DON’T MICROWAVE YOUR MONEY!

Image from Reddit

Microwaves work by shooting electrons at whatever it finds. The electrons create friction as it passes through the surfaces and generates heat. These electrons cannot pass through a metal surface. When you try to microwave metal, you will see sparks as the electrons skip over the metal surface.

Some chefs have discovered ways of using aluminum foil to direct the electrons to use the skipping electrons to add extra heat to one area of the food. As part of the process, the electrons speed up before finding someplace to go. Another technique is to cover areas to minimize the reaction.

Regardless of how you try to control the flow of electrons, they have to find someplace to go. The reaction is the basis of chemistry. A free electron looks to bond with an atom that has more protons than electrons. It balances the equation.

This basic science lesson is to help explain why you do not want to microwave your currency.

You might have heard that using your microwave oven would help kill the COVID-19 virus. Some research says it is plausible, but the idea is for food. If you have any questions about whether your takeout order is safe, put it in your microwave. You can also heat your food in an oven or on your stovetop. As long as you cook the food to over 140°F (60°C), you will kill most pathogens.

But what happens when you put money in your microwave? It will burn!

The Bureau of Engraving and Printing has produced currency notes with a security thread to thwart counterfeiting since 2003. The security thread is a thin ribbon of metal embedded into the currency paper. Hold the currency up to the light, and it will tell you what the denomination should be. On the $100 note, it is a wider strip with a distinct look.

When you microwave money, the electrons will strike the metal thread, pick up speed, and look for a place to land. The next softest material is the currency paper around the security thread. The increase in friction on the currency paper will cause the paper to burn.

Think of it like this: rub your hands together for a few seconds. You will feel your skin begin to heat. Now multiply your hand rubbing by the speed of an electron flying by, and the friction will burn your hands. That is what is happening to the paper.

If you do burn currency paper, bring all the pieces to your bank. The bank will exchange the notes for ones that are not burned and will send them back to the Federal Reserve for disposal.

CLEANING MONEY

First, if you are working with collectibles, DO NOT CLEAN YOUR COLLECTIBLE COINS AND CURRENCY! Cleaning collectible coins, currency, tokens, and medals will reduce their collector value. Just don’t do it!

There are many ways you can clean your circulating pocket change. You can wipe them with a disinfectant, including 70% rubbing alcohol or a household wipe that contains alcohol and Dimethylbenzyl Ammonium Chloride (Clorox and Lyson bleach-free wipes contain this chemical). Another method is to wash coins using warm water and a dish cleaning detergent. Finally, leave coins in your pocket when you wash your pants. The only problem with washing coins with clothes is the racket your dryer will make, and you may dent the drum. Currency may require a warm iron to make flat again.

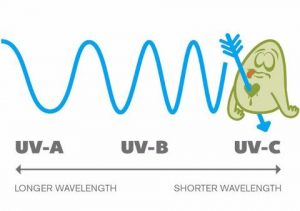

Another method is using ultra-violet (UV) light.

Image courtesy of Phonesoap, a smartphone cleaning device that uses UV-C light.

The short wavelength of UV-C light will penetrate cell walls and kill the DNA within the cells. We are protected from the Sun’s UV-C light by the Ozone Layer of the Earth’s atmosphere. By destroying the Ozone Layer, we let the Sun’s UV-C light penetrate the atmosphere increasing skin cancers.

While UV-C is altering your DNA to create cancers, it is also killing germs using the same properties to alter its DNA.

You can buy lightbulbs that generate UV-C light. However, if you create a UV-C disinfecting station, be careful. Shining UV-C light randomly will cause skin damage worse than a tanning bed. A tanning bed mixes the spectrum of UV light and filter most UV-C light. But a dedicated UV-C light is not good for your body.

Since UV-C light does not generate a lot of heat, you can create an enclosed disinfecting station using almost any material. One example is to create a box using poster board with the edges sealed with duct tape. Cut a hole in the top for the light and then seal the hole with the duct tape. Place your currency inside the box and leave it for 15 minutes.

If you spend a little more money, you could purchase a wall timer. Set the time for the light to turn on after you leave the room and to turn off 15 minutes later. Do not go into the room until the process completes.

There are commercially made devices made with sealed chambers and timers.

Finally, if you want the safest way to disinfect your money, place it in a plastic bag that seals. Close the bag most of the way. Leave about an inch unsealed. Then let the bag sit in a sunny area for about 24 hours. The natural UV-C light will disinfect the money. When you are ready, remove the money and throw the bag away. Use a clean bag for the next round.

Of course, you can avoid all of this by using a credit card that you can clean with a disinfecting wipe when you get home. Contactless payments, like Apple Pay, Google Pay, and Samsung Pay are also alternatives to paying with cash.

Ron Paul Proposes the Collapse of the World Economy

Bernard von NotHaus, creator of the Liberty Dollar, was convicted of counterfeiting for creating “coins resembling and similar to United States coins” and distributing them with the intent to “use [them] as current money.” The verdict was handed down by a federal jury in Statesville, NC on March 18, 2011. Von NotHaus is facing a maximum sentence of 20 years in prison and fines up to $500,000. Sentencing hearing will begin on April 4.

In an email to supporters, von NotHaus indicated that he will appeal his conviction.

A few days before the end of the trial, Rep. Ron Paul (R-TX) introduced H.R. 1098: Free Competition in Currency Act of 2011. Its stated purpose is “To repeal the legal tender laws, to prohibit taxation on certain coins and bullion, and to repeal superfluous sections related to coinage.”

During his Extensions of Remarks on March 15, 2011, Rep. Paul said, “At this country’s founding, there was no government controlled national currency. While the Constitution established the congressional power of minting coins, it was not until 1792 that the U.S. Mint was formally established. In the meantime, Americans made do with foreign silver and gold coins. Even after the Mint’s operations got underway, foreign coins continued to circulate within the United States, and did so for several decades.” Unfortunately, Rep. Paul learned the wrong lesson from history.

Starting with the statement that foreign coins continued to circulate for several decades, fails to recognize the real reason for this. Upon passage of the Constitution and prior to the passage of the Coinage Act of 1792, the new government realized that the they were not ready a would not be ready to supply coins to satisfy the needs of the new nation. Even after the passage of the first Coinage Act, congress realized that the U.S. Mint needed time to produce enough coins for the nation. Rather than plunging the economic potential of the new nation into chaos, the government continue to allow foreign coinage, specifically the Spanish Reales, to be used for commerce. This continued until the passage of the Coinage Act of 1857. Aside from authorizing the issuing of the small cent, which the U.S. Mint did by striking the Flying Eagle Cent, the law gave citizens two years to redeem their foreign money for the equivalent in U.S. coinage. By 1859, no foreign coins were circulating in the United States.

In the years leading up to the Revolutionary War, the new colonies were hampered by a situation where King of England did not allow the colonies to control its own money or create its own monetary policy. In order to expand commerce, colonies issued paper notes. These notes functioned as currency but actually were bills of credit, short-term public loans to the government. For the first time, the money had no intrinsic value but was valued at the rate issued by the government of the colony in payment of debt. Every time the colonial government needed money to pay creditors, they authorized the printing of a specified quantity and denomination of notes. Laws authorizing the issuance of notes were called emissions. The emission laws also included a tax that was used to repay the bills of credit with interest.

As taxes were paid using the paper currency, the paper was retired. As the notes were removed from circulation, that meant less payments the government had to make. On the maturity date, people brought their notes to authorized agents who paid off the loan. Agents then turned the notes over to the colonial government for reimbursement plus a com- mission. Sometimes, colonies could not pay back the loan. They instead passed another emission law to cover the debt owed from the previous emission plus further operating expenses, buying back mature notes with new notes. The colonists accepted this system since it was easier than barter and there were never enough coins to meet commercial needs.

To maintain commerce, many of the notes were tied to the value of the Pound Sterling but the worth of the Pound Sterling was interpreted differently from colony to colony. Although the colonies accepted foreign coins, especially the Spanish silver reales, each colony set its own price of silver as based on its purchasing power. For example, the colonies of North Carolina and Virginia tied the reales’ value to the amount of tobacco that can be traded. This continued following the Revolutionary War so that commerce could continue and the new states could repay war debts.

After the failure of the Articles of Confederation to form that perfect union, the authors of U.S. Constitution understood the a union must be able to be supported out of the whole and not individual parts. It was best explained by James Madison in Federalist No. 44 when he wrote:

Had every State a right to regulate the value of its coin, there might be as many different currencies as States, and thus the intercourse among them would be impeded; retrospective alterations in its value might be made, and thus the citizens of other States be injured, and animosities be kindled among the States themselves. The subjects of foreign powers might suffer from the same cause, and hence the Union be discredited and embroiled by the indiscretion of a single member. No one of these mischiefs is less incident to a power in the States to emit paper money, than to coin gold or silver.

By reigning in the chaos caused by 13 different economic policies, the more perfect union turned this young country into an economic powerhouse that has surprised empires of years past.

The economic strength of the United States is based on strength of its currency that is backed by the full faith and credit of the U.S. government. While there are disagreements as to how to use and maintain that strength, the fact of the matter is that much of the world bases its economic stability on the full faith and credit of the U.S. Dollar. There are many economies that use Dollars as its primary means of exchange like most of the countries in Central America. Most of the world’s commodities are priced in dollars like oil and precious metals. And countries buy United States bonds to help back their currency like China.

By repealing the legal tender laws (31 U.S.C. § 5103), Rep. Paul is proposing to demonetize all United States coins and currency that could lead to a global economic collapse. Countries that use the dollar as their currency will not have a currency; currencies backed by the dollar will be worthless; and the price of world commodities will become unstable as the markets search for a new standard. As we have seen during the current economic crisis, instability causes prices to rise—see the prices of gold, silver, and oil.

H.R. 1098 was referred to the Committees on Financial Services, Ways and Means, and the Judiciary. Rep. Paul is chairman of the Domestic Monetary Policy and Technology Subcommittee under the Committee on Financial Services. Should this bill be successfully reported out of all three committees it would have to passed on the floor of the House of Representatives. If it passes the House, it is doubtful that the bill would pass in the Senate. This aspect of the sausage making process ensures that this bill will never pass. Regardless of what you think about United States monetary policy, it is not in anyone’s interest to plunge the world into economic chaos.

Backup To Get Back Up

I am returning from a break for not only my medical reasons, but the health of my computer also failed. It started when the computer’s memory went bad and the system crashed in the middle of session, including backing up my files. As a result, not only did the internal hard drive fail, but the backup drive also failed. New memory and a drive repair program later, both the computer and I feel better.

Which brings me to today’s topic: BACKUPS! As a proponent of diving further into electronic publishing and electronic access for numismatics, one of the things we have to remember is to back up our data! Not only should you backup your data, but you must have a plan and execute that plan regularly and in a way that will ensure your data is safe.

Which brings me to today’s topic: BACKUPS! As a proponent of diving further into electronic publishing and electronic access for numismatics, one of the things we have to remember is to back up our data! Not only should you backup your data, but you must have a plan and execute that plan regularly and in a way that will ensure your data is safe.

Thinking about backups, you might want to consider using the “3-2-1 plan” to do your backups. The “3-2-1 plan” is three copies of your files on two different storage mediums and one backup off site. In my case, I have one copy on my computer that I use daily, one copy on an external hard disk, and the off site copy is using an online backup service where I consider “the cloud” as a different medium. Yes, you do want to back up a copy of your files away from your computer. If there is an unfortunate catastrophic event including theft, fire, or natural disasters (see what is going on in Japan), then the off-site backup becomes critical in saving your important data.

One of the tools I use to ensure I have critical information backed up is to use a service called Dropbox. Dropbox runs on just about any computer and will automatically backs up selected files. To use Dropbox, you create a free account that gives you 2 gigabytes of storage (you can buy more storage, but I use Dropbox for a few selected files), download the software, install it, and copy the files you want to save into your Dropbox folder. When the software detects new files or that the files have changed, the Dropbox software will securely transfer your files to their servers. I found this beneficial when the backup I made before my computer died did not back up the inventory of my collection. When I reinstalled Dropbox on my computer, the software automatically recovered the files from the server.

I do not know what I would do if I lost my inventory files. I could attempt to recreate those records, but I saved myself a lot of time and heartburn by storing it in my Dropbox. Also, by storing the files in my Dropbox, I can access these files using my iPhone. Dropbox also has apps for the iPad, Android phones, and Blackberry devices. Since I have access to these files using my iPhone, I can check my want list at any time without having to carry around paper.

During this crash, I did not lose any of the images I had taken of some of my coins and currency, some that has appeared on this blog. But had something happened, I use an online service called CrashPlan to backup my system. CrashPlan is good for people with more than one computer and can automatically backup your data to CrashPlan’s servers via the Internet. You can also have CrashPlan backup your files to someone else’s computer (with their permission, of course) or to another disk on your home network. It is a great service even for one computer but fantastic for multiple systems. With the unlimited data plan, all of my pictures are backed up off-site. So if something happened, I have an off-site backup with all of my files.

There are other services that work similarly to CrashPlan. For example, a friend uses Mozy on the laptop he uses for business. When he connects to a hotel’s network, his Mozy software will back up the day’s work. Another Mac friend uses Carbonite and gives it rave reviews. You can read a Comparison of Online Backup Services to determine which service may be right for you based on the features and almost all of them offer free trials.

I do recommend keeping your inventory on your computer—I will discuss software for this another time. But if you do have important data on your computer, including the inventory of your collection, then you should backup your data. You should have three copies of your inventory on two different types of backup media and one should be off-site or away from your computer. Do it now because you never know when something will happen.

Beware of the 2055th Ides of March

One of the most recognizable coin from ancient Rome is the Eid Mar denarius commemorative coin issued by Marcus Junius Brutus after he participated in the assassination of Julius Cæsar on the Ides of March (15th of March), 44 B.C.E. The fame of this coin was already cemented by the time Roman historian Cassius Dio wrote sometime in the second century, “Brutus stamped upon the coins which were being minted in his own likeness and a cap and two daggers, indicating by this and by the inscription that he and Cassius had liberated the fatherland.”

One of the most recognizable coin from ancient Rome is the Eid Mar denarius commemorative coin issued by Marcus Junius Brutus after he participated in the assassination of Julius Cæsar on the Ides of March (15th of March), 44 B.C.E. The fame of this coin was already cemented by the time Roman historian Cassius Dio wrote sometime in the second century, “Brutus stamped upon the coins which were being minted in his own likeness and a cap and two daggers, indicating by this and by the inscription that he and Cassius had liberated the fatherland.”

On the Ides of March, a group of senators conspired to assassinate Julius Cæsar to liberate the Roman Republic and save it from Cæsar’s tyranny. Brutus, who Cæsar thought was a friend and ally, was a leader of the conspirators. After Cæsar arrived at the senate, the conspirators stabbed Cæsar 23 times using daggers they hid under their robes. Cæsar died after seeing that Brutus was part of the conspiracy. William Shakespeare dramatizes this scene in Act 3, Scene 1 of the play Julius Cæsar:

Cæsar: Doth not Brutus bootless kneel?

Casca: Speak, hands, for me! [The conspirators stab Cæsar]

Cæsar: [Turning to Brutus] Et tu, Brute? Then fall, Cæsar!

[Cæsar dies]

Cinna: Liberty! Freedom! Tyranny is dead!

Run hence, proclaim, cry it about the streets.

Cassius: Some to the common pulpits, and cry out

‘Liberty, freedom, and enfranchisement!’

Brutus: People and senators, be not affrighted;

Fly not; stand stiff: ambition’s debt is paid.

There are 60 known examples of the EID MAR denarius in silver and only one known gold example. The gold coin is on loan to the British Museum. The obverse of the coin features the bust of Brutus with the inscription “BRVT IMP L PLAET CEST” which means “Brutus, Imperator (honored military commander), Lucius Plætorius Cestianus.” Lucius Plætorius Cestianus was the manager of the mint workers. It was common for the coiner’s name to appear on Roman coinage as a guarantee to the quality of the metal. The reverse features two daggers on either side of a liberty cap, a symbol of freedom. Inscribed below the cap is “EID MAR,” for the Latin Eidibus Martiis or the “Ides of March” to commemorate the day he saved the republic.

There are 60 known examples of the EID MAR denarius in silver and only one known gold example. The gold coin is on loan to the British Museum. The obverse of the coin features the bust of Brutus with the inscription “BRVT IMP L PLAET CEST” which means “Brutus, Imperator (honored military commander), Lucius Plætorius Cestianus.” Lucius Plætorius Cestianus was the manager of the mint workers. It was common for the coiner’s name to appear on Roman coinage as a guarantee to the quality of the metal. The reverse features two daggers on either side of a liberty cap, a symbol of freedom. Inscribed below the cap is “EID MAR,” for the Latin Eidibus Martiis or the “Ides of March” to commemorate the day he saved the republic.

Anyone in the area of the British Museum on the Ides of March, they are presenting a gallery talk by Ian Leins of the British Museum about the Ides of March. The free 45-minute gallery talk will begin at 13.15 (1:15 P.M. London Time) in Room 68. This would be a fantastic… visit one of the world’s greatest museums and take a break with an interesting talk!

Image of the Eid Mar silver coin courtesy of dig4coins.com.

Image of the Eid Mar gold coin courtesy of the British Museum via guardian.co.uk.

Dear U.S. Mint Marketing Department

When was the last time I placed a mail order for a U.S. Mint product? In fact, when was the last time I called the U.S. Mint’s toll-free number to place an order? If you check your record, I have never placed a mail or telephone order. All of my orders have been made over the Internet with your online catalog. Then why do you persist in sending advertisements via the Postal Service?

How much does it cost for the U.S. Mint to send postal advertisements to me and others who have only placed orders online? Aside from the postage, which I am sure you are paying bulk rates, how much are you paying to print these materials, process the mailing list, and transport these pieces to the bulk mail center?

Today, I received the latest mail advertising the America the Beautiful Quarters Proof Set. Forgetting the fact that I never order partial sets, I have never ordered products from the U.S. Mint based on mailed advertisements. If the U.S. Mint Marketing Department had performed basic business intelligence, not only you would know that sending postal advertisement has not influenced a my purchases but I am on every email list that the U.S. Mint offers. It seems obvious that the U.S. Mint does not use business intelligence to help with their sales.

While producing a top-notch product is very important to you and the collecting public, being able to run the bureau with efficiency is also important. Part of that is to know that sending postal advertisements to people like me is a waste of money at a time when every cent counts. I hope that you can fix this issue so that you can improve the fiscal performance of the U.S. Mint.

The Presidential Dollars Are Vanishing

Did you know that the Presidential $1 Coins are “vanishing from circulation at an alarming rate” because they are being hoarded by collectors? Did you also know that the Presidential $1 Coins were “highly coveted coins every produced by the U.S. Mint” and that they are “vanishing from circulation at an alarming rate?”

Did you know that the Presidential $1 Coins are “vanishing from circulation at an alarming rate” because they are being hoarded by collectors? Did you also know that the Presidential $1 Coins were “highly coveted coins every produced by the U.S. Mint” and that they are “vanishing from circulation at an alarming rate?”

This piffle was detailed on a half-hour infomercial entitled DCN Coin Talk starring a pitchman with an official sounding voice and his vapid female sidekick both acting from a script that would have made Phineas Taylor Barnum proud.

Rather than lying awake in the wee hours of the morning, I treated myself to a snack and sat down on the couch in front of the television. After removing the dog’s bone from under my behind, I started channel surfing to find something interesting. I guess cable television does not think anyone would be awake at 5:00 A.M. since the hundreds of stations were filled with bad reruns and infomercials. I found the end of something interesting and watched. After the closing credits, I was greeted with the opening to DCN Coin Talk.

After the opening banter between the pitchman and his muse, they spoke to their correspondent on the scene somewhere in a white room with only a bank vault-like door. The correspondent standing there in a pitch silent room holding his ear as if he holding an IFB in his ear regurgitating his score that ensured he agreed with the pitchman anchor.

To prove this is a legitimate offer, the pitchman anchor introduces David Ganz, “The Father of the 50 State Quarters Series.” Ganz, a long time numismatic author, former President of the American Numismatic Association, lawyer, and Bergen County (NJ) Freeholder, was presented as their numismatic expert as to the potential value of the coins. If you listened carefully, Ganz really did not endorse the product or the claims of their potential price. Ganz did talk about the worth of Morgan Dollars, which were large coins made from 90-percent silver whose population is lower than modern coins. Ganz did not equate the Morgan Dollar to the current Presidential Dollars, but the pitchman anchor really spun what Ganz said into something so positive that it bordered on overreaching.

“You can pay up to six time face value for some of these coins,” the anchor pitchman announced with a smile almost suggesting you could realize a similar profit as well.

After reaching into my pocket for my iPhone, I opened the browser and searched for an article that was familiar sounding. I found an article written by Ganz for Numismatic News that described his experiences making this informercial.

However, the Danbury Mint can help! For $34.95, the Danbury Mint will sell you a roll of 12 “gem uncirculated dollar coins” encased in a plastic roll. Surrounding the roll is an official-looking paper seal that looks like the type placed over the cap on liquor bottles.

But wait, there’s more. In addition to the roll of 12 gem uncirculated dollar coins, you will also receive an additional coin encased in a capsule so that you can have one to admire that is not in the roll. You will receive one roll a month to catch up on the program. All you do is pay $34.95 plus shipping and handling. And since you need to be able to store you new collection, you will also get a beautiful wood case with a tray to hold the capsules above a drawer to hold the rolls. There is a limited supply. Act now before it’s too late!

While the show was entertaining in its absurdity, I am shocked at the chutzpah. What is even more shocking is that I am sure someone is going to buy into this program. I understand that the coins, materials, case, and infomercial costs money, and the purchaser does not care and wants their investment in these coins to appreciate over time. While nobody can predict the future costs of these coins, the truth is that it is doubtful that the buyer would recover the purchase price!

The truth is quite different than what is claimed by this infomercial.

The largest hoards of Presidential $1 Coins are in the coin rooms of the 12 Federal Reserve branches. According to the testimony during a hearing held in July 2010, the representative from the Fed testified that there were $1.1 billion worth of dollar coins waiting to be circulated. When asked why there were so many coins, then U.S. Mint Director Ed Moy testified that even though they have tried to educate the public on the benefit of the coin, most people prefer to use the paper dollar. The hoard is the result of statutory requirements that regulate how many coins are produced.

Rolls purchased from the bank, dealers, or the U.S. Mint’s Direct Ship Program contains 25 coins. Rolls purchased from a bank or the U.S. Mint are sold at face value. Most dealers are selling the rolls at a $8-12 premium including rolls of dollars that are no longer in circulation. You can also purchase older rolls at banks at face value. Visit your bank branch and ask what they have available.

Roll collectors I have spoken with are not interested in short rolls, especially at the retail price of a full roll. Further, roll collectors want to know that the coins within the rolls are from a specific mint. From what I could tell, it is not possible to determine the mint mark on the coins in the Danbury Mint rolls.

If the roll collector wants to collect encased rolls, they usually opt for PCGS Certified Rolls. The PCGS service only accepts rolls from Mint-sealed packaging and places the coins in sonically sealed rolls with their label and tamper evident hologram. These rolls contain 25 coins and dealers have been selling for $50-65.

I have informally polled several online dealers and found that the only Presidential Dollar coins that cost more than $6 are error coins, specifically those with edge errors. Even the most expensive dealer was selling both P & D as a set for $5.75. The most expensive single coin I found was for the uncirculated Lincoln Dollar for $3.50.

While you can buy capsules to hold the coins for around 50-cents each, the coin tubes you can buy holds 25 coins, a full roll. All companies that sell capsules have a storage system that can be displayed on your credenza and easily stored. Some companies make special albums and folders that display the Presidential Dollars well for a fraction of the cost.

Unless you like the display format and do not care about the long term value of the set as sold by the Danbury Mint, then I would not recommend anyone buy into this offer.