Another Desktop Treasure Hunt Find

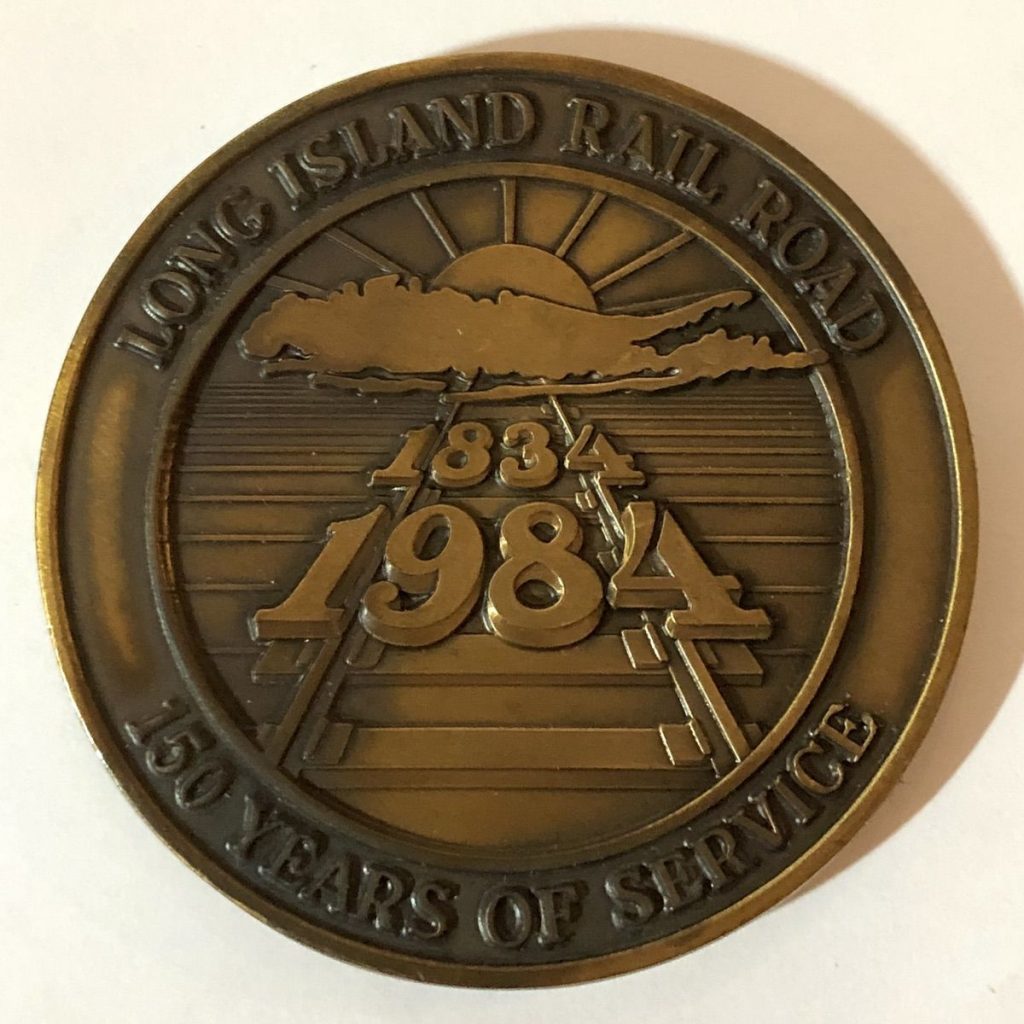

My desk is nowhere near being clean and organized as I would like it to be. Tonight, I lifted a stack of papers looking for something and found my Long Island Railroad Sequicentenial bronze medal.

The Long Island Railroad (LIRR) is the largest commuter railroad in the United States. The LIRR runs the length of Long Island to bring commuters into New York City in the morning and home in the afternoon. The LIRR is part of everyone’s life in Nassau or Suffolk Counties, even if you are not a commuter.

The Long Island Railroad (LIRR) is the largest commuter railroad in the United States. The LIRR runs the length of Long Island to bring commuters into New York City in the morning and home in the afternoon. The LIRR is part of everyone’s life in Nassau or Suffolk Counties, even if you are not a commuter.

When the LIRR was chartered on April 24, 1834, its mission was to provide rail service between New York City and Boston. The service used a ferry connection between Greenport on Long Island’s North Fork and Stonington, Connecticut. Weather and other issues forced that route to stop operating in 1849, but overland routes continued.

The Pennsylvania Railroad purchased the Long Island Railroad in 1900. They broke up the service that went north to Boston and the Long Island segments. The northern service is now part of Metro-North, the third-largest commuter railroad. The LIRR remained as a service to Long Island for both commuter and freight rail.

After World War II, the new middle class began to purchase more cars, causing a decline in ridership. In the early 1950s, New York State began to subsidize commuter rail services around New York City. By 1965, the state purchased the LIRR from the Pennsylvania Railroad to create the Metropolitan Commuter Transportation Authority (MCTA). A short time later, the state bought Metro-North from the New York Central Railroad, who previously purchased it from the Pennsylvania Railroad. When the state completed the purchase of the three remaining subway lines, the agency was renamed the Metropolitan Transportation Authority (MTA).

Today, the MTA is responsible for the New York City Transit Authority (subway and busses), the bridges and tunnels in New York City, the LIRR, Metro-North, and a cross-jurisdiction police department run under state authority. The MTA partners with New Jersey Transit for the parts of their service that run in New York. New Jersey Transit is the second-largest commuter rail service.

Remarkably few railroads have survived in the United States, but the LIRR is still going. The LIRR is the oldest commuter rail service in the United States. It was quite an accomplishment to celebrate 150 years. Along with the announcements of service improvements, the LIRR created many souvenirs, including a bronze medal.

The Medallic Arts Company designed and struck a 64mm (2.5 inches) 5mm thick bronze medal for the LIRR. The obverse depicts the logo the LIRR used to celebrate the sesquicentennial. The reverse uses a logo found on stock certificates from the mid 19th century. It may not have been the original logo, but it was the oldest found.

The surface of the medal has an antiqued finished and appears to have a shellac coating.

Senior executives received the medals as a bonus, and many were given to VIPs. Employees could purchase medals from the LIRR Public Affairs office in Jamaica Station for $8 per medal. To purchase the medals, employees had to provide their “IBM Numbers” at the purchase time.

For those not old enough to remember, “IBM Numbers” were early employee identification numbers. The name came from the number a computer, the company’s IBM mainframe, and assigned to the employee. Companies that used the system would use a punchcard system to identify employees.

The medal is not common but not scarce. Several years ago, an inquiry to the LIRR about the medals amused their public relations department. Aside from not having records that old, nobody in the office worked for the LIRR when the medals were issued.

A casual study of the market shows that most are missing the presentation box. The presentation box was likely only available to the executives and VIPs. It is more difficult to find the medal with the original presentation box.

POLL: Which Top Modern Do You Want In Your Collection?

Last Friday, the Professional Coin Grading Service released its first annual list of the “PCGS Top 100 Modern U.S. Coins.” This list is their opinion of the best coins that have been struck since 1965.

Artist’s conception of the 1964-D Peace dollar, the #1 coin on the new PCGS Top 100 Modern U.S. Coins list.

Let’s assume for the moment that a 1964-D Peace dollar still exists and you had the money to spend, which of the Top 5 in the PCGS Top 100 Modern U.S. Coins would you like for your collection?

If you have any thoughts on other coins in the PCGS Top 100 Modern U.S. Coins, feel free to leave a comment, below.

If money was not an object and the coin existed, which of the PCGS Top 5 Modern Coins would you buy?

Total Voters: 27

Image courtesy of PCGS.

Save the Lewpty Lew

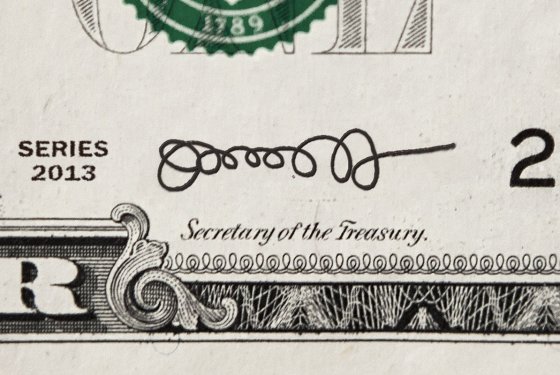

With the announced retirement of Secretary of the Treasury Timothy F. Geithner, President Barack Obama nominated his Jacob Joseph “Jack” Lew, his current Chief of Staff, to be the next Secretary.

Tim Geithner’s signature as it appears on U.S. currency

Should Lew be confirmed by the Senate, which is very likely, he will provide his signature to the engravers at the BEP so that it would replace Geithner’s. Based on past practices, the new Lew-Rios notes would become Series 2009A.

This is not Jack Lew’s signature on a Hostess Cupcake

After hearing how Geithner changed his signature when providing the BEP with currency samples, there are some that want Lew not to change his autograph and have the “Lewpty Lew” appear on United States currency. Between now and February 8, 2013, there is a petition on the White House website to Save the Lewpty-Lew and have Jack Lew’s autograph loops appear on U.S. currency.

If you would like for Jack Lew to add his loops to U.S. currency and not try to make it legible, you can weigh in and sign the petition on the White House website!

PCGS Declares 1964-D Peace #1

Now that it is award season, Professional Coin Grading Service is getting into the act by release its first annual listing of the “PCGS Top 100 Modern United States Coins.” PCGS is using the rising popularity of modern coins, those minted since the change to base metals in 1965, to bring this list to the public. PCGS announced the list on January 11, 2013, during a luncheon at the Florida United Numismatics Convention in Orlando, Florida.

PCGS is offering a $10,000 reward to verify a genuine 1964-D Peace dollar, the number one coin on the new PCGS Top 100 Modern U.S. Coins list. This image is a PCGS artist’s conception of a 1964-D Peace dollar.

“Mint records indicate that 316,076 1964-dated silver Peace dollars were struck at the Denver Mint in May 1965,” said Don Willis , President of PCGS, “but they were all were supposed to be destroyed.”

PCGS believes that not every 1964-D Peace dollar was destroyed and has offered a $10,000 reward “just to view in person and verify a genuine 1964-D Peace dollar.”

In 1964 the price of silver rose to new heights that it made the value of ordinary circulating coins worth more for their metals than their face value. Because of this, silver coins were being hoarded by the public and becoming scarce in circulation. Western states that relied on hard currency including the gaming areas of Nevada needed the U.S. Mint to strike additional coins for circulation.

The striking of a dollar coin had a powerful ally: Senator Majority Leader Mike Mansfield, Democrat from Montana, whose state would be directly affected by the new coins. Although the numismatic press was not in favor of the measure because of its limited ability to solve the coin shortage, Mansfield pushed a bill through congress to authorize the Mint to strike 45 million silver dollars.

After much discussion, the Mint looked for working dies but found that few survived a 1937 destruction order. Those that did survive were in poor condition. Mint Assistant Engraver Frank Gasparro, who would later become the Mint’s 10th Chief Engraver, was authorized to create new dies of the Peace dollar with the “D” mintmark. Since the coins would mostly circulate in the west it was logical to strike them closest to the area of interest.

Treasury Secretary C. Douglas Dillon was opposed to the the coin and wrote a letter to President Lyndon B. Johnson saying that the coins would not be likely to circulate and be hoarded. After Dillon resigned, Mansfield questioned the new Secretary, Henry H. Fowler, who assured Mansfield that the coins would be struck.

Although Mint Director Eva Adams, who was from Nevada, also objected to striking the coin, the Denver Mint began trial strikes of the Peace dollar on May 12, 1965.

When the coins were announced three days later, coin dealers immediately offered $7.50 per coin which would ensure that they would not circulate as intended. Everyone saw this as a poor use of Mint resources during a time of sever coin shortages. Adams announced that the pieces were trial strikes never intended for circulation and were later melted under reportedly heavy security.

To prevent this from happening again, Congress added a provision in the Coinage Act of 1965 (Public Law No. 89-81; 79 Stat. 254) that put a moratorium on striking silver dollars for five years.

There have been reports that some Peace dollars were struck using base metals (copper-nickel clad) as experimental pieces in 1970 in anticipation of the approval of the Eisenhower dollar. The same reports also presume these coins have been destroyed.

“It sometimes takes years for famous coins to surface,” said Hall. “Until 1920, no one knew there actually were 1913 Liberty Head nickels in existence. Until 1962, no one knew the 1804 Draped Bust silver dollar and the other coins in the special presentation set given by the United States to the King of Siam in 1836 were still in existence.”

“When we offered a $10,000 reward in 2003 to be the first to see and authenticate the long-missing Walton specimen 1913 Liberty Head nickel it resulted in the re-discovery of that coin after a 41-year absence from the hobby,” Hall continued. “Perhaps this new reward offer will help solve the mystery of whether any 1964-D Peace dollars survived the melting pots. It’s the number one modern U.S. coin.”

For collectors of silver crown-sized coins and large U.S. dollars, the 1964-D Peace dollar is the ultimate fantasy coin. As someone who collects silver coins including modern bullion issues, it should come as no surprise that I chose the 1964-D Peace dollar for this blog’s logo. My version was made using Photoshop and colored to not look “real” to avoid potential issues from our law enforcement friends at the Department of the Treasury.

It would be difficult to put a price if a version of the coin is found. It would certainly be a unique coin whose auction would start well out of my price range—maybe set a record for being the highest price paid for a single coin, topping the 1933 Farouk-Fenton Saint-Gaudens Double Eagle that sold for $7,590,020 in 2002.

As part of the announcement, PCGS announced the top five in the PCGS Top 100 Modern U.S. Coins as follows:

- 1964-D Peace Dollar: The most controversial and one of the most famous of all modern issues.

- 1975 proof no “S” mintmark Roosevelt dime: Only two known, and one recently sold at auction for $350,000.

- 1974 aluminum Lincoln cent: 1,570,000 were minted but only one is known and is graded PCGS MS62.

- 1976 proof no “S” mintmark Bicentennial Type 2 Eisenhower dollar: only one example is known.

- 2000-W proof Sacagawea dollar struck in 22 carat gold: 12 are known

1964-D Peace dollar image courtesy of PCGS.

POLL: Are you a member of a local coin club?

This week’s poll asks if you belong to a local coin club.

I believe that local coin clubs are more the future of the hobby than national clubs. Members of local coin clubs can get involved in ways they cannot with a national club and have a greater impact in their community than on a national basis.

I am a member of two local clubs, the Montgomery County Coin Club (MCCC) and the Washington Numismatic Society (WNS). I joined MCCC in 2002 when I became interested in collecting again and have been significantly involved since. I think we are a strong club in an area of the country where there are varied interests a lot of alternative activities for people to be involved. Attendance at our monthly meets range from 20 during the slow summer months to over 40 when we have a popular program. For 2013, I will once again serve as the club’s president.

Last year I joined WNS with the intent of going to their meetings and getting involved with a different group of members. While some WNS members are also MCCC members, there people who are not members of both and a different way of doing things. My “real life” work requirements has prevented me from being more involved, but I hope that will change in 2013.

I am also a member of the Maryland State Numismatic Association (MSNA), the umbrella organization over clubs in Maryland where I have been Vice President since 2012. MSNA is in transition because of local changes in the numismatic climate, mainly the three-times per year Whitman Coin and Currency Expo held in Baltimore. The transition gives us an opportunity to try new ideas and help grow interest in numismatics in Maryland.

Being a member of these organizations allows me to meet and talk with others about numismatics. There are some members who are well known on the national scene, those whose regional knowledge has been valuable, and those with interesting collections and ideas that I would have never thought about.

Taking the time to meet other collectors is as rewarding as the hobby—especially with MCCC and WNS who dedicates a part of their meeting to exhibits, a numismatic “show-and-tell” of new finds or something different from their collections.

Are you a member of a local coin club? If not, why not? Vote in the poll and comments are always welcome below!

EDITED TO ADD: To find a club in your area, you can search for one through the ANA Club Directory. You can search by state, zip code, or even by specialty.

Do you belong to a local coin club?

Total Voters: 19

The Bogus Debate Over the $1 Trillion Coin

Obverse of the 2012 American Eagle Platinum Proof

Regardless of the side of the political spectrum you are in this topic, it will not work.

First question is whether it is legal for the U.S. Mint to strike the $1 Trillion coin. Although there are as many answers as there are pundits, everyone points Title 31, Section 5112, paragraph “k” (31 U.S.C. § 5112(k)) that reads as follows:

This law was passed by congress under their authority in Article 1, Section 8 of the U.S. Constitution that says “The Congress shall have Power… To coin Money, regulate the Value thereof, ….” The law’s intent was to give the U.S. Mint the authority to issue the American Eagle Platinum Bullion and Platinum Proof coins. American Eagle Platinum coins have a $100 face value and sell for a premium over the market price of platinum and taking into consideration coin’s production cost. However, the law does not restrict the issuance of the platinum coin to the American Eagle program.

But is it constitutional? The argument from John Carney of CNBC says it is not by twisting a ruling by the Supreme Court. Carney cites the case Whitman v. American Trucking Assns., Inc. (531 U.S. 457 (2001)) in saying that “the Environmental Protection Agency rule making authority was too broad because Congress had failed to provide ‘intelligible principle’ to guide the agency.” Unfortunately, like a lot of people, Carney reads the headlines and not the majority opinion. In the majority opinion, Justice Antonin Scalia wrote the law “does not permit the Administrator [of the EPA] to consider implementation costs” which is against previous precedent because the Clean Air Act, which was under question, “often expressly grants the EPA the authority to consider implementation costs, a provision for costs will not be inferred from its ambiguous provision.”

In other words, the Supreme Court said that because there are conflicts in the law. The “intelligible principle” is that Congress cannot delegate partial authority over one part of a law where other parts have a requirement to consider other circumstances. In other words, the Supreme Court is saying that Congress has to be consistent in delegating its authority.

Could 31 U.S.C. § 5112(k) be interpreted in the same manner? It is possible for the Supreme Court to declare the law unconstitutional, but if they do so they would also have to rule that the law that allowed the U.S. Mint to create the 2009 Ultra High Relief Gold Coin unconstitutional. According to 31 U.S.C. § 5112(i)(4)(C):

Under both 31 U.S.C. § 5112(k) and 31 U.S.C. § 5112(i)(4)(C), the Secretary can authorize the U.S. Mint to strike any denomination platinum or gold coin with the value of $1 Trillion. Since there is no ambiguity or contradictions that would be able to use Whitman v. American Trucking Assns. as a precedence, the constitutionality should not be in question.

If the Secretary could mint and issue a $1 Trillion coin, then the Secretary could mint 17 such coins that could theoretically be used to pay off the country’s debt and give the country a positive balance for the first (and only) time since 1835 under President Andrew Jackson.

For discussion sake, let us say that the Secretary authorized the U.S. Mint to produce a $1 Trillion coin. Who is going to buy the coin?

If the concept is to use the profit (seigniorage) from the sale of the coin, whether it is made of gold or platinum, the coin has to be sold in order for there to be a profit. If the government would just deposit a $1 Trillion coin in the Federal Reserve, then where is the profit for the government? In order for a coin to become legal tender, it has to be bought from the government for at least its face value unless the law allows otherwise (see the American Eagle Bullion program and any of the commemorative programs). The U.S. Mint does not consider a coin to be legal tender until it receives an appropriate deposit of bullion or other forms of legal tender.

It this concept of legal tender that has been behind the government’s position that because the 1933 Saint-Gaudens Double Eagle coin was not paid for by a depositor (part of which is required in 31 U.S.C. § 5122), they are government owned coins (31 U.S.C. § 5121) and not legal tender. This concept has been upheld in the history of the 1933 Saint-Gaudens Double Eagles including the settlement over the Fenton-Farouk coin that sold for $7,590,020 with $20 going to “monetize” the coin.

Most recently, Judge Legrome D. Davis (U.S. District Court for Eastern Pennsylvania) confirmed the legal tender status of the 10 Double Eagles that Joan Langbord allegedly found in a box once owned by her father, infamous Philadelphia jeweler Israel Switt who is considered one of the central figures in the coins removal from the U.S. Mint. In Lanbord et al v. U.S. Treasury (Civil Action No. 06-5315), Judge Davis’s opinion cites past cases including the government’s own case against Israel Switt in 1934 for not forfeiting recalled gold and the previous return of 75 coins attributed to him. His opinion effectively confirms the U.S. Mint’s argument that once it creates a coin it is not legal tender and a liability on their balance sheet until the coins is bought.

If the coin is has to be paid for by a depositor before it can become legal tender, who will buy a $1 Trillion coin?

If the coin is just deposited with the Federal Reserve, there will be a $1 Trillion liability on the government’s balance sheet. In order to make the books balance, the Department of Treasury would have to sell debt bonds to make up the difference and that would add $1 Trillion to the national debt.

If the coin is bought by the Federal Reserve, then the Fed will have to pay $1 Trillion to the U.S. Mint for the coin reducing its overall working capital by $1 Trillion. Paying for a $1 Trillion that could not be used will just transfer the debt from the general treasury to the Federal Reserve. Since the Federal Reserve is in charge of managing the country’s money supply, the net effect will be to reduce the money supply by $1 Trillion that will cause the economy to shrink—any time you artificially remove money from the economy it will shrink which will also weaken the buying power of the U.S. dollar.

Transferring the debt away from the general fund might look good on paper but the effect will shrink the economy and cause more problems than even considering the constitutionality of doing this.

Unfortunately, this scheme was conjured by someone who did not think through the idea thoroughly.

Coin image courtesy of the U.S. Mint.