Weekly World Numismatic News for June 30, 2019

Price of Gold for the 2nd Quarter of 2019

(Chart courtesy of GoldSeek.com)

With the price of gold opening at $1,279.00 on January 2, 2019, it saw some bumps in its price but has largely averaged a modest gain until the price closed at $1,271.15 on May 21. Then it started to climb and climb rapidly by market standards. On Friday, June 28, the end of the second fiscal quarter, gold closed at $1,409.00. The rise is a 10.8-percent gain since May 21.

Gold is considered a safe bet for investors. It is a way of investing in cash or cash equivalence. Investors buying gold will purchase bullion, gold bullion coins like the American Eagle, or shares in a fund that maintains large stores of gold. There are many types of funds and ways to purchase shares in these funds, but it is not the same as owning the physical gold. Most reports are claiming that investors are interested in purchasing physical gold with bullion coins being the preference.

Investors make money by investing with what they consider a manageable amount of risk. If the risk pays off, they can make a lot of money. The risks that fail must be made up elsewhere. Investors diversify their portfolios to mitigate these risks. However, if the institutional and large investors are moving their monies to safe harbors, like gold, they sense a problem.

This relatively sharp jump in the price of gold is being driven by the major investors who are worried about the future of the U.S. economy. They see the various trade wars being detrimental to the economy. One economist said that the recent hike in soybean tariffs to China is going to have long term effects long after this president leaves office.

Although the United States is no longer an agrarian economy, agriculture plays a significant role in the country’s economic health. Upsetting that role that agriculture plays will cause long-term damage to the economy. The soybean tariffs are believed to be the driver that is scaring investors.

You may ask how are soybeans causing gold to rise?

As part of foreign policy in Africa, the government has been supplying countries with the proper climate the means to grow soybeans. It was a way to make the countries self-sufficient by helping create an economy. In many cases, the United States did not follow through on commitments to help with the infrastructure that is needed to create access to the markets. Countries needed irrigation and road improvements. Rather than helping with the upgrades, the United States government concentrated on the military aspects of these country’s problems. A policy of one-problem-at-a-time.

For at least 15 years, China has ignored the military issues and began to supply the money, supplies, and labor to fix the infrastructure. The Chinese government helped build irrigation systems, roads, and provided transportation to build these economies with the promise that China would buy their products.

Although there was significant Chinese investment in Africa, it was still cheaper to buy soybeans from the United States. That situation changed with the 25-percent tariffs placed on soybean exports. The tariffs raised the price of U.S. soybeans beyond what the Chinese would pay to the African exporters. Now China is importing soybeans from Africa while U.S. farmers are provided allegedly short-term subsidies from the federal government.

Now that the infrastructure is in place for China to import soybeans from Africa, the costs have reduced and is projected to have the long-term effect of lowering the U.S. market for soybeans in China. One economist said privately that even if the tariffs were reduced to pre-trade war levels, it might not make it economically viable for China to buy as much from the United States as it did in the past.

Institutional investors see the loss in revenue from China, the increased deficit in providing welfare to soybean farmers, and the danger of the business not returning to the United States. They also see the reduction of tariffs to Russia for wheat and that Russia is also looking to African and South American countries for wheat sources. The competition is making trade prices drop and is making it look like agriculture trade is in trouble.

If exports of United States agriculture are in trouble, then it will hurt the economy. With the uncertainty added to the risk profile investors and fund managers have to manage, they have turned to gold as the natural, safe harbor.

The rise in gold prices always helps numismatics. It helps boost the prices of gold and, by association, other rare coins. However, if the gold prices go up because of economic stress, it will not matter what happens to numismatic prices. Fewer people will be in the market to buy coins.

And now the news…

Gold is a hedge against financial risk, and coins offer convenience.  → Read more at marketwatch.com

→ Read more at marketwatch.com

COIN collectors can now get their hands on a Toy Story 4 50p piece – but you can’t use it in shops. The commemorative coin features popular character Woody in colour with the cowboyR…  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

HAPPY BIRTHDAY US MINT

On April 2, 1792, President George Washington signed the Coinage Act of 1792 into law, giving birth to the United States Mint. David Rittenhouse was appointed as the first director of the Mint whose first job was to build or purchase the first government owned building.

The Coinage Act of 1792 set the basis of US coins to be the dollar that would be on par with the Spanish Milled Dollar. It established gold coins for the Eagle (ten dollars), Half Eagles, and Quarter Eagles. The half dollar, quarter dollar, dismes, and half dismes were to be struck in silver while the cent and half cent would be struck in copper.

The law outlines how the Mint operates in order to preserve its integrity and sets the basis for making debasement (such as shaving the metals from the edge) and counterfeiting illegal acts. Over the years, we learned that the laws required for self oversight was akin to the foxes guarding the hen house.

From good economic times to bad politics, the US Mint has been working for 216 years to meed the demands for circulating coinage while creating objects that drive the passion of numismatists.

Let’s raise a cheer and wish the US Mint a Happy Birthday!

Would You Pick Up A Penny From The Ground?

Sometimes, the debate on the value of our under appreciated zinc-coated-copper cent can get very passionate. While there are multiple sides to every story, we may forget the satire in all of the arguments.

As part of a similar discussion on the Collectors Society forums, we were introduced to this satyrical “scientific” answer to the question, Is a penny worth picking up?. It is a serious sounding, tongue-in-cheek look at what it would cost to pick up one of these coins laying on the ground.

As you read, please check the links in the article’s section titles!

It’s Sunday… we might as well have a little fun!

300

In the movie 300, Leonidas lead 300 of the best Spartan soldiers to prevail over the more powerful Persian army. In sports, 300 is a perfect bowling score where the bowler has thrown twelve straight strikes. The Chrysler 300 is a car model and the face value of the Rocky Mountain Panoramic Photography Commemorative coin is 300 Canadian dollars.

You may ask, “what is this obsession with the number 300?”

This posting marks my 300th posting to the Coin Collector’s Blog.

Three hundred times, I have written, mused, and ranted something about coins. Weather it be about my own collecting pursuits, news, opinions, or an occasional review, I have used this forum to entertain and inform. I thank everyone for reading.

So that this post is not totally self-ingratiating, I do want to go back to an earlier post and provide an update. On December 3, 2006, I wrote about a new acquisition that was not exactly numismatic-related. His name is Boomer, our cute little puggle. At time we brought him home, he was a nine week old bundle. Today, Boomer is 45 pounds of adolescence with the appetite of a Pug and the nose of a Beagle. He is a fun dog with a playful personality who continues to give us joy each day.

So that this post is not totally self-ingratiating, I do want to go back to an earlier post and provide an update. On December 3, 2006, I wrote about a new acquisition that was not exactly numismatic-related. His name is Boomer, our cute little puggle. At time we brought him home, he was a nine week old bundle. Today, Boomer is 45 pounds of adolescence with the appetite of a Pug and the nose of a Beagle. He is a fun dog with a playful personality who continues to give us joy each day.

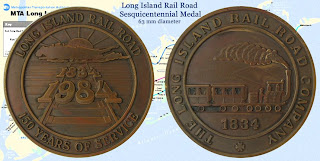

To end this posting with something numismatic, I found an image of a collectible I never posted here. It is a 63 millimeter bronze medal honoring the sesquicentennial (150 years) of the Long Island Railroad. For anyone who has spent any time on Long Island, the LIRR is an important part of the life and culture. Its lines concentrate in Jamaica, Queens where Long Islanders would be dispatched into areas of New York City to the west and home to Long Island toward the east. I purchased this medal a year ago for a nice price since there is a rim ding on the reverse between the “N” and “G” in the word “Long.” Since this minor imperfection does not detract from the medal’s beauty, it was a perfect addition to my New York collection!

To end this posting with something numismatic, I found an image of a collectible I never posted here. It is a 63 millimeter bronze medal honoring the sesquicentennial (150 years) of the Long Island Railroad. For anyone who has spent any time on Long Island, the LIRR is an important part of the life and culture. Its lines concentrate in Jamaica, Queens where Long Islanders would be dispatched into areas of New York City to the west and home to Long Island toward the east. I purchased this medal a year ago for a nice price since there is a rim ding on the reverse between the “N” and “G” in the word “Long.” Since this minor imperfection does not detract from the medal’s beauty, it was a perfect addition to my New York collection!

Happy collecting!

Small Set Back in Double Eagle Case

Litigation between the Langbord family and the United States government continues over the ten 1933 Saint-Gaudens double eagles that were found by the daughter of Israel Switt in a safe deposit box and confiscated by the US government. When the coins are not being displayed, they are stored at United States Bullion Depository in Fort Knox, Kentucy.

Joan Langbord, 76, and her two sons Roy and David, filed a lawsuit in US District Court against the government to retrieve the coins. The Langbords are represented by Barry H. Berke who represented Stephen Fenton in the lawsuit for the Farouk specimen.

In a recent ruling, the court denied the plaintiff’s motion to depose those involved with the decision making process of the Farouk specimen. While more than 40 separate motions have been filed by both sides, it appears that this is the first one denied to the plaintiffs.

As the case moves on, there continues to be speculation of at least one more example in existence. The result of this lawsuit will determine whether that piece comes out of the shadows.

Who said numismatics did not have mystery and intrigue!

Why Is Our Currency Not Accessible?

During a discussion of inexpensive solutions for ways to make authentication into government systems stronger and accessible for the public at a low cost, we were told that the mechanism selected had a version in Braille to allow participation by the blind. Because the program was sponsored by the Department of the Treasury, it was considered ironic that Treasury was concerned about this blind in this program but does not make that same consideration for our currency.

The issue with accessibility of currency has long been an issue, especially since the passages of the Americans with Disabilities Act (Public Law 101-336, signed by President George H.W. Bush). Unfortunately, the Bureau of Engraving and Printing has interpreted Title III (Public Accommodation) as not applying to US currency. Even as the BEP has added new security features and the look to our currency, no changes were made for the blind.

In 2002, the American Council of the Blind (ACB) brought a lawsuit against the Treasury Department demanding that US currency be designed to be accessible to visually impaired people. The court ruled in favor of the ACB complaint in 2006. Treasury was supposed to respond to the order in 30 days from the review. No public statement has been made by Treasury.

From the BEP’s founding in 1861 through the mid-1920s, the bureau had a history of frequently changing currency designs and even changed its size around the turn of the century. Beginning in the 1920s, currency design did not change until the mid 1990s when new security features had to be added curb counterfeit problems.

Advocacy groups continue to petition BEP to make the currency more accessible to the visually impaired. BEP has even been provided with studies of describing the features used by over 100 countries to include the visually impaired. The Reserve Bank of Australia has researched and developed the use of polymer notes with special security features with consideration for the visually impaired with great success.

Rather than implement one of existing technologies that are being used by over 100 countries and the European Union, BEP designers chose to increase the size of the “5” on the reverse of the new $5 note so that it would be visible to those with limited sight capabilities. Allegedly, the intaglio printing used on the note is supposed to help the blind. What the BEP does not mention is that once the note wears, the benefits of the intaglio printing disappear.

The BEP does not have the same design restrictions that is placed on the the US Mint (31 U.S.C. §5112). BEP can change the notes at any time for any reason. The only restriction on US currency is that the denominations must begin with one dollar (31 U.S.C. §5115(a)(2)). So why does BEP continue to discriminate against one class of Americans while continuing to producing an ugly product?