U.S. Mint Pauses 2021 Morgan and Peace Dollar Sales

The U.S. Mint posted the following on its Facebook page at 11:30 PM on Thursday, May 27, 2021:

For those who do not access Facebook, the following is the complete text of the announcement:

In the interest of properly rectifying the situation, the Mint is postponing the pre-order windows for the remaining 2021 Morgan and Peace silver dollars that were originally scheduled for June 1 (Morgan Dollars struck at Denver (21XG) and San Francisco (21XF)) and June 7 (Morgan Dollar struck at Philadelphia (21XE) and the Peace Dollar (21XH)). While inconvenient to many, this deliberate delay will give the Mint the time necessary to obtain web traffic management tools to enhance the user experience. As the demand for silver remains greater than the supply, the reality is such that not everyone will be able to purchase a coin. However, we are confident that during the postponement, we will be able to greatly improve on our ability to deliver the utmost positive U.S. Mint experience that our customers deserve. We will announce revised pre-order launch dates as soon as possible.

Sources reported that unhappy collectors “besieged” the U.S. Mint with email and telephone calls following their latest ordering fiasco. The sources also said that the offices of several members of congress contacted the U.S. Mint after hearing from their constituents.

One source said that collectors contacted the Treasury Office of Inspector General (OIG) and prompted them to question U.S. Mint management on the problems. I have not been able to confirm this story.

Too bad ANA leadership did not take a leadership role on behalf of the hobby.

NGC Registry Competition Changes

NGC Chairman Mark Salzberg

In the past, NGC would accept coins graded by Professional Coin Grading Service in the registry. They did this while PCGS only accepted their own coins. This created a lot of options for collectors. Many of the registry collectors have tried to use only NGC-graded coins as a source of pride. Others have been looking for the best coin for their sets.

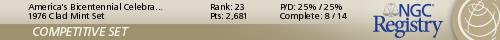

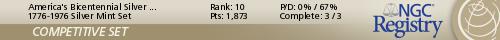

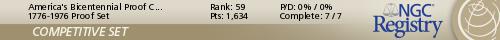

I had started a few registry sets based on the 1975-76 Bicentennial coins. After a few years, I had stopped working on the set while other things took priority. Since I had not looked in a while, it appears that overall, I rank 4,653 with a total 12,050 points. While I know that the point values change based on population, I am not sure how this has changed. What has not changed is my America’s Bicentennial Celebration set, a 1776-1976 Clad Mint Set. According to NGC, the set is still ranked THIRD in this category with a score of 3,883 points.

During the last few years, I have divested many of the coins I purchased for registry sets except for the Bicentennial coinage.

As part of the change, Salzberg’s letter said that coins from “other services” that have been added prior to the change will be allowed to remain. In this case, the other services would be PCGS since it was the only service allowed in registry sets. Salzberg said that there will be no point deductions for those coins.

At 949 registry points, this coin scores the most points in the America’s Bicentennial Mint Registry Set

Unfortunately, I must have missed something because while looking at my sets, my 1776-1976 Silver Mint Set should be a top set but is made up of all PCGS coins. If PCGS coins are still allowed, then why are these coins not counted? Time to sent NGC a note and ask!

Frankly, I am surprised NGC has waited this long to make this change. As the quality of the coins and the number of people participating in registry sets have increased, NGC should have considered this move a few years ago. After all, PCGS does not accept NGC-certified coins in their registry.

In thinking about the competition between the two services, it is interesting that Salzberg noted that there will be some who will be upset “but I cannot continue to allow coins graded by companies whose standards do not match those of NGC.” Since the only non-NGC graded coins allowed in the sets are from PCGS, is this a commentary on PCGS?

Aside from questions that caused the formation of the Certified Acceptance Corporation as the “third-party grading service verifier,” or a fourth-party grading service, there have been some that claim PCGS has lowered their standards to grade more coins at higher grades to make their service more attractive. One dealer pointed out that it was once very rare to submit American Eagle bullion coins to PCGS and receive more than 5-percent graded as a 70 (perfect). Now, if at least 25-percent do not come back with a 70 grading he wonders if there was something wrong.

Another dealer pointed to high-profile online dealers who pre-sell 70 graded coins from both services. How do they know that the services are going to be able to supply these companies with the appropriate inventory? One said that they expect a certain number to come back with the perfect grade based on a percentage of what is submitted, noting that it is easier to predict.

I have no problems with registry set collecting, competition, or NGC only allow coins they graded in their competition. It is their Registry Service and they can set whatever rules they want. I now have to consider whether I want to try to cross-over the PCGS coins or buy new coins.

Post election numismatic analysis

Rhett Jeppson, nominated to be the 39th Director of the U.S. Mint

The immediate impact of the election results is that Rhett Jeppson will not be confirmed to become the Director of the U.S. Mint. Even though the Senate Banking Committee held a hearing for his nomination on March 15, the chance of the GOP-led Senate confirming any of President Obama’s appointment nominations are non-existent.

Jeppson was hired in January 2015 as Principal Deputy Director. Jeppson was hired as a member of the government’s Senior Executive Service (SES) program. In July, it was announced that Jeppson would be nominated as the Director. Since the nomination will likely die in committee, Jeppson will remain on the U.S. Mint staff as a government employee. Although he has not announced his intentions, Jeppson is likely to continue as Principal Deputy Director.

It is unlikely that the next administration will nominate Jeppson or anyone in the near future. Considering that there has not been political appointee running the U.S. Mint since January 2011, maybe President Obama could use his power to convert the term appointment into a permanent government employee. This way, the U.S. Mint can be run by competent managers rather than a pol who might do something like not ordering enough planchets to maintain a major bullion program.

The Bureau of Engraving and Printing is not affected by a change in administrations because the position of the director is a permanent government employee. Len Olijar will remain Director of the BEP as long as he is a government employee in good standing.

As for any of the pending legislation, do not count on anything being passed. Given the results of the election, sources say that the partisan rancor is so fervent that even the most cordial relationships have turned icy. These feelings are not limited to cross-party relationships. There is a growing divide between ideological members in both parties that could almost split the congress into four parties.

To suggest that the partisan bickering to escalate during the lame duck session would be an understatement. Remember, congress passed a continuing resolution, not a real budget, in late September that will expire on December 9. If a budget is not passed by December 9 then the government will have to be shutdown.

The 114th congress will adjourn being one of the most ineffective congress on record.

For the 115th congress that will convene on January 3, 2017, there will be 239 Republicans and 193 Democrats with three runoffs pending (two in Louisiana). Although the Republicans lost 7 total seats, they continue to hold a majority. Currently, Rep. Jeb Hensarling (R-TX) is the Chairman of the House Committee on Financial Services. Although it is not known if Hensarling will remain as chair of this committee, it is likely the new leadership will continue the previous policies. If the attitudes of this committee do not change, there may be very few commemorative coin programs that get through this committee.

Although revenue generating bills are required to be introduced in the House of Representatives (U.S. Constitution, Article I, Section 4), the Senate has been known to introduce commemorative coin bills without argument from their House counterparts. For the 115th congress, the Senate will have 51 Republicans and 48 Democrats with a runoff in Louisiana scheduled for December 10. However, Senate rules make the composition somewhat irrelevant because of their ability to filibuster.

Under the Senate’s filibuster rules (Senate Rule XXII), a senator can inform the presiding member that they intend to filibuster the debate. At that point, the presiding member will set the bill aside to allow other business to continue because the Senate can only work on one item at a time. This means that a filibuster stops all other floor actions. By setting the bill aside and not bringing it to the floor, this allows for other senate business to continue while the leadership tries to gather support for a cloture vote.

Cloture, or closure, is the act to end the free-flow debate of the senate and apply restrictions, such as a 30 hour limit on debate. Cloture requires a three-fifths vote of the senate (60 votes) to agree on cloture. Anyone who remembers some of the past discussions on the composition of the senate, when one party controls 60 seats, they called that a “filibuster-proof majority.” Otherwise, any senator can threaten a filibuster and have that measure buried.

Although it is unlikely that the senate would filibuster the vote on a commemorative coin bill, but it would be obstructed by the another bill ahead of it in the queue.

Even though I would like for the Apollo 11 50th Anniversary Commemorative Coin Act (H.R. 2726 and S. 2957) to pass, I will not be holding my breath during the lame duck session this year or a new version introduced anytime next year.

VOTE!

The election of 1800 was a rematch of the incumbent John Adams, the Federalist, and his Vice President and Democratic-Republican Party nominee, Thomas Jefferson. At the time, the president was elected with the most Electoral College votes and the Vice President was the candidate with the second most votes.

The election of 1800 was a rematch of the incumbent John Adams, the Federalist, and his Vice President and Democratic-Republican Party nominee, Thomas Jefferson. At the time, the president was elected with the most Electoral College votes and the Vice President was the candidate with the second most votes.

There were no rules on how the states selected electoral votes. Some states directly selected electors while others voted for the candidate whose party selected electors. It was 200 years before Florida would become an election issue but for this election, Georgia was the issue when its certificate of election was defective because it was not in the right format. But the President of the Senate, who was the election judge, counted the Georgia votes.

The race ended with Jefferson and Democratic-Republican Vice Presidential candidate Aaron Burr in a 73-73 tie. Since there was no clear winner, the fourth presidential election in the nation’s history set up an early test for the new constitution and was sent to the House of Representatives for resolution.

In 1801, when the House convened on February 11, the chamber was controlled by the Federalists. As the first partisan election, the Federalists were not happy with the choice causing some not to vote or vote against the candidate they liked the least. In 35 ballots over seven days, the vote was 8 states selecting Jefferson, 6 for Burr, and no result for Maryland and Vermont whose delegations tied.

During the votes, Alexander Hamilton, a Federalist, urged his fellow Federalists to support Jefferson. Hamilton thought Jefferson would be a better choice because “by far not so dangerous a man.” Hamilton was not as confident about Burr. Hamilton would later confirm his feeling on July 11, 1804.

After a letter writing campaign by Hamilton, the four delegates from Maryland that supported Burr shifted their vote to “no selection” as did the Burr supporters from Vermont, Delaware, and South Carolina. That would give Jefferson the vote from 10 states to become the third president of the United States.

If we learn nothing else from history, every vote counts. Go out and vote!

Monday out on a limb

We all have our bromides we use to describe Mondays. We have a love-hate relationship with Mondays. Those who love Mondays see it as a new beginning and to start the week on a high note. Others see is as another week of more of the same and another way for things to get worse.

As for me, I make sure I get enough coffee so that I can make it through just about anything.

Rather than dwell on the fact it is Monday and that there is a lot of news even before the day begins, I would rather start with something better. Prettier. More pleasing than anything else. I give you the 2016 Panda silver bullion coin just added to my collection.

- Obverse of the Chinese Panda features the Temple of Heaven

- Reverse of the 2016 Chinese Silver Panda coin

The People’s Bank of China, through its subsidiary Panda Gold Coin, have been striking bullion coins with the image of a panda since 1982. Up until 1999, the images have been almost cartoon-like in nature. Starting in 2000, they hired a new artist who turned the panda image into a fantastic work of art.

The skill of the artist and die makers combine matte and shiny images with fine details to come up with an image that not only endures but keeps these coins selling at a premium. Even with their higher mintages since 2010, I have seen sales of the silver coin up to three-times its original sale value.

Making it more of an interesting coin if you want to collect and have a nice investment is that even with the weight change in 2015. Prior to 2015, the coin was made of one troy ounce of silver or about 31.1 grams. Starting in 2015, the coin was struck using 30 grams of silver.

When the change was discovered after not being officially announced, the industry was up in arms. Why? Because some felt they were being short-changed on 1.1 grams of silver for the same price, sort of like paying for 12 ounces of coffee that comes in the same 16-ounce can (I remember back when that was a newsworthy topic). At the current price spot price of $18.41 per troy ounce, 1.1 grams of silver is only 65-cents.

Somehow, I don’t think 65-cents is going to make a difference in the beauty of the coin.

Rather than worry about 1.1 grams of silver, I just love the coins and was able to purchase one this weekend. As for Monday, I would rather look at the beauty of the panda climbing out on a limb than whatever limb I end up climbing!

FTC Update Hobby Protection Act and Fails

The Federal Trade Commission (FTC) published the “Final Rule of its Rules and Guidelines” for enforcing the Hobby Protection Act (16 CFR Part 304) to include the provisions of the Collectible Coin Protection Act (Pub. L. 113-288) that was signed into law by President Obama on December 19, 2014.

The Federal Trade Commission (FTC) published the “Final Rule of its Rules and Guidelines” for enforcing the Hobby Protection Act (16 CFR Part 304) to include the provisions of the Collectible Coin Protection Act (Pub. L. 113-288) that was signed into law by President Obama on December 19, 2014.

It is the job of the FTC to provide support to enforce the Hobby Protection Act. When updates are made to the law, such as the Collectible Coin Protection Act, the FTC is required to figure out how they will implement the law. Executive agencies, like the FTC, is required to write regulations that conform with the law and legal precedent, announce them to the public, allow for public comment, and then publish the file rule.

On October 14, 2016, the final rules that the FTC will use to enforce the Hobby Protection Act was published in the Federal Register (81 FR 70935). Since this is the final rule, the section begins with explanations and commentary about the information received from the public comments.

What appears to be troubling is that the FTC rejected comments from noted numismatists that there should be a rule to cover the manufacturing of fantasy coins. Fantasy coins are those that were not manufactured by the U.S. Mint. An example cited was the manufacturing of a 1964-D Peace Dollar “FANTASY” since the coins were never officially manufactured. Although the coins were struck, they were considered trial strikes and subsequently destroyed.

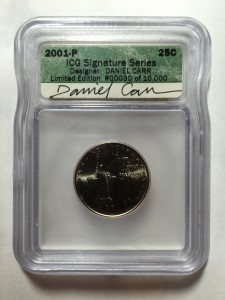

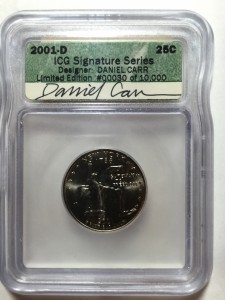

Daniel Carr is a mechanical engineer who also studied computer graphics and later turned it into an art career. He had entered U.S. Mint sponsored competitions for coin designs that have been used on commemorative coins. Carr is the designer of the New York and Rhode Island state quarters and his design was used as the basis of the Maine state quarter.

- 2000-P New York quarter with Daniel Carr’s autograph on ICG label

- 2000-D New York quarter with Daniel Carr’s autograph on ICG label

Carr had bought surplus coining machines from the Denver Mint, repaired them, and had been using them to strike fantasy coins. One of his fantasy coins was the 1964-D Peace Dollar. Over 300,000 coins were struck in 1965 at the Denver Mint anticipating its circulation only to be destroyed after congress disapproved of the way the Mint was allegedly handing the program. Some believe that some coins have survived, much like the 1933 Saint-Gaudens Double Eagle. But like that famed double eagle, it would spark a legal battle if a coin would surface.

Capitalizing on the story, Carr struck his own versions with varieties, errors, and finishes. He sold them as fantasy coins but were not marked in any way. Advertising and writings from Carr explicitly call them fantasy coins, but what about future sellers?

FTC claims it is not necessary to amend the rules “because it can address specific items as the need arises” The FTC further states they have “addressed whether coins resembling government-issued coins with date variations are subject to the Rules.” Using past precedent, the FTC concludes “such coins should be marked as a ‘COPY’ because otherwise they could be mistaken for an original numismatic item.”

Many numismatic industry experts who have seen how Chinese counterfeits have damaged the hobby, wanted the FTC the rule codified so that it would force someone like Daniel Carr to mark his fantasy pieces appropriately. Carr continues to manufacture fantasy pieces based on designs of actual coins changing the date. Recently, Carr has produced Clark Gruber fantasy products with modern dates without the word “COPY” imprinted on the coin.

While Clark Gruber gold pieces were never legal tender, there were allegedly pattern pieces of Presidential dollars that included the required inscriptions and included a denomination. There was no indication on the coins that they were not legal tender even though Carr marketed them as medallions.

The purpose of the CCPA was to prevent counterfeit coins from misleading the public. Carr has allegedly jumped over that line joining the Chinese counterfeiters in an effort that will mislead the public with the apparent blessing of the FTC.

Sources I contacted were not encouraged by the FTC action. It was noted that when Carr’s 1964-D Peace fantasy dollars were reported, the FTC did not take action.

The new rules go into effect on November 16, 2016.