Dec 24, 2013 | ANA, commentary

Nearly two months into the nomination process for American Numismatic Association Board of Governors, I decided to throw my proverbial hat in the ring and run for the ANA Board of Governors. Even though I lost, it was a humbling experience and I appreciate those who supported my candidacy. I continue to believe in the issues I campaigned on and will continue to work to improve the ANA in whatever way I can.

Nearly two months into the nomination process for American Numismatic Association Board of Governors, I decided to throw my proverbial hat in the ring and run for the ANA Board of Governors. Even though I lost, it was a humbling experience and I appreciate those who supported my candidacy. I continue to believe in the issues I campaigned on and will continue to work to improve the ANA in whatever way I can.

I continue to work with the Technology Committee helping the ANA modernize its technological presence.

I have not decided whether I will try again in 2015. However, I will renew the domain names I bought (vote4scott.info and vote4scott.org) because I think they are just too cool to let go back into the wild world of domain naming.

Dec 23, 2013 | celebration, coins, commentary, Federal Reserve, platinum, US Mint

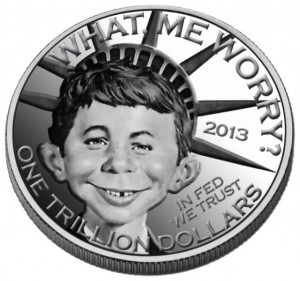

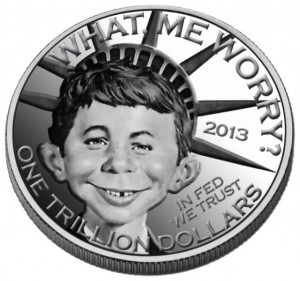

If there was a countdown of the idiocy of the punditocracy of this country, the discussion over the $1 Trillion platinum coin would be the number 1 story. As I previously explained, which it is feasible for the U.S. Mint to strike a $1 Trillion coin, the question remains, “Who will buy the coin?” In order for the U.S. Mint to gain from the seigniorage that would come from minting and selling this coin.

If the coin is has to be paid for by a depositor before it can become legal tender, who will buy a $1 Trillion coin?

How could the coin be used to reduce the debt? If the coin is just deposited with the Federal Reserve, there will be a $1 Trillion liability on the government’s balance sheet. In order to make the books balance, the Department of Treasury would have to sell debt bonds to make up the difference and that would add $1 Trillion to the national debt.

If the coin is bought by the Federal Reserve, then the Fed will have to pay $1 Trillion to the U.S. Mint for the coin reducing its overall working capital by $1 Trillion. Paying for a $1 Trillion that could not be used will just transfer the debt from the general treasury to the Federal Reserve. Since the Federal Reserve is in charge of managing the country’s money supply, the net effect will be to reduce the money supply by $1 Trillion that will cause the economy to shrink—any time you artificially remove money from the economy it will shrink which will also weaken the buying power of the U.S. dollar.

Transferring the debt away from the general fund might look good on paper but the effect will shrink the economy and cause more problems than even considering the constitutionality of doing this.

The bottom line is that regardless of what the U.S. Mint sells, there has to be a buyer. If there is no buyer then all the government would do is transfer balances from one balance sheet to another without any net gain.

Dallas-based Heritage Auctions, held a mock contest on Facebook for the public to design a potential $1 trillion coin. The concept of a coin was even a joke to the folks at Heritage whose mockup included famed Mad Magazine “pitchman” Alfred E. Newman.

Dec 22, 2013 | BEP, celebration, commentary, currency, Federal Reserve

It is that time of then when the pundit class of this country puts together their list of the best, worst, or most impactful stories of the year being concluded. There was even an advertisement on satellite radio about an upcoming show that will list the Top 10 moments in music for 2013. After a meeting of the Board of Directors for the Coin Collectors Blog (all three of us: me, myself, and I), the last ten days of the year will count down what we feel are the Top 10 Numismatic-Related Stories of 2013.

Number 10: Lew’s Lewpts

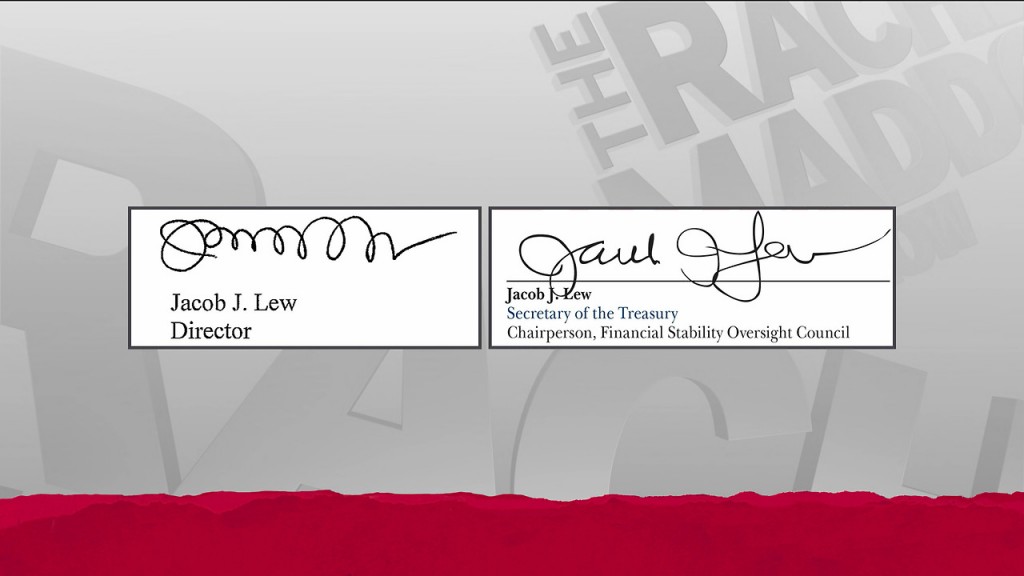

75th Secretary of the Treasury Jacob “Jack” Lew

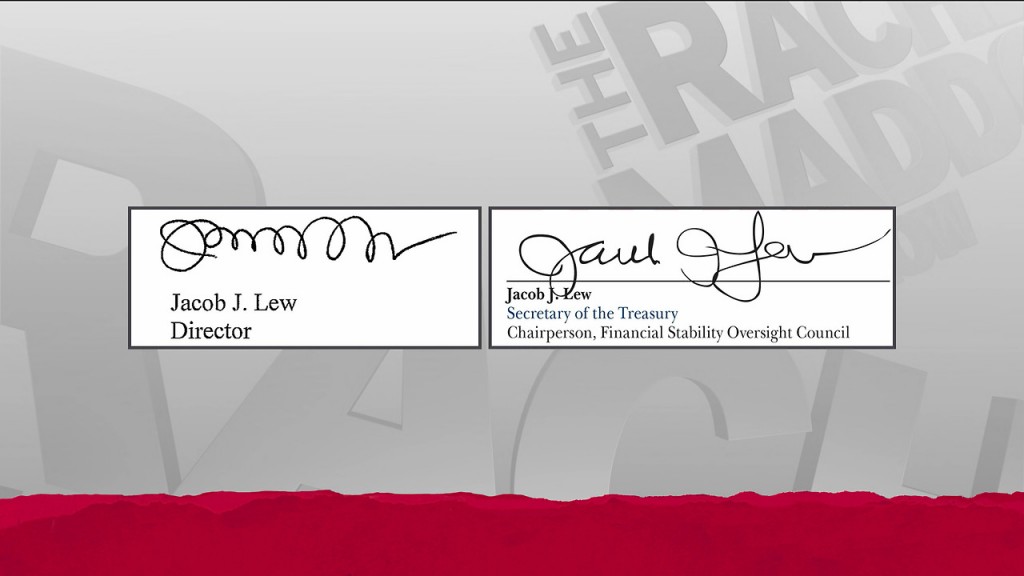

Lew, whose autograph has been called “lewpty” and been compared to the decorative icing on a Hostess cupcake, made a promise to the president that he would do better with his penmanship. During his confirmation hearing, Lew told Sen. Max Baucus (D-MT), Chairman of the Senate Finance Committee, that he promised the president he would do better. This did not satisfy those with an ironic sense for the different when a petition appeared on the White House website to “Save the Lewpty-Lew.”

MSNBC on-air comparison of Jack Lew’s autographs: the original Lewpts on the left and what will appear on U.S. currency to the right.

The other signature on U.S. currency is that of Rosa “Rosie” Gumataotao Rios, Treasurer of the United States. Rios was sworn in as Treasurer on August 20, 2009 and has served in that office ever since. Rios’s signature appears with former Secretary of the Treasury Timothy F. Geithner on Series 2009 notes. Ironically, Geithner also changed his signature when he became secretary.

-

-

Tim Geithner’s autograph before becoming Treasury Secretary.

-

-

Tim Geithner’s signature as it appears on U.S. currency

Rosie Rios signature on the older (Series 2009) $100 Federal Reserve Note

Notes that will include Jack Lew’s signature will appear on all Series 2009-A notes.

Glad we were able to resolve this pressing issue!

Nov 24, 2013 | coin design, commentary, foreign, other, US Mint

A story appeared in the November 18, 2013 edition of The Washington Post that the hard-core stamp collectors, the ones that will buy the products released by the United States Postal Service, are apoplectic about selection of Harry Potter as a subject for a series of stamps.

A story appeared in the November 18, 2013 edition of The Washington Post that the hard-core stamp collectors, the ones that will buy the products released by the United States Postal Service, are apoplectic about selection of Harry Potter as a subject for a series of stamps.

The objections are two-fold. First, Harry Potter is not American and neither is the author of the series J.K. Rowling. The other reason is that the Postal Service bypassed the Citizens’ Stamp Advisory Committee (CSAC) to make the deal with the various commercial concerns to issue the 20-stamp tribute to the boy wizard.

Unlike the Citizens Coinage Advisory Committee, the CSAC is not mandated by law. It was established in 1957 “to select subjects of broad national interest for recommendation to the Postmaster General that is both interesting and educational.” Apparently, there has been tension between the Postal Service and the CSAC.

Like coin collecting, stamp collecting has been in decline as the awareness and usage of their product declines. Coin collectors can point to the decline in coin collecting following the big start of the 50 State Quarters® program, stamp collectors can point to the growth of email, e-publishing, and electronic stamp capabilities as part of the decline of the postal service. The Postal Service feels it has to do something in order to bring new collectors to buy its goods.

The US Postal Service pays tribute to their own famous error, the Inverted Jenny

The Postal Service has been an independent agency of the federal government since 1971. Their operating expenses largely come from the sale of postage and the collection of duties for cross-border movement of the mail. Other revenues are generated from the sales of collectibles including special sets, first-day covers, and other collectibles. Interesting items sell well including the Elvis Presley stamps which were the Postal Service’s bestseller.

One area of regulation that has hurt the Postal Service was a law passed in 2005 that forced the agency to pre-pay retirement benefits for the next 75-years in a series of very large lump-sum payments. Their inability to meet the obligation and maintain the 75-year cushion has been widely reported causing the agency to lose significant revenues while trying to adhere to this ridiculous statutory requirement. No other agency or company is required to pre-pay 75-years of retirement benefits.

Knowing that they have to generate new revenues, Postmaster General Patrick R. Donahoe was quoted as saying that the Postal Service “needs to change its focus toward stamps that are more commercial.”

In other words, Donahoe recognizes that the organization he leads has to think differently in order to attract new customers.

The reaction from the philately community is almost the same as I would expect from the numismatic community if this was done by the United States Mint.

New Zealand Mint produces Monopoly coins for the Island nation of Niue. Did you pass Go?

Next year, the U.S. Mint will issue a curved coin to honor the National Baseball Hall of Fame. While it will be a round coin, the coin will be concave when looking at its obverse. While the closest thing to “different” the U.S. Mint has produced was the 2009 Ultra High Relief Gold Coin, the sales of the Baseball Hall of Fame Commemorative coins may do well because of the theme and they are different.

2007 Somalia Motorcycle Non-circulating Legal Tender Coins

“Harry Potter is not American. It’s foreign, and it’s so blatantly commercial it’s off the charts,” said John Hotchner who was once president of the American Philatelic Society and served on the CSAC for 12 years. Hotchner should be asked about the stamps to commemorate Pixar animation, Disney, and muscle cars. Even though I am a coin collector, I have bought the muscle car commemorative panel along with sheets of motorcycle stamps and a collector book with the stamp of Edgar Allen Poe because I was interested in the theme.

Louis Braille was not American nor did he do his work in America, but congress authorized a commemorative issued in 2009

Coin and stamp collectors have to take their heads out of the past. Stamps are losing to email and coins are losing to credit cards. Neither are going away anytime soon, but if there is to be a future both the U.S. Mint and U.S. Postal Service has to be innovative in order to attract new collectors. While the U.S. Mint is handcuffed by the whims of a dysfunctional congress, the Postal Service can capitalize on one of the most popular books and stories of this generation. If it helps promote stamp collecting and allows them to sell more products, then the Postmaster General should be congratulated for a job well done.

Maybe there is something that can be done to add to the catalog of the U.S. Mint in order to generate more interest. Until then, this muggle will be ordering something from the Harry Potter collectibles offered by the Postal Service for his wife who is a Harry Potter fanatic!

What do you think? Weigh in on the discussion in the comments (below).

Credits

- All stamp images courtesy of the United States Postal Service.

- Monopoly coin image courtesy of the New Zealand Mint.

- Louis Braille Commemorative image courtesy of the U.S. Mint.

- Somalia motorcycle coin images are courtesy of the author.

Oct 30, 2013 | CCAC, coin design, coins, commentary, Eagles, platinum

The buzz around the numismatics industry is the article that appeared on the front page of Coin World saying that the Citizens Coinage Advisory Committee rejected the U.S. Mint proposal to use classic coin designs as the basis for a new series of American Eagle Platinum Proof coins.

According to the article, CCAC Chairman Gary Marks commented, “My message is, ‘Let’s do something modern, something new.’”

2012 American Eagle Platinum Proof reverse — “To Provide for the Common Defence”

Unlike other coin programs, the law governing the platinum bullion coins (31 U.S.C. §5112(k)) allows “The Secretary [to] mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.”

Now, The Secretary’s proxy, the management at the U.S. Mint, is proposing a series based on classical coins designs. Using charts showing declining coin sales, they claim that a study shows that “classic Eagle” and “classic coin” designs are popular amongst their customer.

The U.S. Mint may be reading too much into their studies.

First, any sales studies over the last four years have to be taken with a heavy dash of salt. As much as the economy affects their circulating coin programs it also affects the collector coin programs. Since coin collecting is not a necessity, expecting sales to do anything but decline during an economic downturn is naive.

The other problem with coin sales are the coins programs themselves. Rather than give the quarters programs a rest and come up with something different, congress, who decides what the U.S. Mint can do, passed the America’s Beautiful National Parks Quarter Dollar Coin Act of 2008 (Public Law 110-456) to overload our senses with yet another 10-year program. It was justified by noting the seigniorage of the 50 States Quarters program.

This leads to the crux of the problem: the tail wagging this dog are marketeers and bureaucrats rather than collectors and those concerned with how American coinage represents this country.

1928 Peace Dollar is a classic and under-appreciated design

A lot of people love the classic designs but on the classic coins. There comes a time to move forward and come up with something different and fresh. Although I have not agreed with some of the CCAC’s decisions, I agree with this decision.

When asked if there should be a theme to the design, CCAC member and medal sculptor Wendy Wastweet said, “No. The artists would be delighted to be free.”

Why not let the U.S. Mint artists have free reign to come up with new designs? They have proven that when allowed to use their talents they can create some of the best designs in the world.

The CCAC has been consistent in tell the U.S. Mint to get out of the way of the artists. In fact, the CCAC Blueprint Report released in February 2011 recommended better working conditions for the U.S. Mint’s artists and engravers while giving them a freer hand in using their talents for new coin designs.

In more than two years, the U.S. Mint has not changed allowing their marketing bureaucracy misread statistics in an attempt to fix a problem they continually demonstrate they have no understanding or insight. The CCAC is right to tell the U.S. Mint to come up with something better. In the process, if the marketing department would stand aside and let the artists be creative, I am reasonably certain these talented individuals will create something far more interesting than any marketeer, bureaucrat, or any member of congress.

American Eagle Platinum proof reverse courtesy of the U.S. Mint.

Sep 26, 2013 | ancient, coins, commentary, foreign, legal

Fred and Wilma (not their real names) are friends who decided to celebrate their empty nest by taking a trip to the Mediterranean after dropping their youngest child off at college. Fred is what I respectfully call a hacker. He is a wizard programming computers and someone who I go to in order to understand some of the more esoteric aspects of computer exploits he researches. In his spare time, Fred plays with his computers and tinkers with electronics. Fred is also known as an overgrown boy scout. He is contentious about his work, children, and the activities he is involved with. Fred is probably the most honest person I know.

Fred and Wilma (not their real names) are friends who decided to celebrate their empty nest by taking a trip to the Mediterranean after dropping their youngest child off at college. Fred is what I respectfully call a hacker. He is a wizard programming computers and someone who I go to in order to understand some of the more esoteric aspects of computer exploits he researches. In his spare time, Fred plays with his computers and tinkers with electronics. Fred is also known as an overgrown boy scout. He is contentious about his work, children, and the activities he is involved with. Fred is probably the most honest person I know.

Fred is not a coin collector and has no interest in collecting coins even though he does own the 2004 Thomas Edison commemorative coin and the 2005 Albert Einstein 2 Shekel proof coin from Israel because these are two people he admires. On many occasions, Fred has said that he did not understand what I saw in collecting coins. Even after showing him my original Lincoln cent folder with coins I have found in change dating back to when I started collecting, he did not understand the lure of the chase.

While sitting on a beach along the Mediterranean, Wilma started to dig in the sand around a sleeping Fred to have fun at his expense. After she dug nearly two feet down, Wilma unearthed metal object that she originally thought was trash. After waking Fred and watching him roll into her newly dug hole, Fred brushed himself off and looked at what she found. A trip to the water to rinse off the items to find three ancient coins and a shell. The way it was described to me was that the coins were sitting in the shell as if it were a change holder. They dug some more and found three more coins. To some degree, he began to understand the thrill of the chase.

With the help of the hotel concierge, Fred and Wilma found a coin dealer who spoke English to ask about the coins. After talking with the dealer they found that the coins were common and would only be worth the equivalent of a few dollars. Undeterred, the coins were placed in a small bag and throw in the bottom of their carry on luggage as souvenirs and continued with their vacation.

A few days later, Fred and Wilma packed their bags and went to the airport to return home. At their host country’s departure screening, Fred was asked if there was anything to declare. Fred, being an overgrown boy scout, declared everything—even things he did not have to declare. As the officers were inspecting the items on the table, one picked up the bag with the coins and asked about coins. Fred showed the officer the written estimate from the dealer thinking that would resolve any issue.

According to Fred, the officer took coins and the estimate to another officer he described as having more decorations on his uniform. This higher ranking officer looked at the coins and paper while discussing the situation in their native language. After a moment, Fred became concerned and Wilma became nervous.

Another officer walked over with the higher ranking officer and acted as a translator as it was explained to Fred that the coins were “cultural antiquities” and would be confiscated. Fred was not happy but he accepted the situation until the translator said that Fred and Wilma would be detained while the officials investigated. They were allowed to gather their luggage and were escorted to a nearby room.

After waiting for an hour, another official came into the room and spoke to Fred and Wilma in English. Fred explained how he obtained the coins and why he was taking them home. After the official started questioning them as if they were criminals Fred asked to speak with the United States Embassy.

Fred and Wilma were escorted by local police to two separate facilities to be incarcerated pending an investigation. The facilities were in separate parts of town since these were not co-ed accommodations. They waited two days before seeing anyone other than the guards.

Two days later, both were escorted to a local judge and said they were being charged with trying to smuggle antiquities out of the country. An attorney was appointed to represent them. The attorney did not speak English and only wanted them to plead guilty for a three-year sentence. Thankfully, there was an American in the courtroom who told the attorney that he would contact the U.S. Embassy and not to plead on the case.

The next day, someone from the Embassy was able to have Fred and Wilma released to their custody, recovered their luggage, and let them stay in the embassy while trying to resolve the situation.

Obviously, the embassy accommodations were better than what they had at the local jail. Fred described the embassy staff as very nice including the natives who worked non-diplomatic jobs. Unfortunately, they could not leave the embassy since they were technically under house arrest. Although it was a gilded cage it was still a cage.

It took nine days to resolve the issue which Fred was told was lightning speed for that country. The coins were left in the country they were visiting, which Fred offered to do at the airport when confronted by the officials. They were driven to the airport by a U.S. military driver and escorted to the screening area by a member of the diplomatic staff who ensured their passports were returned and that they were allowed to board the plane.

The plane landed in a more friendly country where Fred and Wilma were met by local and U.S. officials for a debrief. Although the debrief was friendly, it did come after a stressful period in another country and lasted a few hours. Eight hours after landing in London, Fred and Wilma was en route back to the United States.

The country where this incident occurred is allegedly friendly with the United States but that did not stop the officials at the airport from treating them with suspicion over the possession of a few common ancient coins. Based on Fred’s description of the coins, I asked a dealer who said that $20 would be an average retail price for the coins. When asked if Fred wanted to buy similar coins, Fred could not decline fast enough!

I have written several posts about the impact of the Convention on Cultural Property Implementation Act (CPIA; 19 U.S.C. §§ 2601 et seq.) and the potential for foreign countries to use Memoranda of Understanding that the State Department’s Cultural Property Advisory Committee (CPAC) agrees to without considering citizen comments. The CPAC has said that the collateral issues raised by the comments are baseless. Fred can tell them otherwise.

Fred said that the embassy would not answer questions about what happened. Neither did the government officials during their layover in Europe. He was told that they should be thankful that this “only” lasted two weeks because it could have taken two months or even two years to resolve.

Next time the Ancient Coin Collectors Guild (ACCG) asks for assistance in addressing a call for comments from the CPAC regarding a foreign country’s MOU request, please remember the plight of Fred and Wilma. Although their ordeal lasted “only” two weeks, the next person may not be as lucky and find themselves in the jail of a country whose laws are far less humane than the United States.

Image of the ancient coins courtesy of

NGC. These are

not the coins the story is about.

Sep 11, 2013 | coins, commemorative, commentary, personal

Twelve years ago, I was a few miles away from the Pentagon when a plane crashed into its side. I remember driving to work hearing about the plan crashes in New York originally thinking that what I predicted many years ago finally came true, a small plane crashed into the World Trade Center. The reports turned grim as I kept driving toward my office.

When I arrived, I sat in the car a while listening to the radio and trying to call friends I knew who worked in lower Manhattan. I remember one was working in the World Financial Center across the street from the Twin Towers. I later found out that he had taken a job on the other side of the river in New Jersey a year earlier.

Another friend was working in 6 WTC, a 40 story building next to 2 WTC or Tower 2. Thankfully, he and his coworkers were able to escape before the second tower collapsed onto that building.

Just after the plane crashed into the Pentagon we were sent home.

I came home to the empty house my late first wife and I bought. She had died five months earlier and this time, the quiet of the house was deafening. I tuned on the television just before the second tower collapsed.

Although it was twelve years ago, I remember the day like it happened yesterday. Those who were around when President Kennedy was assassinated say the same thing about that day. It is difficult to forget these traumatic events, which is good. We should not only remember them but remember what happened after in order to do better next time. We need to learn from history rather than repeat it.

-

-

September 11 National Medal obverse features Lady Liberty holding the Lamp of Remembrance. Behind her are beacons of light stretching skyward. Liberty, the lamp and the light symbolize not just the immeasurable loss on that fateful day, but also the resiliency and triumph of those who persevered. The inscriptions are ALWAYS REMEMBER and 2001–2011.

Designer: Donna Weaver

Engraver: Phebe Hemphill

-

-

September 11 National Medal reverse depicts an eagle, symbolizing the strength of the survivors, families and Nation, against a backdrop of cascading water. The flowing water is emblematic of peace, serenity, healing and the continuity of life. The inscriptions are HONOR and HOPE.

Designer: Donna Weaver

Engraver: Joseph Menna

Medal images and descriptions courtesy of the U.S. Mint.

Aug 9, 2013 | ANA, commentary, technology

Earlier this week I read an article by Patrick Heller how the aging collector population would affect the supply and demand for numismatic items. One point Heller makes is that as collectors pass on and leave significant collections to heirs, he finds “that most heirs do not share the same passion for the holdings as the coin collector who died.”

Heller further notes, “In more than a few instances, those selling the collections have much less numismatic knowledge than the collector who died to be able to liquidate the treasures for the best price.”

Although it was not the premiss of Heller’s article, what really has to be addressed is how to increase the number of collectors and provide help to non-collectors who find themselves in the position to have to deal with a collection left behind by a deceased loved one. Of course there are two books that will explain what those selling collections as part of an estate, but sometimes they need more help.

For those interested in collecting, there needs to be an outlet to find information and be able to participate in the community. Information has to be engaging and the collector should be encouraged to collect what they like and like what they collect.

There are so many ways to collect numismatic items that it will be difficult to list them in one place. One way to start is to try to engage the collector where they are. Today, that means finding them on the Internet.

The future of every hobby, business, and nearly every aspect of life will be online.

Some might suggest that you cannot do everything online. While that may be true, the online world helps open the doors to the off line experience.

I am not suggesting that numismatics should look at the Internet as one large online supermarket or auction house. The Internet can be the gateway to knowledge. It can explain to the family that inherited grandpa’s collection how to handle it without getting ripped off. It can explain that transportation tokens may be the ultimate local collectibles and finding them can be even more challenging than finding coins. It can explain what are the positives and negatives to collecting modern non-circulating legal tender coins. It can open the door to collecting foreign coins and currency from the country your parents or grandparents came from.

The Internet can also explain that your State Quarter collection may not be as valuable as you though, including those purchased on that alleged “special sale” on television. However, that extra tree on the Minnesota quarter may be worth just a bit more than 25-cents!

“Buy the Book before the coin” is a popular mantra repeated in the hobby. But which book? If you look at the catalogs of coin books from all publishers, there are so many books how do you know which one to buy. Some people even recommend reading auction catalogs. While many auction catalogs are really sales pitches, catalogs for special sales have some wonderful information, great images, and even pointer to other references.

There needs to be a central repository for numismatic information from a trusted source that is not trying to sell you on their version of numismatics.

This is where the American Numismatic Association comes in the picture.

Over the last year, the ANA has been working to enter the 21st century to offer more services online. Even though it may appear that the ANA is barely out of the 20th century in technology, employees at the ANA headquarters have done yeomen work with what they have. But the work is only beginning.

Building online services is not easy when your product is not easily defined. Those of us in the information industry call it the “Big Data” problem because data is the driver, there is a lot of it, and managing it is not as easy as it seems. Data can be ordered in more ways than an inventory of coins or a catalog of auctions.

When looking at the problem, data tends to grow and that growth has to be managed whereas a dealer’s inventory can be in flux and auction data is static and controllable.

These problems not only makes what the ANA is trying to do to be that information leader very difficult, but doing it in a compelling manner that makes that could help attract new collectors makes the job even tougher.

Next week at the World’s Fair of Money, the ANA Board of Governors will hear about the selection of a new contractor to help take the next steps in conquering big numismatic data. They will also hear from impassioned members of the Technology Committee who only wants this contractor to succeed and do so in a way to allow the ANA to provide premier online services—a model for other non-profit hobby organizations.

Creating these online services will not happen overnight. In fact, it may take a year or longer to see significant advancements. That is the nature of building these services essentially from scratch. But it is worth the wait.

In the end, there will be resources for members and the public that will promote the hobby in a way that only the ANA can do. Hopefully, it will convince those who let their membership expire to return to the ANA, strengthen the bond between ANA members and clubs, and lure collectors who are interested to join us.

As an ANA member and a member of the Technology Committee, I hope you will support the ANA’s efforts because if the demographics cannot be skewed a little younger, we may be looking at a bleaker future for the hobby.

About the pictures… when I talk about technology I tend to think about the time I started and the Control Data Corp. Cyber 18/30 that was significant in my college days. We used to call her “LC” for Little Cyber. It helps remind me of where computing has come, especially that my iPhone is millions of times more powerful than LC!

Of course if I’m taking a walk down memory lane, I have to include the Poly 88, the first computer I ever programmed!

Jun 5, 2013 | ANA, commentary, legal

I know I have not been writing a lot as of late. Those of us in the Washington, D.C. area know the problems that sequestration has caused on government agencies. It might take another month before we regain a rhythm that will allow me to plan my time better. I have a nice To-Do list of stories I want to post including four book reviews and a few iPhone apps that are interesting.

I also do not want to use this blog as a campaign vehicle because that would be boring for you to read and for me to write. But when something as big as the most recent news comes out and I am asked for a comment, I have no choice but to use this blog to answer the many email inquiries once so we can get on with life.

Contemplation of Justice by James Earle Fraser, outside of the U.S. Supreme Court, Washington, DC

The amended complaint is shocking and salacious. For those not familiar with the law and read that Shepherd is accusing the ANA of being a Racketeer Influenced and Corrupt Organization (RICO; 18 U.S.C. Chapter 96), it makes it look like the ANA is being compared to any number of organized crime figures you might have read about in the newspapers. Even though the RICO statutes were written to fight organized crime, using it is a common tactic by plaintiff lawyers to scare the defendants they are suing.

In order for a RICO charge to be accepted by the court, Shepherd and his lawyers will have to prove that a person as a member of an enterprise or the enterprise itself has committed to of 35 different crimes (18 U.S.C. § 1961). The crimes that Shepherd is alleging that the ANA has committed are racketeering, theft, and fraud.

Racketeering sounds like an ominous charge. Racketeering is a crime when two or more people conspire to fraudulently solve a problem. Shepherd alleges that a few employees of the ANA and members of the Board of Governors made up stories about Shepherd in order to find a way to relieve him of his duties for cause so they can invalidate his contract. The stories are salacious in nature and constitute Shepherd’s accusation of defamation that allows him to attach others to the case to show that there were more than two people involved.

The theft charge is from the guilty plea by former collections manager Wyatt Yeager. In January 2012, Yeager plead guilty to stealing items from the ANA Money Museum worth nearly $1 million. Yeager was sentenced to 27 months in a federal prison, two years of supervised probation, and ordered to pay restitution to the ANA.

With the theft charges already verified by a criminal court, Shepherd has to prove that the ANA committed fraud and at least two of the co-defendants conspired to fraudulently have him dismissed to resolve whatever issues the co-defendants perceived hurt the ANA. That would prove the case under RICO and hold the co-defendants and the ANA liable for Shepherd’s dismissal.

If you decide to read the pleading please remember that it is one side of the story. While the accusations are salacious and disturbing, we have not heard from the ANA or the co-defendants. This is a stark contrast to how they handled Shepherd’s dismissal when they could not stop talking. However, the ANA has a new general counsel who may be a little more cautious than the previous general counsel. The previous general counsel, Ron Sirna, is a co-defendant on this lawsuit.

Shepherd’s charges against the ANA and the co-defendants are disturbing. In fact, the nature of the salacious accusations is disturbing. If there is any truth in these accusations, those involved must be disciplined. Employees involved should be required to undergo remediation to keep their jobs or be dismissed if their action crossed the legal line.

According to the ANA Code of Ethics, members are required to “To base all of my dealings on the highest plane of justice, fairness and morality, and to refrain from making false statements as to the condition of a coin or as to any other matter.” Any member found to have be part of the racketeering that Shepherd’s lawsuit alleges, should be subject to an ethics review.

I was recently reminded of a quote from Inferno, the first part of Dante Alighieri’s epic poem The Devine Comedy: “The darkest places in hell are reserved for those who maintain their neutrality in times of moral crisis.” Therefore, members of the Board of Governors who did not “report any knowledge of waste, fraud, corruption or impropriety relating to the Association to all other Board members immediately upon learning thereof” (Code of Ethics, Section 12) should also be subject to an ethics review.

Shepherd is also not absolved from his part. While he may have a legitimate case, his timing is suspect. Why did he wait until the beginning of the election to amend his complaint laced with descriptions of salacious accusations at this time? Shepherd has to remember that while he makes accusations, it takes two to tango, which means that he may have had a part in acts that the pleading describes. It is also possible that Shepherd and his attorneys picked only examples that are in his favor. Until the ANA answers the charges levied by Shepherd we are left wondering what was left out?

The bottom line is that it is time to clean house. ANA members must elect a Board of Governors that will act more like a Board of Directors. People who will be professional, open, and work for the benefit of the ANA. The Board of Governors must treat the association like the $6 million business it is and set up programs for the professional office to support the association for the benefit of the members and not the benefit of the staff. While there may be a few people with issues, as described in Shepherd’s pleading, those few people are making the situation difficult for those who are doing a wonderful job.

If I am privileged to receive enough votes to be elected to the Board of Governors, I renew the promise I made previously that the first motion I will make will be to hire an executive management firm that has a verifiable background in helping non-profit organizations to review the entire ANA management structure. This stuff has to stop so that we can get on with the business of building our collections with all of the advantages the ANA can provide us, the members.

Image from Photographs from the Supreme Court’s Collection.

May 4, 2013 | ANA, commentary

May Day was an eventful day for the numismatic community. On May 1, the American Numismatic Association issued a press release announcing the appointment of Kim Kiick as the ANA’s new Executive Director.

May Day was an eventful day for the numismatic community. On May 1, the American Numismatic Association issued a press release announcing the appointment of Kim Kiick as the ANA’s new Executive Director.

I will support Kim Kiick as the ANA’s Executive Director as a member and if I should be privileged to be elected to the Board of Governors.

My issue is not with Kim but with the Board of Governors and the way this entire situation was handled.

Since my first comment regarding the firing of Jeff Shevlin, my Inbox has been flooded with reports and allegations of improprieties on all sides regarding this situation. Unfortunately, these are allegation without evidence. Unless someone can provide tangible evidence, any comments about this would be irresponsible. If anyone has evidence, they can contact me via email or hand it to me at the National Money Show in New Orleans next week.

If the evidence points to any type impropriety, I will look for remedies on behalf of the ANA. Remedies can include bringing an ethics complaint to the Board or if employment laws were broken, I can recommend appropriate legal action.

One issue I have is the hiring of Unlimited Potential, a management consulting firm based on Colorado Springs. According to the ANA press release, Beth Papiano of Unlimited Potential will “work with the Executive Director, Board of Governors and staff to increase the effectiveness of each and to improve communications and leadership skills.” While this appears to be the right approach, the selection of Ms. Papiano is suspect.

Sources provided evidence that Ms. Papiano was involved with the 360-degree feedback review of Jeff Shevlin. According to Wikipedia, a 360-degree review “is feedback that comes from members of an employee’s immediate work circle. Most often, 360-degree feedback will include direct feedback from an employee’s subordinates, peers, and supervisor(s), as well as a self-evaluation. It can also include, in some cases, feedback from external sources, such as customers and suppliers or other interested stakeholders.” According to my sources, the report provided to the Board of Governors did not contain reviews from everyone in the primary circle because they were not interviewed. Further, the 360-degree feedback review did not include indirect feedback because as a member of the ANA Technology Committee and an interested stakeholder based on my participation with this committee, I was not interviewed.

In reviewing 360-degree feedback, a Forbes article discusses why these types of reviews fail. If my sources are true, three of the points may have lead to this situation: The 360 tool/questions are too vague; People offer comments that are personal in nature rather than constructive; and Forgetting the strengths and only focusing on weaknesses.

While the Board of Governors will not talk about their deliberations, they should be taken to task about the process. Was the proper questions used? Was the feedback filtered for personal feelings leaving only constructive comments? Why was not everyone interviewed as part of the process? Finally, what experience does Ms. Papiano have in performing these 360-degree reviews?

It appears that experience matters. In criticizing the article that appeared in Forbes, Jack Zenger and Joseph Folkman published a commentary on the blog for the Harvard Business Review that “Yes, we sigh, there are too many 360 implementations that are pathetic wastes of time, resources, and—worst of all—opportunity.” Was the review a pathetic waste of an opportunity to properly review the organization and why there have been three dismissed executive directors in the last ten years?

I am trying to find out more about Ms. Papiano since her work resulted in the firing of one executive director and involved in the coaching of the current executive director. Unfortunately, for someone who claims to be a “nationally known coach and social systems consultant,” I cannot find any reference of her work before 2011. I am still researching in what context she is “nationally known” because everything I find only goes back for three years.

The Colorado Secretary of State Office has a record for the trade name Unlimited Potential being registered on September 1, 2004. Ms. Papiano is a sole proprietor with no indication of employees even though her company website uses a lot of first-person plural statements.

Does this mean she is not qualified? I am not sure. While trying to find more information about Papiano and Unlimited Potential, I found the profile she entered at Naymz, a site for people to manage their “social reputation” online. According to this information, Papiano has owned Unlimited Potential since 2004. Prior, she was an employee for Quantum (a computer storage company), Sun Microsystem (since purchased by Oracle), and Hewlett-Packard. There is no indication that she has any experience with the management or executive consulting of non-profit organizations. In fact, her Naymz profile does not mention any experiences with non-profit companies. The first sentence of her profile says “20+ years as an organizational effectiveness manager and executive coach inside Fortune 100 companies….”

One thing that bothers me is the obvious mistake of beginning a sentence with a number. While I admit that my writing on this blog has been less than perfect, when I write something in the professional arena I make sure it is grammatically and structurally correct. Mistakes happen, but someone who is responsible for communicating results should demonstrate a better command of the language.

But does this really mean Papiano is not qualified? I continue to be not sure but the search for qualifications continue to raise questions. It is possible that with all the market bluster that she tried to generate for herself over the last few years, that she could be an effective managing consultant. Then I visited the testimonials section of her website to find unattributed quotes and “client results” also without attribution. Maybe I have been living and working in the Washington, D.C. area too long because not having a history that could be verified is not comforting. “Trust, but verify” was a phrase made famous by Ronald Reagan. I think it applies here.

Papiano may be good at what she does but she may not be the right person for the ANA to have as a management consultant at this time. I question whether Ms. Papiano may have been either careless in performing the 360-feedback review, unwittingly complicit in a targeted attempt at having Jeff Shevlin fired, or an opportunist thinking that she could manipulate the situation to get a follow-on contract with the ANA.

In letters sent to numismatic publications and a note posted on the PCGS forums, I called for a management consultant to review the ANA organization. In the letters I wrote “Rather than begin the search for an executive director, I call on the ANA Board of Governors to hire an executive consulting firm to evaluate the operations of the ANA. The firm should have no connection with anyone in the ANA and should be directed to present their findings to the new board at their first meeting during the World’s Fair of Money in August.” Unfortunately, the Board chose to move forward quickly without allowing the new board to review the situation and also chose to retain Papiano.

If elected to the Board of Governors, the first motion I will make will be to hire an executive management firm that has a verifiable background in helping non-profit organizations to review the entire ANA management structure. This management consulting firm will be asked to asses the ANA as follows:

- Review the organizational structure of the ANA headquarters

- Review the employment policies for those working at the ANA headquarters

- Review the employee environment at the ANA headquarters and make recommendations for improvement

- Review the Board of Governors’ current and past relationships with the employees at the ANA headquarters

- Review the 360-degree feedback review of Jeff Shevlin and the process which caused his termination

- Perform a similar review with regard to the termination of Larry Shepherd

- Review the mentoring plan for Kim Kiick for effectiveness

- Provide recommendations to the by-laws and/or ANA policy to provide membership with the assurance that the ANA is being properly run

As part of my motion, I will provide recommendations as to who the Board of Governors could hire. These recommendation will consist of management consulting firms that have had verifiable experience working with non-profit companies and no ties to the ANA in any manner.

Of course the Board can vote against my proposal or I could not be elected to the Board of Governors. In either case, I will continue to pursue this issue because the status quo is unacceptable.

Image of Kim Kiick courtesy of the ANA.

Nearly two months into the nomination process for American Numismatic Association Board of Governors, I decided to throw my proverbial hat in the ring and run for the ANA Board of Governors. Even though I lost, it was a humbling experience and I appreciate those who supported my candidacy. I continue to believe in the issues I campaigned on and will continue to work to improve the ANA in whatever way I can.

Nearly two months into the nomination process for American Numismatic Association Board of Governors, I decided to throw my proverbial hat in the ring and run for the ANA Board of Governors. Even though I lost, it was a humbling experience and I appreciate those who supported my candidacy. I continue to believe in the issues I campaigned on and will continue to work to improve the ANA in whatever way I can.

May Day was an eventful day for the numismatic community. On May 1, the

May Day was an eventful day for the numismatic community. On May 1, the