Oct 22, 2011 | Eagles, silver, US Mint

On Thursday, October 20, the U.S. Mint not only confirmed that the American Eagle 25th Anniversary Silver Coin Set at noon Eastern Time (ET) on October 27, 2011, but that the price was set at $299.95 with a limit of 5 sets per household. The U.S. Mint caveated the price noting that the price is subject to change depending on the price of silver.

On Thursday, October 20, the U.S. Mint not only confirmed that the American Eagle 25th Anniversary Silver Coin Set at noon Eastern Time (ET) on October 27, 2011, but that the price was set at $299.95 with a limit of 5 sets per household. The U.S. Mint caveated the price noting that the price is subject to change depending on the price of silver.

Earlier this week, I attempted to predict the price of the set. At that time, the guess was $368.95 with the price of silver at $42—which was the price when I did the calculations, not posted the article. If we give me the approximate $10 drop in silver ($50 for five coins), and take away the 33-percent markup ($16.50) should have lowered my guess to $312.45. That would be only a $13.50 difference. So my guess was only significantly off by my assumed price of silver.

Spin aside, I am looking forward to this set. Hopefully, their website will stay up long enough to allow me to place my order!

Image courtesy of the U.S. Mint.

Oct 17, 2011 | Eagles, silver

Several stories have confirmed that the American Eagle 25th Anniversary Silver Coin Set will go on sale October 27, 2011. Shipping is expected to begin in late November.

The United States Mint American Eagle 25th Anniversary Silver Coin Set will include five one-ounce American Eagle Silver Coins:

- one proof coin from the United States Mint at West Point

- one uncirculated coin from the United States Mint at West Point

- one uncirculated coin from the United States Mint at San Francisco

- one reverse proof coin from the United States Mint at Philadelphia

- one bullion coin

All five coins will be mounted in a custom-designed, highly polished, lacquered hardwood presentation case accompanied by a Certificate of Authenticity.

The U.S. Mint plans to produce 100,000 of these set with a limit of 5 sets per household. The prices has still not been set.

If we were to speculate on the potential price of this set, we can look at the cost of the 20th Anniversary American Silver Eagle Set. In August 2006, when the 20th Anniversary set when on sale, $100 purchased a 2006-W Proof, 2006-W Burnished, and 2006-P Reverse Proof coins. That year, the U.S. Mint sold the 2006-W Proof Silver Eagle for $27.95 and the 2006-W Burnished Eagle for $19.95. Using the proof price for the reverse proof, the total cost was $75.85. By pricing the set at $100, that is a 33-percent markup.

For the 25th Anniversary American Silver Eagle set, there are two proof coins currently selling for $29.95, two uncirculated coins now selling for $50.95, and the current price of silver is $42—but these calculations will use the price of the uncirculated coins currently on sale at the U.S. Mint as a basis for this speculation. With these prices, the total cost of the coins are $272.75. Given that the 20th Anniversary set was marked up about 33-percent, the total cost with the mark-up is $362.75.

Adding to the costs will be the “custom-designed, highly polished, lacquered hardwood presentation case accompanied by a Certificate of Authenticity.” This differs from the cardboard-based packaging that was used for the 20th Anniversary set. Aside from the labor, the U.S. Mint has to account for materials. Therefore, the speculative cost of the set will be $368.95.

Remember, you heard it here first!

Aug 19, 2011 | bullion, Eagles, silver, US Mint

The U.S. Mint announced that they will issue a limited-edition five coin silver set to commemorate the 25th anniversary of the American Eagle program.

The U.S. Mint announced that they will issue a limited-edition five coin silver set to commemorate the 25th anniversary of the American Eagle program.

The United States Mint American Eagle 25th Anniversary Silver Coin Set will include five one-ounce American Eagle Silver Coins:

- one proof coin from the United States Mint at West Point

- one uncirculated coin from the United States Mint at West Point

- one uncirculated coin from the United States Mint at San Francisco

- one reverse proof coin from the United States Mint at Philadelphia

- one bullion coin

All five coins will be mounted in one custom-designed, highly polished, lacquered hardwood presentation case accompanied by a Certificate of Authenticity.

The U.S. Mint plans to produce 100,000 of these set with a limit of 5 sets per household. They anticipates accepting orders in late October. Price has not been set.

The reverse proof American Silver Eagle appeared in the 20th anniversary set in 2006. It is am impressive looking coin of the Adolph A. Weinman’s Walking Liberty design. I will definitely be working the phones and online to order sets of these coins.

Image courtesy of the U.S. Mint.

Aug 3, 2011 | bullion, Eagles, silver, US Mint, video

Have you ever wondered about the production process for the American Eagle Silver Bullion Coins? American Eagle silver bullion coins are struck at the U.S. Mint facility at West Point located near the U.S. Military Academy. Originally built as a bullion depository, the facility strikes silver, gold, and platinum bullion and proof coins. It is not open to the public.

You can take a video tour of the facility (embedded below) through the U.S. Mint’s Mint TV YouTube channel. Jennifer Butkis, Production Manager at the West Point Facility guides the viewer through the minting process. At the end Tom Dinardi, Deputy Plant Manager, praises the work of the people at the facility.

Enjoy the video:

Oct 7, 2010 | Eagles, gold, US Mint

Ready… Set… BUY!

If you forgot, the 2010 American Eagle Gold Proof coins are now onsale at the U.S. Mint’s online catalog. The one ounce proof coin in display case will open at $1,585. The half-ounce coin opens at $806, quarter-ounce is $415, and the one-tenth ounce coin is $180.50. Opening price for the four coin set is $2,938.

As with other bullion coins, the U.S. Mint will reprice their products on Thursdays depending on market conditions. Gold spot price is currently $1333.90 as I type this—about an 18.8 percent premium.

Oct 4, 2010 | Eagles, silver, US Mint

November 19, 2010!

Circle the date. Add a reminder on your electronic calendar. Program your toaster to remind you. November 19 is the date that the U.S. Mint will begin to sell American Silver Eagle PROOF coins!

Reported by Dave Harper of Numismatic News on his blog, the coins will cost $45.95 per coin with a limit of 100 coins per household. That is a significant increase in the price because of the price of silver ($22.03 per troy ounce as I type this). Delivery is planned for December 1.

UPDATE: You can read the U.S. Mint’s press release here.

For fans of the American Silver Eagle proof who mourned the lack of 2009 coins, this is great news. It has been a while since I was happy about the announcement of a coin release.

I commend the U.S. Mint for this move to make collectors happy.

Oct 3, 2010 | Eagles, gold, palladium, platinum, silver, US Mint

In a rare swift move by the House of Representatives, H.R. 6166, American Eagle Palladium Bullion Coin Act of 2010, was introduced, discharged from the House Committee on Financial Services, considered on the floor, and passed without objection. With its passage in the House, the bill was Engrossed and sent to the Senate for consideration.

In the Senate, the bill was read twice and referred to the Committee on Banking, Housing, and Urban Affairs. Congress has adjourned for the election season.

H.R. 6166 was introduced by Rep. Denny Rehberg (R-MT), the representative at-large from Montana. Montana is home of the Stillwater Mining Company, (NYSE: SWC) the only producer of palladium in the United States. Stillwater also owns platinum mines that supplies the U.S. Mint with platinum for American Eagle Bullion coins. With this bill, Rehberg adds his name to a long line of congressmen who have introduced bills to protect their state’s mining interests by using the U.S. Mint as a primary purchaser.

In the world of metal investing, palladium is behind gold, silver, and platinum in demand. Palladium is not as popular in the United States as it is in other countries. Palladium sells better than silver in Canada and Europe. It is rarer than gold, but a little more abundant than platinum but has the silky look of platinum while being almost as ductile as silver. Artists in Europe and Asia are beginning to use palladium instead of platinum for their higher-end designs.

Since the price of palladium is less than the price of gold and platinum, it is possible that investors could consider palladium as part of a diverse portfolio. Those who believe in “end of the world” scenarios will not be interested because the secondary market is not as strong as it is for gold.

The bill requires that “the obverse shall bear a high-relief likeness of the ‘Winged Liberty’ design used on the obverse of the so-called ‘Mercury dime’” making it yet another bullion coins using a design from the early 20th century. For the reverse, the law says that it “shall bear a high-relief version of the reverse design of the 1907 American Institute of Architects medal.” Both the Mercury Dime and 1907 AIA medal were design by Adolph A. Weinman, whose Walking Liberty design is used on the American Silver Eagle coin.

The bill requires that “the obverse shall bear a high-relief likeness of the ‘Winged Liberty’ design used on the obverse of the so-called ‘Mercury dime’” making it yet another bullion coins using a design from the early 20th century. For the reverse, the law says that it “shall bear a high-relief version of the reverse design of the 1907 American Institute of Architects medal.” Both the Mercury Dime and 1907 AIA medal were design by Adolph A. Weinman, whose Walking Liberty design is used on the American Silver Eagle coin.

In other words, congress saying that it does not trust the U.S. Mint to create a design suitable for this coin. While some might have an issue with the design of recent coins, it would be nice to unleash the creativity of the U.S. Mint’s artists and allow them to make a design to represent Liberty. Maybe if the artists were less constrained, they can use their talents.

Another provision of the bill is that aside from using palladium from U.S. sources, it allows the U.S. Mint to purchase palladium from other sources. The bill also makes a distinction between proof and bullion coins allowing the U.S. Mint consider minting proofs to meet collector demand… or not depending on whether there is a demand and a supply to meet the demand. In other words, it will be up to the government lawyers to figure out what is meant by the wording in the bill!

If the bill passes the Senate and signed by the President, palladium bullion coins will not be issued until 2012 because it is too late in the year for the U.S. Mint to plan to issue this coin.

1938 Mercury Dime image is owned by the author.

Image of the 1907 AIA Medal copied from Architecture: celebrating the past, designing the future by Nancy B. Solomon.

Dec 31, 2009 | bullion, Eagles, gold

On the NGC Forums, there was a discussion about collecting gold dollars where someone asked about their composition. Being curious, I looked up the composition information. What I found was that there were different compositions that was tied to the evolution of US coinage.

After posting the basic information, I thought it would be interesting to look up which series of gold coins were made from each of the different compositions. The rest of this posting is what I found after consulting a few references.

The Coinage Act of 1792, the First Coinage Act, set the standard for gold coinage to be .9167 fine with the balance of silver and copper. Gold coins struck 1792-1834 were made of this composition. These coins include:

- Turban Head $2½ Quarter Eagles (1796-1807)

- Capped Bust $2½ Quarter Eagles (1808-1834)

- Capped Bust to the Right $5 Half Eagles (1795-1807)

- Capped Bust to the Left $5 Half Eagles (1807-1812)

- Capped Head to the Left $5 Half Eagles (1813-1834)

- Capped Head to the Right $10 Eagles (1795-1804)

The Coinage Act of 1834, the Second Coinage Act, set the price of gold at $20.67 and changed the composition to .8992 fine with the balance of silver and copper. Gold coins struck from 1834-1839 were made of this composition. These coins include:

- Classic Head $2½ Quarter Eagles (1834-1939)

- Classic Head $5 Half Eagles (1834-1838)

The Coinage Act of 1837, also called the Bland-Allison Act, put the US on a bimetal monetary standard mostly to help the silver industry following the Panic of 1873. Originally, President Rutherford B. Hayes vetoed the bill only to have congress override the veto. Gold coins struck from 1839-1933 were made of .9000 gold and the balance was silver and copper. These coins include:

- Liberty Head One Dollar (1859-1854)

- Indian Princess Dollar (1854-1889)

- Liberty Head $2½ Quarter Eagles (1840-1907)

- Indian Head $2½ Quarter Eagles (1908-1929)

- Indian Princess 3 Dollars (1854-1899)

- Liberty Head $5 Half Eagles (1839-1908)

- Indian Head $5 Half Eagles (1908-1929)

- Liberty Head, No Motto Above Eagle $10 Eagles (1838-1866)

- Liberty Head, Motto Above Eagle $10 Eagles (1866-1907)

- Indian Head $10 Eagles (1907-1933)

- Liberty Head $20 Double Eagles (1849-1907)

- Saint-Gaudens $20 Double Eagles (1907-1933)

All gold commemoratives, both prior to 1933 and since 1982, are struck using .9000 gold. Commemorative struck before 1933 was filled with 1-part silver and 2-parts copper. Commemorative coins struck since 1982 use a 2-part copper to 1-part nickel filler.

The $4 Stella patterns were an attempt to create a standard coinage composition for international trade. The composition called goloid was made of 6 grams of gold, 0.3 grams of silver, 0.7 grams of copper. A Flowing Hair and Coiled Hair Liberty Head patterns were struck in 1879 and 1880.

American Gold Eagle bullion and proof coins are .9167 gold (22 carat). The one ounce gold Eagle contains one troy ounce of gold plus .0909 troy ounces of filler consisting of 2-parts nickel to 1-part copper.

The American Buffalo gold coin contains one troy ounce of .9999 fine gold (24 carat) with copper as the filler.

I hope someone finds this useful.

Oct 19, 2009 | bullion, Eagles, gold, silver, US Mint

I am sure you heard that the US Mint has announced that they will not produce American Eagle gold and silver proof coins “[because] of unprecedented demand for American Eagle Gold and Silver Bullion Coins.” Is there really an unprecedented demand?

What We Should Have Learned

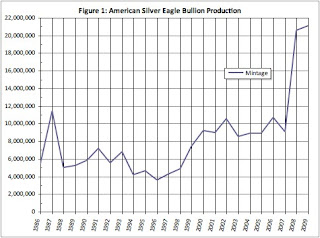

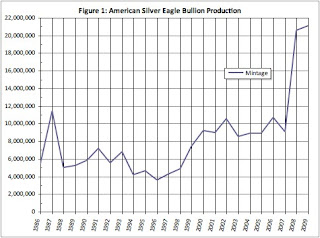

In an analysis posted here last April, production totals for 2008 showed that the US Mint experienced an extraordinary increase in demand for American Silver Eagle bullion coins striking over 20 million ounces of silver for the first time. This was a 128-percent increase over the 2007 production and almost twice as large as 2006, the second highest production total.

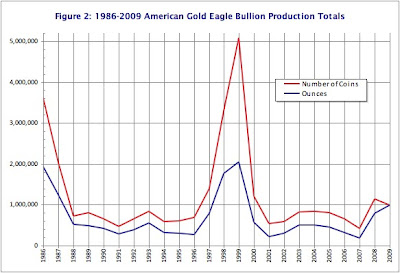

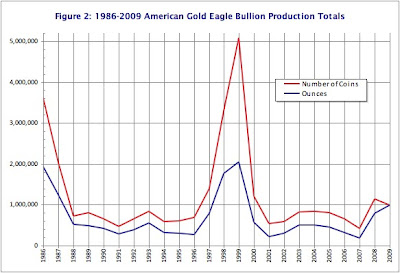

Gold production totals revealed a different story. There was an unprecedented demand in 1998-1999 where the number of American Gold Eagle coins and the ounces of gold used has not been matched by the US Mint. In addition to striking over 5 million coins using over 2 million ounces of gold, the US Mint also struck over 4.4 million 50 State Quarters in the program’s first year of issue. The production of 1.1 million coins using 788,500 ounces of gold was only a bit above average but the most in the 21st century.

Since the start of the current economic crisis that experts say began in December 2007, it was clear that the US Mint was unprepared when investors turned to purchasing American Eagle coins looking for safe investments. In fact, the US Mint admitted that the US Mint knew they were experiencing shortages as early as June 2008. By October, the US Mint had to announce that there is a shortage of bullion because the US Mint could not purchase enough material at market prices to meet the demand. After a year, the US Mint announced that “the United States is lifting the allocation process,” ending the rationing of bullion issues.

Whoever said no news is good news has never met the politicians running the US Mint.

Where We Stand Today

With the announcement by the US Mint, I downloaded the 2009 bullion production totals and added it to the previous analysis to see if there has been an unprecedented demand.

If the demand for silver in 2008 was any indication, it would be matched or exceeded by the demand in 2009. Through the first week in October, the US Mint has struck over 21 million one-ounce American Silver Eagle bullion coins. That is more coins than the 20.5 million struck in 2008. Figure 1 shows that if the trend continues, 2009 will exceed all silver production totals for American Silver Eagle coins.

Click image to enlarge

Click image to enlargeAlthough there was a dip in the monthly production for September (see Figure 2), trends show that American Silver Eagle coins struck in the fourth quarter (the first quarter of the fiscal year) can outpace production in earlier in the year. It is possible that the US Mint could produce another 10 million silver coins by the end of the year, especially if collectors plan to buy bullion coins to fill in the whole made by the 2009 discontinuance of the proof coin.

Click image to enlarge

Click image to enlargeGold Glitters, But…

Although production for the 2009 American Gold Eagle is outpacing production for 2008, this cannot be said about gold. While gold will surpass last year’s production totals, the US Mint will not produce the amount of coins or strike the amount of gold that they did in 1998 and 1999 (see Figure 3). And while the US Mint may strike more than the 1.3 million coins that marked 1997, they will do so by striking only one-ounce coins.

Click image to enlarge

Click image to enlargeEven with the production increases in 2009, the combined unit production of the gold and silver American Eagle coins will be less than it was a decade ago.

So What Is The Mint Doing?

At the end of April, it was reported that US Mint ceased production of nickels and dimes that would last for six months because of the reduced demand from the Federal Reserve. They continued the production of other coins with changing designs, such as the Bicentennial Lincoln Cent, DC & Territories Quarters, and Presidential Dollars. Recent reports show that the US Mint has not continued striking nickels and dimes while producing fewer quarters than any series since the start of the 50 States Quarter program began in 1999.

The Philadelphia Mint has also ceased production of Kennedy Half Dollars. In fact, Denver has out produced Philadelphia by 26.5 million coins.

As part of the announcement of the temporary cessation of production, the US Mint said that workers will participate in a six-month productivity maintenance program and capital maintenance in order to keep the rank-and-file workers employed.

According to the US Mint’s Annual Reports, American Eagle coins are struck at both Philadelphia and West Point. Bullion issues do not include mint marks making it difficult for collectors to determine where the coins were struck.

If there are idle coin presses at the Philadelphia Mint and employees not working on the production of business strikes, why has management not allocated the appropriate resources to meet the demand for bullion as well as the demand for collector American Eagle coins?

Between 1998 and 2001, the US Mint was running at full production including the new 50 State Quarters and was able to meet the bullion and collector demand for American Eagle coins. In fact, between the two years, the US Mint was producing half-dollars for regular circulation and changed the production of dollars from the Susan B. Anthony dollars to the Sacagawea design. Even with the economic slowdown, the US Mint produced a record number of coins in 2001.

With coin presses silent and the lack of sell outs for this year’s commemorative coins, why can’t the US Mint keep up with the investor and collector demand for American Eagles?

It Does Not Make Sense

Even though there was a coin shortage in the mid-1960s, production at the US Mint exceeds what it is today. In order to find production totals as low as they are this year, we would have to look over 50 years ago when the Philadelphia Mint was in its third building and only producing five types of coins with no commemoratives.

Today, the Philadelphia Mint is in a larger building with more state of the art equipment. The same facility that helped produce record numbers of coins less than ten years ago while striking bullion that included platinum American Eagle coins.

The only answer is the incompetence of the US Mint’s management.

It is very clear that the leadership of Director Edmund Moy and Deputy Director Andrew Brunhart must be questioned. Moy was a patronage appointee who has no experience managing a manufacturing operation or in any other type of position where workflow and resource management is critical. Brunhart, who was hired for his “expertise in organizational change,” appears to be changing the US Mint the same way he changed the Washington Suburban Sanitary Commission (WSSC), for the worse.

I know that the country has issues that may be more important than who is running the US Mint. But the US Mint is a profit center for the federal government and those profits (seignorage) are being hurt by its leadership’s inability to manage its resources properly. Therefore, it is time that President Obama set aside a few moments to replace these political hacks before they destroy one of America’s oldest bureau.

Will You Help?

If you are a collector, investor, or have an interest in seeing the US Mint successfully carry out its mission, I ask that you write a letter (addressed to 1600 Pennsylvania Ave NW, Washington, DC 20500-0001), send an email, or go to the White House website contact form and tell President Obama that Director Moy and Deputy Director Brunhart are damaging this venerable institution.

Hopefully, we can convince the President to act now before US Mint management tries something insipid, like blame collectors for their problems as they tried to do in the mid-1960s.

Dec 20, 2008 | cents, coins, commemorative, dollar, Eagles, gold, quarter, state quarters, US Mint

As we end 2008 and look to 2009, numismatists are going to have a lot of options to add to their collections. There will be quite a number of coins that will excite many. But the shear numbers may be overwhelming to others. However you feel, the US Mint will have a very busy year. Let’s look at what is coming up in the new year.

First, three coins will not see any changes. The “Return to Monticello” Jefferson Nickel introduced in 2006 will not be changed. Neither will the Roosevelt Dime, in circulation since 1946, and the Kennedy Half Dollar, as it has been since 1964 except for the Bicentennial issues.

For 2009, we will celebrate the bicentennial birthday of Abraham Lincoln. In celebration, congress has authorized the 2009 Lincoln Bicentennial One Cent Program as part of Public Law 105-145. As part of this program, the Mint will issue four reverse design representing Lincoln’s birth and early childhood in Kentucky (1809-1816), his formative years in Indiana (1816-1830), his professional Life in Illinois (1830-1861), and an extraordinary presidency in Washington, DC (1861-1865).

As part of the Lincoln Cent program, the US Mint will issue a 2009-S VDB non-circulating coin that will be struck in the .950 copper alloy used when the 1909-S VDB was first struck. Also, Public Law 109-285 was passed earlier this year that created Abraham Lincoln Commemorative Silver Dollar to round out the celebration of our 16th president.

To round out the State Quarter program, 2009 will issue quarters to honor the District of Columbia and five US territories: Puerto Rico, Guam, American Samoa, the US Virgin Islands, and the Commonwealth of the Northern Mariana Islands. The DC and US Territories Quarter Program authorized by congress in an amendment as part of an omnibus budget bill at the end of 2007.

The same omnibus budget bill also removed the motto “IN G-D WE TRUST” from the edge of the dollar coins. The amendment was introduced by Rep. Virgil Goode (R-VA) who was defeated for re-election.

The Presidential $1 Coin Program continues in 2009 to honor presidents William Henry Harrison, John Tyler, James K. Polk, and Zachary Taylor. Harrison had the shortest term when he died one month into office after contracting the flu following his refusal to wear an overcoat during his two-hour inaugural address on a cold day in March, 1841. All of the packaging options with Presidential $1 Coins will not be offered in 2009 after not selling well the last two years.

Along with the presidents, the First Spouse Gold Coins will be issued for Anna Harrison, Letitia Tyler, Julia Tyler, Sarah Polk and Margaret Taylor. Letitia Tyler was the first President’s wife to die in the White House. Julia Tyler became First Lady after marrying John Tyler in 1844.

Native American $1 Coins program will begin in 2009 with a design honoring the “Three Sisters’ agriculture, in which corn, beans and squash growing in the same mound enhanced the productivity of each plant. It was a unique program that lead to the concept of crop rotation we know today. This change was authorized by Public Law 110-82 and add edge lettering to these coins.

That brings the total number of circulating coins to 18! Proof sets will have 18 coins and the uncirculated Mint Sets will have 36 coins. Although the Mint has not announced pricing, it would be fair to guess that the prices will raise with more coins in the set. Clad and Mint sets should see a modest price increase. Silver proof sets will add an additional silver quarter and is likely to see a $10-15 rise in price.

Beyond circulating coinage, the Mint will produce the 2009 Louis Braille Bicentennial Silver Dollar to honor the 200th anniversary of Braille’s birth. It is being touted by the Mint as being the first coin with readable Braille.

Precious metals programs will change in 2009. First, only the bullion issues of the American Eagle coins will be strucl. The Mint has discontinued the collector’s uncirculated coin program, eliminating the W mintmark from their portfolio. American Eagles will be available in proof and bullion coins in one-ounce, half-ounce, quarter-ounce, and tenth-ounce denominations.

American Buffalo 24-Karat Gold Coins will also continue in 2009 but without fractional issues. The Mint will offer only one-ounce proof and investor bullion coins.

Last, but certainly not least, is probably the most intriguing coin that will be issued in 2009: the 2009 Ultra High Relief Double Eagle Gold Coin. The coin’s design will be a high-relief $20 gold piece on a double-thick, 24-karat gold planchet (sometimes called a piefort) 27 millimeters in diameter. The design will feature Augustus Saint-Gaudens’ original 1907 design where the date will be in roman numerals (MMIX). The inspiration for this coin came from 1907 when the Mint tried to strike an experimental double eagle coins using two stacked $10 eagle planchets. When the Mint’s management realized that congress would have to approve the striking of the coin for circulation, the project was abandoned and the test pieces were melted. Aside from the date, the only difference between the 1907 test pieces and the 2009 bullion issue is that the the motto “In G-D We Trust” will be added over the rising sun as it appeared in 1908. It is expected that these coins will be struck in proof-only varieties.

It will be quite a year!

On Thursday, October 20, the U.S. Mint not only confirmed that the American Eagle 25th Anniversary Silver Coin Set at noon Eastern Time (ET) on October 27, 2011, but that the price was set at $299.95 with a limit of 5 sets per household. The U.S. Mint caveated the price noting that the price is subject to change depending on the price of silver.

On Thursday, October 20, the U.S. Mint not only confirmed that the American Eagle 25th Anniversary Silver Coin Set at noon Eastern Time (ET) on October 27, 2011, but that the price was set at $299.95 with a limit of 5 sets per household. The U.S. Mint caveated the price noting that the price is subject to change depending on the price of silver.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_6.gif)