Mar 21, 2015 | bullion, gold, markets, news, palladium, platinum, US Mint

Last day at the London Fix market

The move to an electronic system followed the revelation that in June 2012 an employee of Barclays Bank manipulated the gold fixing process. Unfortunately, it was not an isolated incident. When Barclays was investigated, it was revealed that there were such system and control failures that members of the bank had been manipulating gold prices since they started hosting the market. In May 2014, the Financial Control Authority, the British equivalent Commodity Futures Trading Commission, fined Barclays £26 million for not properly managing the market.

What made the old system susceptible to manipulation was that it was still widely a human controlled process with bidding arbitrarily controlled behind then scenes. Even as the market moved toward a more technological approach, it was as if the technology was being used as the proxy with a human still doing the arbitration. Think of it as if the computers would provide the bidding but there was still an human auctioneer managing the bids.

The new market is electronically run and monitored in cooperation with the LBMA. Rather than a single source being responsible for all of the benchmark prices, the LBMA Gold price auctions are held twice daily by the ICE Benchmark Administration (IBA) at 10:30 AM and 3:00 PM London time in U.S. dollars. IBA is an independent subsidiary of the Intercontinental Exchange (ICE) responsible for the end-to-end administration of benchmark prices. They do not buy or sell commodities but manage the transactions and setting rates based on market forces.

To further diversify the market, the LBMA Silver price auction is operated by the CME Group, a Chicago-based market maker, and administered by Thompson Reuters. The London Metals Exchange administers the platinum and palladium price market. Silver auctions are held once per day at noon London time.

Proponents of the new market system touts its stronger oversight and detailed audit trail capabilities to support the new regulations as making this market more trustworthy than the previous system. Detractors wonder if the new electronic system could create market inequities that was seen in U.S. markets with programmed trading.

News reports suggest that the new market operated without problems on its opening day. In fact, the market saw a rise in all metals by the afternoon auction.

Snapshot of the bullion market on March 20, 2015 (static image, will not update)

Since the U.S. Mint sets its price based on the London market, they sent the following note to Authorized Purchases of bullion products on March 18, 2015:

This is to inform you that on Friday, March 20, 2015 the U.S. Mint will start using the LBMA Gold Price (PM) to price and settle all of its gold bullion coin orders. The new gold price replaces the London Gold Fix and will be managed by the ICE Benchmark Administration (IBA). We do not anticipate any transition issues. Moving forward all gold bullion transactions with the United States Mint will utilize the new LBMA Gold Price (PM) in place of the (PM) London Gold Fix.

While the move will make the markets more transparent and possibly open it to more participants, it is uncertain how this will affect the price of metals in the long term. For that, my crystal ball does not compute!

London Metals Exchange market images courtesy of

Mining.comLondon gold price snapshot courtesy of

Kitco.

Feb 6, 2015 | bullion, coins, commemorative, commentary, gold, policy, silver, US Mint

Reverse of the 2015 US Marshal Service 225th Anniversary Commemorative Coins

Time and again, we hear that congress wants the government to save money. They want agencies to reduce costs and build efficiencies. How can agencies save money when members of congress introduce legislation that is counter to those goals?

Congress has been told that the U.S. Mint could save money if they standardized gold coins to 24-karat coins and silver to at least .999 fine quality. Aside from making the coins more attractive to more buyers including investors, the U.S. Mint does not have to pay more for someone to “dirty” the metals to create planchets that contain 90-percent of the metals.

Modern manufacturing methods are geared to process mined metals to create purer metals. In order for the gold or silver to be used to make the 90-percent alloy, it has to be dirtied with another metal, such as copper, before creating the planchets. While it makes the metals cheaper, the process increases the costs per planchet because of the extra work involved.

Congress exasperates this problem by not listening to the U.S. Mint and doing a virtual copy-and-paste from previous bills that says $5 gold commemoratives be made from 90-percent gold and silver dollars from 90-percent silver.

Rather than listening to the U.S. Mint, Rep. Sean Maloney (D-NY), or a non-responsive staffer in his office, did a copy-and-paste of previous commemorative bills to introduce the National Purple Heart Hall of Honor Commemorative Coin Act (H.R. 358) that calls for a 90-percent gold $5 coin and a 90-percent silver dollar.

Regardless of how one feels about the use of commemorative coins for fundraising, if congress is going to authorize a commemorative coin, why not allow the U.S. Mint to take advantage to more efficient manufacturing and stop making them dirty the metals?

It is possible that if the U.S. Mint could create commemorative coins worthy of being on par with investor grade coins, not only could they save money in the manufacturing process which could lower the costs of the coins, but they could sell more coins. If the U.S. Mint sells more coins they could collect more of the surcharges to benefit their intended causes.

If congress really cared about saving money and increasing efficiency in the government, members like Rep. Maloney will look beyond rhetoric and actually do something, no matter how simple it is.

Up next, why some members of congress should leave well enough alone!

Image courtesy of the U.S. Mint.

Jan 10, 2015 | bullion, counterfeit, gold, legal, news, scams

PAMP Gold Ingot

Traveling Suspects Arrested

Two suspects have been arrested for selling fake Suisse Pamp carded gold bars (2.5gm, 5gm,10gm and 1 ounce) at a coin shop in Greenwood, Indiana. Search of the suspects vehicle revealed multiple identification cards, business and pamphlets from different coin shops and an additional 250 fake gold bars and coins. Based upon receipts located in the vehicle the suspects had been selling the fake gold to shops in Illinois, Kentucky, Tennessee and Indiana since September, 2014.

The suspects were driving a silver Ford Focus with Missouri license plates. The suspects are being held for Theft by Deception.

Aaron Taylor

Western Union, IL

Second suspect was identified as Nelson Hernandez (No photo available) alias Benjamin Wade.

Anyone having been in contact with either of these subjects should contact:

Doug Davis, 817-723-7231,

Doug@numismaticcrimes.org

If you have information, please contact Doug Davis. Let’s keep the hobby for both collectors and investors safe!

Dec 10, 2014 | bullion, coins, Eagles, halves, silver, US Mint

A couple of quick news items that came out of the U.S. Mint on Tuesday.

The U.S. Mint reported that as of December 8, 2014, they had sold a record 42,864,000 one troy ounce American Silver Eagle Bullion coins for all of 2014. This beats the previous record of 42,675,000 coins sold in 2013. Sales of the 2014 bullion coins to authorized dealers will end during the week of December 15.

The U.S. Mint reported that as of December 8, 2014, they had sold a record 42,864,000 one troy ounce American Silver Eagle Bullion coins for all of 2014. This beats the previous record of 42,675,000 coins sold in 2013. Sales of the 2014 bullion coins to authorized dealers will end during the week of December 15.

Taking a sample of five different bullion dealers, the average price is around $20 for one American Silver Eagle Bullion coin. If each coin is worth about $20 each, that means the U.S. Mint sold $857.28 million in silver bullion for 2014. Remember, this is for the bullion coin. This does not count the collectible versions such as the proof or the West Point struck uncirculated coin.

The other announcement was that the U.S. Mint will sell a new product, Coin Discovery Set — An Introduction to Coin Collecting. The set costing $24.95 will include three 2014 Kennedy Half-Dollars in three different finishes—proof, uncirculated and circulating. It will also include two coin tubes for quarters, a magnifying glass, cotton gloves, and a booklet that explains the coin production process. The box will the the size to store U.S. Mint proof sets.

The other announcement was that the U.S. Mint will sell a new product, Coin Discovery Set — An Introduction to Coin Collecting. The set costing $24.95 will include three 2014 Kennedy Half-Dollars in three different finishes—proof, uncirculated and circulating. It will also include two coin tubes for quarters, a magnifying glass, cotton gloves, and a booklet that explains the coin production process. The box will the the size to store U.S. Mint proof sets.

Sales will open at noon Eastern Standard Time (1600 UTC) on Tuesday December 16, 2014. While there will be no household ordering limit, the U.S. Mint has set a product limit to 45,000 sets.

Images courtesy of the U.S. Mint.

Nov 6, 2014 | bullion, coins, commentary, gold, US Mint

Every Thursday morning, the U.S. Mint looks at the afternoon London Fix price of gold and adjust their bullion-related coins based on their published tables. This morning, the U.S. Mint adjusted prices after noting that the afternoon London Fix priced gold at $1,145.00 per troy ounce. Based on the table published in the Federal Register, the price of the 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin was reduced to $1,165.00!

Every Thursday morning, the U.S. Mint looks at the afternoon London Fix price of gold and adjust their bullion-related coins based on their published tables. This morning, the U.S. Mint adjusted prices after noting that the afternoon London Fix priced gold at $1,145.00 per troy ounce. Based on the table published in the Federal Register, the price of the 50th Anniversary Kennedy 2014 Half-Dollar Gold Proof Coin was reduced to $1,165.00!

Please pardon me as I laugh at all of those dealers whose questionable ethics caused despicable scenes in Philadelphia, Washington, Denver, and Rosemont at the ANA World’s Fair of Money when the introduction price was $1,240. Those who have waited to order the coin directly from the U.S. Mint for a coin that does not have a mintage limit will have saved $75 from the issue price. And by buying from the U.S. Mint, you do not have to pay the alleged “numismatic premium” dealers will apply for the special label encased on the plastic they paid to have the coin entombed in.

Regardless of what the politicians say, some business pundits recognize that the economy is moving forward and the stronger dollar will continue to push prices lower.

If the price of gold drops below $1,100 by next Wednesday afternoon’s London Gold Fix, the price of the Kennedy gold halves will drop to $1,127.50. If that happens, I will be back to laugh even more!

Sep 12, 2014 | bullion, coins, gold, halves, US Mint, values

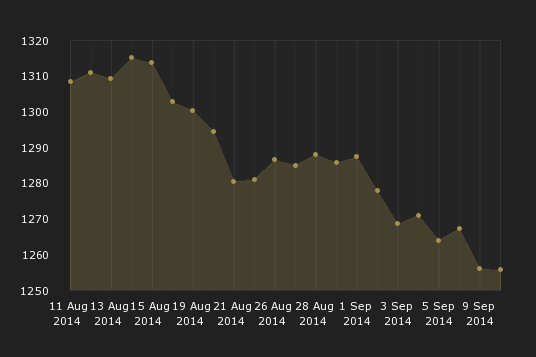

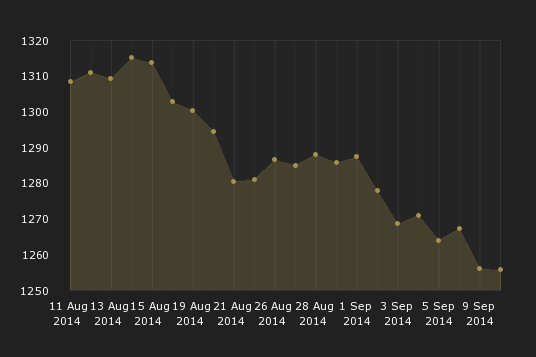

If you have not seen what has been going on in the gold market, the prices have been falling. The financial press has not provided a single reason as to why the gold market is going down but there is a consistent view that the United States economy showing strength with unemployment dropping and low inflation may be alleviating fears in the markets. Stocks are rising and it is suspected that investors are selling their gold shares in order to participate in the bull market.

For collectors it means that the U.S. Mint could adjust the prices of precious metal products. In particular, the price is coming down that could affect the price of the Kennedy gold half-dollar. Based on the table published in the Federal Register [PDF], if the London Fix price of gold falls below $1,250 per troy ounce, the price of the coin will drop to $1,202.50 or $37.50 below the $1,240 issue price.

The London Fix is now managed by The London Bullion Market Association. Gold prices are set by an auction that takes place twice daily by the London Gold Fixing Company at 10:30 AM and 3:00 PM London time. Auctions are conducted in U.S. dollars. The benchmark used by the U.S. Mint is the PM Fix price on Wednesday.

On September 10, 2014, the London PM Fix was $1,251.00 which will leave the price of the Kennedy gold half-dollar $1,240.

London PM Gold Fix for the month leading up to September 10, 2014

London PM Fix on September 10 was $1,251.00

Prices are in U.S. dollars

A strong economy is good for many reasons. In this case, when the price of gold drops the price of gold coins also drops. While this is not good for investors, it benefits collectors who will buy one or two coins for their collections. It also means that the value of the inventory that the dealers who spent a lot of money and effort in order to be first will be worth less than previously. After all, if the U.S. Mint is going to produce as many coins as the demand, then the public is better off saving money and buy from the U.S. Mint.

As anyone who has invested money will tell you that it is dangerous to try to time the market. I am sure that if you can figure out when the price of gold will be at its lowest while the U.S. Mint is still selling the Kennedy gold half-dollar, I know a bunch of people on Wall Street who want to talk with you. That being said, I have a feeling that the trends are in favor of waiting to see what happens. Although I have not decided whether I will buy a coin, I am going to wait to see what the market does. If the price of gold continues to fall, I could be convinced to buy one of these coins for myself.

Pricing for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin

As published in the Federal Register (

79 FR 38127)

on July 3, 2014

| London PM Fix |

Item |

Sale Price |

| $1000.00 to $1049.99 |

¾ Troy oz |

$1,052.50 |

| $1050.00 to $1099.99 |

¾ Troy oz |

$1,090.00 |

| $1100.00 to $1149.99 |

¾ Troy oz |

$1,127.50 |

| $1150.00 to $1199.99 |

¾ Troy oz |

$1,165.00 |

| $1200.00 to $1249.99 |

¾ Troy oz |

$1,202.50 |

| $1250.00 to $1299.99 |

¾ Troy oz |

$1,240.00 |

| $1300.00 to $1349.99 |

¾ Troy oz |

$1,277.50 |

| $1350.00 to $1399.99 |

¾ Troy oz |

$1,315.00 |

| $1400.00 to $1449.99 |

¾ Troy oz |

$1,352.50 |

| $1450.00 to $1499.99 |

¾ Troy oz |

$1,390.00 |

| $1500.00 to $1549.99 |

¾ Troy oz |

$1,427.50 |

| $1550.00 to $1599.99 |

¾ Troy oz |

$1,465.00 |

| $1600.00 to $1649.99 |

¾ Troy oz |

$1,502.50 |

| $1650.00 to $1699.99 |

¾ Troy oz |

$1,540.00 |

Fixing chart courtesy of London Gold Fixing Company.

Feb 6, 2014 | bullion, coins, commentary, counterfeit

Of all the threats to the numismatics industry one stands out as being the biggest threat: counterfeiting. While thefts and violence of dealers are tragedies, the theft is more localized and easier to deal with because, for the most part, criminals are stupid and leave evidence. Also, since the dealer community is small and there is cooperation from the pawn industry, there is a higher resolution from thefts than expected.

Counterfeiting is worse. Counterfeiting can be a systemic problem that infects the industry in the same way a virus infects your body. To extend the analogy, thefts would be like breaking a finger. It will hurt and cause problems, but the rest of the body will survive. A virus hurts the entire body.

A counterfeit coin is added to the market and is sold to an unsuspecting buyer. The buyer figures out that the coin is counterfeit and is usually embarrassed to admit their mistake. Rather than report the crime or just chalk it up to bad luck, they try to resell the coin, even at a loss, to make up some of the money. The buyer, who is now the reseller, can plead ignorance by claiming buyer’s remorse and say that they decided they did not want the coin.

Overseas counterfeiters, mostly from China, also setup broker networks where they sell their creations to United States-based sellers for them to sell to unsuspecting buyers. While many use online sources to sell these counterfeits, many will try to sell them to low-end coin shops, bullion traders like the ones who setup in hotel rooms, and pawn shops. Unfortunately, they are successful in selling of these items to what should be trusted dealers keeping them in hobby circulation like a virus coursing through your veins.

The problem is not limited to raw coins. Counterfeiters have figured out ways to counterfeiting both the NGC and PCGS holders along with their holographs and seals in order to fool potential customers. Since both companies make it easy to look up serial numbers via their websites, counterfeiters will use the serial number of a real coin and counterfeit that coin for the holder. Both NGC and PCGS have been doing as much as technology allows when upgrading their holders and holographic seals to thwart counterfeiters.

A reminder of the issue landed in Inboxes today from Doug Davis of the Numismatic Crime Information Center. Rather than describe the warning, here it is in its entirety:

COUNTERFEIT SUSPECT

Dealers in Illinois, Missouri, Oklahoma and Kansas should be on the look out for a suspect selling counterfeit coins and bullion within the last ten days. The suspect has been identified as Gabe Owen and sometimes uses the alias Garet or Gabriel Owen. Owen is a white male and uses a Kansas driver’s license or a passport as identification. The vehicle driven by Owen is a white Yukon or Tahoe.

Owen is attempting to sell gold bars, one ounce gold eagles, a 1795 PCGS VF dollar and silver eagles. The same suspect was identified in similar incidents and reported by NCIC approximately one year ago.

We are working with authorities to get a current photo. At the present time there is no outstanding warrant for this subject.

A basic tool against counterfeiting is education. You should know and understand what you are buying. While this sounds basic, you have to think about the coins you are purchasing. For example, collectors of Morgan dollars might think they know what the coin looks like and what to look for, but do you really know? Could that variation in the strike be a known variety, known as VAMs after ground breaking research into Morgan dollar die varieties by Leroy C. Van Allen and A. George Mallis? What if it is a real Morgan dollar that was once cleaned or tooled that would be at least worth its value in silver?

Even if you do not have the education give a definitive answer, how many times have you heard the target of a scam say that something did not seem right or that they questioned a lot of what the seller was saying? More times than not, these instincts are usually right and the few times they are not right, you should feel better knowing that at least you had the sense to listen to that inner voice because you might need it next time.

Always remember, if the deal is too good to be true, it probably is not a good deal!

While counterfeiting is illegal and there are protections under the Hobby Protection Act, the only person that can be prosecuted is the seller. Under the law, the only other person who could be prosecuted is the manufacturer. In most cases, the manufacturer is outside of the United States and beyond the reach of law enforcement.

One tool that can help is H.R. 2754, the Collectible Coin Protection Act. The Collectible Coin Protection Act updates the Hobby Protection Act by allowing law enforcement to target the distributors as well as the sellers. By making the changes H.R. 2754 prescribes, it allows law enforcement to cut off the supply lines from the counterfeit manufacturers.

H.R. 2754 passed the House of Representatives on July 30, 2013 and was sent to Senate for their consideration. However, the bill is sitting in the Senate Commerce, Science, and Transportation waiting to be scheduled. Even if your senators are not a member of this committee, if they hear from constituents that this is a concern, they will speak with the committee chairman Sen. Jay Rockefeller (D-WV) or the ranking member Sen. John Thune (R-SD) to bring this to a vote.

Be part of the antidote to this virus and go to senate.gov, use the pull down menu in the upper-right corner of the page to select the state you live or work. Please contact both of your senators and let them know that you support the Collectible Coin Protection Act. When you contact your senators, tell them that the bill is revenue neutral. It will not add to the deficit and will not require additional appropriations.

In the meantime, please be careful and educate yourself before making that purchase. Buy the book before you buy the coin may be more important now than ever.

The advantage is that almost any book at almost any price is a bargain. You cannot buy them much cheaper. The profits come from knowing what is between the covers. The best collections are built on knowledge, not price sheets.

I could not have said it better!

Nov 25, 2013 | bullion, coins, commemorative, Eagles, poll, US Mint

2012 American Eagle Platinum Proof reverse “To Provide for the Common Defence”

Let’s pretend that the Citizens Coinage Advisory Committee could bypass congress (very wishful thinking!), Citizens Coinage Advisory Committee, and the U.S. Commission of Fine Arts to build a portfolio of non-circulating legal tender commemoratives to increase collector sales. Today’s poll, which will run for two weeks, asks what the U.S. Mint should do with its pretend freedom.

Loading ...

For the record, I am in favor of allowing the U.S. Mint to increase the offerings under the American Eagle program. The U.S. Mint has done some of that to this point with the enhanced reverse uncirculated coins and special sets. There should be more special offerings or different offerings. The U.S. Mint could change the reverse designs to honor different themes like they have been doing on the reverse of the platinum American Eagle coins.

I would also like to see more of the enhanced uncirculated American Silver Eagle coins. The way it enhanced Adolph Weinman’s Walking Liberty design makes it a great looking collectible.

Jul 29, 2013 | bullion, coins, commemorative, nclt, policy

Last March, three members of the Citizens Coinage Advisory Committee met with Rep. Andy Barr (R-KY), a freshman member of the House Financial Services Committee that oversees the U.S. Mint, to pitch the idea of Liberty-themed coins.

Last March, three members of the Citizens Coinage Advisory Committee met with Rep. Andy Barr (R-KY), a freshman member of the House Financial Services Committee that oversees the U.S. Mint, to pitch the idea of Liberty-themed coins.

Initially, the proposal was to issue a series of Liberty-themed coins for the five silver-colored circulating coins but dropped the 5-cent coins after Barr said that there must be no cost to the taxpayer. Currently, the U.S. Mint reports that it costs 10.9-cents to produce the Jefferson nickel and was removed from discussion. What the politicians fail to grasp is that coin production does not cost the U.S. taxpayer anything because all of the money used to operate the U.S. Mint comes from the seigniorage collected on all coins, commemoratives, and tokens sold including circulating coinage to the Federal Reserve. Since the Federal Reserve does not use taxpayer money in its operation, the purchase of circulating coins generates a profit for the government.

Although removing the 5-cent coins from consideration is a wise political move, it demonstrates the illogic and dysfunction of the politics. It also illustrates why the current system of how congress controls the U.S. Mint is unsustainable and needs to be changed.

No other mint in the world is under the same legislative control as the U.S. Mint. Every other major mint are autonomous entities running under the authority of the government required to produce circulating coinage for the country’s central bank and must obtain approval from the central bank to create any legal tender coin. A government can decide that it should produce certain denomination or stop producing a denomination and the autonomous entity must comply.

People who want to discontinue the use and production of the one-cent coin looks to Canada as an example of how a country to stop producing their lowest denomination and be successful. While it is too soon to judge the success and failure of this move, what is lost on people is how the Royal Canadian Mint, a Crown corporation of Canada, is required to comply with the laws passed by the Canadian Parliament. If the Canadian Parliament passes a law that says the Royal Canadian Mint is not to produce any more one-cent coins, than the Royal Canadian Mint does not produce one-cent coins.

The 2004 Poppy Quarter was the Royal Canadian Mint’s first colorized circulating coin.

Nearly every mint operates in the same manner. while the Royal Mint is more conservative in their issues, the Perth Mint, the Mint of Poland, and Austrian Mint operate in a similar manner.

Some countries do not operate a mint even as a public corporation. Countries like Niue, Somalia, and Isle of Man that have produced popular NCLT issues contract their minting to other mints, such as the New Zealand Mint, or to private corporations like the family-owned Pobjoy Mint. Even the government of Israel thought it was best to privatize their mint. After being established in 1958 by then Prime Minister David Ben-Gurion, the Israel Coins & Medals Corp was privatized and sold in 2008 where they continue to operate under the authority of the Israeli government and the Bank of Israel.

2007 Somalia Motorcycle Non-circulating Legal Tender Coins

Those who would be against privatizing the U.S. Mint immediately point to Article I, Section 8 of the U.S. Constitution that says “The Congress shall have Power… To coin Money, regulate the Value thereof,” as the reason not to privatize the U.S. Mint. While the Constitution gives congress this authority, it does not say that the government has to own the means of production nor does it say that congress has to dictate the design of that money. In its most basic term, “to coin money” means to authorize production of and make legal tender of coins used in commerce (for a full description based on case law, see this section).

2013 Niue Monopoly Coins struck by the New Zealand Mint. Is this too much?

In a huff, those who argue against government-owned corporation point to Freddie Mac and Fannie Mae as examples of the dangers of making critical government functions private. Unfortunately, these people are reading the headlines and not the reasons for Freddie and Fannie’s problems caused by the recent fiscal crisis. While both companies can be blamed for their parts in the failure of the markets, a lot of their blame can be traced to the laws that congress passed giving them a complicated deregulated environment from which to try to accomplish their goals. Rather than find a way to fix the issues, congress wants to end the programs Freddie and Fannie support and close those entities even though new regulations have been working.

The problem with making the U.S. Mint a government-owned corporation would be the 535 member board of directors (congress) whose knowledge of what it would take to do this right is suspect. This is the same congress that has forced the Postal Service to over pay into its pension fund while forgetting that it has to the power “to pay the Debts and provide for the common Defence and general Welfare of the United States” by shutting down the government or preventing the payment of debt by manipulating the artificial debt ceiling.

It would be possible to make the U.S. Mint a government-owned corporation using the lessons learned from the governance of the Postal Service, Fannie Mae, Freddie Mac, and any number of other world mints. A charter would be established to make the government-owned Mint corporation the sole provider of circulating coins to the federal reserve and that its operations would be managed by a board with representation from the executive branch, legislative branch, and the Federal Reserve. The board would have oversight power over the Mint corporation and work within the parameters set up by the charter.

Provisions of the charter would be that congress would regulate coinage in that nearly every part of 31 U.S.C. § 5112 would be eliminated except for paragraph (a) that describes the denominations and their size specifications. All laws regarding weights, composition, and design with the exception of the first sentence of paragraph (d), would be eliminated.

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

A new charter would allow congress to designate two commemorative coins per year with a surcharge to be paid to an organization as it does today, but the Mint corporation could create additional non-circulating legal tender coins with its own designs that are made legal tender by following the specifications of the law (e.g., 31 U.S.C. § 5112(a)(10) allows for “A five dollar gold coin that is 16.5 millimeters in diameter, weighs 3.393 grams, and contains one-tenth troy ounce of fine gold.”) and approved by the design board, the Mint charter board, and the Federal Reserve.

The design board would be the Citizens Coinage Advisory Committee. Rather than have two design groups, one that whose purpose outside of reviewing coins is to review architecture, only the CCAC would continue as the approved design board. This way, the Mint corporation would have artistic oversight by a dedicated organization and not have to worry about whether the U.S. Commission of Fine Arts, whose purpose is to oversee the architecture of Washington, understands design and the issues with striking those designs.

We should keep the 24-karat gold Buffalo coins, too!

Freeing the U.S. Mint to be more autonomous and provide them the ability to create new products will not cost the taxpayer anything. In fact, it has the potential for the new corporation to earn more than it does now with new products on the market because if you notice, I never said to get rid of the U.S. Mint Public Enterprise Fund (31 U.S.C. § 5136). On the contrary, the new Mint corporation should be required to set an operations budget and leave the budget plus 25-percent in the Public Enterprise Fund for emergencies. The rest should be deposited in the account of the company’s shareholders: the General Treasury of the United States of America.

In this scenario, it will not matter that it costs more than face value to manufacture the cent and 5-cent coins. The losses can be made up by selling other products to a world that trusts the U.S. Mint—a world that buys more bullion and collectibles from the U.S. Mint than any other country. Imagine how much the new Mint corporation could help reduce the deficit if allowed to be run more like a commercial enterprise than an over regulated government agency.

If it is said that the private sector can do better than the government, here is one way to put that rhetoric to a test!

Today’s Poll

What do you think? In addition to writing a comment below, how about participating in a poll. Do you think that the U.S. Mint should become a government-owned corporation?

Loading ...

U.S. Mint logo courtesy of the

U.S. Mint.

Image of the 2004 Canadian Poppy Quarter courtesy of

Talisman Coins.

2013 Niue Monopoly Coin images courtesy of the

New Zealand Mint.

All other images are property of the author.

Jun 7, 2013 | bullion, coins, Eagles, gold, news, silver, US Mint, video

This year, the U.S. Mint Facility at West Point, New York turn 75 years old. When opened in 1937, it was to be the nation’s silver bullion depository giving it the nickname “The Fort Knox of Silver.” In 1988, West Point was granted mint status.

This year, the U.S. Mint Facility at West Point, New York turn 75 years old. When opened in 1937, it was to be the nation’s silver bullion depository giving it the nickname “The Fort Knox of Silver.” In 1988, West Point was granted mint status.

The “W” mintmark on U.S. coins is highly prized since it is the only mint not to strike circulating coins with its own mintmark. While the West Point Mint did strike cents from 1973 through 1986, the coins produced were not struck with a mintmark.

Today, the West Point Mint only strikes precious metal coins. From commemoratives through bullion American Eagle coins, West Point produces more precious metal coins than any other Mint in the world, including the San Francisco Mint.

Located just outside the United States Military Academy, the West Point Mint does not allow visitors or tours for security reasons. However, exceptions are made. With the facility celebrating its 75th anniversary, the U.S. Mint has been allowing journalists to visit and take pictures of their operations.

Thus far, the best set of images were published in the Daily News. In the article, “West Point Mint, with $80 billion in precious metals, celebrates 75th anniversary,” the reporters visit the West Point Mint and bring back some very interesting picture. You can read the story on the Daily News’s website or if you just want to see the pictures, you can see this board I created on Pinterest.

The Daily News also created a two-minute video looking inside the facility. The video follows (if it begins with a commercial, it is being sent by the Daily News—the cost of embedding their video):

If you are having problems seeing the video, go here.

All images and the video courtesy of the Daily News.