Weekly World Numismatic News for February 7, 2021

If you missed the five-second commercial from Reddit after the halftime show, you missed their touting their service as a place to discuss things. Lately, Reddit has been famous for a sub-Reddit that helped promote the stocks of GameStop, AMC movie theaters, and BlackBerry. All companies whose business models have not kept up with technology or are suffering because of the pandemic.

If you missed the five-second commercial from Reddit after the halftime show, you missed their touting their service as a place to discuss things. Lately, Reddit has been famous for a sub-Reddit that helped promote the stocks of GameStop, AMC movie theaters, and BlackBerry. All companies whose business models have not kept up with technology or are suffering because of the pandemic.

An interesting aspect of this story is the Robinhood trading platform’s use to buy and sell these stocks. Robinhood is a no-commission trading service that many of the people participating in the sub-Reddit use to trade. Not only are they gaining free access to the markets, but they were able to cause significant losses amongst the large hedge funds. The hedge funds did not like losing money to what they considered non-professionals. The Reddit users called it the democratization of the markets.

Although these stocks have returned to more reasonable levels as compared to their earnings, people in the sub-Reddits are looking to make statements in other markets. One of the markets they are trying to work on is silver.

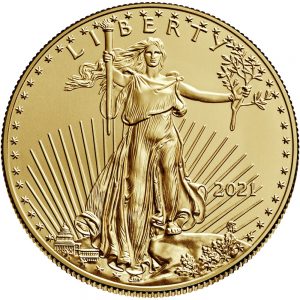

Precious metals continue to be a safe haven for uncertain markets. With the uncertainty of the markets and the Exchange Traded Funds (ETF) in the metals market and changes in some rules, investors demand access to physical metals.

Rather than buying bullion, investors are buying legal tender coins. Even with the high numismatic premiums on precious metals coins, they are reporting limited supply. The highest demand is for the American Silver Eagle and the Canadian Silver Maple Leaf. Both mints are reporting record production of these coins.

When an ETF creates its market basket of stocks, the exchanges require that each of the stocks have specific minimum holdings of physical metals to back the prices. ETFs are finding they have to rebalance their portfolios since the funds holding the metals are not increasing their holdings as much as the general public. Their lack of buying is keeping the price of metals stable.

Dealers are reporting that individual and smaller institutional investors are buying silver. Although these buyers do not impact the broader market, they are impacting the numismatic premium. People are paying upwards of 35 percent over the spot price.

The rules will prevent the Reddit mob from manipulating the metals markets. However, until there is more certainty in the market, there will continue to be a high numismatic premium for bullion coins.

And now the news…

→ Read more at fxstreet.com

→ Read more at fxstreet.com

→ Read more at abc4.com

→ Read more at abc4.com

→ Read more at kitco.com

→ Read more at kitco.com

→ Read more at gazetteherald.co.uk

→ Read more at gazetteherald.co.uk

Silver costs drive down the costs of collector coins

Although the price of silver is up from the beginning of the year ($15.71 on January 2 to $17.22 on February 2), the price is down from the $19.94 on January 2, 2014. Silver climbed as high as $22.05 on February 24, 2014 to as low as $15.28 on November 6, 2014. Silver prices have been on a steady climb this year with a recent peak of $18.23 on January 23, 2015.

I attach no meaning to these number except that it has allowed the U.S. Mint to lower the price of silver coins.

The changes that were announced are as follows:

| Product | 2015 Retail price |

|---|---|

| American Eagle One Ounce Silver Proof Coin | $ 48.95 |

| American Eagle One Ounce Silver Uncirculated Coin | 39.95 |

| Congratulations Set | 50.95 |

| United States Mint Proof Set® | 32.95 |

| United States Mint Uncirculated Set® | 28.95 |

| America the Beautiful Quarters Circulating Coin Set™ | 7.95 |

| Annual Uncirculated Dollar Coin Set | 46.95 |

| America the Beautiful Five- Ounce Silver Uncirculated Coin™ (5 issues) | 149.95 |

This year, the U.S. Mint has started selling the 2015-W American Silver Eagle Proof collectors coin earlier than in previous years. In fact, I have already received my coin.

Budget? What budget?

In celebration of a reoccurring activity but the government, on Groundhog Day the President released his Fiscal Year 2016 (FY16) budget request. Forgetting the usual politics surrounding congress’s reaction, the budget for numismatic-related production is largely irrelevant. Since 1950, the Bureau of Engraving and Printing has been funded using income from operations, mostly sale of currency to the Federal Reserve (Public Law 81–656, 31 U.S.C. § 5142). The United States Mint Public Enterprise Fund was established in 1996 to better manage the seigniorage earned from coin production (Public Law 104-52, 31 U.S.C. § 5136).

In celebration of a reoccurring activity but the government, on Groundhog Day the President released his Fiscal Year 2016 (FY16) budget request. Forgetting the usual politics surrounding congress’s reaction, the budget for numismatic-related production is largely irrelevant. Since 1950, the Bureau of Engraving and Printing has been funded using income from operations, mostly sale of currency to the Federal Reserve (Public Law 81–656, 31 U.S.C. § 5142). The United States Mint Public Enterprise Fund was established in 1996 to better manage the seigniorage earned from coin production (Public Law 104-52, 31 U.S.C. § 5136).

In short, both money production bureaus will be able to withdraw the money from their respective funds to fully support their operations.

Department of the Treasury requested that the BEP be allowed to withdraw $863 million for operations. The BEP have a total outlay of $918 million but will leverage $50 million from their current operating funds to make up the difference. Using projections from the previous years, the BEP anticipates an order for 8.3 billion notes or a 15-percent increase. Of the area that the BEP will be concentrating on includes additional research into anti-counterfeiting methods, make currency more accessible to the visually impaired, and modernizing the production process in Washington, D.C.

The budget does mention that the BEP was given legal authority to print currency for foreign countries with the approval of the State Department in 2005. However, the BEP has yet to be contracted by any country for this service. Many countries appear more interested in using the polymer substrate produced by the Reserve Bank of Australia than continuing to use cotton-fiber paper, which is favored in the United States.

Funding for the U.S. Mint is different in that while the Federal Reserve pays a fixed fee per currency note to the BEP, they pay face value for the coins they purchase from the U.S. Mint. Even though it costs more than face value to produce the one-cent and five-cent coins, the deficit is more than made up on the quarter dollar, the workhorse of the U.S. coin economy.

To fund its $3.59 billion operation, the U.S. Mint will be allowed to withdraw up to $20 million from their Public Enterprise Fund. That appropriation is only a cushion in case there is a shortfall in the anticipated $4.14 billion revenues. Although the U.S. Mint is now being run by Principal Deputy Director Rhett Jeppson, the organization is unlikely to reverse the production improvements implemented by former Deputy Director Richard Peterson.

One notable statement says, “The 2016 Budget includes a proposal to require the silver coins in United States Mint Silver Proof Sets to contain no less than 90 percent silver. Under current law, the half-dollar, quarter-dollar and dime coins in these sets “shall be made of an alloy of 90 percent silver and 10 percent copper.” Allowing the Mint to have flexibility in this composition will improve efficiency in the production process, lowering the costs for these products.” It appears that the U.S. Mint is asking congress to allow them to use another metal than copper while not changing the silver content. With the cost of copper rising to historic levels, using a less expensive metal on a coin that is not intended for circulation could be a cost savings.

While there will be political fireworks over other aspects of the president’s budget, those of us concerned with the money production by the Department of the Treasury can sit back and worry about other issues.

Coin-related legislation to open the 114th Congress

The 114th Congress was gaveled into session on January 5, 2015 with an air of optimism that both ends of Pennsylvania Avenue would be able to work together. Optimism can last as long as someone does not offend their opponent or there are significant lingering issues. Let the games begin.

The 114th Congress was gaveled into session on January 5, 2015 with an air of optimism that both ends of Pennsylvania Avenue would be able to work together. Optimism can last as long as someone does not offend their opponent or there are significant lingering issues. Let the games begin.

We open February with the New England Patriots winning the Super Bowl. Two weeks after the controversy over the deflation of the Patriots’ game balls, they came from behind and won the game on a last minute goal line interception. While many of the commercials were less than memorable, the game lived up to the super name. But for congress, it is only the first minutes of the game. With 23 months to go in the 114th Congress, the insanity is just beginning.

Here are the numismatic-related bills introduced in January:

S. 95: A bill to terminate the $1 presidential coin program

H.R. 358: National Purple Heart Hall of Honor Commemorative Coin Act

H.R. 516: Cents and Sensibility Act

In the days to come I will have a commentary on these bills. All three have flaws that congress keeps ignoring and it is time to take action to let them know how they can get things very wrong even on something as simple as coins. Stay tuned!

En mémoire

Sometimes it is difficult to separate the world from numismatics.

Sometimes it is difficult to separate the world from numismatics.

Numismatics has always been the ultimate expression of politics and history. Governments, which control the currency they release, decide what images are imprinted on their coins and currency and how they appear. People may argue over those depictions but in the end, they are the images that last.

Victors commemorate their triumphs on coins and currency.

Losers ignore those eras as if they did not exist. Sometimes, they even pass laws that makes those previous thoughts illegal as they have in Germany and Canada with regard to World War II.

We here in the United States cherish our freedoms. Freedom of speech and expression are a hallmark of our society. Even if the speech is disagreeable, the right to be wrong is as strongly protected as any other expression in our society.

I am able to write about numismatics and have the freedom to criticize the government on how it treats the hobby because of those freedoms.

Because this is not supposed to be a political blog I hesitated to comment on the shootings that occurred in Paris at the satirical newspaper Charlie Hebdo. But as a member of the world community whose blog is read in 22 countries (according to my logs), I want to extend my condolences to the people of France who lost loved ones for either being someone expressing their opinions as satyr or being in the wrong place at the wrong time. I apologize for the delay because it is a bit off topic.

Countries use coins and currencies as their vehicle for expression, I use this blog. We cannot ignore the power of the written word or the privilege of freedom.

Je suis Charlie!

How easy is it to pass counterfeit currency

As I was waiting to checkout, the person running the cash register was having difficulties with someone whose credit card was not being accepted. It did not matter what the problem was, the issue was holding up the line. While waiting, the gentleman next on line turned to me and said, “This is why I pay in cash.”

Apparently, my fellow line waiter and I had one thing in common, we both visited the bank prior to doing our shopping. He paid for his purchase with crisp, new currency. Just like my new currency, they were mostly $20 Federal Reserve Notes in serial number order fresh from a pack that was opened in the bank.

When the cashier counted the money, she picked up a pen and drew a line on each note. The pen was a counterfeit detection pen that contains an iodine-based ink used to determine whether the paper used is counterfeit.

These iodine pens test whether the paper is legitimate by checking if the iodine reacts with the starch that is used in commercial paper to make them look brighter. If the paper contains starch, then the ink turns dark indicating the paper is not real currency paper. Otherwise, the mark stays amber on the normal cotton bond paper.

There are two problems with this method of counterfeit detection. First, it is relatively easy to defeat the iodine pen by washing and bleaching a low denomination bill and reprinting a higher denomination on the same paper. By using legitimate currency paper, testing it with the iodine pen will not detect that it is counterfeit.

I remember there was a story on one of the television networks about how counterfeiters bleached $5 notes and passed them off as $20 notes after reprinting them. While searching, I found the following video of NBC’s Chris Hanson as he reported about this on Dateline:

Another problem with using iodine pens is that merchants that use them put their customers in danger who have iodine allergies. Those of us with severe iodine allergies can experience anaphylaxis, a serious reaction whose rapid onset can be so severe that it can cause death. As one of those people with severe iodine allergies, I watched this scene in horror.

Following a discussion with the manager, I consented to using a credit card since this was not one of those retailers that have been in the news for being hacked.

After all the Bureau of Engraving and Printing does to ensure that the new currency is more difficult to counterfeit and how the criminals are getting around these iodine pens by using real currency paper, it is incredible to think that these stores are still using tried but untrue measures for counterfeit detection.

In the meantime, the more serious counterfeiters are bleaching and overprinting $5 notes because as the criminal in the video says, nobody looks!