Aug 6, 2014 | coins, gold, halves, US Mint

Although I am not able to attend this year’s World’s Fair of Money, I have been keeping up with the news coming out of Rosemont. Amongst the interesting news reports are those about the long lines collectors were standing in for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin. There was even a story that claimed dealers paid homeless people to stand in line because of the U.S. Mint’s purchase limit of one coin per person.

Although I am not able to attend this year’s World’s Fair of Money, I have been keeping up with the news coming out of Rosemont. Amongst the interesting news reports are those about the long lines collectors were standing in for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin. There was even a story that claimed dealers paid homeless people to stand in line because of the U.S. Mint’s purchase limit of one coin per person.

Watching the scene from afar gives it a reality television-like feel. Just like reality television, I find it difficult to understand the appeal of having to be the first or one of the first to purchase the coin. In this case the people who bought the first coin had the coin slabbed and was paid $20,000 for the coin, what about the people standing in line behind them? Were they expecting to resell the coin to a dealer desperate to have the coin in their inventory? Was the line there representing dealers who will advertise that they have the coin from the first day of issue and mark up the price for those who collect the labels and not the coin?

If you are interested in purchasing the coin and not worried about the hype, I recommend that you buy the coin directly from the U.S. Mint. First, the U.S. Mint has already announced that there will not be a production limit. While there are initial sales limit, the U.S. Mint will strike as many as ordered. Second, those coins purchased at the U.S. Mint booth at the World’s Fair of Money will likely be removed from the U.S. Mint packaging and entombed in one of the third party grading company’s hunk of plastic. The price will be overly inflated.

When you buy the coin from the U.S. Mint, the price you will pay is the market price of three-quarters of a troy ounce of gold, the full cost of manufacture, and the packaging. According to the U.S. Mint, “The coins are encapsulated and packaged in a single custom-designed, brown mahogany hardwood presentation case with removable coin well and are accompanied by a Certificate of Authenticity.” That mahogany hardwood presentation case is probably not cheap. If it is the same case that has been used for past special coin programs, then it is a nice package and should display the coin nicely. You will probably not receive the presentation case from the dealer that slabbed the coin. In fact, some dealers have started to sell the empty presentation cases without the coin—essentially, double-dipping at the expense of the purchaser of the coin.

The final reason to buy the coin directly from the U.S. Mint online or via the telephone is that there is a limit of five coins per household. When you buy the coin at one of the U.S. Mint facilities or this week at the World’s Fair of Money, you are limited to buying one coin and that there is a daily sales limit of 500 coins at each location.

With no offense intended to dealers who will have plenty of opportunities to make money on this coin in the future, I recommend that Coin Collectors Blog readers who want to purchase a coin for their own collection to buy it directly from the U.S. Mint. Even if the price of gold rises, the U.S. Mint pricing table [PDF] for these coins shows that the difference is about $35 per pricing band. I suspect that it will be less than the premium that many dealers will add to the price of the coin at the same time it is available from the U.S. Mint, except that they can sell you the coin now and you will not have to wait.

First Day Sales Figures

The U.S. Mint released their first day sales figures for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin:

| Online/Call Center Sales |

54,825 |

| ANA World’s Fair of Money |

493 |

| U.S. Mint Headquarters, Washington, DC |

376 |

| Philadelphia Branch Mint |

500 |

| Denver Branch Mint |

500 |

| All sites |

56,694 |

Coin image courtesy of the U.S. Mint.

Aug 4, 2014 | ANA, technology, web

The future of the American Numismatic Association began on Friday, August 1 with the launch of the new ANA website!

The future of the American Numismatic Association began on Friday, August 1 with the launch of the new ANA website!

What are you talking about, the ANA has a website.

This is the NEW website with a new look and new technology.

But it’s the ANA, the website must be like putting lipstick on a pig.

No, it isn’t. The website is a complete re-engineering of the ANA online and digital assets to move the ANA into the present and position the organization for the future. First, the computers that the site is running on are no long in the headquarters in Colorado Springs. The new computers are located in a world-class data center run by Level 3 Communications, one of the leading service providers in the industry. Level 3 has an impeccable reputation for being able to manage computers and networks that anyone with a technical background working with the ANA on this project did not question this as the choice for the hosting of the new website.

Supporting the website is a new membership management system that the staff in Colorado Springs has reported as being easier to use and makes it easier to support the members. Rather than having to work around the problems and mistakes of the older software, the new software allows the ANA to update its procedures to better serve the members.

Finally, the website is supported by a new content management system (CMS) that makes it easier to add and change information as necessary. A CMS is the software stores the information you see in your browser and is served up to you on demand. CMS helps keep data in a way to allow it to be more easily managed so that it can be displayed in the browser in a way that will help you stay engaged.

While it looks like the ANA just changed the look of their website, everything about the ANA web presence has changed. It is a new service that will allow the ANA to introduce and engage more members as the world shifts to being online.

Yes, it looks nice, but are they introducing anything new?

Looking nice is important but it is only the beginning. The first application that has been rolled out is the social engagement features. There’s a place to post articles to share with the community, a forum to chat with other numismatists, and a place to show off your collection. There are also ways to interact with the ANA, pay your dues, and read the online version of The Numismatist.

Social media already exists and several forums where people can interact. What makes this so special?

First and foremost, rather than trying to interact with Internet trolls you will be interacting with fellow members of the ANA. While they may decide to participate using an alias, you can be assured that only ANA members will be allowed to register and us the ANA’s system.

So what’s the big deal? There are other sites with numismatic content.

Remember those commercials that touted “membership has its privileges,” this is only the beginning of what will be available exclusively to ANA members. One of the first socialization features is for contributors to earn “coins” or electronic awards for contributing to the numismatic community. Right now, the coins only provide ANA members bragging rights, but in the future, the coins will include potential prizes, discounts with ANA member establishments, and other incentives.

So the ANA has turned the website into a game?

The ANA has turned their website into a one that is more engaging for the membership and to attract new members. The world is moving online and in order for the ANA to serve all members, the ANA has to embrace and expand its online presence. The ANA Board of Governors’ goal is to make money.org be the numismatic hub of the community. The place to go where is anyone has a numismatic question, they can start with the country’s premier numismatic organization.

Well… it looks interesting. I’ll give it a look and see what happens.

I hope everyone gives it a look and provides feedback to the ANA. A lot of people really did a lot of work getting this first release completed on time and on budget. And not only that, the areas where the ANA holds and processes personal information was secure from the beginning because one of the site’s advisors (me) is an information security professional in real life. There was no way I was going to jeopardize my professional reputation by being involved with something known to have security problems. Besides, as an ANA member, they are storing my information and processing my credit card, too!

Everyone please go to money.org and interact with the website. Engage in the forums. Let us know what you think!

Aug 3, 2014 | BEP, coins, currency, Federal Reserve, US Mint

While doing my monthly review of the numismatic-related political news for the Gold & Silver Political Action Committee, I came across a bill that seems to have missed the numismatic press. One reason it was missed might be that the provisions are buried in a larger bill and has a name that might not be as noticeable. However, there are two issues buried in a larger bill. The bill is as follows:

H.R. 5196: Unified Savings and Accountability Act (or USA Act)

Sponsor: Rep. Mike Coffman (R-CO)

• To reduce waste and implement cost savings and revenue enhancement for the Federal Government.

• Introduced: July 24, 2014

• Referred to several committees based on jurisdiction of the provision.

Track this bill at https://www.govtrack.us/congress/bills/113/hr5196

Buried within the bill are two provision that may be of interest to collectors.

Sec. 203. Prohibition on non-cost-effective minting and printing of coins and currency.

If passed, Section 203 would require that the U.S. Mint stop striking any coin that costs more to manufacture than its face value four years following the passage of this bill. Using current standards, the U.S. Mint would be required to stop producing one- and five-cent coins by late 2018 because they cost more than their face value to produce. One of the problems with this bill is what would happen if the price of copper and zinc, the drivers in the price of both coins, were to fall and the costs were reduced to below face value? Would the coins be struck again?

Sec. 205. Replacing the $1 note with the $1 coin.

As the title suggests, Section 205 will replace the one-dollar Federal Reserve Note with the dollar coin. The section begins with requiring the Federal Reserve to “sequester” Susan B. Anthony dollars to remove them from circulation. There is a provision for their value as numismatic collectibles.

The plan to remove the $1 FRN is just to stop issuing the notes and replace them with coins as the notes come out of circulation after a one-year educational period. The Federal Reserve would continue to use the notes alongside the coins until 600 million coins are in circulation or for four years, whichever comes first. The bill allows the Bureau of Engraving and Printing to continue to print the $1 FRN for collectors.

Given the current state of congress, the likelihood of this bill passing is slim-to-none, and, as a friend liked to say, “Slim just left town.” Some of the other provisions of this bill might be introduced into an omnibus budget bill following the November elections, but it is doubtful that these sections will make it past this introduction.

Then again, who knows? Congress has surprised us in the past!

Jul 31, 2014 | coins, gold, halves, US Mint

According to the U.S. Mint:

According to the U.S. Mint:

Because of the expected overwhelming response, dialog with our customers and many others interested in the 50th Anniversary Kennedy Half-Dollar Gold Proof Coin, the United States Mint is reducing the over-the-counter purchase limit to one unit per customer.

This change in the purchase limit will give more members of the public an opportunity to purchase this popular coin, essentially doubling the number of customers able to purchase it. The number of units available at each retail location (Philadelphia and Denver facilities, Washington, D.C., headquarters and Chicago ANA World’s Fair of Money) will remain the same. There will be 500 units available initially at each United States Mint location (Philadelphia, Denver and Washington) and an additional 100 units per day for the first three days after the product launch. There will be 2,500 at the ANA, 500 available per day of the convention.

The household ordering limit of five will remain the same.

UPDATE: The price effective for the August 5 opening day of sales for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof is $1,240. See the U.S. Mint’s online catalog for more information.

NOTE: Usually I do not post press releases directly since there are many other places to see these announcements. Since there has been a lot of interest in these coins, I am posting this as a service to my readers.

Jul 26, 2014 | CCAC, commentary, medals, silver

Proposed reverse for the 2015 Ultra High Relief gold coin

These are fair criticisms. I did not attend the April meeting and Chairman Marks provided good introductory explanations prior to the discussion. Before commenting, I should have looked at the previous meeting’s notes which are available on the CCAC website. In retrospect, my criticism about the program was probably not fair. However, it is fair to question the direction the CCAC is proposing.

The other criticism that I will alter but not retract is the one when I said there was an “over-the-top cult-like patriotic gushing by some of the members over the proceedings.” Rather, what I should have said is that the CCAC was very full of themselves to the point of being too self-congratulatory and overblowing the self-perceived importance of what is being proposed.

What is being proposed is a medals program that Marks tentatively called an “American Liberty Silver Medal Program.” The purpose would be for the U.S. Mint to produce modern images of Liberty in medal form. Medals produced under this program would be dated silver proof medals on similar one-ounce planchets that are used for the American Silver Eagle program.

A second program would be a “freestyle medal of an American theme.” The U.S. Mint would solicit ideas from their artist/engravers to be reviewed by the CCAC. One freestyle medal would be produced each year. As part of the proposal, it was suggested that the medals also be produced in bronze to make them more accessible to the average collector.

What is important is that these are proposals for medals and not coins. Medals can be made of any metal and be dated but they will not bear a denomination and would not be legal tender.

2011 9/11 National Medal (obverse)

What prevented the sales of the September 11 National Medal? It cannot be the design because most people believe it is one of the best medals ever to be produced by the U.S. Mint. Could it be the price? The medal was priced at $66 with a $10 premium to be paid to the museum. This was $10 more than price for the proof American Silver Eagle coin.

Although the September 11 National Medal was a beautiful work of art the price was not too out of line for a silver medal, the fact that it was a medal and not a coin most likely prevented it from being purchased in greater numbers. Even though a commemorative coin will not enter circulation, there may be a psychological barrier from a medal being accepted by collectors because it is not a legal tender coin.

I did not purchase one of these medals. Even though $10 would go to the museum, I opted to write a check as a donation rather than pay for the medal. Even though I like the design, the medal is not something I feel is right for my collection. In writing a check I was also able to use the donation as a charitable tax deduction, which I would not be allowed to do if I purchased the medal. I also do not have this piece of metal that might not resell with a numismatic premium when it comes time to divest my collection.

Reflecting on the meeting and the proposal, those that I corresponded with and I expressed a lot of skepticism that this program would be a success. Regardless of how beautiful the artwork, many believe these medals will not be as popular with the public as portrayed by the CCAC during the meeting.

In fact, if you listened to what members of the CCAC said, you would think that these medals would be the best thing to come out of the U.S. Mint since President Theodore Roosevelt’s “pet crime.” While I really do not want to assail Gary Marks, his remarks at the end of the meeting exemplify this extreme self-ingratiation:

I believe that this is the single most impactful idea that the mint can pursue at this point in time in the United States. With a medals programs such as this, finally, we can have the freedom to have the art come forward. Finally, liberty will be liberated

The committee is energized.

Overall, the CCAC was overly self-congratulatory for doing something that will arguably have the least impact on the collecting community. It was these types of statements from the members of the CCAC that prompted my comments on Tuesday.

Images courtesy of the U.S. Mint.

Jul 25, 2014 | coins, dollar, history

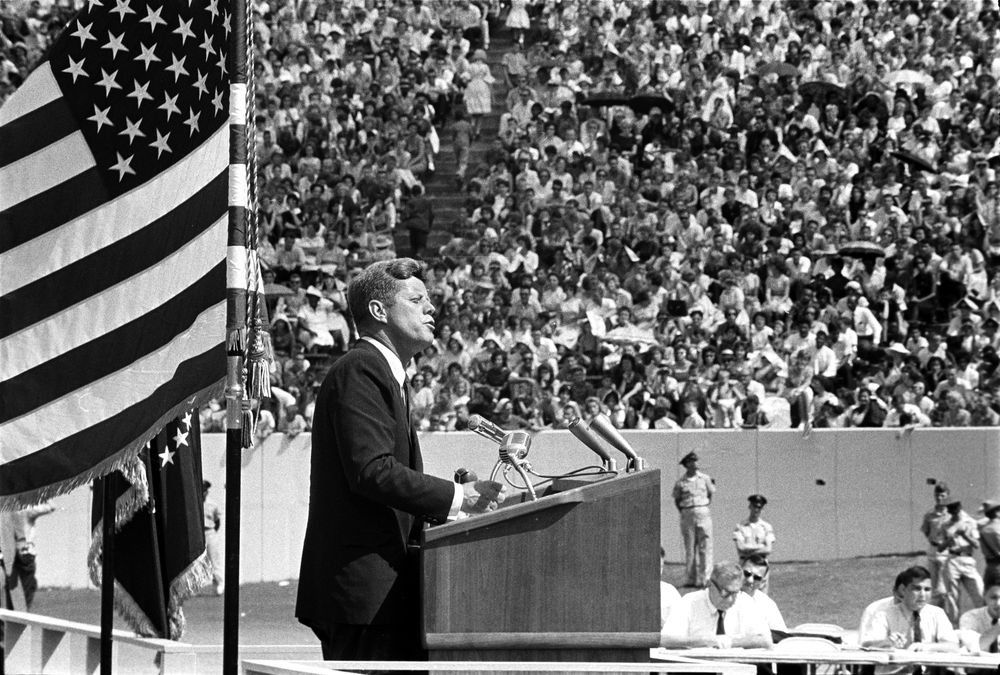

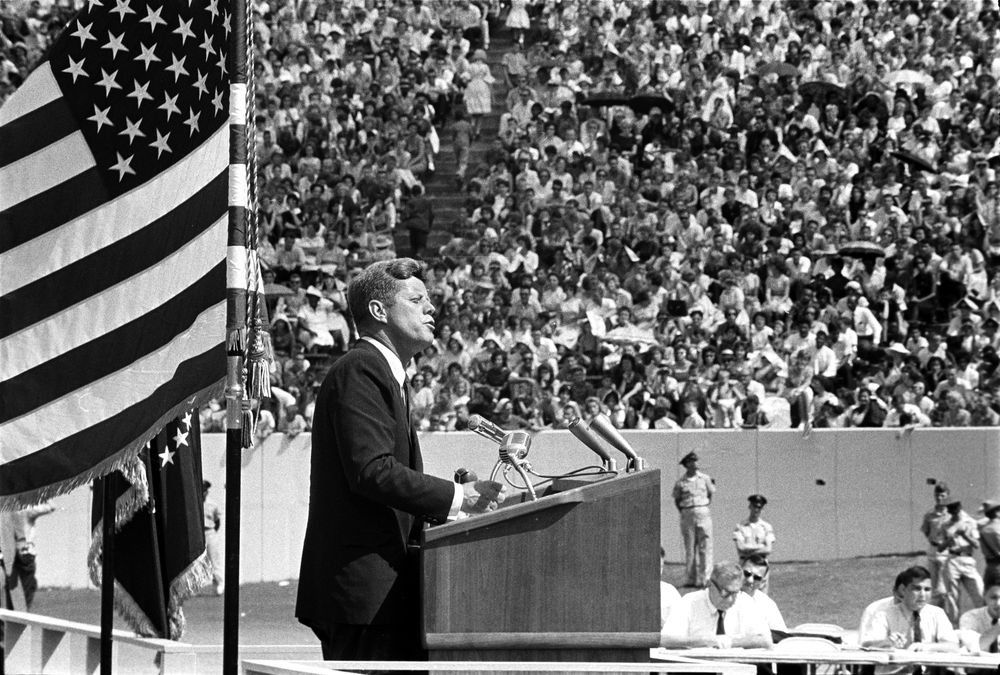

We choose to go to the Moon in this decade and do the other things, not because they are easy, but because they are hard; because that goal will serve to organize and measure the best of our energies and skills; because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win…. It is for these reasons that I regard the decision last year to shift our efforts in space from low to high gear as among the most important decisions that will be made during my incumbency in the office of the Presidency.

—President John F. Kennedy at Rice University in Houston on September 12, 1962

On July 20, 1969, just 45 years ago, Neil Armstrong became the first man to walk on the moon fulfilling President Kennedy’s dream. We have learned from those that were there that it was a hard and did require the best of our energies and skills. It was a challenge everyone accepted and made a success in seven years as the social and political turbulence of the 1960s were in high gear.

On July 20, 1969, just 45 years ago, Neil Armstrong became the first man to walk on the moon fulfilling President Kennedy’s dream. We have learned from those that were there that it was a hard and did require the best of our energies and skills. It was a challenge everyone accepted and made a success in seven years as the social and political turbulence of the 1960s were in high gear.

Space continues to be a fascinating topic as the “final frontier” of exploration. While there are areas of Earth’s oceans that remain unexplored, more people look to the stars as the next place for human exploration.

The politics and the politics of space have changed over the years but not the fascination of space exploration. One of the oldest science fiction franchises is based in space (Star Trek) and has been the inspiration for a lot of scientific development. While there were contractors building the parts NASA needed to fly into space, today there are companies that are building their own rockets and planning their own exploration.

Space has been a theme of coins, currency, and stamps around the world. An Internet search using the phrase “space themes on coins” can show a small sample of some of the coins that featured images commemorating space exploration. But the country that landed and walked on the moon first will not be amongst that list.

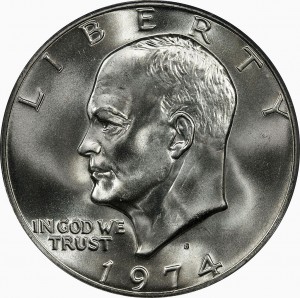

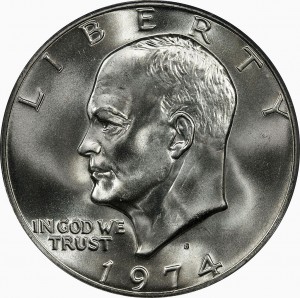

Although the United States has launched more rockets containing humans into space than any other nation and was the first to walk on the moon, the only tribute to space exploration was the use of the Apollo 11 insignia as the design by Frank Gasparo on the reverse of the Eisenhower and Susan B. Anthony dollars. For the Bicentennial issues in 1975 and 1976, an image of the Liberty Bell was superimposed over part of the image of the moon. This was the idea of Dennis R. Williams who won the design competition in 1974.

Eisenhower Dollar Obverse

Eisenhower Dollar Reverse

Eisenhower Dollar (Type 2) Bicentennial Reverse

Obverse of the Susan B. Anthony Dollar

Reverse of the Susan B. Anthony dollar

Given the remembrances of President Kennedy’s assassination and the celebration of the issuance of the half-dollar bearing his likeness, maybe it would be a nice idea to commemorate this achievement with a genuine United States commemorative coin.

John F. Kennedy speaking at Rice University where he gave his famous speech declaring the U.S. will land on the moon before the end of the decade.

Image of Kennedy speaking at Rice University courtesy of the JFK Library.

All other images courtesy of Wikimedia Commons.

Jul 22, 2014 | CCAC, coins, Eagles, gold, medals, silver, US Mint

Proposed reverse for the 2015 Ultra High Relief gold coin

Along with the gold coin will be a companion silver coin struck on the one-ounce planchet that is used for the American Silver Eagle. Although it was not specifically addressed, it is assumed that silver coin will be of the same or similar relief of the gold coin.

This afternoon I was able to break away from my daily activities to attend the CCAC meeting via conference call. This is the first time I attended one of their meetings and came away a little surprised and a little appalled.

What surprised me with the meeting is how in lock-step the committee is on everything. There appears to be no disagreement or questioning of what the U.S. Mint had proposed. Granted the committee members may have history with the issues beyond this meeting, but I was surprised that alternatives were not recommended or discussed.

The committee was excited because the proposal was somewhat in alignment with a motion they passed last April to create a Liberty Medal series. According to Gary Marks, chairman of the CCAC, the Liberty Medal Series would be an arts medal produced by the U.S. Mint to foster new design and innovation. It is to encourage the artists to have artistic impression beyond what they are allowed to do as part of the coin programs.

I do not know if it was previously discussed but according to the authorizing law for the American Silver Eagle bullion program (31 U.S.C. § 5112(e)(3)) the coins must have a design “symbolic of Liberty on the obverse side” and “of an eagle on the reverse side.” The law does not say that the obverse must be Adolph Weinman’s Walking Liberty design and it does not say that the reverse must be a heraldic eagle. Why has the committee not considered using the existing American Silver Eagle program to create a Liberty design program?

In discussing the overall medallic arts program, the CCAC decided to create a study group to come up with a plan to recommend to the U.S. Mint. Aside from the “American Liberty Silver Medal Program,” as described by Marks, he also proposed Freestyle Medal of an American theme. This would be one medal per year that would be artistic representations.

CCAC Member Heidi Wastweet said that the arts medal will allow for experimenting; allow the artist and designers to “expanding our wings” for future projects. As a result, it will let future stakeholders know what is possible so that it would inspire better designs.

While a medals program is a good idea, what seems to be missing is the subject matter. If the Liberty design can be leverage through the American Eagle bullion program, why not have medals used to honor history? Why is it when nations around the world issued commemorative coins honoring D-Day, the United States, whose mint is overly regulated by intransigent politicians, did not issue any commemorative item on the 70th anniversary of an event that changed world history?

Expanding the medals program in this manner would be the perfect way to honor history when congress has failed to remember they represent a country rather their owners… I mean donors!

Where I was appalled was what I saw as over-the-top cult-like patriotic gushing by some of the members over the proceedings. I thought the CCAC was supposed to be an oversight organization; at least that is how it appears to be described in the authorizing law (31 U.S. Code § 5135). There should not be a problem with supporting the work of the U.S. Mint and support the artists whom everyone agrees should be treated better. However, there were some comments that sounded more like members were wrapping themselves in the flag rather than working on an oversight committee.

As part of his closing remarks, Chairman Marks said, “I believe that this is the single most impactful idea that the Mint can pursue at this point in time in the United States.” Unfortunately, I wish this was the case. It appears to be another missed opportunity by the CCAC similar to previous missed opportunities by this committee.

I will have more commentary in the coming days.

Background from the U.S. Mint

Potential Products

2015 24-karat Gold Ultra High Relief Coin

2015 Silver Medal

Background

- As a result of the success and popularity of the 2009 Ultra High Relief Double Eagle Gold Coin, the United States Mint (Mint) is considering producing a 2015 24-karat Gold Ultra High Relief (UHR) Coin.

- The CCAC recommended a new eagle design for the reverse of the American Eagle Silver One Ounce Coin, a change the Mint is not pursuing, opting instead to consider showcasing the beauty and intricacies of the recommended design on a 2015 24k Gold UHR Coin.

- To compliment such a reverse, the Mint would consider featuring a new, modern rendition of Liberty on the obverse of the 2015 24k Gold UHR Coin.

- If developed, a 2015 24k Gold UHR Coin would be comparable to the 2009 Ultra High Relief Double Eagle Gold Coin, in that it would also be one troy ounce. The denomination would also have to be determined.

- To make such a design accessible to various ranges of collectors, the Mint is considering the possibility of producing a medal, struck in silver, bearing the same design as a 2015 24k Gold UHR Coin. Striking these medals in silver would provide an additional opportunity to showcase the intricacy of the design features and the beauty of the artwork.

- If this concept is pursued, the United States Mint would seek Secretary of the Treasury approval to strike this gold coin under authority of 31 U.S.C. § 5112(i)(4)(C).

- If this concept is pursued, the United States Mint would seek Secretary of the Treasury approval to strike this silver medal under authority of 31 U.S.C. § 5111 (a)(2).

Design History

- In 2009, the United States Mint fulfilled the original vision of Augustus Saint-Gaudens with the release of the 2009 Ultra High Relief Double Eagle Gold Coin; closing one chapter of American coin design and beginning a new one.

- If produced, 2015 24k Gold UHR Coins could be viewed as a follow up to the 2009 Double Eagle UHR, contrasting classic American coin design with modern American coin design.

Image courtesy of the U.S. Mint.

Jul 21, 2014 | CCAC, coin design, coins, gold, medals, Peace, silver

2009 Ultra High Relief Double Eagle Gold Coin

“Discussion of a potential 2015 24K Gold Ultra-High Relief Coin and accompanying silver medal.”

In 2008, it became then Mint Director Edmund Moy’s “pet project” to create the ultra-high relief Augustus Saint-Gaudens double eagle design in a manner that Saint-Gaudens originally envisioned. The result was the 2009 Ultra High Relief Gold Coin. The design was based on the plaster casts originally made by Saint-Gaudens that was digitized and the equipment purchased that would be able to strike the coin.

Moy is no longer Director but the U.S. Mint still has the equipment used to strike the coin. The question is what does the U.S. Mint have in mind for creating a high-relief coin?

Also, what do they have in mind for an accompanying silver medal and how do they justify creating a medal? While the U.S. Mint can use the same law that authorizes the 24-Karat Gold Buffalo coin (31 U.S.C. § 5112(q)), it is uncertain what can be leverage for the silver medal. It is possible that the U.S. Mint might be leveraging 31 U.S.C. § 5111(a)(2) that says The Secretary of the Treasury “may prepare national medal dies and strike national and other medals if it does not interfere with regular minting operations but may not prepare private medal dies.” Before we pass further judgement we will wait to hear what the U.S. Mint says.

As for the subject, since they Saint-Gaudens double eagle design as been used, what other high-relief design has issues? The only design that comes to mind is the Anthony de Francisci Peace dollar. But not just the Peace dollar, but the original design with the broken sword.

The broken sword was not well received. According to numismatic researcher Roger Burdette, he discovered a editorial that appeared in the New York Herald that summarized the feeling about the broken sword:

A sword is broken when its owner has disgraced himself. It is broken when a battle is lost and breaking is the alternative to surrendering. A sword is broken when the man who wears it can no longer render allegiance to his sovereign. But America has not broken its sword. It has not been cashiered or beaten; it has not lost allegiance to itself. The blade is bright and keen and wholly dependable. It is regrettable that the artist should have made such an error in symbolism. The sword is emblematic of Justice as well as of Strength. Let not the world be deceived by this new dollar. The American effort to limit armament and to prevent war or at least reduce its horror does not mean that our sword is broken.

1921-D Peace Dollar

Although struck in Denver in late December 1921, the 1921-D Peace dollar was released into circulation on January 3, 1922.

Later that year it was determined that the high-relief design was causing dies to break at a faster pace than planned. The Mint then lowered the relief in order to keep striking coins at the rate required by law. This became the second type of the Peace dollar series.

Because 2015 will be 95 years since the first Peace dollar, I suspect that the high-relief gold coin will be a 2015 tribute to that first Peace dollar.

Artist’s conception of a 1964-D Peace dollar.

The striking of a dollar coin had a powerful ally: Senator Majority Leader Mike Mansfield, Democrat from Montana, whose state would be directly affected by the new coins. Although the numismatic press was not in favor of the measure because of its limited ability to solve the coin shortage, Mansfield pushed a bill through congress to authorize the Mint to strike 45 million silver dollars.

After much discussion, the Mint looked for working dies but found that few survived a 1937 destruction order. Those that did survive were in poor condition. Mint Assistant Engraver Frank Gasparro, who would later become the Mint’s 10th Chief Engraver, was authorized to create new dies of the Peace dollar with the “D” mintmark. Since the coins would mostly circulate in the west it was logical to strike them closest to the area of interest.

When the coins were announced, coin dealers immediately offered $7.50 per coin which would ensure that they would not circulate as intended. Everyone saw this as a poor use of Mint resources during a time of severe coin shortages. Adams announced that the pieces were trial strikes never intended for circulation and were later melted under reportedly heavy security.

There have been reports that some Peace dollars were struck using base metals (copper-nickel clad) as experimental pieces in 1970 in anticipation of the approval of the Eisenhower dollar. The same reports also presume these coins have been destroyed.

While we are speculating, the companion silver medal could be a modern tribute to the 1964-D Peace dollar by minting a 1915-D silver medal with the same design but without a denomination. It would be the same design but with out “ONE DOLLAR” struck on the reverse.

A high-relief 24-karat gold Peace dollar design and a silver version without the denomination. That’s my prediction, what’s yours?

2009 Ultra-High Relief image courtesy of the U.S. Mint

1921-D Peace dollar courtesy of the author.

Artists conception of the 1964-D Peace dollar courtesy of PCGS.

Jul 14, 2014 | coins, fun, grading

This 1878 eight tail feathers Morgan dollar, graded PCGS PO-1 (none worse!), is from the End of the Trail VIII Collection of Low Ball Morgan dollars that will be exhibited for the first time during the 2014 ANA World’s Fair of Money.

In 2009, PCGS began to offer rewards for what they called and “everyman” or second tier registry competition. Apparently, it became a race to the bottom. While people are looking for the best coins their money can buy, someone went quite the opposite and set out to find the worst of the worst.

“It is the all-time finest, or in this case, the worst-of-the-worst basic Morgan dollar set in the Low Ball category. While collectors have a lot of fun with the Low Ball sets, remember that it often is just as difficult and exciting to build a low grade set as it is to assemble a high grade collection,” said PCGS President Don Willis.

Who am I to argue. After all, someone put together a set of PO-1 and FR-2 coins, many marked “None Worse,” and probably cost more to have them graded than the coins cost to purchase. Then who is to say that some did not find their way into a pocket or two before being submitted?

Cynicism aside, there is something ironic about putting together a set like this and it has to do with just having fun. It had to be a lot of fun to go around and search through junk boxes or ask dealers for their worst coins. It must have been interesting seeing the face of some of the dealers when they hand over their worst Morgan dollars only to be told they were not bad enough.

Think about it for a moment. Dealers are looking for the best, most pristine inventory to sell to eager buyers who walk by their cases looking at the pretty and shiny coins. When coins are not good enough to make the inventory, they are thrown into junk boxes for people to pick through. Larger coins, like Morgan dollars, would be sold for a price around their melt value since there would not be much of a numismatic premium.

The adventure had to be a lot of fun for the person assembling the set.

That what this is all about, having fun! If you are stressing out about the worth of your set, are you really having fun? Are you having fun worrying about the plastic entombing the coin or whether someone placed a sticker on that plastic or is the coin the most important part of your collection?

I know the registry sets exist for the third-party grading services to promote their products and get people to submit coins. I know putting together a top set can be gratifying. But is it fun? Are you putting together that set for the fun or the profit?

There are a lot of people who collect coins in some form. Some collect high grade Morgan dollars while others collect varieties or VAMs. Some pursue the best and most rare coins while you find many digging through junk boxes at the shows looking for that one small gem to fill the hole in their collection. You may like high-grade Buffalo nickels while others are searching half-dollar rolls they pick up at their local bank.

Regardless of how you collect, what you collect, and where you find your collection, if you are not having fun then maybe you should rethink what you are doing.

Just for kicks, here are three of my “low ball” coins:

This 1794 Liberty Cap Head Right Large Cent has been around since the time of George Washington and looks the part. This coin has been cleaned making it a candidate for a no-grade if I should submit it to a grading service.

A very worn flat 1798 Draped Bust Large Cent. It took a lot of light and a 16x loupe to determine the date!

Another worn flat Draped Bust Large Cent. This one is from 1803 and just has a lot of character.

Now if you would excuse me, there are some tokens and medals from my hometown of New York I bought at the Whitman show I need to add to my collection.

Morgan dollar image courtesy of PCGS.

Jul 11, 2014 | ancient, coins, commentary, policy

During a time where disinformation is a product of hyper-partisanship, it is difficult to write about issues without feeding into the conspiracy theories of the day. The problem with conspiracy theories is that there are so many moving parts and so many people who would have to cooperate that when you really think about their content beyond the headline, you understand how difficult it would be for conspiracies to exist on the scale many suggest.

Conspiracy theories are not a new phenomenon. What is new is how fast they can spread and how the extremes on both side of the aisle can see the same circumstances are come up with radically different conclusions.

Rather than talk about conspiracies, we should look at the issues as more of the result of unintended consequences.

1933 Saint Gaudens Double Eagle is an example of the Law of Unintended Consequences.

For collectors of ancient coins, it is difficult to ignore the law of unintended consequences of Cultural Property Implementation Act (CPIA; 19 U.S.C. §§ 2601 et seq.) and how it is implementation by the State Department’’s Cultural Property Advisory Committee (CPAC). CPIA is the law that was created when the United States signed and the Senate approved the Convention on the Means of Prohibiting and Preventing the Illicit Import, Export and Transfer of Ownership of Cultural Property 1970, often called the 1970 UNESCO Convention. The purpose of the treaty was to stop archaeological pillaging and trafficking in cultural property. In real terms, it would prevent the filling of the British Museum in London with the artifacts from ancient Egypt, Greece, the Middle East, North Africa, and any other place where the British tried to maintain their empire.

EID·MAR Silver Coin commemorating the death of Cæsar on March 15

Although this may sound reasonable, Article 1 paragraph (e) of the treaty defines a category of cultural property as “antiquities more than one hundred years old, such as inscriptions, coins and engraved seals.” This means that any coin minted before 1914 can be considered cultural property and not only be subject to restrictions but confiscated if it cannot be proven that it was found or purchased legally prior to the convention.

With the different rules and laws around the world that has different documentation requirements that were more lax prior to the convention, how does the collector of ancient coins prove the coin that was bought in good faith from a dealer or another collector is not a country’s cultural property? A coin that could have changed hands hundreds of times since it arrived in the United States and enjoyed by its collectors may have had its more modern provenance lost to time and be subject to confiscation by the State Department and returned to the country of origin.

Although the CPAC tries to make the Memoranda of Understanding between the foreign country and the United States simple, the law and convention has a number of problems that have not been addressed in the 40 years it has been in existence. One problem is the existence of ancient Roman coins all over Europe. While the coins were minted in Rome, they were carried throughout the empire by the military, business people, and travelers that were eventually left behind. Since the coins were struck in Rome does it mean that the coins are the property of Italy or the country where they were found? If they country where they were found follows the convention to its letter, since the coins were not manufactured there are they really cultural objects and subject to these export and trade restrictions?

While those of us in the United States have been captivated by the Saddle Ridge Hoard of gold coins, people in the United Kingdom have been buying metal detectors in record number to scour the countryside looking for ancient coins left behind by their ancestors. Recently, someone found four coins dating back to the Iron Age that sparked an archeological search. The find included Roman coins that were not made in England or the land that would become England. Are these British artifacts?

As an aside, British law allows the finders to keep the coins. But since the full archeological search was managed by a British university in conjunction with the military, subsequent finds are the property of the crown since both are paid using public tax money. However, based on the wording of the 1970 UNESCO Convention, does Italy have a claim if they want to pursue those coins?

Recently, the CPAC held an open meeting to hear the new Egyptian government’s request to ban the import of artifacts dating through the time of the Ottoman Empire. Based on reporting by Richard Gierdroyc in Numismatic News, the questioning of the committee and the answers by those representing the archeological community not only would not grant an exemption for coins but would consider the confiscation of coins that could not be proven to have been legally purchased prior to the 1970 UNESCO Convention and have since fairly traded.

Recently, the CPAC held an open meeting to hear the new Egyptian government’s request to ban the import of artifacts dating through the time of the Ottoman Empire. Based on reporting by Richard Gierdroyc in Numismatic News, the questioning of the committee and the answers by those representing the archeological community not only would not grant an exemption for coins but would consider the confiscation of coins that could not be proven to have been legally purchased prior to the 1970 UNESCO Convention and have since fairly traded.

There is a very vocal crowd in the archeological community that would want to see everything dug up from the earth put into museums or otherwise locked away from the public. (Links to these people omitted on purpose) Using the pejorative “coinys” to describe collectors of ancient coins, these people have advocated for the confiscation of these coin so that they can be entombed behind display glass inside the state run museums of the world. They consider coinys profiteers who would rather trade in history than preserve history.

Collecting, in all of its forms, is a preservation of history. Whether you collect coins, stamps, political campaign buttons, old car emblems, license plates, old kitchen objects, books, toys, postcards, letters, and other ephemera, these items would be lost to time if people did not save them. Owning history helps connect us to our past and even helps us understand how the world has evolved.

History must be preserved and every country has the right to protect the property within its borders. If Egypt wants to protect its property and any future property that archeologists discover, then that should be their right. However, if Egypt wants to restrict United States collectors of coins or other artifacts that have been in circulation for many years, it is suggested that they end their hypocrisy by preying on the “we must do right by the world” policies of the United States and demand that the British Museum to return its holdings.

Although I am not able to attend this year’s World’s Fair of Money, I have been keeping up with the news coming out of Rosemont. Amongst the interesting news reports are those about the long lines collectors were standing in for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin. There was even a story that claimed dealers paid homeless people to stand in line because of the U.S. Mint’s purchase limit of one coin per person.

Although I am not able to attend this year’s World’s Fair of Money, I have been keeping up with the news coming out of Rosemont. Amongst the interesting news reports are those about the long lines collectors were standing in for the 2014 50th Anniversary Kennedy Half-Dollar Gold Proof Coin. There was even a story that claimed dealers paid homeless people to stand in line because of the U.S. Mint’s purchase limit of one coin per person.

According to the

According to the