Oct 26, 2021 | commentary, US Mint

Ventris Gibson, Acting Director of the U.S. Mint (LinkedIn photograph)

Gibson, a Navy veteran, previously served as the Director of Human Resources for Washington, DC’s Department of Human Resources. Previously, Gibson was Deputy Chief Human Capital Officer at the Department of Health and Human Services (HHS) and held similar positions at the National Labor Relations Board (NLRB).

Gibson is a member of the federal government’s Senior Executive Service (SES). She is a federal employee, and the Acting Director does not require congressional approval. The law allows a person in an acting role to serve for a maximum of 180 days.

Treasury was quick to note that Gibson is the first African American person to lead the bureau. Deputy Secretary Wally Adeyemo said, “Her historic appointment reflects our ongoing commitment to building a qualified, diverse workforce at Treasury and its bureaus that will serve the American people well.”

Is Gibson really qualified for this position? The U.S. Mint is the world’s largest manufacturer of coins. The U.S. Mint reports that they have manufactured over 11.2 BILLION coins in 2021. Although Gibson has extensive government experience, she does not have any experience manufacturing or producing a product.

Gibson has extensive experience with human resources, but the U.S. Mint not only has a diverse workforce but a constituency that watches everything the bureau does. HHS and NLRB do not have a constituency like the U.S. Mint. The collecting community is very critical as to how this bureau does its job. While the law governs what the U.S. Mint can do, the areas where they have latitude, the decisions are more diverse than human resources.

Does having a human resources background make Gibson qualified in collector relations? An HR professional may be able to talk with collectors, but does she understand the market? The last two directors had numismatic experience before their appointments.

Does having a human resources background make Gibson qualified to manage an e-commerce service? The numismatic media has documented the failures of the U.S. Mint’s e-commerce system. Fixing the system requires leadership and the ability to understand what the technical people are saying. As a former government contractor, I watched as SES and appointees did not properly question rosy contractor reports only to watch as the contractors could not deliver results. The U.S. Mint’s contractor has not delivered. What assurances do we have that Gibson can understand when the contractor is lying?

There is nothing wrong with human resource professionals but are they qualified to run a government manufacturer with an opinionated customer base? I guess we shall see.

Sep 23, 2021 | ANA, commentary

When they persisted in questioning him, he stood up and said to them, “The one without sin among you should be the first to throw a stone at her.”

— John 8:7

During an open session of the ANA Board of Governor on January 19, 2021, a session not advertised in a prominent location, the Board voted to remove Farran Zerbe’s name from the top service award offered by the organization.

Let’s take a look at the reasons given for removing Zerbe’s name from the ANA award. According to the ANA’s press release:

A retrospective look at Zerbe’s professional dealings uncovered accusations that he made deceptively inflated claims about the future value of the Louisiana Purchase Exposition gold dollars he sold; complaints of hucksterism and fraud for his creation and sale of coin-like 1904 gold-plated exposition souvenirs;

Modern hucksterism that the ANA Board does not seem to mind versus one that allegedly occurred 112 years-ago.

I have documented inflated prices and deceptively inflated claims by Rare Collectibles TV, DCN Coin Talk, and other scams that walked into my shop that purchased coins from these members of the ANA. the RCTV pitch included Miles Standish, and the DCN Coin Talk pitch included David Ganz. Ganz, like Zerbe, is a past ANA President.

These are not the only cases of inflated claims on coins that have appeared on television. Frequent viewers of “The Coin Collector” on HSN regularly send emails asking if they are legitimate. I purposely avoided the show because I already have heartburn issues, and it would put a severe test on my regimen of Pepcid.

What do we do with gold dealers who also make deceptively inflated claims about bull markets? Remember, some of these dealers are past Zerbe Award winners. After all, I have rarely read an analysis from them saying it was time to sell off your gold holdings.

Zerbe also served as head numismatist for the expositions in 1905 (Portland) and 1915 (San Francisco). Were there any accusations for those expos? Or was there cherry-picking of reasons to justify their actions?

What is the difference between the claim that Zerbe made inflated claims on coins versus the television hucksters? Zerbe is dead and cannot defend himself. The hucksters are living and have given money to the ANA.

[A]llegations that he unscrupulously obtained personal ownership of The Numismatist in 1908 from relatives of the ANA’s late founder, Dr. George F. Heath (then ANA Vice President W.W.C. Wilson subsequently purchased the periodical and donated it to the Association in 1910);

The first word of this is “allegations.” His actions were alleged. Can the allegations be substantiated? What evidence do they have?

Whatever evidence they have is circumstantial and hearsay. I understand that someone can make a strong case using circumstantial evidence, but when the case is being built against someone who cannot testify, there should be almost no questions.

An example of solid circumstantial evidence would be that if you go to bed, the ground is clear. When you wake up, there is snow on the ground. You did not see the snowfall, but you see the snow on the ground. The snow on the ground is circumstantial evidence that there was a snowfall overnight.

Finally:

… and claims of bribery involving the 1909 ANA election in which Zerbe’s friend John M. Henderson was named president.

CLAIMS? The ANA Board of Governors has chosen to besmirch the name of a past president, the driving force behind the creation of the Peace Dollar, and whose collection formed the basis of the Chase Money Museum on CLAIMS?

What are the claims? Who made the claims? What documentation do we have of the claims?

No ANA dealer face an ethics examination after the fiasco of the 2014 Kennedy Half Dollar 50th Anniversary Gold Coin release. (Image is a screen grab courtesy of ABC 7 News, Denver)

The problem I have with all of this is that there is NO documentation offered to the membership. The ONLY documentation provided is a 119-word paragraph, most of it reproduced here.

Another problem I have is that the ANA holds open Board sessions with little advertisement. Had I known about the session, I would have made myself available. Unfortunately, the Board is lax with their membership engagement making it seem they are a club amongst themselves.

The press release does not report the vote total for the motion. I am sure that the press release would report it was a unanimous vote if it was the case. But the tersely written press release suggests there was contention behind the decision. The ANA does not write terse press releases. Look it up!

The decision was made by a Board of Governors with a sitting member that was once asked to resign from a previous Board because “He realized he had made a mistake.” It was a mistake related to a lawsuit against the ANA by former ANA Executive Director Larry Shepherd.

What did Steve Ellsworth add to the discussion? As past president, Ellsworth is a non-voting member of the Board of Governors. However, given his previous actions that left the ANA flat-footed when the pandemic closed everything down, it would be interesting to hear his counsel on this matter.

Unless the ANA Board of Governors publishes the details of the allegations against Zerbe, including source material and where it was discovered, then the move adds the ANA to the “woke community” looking to cancel a historic member of the numismatic community.

Therefore, as a member of the ANA, I hereby move that the ANA Board of Governors reinstate the name of Farran Zerbe to the organization’s highest honor.

Sep 21, 2021 | coins, commentary, Eagles, scams, technology

Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China who advertised on Facebook.

Over the last few weeks, I have been counseling several people about requesting a chargeback for receiving counterfeit merchandise. Requesting chargebacks have their problems, too. Some credit card issuers will use the chargeback as an excuse not to renew your credit card.

During this time, another group has been trying to work with Facebook to stop the scammers from reaching consumers.

On Monday, three numismatic groups sent a letter to Facebook Founder Mark Zuckerberg asking why he did not respond to a similar letter a month ago. The letter was signed by Doug Davis, Director of the Anti-Counterfeiting Educational Foundation, Mark Salzberger, Chairman of Numismatic Guaranty Company, and Bob Brueggeman, Executive Director of the Professional Numismatists Guild. You can read the press release and letter here.

It is not surprising that Facebook and Zuckerberg have not answered previous letters. If you watch other media reports about Facebook, the company is notorious for trying to sweep issues under the proverbial rug until something brings it to the forefront. While Facebook claims they are responsive to the communities, they respond solely when someone yells and causes an uproar.

Although some find Facebook useful, it is a cesspool of scammers and trolls playing on the gullible looking to prove P.T. Barnum correct: There’s a sucker born every minute.

News organizations worldwide have reported how criminals use Facebook advertising for crimes, including selling counterfeit merchandise, false activism (e.g., Fake News), and human trafficking.

Facebook’s response has been the same. They promise to try harder and look to add code to help protect their users. The result is that they try to implement a technical solution that works to the point of being able to placated the current activists. The problem is that while Facebook depends on artificial intelligence to protect its platform, company leadership has not shown any real intelligence to understand that there may not be a technical solution to every problem.

It is easier for Facebook to scan for words that someone believes are hurtful than to look at an advertisement selling a one-ounce silver coin for less than its silver value. Besides, the alleged bully is not paying for to have their content distributed to a target audience that includes you.

Facebook really doesn’t care because they are getting paid. They were being paid as late as 2018 by a Russian troll bot for placing activist ads after being admonished for accepting campaign ads paid in Russian rubles in 2016.

Zuckerberg and company do not care. He is getting paid and so is their management. They lie just enough to get past alleged watchdogs in a way to keep confidence in their market price. After all, Facebook stock (NASDAQ: FB) is up 32.25% for the year as of Sep 20, 2021. Why should they care what you think about their advertisers? In the meantime, consumers are getting defrauded by scammers allowed to roam freely by a company that advertises on television as being a place to build a community.

Do not expect help from the government. In between their partisan fighting, members of Congress do not have the knowledge or competence to figure out how to fix the issue. Most members of Congress are lawyers with no technical background nor did any study the technical issues enough to make competent decisions.

Although Congress is to blame, the voters must accept their part of the responsibility. Instead of voting in competent people, they send these old folks with no technical background back to Washington. Many have held their seats for over 20 years without any incentive for advancement. So they grow old without learning new ways and blame everyone else for what they are not doing. Think of the problem like this: 26 of the 100 Senators are 70 years of age or older. None of these people had any experience with computers as students or early in their careers. Most can barely use a smartphone (Steve King actually asked Google CEO Sundar Pichai why his daughter’s iPhone behaved strangely). Even if they did, when was the last time you saw an elderly member of congress with a computer or even a smartphone?

Davis, Salzberg, and Brueggeman will have an uphill battle with Facebook. Everyone does. But the ACEF and PNG need to think beyond talking reason to Zuckerberg. They need to work with Congress to help them understand the technologies and what regulations will be effective without putting undue limits on the technology companies.

NOTE TO THE DAVIS, SALZBERG, AND BRUEGGEMAN:

I know of one person in the numismatic industry that has a background in technology and public policy. This person worked as a contractor to the federal government for 25 years as an information security analyst. This person worked for a PAC concerned with numismatic issues and has a Masters’ with a concentration in information security and technology public policy from Carnegie Mellon University. You can contact this person at

coinsblog.ws/contact.

Aug 8, 2021 | commentary, news

Greetings from Athens, Georgia!

New Change Find: a 2021 Roosevelt Dime

As of today, it looks like my next show will be the Whitman Expo in Baltimore next November.

Please don’t think that the trip is all work. When I come to Athens, I am reminded of my youthful days as a student at Georgia. It is always interesting to see how the area has changed, but it is fascinating as to what remains the same. Tonight’s dinner came from The Taco Stand on Milledge Avenue. The sign inside said it has been open since 1977, and I was a freshman in 1978. My Baja Burrito was a taste down memory lane.

When I received my change, one of the dimes is dated 2021. It marks the first time that I found a 2021 coin in my pocket change. It has only taken 219 days and a trip to Athens to find my first 2021 coin. I was hoping to find the new Washington Crossing the Delaware quarter first, but a dime is a good find with the year more than half-over.

Last week, The National Sports Card and Collectors Convention (The National) held its annual show in Rosemont. According to the reports from many collector publications, the show was a rousing success. Although there were a few complaints about Cook County’s mask mandate, the reports said it did not take away from the show and called it a success. Sports cards have made a big comeback that even some of the over-produced cards of the 1980s and 1990s are selling. It has helped players find ways to be accessible to fans and willing to sell their wares to anyone who will pay.

Finding new avenues to attract new collectors and existing collectors to spend more is always a challenge. Sports memorabilia collectors are beginning to see what can happen with the new market in college sports’ Name, Image, and Likeness (NIL) rules. The NIL rules allow college players to sell their name, image, and likeness and remain eligible for college sports.

There was always a potential for better college players to earn money for NIL, but the NCAA rules prevented this. The NCAA suspended Georgia’s Todd Gurley for four games for selling his jersey to a collector in 2014. He used the money to take his girlfriend to dinner. And I won’t talk about Reggie Bush who’s situation is a travesty given the new rules.

Numismatics has to consider what it will take to expand the base. The base is not going to be expanded by recycling the Morgan and Peace dollars. You expand the base by embracing everything new and welcoming everyone that does not care about the old. There is so much fun to have with modern coinage that I think I will explore more over the next few months.

In the meantime, if you can make it to Rosemont for the ANA World’s Fair of Money, have fun. If you are like me and have Real World commitments that prevent you from going, stay tuned. There is a lot more to come!

And new the news…

August 8, 2021

Archaeologists have uncovered 2,640- to 2,550-year-old clay moulds for casting spade coins as well as fragments of finished spade coins at Guanzhuang in Xingyang, Henan province, China. The technical characteristics of the moulds demonstrate that the site — which was part of the Eastern Zhou period (770-220 BCE) bronze foundry — functioned as a mint for producing standardized coins.

→ Read more at

sci-news.com

August 8, 2021

CARSON CITY — See historic Coin Press No. 1 in action Saturdays in August at the Nevada State Museum, Carson City, before it goes on hiatus in September for maintenance.

→ Read more at

carsonnow.org

August 8, 2021

A punch-marked silver coin that was dug out during the seventh phase of excavation at Keeladi last week has sent a wave of excitement among archaeologists, as they are further able to collate and establish trading activity of the civilisation believed to have flourished on the banks of Vaigai river more than 2,500 years ago.

→ Read more at

thehindu.com

August 8, 2021

A Roman coin of the last pagan emperor which might have been deliberately damaged as an "act of erasure" was found by two metal detectorists.

→ Read more at

bbc.com

If you like what you read, share and show your support

Jul 28, 2021 | coins, commentary, grading

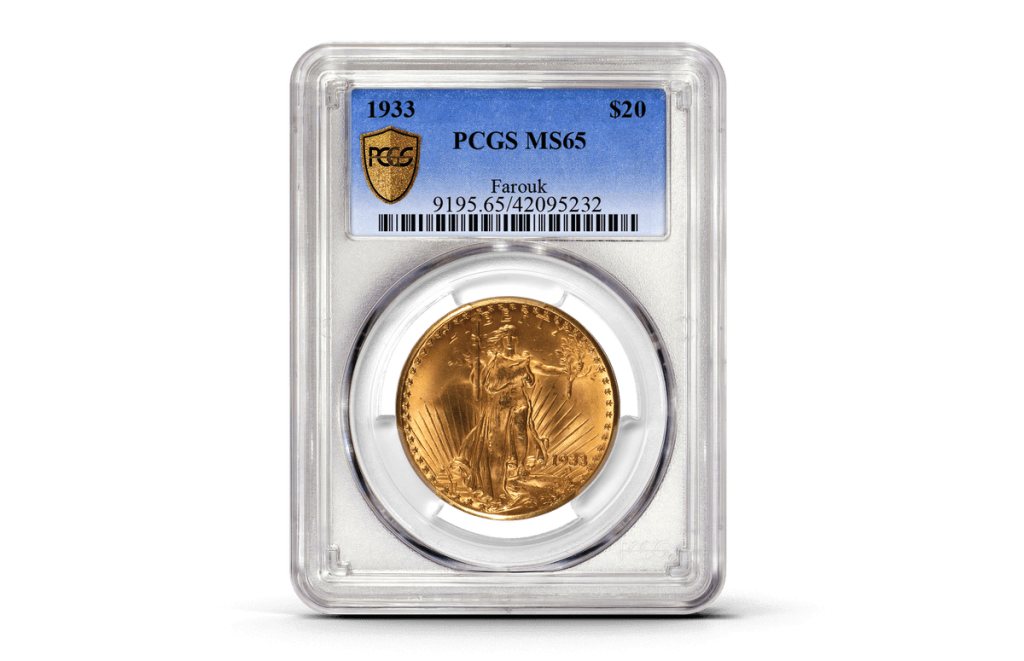

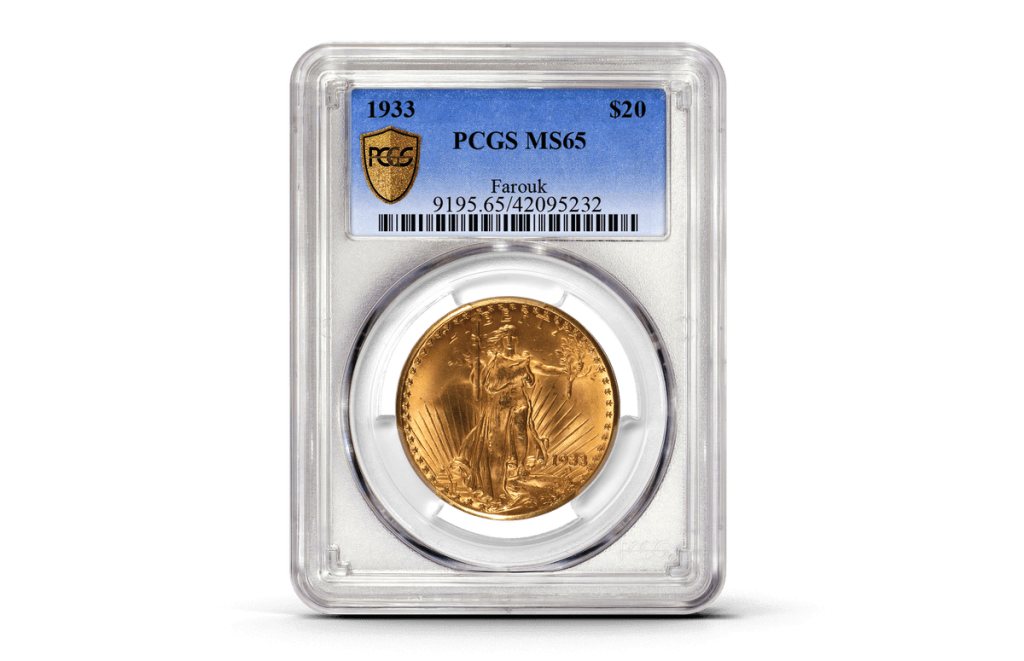

Last April, PCGS announced that they had certified the 1933 Saint-Gaudens Double Eagle Gold Coin that Stuart Weitzman recently sold at auction. The coin sold for $18.9 million to an undisclosed buyer on June 8, 2021, by Sotheby’s

On July 27, 2021, PCGS announced that they entombed the most expensive coin in the world in their plastic.

-

-

1933 $20 Obv – The 1933 Saint-Gaudens Double Eagle is a gold coin with a $20 face value that sold for nearly $19 million in June 2021 and was graded MS65 by Professional Coin Grading Service. The obverse, seen here, depicts a striding Miss Liberty before a sunrise over the U.S. Capitol in Washington, D.C. Courtesy of Professional Coin Grading Service.

-

-

1933 $20 Rev – A flying eagle graces the reverse of the 1933 Saint-Gaudens Double Eagle, a gold coin with the face value of $20 that was originally designed by namesake sculptor Augustus Saint-Gaudens in 1907. Courtesy of Professional Coin Grading Service.

While I acknowledge there is a place for third-party grading services in the collecting market, certifying and encasing the most valuable coin in the world does not qualify.

Although forgeries and fakes are infesting the market, a coin like this one-of-a-kind wonder with a story that reads like a best-selling whodunit the coin is so unique that encasing it away from the world has no equivalent in other collectibles.

Art collectors spend more money for the rarest of paintings only to display them without encapsulation. For example, Salvator Mundi attributed Leonardo da Vinci sold in 2017 for a world record of $450.3 million to Prince Badr bin Abdullah of Saudi Arabia. The prince intends to display it at the Louvre Abu Dhabi. Although the display will have security, the painting will be on display for all to see, not entombed in plastic.

Slabs give coins a homogenous feeling. All slabs look the same. There is little to distinguish the coins other than the information on the label. But the label is not the coin. It hides the differences away from the admirer. A row of slabbed coins does little to enhance the fact that each is different.

Coin collectors have given up eye appeal and the emotion of seeing a beautiful coin to the third-party grading services. Collectors have become mesmerized by labels, numbers, and even stickers without truly understanding what they mean.

Recently, a friend purchased a Carson City minted Morgan Dollar that we thought should grade DMPL (deep-mirrored proof-like). The coin was beautiful but had some slight inclusions. There were bag and handling marks on the coin, but we were confident that the coin would earn the DMPL designation.

When he sent the coin to a third-party grading service for encapsulation (not my coin, so it was not my decision), we played “guess the grade.” My guess was lower than my friend’s. He was more optimistic and overlooked some of the issues I saw. Even though the coin was graded MS-62 DMPL, it did not take anything away from the coin’s beauty.

Except my friend was upset, and the coin is in plastic.

He was conditioned by the phenomenon of grading every coin that the higher the grade, the better the coin. Forget that the coin was beautiful to look at, and he paid less for the coin than if it was graded. He really wanted the coin to grade MS-64. After all, MS-64 is better than MS-62, right?

Now that the coin is encased in plastic, it has lost its luster. I am sure the coin is fine, and the third-party grading service did not damage the coin, but the plastic mutes the impressive DMPL fields. I do not have the same emotional response to the coin in the plastic.

As a result, he wants to crack out the coin and send it to the other third-party grading service to see if he can get a higher grade. I shook my head and wished him good luck.

I am worried that by encasing the only 1933 Saint-Gaudens Double Eagle Gold Coin that is legal to own in a plastic case, the coin will lose its impressive look and make it like any other coin.

If you like what you read, share, and show your support

Jul 23, 2021 | commentary, US Mint

In this final installment of my look at the U.S. Mint’s current problems, I will translate the expletives I wrote in the margins of my notes into an editorial about what I learned.

The impression left by the U.S. Mint officials I spoke with is that the lawyers had more say over policy than the appointed director or the career executives. When questioned as to why the U.S. Mint did not implement additional cybersecurity measures against Internet robots, the answer was that the lawyers prevented a sound business decision.

The impression left by the U.S. Mint officials I spoke with is that the lawyers had more say over policy than the appointed director or the career executives. When questioned as to why the U.S. Mint did not implement additional cybersecurity measures against Internet robots, the answer was that the lawyers prevented a sound business decision.

I do not know why the lawyers prevented the U.S. Mint from implementing appropriate cybersecurity controls to prevent Internet robots and other abuses. Whatever the reason, it caused the U.S. Mint to violate the Federal Information Security Management Act (FISMA). Ignorance of FISMA put the U.S. Mint’s cybersecurity in jeopardy during a time when the Internet is becoming more dangerous.

When I used to work as an information security contractor for the U.S. government, including with Treasury bureaus, agencies would work in anticipation of the passage of relevant laws. When I worked for the IRS, another Treasury bureau, the lawyers and analysts would work on the implementation requirements for the new law. They drafted everything from new forms to planning for the programming necessary to implement the new law. Other agencies did the same. If the lawyers prevented the U.S. Mint from anticipating the passage of a law, then the lawyers are overanalyzing the law. It is called being pedantic.

Where was the U.S. Mint management? The lawyers are supposed to provide advice. They are not supposed to be the final answer. Even though the U.S. Mint did not have a permanent director until David Ryder was confirmed by the Senate, someone was in charge. Why is that person not held responsible for the problems?

David J. Ryder at the hearing regarding his nomination to be the 39th Director of the U.S. Mint

Has Ryder even worked on the security of U.S. coinage? Criminals are duping the collecting public by peddling counterfeit American Silver Eagles. Why has the U.S. Mint not implemented security features in the American Eagle program? If the security of the physical currency is Ryder’s specialty, why has he not implemented it to protect the public?

This is not Ryder’s first rodeo. He was appointed the U.S. Mint director in 1992 by President George H.W. Bush. Ryder should understand how the government works. But his performance during his current appointment and the decisions he has made have the numismatic public questioning his competence.

When someone writes a critical opinion piece, they should provide possible solutions. In this case, I am not sure that any suggestion would work. The U.S. Mint does not listen to the collecting public. When they feign interest, the people who try to be responsive move along with the political winds, and new appointees ignore the lessons of the past under the guise of “Not invented here.”

A common problem among political appointees is that they come into any job thinking they know better than career appointees. It causes them to ignore the past and rediscover previous mistakes. I spent a career fixing the security problems caused by mistakes made by appointees.

I wonder if a civilian advisory board would help the U.S. Mint? The board would consist of experts in numismatics and government processes. But it will give the bureau someone to blame if something goes wrong because if I learned nothing else from my 25 years working for the government, career executives and appointees are collectively risk-averse.

If you like what you read, share, and show your support

Jul 7, 2021 | ANA, commentary

Dr. Ralph Ross (photo credit: ANA)

The rest of the Board of Governors will consist of:

- Mary Lynn Garrett

- Clifford Mishler

- Shanna Schmidt

- Michael Ellis

- Rob Oberth

- Charles Morgan

- Mark Lighterman

Although this was not my choice for leadership, I will support them for their two-year term. The President, Vice President, and the Board of Governors deserve the support of the entire membership regardless of what you thought about the election.

In responding to the last election, I wrote, “The ANA is at a critical juncture in its modern history. There is a societal change happening that is affecting many hobbies and traditional institutions.” Rather than the situation getting better, it has only heightened the urgency.

The reaction to the pandemic showed that the ANA is an organization bogged down by people with old ideas and very little creativity when it comes to adapting to the changing culture. The ANA and its Board of Governors were dragged kicking and screaming into the 21st century to survive and not because they wanted growth.

At the time, the ANA looked clueless because the leadership of the Board of Governors was clueless. When they took the reigns off the people at the ANA headquarters, it was evident that they were working in the Association’s best interest despite the Board’s dysfunction. While the people at the headquarters were helping the ANA to survive while working from home, the Board seemed lost.

As I said two years ago, the status quo is no longer acceptable. Zoom is yesterday’s technology and not something to use to build a future. There are better technologies that have emerged from the pandemic that the ANA can use to expand its outreach.

In addition to the technology, the ANA must become a leader in consumer protection for the hobby. For the last year, the number of Chinese counterfeits has increased. Scammers are using new tactics to fool buyers into thinking they are getting a deal on silver coins. Rather than help the public, the ANA has been silent.

The ANA must be the organization to lead the effort against these counterfeits. They can partner with National Coin & Bullion Association (formerly ICTA) and the Professional Numismatic Guild (PNG) to create a nationwide anti-counterfeit education program. A plan can be formulated by the fall, with a national education program occurring shortly after.

President-elect Ross made his platform about education. Here is the first idea to make an educational impact for the ANA.

Overall, 19,027 ANA members were eligible to vote in this election. That is down from 19,737 in 2019. There were 5,560 votes cast, representing 29.22 of the eligible voters. That is down from 31.06 percent in 2019.

Fewer members and fewer voters are just one legacy of this past Board of Governors. If the ANA does not find ways to better engage with members and draw in new members, these numbers will be reduced in 2023.

If members have ideas that could help the ANA, let them know what you think. As a member, your input carries weight, and you should be able to participate. When you do write, please keep it respectful and include your membership number.

It is your ANA. Your ANA needs your input. Support the new Board and help them find their direction.

Note About the Makeup of the Board

Following the announcement, there were two persistent comments appearing in my Inbox about the demographics of the Board of Governors. I am very disturbed by the comments.

I do not subscribe to the idea that a person is not qualified for the job because of demographic characteristics. I never have. This is not because I am “woke,” but this is how I have been for as long as I can remember.

I will not respond well to a statement like, “I don’t like this person because…” and insert some ridiculous demographic reason. Let us all get along and work together to make the ANA better.

May 24, 2021 | commentary, US Mint

The United States Mint, a federal bureau in the United States Department of the Treasury, issued a statement via social media regarding the failure of their systems to handle the ordering load for their most recent release:

COMMENTARY: Wash, rinse, and repeat.

We have heard this in the past and they have done nothing.

If the U.S. Mint is using a contractor to maintain their ordering system, the contractor must be terminated for cause.

Has the U.S. Mint addressed the failure of the Contracting Officer (CO) or Contracting Officer’s Technical Representative (COTR)?

It is time to address these failures to the Treasury Office of the Inspector General and other government oversight organizations.

May 24, 2021 | commentary, news

Your humble blogger in front of The Arch at the University of Georgia. The last time I was there I had hair!

This past week, I had to make a trip to Georgia for business. The trip required a flight from Baltimore to Atlanta. Travelers must follow TSA and the FAA rules for safety, including masks in the airport and on planes.

Unfortunately, the wearing of masks became a political issue. It’s not. It’s a mask. The idea of the mask is to protect you and to protect others. Masks are an inexpensive tool to reduce the spread of the virus. Nothing else!

During this trip, I learned the difference in attitudes with different people in Baltimore and Georgia. While at BWI Airport, the less than the capacity crowd was very diligent with their masks. Very few people were leaving noses uncovered, and one person politely asked me to replace my mask after taking a sip from my water bottle. It was a sense of community caring, not punitive.

Hartsfield-Jackson Airport was a different story. The number of people prevented moderate social distancing. Everyone packed into the transport trains, and the mask-wearing varied from covering the chin to uncovering the nose.

Arriving in Athens, Georgia, home of my alma mater, the University of Georgia, the scene was different. Walking the streets and the time I spent on campus, you can tell the difference between the students and everyone else. The students were wearing masks and keeping distances. Students working in local businesses were more diligent than the parents that were in town for commencements.

I had the opportunity to discuss the situation with some of the students. They relayed stories about how the students did not take the pandemic seriously until it spread on campus.

The problems are not with the students and those concerned about public health. The problems are with those who see masks as a conspiracy. Many numismatic dealers have indicated they are on the side of the conspiracy theorists.

The attitude of these dealers, mostly older and obstinant, can turn the re-opening of the hobby into a disaster.

The World’s Fair of Money will be limited to 300 tables to comply with Illinois Health Department rules. Currently, there has been no announcement regarding attendance limited. Given the attitudes of the anti-maskers, especially amongst the dealer population, I am afraid that the World’s Fair of Money will become a super spreader event.

You might want to question my assertion because of the presence of the vaccines. While the vaccines provide immunity against the SARS-CoV-2 virus that has plagued the United States for more than a year, combating the variants is uncertain. Research has shown that the vaccines will fight some of the variants, but not all of them.

As people travel, the variants will spread with the people that will carry them. The only way to prevent the variants from ruining the re-opening is to get serious about wearing masks.

Yes, wearing masks suck. As someone with allergy and respiratory issues, wearing a mask is very uncomfortable. During the workday, I will take my dog for a walk when I need to take off my mask. I know that for a year or two discomfort, we can re-open society and hold shows again.

We need to come together as a community and be leaders for the country. Numismatics has the chance to lead. By leading and acting as we care for one another, we can look like heroes to the rest of the world and possibly attract new members.

Care for your fellow numismatist and potential new numismatists. Wear a mask!

And now the news…

May 19, 2021

Coins celebrating the writer and poet Maya Angelou, left, and the astronaut Sally Ride will be issued next year as part of the U.S. Mint’s American Women Quarters Program.United States Mint

→ Read more at

nytimes.com

May 20, 2021

A silver coin found in Maryland after almost 400 years provided a big clue for archaeologists searching for St. Mary's Fort — one of the earliest English settlements in the New World. The coin, a silver shilling with a portrait of King Charles I, was created by the royal mint in the Tower of London back in England at around the time the fort was settled in 1634, according to Travis Parno, the director of research and collections at the Historic St.

→ Read more at

cnn.com

May 21, 2021

WITH most of us spending more time at home, you want may to dig through your spare change for rare and valuable coins. If you spot one of the top six, then you could end up making a tidy profit, as they're worth up to $10,633 each.

→ Read more at

the-sun.com

If you like what you read, share, and show your support

May 18, 2021 | coins, commentary, nclt

The evolution of coin collecting is here. It is all around you, and if you are collecting using blue and brown folders or plastic holders, you are not part of the evolution or at the periphery of the evolution.

The evolution of coin collecting is here. It is all around you, and if you are collecting using blue and brown folders or plastic holders, you are not part of the evolution or at the periphery of the evolution.

New collectors are collecting based on a coin’s theme. They are not interested in date or mintmark series of coins but want a connection to their collectible. The coins must have a meaning.

A midwest club of sports collectors invited me to speak about coins with sports themes. They had heard of the Basketball Hall of Fame coin but wanted to know more. I gathered my information and joined them via Zoom.

For this talk, I made a list of commemorative coins celebrating sports. This list includes the Baseball Hall of Fame coins, the many Olympic commemorative coins, and the Jackie Robinson commemorative coins.

As part of the discussion, they asked why collectors did not like the colorized Basketball Hall of Fame coins. One club member tried to buy the colorized clad proof from a local coin shop and was shamed by the shop’s owner for wanting this coin. The shop owner said that it was a damaged coin and that it will not be worth much in the future. Rather than selling the collector the colorized coin, he tried to sell a regular proof.

Unfortunately, the “traditional” numismatic feeling is that a coin is a legal tender flat metal disc with a denomination with a date, and some have mintmarks. Within the collection of the flat discs, there may be variation in how the coin was struck, changes in dies, and other unintended alterations the hobby calls errors. But that is not what interests today’s collectors.

One of the club members has been collecting the Super Bowl coins from the Highland Mint. He loves football, and the Highland Mint produces the coins for the Super Bowl coin toss. They sell replicas to collectors. The Highland Mint also sells commemorative replica sets for all of the Super Bowls’ coins. For the years before the Highland Mint’s involvement, they created a coin that may have been appropriate for the game.

After listening to the story and the information about the coins, I called him a numismatist. I told him that he did not have to collect legal tender coins to be a numismatist. By having a niche collection of numismatic-related items and learning everything about them, I said that is what numismatics is all about.

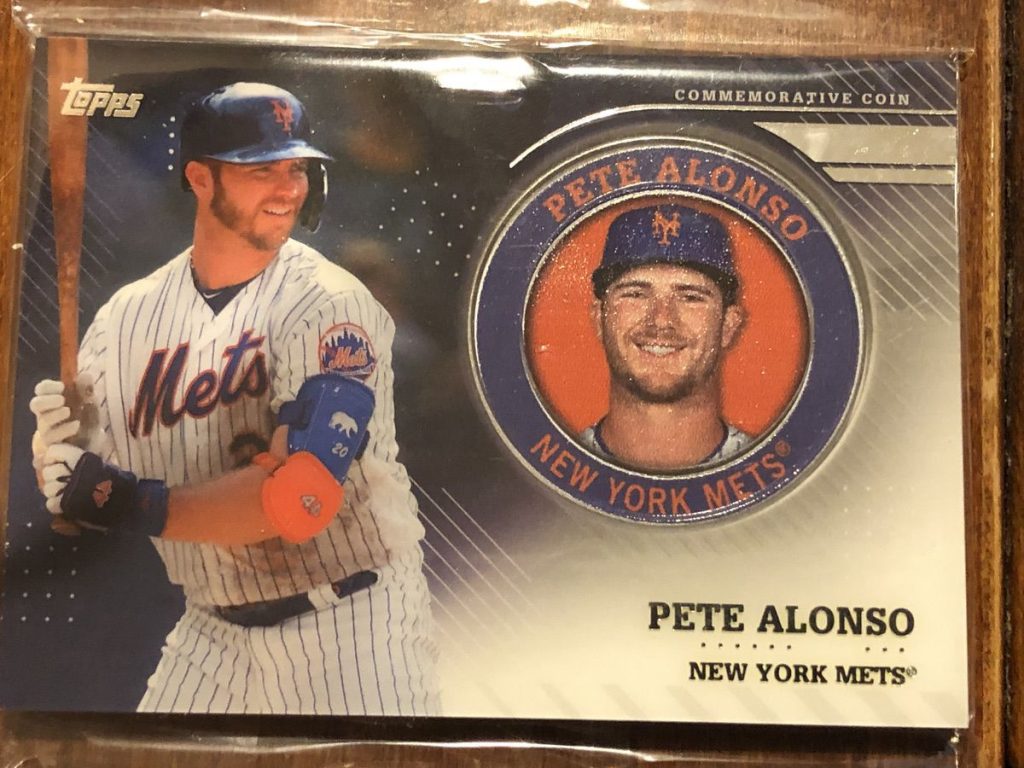

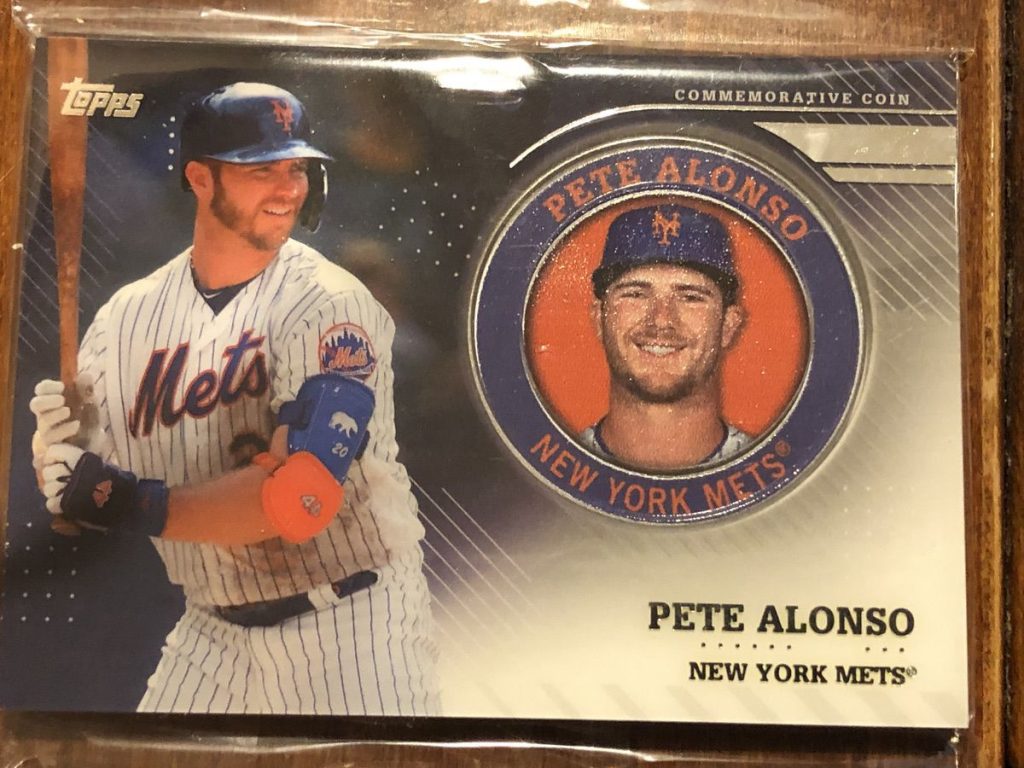

In the process, club members told me about coins that Topps made as a promotion in 2020. Inside special packs, there was a thicker card with a coin inserted honoring the player. Following a quick search, I purchased the two versions of the coin card with New York Mets ace Jacob deGrom and slugger Pete Alonso.

-

-

Topps Jacob deGrom first issue card and coin

-

-

Topps Pete Alonso second issue card and coin

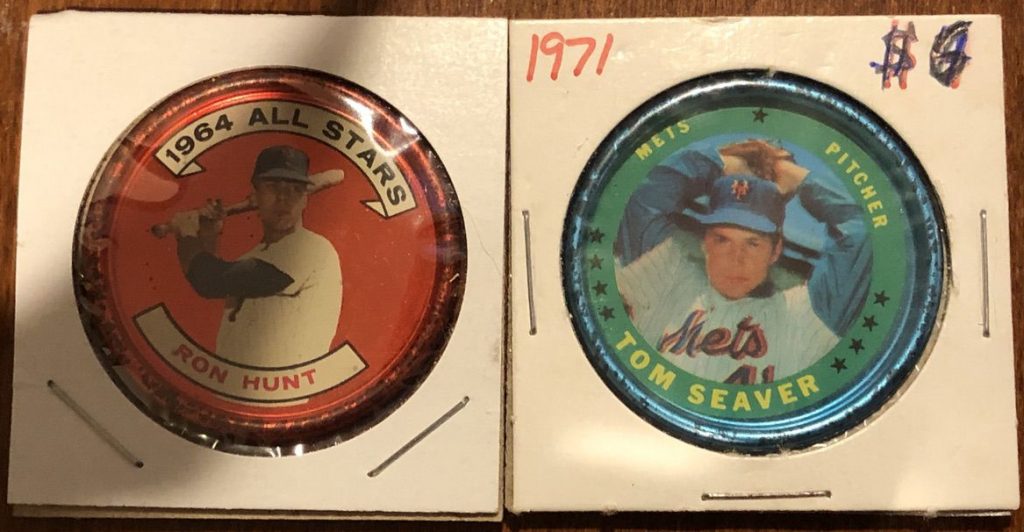

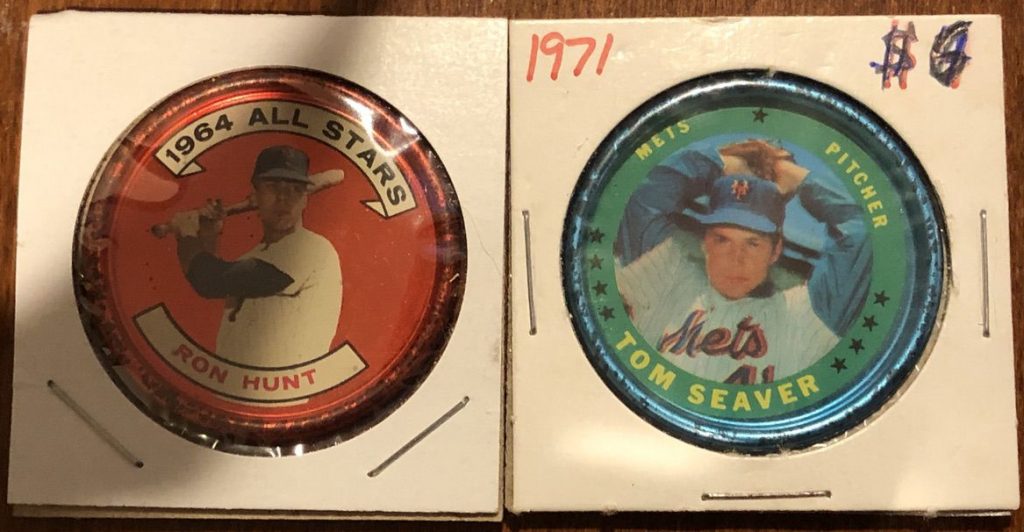

I also found a few 1964 and 1971 aluminum coins, sometimes referred to as pogs, for a few previous members of the Mets, including “The Franchise,” the late Tom Seaver. I think I just started a new collection!

1964 Topps Ron Hunt (left) and 1971 Topps Tom Seaver (right)

Towards the end of the meeting, someone asked if I knew anything about the new Rolling Stones Coin. The Crown Mint produces a silver 10 gram, 1-ounce silver, and 12-gram gold coin using the tongue and lips logo for Gibraltar. The silver coins feature colorized highlights.

As we talked about the coins, I picked up my philatelic numismatic cover (PNC) with the Queen coin from the Royal Mint and put it in front of the camera. I also mentioned that the Royal Mint produced a commemorative for Elton John. Although the coin covers are sold out at the Royal Mint, I went to the Royal Mail website and found Elton John and other commemoratives, including coin covers for James Bond.

Queen Coin Cover is created in cooperation with the Royal Mint and Royal Mail (Image courtesy of the Royal Mint).

After the meeting, I was thinking about themed coins and wondered if the numismatic community can partner with other collectibles to create a more dynamic show.

For example, why not partner with the New Zealand Mint, Perth Mint, Royal Canadian Mint, and others that produce licensed comic-related coins and the publishers to create a Coin and ComicCon. The coins will be the centerpiece of the event but invite the fans to add a different flair.

There are so many themed coins that the hobby can set up CoinCons that bring in different themes with the coins as the centerpiece. A Sports CoinCon would feature sports on coins, and the grading services can sponsor autograph signings of the labels. Coin dealers could set up next to sports dealers to sell coins. And the coins do not have to be limited to a sports theme. If the dealer can sell investor coins or other themed coins, they can gain from the experience.

Outside of numismatic circles, silver and mixed metal non-circulating legal tender (NCLT) coins are popular. The mixed metals are not limited to ringed coins. Using metals like gold and niobium to highlight features is as popular as colorized coins.

Other possible CoinCon themes include advertising, art, nature, history, science, and almost anything else. An International CoinCon could set up conference rooms with different themes connected by a single hall to allow collectors to go between rooms to experience other collectibles. The CoinCon can invite auctioneers of each theme to hold auctions during the show, especially if their lots have coins to feature. How much fun could it be to have a science and technology theme in a CoinCon and hold an auction with space-related coins and souvenirs?

A CoinCon is not collecting as we knew it yesterday. Today’s collectors want a connection to what they collect. All hobby businesses must understand that this is the present and future of collecting.

→ Read more at

→ Read more at

The impression left by the U.S. Mint officials I spoke with is that the lawyers had more say over policy than the appointed director or the career executives. When questioned as to why the U.S. Mint did not implement additional cybersecurity measures against Internet robots, the answer was that the lawyers prevented a sound business decision.

The impression left by the U.S. Mint officials I spoke with is that the lawyers had more say over policy than the appointed director or the career executives. When questioned as to why the U.S. Mint did not implement additional cybersecurity measures against Internet robots, the answer was that the lawyers prevented a sound business decision.