Why do colored coins bother me?

Whenever I comment on using design elements on coins that do not involve engraving I am reminded that one person’s gimmick is another’s innovation. I am also reminded that I have demonstrated a bit of hypocrisy by purchasing some of these coins for my collection including celebrating the innovation of one of these coins. So why do I have a near visceral reaction to the introduction of a coin whose purpose is to commemorate with a non-engraved design elements?

The question came to mind after the Perth Mint introduced the “Charlie Chaplin – 100 Years of Laughter 2014 1oz Silver Proof Lenticular Coin.” The coin is issued by the Pacific island nation of Tuvalu to honor the 100th anniversary of Charlie Chapin’s first movie appearance as The Tramp. The ingot-shaped coin features the Ian Rank-Broadley designed portrait of Queen Elizabeth II on the obverse and an image of Chaplin on the reverse.The reverse does not use just any image. It is the iconic image of the waddling tramp walking away from the camera. Like the image on the screen, this is a moving image. Using lenticular technology, the image will shift as you move the coin making it appear that Chaplin is walking.

Chaplin was the nascent movie industry’s first megastar. Although Mary Pickford and Douglas Fairbanks were the most recognizable of the time, Chaplin was the first actor whose movies were considered a success because he was involved with them. And while there were posters and booklets printed about other stars, Chaplin was the first to be fully merchandised around the world including a Chaplin doll that is one of the most prized toy and movie memorabilia collectibles today.

Even though Chaplin was the phenomenon of this time and I consider myself a fan, I am having a difficult time liking this coin.

In fact, I downright hate it!

I cannot explain why I hate this coin because I am interested in the Niue 2007 Van Gogh silver coin and the Andorra 2008 Renoir 10 Diners silver coin. All three coins are colored coins and ingot shaped, but the Chaplin coin really bothers me.

Although I did not like the Monnaie de Paris 2012 Yves Klein commemorative coin with the blue hand, I did not have this type of reaction. However, I still like the 2006 Canadian Breast Cancer commemorative and circulating quarter with enameled features.

One of the differences between the colored coins that I like versus those that I do not are the ones I like do have some engraving involved. And even though I do not like the Yves Klein commemorative, I do not find it as objectionable because the blue hand is an enhancement and not the entire design on the coin.

Not counting the Somalia motorcycle and sports car coins, I seem to have this response where the coloring or design gimmick encompasses the entire design of the coin. Once the coloring or other design elements that are not engraved go beyond enhancements and are used to create the design is when I begin to object.

It could also be the subject matter. As a resurgent gear-head with an eye toward the classics, the Somalia classic motorcycles and sports car coins appeal to me while the coins with colored birds and flowers do not. As the surviving spouse of a cancer victim, I supported the use of coins to raise money for cancer research by the Royal Canadian Mint, but none of the current hologram coins would interest me if they did not have the holograms.

Color and other enhancements on coins are here to stay. If there were not a market for them then the various mints would not produce these types of coins. It may be something that will attract more collectors and grow the hobby, which is good.

Maybe I should think about these enhancements like I think about cars: I want a car that drives and feels like a car and a coin that is engraved art; I do not want to drive a computer nor a coin that seems gimmicky.

- Image of the 2014 Charlie Chaplin 1-ounce lenticular silver coin courtesy of the Perth Mint.

- Images of the Van Gogh and Renoir coins courtesy of Talisman Coins.

Can we fix the U.S. Mint?

Last March, three members of the Citizens Coinage Advisory Committee met with Rep. Andy Barr (R-KY), a freshman member of the House Financial Services Committee that oversees the U.S. Mint, to pitch the idea of Liberty-themed coins.

Last March, three members of the Citizens Coinage Advisory Committee met with Rep. Andy Barr (R-KY), a freshman member of the House Financial Services Committee that oversees the U.S. Mint, to pitch the idea of Liberty-themed coins.

Initially, the proposal was to issue a series of Liberty-themed coins for the five silver-colored circulating coins but dropped the 5-cent coins after Barr said that there must be no cost to the taxpayer. Currently, the U.S. Mint reports that it costs 10.9-cents to produce the Jefferson nickel and was removed from discussion. What the politicians fail to grasp is that coin production does not cost the U.S. taxpayer anything because all of the money used to operate the U.S. Mint comes from the seigniorage collected on all coins, commemoratives, and tokens sold including circulating coinage to the Federal Reserve. Since the Federal Reserve does not use taxpayer money in its operation, the purchase of circulating coins generates a profit for the government.

Although removing the 5-cent coins from consideration is a wise political move, it demonstrates the illogic and dysfunction of the politics. It also illustrates why the current system of how congress controls the U.S. Mint is unsustainable and needs to be changed.

No other mint in the world is under the same legislative control as the U.S. Mint. Every other major mint are autonomous entities running under the authority of the government required to produce circulating coinage for the country’s central bank and must obtain approval from the central bank to create any legal tender coin. A government can decide that it should produce certain denomination or stop producing a denomination and the autonomous entity must comply.

People who want to discontinue the use and production of the one-cent coin looks to Canada as an example of how a country to stop producing their lowest denomination and be successful. While it is too soon to judge the success and failure of this move, what is lost on people is how the Royal Canadian Mint, a Crown corporation of Canada, is required to comply with the laws passed by the Canadian Parliament. If the Canadian Parliament passes a law that says the Royal Canadian Mint is not to produce any more one-cent coins, than the Royal Canadian Mint does not produce one-cent coins.

While parliament does prescribe that certain coins be made, the Royal Canadian Mint is free to produce coins of its own designs to sell to the public. They work with the Bank of Canada on the approval of designs and the Bank of Canada allows the Royal Canadian Mint to strike coins with a denomination so that these have legal tender status. Most of these coins are bullion and non-circulating legal tender (NCLT) issues sold to investors and collectors for the sole purpose of generating revenues (seigniorage).Nearly every mint operates in the same manner. while the Royal Mint is more conservative in their issues, the Perth Mint, the Mint of Poland, and Austrian Mint operate in a similar manner.

Some countries do not operate a mint even as a public corporation. Countries like Niue, Somalia, and Isle of Man that have produced popular NCLT issues contract their minting to other mints, such as the New Zealand Mint, or to private corporations like the family-owned Pobjoy Mint. Even the government of Israel thought it was best to privatize their mint. After being established in 1958 by then Prime Minister David Ben-Gurion, the Israel Coins & Medals Corp was privatized and sold in 2008 where they continue to operate under the authority of the Israeli government and the Bank of Israel.

Although it could be successfully argued that some of the mints have gone overboard with their bullion and NCLT programs like the Royal Canadian Mint and Perth Mints, it could also be noted that other mints have show great constraint in what they have produced. An example of showing restraint would be the Britain’s Royal Mint and Australian Mint who have concentrated on producing quality and not quantity. These are all models to learn from for the future.Those who would be against privatizing the U.S. Mint immediately point to Article I, Section 8 of the U.S. Constitution that says “The Congress shall have Power… To coin Money, regulate the Value thereof,” as the reason not to privatize the U.S. Mint. While the Constitution gives congress this authority, it does not say that the government has to own the means of production nor does it say that congress has to dictate the design of that money. In its most basic term, “to coin money” means to authorize production of and make legal tender of coins used in commerce (for a full description based on case law, see this section).

An argument used against privatizing the U.S. Mint is to compare what could happen to the U.S. Postal Service. However, the Postal Service is not a government-owned corporation. According to 39 U.S.C. § 201, it is “an independent establishment of the executive branch of the Government of the United States.” While it has many independent powers, it still regulated by congress and subject to insipid rules no private company could ever meet.In a huff, those who argue against government-owned corporation point to Freddie Mac and Fannie Mae as examples of the dangers of making critical government functions private. Unfortunately, these people are reading the headlines and not the reasons for Freddie and Fannie’s problems caused by the recent fiscal crisis. While both companies can be blamed for their parts in the failure of the markets, a lot of their blame can be traced to the laws that congress passed giving them a complicated deregulated environment from which to try to accomplish their goals. Rather than find a way to fix the issues, congress wants to end the programs Freddie and Fannie support and close those entities even though new regulations have been working.

The problem with making the U.S. Mint a government-owned corporation would be the 535 member board of directors (congress) whose knowledge of what it would take to do this right is suspect. This is the same congress that has forced the Postal Service to over pay into its pension fund while forgetting that it has to the power “to pay the Debts and provide for the common Defence and general Welfare of the United States” by shutting down the government or preventing the payment of debt by manipulating the artificial debt ceiling.

It would be possible to make the U.S. Mint a government-owned corporation using the lessons learned from the governance of the Postal Service, Fannie Mae, Freddie Mac, and any number of other world mints. A charter would be established to make the government-owned Mint corporation the sole provider of circulating coins to the federal reserve and that its operations would be managed by a board with representation from the executive branch, legislative branch, and the Federal Reserve. The board would have oversight power over the Mint corporation and work within the parameters set up by the charter.

Provisions of the charter would be that congress would regulate coinage in that nearly every part of 31 U.S.C. § 5112 would be eliminated except for paragraph (a) that describes the denominations and their size specifications. All laws regarding weights, composition, and design with the exception of the first sentence of paragraph (d), would be eliminated.

2013 American Eagle West Point Two-Coin Silver Set with reverse proof and enhanced uncirculated coins.

A new charter would allow congress to designate two commemorative coins per year with a surcharge to be paid to an organization as it does today, but the Mint corporation could create additional non-circulating legal tender coins with its own designs that are made legal tender by following the specifications of the law (e.g., 31 U.S.C. § 5112(a)(10) allows for “A five dollar gold coin that is 16.5 millimeters in diameter, weighs 3.393 grams, and contains one-tenth troy ounce of fine gold.”) and approved by the design board, the Mint charter board, and the Federal Reserve.

The design board would be the Citizens Coinage Advisory Committee. Rather than have two design groups, one that whose purpose outside of reviewing coins is to review architecture, only the CCAC would continue as the approved design board. This way, the Mint corporation would have artistic oversight by a dedicated organization and not have to worry about whether the U.S. Commission of Fine Arts, whose purpose is to oversee the architecture of Washington, understands design and the issues with striking those designs.

This charter can be written in a way to create a special inspector general that would work with the Department of the Treasury to help the executive branch maintain oversight over the new corporation.Freeing the U.S. Mint to be more autonomous and provide them the ability to create new products will not cost the taxpayer anything. In fact, it has the potential for the new corporation to earn more than it does now with new products on the market because if you notice, I never said to get rid of the U.S. Mint Public Enterprise Fund (31 U.S.C. § 5136). On the contrary, the new Mint corporation should be required to set an operations budget and leave the budget plus 25-percent in the Public Enterprise Fund for emergencies. The rest should be deposited in the account of the company’s shareholders: the General Treasury of the United States of America.

In this scenario, it will not matter that it costs more than face value to manufacture the cent and 5-cent coins. The losses can be made up by selling other products to a world that trusts the U.S. Mint—a world that buys more bullion and collectibles from the U.S. Mint than any other country. Imagine how much the new Mint corporation could help reduce the deficit if allowed to be run more like a commercial enterprise than an over regulated government agency.

If it is said that the private sector can do better than the government, here is one way to put that rhetoric to a test!

Today’s Poll

What do you think? In addition to writing a comment below, how about participating in a poll. Do you think that the U.S. Mint should become a government-owned corporation?

Image of the 2004 Canadian Poppy Quarter courtesy of Talisman Coins.

2013 Niue Monopoly Coin images courtesy of the New Zealand Mint.

All other images are property of the author.

POLL: Should the U.S. Mint be allowed to make colored coins?

Source: newzealandmint.com via CoinsBlog on Pinterest

It seems that the biggest trend in modern collectibles are colored non-circulating legal tender (NCLT) coins. You have seen these coins from various countries including Canada, Somalia, New Zealand, and Australia to name a few.

Not all colored coins are made of precious metals. My set of Somalia Motorcycle and Classic Sports Cars coins are silver-plated copper-nickel coins. In fact, most of the Somalia-shaped coins are not made from precious metals. But the shaped coins are so cool that they find buyers around the world, including with me.

Amongst the newest shaped NCLT coins are the New Zealand Mint’s new Star War set and Monopoly coins—that cost more than you would get passing Go!

In addition to making commercial collectibles, coins have had art imprinted on them, enhanced designs, and even commemorate something based on the country of issue.

Source: Uploaded by user via CoinsBlog on Pinterest

So what do you think? Should congress give the U.S. Mint permission to produce colored coins? Rather than pay for a third-party colored coins, what if the U.S. Mint produced a colorized American Silver Eagle coin? Or maybe a bi-metalic coin where the coin is silver and Adolph A. Weinman’s Walking Liberty design is struck in gold on specially made planchets?

Vote in the current poll and let me know what you think below.

Should the U.S. Mint be allowed to make colored coins?

Total Voters: 27

2013 Will Be Interesting

We end numismatic 2012 almost the same way as we began, discussing what to do about the one-dollar coins. The over production lead to a quite a number of bills introduced in congress to try to fix the perceived problem but none ever made it to a hearing, let alone out of a hearing. Rather, the U.S. Mint hired Current Technologies Corp. (CTC) to perform an alternative metals study required by congress.

When the U.S. Mint finally published the report and a summary they made a recommendation to study the problems further because they could not find suitable alternatives to the current alloys used. While reading the summary gives the impression that the request is reasonable, the full 400-page report describes the extensive testing and analysis that the U.S. Mint and CTC performed leaving the reader curious as to why they were unable to come to some sort of conclusion—except that there is no “perfect” solution. This is a story that will continue into 2013 and be on the agenda for the 113th congress when it is seated on January 3, 2013.

The other part of the discussion is whether or not to end the production of the one-dollar Federal Reserve Note. It was the last hearing before the House Financial Services subcommittee on Domestic Monetary Policy and Technology for Rep. Ron Paul (R-TX) and the 112th congress that will certainly carry over into 2013.

This does not mean the Bureau of Engraving and Printing is without its controversy. In order to comply with the court order as part of American Council for the Blind v. Paulson (No. 07-5063; D.C. Cir. May 20, 2008 [PDF]) and the subsequent injunction (No. 02-0864 (JR); D.C. Cir. October 3, 2008 [PDF]), the BEP has been working to provide “Meaningful Access” to United States currency.

Secretary of the Treasury Timothy F. Geithner approved the methods that will be used to assist the blind and visually impaired to U.S. currency on May 31, 2011. In addition to examining tactile features, high contrast printing, and currency readers, the BEP issued a Request for Information for additional information to implement their plan. The BEP will be participating at stakeholder organization meetings to socialize and refine their plans. There will probably be few announcements before the conventions of the National Federation of the Blind and American Council of the Blind this summer.

Another building controversy from the BEP is whether the redesigned $100 notes will find its way into circulation. Introduced in April 2010, full production has been delayed because of folding during the printing process. The situation has to be so severe that the BEP has not announced a new release date and delayed releasing the 2011 CFO Report [PDF] to the end of Fiscal Year 2012 while finding a way to bury the scope and costs of the delays. Will the redesigned $100 Federal Reserve Note be issued in 2013? Stay tuned!

Staying with currency issues, there should be a new series of notes when a new Secretary of the Treasury is appointed. It is known that the current Secretary Timothy F. Geithner wants to pursue other options. If the BEP follows its past practice, notes with the new Secretary of the Treasury’s signature would be Series 2009A notes. There have been no reports as to whether Treasurer Rosie Rios will continue in her position.

As for other products, the BEP will continue to issue specially packaged notes using serial numbers that are either lucky numbers (i.e., “777”) or ones that begin with “2013” as part of their premium products. Of course they will continue to issue their sets of uncut currency.

Another carry over from 2012 will be whether the U.S. Mint will issue palladium coins that were authorized by the American Eagle Palladium Bullion Coin Act of 2010 (Public Law No: 111-303 [Text] [PDF]). The law requires that the U.S. Mint study of the viability of issuing palladium bullion coins under the Act. That report was due to congress on December 14, 2012 but has not been made public at this time.

Bibiana Boerio was nominated to be the Director of the U.S. Mint.

Other than the higher prices for silver products, the U.S. Mint should not generate controversies for its 2013 coin offerings. There will be no changes for the cent, nickel, dime, and half dollar with the half dollar only being struck for collectors since it has not been needed for circulation since 2002. These coins will be seen in uncirculated and proof sets with silver versions for the silver sets.

For the sets with the changing designs, the reverse of the 2013 America the Beautiful Quarters Program will honor:

- White Mountain National Forest (NH)

- Perry’s Victory and International Peace Memorial (OH)

- Great Basin National Park (NV)

- Fort McHenry National Monument and Historic Shrine (MD)

- Mount Rushmore National Memorial (SD)

There has been no confirmation from the U.S. Mint whether they will strike San Francisco “S” Mint quarters for the collector community as they did in 2012.

The 2013 Presidential $1 Coins ends the 19th century and begins the 20th century with some of the more interesting Presidents of the United States in history:

If we honor the Presidents we have to honor their spouses. In 2013, the First Spouse Gold Coins will honor:

- Ida McKinley

- Edith Roosevelt

- Helen Taft

- Ellen Wilson (died 1914)

- Edith Wilson (married Woodrow Wilson 1915)

The U.S. Mint has not released designs for these coins at the time of this writing.

The 2013 Native American $1 Coin will feature a reverse commemorates the Delaware Treaty of 1778. Since the dollar coin does not circulate, only collectors have enjoyed the great designs of this series since it began in 2009.Congress has authorized two commemorative coin programs for 2013:

- Girl Scouts of the United States of America Centennial Silver Dollar that will benefit the Girl Scouts of the USA

- 5-Star Generals Commemorative Coin Program that will include gold $5, silver dollar, and clad half-dollar coins. Proceeds will go to the United States Army Command and General Staff College

American Eagle coin programs will continue with the bullion, collector uncirculated, and proof coins for both the silver and gold. The American Eagle Platinum bullion coin will continue to use its regular reverse while the American Eagle Platinum Proof will continue with the Preamble Series. The Preamble Series is a six year program to commemorate the core concepts of the American democracy as outline in the preamble of the U.S. constitution. For 2013, the reverse will be emblematic of the principle “To Promote the General Welfare.” The U.S. Mint has not issued a design at this time.

Currently, there are no announced special products or sets using American Eagle coins and no announced plan for special strikings such as reverse proofs or “S” mint marks.

Finally, we cannot forget the American Buffalo 24-Karat Gold Coins that will be available as an uncirculated coin for the bullion/investor market and a proof coin for collectors.

And I bet you thought that 2013 would be a mundane numismatic year!

Are We Selling Cars or Coins?

A few weeks ago I started to receive email advertisements from several coin companies offering to sell 2012 coins. One note was found in my Junk folder from the end of October. I began to wonder if we are selling coins are cars?

Those of us living in the United States cannot engage in any media without seeing one advertisement for next year’s newly redesigned, sleeker, faster, shiny, new four-wheeled wonder from Detroit, Japan, Korea, or Germany with better handling, more fuel efficient, and technology that will do everything but brew your coffee but will tell you where you can find a cup. Anyone old enough can remember when the next model year would come out in the fall of the previous year—and in those days, you could order a car to your specification for delivery in November or December.

Although it started a few years ago, it seems that many of the world’s mints are not only beginning to advertise their next year’s offerings, but are striking them, too. I have seen advertisements from the Royal Australian Mint, Perth Mint, Royal Mint, the Royal Canadian Mint, the People’s Bank of China, and Tuvalu. These 2012 coins, mostly commemorative issues, are gilded, enameled, and painted on designs with crystals, diamonds, and even rub-and-sniff coins—new, shiny, and better than last year’s versions.

“Order now! Operators are standing by!”

Has the numismatic market become too gimmicky that these mints and central banks are resorting to car selling techniques?

I have bought my share of gimmicky collectibles, but that was at a time when these were novel. Now, it seems that many of these world mints have come up with various gimmicks in order to sell more non-circulated legal tender coins. It seems as if the metal and design are not enough any more.

Fortunately, or unfortunately depending on your view, this could not happen in the United States. The U.S. Mint is the most regulated of all the world mints. Every coin and medal manufactured by the U.S. Mint must be allowed by a law passed by congress. Unless congress authorizes the use of color, crystals, gilded, or other non-engraved design elements, they will not appear on a U.S. coin. Even though the U.S. Mint is allowed to strike coins early, the law prevents them from issuing the coins dated in the future.

I am not going to ask if the gimmicks are good for the hobby because these new issues have the potential to introduce coins to new collectors. But how far will it go? Does the hobby really need to create contrived collectibles to generate interest?

A Driving New Collectible

In keeping with my “that’s neat” collecting theme, I added another set of interesting non-circulating legal tender coins to my motorcycle coins. This time, it’s sports cars!

In 2010, the Federal Republic of Somalia continued its series of odd-shaped coins and added a series to honor famous sports cars. While the motorcycle coins are based on the designs of various motorcycles and not supposed to depict actual production models, the Sports Car Coins were made to represent the real classic sports cars—the cars of my boyhood dreams.

The six coins include (see picture, left-to-right, top-to-bottom) a green 1965 Ford Mustang, a gray 1964 Aston-Martin DB-5, blue and orange Lamborghini, red Ferrari, yellow Porsche, and a black Corvette. Fans of the James Bond movies will recognize the Aston-Martin DB-5 as the car Sean Connery drove in Goldfinger and Thunderball.

The six coins include (see picture, left-to-right, top-to-bottom) a green 1965 Ford Mustang, a gray 1964 Aston-Martin DB-5, blue and orange Lamborghini, red Ferrari, yellow Porsche, and a black Corvette. Fans of the James Bond movies will recognize the Aston-Martin DB-5 as the car Sean Connery drove in Goldfinger and Thunderball.

If you were wondering, car that was used in the movies was sold at auction in 2010 to an Ohio man for $4.6 million (£2.9 million), which includes the 12-percent auction premium.

Now if they would make a coin based on my all-time favorite classic car I would be the first on line to purchase one. That would be a 1959 Cadillac Eldorado Biarritz Convertible in red—big fins and all!

Click on image to see a larger version.

I’m Bored

I’m bored with the America The Beautiful Quarters Program.

I’m bored with the commemorative coins that is produced by the U.S. Mint.

I’m bored with soap opera surrounding what U.S. Mint is going to do with the American Eagle coins.

I’m bored with many of the designs that the U.S. Mint has produced while ignoring the best efforts of the Citizens Coinage Advisory Committee and the U.S. Commission of Fine Arts to tell them otherwise.

I’m bored with what is coming out of the U.S. Mint and looking at the interesting collector coins coming out of other mints who are being more innovative with their designs. Where the U.S. Mint has produced one ultra-high relief coin, the Royal Canadian Mint has three high-relief coin designs for 2011.

I’m bored with the themes of the coins coming out of the U.S. Mint. While the Medal of Honor Commemorative is a worthy coin and one of the few good designs to come out of the U.S. Mint, but I am fascinated by what some of the other mints are doing. The Mongolia 2011 500 Tugrog Endangered Wildlife silver commemorative features the Ural Owl struck in high relief with an antique finish and Swarovski Crystal Eyes. This is part of the same series that produced the 2007 Wolverine coin that was named the 2009 Coin of the Year. It also was a high relief coin with an antique finish and Swarovski Crystal eyes. We have great artists in the United States, why can’t the U.S. Mint create coins like this?

Why can’t the U.S. Mint celebrate the history of auto making in the United States the way Tuvalu celebrates Classic Sports Cars or great American motorcycles the same way Somalia did in 2007?

My late mother was a fan of impressionism. She could tell you anything about the artists and the art of that era. One day, I showed here the 2007 Niue Island Van Gogh rectangular silver dollars and thought the design was one of the neatest things she saw. Every time I see on online I am reminded of her interest in a coin when she was not a coin collector. Could we interest others artists if the U.S. Mint created coins honoring American artists? Can you imagine what could be done with Georgia O’Keeffe’s flowers, Andy Warhol’s pop art, or even Louis Comfort Tiffany’s glass designs? These could become popular collectibles and generate significant seignorage for the U.S. Mint.

The reason why the U.S. Mint is behind the rest of the world is because of congress. Congress has taken its power to coin money and has clutched it in such a pedantic manner that it has turned the U.S. Mint into a tired looking organization that is falling behind the rest of the world. Although as a factory for circulating coin, the U.S. Mint produces more coins than any other world mint, they are losing the potential seignorage and artistic prestige to other mints that are producing interesting coins that people want to collect.

There is nothing in the constitution that says the U.S. Mint has to be structured the way it is. All we have is 219 years of “this is the way we wrote the law” that binds the United States to a system that is questioned every few years.

One idea is the model an independent U.S. Mint after the operating model of other world mints. One example that could be adopted is to model a new public corporation after the Royal Canadian Mint. While the RCM is required to produce circulating coinage for the Bank of Canada, they have a little more freedom to produce a portfolio of non-circulating legal tender coins that appears to have a broad appeal. Since many of these NCLT coins are made of precious metals, collectors and investors have been purchasing the RCM’s coins as investments.

As a public corporation, the U.S. Mint would continue to be required to supply circulating coins to the Federal Reserve, maintain the American Eagle Bullion program, and the current commemorative program. As a public corporation, they could add support for additional NCLT coins coins that could compete with other world mints to sell coins with great designs.

I realize that this is a very high-level idea of a new future for the U.S. Mint that requires additional details but it would be a waste of time to pursue this further. Given the personalities in congress who would have to approve such a measure, the chance of this happening is the same as the chance of ending the printing of the one-dollar note.

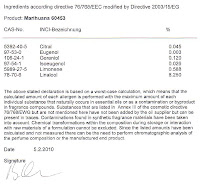

Legal Scent of Marijuana

In scouring my email for whatever cyber bargains are out there, I received a note touting the 2010 Republic of Benin Plants of the World Scented Coins. Announced last March, the coins will represent four distinct plants of the world and their scents. Since the Republic of Benin is not exactly on my watch list, I was drawn read more when told that the scent was for Cannabis Sativa, more commonly known as marijuana!

In scouring my email for whatever cyber bargains are out there, I received a note touting the 2010 Republic of Benin Plants of the World Scented Coins. Announced last March, the coins will represent four distinct plants of the world and their scents. Since the Republic of Benin is not exactly on my watch list, I was drawn read more when told that the scent was for Cannabis Sativa, more commonly known as marijuana!

The West African nation of Benin has joined Somalia, Palau, Cook Islands, and other small countries to produce coins with different designs and features to profit on the growing market in non-circulating legal tender (NCLT) coins. Not only is the plant of the reverse of the coin colored, but it is scented to smell like the plant. The scent is professionally mixed perfume that is embedded into the coloring that does not require the coin to be handled in order to smell the results.

It is important to note that the scent does not contain tetrahydrocannabinol (THC) or any of the other cannabinoids that would cause problems at the airport or by law enforcement. Rather the fragrance is from synthetic materials that at worst could cause an allergic reaction.

It is important to note that the scent does not contain tetrahydrocannabinol (THC) or any of the other cannabinoids that would cause problems at the airport or by law enforcement. Rather the fragrance is from synthetic materials that at worst could cause an allergic reaction.

The coins is silver plated over a copper-nickel base weighing 27 grams and is 28.61 mm in diameter. Its face value is 100 Francs CFA (about 20.2-cents in U.S. Dollars) and its production is limited to 2,500 pieces. Benin set the list price at $99.95, but it can be found for less, such as this online dealer.

This can be an interesting gift for your favorite numismatist, horticulturalist, or whomever this holiday season!

Images courtesy of Talisman Coins.