The Passing of Annie Glenn

Feb 17, 2012 — Mercury astronaut John Glenn and his wife, Annie, pose during a luncheon Feb. 17, 2012, celebrating 50 years of Americans in orbit, an era which began with Glenn’s Mercury mission MA-6, on Feb. 20, 1962.

Photo credit: NASA/Kim Shiflett

Annie Glenn was an advocate for those with speech disorders and child abuse. She grew up with a severe stutter that she hid from the public. After undergoing an intensive program at Hollins College, she learned to control her stutter. It gave her the confidence to be an advocate for those who could not speak.

After many years of advocacy, The Annie Glenn Award was created to honor individuals who overcome communications disorders.

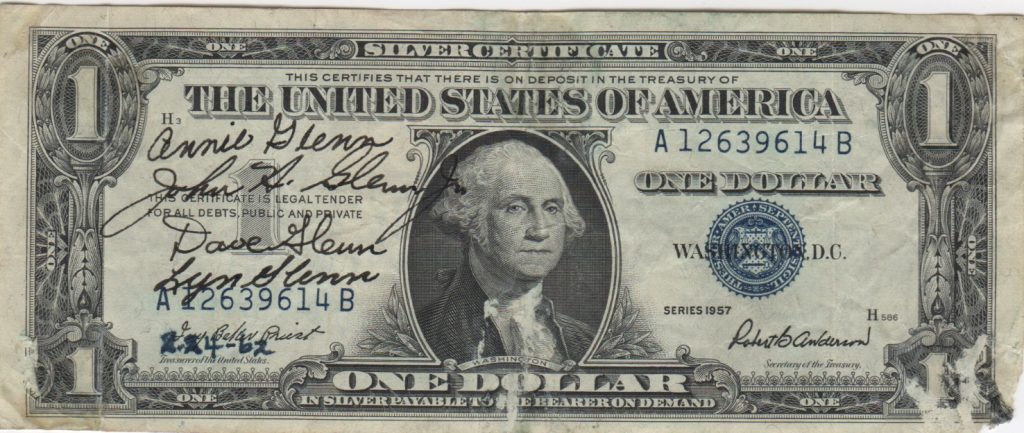

Although there have been many deaths during this pandemic, a few have touched the numismatic community. Aside from being the spouse of a famous American, I own a numismatic collectible with her autograph. The $1 silver certificate may not be worth much as a numismatic collectible, but with the passing of John and Annie Glenn, it becomes more precious.

Glenn family autographed “Short Snorter” dated February 24, 1962, four days after Glenn orbited the earth in Friendship 7

Rest in Peace, Annie Glenn.

First National Parks Quarter Found in Change

Glacier National Park is located in northwest Montana named for its prominent glacier-carved terrain. The rugged terrain has been a favorite for hikers and photographers. In 1895, Chief Whit Calf of the Blackfeet tribe sold the land to the United States government for $1.5 million with the provision that the Blackfeet could continue to hunt on the land and that the land be made public land. By 1910, President William Howard Taft signed the bill that made the land a national park.

The Glacier National Park Quarter was the second of 2011 and the seventh in the America The Beautiful Quarters Program.

According to the U.S. Mint, 31.2 million Glacier National Park Quarters were struck in Denver and 30.4 million were struck in Philadelphia. Prior to that, 347 million quarters were produced in 2010 and 61.2 million Gettysburg Park Quarters were produced prior to Glacier National Park.

After all this production and over a year-and-a-half into the program, I received my first National Parks Quarter in pocket change. The quarter was given to me in a local grocery store after an early evening venture to fill the pantry. I was pleasantly surprised to see finally find one in change.

I also was able to take two 2010 Native American Dollar Coins from the cashier as part of my change. I will spend them over the weekend hoping they will continue to circulate and not end up back in the Federal Reserve’s coin room.

Markets Are Nervous

With the politics of the economy turning volatile, I tried to keep out of that discussion on this blog to keep the discussion to coin-related issues. But with the price of gold climbing to its highest nominal rates of all time, it is difficult to ignore the market. As I write this, gold is current 1793.20 per troy ounce on the spot market.

Market volatility has been blamed on many fronts. It started with Standard & Poor’s, the rating agency that gave top grades to derivatives that caused the market failures in 2008, downgrading the credit rating of the United States to AA+ from AAA. The word came across the pond that the PIIGS of Europe may not only be too big to fail, but too big to help. The PIIGS are the five Eurozone nations who are either in economic collapse or near one: Portugal, Italy, Ireland, Greece, and Spain.

The more volatile the markets are, the more investors run for gold running up the prices.

But if you think the prices are high, consider what happened on January 18, 1980 when gold closed at 850.00 per troy ounce. That run up of gold came during the time that the Hunt Brothers were trying to corner the silver market as a reaction to the down economy and the rise in the solver market. Adjusted for inflation, $850 in 1980 would be equivalent to $2,328.44 in today’s dollars. If this does not dampen you excitement over the price of gold, you could watch the argument between “experts” who think $2,000 per ounce is possible versus others saying that gold could plummet in value. Consult a profession before you make any investment.

Silver has not faired as well as gold. While trying to figure out why, I found a lot of information that while both metals have industrial applications, gold is seen as a financial metal while silver is more plentiful and is considered a more industrial metal. Rather than investors trying to have silver keep pace with gold, the way gold kept pace with silver in 1980, the old 15-to-1 and even 25-to-1 silver to gold ratios are no longer valid measures. At the current 39.29 per troy ounce, the ratio is 44-to-1. Some believe that 35-to-1 and higher may be the new “normal.”

For a little perspective on the price of silver, it is currently training at 39.29 per troy ounce, down from its high of 48.70 on May 28. That did not pass the nominal close of 52.50 reached on January 7, 1980 when the Hunt Brothers tried to corner the silver market. Adjusted for inflation, the Hunt Brothers ran the price to the equivalent of 143.82 in today’s dollars. Even at a 25-to-1 ratio, the price of gold would have to climb to $3,575 per troy ounce before the value of silver breaks 1980’s records.

In 1980, the Dow Jones Industrial Average closed at 832.00 on January 7 and 867.15 on January 18 before dropping in March. It would take the market until November 20 to close at over 1000 for the first time in its history. After dropping back and flirting with 1000 points a few more times, it would take until 1982 before the market climbed and stay over 1000 points.

What have we learned from this look at history? Not much. At first glance it looks like the economy is not as bad as it was in 1980. But that history was caused by market manipulation. Will history repeat itself? Time will only tell.

Minting the American Silver Eagles

Have you ever wondered about the production process for the American Eagle Silver Bullion Coins? American Eagle silver bullion coins are struck at the U.S. Mint facility at West Point located near the U.S. Military Academy. Originally built as a bullion depository, the facility strikes silver, gold, and platinum bullion and proof coins. It is not open to the public.

You can take a video tour of the facility (embedded below) through the U.S. Mint’s Mint TV YouTube channel. Jennifer Butkis, Production Manager at the West Point Facility guides the viewer through the minting process. At the end Tom Dinardi, Deputy Plant Manager, praises the work of the people at the facility.

Enjoy the video:

Review: E-Numismatist Is Worth Its Quirks

Back in March I asked, “Where’s my e-Numismatist?” A few months later, the American Numismatic Association released two apps for iPhone and iPad users to read The Numismatist electronically. Since I had to travel recently, I felt it was time to use and review these apps.

Back in March I asked, “Where’s my e-Numismatist?” A few months later, the American Numismatic Association released two apps for iPhone and iPad users to read The Numismatist electronically. Since I had to travel recently, I felt it was time to use and review these apps.

During the last week, I had to travel for family business and brought both my iPhone and iPad with me to have content to keep me occupied between business. One of the apps that I was interested in exercising was ti read The Numismatist on the iPhone and The Numismatist HD version for the iPad.

First thing that you notice is that although the programmers tried to make the experience similar on both devices, the additional screen space on the iPad makes it a better experience. But the iPod version is very serviceable using options available in the application.

After the obligatory splash screen, the reader is presented with a screen showing the covers of The Numismatist to read. If you started reading an issue, the corner of the cover is folded down and the page number of the last page you viewed is displayed. If you have not read or downloaded an issue, there will be a down arrow button embossed over the image. Press the cover of the issue you want to read to begin.

After the obligatory splash screen, the reader is presented with a screen showing the covers of The Numismatist to read. If you started reading an issue, the corner of the cover is folded down and the page number of the last page you viewed is displayed. If you have not read or downloaded an issue, there will be a down arrow button embossed over the image. Press the cover of the issue you want to read to begin.

If you open a new issue, you are shown a table of contents with an option to download or read online. If you are going to be connected to Internet, you can read it online. Reading online means that as you turn the virtual pages, they will be downloaded on demand. By clicking download you will download the entire issue. In either case, this is where you find an initial problem with the app: downloading is slow.

When I first tried to use the app, I was reading the May 2011 Numismatist using an iPhone connected via 3G over AT&T. Trying to go from section to section was so slow that it was painful. After switching to a WiFi connection that was routed directly to a broadband connection, it was faster and almost as painful. I switched phones from my iPhone 3G to an iPhone 4 and the pain continued. After continued frustration, I used some online tools to figure out that the images of The Numismatist pages are very big. The amount of data being downloaded seems excessive.

Since my iPad is WiFi only and I wanted to read the June 2011 edition on the plane, I chose to download the entire issue because I will not be connected. Watching the progress of the download is almost like watching grass grow. With each issue over 100 pages, it took a long time to download. Also, I am not sure if it is a system issue or the way the app is written, but the download slows if I used another app during the download. Anecdotally, I have run a streaming music app while downloading an app from the App Store and reading email with more success than downloading an electronic issue of The Numismatist.

Since my iPad is WiFi only and I wanted to read the June 2011 edition on the plane, I chose to download the entire issue because I will not be connected. Watching the progress of the download is almost like watching grass grow. With each issue over 100 pages, it took a long time to download. Also, I am not sure if it is a system issue or the way the app is written, but the download slows if I used another app during the download. Anecdotally, I have run a streaming music app while downloading an app from the App Store and reading email with more success than downloading an electronic issue of The Numismatist.

I started the download of the July 2011 edition before going to sleep on my last night using my hotel’s WiFi service. When I awoke the next morning, the edition was downloaded allowing me to start reading on the plane trip home.

Once the issue is downloaded, the app is nearly wonderful. For iPhone users, most of the articles could be read using the text-only option. This will show the entire article text without any images. Since many of the images are embellishments from iStockphoto, you would not miss much. However, articles that show numismatic items should be viewed with images. Reading the image pages on the iPhone shows the downside of the small screen, but you can double-tap the screen then use the open pinch motion to expand the text to be readable.

Once the issue is downloaded, the app is nearly wonderful. For iPhone users, most of the articles could be read using the text-only option. This will show the entire article text without any images. Since many of the images are embellishments from iStockphoto, you would not miss much. However, articles that show numismatic items should be viewed with images. Reading the image pages on the iPhone shows the downside of the small screen, but you can double-tap the screen then use the open pinch motion to expand the text to be readable.

Reading imaged pages is more comfortable on the iPad. The screen size of the iPad makes it suitable for reading in portrait mode. In landscape mode, the iPad will show two facing pages. Like the iPhone, the page can be resized after double-tapping to zoom in. Regardless of whether you use the app in portrait (preferred) or landscape mode, you get the full experience of dead-tree version but in electronic form and with links.

In keeping with it being an electronic version is that links are embedded into the pages. Some links help in the navigation of the issue. For example, the table of contents contains links to each of the stories. If you find something you like, tap the name and the app will advance to that page. If you read an advertisement that you want more information, you can tap on the link in the ad you will be directed to the vendor’s website. Same for links embedded into stories. Email links will open a blank message with the email address in the “To:” line for you to send a message.

In keeping with it being an electronic version is that links are embedded into the pages. Some links help in the navigation of the issue. For example, the table of contents contains links to each of the stories. If you find something you like, tap the name and the app will advance to that page. If you read an advertisement that you want more information, you can tap on the link in the ad you will be directed to the vendor’s website. Same for links embedded into stories. Email links will open a blank message with the email address in the “To:” line for you to send a message.

My one complaint about links is that links to webpages are limited to the embedded browser in the app. After tapping a link, the screen will “raise” a browser insert and show the webpage. With the webpage open, you can expand it to show in the full screen or close the browser pane. The problem is that I may want to open the page in Safari so that I can bookmark the page. However, the app does not have an “Open in Safari” or “Bookmark Page” option. Many other apps can do this and should be added to The Numismatist app.

One annoying “feature” of both versions of the app is that you cannot advance pages when zoomed in. Once you double-tap to activate the zoom, you have to double-tap again to return to “page mode” in order to turn the virtual page. It was annoying that while being engrossed in a longer article, I could not turn the page until I remembered to double-tap again. After advancing to the next page, I then had to double-tap to zoom in again. After a while, I put my glasses back on so I could read the text without relying on the zoom feature.

One annoying “feature” of both versions of the app is that you cannot advance pages when zoomed in. Once you double-tap to activate the zoom, you have to double-tap again to return to “page mode” in order to turn the virtual page. It was annoying that while being engrossed in a longer article, I could not turn the page until I remembered to double-tap again. After advancing to the next page, I then had to double-tap to zoom in again. After a while, I put my glasses back on so I could read the text without relying on the zoom feature.

With two flights of over an hour, I was able to read the entire June issue and half of the July issue on the iPad. Even with the annoyances, I found it easier to carry along with other electronic publications than dead tress. Even without the app being fixed, I am seriously considering converting my membership to electronic delivery only on my next renewal. I grade The Numismatist app and its HD counterpart for the iPad MS63. Although I recommend the iPad version over the iPhone version, the iPhone version is very usable—but consider using it on an iPhone 4. Using the app on an iPhone 3G or 3Gs shows the limitations of that hardware.

If you want to consider the e-subscription only, make sure you have an iPad. In addition to the iPad’s other advantages, this app makes it worth owning one.

Here are screen images from The Numismatist app from the iPhone:

Wasteful Presidential Coin Act

Not to be outdone, Rep. Jackie Speier (D-CA12) with co-sponsor Rep. Jared Polis (D-CO2) introduced their own bill in the House of Representatives to end the Presidential $1 Coin Program. On the same day Sens. Vitter and DeMint introduced their bill, Speier and Polis introduced H.R. 2593, Wasteful Presidential Coin Act of 2011.

Don’t you love the way congress can editorialize in what is supposed to be serious laws?

But wait, there’s more!

The bill is essentially the same as the Senate version. However, in an attempt to become managers of the Federal Reserve coin rooms, Reps. Speier and Polis has added a new section to their version of the bill:

What Speier and Polis is saying is that they know better than the Federal Reserve on how to manage the coins in their possession. Should the Federal Reserve find that in the future they want to add stock to their coin rooms, like when congress actually does the right thing and end the printing of the $1 federal reserve note, the Federal Reserve could find itself in a shortage situation in trying to comply with the law.

This is the type of legal provision that has the potential to create unintended consequences. Further, I do not think that congress should manage the cash operations of the Federal Reserve. They can barely manage the nation’s budget, I do not want these people trying to manage the Fed.