Fun with gold history

Sometimes, finding a link to a page that describes what things were like the year you were born can lead to educational and fun reading.

Sometimes, finding a link to a page that describes what things were like the year you were born can lead to educational and fun reading.

A friend sent a link to an October 2020 article on Stacker titled “Cost of gold the year you were born.” Aside from finding out that gold broke the $35 barrier the year I was born, the article outlines economic history from 1920 to 2020.

Some of the descriptions also will help explain some of the numismatic decisions that affect collectors. Understanding the economic history behind money can help understand where collectibles are today.

While reading through the list, I picked out ten significant highlights of the last 100 years:

- 1932: The last year the U.S. Mint struck gold coins that were circulated

- 1949: Switzerland stops minting the 20 Franc gold coin, the last gold coin struck for circulation

- 1955: San Francisco Mint stopped coining operations (it would return 13 years later)

- 1967: South Africa introduces the Krugerrand

- 1975: Gold ownership made legal again

- 1979: Canada introduces the gold Maple Leaf

- 1982: China introduces the gold Panda

- 1985: Reagan signs the Gold Bullion Coin Act

- 1998: The euro is introduced

- 2000: The Denver Mint produced 15.4 billion coins, the most of any mint

Understanding history is another way to get more out of your collection.

Read! Educate! And collect!

A story that will not go away

The other day I walked into the office of a big-shot producer and pitched a story for a movie that had the possibilities of a sequel. Here is the story I pitched:

The other day I walked into the office of a big-shot producer and pitched a story for a movie that had the possibilities of a sequel. Here is the story I pitched:

Flash to Washington where President Franklin D. Roosevelt signs Executive Order 6102 that banned the private use of gold for currency.

Transition back to Philadelphia where a shadowy figure, presumably the U.S. Mint’s cashier, is locking the doors of the coin room but is clearly clanking coins in his pocket.

Watch as the cashier grabs his coat, hat, a small bag and leaves the Mint. He walks to the Philadelphia’s diamond district where he knocks on the backdoor of jeweler Israel Switt. Switt opens the door and the two men talk. Switt hands the cashier a bag and the cashier hands the bag he was carrying to Switt then leaves.

Fast forward to 1944. An emissary for King Farouk of Egypt is meeting with someone at the State Department to obtain permission to export a 1933 double eagle to Egypt for his vast collection. Not knowing whom to call, the State Department worker calls the Smithsonian who verifies the coin that leads to an export permit.

Next, a series of investigations and stories about the seizing of 10 double eagle coins that the Secret Service says should not have left the U.S. Mint. This part of the story goes to 1952.

Scene is the famous Waldorf-Astoria Hotel in New York in 1996. British coin dealer Stephen Fenton is attempting to buy a 1933 double eagle when the Secret Service interrupts the transaction and arrests him.

Attorney Barry Berke helps get Fenton out of jail and begins to build a case against the government. The defense claims that King Farouk of Egypt legally exported the coin. Some court drama and negotiations lead to charges against Fenton being dropped but the coin not returned to Fenton.

The scene is Federal Court in Manhattan where Berke is negotiating a settlement with federal attorneys. Finally, in July 2001, both sides agree that the coin would become federal property and sold at auction. The Fenton and the government would split the proceeds of the auction. The government required the buyer pay an extra $20 to officially monetize the coin.

Flash to the World Trade Center where the coin is removed from a safe and transferred to the government.

Brief pause for a scene about the destruction of the World Trade Center.

Fade to Southeby’s Auction on July 30, 2002 where the coin sells for $6.6 million plus a 15-percent buyer’s premium. After the auction Stephen Fenton received $3.3 million. Another $3.3 million was deposited in the federal treasury. Southeby’s and their auction partner Stack’s earned $990,000. The president of Southeby’s will pull $20 out of his pocket and hand it to the government’s representative to monetize the coin.

New scene is in a dark basement in Philadelphia. Joan Langbord, Israel Switt’s surviving daughter, will be opening boxes as if she was looking for something. Soon she would find a bag with ten 1933 Saint-Gaudens double eagle coins.

Langbord contacts the U.S. Mint and hands the coins over for authentication. In July 2005 they determine the coins are real and confiscates them.

Langboad contacts Berke to help recover the coins.

First trial occurs in July 2011, which leads to a unanimous decision against Langbord who was joined by her sons in the lawsuit. The elderly Langbord did this to protect the family’s interest.

Scene changes to the transfer of the ten coins to the Bullion Depository at Fort Knox, Kentucky.

Langbord appeals and a three-judge panel will vacate the forfeiture and order the government to return the coins.

The government appeals and asks that the return order be vacated in order to appeal the decision. Rather, the Chief Judge of the Third Circuit will stay the order and ruled that the appeal will be en banc, meaning that the appeal will be heard before the entire bench of judges this year.

Fade to the image of the ten coins in Fort Knox with the lettering “To be continued…” overlaying the screen.

The producer found the story so unbelievable that he threw me out of his office.

Just goes to prove that reality is weirder than fiction!

Summary of July 2015 coin-related legislation

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

The term Dog Days goes back to ancient Roman times when calendars were measured by the stars. While trying to measure time, the hottest part of the summer would coincide with the brightest star, Sirius, being dominant in the sky. Sirius is part of the constellation Canis Major (big dog).

During the period from about 20 days prior to the height of Sirius to 20 days following, Canis Major would only appear with the sunrise and sunset. Because ancient Romans thought Sirius contributed to the heat and humidity, this period would be called the Dog Days.

Today’s society has attached many meanings to the Dog Days of Summer. In baseball, it is the jockeying for position to get ready for the pennant races. Football begins training camps, politicians warm up to run for office (sometimes a year early), and the temperatures are rising with the east getting too wet and the west not getting wet enough.

These contrasts illustrate a congress that sometimes looks like they are really trying to do something and then really trying to put the “fun” in dysfunctional!

In July, it looks like congress really tried to do some work. Here are the coin-related legislative actions from our from our representatives on Capitol Hill:

It’s the law!

H.R. 893: Boys Town Centennial Commemorative Coin Act

- 2017 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 350,000 silver $1 coins with $10 surcharge

- 300,000 clad half-dollars with $5 surcharge

- Surcharge paid to Boys Town

Read the details of this law at https://www.govtrack.us/congress/bills/114/hr893

Passed the House

H.R. 2722: Breast Cancer Awareness Commemorative Coin Act

- 2018 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 400,000 silver $1 coins with $10 surcharge

- 750,000 clad half-dollars with $5 surcharge

- Surcharge paid to Breast Cancer Research Foundation for the purpose of furthering breast cancer research

Track this bill at https://www.govtrack.us/congress/bills/114/hr2722

Commemorative Coin Legislation Introduced

H.R. 2980: Mayflower Commemorative Coin Act

- 2020 Commemorative program

- 50,000 $5 gold coins with $35 surcharge

- 100,000 silver $1 coins with $10 surcharge

- Surcharge paid to General Society of Mayflower Descendants for educational purposes.

Track this bill at https://www.govtrack.us/congress/bills/114/hr2980

S. 1715: Mayflower Commemorative Coin Act

Track this bill at https://www.govtrack.us/congress/bills/114/s1715

H.R. 2978: Thirteenth Amendment Commemorative Coin Act

- 2015 Commemorative program

- 250,000 $50 bi-metallic (gold & platinum) with $10 surcharge

- 250,000 $20 gold coins with $10 surcharge

- 500,000 silver $1 coins with $10 surcharge

- Surcharge paid to Smithsonian National Museum of African American History and Culture.

Track this bill at https://www.govtrack.us/congress/bills/114/hr2978

Other coin-related legislation

H.R. 3097: Commemorative Coins Reform Act of 2015

Track this bill at https://www.govtrack.us/congress/bills/114/hr3097

H.R. 3300: To reduce waste and implement cost savings and revenue enhancement for the Federal Government.

Track this bill at https://www.govtrack.us/congress/bills/114/hr3300

POLL: Are you buying the American Liberty Gold Coin?

I think I covered all of the options. If I have not or you want to add more commentary, even (especially) if you disagree with me, then leave a comment. Remember, the only comments I reject are for bad language and spam. Keep it clean and it will appear as soon as I can get to them.

Are you going to buy the new 2015 American Liberty High Relief Gold Coin?

Total Voters: 72

What is the U.S. Mint doing?

What is going on at the U.S. Mint? For an organization whose actions are micromanaged by law seems to be finding a way to get around those rules to make some real questionable decisions.

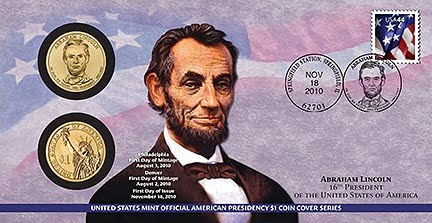

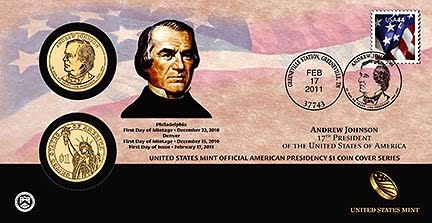

First, the U.S. Mint begins production of uncirculated San Francisco struck America the Beautiful Quarters in 2012 leaving the coins of the first two years of the program out. Collectors of the entire set will have two uncirculated options for 2010 and 2011 but a partial set for the rest of the program. Why start something like this in the middle of the program?Just before the release of the S-mint quarters, the U.S. Mint changed its branding and changed the design of the Presidential $1 Coin Cover. Those of us who collect the coin covers now have two different formatted designs that shows when you show your 2010 Abraham Lincoln cover followed by the 2011 Andrew Johnson cover. And the change puts a thick black bar across the bottom forcing the portrait to be reduced making it an ugly design.

Although I love the reverse proof coins and do not think including them in special sets, such as the 2015 Reverse Proof Roosevelt Dime as part of the 2015 March of Dimes Special Silver Set, but there are persistent rumors of a Presidential dollar reverse proof set. Why add a reverse proof set in the middle of a series? What is the U.S. Mint thinking? Adding a reverse proof to an existing series is as wrong as the S-mint national parks quarters.

Allegedly, there is “excitement” being made over the new 24-karat $100 Liberty gold coin. First, there was a lot of industry discussion on the $100 face value, which is irrelevant to the issues. What difference does the denomination make on a non-circulating coin? But am I the only one who thinks the image of Liberty looks like an anorexic weakling?Look at some of the past images of Liberty and they have a stronger look. Two of the most famous by Augustus Saint-Gaudens and Adolph A. Weinman has a striding Liberty that shows character. George Morgan’s Liberty had a regal look and Anthony de Francisi’s Liberty on the Peace dollar is just a marvel of beauty. This image is so uninspiring that I would buy the coin only because it is the first year of issue and has some investment potential. Otherwise, if I were to invest in 24-karat gold coins I would continue to buy the American Gold Buffalo.

The appealing feature of the coin is the eagle on the reverse. While there have been flying eagles on Christian Gobrecht dollar, James B. Longacre’s Flying Eagle cent, and Saint-Gaudens’ $20 gold coin, the new design brings forward the strength of the eagle gripping an olive branch to symbolize peace. Although the eagle depicted on Official Seal of the United States includes arrows in one of the eagle’s claws, modern sensibilities will prevent the symbolism that the arrows would depict.I know that the designs were approved by the Citizens Coinage Advisory Committee and the U.S. Commission of Fine Arts. But, as usual, their motivations and sense of design is really in question. Maybe it is time we drop one of these committees and streamline the process.

Expanding collecting options from the U.S. Mint is good for the hobby. However, adding options to existing series and ugly coins should be discouraged.

All other images courtesy of the U.S. Mint.

Jeppson nominated to be 39th Mint Director

In January, Treasurer of the United States Rosie Rios Principal Deputy Director announce the appointment of Jeppson as the Principal Deputy Director. In that role, Jeppson is responsible for the day-to-day operation of the bureau.

This is President Obama’s second attempt at nominating a director for the U.S. Mint. In September 2012, Obama tried to nominate Bibiana Boerio to the position. The former Chief Financial Officer of Ford Motor Credit and Managing Director of Jaguar Cars Ltd, then a subsidiary of Ford, did not receive consideration from the Senate before the 112th congress adjourned for the last time.

The U.S. Mint has not had a permanent director in 54 months, since Edmund Moy resigned in January 2011. Since Moy’s departure, Deputy Director Richard Peterson has been capably running the world’s largest coin manufacturing agency. Peterson returned to the position of Deputy Director for Manufacturing and Quality on Jeppson’s appointment.

Since the Director of the U.S. Mint is an appointed position, the U.S. Senate has the power of “Advice and Consent” on the nominations to head departments. Until this do-less-than-nothing congress gets around to doing their job, Jeppson will continue to manage the U.S. Mint as a federal executive employee but without the Director’s title.

Jeppson’s biography in the President’s announcement was as follows:

Matthew Rhett Jeppson is the Principal Deputy Director of the Mint, a position he has held since January 2015. Mr. Jeppson was Associate Administrator in the Office of Veterans Business Development at the Small Business Administration (SBA) from 2012 to 2015 and also served as the Acting Chief Operating Officer of SBA from 2014 to 2015. From 2010 to 2012, he was Lead Crisis Response Planner at U.S. European Command. Mr. Jeppson served as Deputy Director of Operations for U.S. Forces Afghanistan from 2009 to 2010. From 2004 to 2008, he was Chief of Joint National Training Capability and European Engagements Lead at the United States Special Operations Command and served as Counter-Terrorism Planner and Chief of Current Operations for Marine Forces Europe from 2001 to 2003. Mr. Jeppson was Director of State Purchasing and Special Assistant to the Secretary at the Department of Business and Professional Regulation of the State of Florida from 1999 to 2003, and he served as Operations and Exercise Officer at Special Operations Command Central from 1995 to 1999. He was Vice President of E. Mark Jeppson, Inc. from 1992 to 1994. He also served as Principal Battalion Staff Officer, 81mm Mortar Platoon Commander, Rifle Company Executive Officer, and Rifle Platoon Commander in the 1st Marine Division from 1989 to 1991. Mr. Jeppson received a B.A. from the University of Florida.