Weekly World Numismatic News for April 24, 2022

National Coin Week wraps up this weekend, celebrating coin designs. One thing that has been constant throughout the 21st century is changing coin designs. It started with the 50 State Quarters program and has affected every circulating coin except the half-dollar and the dime.

National Coin Week wraps up this weekend, celebrating coin designs. One thing that has been constant throughout the 21st century is changing coin designs. It started with the 50 State Quarters program and has affected every circulating coin except the half-dollar and the dime.

Although the design has lasted more than 25 years, it is not likely that the Treasury Department will change the design. The story of the JFK assassination continues to resonate with a significant sector of the population, and Kennedy’s popularity remains.

Franklin D. Roosevelt’s appearance on the dime is different. Roosevelt helped create the March of Dimes, and following his death, Congress decided that adding his portrait to the dime was the best way to honor the late president. Since its release in 1946, the dime’s design has not changed.

The Roosevelt Dime is the smallest coin produced by the U.S. Mint. Changes to the design may not display as well. When John Sinnock designed the coin’s reverse, the similarity with the Mercury dime was not a coincidence. Aside from the symbolism, the U.S. Mint knows the design will strike well on a small planchet.

While the ability to strike the designs continues to be a concern, modern technology could help produce a suitable design. The problem is, what would make an appropriate design?

Until someone in Congress proposes a bill to change the dime’s design, it will remain the longest-running design on U.S. coins.

And now the news…

→ Read more at mining.com

→ Read more at mining.com

→ Read more at malaysiandigest.com

→ Read more at malaysiandigest.com

→ Read more at ancient-origins.net

→ Read more at ancient-origins.net

→ Read more at dailymail.co.uk

→ Read more at dailymail.co.uk

→ Read more at ancient-origins.net

→ Read more at ancient-origins.net

Is the U.S. Mint the hobby’s problem?

Before the February 11th sale of the 2021-W American Silver Eagle Proof coins, the U.S. Mint allowed dealers to buy the coins in bulk. Coin World reports that dealers were able to purchase coins three-days in advance of the public sale.

Before the February 11th sale of the 2021-W American Silver Eagle Proof coins, the U.S. Mint allowed dealers to buy the coins in bulk. Coin World reports that dealers were able to purchase coins three-days in advance of the public sale.

The U.S. Mint had a product limit of 327,440 coins with a household limit of 99 coins. Since learning about this, it was surprising that coins available to purchase. The coin sold out in a few moments.

Speculators purchased as much as they could afford then listed their inventory on eBay. They are profiting from the U.S. Mint’s decision to serve the dealers rather than the collector. If you want to buy the coin on eBay, the average sale price of the coin issued at $73 is $110-140. It is a 33-percent to 48-percent increase over the issue price.

Who does the U.S. Mint serve, the collectors or the dealers? If the U.S. Mint serves the collectors, then a policy change is necessary to work better with the collector community.For those who complain about coin designs and base-metal coinage as a threat to the hobby, what about the U.S. Mint’s action to shutout collectors from silver coins?

If the U.S. Mint serves the dealers, they do not serve the public and do not serve the hobby. If the approach is all about business, then what about the collectors?

When Rhett Jeppson started the U.S. Mint’s Numismatic Forum in 2016, the promise was to bring in different members of the numismatic industry to help guide the mint into the future for the benefit of the hobby. Jeppson was nominated to be the Mint’s Director but was never confirmed.

The U.S. Mint continued with the forms in 2017, 2018, and 2019. Reports of those meetings said that they were productive. It has not made an impact.

Since the Senate approved David Ryder as director, he has done little to make the U.S. Mint more responsive to the customer. The Numismatic Forums have ceased, and Ryder seems to favor creating collectible coins instead of getting the coins into collectors’ hands.

An example of what is wrong with Ryder’s approach is when there were ordering problems with the V75 American Silver Eagle. Instead of saying that the U.S. Mint will work on the issue, Ryder touts the collectibles he created.

What good is creating collectibles if the collector cannot purchase the coins?

The ever-changing quarter designs, privy marks, and other things people complain about will not hurt the hobby. Forcing the collector into the unregulated secondary market to buy newly issued coins will drive collectors away.

Fun with gold history

Sometimes, finding a link to a page that describes what things were like the year you were born can lead to educational and fun reading.

Sometimes, finding a link to a page that describes what things were like the year you were born can lead to educational and fun reading.

A friend sent a link to an October 2020 article on Stacker titled “Cost of gold the year you were born.” Aside from finding out that gold broke the $35 barrier the year I was born, the article outlines economic history from 1920 to 2020.

Some of the descriptions also will help explain some of the numismatic decisions that affect collectors. Understanding the economic history behind money can help understand where collectibles are today.

While reading through the list, I picked out ten significant highlights of the last 100 years:

- 1932: The last year the U.S. Mint struck gold coins that were circulated

- 1949: Switzerland stops minting the 20 Franc gold coin, the last gold coin struck for circulation

- 1955: San Francisco Mint stopped coining operations (it would return 13 years later)

- 1967: South Africa introduces the Krugerrand

- 1975: Gold ownership made legal again

- 1979: Canada introduces the gold Maple Leaf

- 1982: China introduces the gold Panda

- 1985: Reagan signs the Gold Bullion Coin Act

- 1998: The euro is introduced

- 2000: The Denver Mint produced 15.4 billion coins, the most of any mint

Understanding history is another way to get more out of your collection.

Read! Educate! And collect!

Weekly World Numismatic News for March 7, 2021

Prices are rising.

Whether you talk about the price of groceries, gas, or collectibles, prices are rising. So are the price of the collectibles markets, including numismatics.

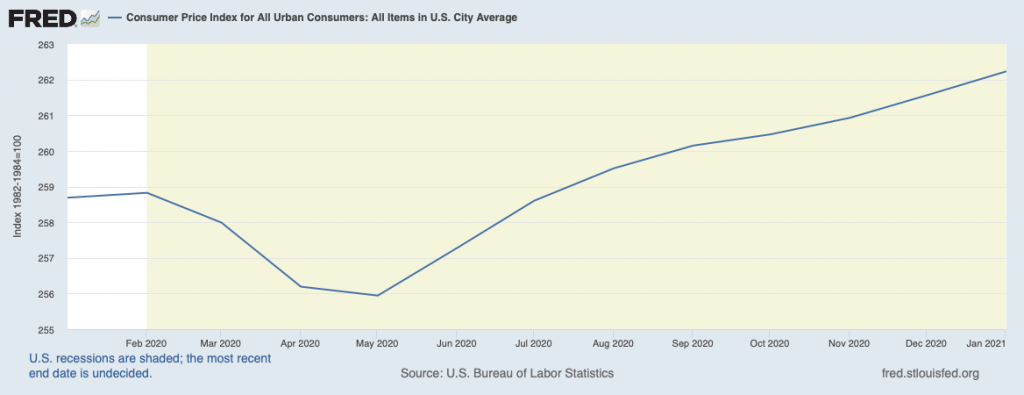

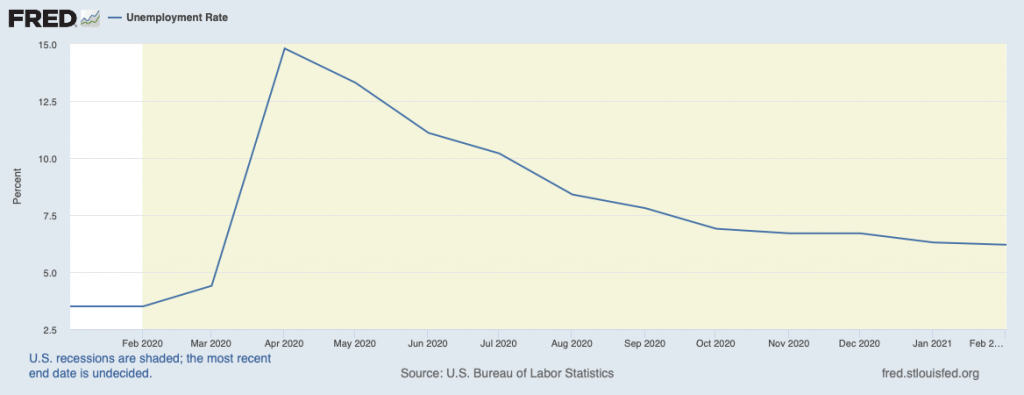

According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) has been steadily rising for six months. While the prices are rising, unemployment has dropped from the beginning of the pandemic high of 14-percent to the 6.2-percent rate, BLS recently announced.

-

Charting the Consumer Price Index during the pandemic

(Chart courtesy of the St. Louis Fed)

-

Charting the Unemployment rate during the pandemic

(Courtesy of the St. Louis Fed)

With all of this economic stress, why are collectibles, especially numismatics, are seeing rising prices?

An auction industry source said that there is a pent-up demand for something resembling normal. Instead of the everyday routine, those with means are buying. In the last six months, the industry reports that prices realized for all sectors have risen at rates higher than seen in many years. Estate auctions are attracting new customers looking for unique items.

Numismatics is in the middle of the trend, with collectors and investors looking for something to do. Collectors are spending more time with their collections and looking to expand. Investors see the rise in values because of the rise in precious metal prices and have driven the market higher.

-

One year gold spot price

(Graph courtesy of PCGS)

-

One year silver spot price

(Graph courtesy of PCGS)

One of the areas where the price changes are noticeable is in the markets for precious metals. While the spot price for gold and silver has been relatively steady, the numismatic spread for coins has climbed. Dealers are reporting that generic gold and silver for numismatic items increased over the last six months.

(graphs courtesy of PCGS)

- One year trend of generic gold coin prices

- One year trend of Morgan and Peace Dollar prices

- One year trend of 20th Century coin prices

Several industry reports note a higher demand for physical ownership of precious metals, putting pressure on the markets. But rather than buying bullion, investors are purchasing coins. Demand for American Eagle products has outpaced many dealer’s abilities to purchase supplies. When bullion coins were not available, investors purchase coins produced for the collector market, including proof and special issues coins.

Recently, the U.S. Mint set a 99 coin limit when they released the 2021-W American Silver Eagle Proof coin with the original reverse. The coin sold quickly. When asked, the U.S. Mint claimed they did not have the statistics about the number of 99 coin purchases they fulfilled. Collectors report that they were shut out of coin purchases while dealers have been slabbing and selling the coins mostly to investors.

If the predictions are true, economists believe that there will be a roaring 2020s similar to the roaring 1920s following the Spanish Flu Pandemic. Considering the current trends, the secondary market for numismatics may make it too expensive for the average collector to participate in the market.

And now the news…

→ Read more at lancasteronline.com

→ Read more at lancasteronline.com

→ Read more at tweaktown.com

→ Read more at tweaktown.com

→ Read more at hurriyetdailynews.com

→ Read more at hurriyetdailynews.com

→ Read more at scoop.co.nz

→ Read more at scoop.co.nz

→ Read more at bangordailynews.com

→ Read more at bangordailynews.com

February 2021 Numismatic Legislation Review

Welcome to the first legislative report for the 117th Congress.

Welcome to the first legislative report for the 117th Congress.

Every two years, a new Congress opens to an alleged promise of a productive session. But like all political promises, the ideals disappear after the opening gavel.

Aside from the public business that makes the news, the House of Representatives set itself up for a lot of busywork. Through February, members of the House have submitted 1,461 bills to be considered. It is the soonest the House has reached 1,000 bills in the last ten years.

If the House is nicknamed “The Raucus Caucus,” then the Senate is the more deliberative body. That is until they appear in the well of the chamber to wax poetic about some issue only to change their minds when the cameras are on them. But the 100 members of the Senate, with two seat changes in January, proposed 479 bills through February. The pace is a little faster than in previous sessions.

Of the 1,907 bills proposed in either chamber, only three had to do with numismatics. Two of the bills are the typical commemorative proposals and the nonsense proposed by Mike Lee.

If this is representative of what we can expect from the 117th Congress, it will be a boring session for numismatics.

H.R. 1057: To require the Secretary of the Treasury to mint coins in commemoration of the National World War II Memorial in Washington, DC, and for other purposes.

H.R. 905: To require the Secretary of the Treasury to mint coins in commemoration of the health care professionals, first responders, scientists, researchers, all essential workers, and individuals who provided care and services during the coronavirus pandemic.

S. 185: Cancel the Coin Act

Weekly World Numismatic News for February 28, 2021

I still need more signatures to appear on the ANA Board of Governors ballot. If you are an ANA member, please download the petition, sign it with your ANA member number, take a picture with your smartphone and email it to me at scott@coinsblog.ws. Your help is appreciated.

I still need more signatures to appear on the ANA Board of Governors ballot. If you are an ANA member, please download the petition, sign it with your ANA member number, take a picture with your smartphone and email it to me at scott@coinsblog.ws. Your help is appreciated.

Several people asked about my positions on a few issues. Here are the top three:

- I am 100% for reviving the Exhibition Committee. I favor amending the ANA By-Laws to make the Exhibition Committee a required standing committee of the association.

- I have no position on the holding of the 2021 World’s Fair of Money now. I know everyone wants a grand show, but I am concerned about general safety. The ANA should wait until May before making a decision based on the facts rather than speculation. Remember, my father died of COVID-19, making me very sensitive to the issue.

- Several people expressed concern that the ANA heavily favors the dealers. The perception comes from the number of dealers in leadership roles and making decisions for the ANA. The members in leadership roles are doing what is best for the hobby, but I understand the need for additional input from collectors. There are ways for collectors to be more involved.

I will write more about these issues at another time.

For now, I found four fascinating news stories for the week. The story that collectors should read is from the BBC, “Coins can inspire people to look into the past.” Following their story on Decimalisation in the United Kingdom, they heard from many Britons who shared their coin collecting stories. The piece offers the stories of five collectors and their collections.

→ Read more at progress-index.com

→ Read more at progress-index.com

→ Read more at bbc.com

→ Read more at bbc.com

→ Read more at businessinsider.co.za

→ Read more at businessinsider.co.za

→ Read more at artic.edu

→ Read more at artic.edu