HAPPY NEW YEAR 2022!

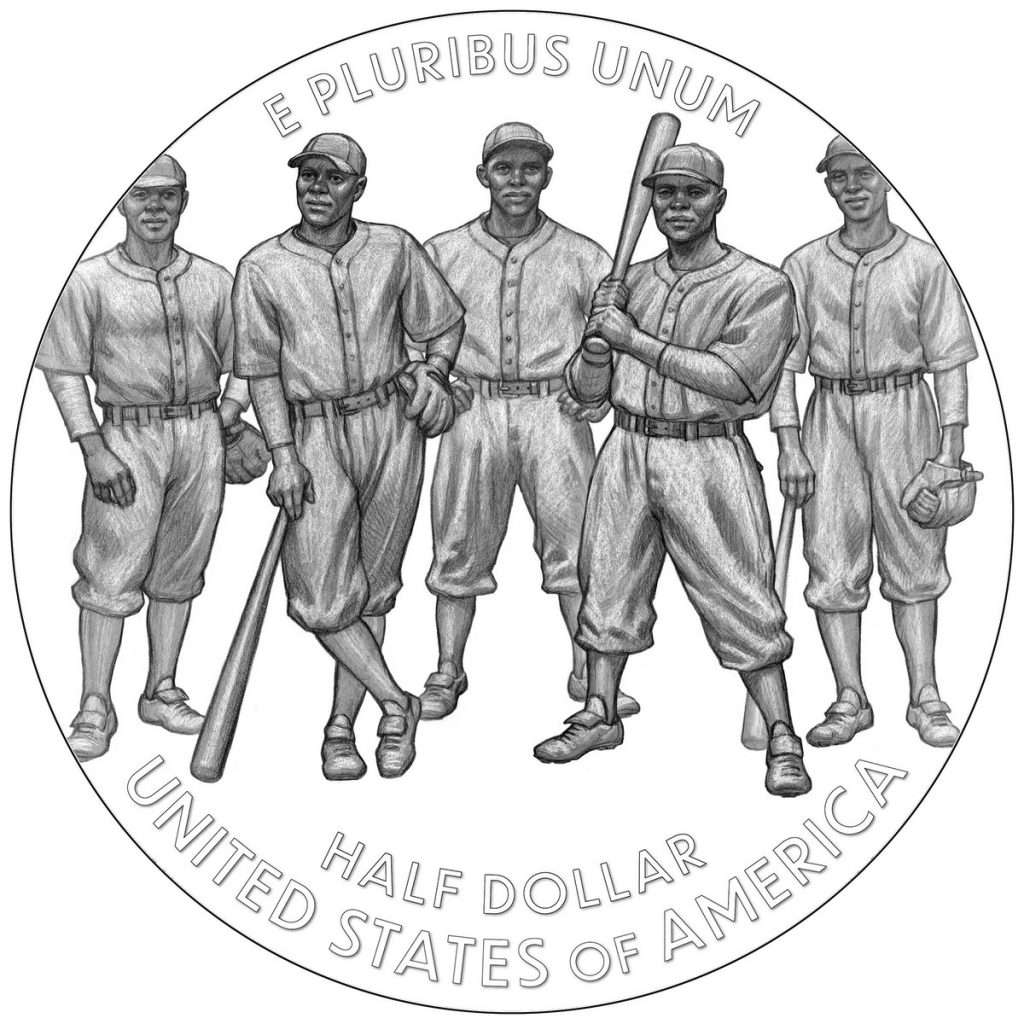

- 2022 Negro Leagues Baseball Commemorative clad half-dollar reverse

- 2022 National Purple Heart Hall of Honor Commemorative clad half-dollar obverse

- 2022 Quarter Obverse design by Laura Gardin Fraser

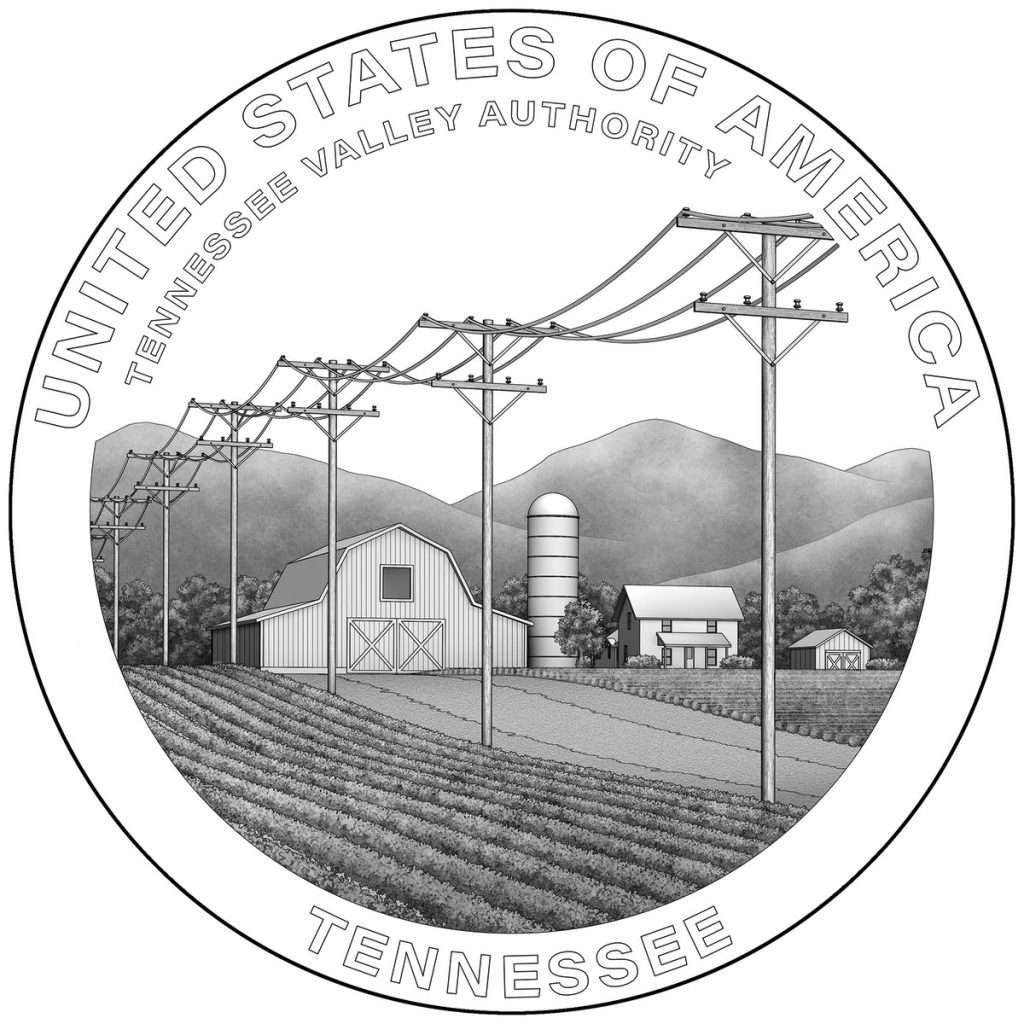

- 2022 Tennessee Dollar

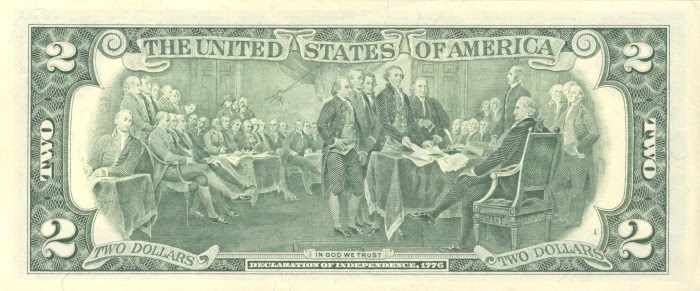

Celebrating Independence Day 2019

Independence Day in the United States is a celebration of the formal breakup with the British monarchy. But like a lot of political decisions on this side of the pond, it was a decision that caused a lot of debate. For example, during the discussion on whether to declare independence, Maryland was one of four colonies to hold out. The others were New York, Pennsylvania, and South Carolina.

Independence Day in the United States is a celebration of the formal breakup with the British monarchy. But like a lot of political decisions on this side of the pond, it was a decision that caused a lot of debate. For example, during the discussion on whether to declare independence, Maryland was one of four colonies to hold out. The others were New York, Pennsylvania, and South Carolina.

Here are five other historical notes about the declaration:

- The preamble of what would become the beginning of the Declaration of Independence passed on May 15, 1776.

- On June 11, 1776, the “Committee of Five” was appointed to draft a declaration. Committee members were John Adams of Massachusetts, Benjamin Franklin of Pennsylvania, Thomas Jefferson of Virginia, Robert R. Livingston of New York, and Roger Sherman of Connecticut. They completed the draft on June 28, 1776.

- The Continental Congress debated the draft on July 1-2, 1776. New York and South Carolina were still holdouts, and the two Deleware representatives were deadlocked. This lead to the historical ride of Caesar Rodney, who rode 80 miles to Philadelphia to vote in favor of independence.

- After Thomas Jefferson made the final agreed upon corrections to the document, the Continental Congress approved the draft on July 4, 1776, with 12 votes. Only New York abstained since they did not have the authority from their government.

- The final signatures were added on August 2, 1776. Since New York approved the resolution of independence on July 10, the New York delegation is included amongst the signatures.

Although we celebrated the birth of the nation in 1776, the new country was not recognized until 1783 when the two nations signed the Treaty of Paris.

June 2019 Numismatic Legislation Review

Even while other things were going on, Congress found time to introduce and vote on numismatic-related legislation during the mother of June. The most significant development was the passing of the Women’s Suffrage Centennial Commemorative Coin Act (S. 1235) by unanimous consent.

Even while other things were going on, Congress found time to introduce and vote on numismatic-related legislation during the mother of June. The most significant development was the passing of the Women’s Suffrage Centennial Commemorative Coin Act (S. 1235) by unanimous consent.

If passed by the House of Representatives and signed by the President, the bill would create a commemorative silver dollar in 2020 with a surcharge of $10 per coin that will go to the Smithsonian Institution’s American Women’s History Initiative.

When this bill was sent out of committee to the floor for a vote, the media was all in a twitter (pun intended) about the bipartisan nature of the bill’s support. The bill was introduced on April 30, 2019, by Sen. Marsha Blackburn (R-TN) and cosponsored by every female senator. Subsequently, male senators added their support to where the bill had 82 cosponsors. While we live in very partisan times, those of us who watch numismatic-related legislation understands that these bills are not controversial and tend to gain bipartisan support.

The bill is being held at the desk in the House of Representatives and not assigned to a committee. Although a call to the House did not provide answers, a source says that it is being held for procedural reasons.

According to the source, an objection was made by a member because the member believes that the bill violates the constitution. According to Article I Section 7 of the United States Constitution, it says that “All bills for raising revenue shall originate in the House of Representatives.” Since commemorative coin bills raise revenue for private and public (seigniorage) sources, someone believes that the Senate overstepped its bounds.

There was no report as to who filed the objection.

S. 1235: Women’s Suffrage Centennial Commemorative Coin Act

H.R. 3155: 75th Anniversary of the End of World War II Commemorative Coin Act

S. 1794: CENTS Act

H.R. 3483: To require the Secretary of the Treasury to mint commemorative coins in recognition of the 75th anniversary of the integration of baseball.

S. 1954: A bill to require the Secretary of the Treasury to mint commemorative coins in recognition of the 75th anniversary of the integration of baseball.

S. 2042: A bill to require the Secretary of the Treasury to mint coins in commemoration of the National Purple Heart Hall of Honor.

Weekly World Numismatic News for June 30, 2019

Price of Gold for the 2nd Quarter of 2019

(Chart courtesy of GoldSeek.com)

With the price of gold opening at $1,279.00 on January 2, 2019, it saw some bumps in its price but has largely averaged a modest gain until the price closed at $1,271.15 on May 21. Then it started to climb and climb rapidly by market standards. On Friday, June 28, the end of the second fiscal quarter, gold closed at $1,409.00. The rise is a 10.8-percent gain since May 21.

Gold is considered a safe bet for investors. It is a way of investing in cash or cash equivalence. Investors buying gold will purchase bullion, gold bullion coins like the American Eagle, or shares in a fund that maintains large stores of gold. There are many types of funds and ways to purchase shares in these funds, but it is not the same as owning the physical gold. Most reports are claiming that investors are interested in purchasing physical gold with bullion coins being the preference.

Investors make money by investing with what they consider a manageable amount of risk. If the risk pays off, they can make a lot of money. The risks that fail must be made up elsewhere. Investors diversify their portfolios to mitigate these risks. However, if the institutional and large investors are moving their monies to safe harbors, like gold, they sense a problem.

This relatively sharp jump in the price of gold is being driven by the major investors who are worried about the future of the U.S. economy. They see the various trade wars being detrimental to the economy. One economist said that the recent hike in soybean tariffs to China is going to have long term effects long after this president leaves office.

Although the United States is no longer an agrarian economy, agriculture plays a significant role in the country’s economic health. Upsetting that role that agriculture plays will cause long-term damage to the economy. The soybean tariffs are believed to be the driver that is scaring investors.

You may ask how are soybeans causing gold to rise?

As part of foreign policy in Africa, the government has been supplying countries with the proper climate the means to grow soybeans. It was a way to make the countries self-sufficient by helping create an economy. In many cases, the United States did not follow through on commitments to help with the infrastructure that is needed to create access to the markets. Countries needed irrigation and road improvements. Rather than helping with the upgrades, the United States government concentrated on the military aspects of these country’s problems. A policy of one-problem-at-a-time.

For at least 15 years, China has ignored the military issues and began to supply the money, supplies, and labor to fix the infrastructure. The Chinese government helped build irrigation systems, roads, and provided transportation to build these economies with the promise that China would buy their products.

Although there was significant Chinese investment in Africa, it was still cheaper to buy soybeans from the United States. That situation changed with the 25-percent tariffs placed on soybean exports. The tariffs raised the price of U.S. soybeans beyond what the Chinese would pay to the African exporters. Now China is importing soybeans from Africa while U.S. farmers are provided allegedly short-term subsidies from the federal government.

Now that the infrastructure is in place for China to import soybeans from Africa, the costs have reduced and is projected to have the long-term effect of lowering the U.S. market for soybeans in China. One economist said privately that even if the tariffs were reduced to pre-trade war levels, it might not make it economically viable for China to buy as much from the United States as it did in the past.

Institutional investors see the loss in revenue from China, the increased deficit in providing welfare to soybean farmers, and the danger of the business not returning to the United States. They also see the reduction of tariffs to Russia for wheat and that Russia is also looking to African and South American countries for wheat sources. The competition is making trade prices drop and is making it look like agriculture trade is in trouble.

If exports of United States agriculture are in trouble, then it will hurt the economy. With the uncertainty added to the risk profile investors and fund managers have to manage, they have turned to gold as the natural, safe harbor.

The rise in gold prices always helps numismatics. It helps boost the prices of gold and, by association, other rare coins. However, if the gold prices go up because of economic stress, it will not matter what happens to numismatic prices. Fewer people will be in the market to buy coins.

And now the news…

Gold is a hedge against financial risk, and coins offer convenience.  → Read more at marketwatch.com

→ Read more at marketwatch.com

COIN collectors can now get their hands on a Toy Story 4 50p piece – but you can’t use it in shops. The commemorative coin features popular character Woody in colour with the cowboyR…  → Read more at thesun.co.uk

→ Read more at thesun.co.uk

Hey ANA Members, it’s time to VOTE!

The countdown to the July 1 deadline to vote for the next American Numismatic Association Board of Governors approaches, it is time to look at the candidates and determine who can best lead the organization forward.

The countdown to the July 1 deadline to vote for the next American Numismatic Association Board of Governors approaches, it is time to look at the candidates and determine who can best lead the organization forward.

For the first time in many years, there are races for President, Vice President, and Board of Governors. This year this is a choice. Here are my choices:

President

For ANA president members have the choice of COL Steven K. Ellsworth, ret., or Donald H. Kagin, Ph.D.

Ellsworth is currently a member of the ANA Board of governors and the owner of Butternut Coin Company, which moved from Virginia to Tennessee. Ellsworth has been around but has many strong opinions that have irritated several of the ANA’s constituency. Recently, during the National Money Show, Ellsworth made statements that exhibitors and the exhibit committee interpreted as hostile to them. Unfortunately, when he had the opportunity to clarify his position, his tone turned combative while making accusations of there being a clique amongst the exhibitor community.

Kagin grew up in the numismatics business, the son of a very prominent member of the ANA. But Kagin is not without his issues. He was a member of the Board of Governors during the fiasco with Executive Director and Legal Counsel Christopher Cipoletti in 2007. Then there were the Larry Shepherd issues that led to more embarrassment. For the subsequent election, Kagin said that he and the Board made mistakes and he wanted another chance. Kagin lost the election during a “throw the bums out” feelings by the membership.

Over the last few years, it appears that Kagin has learned from his mistakes. Sometimes it takes falling on your behind to be able to learn from those mistakes. It also seems that his vision for the ANA has matured since his return to the Board.

The Coin Collectors Blog endorses Don Kagin for ANA President for his sober vision and less combative personality, which is necessary for the ANA.

Vice President

The race for ANA Vice President is between Dr. Ralph W. Ross and Thomas J. Uram.

Although I have briefly met both gentlemen, I cannot say that I have had an extensive conversation with either. The personality dynamics are very different. Although that should not be a determining factor, the differences make it a consideration.

Ross has been a member of the Board of Governors for some time. He is a teacher by trade, which can be beneficial to figure out how to spread the word about numismatics beyond the ANA. In reality, where has he been? In my interaction with the Board, Ross is its quietest member. We do not hear much from him or about him regarding his position on the Board. He is just there.

Uram has been an active participant for some time. He is an exhibitor, judge, and has acted as a coach to exhibitors. Having someone on the Board who understands the exhibitor community may be good for the ANA.

Uram is not a professional numismatist but has had a long career in the financial services industry. Given the ANA’s propensity for having consistent financial problems, having someone around who can make sure the ANA stays fiscally stable may be a good idea.

Finally, Uram is a member of the Citizens Coinage Advisory Committee (CCAC) as an appointee of the Secretary of the Treasury. Although I have been a critic of the CCAC and not a fan of the Secretary, having someone with that type of experience could have its advantages.

Therefore, the Coin Collectors Blog endorses Tom Uram to be the next Vice President of the ANA.

Board of Governors

There are ten candidates to fill seven seats. Three people will not be serving on the Board. I will not comment on every one of the candidates in this space. I will provide some thoughts on what has gone into my decision.

First, I do not endorse Mike Ellis and his return to the Board. Although I believe in second chances, some have to come with a significant amount of contrition and time. It has not been long enough after “he had made a mistake and chose to step down from the board.” Any person who had to step down from the Board of Governors because of “mistake” must be required to jump a higher hurdle to return. I am still waiting for the jump.

While I have nothing against Greg Lyon, this would be his sixth and final term on the Board. After ten years as a member of the Board of Governors, it is time to step aside and allow new people into leadership.

There are endorsement forthcoming for Muriel Eymery and Shanna Schmidt. Eymery, who is from London, would bring a very different perspective to the ANA that is very necessary. Her view on foreign collectors and the world of numismatics outside of the United States would be an asset to an organization that appears insular. This type of diversity would benefit the ANA.

Schmidt is a dealer with a specialty in ancient numismatics and has a background beyond numismatics. Aside from adding diversity to the Board of Governors, which is very necessary, the line in her biography that attracted me was that her “master’s thesis was on the cultural-property debate as it relates specifically to ancient coins.” It is a topic that I have commented on several times and wish the ANA would involve itself with on behalf of the numismatic community.

Based on the considerations, the Coin Collectors Blog endorses the following seven candidates for the ANA Board of Governors (in alphabetical order by last name): Rick Ewing, Muriel Eymery, John Highfill, Cliff Mishler, Paul Montgomery, Robert Oberth, and Shanna Schmidt.

If you are an ANA member, go vote!

If you are not an ANA member, you should consider becoming one!

VIDEO: DIY Mechanical Coin Sorting Machine

Although this video is “sponsored” by Wix, it is interesting to watch the process of making a coin sorting machine. Just ignore the Wix ads at the beginning and end of the video.

If you want to watch the video on YouTube and see the rest of the text with the advertisement, click here.