recently released Union soldiers returning home after having been prisoners of war during the American Civil War at Confederate prisons located at Andersonville and Cahaba. Treasury may issue coins minted under this bill to the public only during the one-year period beginning on January 1, 2023. All sales of such coins shall include a surcharge to be paid to the Sultana Historical Preservation Society, Inc. to establish and maintain a new Sultana disaster museum.

Introduced in House — Jul 27, 2021

Referred to the House Committee on Financial Services. — Jul 27, 2021

H.R. 5232: Working Dog Commemorative Coin Act

Introduced in House — Sep 10, 2021

Referred to the Committee on Financial Services, and in addition to the Committee on the Budget, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. — Sep 10, 2021

H.R. 5472: To amend title 31, United States Code, to limit the face value of coins.

Introduced in House — Sep 30, 2021

Referred to the House Committee on Financial Services. — Sep 30, 2021

Oct 3, 2021 | coins, news

The Sun is searching eBay for interesting coins and hyping the prices as part of their U.S. Edition (Image courtesy of The U.S. Sun)

In the U.K. version of The Sun, someone watches eBay auctions and writes about whatever sells for more than face value. There are many stories about the extraordinary prices for the sale of 50 pence circulating commemoratives, error coins, and some demonetized the Royal Mint issues.

Now that The Sun is publishing for the United States market, an editor is watching eBay for the sale of U.S. coins. Although most of the stories have been about error coins, they have picked up on higher prices of classic coins. Almost all of their stories have been about what appears to be well-preserved ungraded coins. These are the type of coins that someone might find in a relative’s draw.

These columns have a lot of fans in the United Kingdom. It will be interesting to see if they catch on in the United States.

And now the news…

September 27, 2021

Freedivers in Spain notified the authorities after finding a handful of gold coins dating to the fall of the Western Roman Empire (Image credit: Xàbia City Council; University of Alicante )

→ Read more at

livescience.com

September 28, 2021

Research commissioned by the South African Reserve Bank (SARB) shows that there is an economic case for introducing a R10 coin in South Africa – however, there are concerns about uptake from the public, says Pradeep Maharaj, the central bank’s chief operating officer.

→ Read more at

businesstech.co.za

September 29, 2021

FacebookTwitterWhatsAppEmailPrintFriendly A commemorative $1 coin issued by the Royal Canadian Mint marks the 125th anniversary of the discovery of gold in the Klondike region of Yukon.

→ Read more at

rcinet.ca

October 2, 2021

The story of how a poor Irish migrant from Donegal became the face of American’s ten-dollar gold coin has been made into a documentary. Mary Cunningham, a native of Carrick, was working in a restaurant in New Hampshire when she caught the eye of the famous sculptor Augustus Saint-Gaudens.

→ Read more at

irishcentral.com

October 3, 2021

MANILA – The Bangko Sentral ng Pilipinas (BSP) on Sunday called for a law against hoarding of extremely large volume of coins after some P50 million worth of loose change were found in Quezon City last week.

→ Read more at

news.abs-cbn.com

Sep 26, 2021 | coins, news, US Mint

David J. Ryder, Director of the U.S. Mint.

Ryder served as the 34th and 39th Director after being appointed by two different administrations. Ryder came into this term touting his work with physical money security. During his confirmation hearing, Ryder said he worked for Secure Products, a company focused on developing anti-counterfeiting solutions for currency and branded products. Ryder also testified that he was involved in developing the Royal Mint’s new 12-sided one-pound coin.

The U.S. Mint claims security measures built into the new American Silver and Gold Eagle coins. However, there do not seem to be breakthroughs similar to those used by the Royal Mint and Canadian Royal Mint on their bullion products.

Ryder may want his legacy to be introducing new products, but the public will remember the colossal failure of the U.S. Mint’s e-commerce system. As Director, he was supposed to oversee the entire operation and not just one aspect. Those failures will weigh on his legacy.

Alison Doone is a career civil servant who entered the Senior Executive Service (SES) in 2004. After working at several other agencies, Doone served as the Mint’s Chief Administrative Officer since March 2021.

The Federal Vacancies Reform Act of 1998 requires the president to send a nomination to the Senate within 90 days to fill a vacant position. During that time, an acting director can serve in that role for only 180 days. As we saw in the 2,629 days (7 years, 2 months, and 13 days) between the resignation of Edmund Moy and the confirmation of David Ryder, the government has ways to get around the law to maintain operational consistency.

And now the news…

September 17, 2021

If artifacts could talk, we’d love to hear this one’s tale. This pierced German coin from the 17th century was recovered during a systematic excavation at the Jacob Jackson Home Site, part of Harriet Tubman Underground Railroad National Historical Park (HATU).

→ Read more at

nmscarcheologylab.wordpress.com

September 17, 2021

Readers of a certain age will remember the florin, or flóirín as it was in Irish. Those of an uncertain age will even recall when it was Ireland’s two-shilling coin, complete with the leaping salmon of Percy Metcalfe’s classic 1928 design.

→ Read more at

irishtimes.com

September 22, 2021

The coin, known as the Triple Unite, was minted in Oxford in 1643 during the English Civil War and had the value of 60 shillings, or three pounds.

→ Read more at

bbc.com

September 23, 2021

LAKE MARY, Fla. – A Florida teenager recently made a spectacular find while on an ocean dive: a rare gold coin believed to be from the 1715 Spanish Treasure Fleet.

→ Read more at

fox35orlando.com

September 24, 2021

(CNN) — Two amateur free divers have found one of the largest collections of Roman coins in Europe off the east coast of Spain. Luis Lens and César Gimeno were diving off the island of Portitxol in Xàbia on August 24 when they found eight coins, before further dives by archaeologists returned another 45 coins, according to a press release from the University of Alicante on Tuesday.

→ Read more at

edition.cnn.com

Sep 21, 2021 | coins, commentary, Eagles, scams, technology

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China who advertised on Facebook.

Over the last few weeks, I have been counseling several people about requesting a chargeback for receiving counterfeit merchandise. Requesting chargebacks have their problems, too. Some credit card issuers will use the chargeback as an excuse not to renew your credit card.

During this time, another group has been trying to work with Facebook to stop the scammers from reaching consumers.

On Monday, three numismatic groups sent a letter to Facebook Founder Mark Zuckerberg asking why he did not respond to a similar letter a month ago. The letter was signed by Doug Davis, Director of the Anti-Counterfeiting Educational Foundation, Mark Salzberger, Chairman of Numismatic Guaranty Company, and Bob Brueggeman, Executive Director of the Professional Numismatists Guild. You can read the press release and letter here.

It is not surprising that Facebook and Zuckerberg have not answered previous letters. If you watch other media reports about Facebook, the company is notorious for trying to sweep issues under the proverbial rug until something brings it to the forefront. While Facebook claims they are responsive to the communities, they respond solely when someone yells and causes an uproar.

Although some find Facebook useful, it is a cesspool of scammers and trolls playing on the gullible looking to prove P.T. Barnum correct: There’s a sucker born every minute.

News organizations worldwide have reported how criminals use Facebook advertising for crimes, including selling counterfeit merchandise, false activism (e.g., Fake News), and human trafficking.

Facebook’s response has been the same. They promise to try harder and look to add code to help protect their users. The result is that they try to implement a technical solution that works to the point of being able to placated the current activists. The problem is that while Facebook depends on artificial intelligence to protect its platform, company leadership has not shown any real intelligence to understand that there may not be a technical solution to every problem.

It is easier for Facebook to scan for words that someone believes are hurtful than to look at an advertisement selling a one-ounce silver coin for less than its silver value. Besides, the alleged bully is not paying for to have their content distributed to a target audience that includes you.

Facebook really doesn’t care because they are getting paid. They were being paid as late as 2018 by a Russian troll bot for placing activist ads after being admonished for accepting campaign ads paid in Russian rubles in 2016.

Zuckerberg and company do not care. He is getting paid and so is their management. They lie just enough to get past alleged watchdogs in a way to keep confidence in their market price. After all, Facebook stock (NASDAQ: FB) is up 32.25% for the year as of Sep 20, 2021. Why should they care what you think about their advertisers? In the meantime, consumers are getting defrauded by scammers allowed to roam freely by a company that advertises on television as being a place to build a community.

Do not expect help from the government. In between their partisan fighting, members of Congress do not have the knowledge or competence to figure out how to fix the issue. Most members of Congress are lawyers with no technical background nor did any study the technical issues enough to make competent decisions.

Although Congress is to blame, the voters must accept their part of the responsibility. Instead of voting in competent people, they send these old folks with no technical background back to Washington. Many have held their seats for over 20 years without any incentive for advancement. So they grow old without learning new ways and blame everyone else for what they are not doing. Think of the problem like this: 26 of the 100 Senators are 70 years of age or older. None of these people had any experience with computers as students or early in their careers. Most can barely use a smartphone (Steve King actually asked Google CEO Sundar Pichai why his daughter’s iPhone behaved strangely). Even if they did, when was the last time you saw an elderly member of congress with a computer or even a smartphone?

Davis, Salzberg, and Brueggeman will have an uphill battle with Facebook. Everyone does. But the ACEF and PNG need to think beyond talking reason to Zuckerberg. They need to work with Congress to help them understand the technologies and what regulations will be effective without putting undue limits on the technology companies.

NOTE TO THE DAVIS, SALZBERG, AND BRUEGGEMAN:

I know of one person in the numismatic industry that has a background in technology and public policy. This person worked as a contractor to the federal government for 25 years as an information security analyst. This person worked for a PAC concerned with numismatic issues and has a Masters’ with a concentration in information security and technology public policy from Carnegie Mellon University. You can contact this person at

coinsblog.ws/contact.

Sep 20, 2021 | cash, cents, coins, news

Yes, I’m a day late. At least I’m not a dollar short!

It is not a surprise to economic and market watchers that there is a perceived coin shortage. The problem is not just in the United States, but worldwide central banks are trying to fix their circulation issues.

It is not a surprise to economic and market watchers that there is a perceived coin shortage. The problem is not just in the United States, but worldwide central banks are trying to fix their circulation issues.

Over the last three months, the Reserve Bank of India (RBI) has been trying different tactics to get money to circulate. In addition to striking more coins, they promote new designs and a program for citizens to redeem old coins for the newly issued coins. It has a moderating effect on the COVID crisis at high levels in the country.

India has also been dealing with rumors one type of circulating coin has been counterfeited or been withdrawn and not legal tender. However, the RBI has insisted that the coins are legal tender but continue to promote them with the redesign.

The Royal Mint has stepped up the production of 1 penny coin for circulation. Physical money is used more in the UK than electronic transactions, especially outside of the cities. Although some feel the penny has been overproduced and would rather see the 2 pence coin used, the increase in the number of transactions since the lifting of COVID restrictions created the demand.

The United States continues to see shortages. Most of the reports are coming from outside of the major metropolitan areas. Most are looking for one-cent coins. Experts are blaming accelerated consumer spending in areas where cash payments are more prevalent. More populated urban regions are seeing more electronic transactions than cash.

Let’s keep the economy moving. Spend those coins! (not the ones you collect)

And now the news…

September 14, 2021

Bankers thought the nationwide coin shortage was over, as the U.S. economy reopened and previously housebound consumers were able to unload more of their change. But a combination of factors — including government stimulus payments, accelerated consumer spending and the threat of the COVID-19 delta variant — has stymied progress and forced retailers to resort again to asking shoppers for exact change.

→ Read more at

americanbanker.com

September 14, 2021

Croatian National Bank (HNB) Governor Boris Vujčić said on Monday after meeting with European Commission Vice President Valdis Dombrovskis that a test production of euro coins with Croatian national motifs should begin by the end of this year, with possibly about two million coins being minted.

→ Read more at

croatiaweek.com

September 15, 2021

LAS CRUCES – The Las Cruces Police Department received two reports of movie prop money that was passed as legal tender over the weekend, a news release on Monday stated. In the news release police stated movie prop money can look like actual currency but, in most instances, does not have the same texture.

→ Read more at

lcsun-news.com

September 15, 2021

A very rare large gold coin from the reign of Charles I is expected to fetch £50,000 when it is sold at auction.

→ Read more at

newschainonline.com

September 15, 2021

A huge hoard of Iron Age gold artifacts has been uncovered by an amateur metal detectorist in Denmark. The "enormous" find consists of almost one kilogram (2.2 pounds) of gold buried 1,500 years ago, according to a press release from the Vejlemuseerne museum, which will exhibit the hoard.

→ Read more at

cnn.com

September 16, 2021

One penny coins were back in production last year after none were minted for general circulation in the previous two years, Royal Mint figures show.

→ Read more at

bbc.com

Sep 16, 2021 | coins, Royal Mint

Three Graces UK Five-Ounce Silver Proof obverse (trial piece) – TR213GS5

One of the more fascinating events of Collect Week is the auction for Die Trial Pieces. Die Trial pieces are coins struck before the production run as a test. The Royal Mint has a good description of Die Trials on its website.

The list of die Trial Pieces includes gold and silver strikes from 2019 and 2020. Each coin has a hallmark attesting to the quality of the strike as defined by the Royal Mint. The Royal Mint published a list of 60 Die Trial Pieces that will be in the auction.

There are also webinars held during the week. You may have to adjust your sleep pattern to attend if you are interested, but it might be worth your time. The list of webinars advertised are:

If I get up in the middle of the night to attend a webinar, I will attend “The Importance of Die Trial Pieces.” The description makes it sound like they will discuss the minting process from the Royal Mint’s perspective.

“Making the Grade” may be worth an extra pot of coffee to see how the UK views grading.

Learning more about collecting is fun, and it is good to hear from different voices.

Sep 15, 2021 | coins

2021-W American Silver Eagle Type 1 Proof

Whether you are putting together a price guide or anything to covey information, you must first determine what data you want to report. As I look at the American Eagle series, reporting prices is not the same as a price guide with grades across the top and rows for each year and prices on each row. It is not how American Eagles are collected.

American Eagle coins are collected either in their original mint packaging, also called their original government packaging (OGP), or graded by a third-party grading service and housed in a holder. Based on a quick, non-scientific survey, it does not appear that many people are collecting American Eagle bullion coins and filling holes in albums.

The first decision was easy. American Eagle coins struck for the numismatic market would be priced based on whether the collector had the OGP or not. While using the data from eBay to see if there was a price difference, there was a $10-20 difference for proof coins and an $8-15 difference for other strikes, like the burnished American Silver Eagle coins.

Many people believe that eBay is not a good source of data. Although there is a bias against eBay, the information learned by analyzing the buying trends from such a diverse market can tell a story. I will not base the prices on a survey of only eBay. The book will include a survey of dealer prices and other markets.

The first two columns of prices will be if the coin is in its OGP or not in its OGP. The rest of the table will have columns for graded coins.

Prices for graded coins have different considerations. At what point does the difference between grades become irrelevant? Using the eBay survey, it seems that the numismatic premium is significant for a 70 grade and lesser for 69. When the grade is 68 or lower, the average appears to be bullion cost plus a smaller numismatic premium.

Bullion coins do not come in packages, but there are other considerations. The U.S. Mint packs the bullion coins in special rolls that seem to affect prices. Rolls get packed in monster boxes for shipping to authorized purchasers. Those monster boxes also have a different price structure.

The problem is that the rolls and monster boxes have a limited shelf-life. Although there appear to be some rolls and monster boxes from previous years, most of the rolls for sale are from the current year.

One more consideration is that some collectible American Eagles are only available as part of sets. Sets in their OGP will be priced based on market factors while providing only the price for graded coins in the main tables.

For now, the price tables will look like this:

Prototype ASE Proof Price Table

| Year |

Mintage |

OGP |

<69 |

69 |

70 |

| 1986-S |

1,446,778 |

45 |

55 |

72 |

350 |

| 1987-S |

904,732 |

. . . |

Note that the price data is just filler. They are not correct!

Prototype ASE Bullion Price Table

| Year |

Mintage |

Bullion |

<69 |

69 |

70 |

| 1986 |

5,393,005 |

35 |

45 |

66 |

220 |

| 1987 |

11,442,335 |

. . . |

If you have another idea, please leave it as a comment below.

Sep 13, 2021 | coins, Eagles, silver, US Mint

I like big silver coins.

I like big silver coins.

Some like gold. Others like copper. I like silver.

Since 1986, I have been collecting American Silver Eagle Proof coins. It is a collection my later father started for me and, until 2019, purchased the individual proof coins. I supplemented the collection with the special sets that the U.S. Mint issued, but it is a nearly complete set of proof coins in their original government package.

Although I have to find the 1995-W anniversary set for the elusive 1995-W American Silver Eagle, I have been trying to keep the collection up to date. It is why I hung up on a business call to make sure I was logged in to the U.S. Mint website to purchase the Reverse Proof Two-Coin Set.

By 11:58 AM, I was on the page for the set. As the time counted down to noon, I refreshed the page waiting for the Add-to-Bag button.

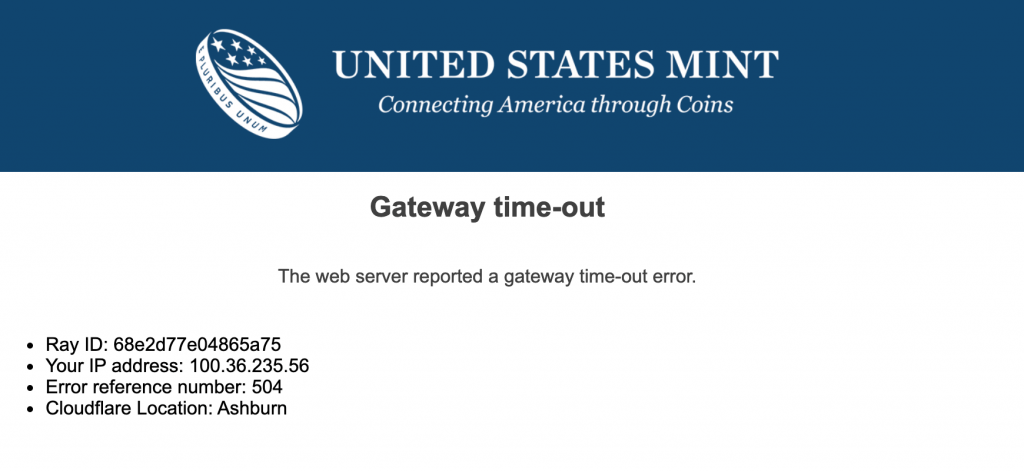

I am probably not the only one pushing the refresh button two minutes until noon. Until the Add-to-Bag button appeared, the system was responsive. Of course, the page was likely cached by Cloudflare or my ISP (Comcast), but it was responsive. At the stroke of noon, all that ended.

The first thing we notice is that someone rebranded the Cloudflare gateway error page. Although I do not have inside information, I would bet that Cloudflare told the U.S. Mint to make it so that they don’t get blamed.

I wonder if Cloudflare demanded the U.S. Mint rebrand their gateway error page so that they don’t get the blame?

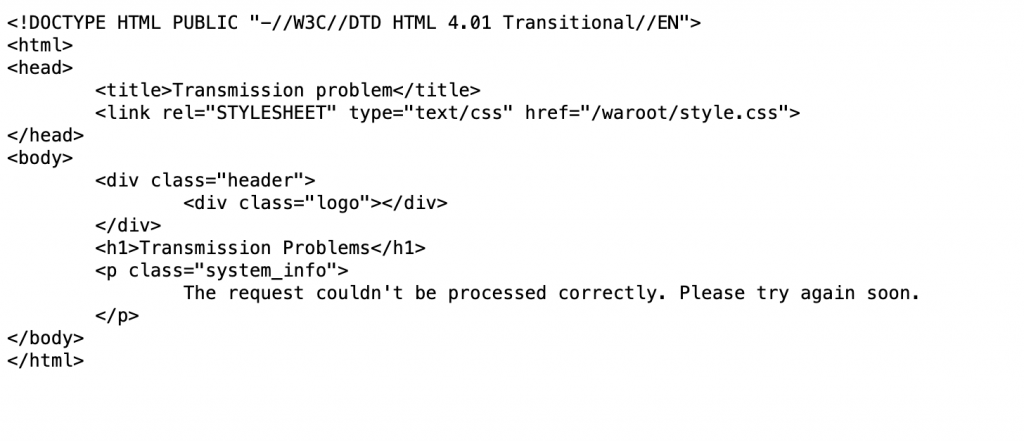

Another change is the HTML file that appeared as a text file. Under Safari, the file type kept downloading the information to my Downloads folder. Under Firefox, one of the systems in the chain treated me to a small HTML file.

Under the hood HTML output as a web page?

Somehow, a set made it into my bag, and I made it to the checkout page. I couldn’t use my stored credit card because I would see the Bad Gateway error. The card was next to me, and I furiously typed.

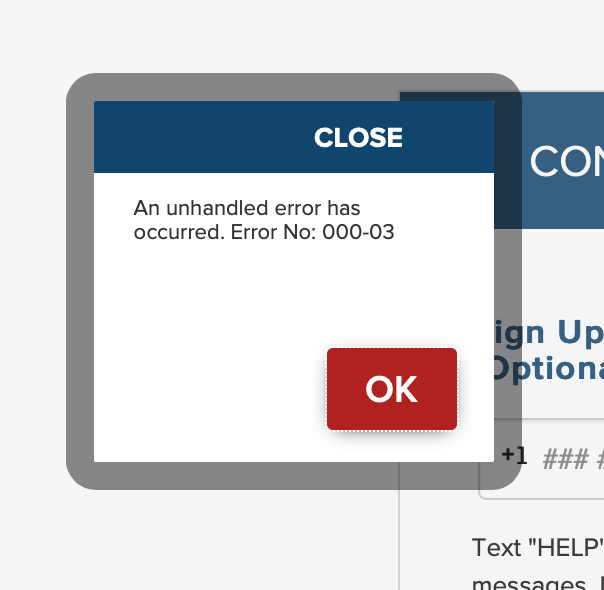

Suddenly, there was a new error. I don’t know what it means, but the U.S. Mint’s programmers did not know how to handle that error. How do I know that? The error message provided said so.

This is a new error. In my days as a programmer, we would be chastised for this type of error message!

According to several reports, the website crashed at the beginning of the process. It was difficult to tell, but the U.S. Mint admitted there were problems. They announced that there were products available at 1:19 PM on social media.

After stubborn persistance, I received the confirmation of my order at 12:48 PM.

I asked the U.S. Mint for comment. I will let you know what they say.

Sep 12, 2021 | coins, counterfeit, news

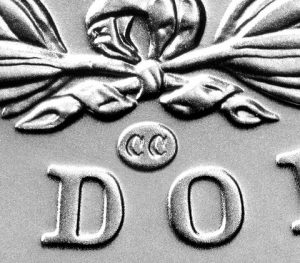

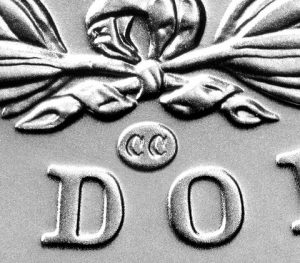

CC Privy Mark for the 2021 Morgan Dollar

According to Coin World, the coins have several issues, but the primary problem is that the U.S. Mint has not shipped any coins. How can you buy a coin that the manufacturer has not shipped?

Another scam you can find on eBay is that some sellers are offering MS-70 coins for “pre-sale.” How can a seller sell a coin graded MS-70 that has not been released or graded by the grading service? How will these sellers guarantee that the coins they receive from the U.S. Mint will grade MS-70 unless they pay off the grading service?

I know many collectors want to add these coins to their collection. You may want to wait until the coins are issued, the grading services see the coins in hand, and the suckers get out of the market. If you want to see what I mean, look at the 25th Anniversary American Silver Eagle Set. After they were released, the prices climbed to $500-700 with limited availability. Although the price numbers have not changed, the value of $500 is less than in 2011 and is generally available.

And now the news…

September 10, 2021

Renovators discovered a hidden box and pouch stuffed with rare gold coins, minted during the reigns of French Kings Louis XIII and Louis XIV

→ Read more at

smithsonianmag.com

September 12, 2021

Telangana’s Rachakonda police seized fake Indian currency notes with a face value of over Rs 1 crore and genuine currency worth Rs 1.3 lakh after busting a gang involved in cheating people on the pretext of exchanging black money.

→ Read more at

indianexpress.com

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

It has been a few months since I reported on the numismatic-related bills in Congress. For the last few months, there has been little to report. Members of Congress have introduced several vanity bills, but watching their actions has been frustrating.

→ Read more at

→ Read more at

It is not a surprise to economic and market watchers that there is a perceived coin shortage. The problem is not just in the United States, but worldwide central banks are trying to fix their circulation issues.

It is not a surprise to economic and market watchers that there is a perceived coin shortage. The problem is not just in the United States, but worldwide central banks are trying to fix their circulation issues.