Time for the ANA to wake up and EDUCATE against counterfeit scams

There was once a time that the American Numismatic Association worked with stakeholders to protect numismatic buyers. The ANA worked with eBay to create marketplace protection rules. They were involved with helping raise awareness to gain the passage of the Collectible Coin Protection Act. But where has the ANA been over the last eight years?

There was once a time that the American Numismatic Association worked with stakeholders to protect numismatic buyers. The ANA worked with eBay to create marketplace protection rules. They were involved with helping raise awareness to gain the passage of the Collectible Coin Protection Act. But where has the ANA been over the last eight years?

Since the passage of the Collectible Coin Protection Act 2014, the ANA has been silent on all aspects of counterfeit coins entering the United States, primarily from China. In the past, the ANA has partnered with China Gold Coin to manufacture Panda silver coins with the ANA logo for the World’s Fair of Money. China Gold Coin is a People’s Bank of China subsidiary that manufactures the Panda bullion coins.

According to the ANA’s website, its mission statement begins:

The education process has been lacking in the area of consumer awareness. While some of the topics are covered in their introductory collecting course, are no courses, statements, or seminars about the scams collectors face daily.

Previously, the ANA has used its position as a national organization to work with eBay to make the online marketplace safer for buyers. It is impossible to eliminate all problems, but the result has been a safer marketplace for eBay buyers. It is a program that the ANA can proudly take credit.

But when it comes to Chinese counterfeits, the ANA has been silent.

The ANA must develop a plan to educate the public to help the collecting and investing public how to protect themselves against the scammers.

- Two counterfeit American Silver Eagles purchased from LIACOO, a company based in China who advertised on Facebook.

- The font for LIBERTY is too thin. Also, the stars in her flag draped over the shoulder are too small.

- Aside from the rims being to thin, look at the U in United and the dash between SILVER and ONE. These are not correct for the 2020 ASE.

While the ANA devises a plan, they can produce videos that teach collectors to avoid scams. The videos can feature the ANA President, prominent dealers, collectors, and anyone who can help deliver a message. Find someone who was scammed to talk about their experience. Two videos can include a guide to examining an American Silver Eagle to determine if it is a counterfeit coin.

The ANA must advertise the release of the videos nationally. While the numismatic press will promote these videos, the promotion must appear in the non-numismatic media. The promotion must go beyond the press release, and Spokespeople must be made available to media outlets catering to a broader audience.

The ANA can craft a plan to educate the collecting and investing public during the video production to protect against counterfeit coins. The plan must continue to educate the collecting public and educate law enforcement and politicians who can become involved with a scammed collector. The ANA can partner with the U.S. Mint, Bureau of Engraving and Printing, and the U.S. Secret Service to add depth to the public education program.

A plan must include working with Facebook to eliminate advertisements for counterfeit coins.

If the ANA Board of Governors does not know where to begin, consider the Ad Council’s campaign criteria to develop a plan. Even if the ANA cannot convince the Ad Council to work with the ANA, they are successful guidelines to publicize this issue.

April 2020 Numismatic Legislation Review

Although the calendar passed May the Fourth (be with you) and Cinco de Mayo, the days are running together that the one thing I forgot was the end of April. Days are blurring together to the point that I forgot that Thursday was senior day at some local stores. I do not mind the label of a senior citizen. It means that I survived to wear that moniker.

Although the calendar passed May the Fourth (be with you) and Cinco de Mayo, the days are running together that the one thing I forgot was the end of April. Days are blurring together to the point that I forgot that Thursday was senior day at some local stores. I do not mind the label of a senior citizen. It means that I survived to wear that moniker.

So that I can correct this senior moment, it is time to talk about the one numismatic-related bill introduced in the House of Representatives in April.

H.R. 6555: United States Semiquincentennial Quarter Series Act

The United States Semiquincentennial Quarter Series Act (H.R. 6555) would create a five quarters program to celebrate the U.S. Semiquincentennial (250 years) in 2026. If the bill passes, the U.S. Mint will “issue quarter dollars in 2026 with up to five different designs emblematic of the United States semiquincentennial. One of the quarter dollar designs must be emblematic of a woman’s or women’s contribution to the birth of the Nation or the Declaration of Independence or any other monumental moments in American History.”

According to the bill, the Secretary “may” mint “$1 coins with designs emblematic of the United States semiquincentennial.”

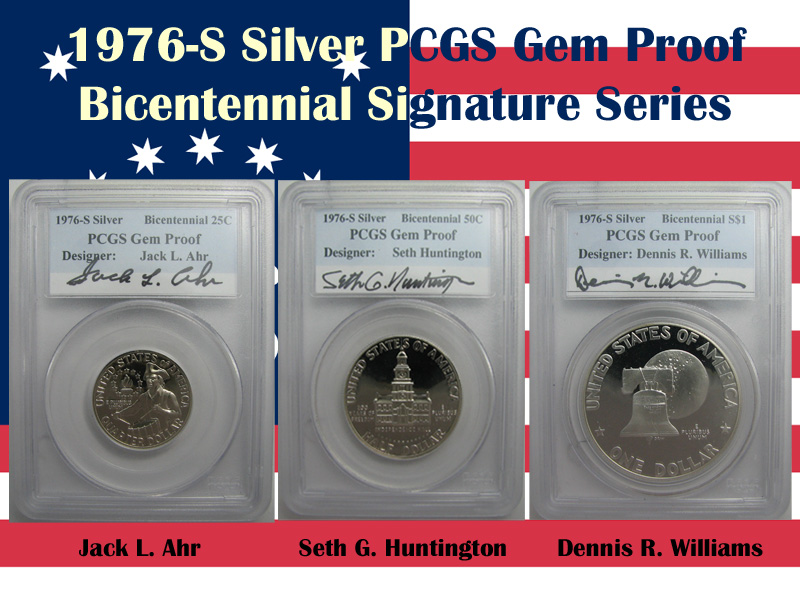

H.R. 6555 takes a different approach than the Bicentennial coinage. For the Bicentennial, the program lasted two years, 1975-1976. The coins were dated 1776-1976, and the reverse of the quarter, half-dollar, and dollar coins were redesigned. The previous designs returned in 1977.

The country is busy with other issues rather than being concerned with the nation’s semiquincentennial. But it is nice to think about a celebration than the worries we are going through today.

QUARANTINE READING LIST: Reading History for FREE

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of COVID-19 is to stay home. Although the United States has 4.25-percent of the world’s population, it has 33.19-percent of the reported cases of the disease with a death rate of 5.77-percent.

Even as some areas of the country are easing quarantine restrictions, the best way to prevent the spread of COVID-19 is to stay home. Although the United States has 4.25-percent of the world’s population, it has 33.19-percent of the reported cases of the disease with a death rate of 5.77-percent.

The dangers of the novel coronavirus are not only to older people, who dominate the hobby, reports that younger people who may not have shown symptoms have experienced strokes. Even the youngest children are showing symptoms that resemble Kawasaki disease.

I know it is a financially and mentally tough situation. The business I worked hard to build was beginning to break through when Maryland ordered non-essential companies to close. When I am not working alone to organize a warehouse, I am finding solace in numismatics.

During the last few weeks, I have been reducing the to-be-read pile of books. But I am beginning to run out of books. I am looking for something different. Since I like history and tying history with numismatics, I am looking to learn something new. With a tight budget, I am also looking for something new that does not cost much.

I found four entries to my Quarantine Reading List that are interesting and have taught me something. The best thing about each of the books is that each is available online.

U.S. Mint Modern Era

Other than the formation of the U.S. Mint, there is no single seminal event that marks its history than the elimination of silver from circulating coinage. It is the dividing line between what is considered classical coinage and the modern era.

Other than the formation of the U.S. Mint, there is no single seminal event that marks its history than the elimination of silver from circulating coinage. It is the dividing line between what is considered classical coinage and the modern era.

When you find information about the era, it discusses the discussion and the result that created clad coinage. But when you dig into the policy, there is a bigger story. As with a lot of history, the details help us understand the road to where we are today.

The road to modern coinage began with changes in the laws and policies at the U.S. Mint. The one place that every law and policy announcement documented is in the “Annual Report of the Director of the Mint Fiscal Year June 30, 1965.”

What makes this over 300-page document interesting to read are the details that are no longer present in present-day Annual Reports. The text reprints congressional testimony, reports, announcements, policies, and the laws that affected the U.S. Mint. Since this report covers the last half of calendar year 1964 and the first half of calendar year 1965, it is ideally situated to document the government’s action from silver to clad coinage.

The first numbered page begins with the text of the Coinage Act of 1965.

For those that like charts and data, you can go to page 201 to read the section on “The World’s Monetary Stocks of Gold, Silver, and Coins in 1964.” It is a look at circulating coinage of the entire world for 1964. It is a fascinating view that the U.S. Mint stopped doing in 1972.

Download your copy of this Annual Report → here.

Colonial Currency

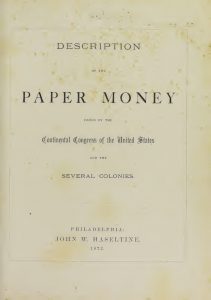

While looking for records about colonial currency, I stumbled on an electronic copy of Description of the Paper Money Issued by the Continental Congress of the United States and the Several Colonies by John W. Haseltine, published in 1872. Haseltine was a dealer, auctioneer, and cataloger of many collectibles, including coins. Many of his catalogs were sparsely illustrated, but the listings have proven invaluable.

While looking for records about colonial currency, I stumbled on an electronic copy of Description of the Paper Money Issued by the Continental Congress of the United States and the Several Colonies by John W. Haseltine, published in 1872. Haseltine was a dealer, auctioneer, and cataloger of many collectibles, including coins. Many of his catalogs were sparsely illustrated, but the listings have proven invaluable.

Paper Money Issued by the Continental Congress is one of those catalogs. Its contents are nothing more than lists of colonial currency issued in the 18th century. It is a useful reference for anyone with interest in the currency of that era. Download a copy → here.

If you want a colonial currency reference that is more extensive, you can download The Early Paper Money of America by Eric P. Newman → here.

Branch Mints and Gold Coins

Did you know that the Charlotte Mint was the first branch mint outside of Philadelphia? Authorized in 1835 following the gold strike at the Reed Gold Mine, it became operational in 1838. The Charlotte branch mint was closed when the building was seized in 1861 by the Confederacy during the Civil War.

Did you know that the Charlotte Mint was the first branch mint outside of Philadelphia? Authorized in 1835 following the gold strike at the Reed Gold Mine, it became operational in 1838. The Charlotte branch mint was closed when the building was seized in 1861 by the Confederacy during the Civil War.

When I wanted to learn more about the Charlotte Mint, I was pleasantly surprised to discover that Charlotte Mint Gold Coins, 1838-1861 by Douglas Winter is available to read online or to download. The book is an easy read with illustrations, and a catalog of the coins struck at the mint. You can find the book → here.

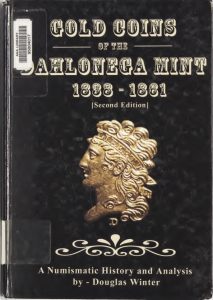

The branch mint in Dahlonega, Georgia, opened after Charlotte also to mint gold coins from a nearby gold strike. Dahlonega was also seized by the Confederacy in 1861 and did not reopened.

Gold coins minted at Dahlonega carry the “D” mintmark. Since Dahlonega only struck gold coins and gold coins were not struck in Denver, this has not been an issue. To read about the colorful history of this branch mint, read Gold Coins of the Dahlonega Mint 1838-1861, Second Edition, by Douglas Winter. The book is similar in format to Winter’s Charlotte book. You can find this book → here.

Gold coins minted at Dahlonega carry the “D” mintmark. Since Dahlonega only struck gold coins and gold coins were not struck in Denver, this has not been an issue. To read about the colorful history of this branch mint, read Gold Coins of the Dahlonega Mint 1838-1861, Second Edition, by Douglas Winter. The book is similar in format to Winter’s Charlotte book. You can find this book → here.

Winter did write books about the gold coins struck at the New Orleans and Carson City Mints, but I had not read either book at the time of this writing. These books and more free resources are available through the Newman Numismatic Portal.

Weekly World Numismatic News for May 3, 2020

This past week has been interesting for the precious metals markets. When the market seems like it will take off, prices modulate and lay flatter than a pancake. Predictions as what the markets will do are all over the place without a consensus answer from analysts.

This past week has been interesting for the precious metals markets. When the market seems like it will take off, prices modulate and lay flatter than a pancake. Predictions as what the markets will do are all over the place without a consensus answer from analysts.

It reminds me of the quote attributed to President Harry S. Truman, “Give me a one-handed Economist. All my economists say; ‘on one hand…,’ then ‘but on the other….’”

This past week, the Anti-Counterfeiting Educational Foundation (ACEF) weighed in with another problem in this market: COUNTERFEITING!

Counterfeiting is not a new problem. What makes the problem more pronounced is that with much of the country staying home and Internet usage increasing, the number of websites trying to scam people out of money has risen. ACEF has been monitoring the problem and has reported over 100 websites selling counterfeit coins and bullion to government enforcement agencies.

Many of these counterfeiters create slick websites. Not only is it easy to create professional-looking sites with modern tools, but it is easy to copy information from one website to another. Once the scammer has the information they want, it is easy to repurpose it to scam people. They also copy the text from legitimate websites, especially if English is not their first language. It is easier to steal the text than have to create their own.

- If the price is too good to be true, it is probably a scam. Check a site like kitco.com for the current Bid/Sell price. If the offer price is below the current Bid, be wary of the seller.

- Many scammers do not include real information about their location. Beware of the seller if they do not have a physical address. I know that there are exclusively online dealers that work from home but use post office boxes, so they do not publicize their home address. For those dealers, you will have to do more investigations. However, if the dealer is using a private postal box, you may want to avoid their offers. Private postal box services have fewer verification checks than the Post Office. Also, if something happens with a Post Office Box, you will have a stronger case when you complain to the Postal Inspection Service.

- Nearly everything said about addresses can apply to telephone numbers. Telephone numbers can be faked, rerouted, sent to a pay-as-you-go phone that some people call a “burner phone,” and so many more options. The problem also exists for toll-free telephone numbers but with an additional issue: when you call a toll-free telephone number, the owner of the number will get the phone number of the telephone you used to call. Since the recipient is paying for the call, they have the right to know where the call originated.

“But Scott,” you ask. “How do I figure out if this information is real?”

Let your favorite search engine be your friend.

Use your favorite search engine and type the address into the search bar. What information comes up for that address? Is the address a business? A private home? A private mailbox service?

Use an online map service that shows street views, like Google Maps. Search for the address found on the website. What can you learn from looking at the street view?

You can also enter the telephone number as a search term. In many cases, you will find one of the many “is it a scam” websites. These sites rely on users to enter data about their experiences with the telephone number. Click on a few to see what others have said about the telephone number in question.

With those essential tools, you should be able to avoid most scammers. Unfortunately, the professional scammers know their way around these issues. Then again, some of those scammers work out in the open. They run legally but use emotion, patriotic-sounding buzzwords, and extremist rhetoric to convince buyers to overpay for their products.

If you think you have been scammed or there is a question about a dealer, contact the ACEF (www.acefonline.org) and ask for assistance.

Finally, if you are in the market to buy precious metals, you should consider working with a member of the Accredited Precious Metals Dealer program (www.APMDdealers.org).

And now the news…

→ Read more at bloomberg.com

→ Read more at bloomberg.com

→ Read more at newzhook.com

→ Read more at newzhook.com

→ Read more at finance.yahoo.com

→ Read more at finance.yahoo.com

→ Read more at moneyweek.com

→ Read more at moneyweek.com

Still Trying to Figure Out the Pandemic Gold Market

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

In last Sunday’s Weekly World Numismatic News, it opened with a discussion about how gold and silver were doing in the current market. While researching the data, the indication was that physical bullion and electronic purchases were driving the markets. Bullion coins were not a factor.

On Monday, Bloomberg News published an article that suggested otherwise. The article notes that retail buyers of gold are paying up to $135 per ounce above spot prices. An analyst interview for the article said, “There has never been a time for American Gold Eagles at this premium level.”

A call to a trusted source explained the differences in the reporting.

Last year, gold hit a low of $1,269 per troy ounce. With good economic indicators, investors thought that the prices would continue to fall. The market did not see value in buying a declining asset. Sellers were hoarding their stock until prices became more favorable.

The lack of buying, especially by retail investors, left dealers with a lot of inventory. With inventory building, dealers did not buy additional coins from the U.S. Mint’s dealers. As the prices rose, sellers started to sell their gold coins adding to the inventory.

Then came the coronavirus pandemic.

Markets hate uncertainty. The coronavirus pandemic has made uncertainty the only certainty. Not knowing where to turn, many sources are reporting significant gold sales. Where the reports differ is the source of the gold.

Although sources confirm that physical bullion and warrants are producing the highest volumes, they say it is because the investors cannot find enough bullion coins to satisfy market demands. The markets adjusted.

The demand increased when the U.S. Mint temporarily closed the West Point Mint. While the reaction did not rise to panic-like levels, retail gold buyers sought bullion coins, primarily American Gold Eagles, with greater urgency.

Professional investors are buying bullion and other gold products, including classic United States gold coins. The retail demand for American Gold Eagle coins has driven up the price. As the price for Eagles rises, it has driven up the cost of other bullion coins, including the Canadian Maple Leaf and Krugerrand.

When considering the purchase of gold coins, keep the spread in mind. If you purchase gold coins with a $150 premium over spot, to ensure that your investment generates a return, the bid price has to raise $150 plus whatever premiums dealers place on the coins. It might require the price of gold to rise $200-255 per troy ounce to break even.

Investors thought that the supply would ease with the Royal Canadian Mint resuming processing of bullion. However, in the beginning, the Royal Canadian Mint will produce large gold bars to satisfy orders from central banks so they can settle on accounts. They will also be striking silver Maple Leaf bullion coins.

Some reports suggest that most of the early production of silver coins will stay in Canada.

After discussing the markets with three different analysts, the only certainty is uncertainty. Each had an opinion that differed from each other but agreed that someone is going to make money.

Weekly World Numismatic News for April 26, 2020

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

As the stay or safe at home orders continue, news in the investing world around coins and bullion is whether there will be a recovery and what will happen.

While investors are turning to gold as the equity markets are less than stable, reports that bullion and bullion-related warrants are outselling all coin offerings. Even though the West Point Mint briefly paused coin production, the markets have not felt the impact.

Silver prices are faring as well as gold. The area that silver is gaining strength is in the industrial markets. Driving the price is the demand for electronics. The primary use of silver is in the braising that ensures the connections between the chips are secure and with the production of LEDs.

Industrial silver is in more demand than industrial gold. As Asian electronics production begins to ramp up, some investors feel that there may be a temporary shortage of silver. One analyst suggested that silver prices could climb to $18 per ounce. Silver is currently $15.26 per troy ounce.

On the other hand, the reports of economic contraction have suggested that bullion prices will collapse. If this is the case, then there will be more to worry about than the market price of bullion.

And now the news…

→ Read more at washtimesherald.com

→ Read more at washtimesherald.com

→ Read more at seekingalpha.com

→ Read more at seekingalpha.com

→ Read more at iflscience.com

→ Read more at iflscience.com

→ Read more at snopes.com

→ Read more at snopes.com