Jun 29, 2013 | ANA, news

On Friday, the American Numismatic Association announced that President Tom Hallenbeck will announce the results of the 2013 ANA elections online on July 3, 2013 at 4:30 P.M. Mountain Time (6:30 P.M. on the east coast). The broadcast will be over YouTube on the ANA’s YouTube channel. Walt Ostromecki, who ran for president unopposed, Jeff Garrett, who was unopposed for vice president, and the 14 members running for the remaining seven seats on the Board of Governors will participate by telephone.

On Friday, the American Numismatic Association announced that President Tom Hallenbeck will announce the results of the 2013 ANA elections online on July 3, 2013 at 4:30 P.M. Mountain Time (6:30 P.M. on the east coast). The broadcast will be over YouTube on the ANA’s YouTube channel. Walt Ostromecki, who ran for president unopposed, Jeff Garrett, who was unopposed for vice president, and the 14 members running for the remaining seven seats on the Board of Governors will participate by telephone.

For me, this will be interesting since the time is during my commute. Those who have not had the privilege of being in the Washington, D.C. metropolitan area during rush hour wonders why it is called “rush hour” since it looks like nobody is rushing and it lasts a lot more than an hour. We laugh cynically at all the reports that consistently rank this area’s traffic amongst the worst in the nation even topping Los Angeles. Even though it appears that many people will take the opportunity to go on vacation, the day before a holiday always raises the traffic levels. With it being the day before Independence Day, it should make traffic more fun!

If I cannot leave my office early, I will be on the telephone from my car—hands-free as it is the law in Maryland and the District of Columbia—probably sitting in Beltway traffic. I will probably have my favorite beverage with two additional shots while driving and on the phone. This will make the commute very interesting!

For those who missed the announcement, the following is the press release issued by the ANA:

ANA Board of Governor election results to be broadcast online

President Tom Hallenbeck will announce 2013-15 board during live broadcast

American Numismatic Association President Tom Hallenbeck will announce the winners of the 2013-15 Board of Governors election during a live online broadcast at 4:30 p.m. Mountain Daylight Time on Wednesday, July 3, 2013.

The broadcast will be available at Money.org/Elections and on the ANA’s YouTube channel at YouTube.com/AmericanNumismatic.

A press release announcing the newly elected board members will be issued to the ANA membership and the media immediately following the broadcast. Results will be posted on Money.org as well as on the ANA’s Twitter, Facebook, Google+ and LinkedIn accounts.

The election was conducted by Survey & Ballot Systems Inc., headquartered in Eden Prairie, Minn. For the first time ever, ANA members were given the option of voting online or with a traditional mail-in ballot.

The American Numismatic Association is a congressionally chartered nonprofit educational organization dedicated to encouraging people to study and collect money and related items. The ANA helps its 28,000 members and the public discover and explore the world of money through its vast array of education and outreach programs, as well as its museum, library, publications, conventions and seminars. For more information, call 719-632-2646 or go to www.money.org.

Jun 27, 2013 | coins, dollar, legislative

Earlier this month, Sen. Tom Harkin (D-IA) introduced the Currency Optimization, Innovation, and National Savings (COINS) Act (S. 1105) to transition the United States to the use of a one-dollar coin rather than a paper dollar. Harkin introduced the bill with Senators Tom Coburn (R-OK), Mike Enzi (R-WY), John McCain (R-AZ), and Mark Udall (D-CO) as co-sponsors. The bill was assigned to the Senate Committee on Banking, Housing, and Urban Affairs. Only Sen. Coburn is a member of the Senate Banking Committee.

Earlier this month, Sen. Tom Harkin (D-IA) introduced the Currency Optimization, Innovation, and National Savings (COINS) Act (S. 1105) to transition the United States to the use of a one-dollar coin rather than a paper dollar. Harkin introduced the bill with Senators Tom Coburn (R-OK), Mike Enzi (R-WY), John McCain (R-AZ), and Mark Udall (D-CO) as co-sponsors. The bill was assigned to the Senate Committee on Banking, Housing, and Urban Affairs. Only Sen. Coburn is a member of the Senate Banking Committee.

This gang of five appears to have put a lot of thought into the bill in order to try to make the transition more palatable. The first provision of the bill is to remove Susan B. Anthony dollars from circulation within six month. Introduced with much fanfare in 1979 as the first U.S. circulating coins to feature the portrait of a woman, the Susie B.’s were an instant failure when they were mistaken for quarters. They were such a failure, some (alleged) journalists who does not know that the dollar coin was redesigned in 2000 to gristle when thinking of their past experiences.

When the coins are withdrawn from circulation (the bill calls them “sequestered”), they will be available for sale to coin dealers and can be sold to countries that use the U.S. dollar as its currency. Otherwise, these Susie B.’s will remain in legal and withdrawn by the banks when they are deposited. Although the bill does not provide explanation for these provisions, it can only be assume to prevent these coins from causing the confusion we experienced when they were released in 1979.

Aside from the circulation reporting requirements, the section encourages countries that have adopted the U.S. dollar to order coins from the Federal Reserve and for the member banks to only ship dollar coins. However, there are countries that have adopted U.S. currency as its standard that cannot afford the shipment of paper currency and have experienced a shortage of Federal Reserve notes for use in its daily commerce. The switch to coins will make shipping that much more expensive and may lead to a currency shortage in some countries.

As the Federal Reserve “sequesters” SBA dollars, the bill says that the Fed is to start replacing notes with coins but not completely. The bill allows both the notes and coins to circulate concurrently until more than 600 million coins are put into circulation or after four years, whichever comes first. Once the co-circulation trigger is met, the Fed will not be allowed to order currency for one year, thus reducing the supply of the paper note leaving people no choice but to use the dollar coin.

One interesting provision of the bill is that it does not completely eliminate the dollar note. According to the bill, the Fed may produce dollar notes “from time to time are appropriate solely to meet the needs of collectors of that denomination.” Much like the half dollar coin that does not circulate but is included in sets and made available to the collecting community, this will allow the Bureau of Engraving and Printing to produce special sets using one dollar notes in much of the same way they do with the $2 notes today.

A little noticed provision of the bill updates the handling of seigniorage that the U.S. Mint deposits into the United States Mint Public Enterprise Fund (31 USC § 5136). The revision simply allows congress to estimate the value of the seigniorage that will be deposited into the Public Enterprise Fund to be used for the budget process. Without this change, the government can only use the actual value in the account, which is the amount deposited in previous years.

It is probably not lost on these senators that since the Treasury pulled back on the production of dollar coins that the amount of seigniorage has decreased. If congress is going to force the dollar coin into circulation, it will increase the seigniorage the U.S. Mint will collect making those profits a prime target for the government to use for its own purposes. This provision will allow congress to attach those profits before being collected rather than waiting for them to be collected. Although this may not sound right, it is consistent with how congress estimates the collection of tax receipts for the current budgetary process.

Considering my recent experience in Canada using one dollar (Loonies) and two dollar (Toonies) coins, I would like to see this bill passed into law. Given the gridlock that congress has demonstrated by passing only 14 bills to this point of the 113th congress, one cannot be optimistic about congressional action.

Jun 25, 2013 | Canada, cash, cents, coins

I am back after taking two weeks off for a little travel. As part of my ventures I spent some time in Canada. My wife, whose family is from the French-speaking areas of Quebec, had me trail along while she visited relatives. Even though I cannot speak French (très peu or “very little” is my response to when I was asked) I did have a good time. My wife’s relatives are good people and it would be interesting to see some of them come to the United States to visit.

While I was in Canada I decided that it would be interesting to buy rolls of one dollar (Loonies) and two dollar (Toonies) coins and see what I can find. The process was very interesting. First, I had to find a teller who could help me in English and accept U.S. currency. Thankfully, my wife had business at a local bank and the banker she worked with introduced me to a teller I could work with.

As I was introduced to the teller, I decided to buy two rolls of Loonies and Toonies. I thought this would be a good idea since these rolls may not have many coins. After all, rolls of U.S. dollars has 25 coins and the half dollars have 40 coins. I was surprised to learn that both the one and two dollar Canadian coins contain 50 coins! Playing it cool, I pretended I was not surprised and decided that purchasing 100 of each coin would be more fun to go through.

The rolls that were handed to me were clear plastic with locking tabs to hold the coins in place. Opening the roll is as easy as pulling apart the tabs. It does not require banging the rolls on the counter or tearing apart paper. While I did not open the roll all of the way, I was able to press the tabs closed to keep the rolls together.

Since I was paying for the rolls using U.S. currency, the bank used the current exchange rate for the conversion. With an exchange rate of a fraction over 98-cents per Canadian dollar, the two rolls cost less than $150 in U.S. currency. This presented a problem trying to pay with coins. Thankfully, my wife had some Canadian currency and paid for part of the transaction and added the C$5.00 fee since I was not a customer. What was more interesting was that without one-cent coins in circulation, the change had to be rounded. In this case, the change was rounded up!

After I walked out of the bank I began to wonder how the bank balances its books? Having worked on computer systems that supports accounting with all of the auditing capabilities and the ability to balance many accounts at once, what happens when the balances do not match? Do the banks track the plus-or-minus cents in order to make the books balance?

While in Canada I had to continue with my usual coffee habit and found myself at a Tim Hortons. For the United States audience not in the northeast where there are Tim Hortons franchises, Tim Hortons was founded in 1964 by Miles “Tim” Horton, a hockey player and entrepreneur, in Ontario as a donut shop. Although Horton died as a result of a 1974 automobile accident, his namesake restaurant is the largest fast-food chain in Canada. When I am asked to describe Tim Hortons I say that it is similar to Dunkin Donuts but with a better system and better coffee. When purchasing coffee at the Tim Hortons and paid using cash, the store worker would enter the amount of money I handed over and the electronic cash register calculated the change. On the screen it noted the change and how much would be actually dispensed without the one-cent coins. When I made a $1.78 purchase and handed the cashier a toonie, the cash registers said I was owed 20-cents in change.

Even though these transactions were in my favor, I had mixed feelings about the situation. I could have paid the exact amount using a credit card, but I am not comfortable using my credit card for small transactions.

Canadians seem to be comfortable, or at least accepting, with the elimination of the one-cent coin. I noticed they are comfortable with the one and two dollar coins. In fact, I liked having the coins from change while purchasing my coffee or other items while in Canada.

I am not sure that eliminating the one-cent coin or the paper dollar is ever going to happen in the United States, but if Canadians can adapt then I do not see why we should not be able to!

Jun 9, 2013 | coins, counterfeit, legislative, policy

Following the failure of the House of Representatives to even consider the Collectible Coin Protection Act in the 112th Congress (H.R. 5977), Representative Lamar Smith (R-TX) kept his promised and re-introduced the bill into consideration for the 113th Congress. On May 7, 2013, H.R. 1849 was assigned to the House Energy and Commerce Committee. The bill was introduced two days before the National Money Show, the current co-sponsors are Reps. Bill Cassidy (R-LA), Steve Scalise (R-LA), and Henry Waxman (D-CA). Fred Upton (R-MI) is the Chairman of the Energy and Commerce Committee and Waxman is the Ranking Member. Both Cassidy and Scalise are members of that committee.

The bill is exactly the same as H.R. 5577 that was introduced late in the 112th congress.

Rep. Steve Scalise is a new addition to this bill. He represents Louisiana’s 1st District that covers an area north and to the west of New Orleans that includes Metarie and Slidell. Scalise attended a reception at the National Money Show where he expressed his commitment to see the bill pass.

Scalise is the newly elected chairman of the Republican Study Committee (RSC), a caucus of House Republicans “organized for the purpose of advancing a conservative social and economic agenda in the House of Representatives.” In an interview during the National Money Show reception, Scalise said that would be H.R. 1849 an effective tool to help the hobby and since it is revenue neutral, he will recommend it to the 174 members of the RSC.

Currently, the Hobby Protection Act (15 U.S.C. §§2101-2106 and 16 CFR 304) does not allow for enough protection for the buyer. Aside from requiring the word “COPY” to appear on a copy, it does not allow for buyers or the government to take action against resellers, only the manufacturers.

When the Hobby Protection Act was first enacted in 1973 and updated in 1988, the online world did not exist the way it does today. It was easier to trace the manufacturers and the overseas sellers than the distribution channels are today. By the time a counterfeit coin reaches the United States, it could have been bought and purchased several times before being noticed. Then there is no remedy for those who have been duped.

Another problem is that the counterfeiters are learning to counterfeit slabs. Both NGC and PCGS have seen their slabs counterfeited or altered holding counterfeit coins. Both NGC and PCGS have the same problems with trying to protect their brands against counterfeiters.

The introduction of the bill is the result of the work of the Industry Council for Tangible Assets (ICTA) and Gold and Silver Political Action Committee (GSPAC), and the numismatic community working with key representatives to craft an effective legislation. It is also written to ensure support from congress. Benefits of the new law are as follows:

- Include the distribution and sale of items not properly marked as being a COPY

- Expands the provisions to include “any person who provides substantial assistance or support to any manufacturer, importer, or seller” who knowingly engages in any act or practice that violates the Act;

- Expands the ability for those who were sold counterfeit items to include the counterfeiter, their agent in the United States, or anyone who knowing “transacts business” in violation of this Act;

- Extend trademark violations and remedies to help third-party certification services protect against counterfeit holders.

These new provisions will allow collectors, dealers, and grading services to bring legal actions that are much more effective, with much stronger remedies than previously existed. It will allow those harmed to work with the Justice Department to bring criminal actions, where apporpriate.

WE STILL NEED YOUR HELP

The only way to ensure that H.R. 1849 becomes law, especially since we are approaching the end of this session in an election year, is to contact your member of congress will let them know that the numismatic community supports this Act and that their support is important.

To contact your representatives, visit house.gov and enter your Zip Code at the top right of the page. When you contact your representative, you should mention that H.R. 1849 is revenue neutral and will not require additional appropriations. The bill will go a long way in combating counterfeit rare coins in the marketplace, saving collectors and investors millions of dollars in fraudulent transactions.

To read a copy of the bill and to track its progress, you can use govtrack.us. Sign up for a free account then visit this link for information about this bill and how to track its progress.

An example of a Morgan Dollar cut in half to match a date with a mintmark to have the coin appear something it is not. Coin was in a counterfeit PCGS slab and caught by one of their graders.

DISCLAIMER: I am working as Political Coordinator for the Gold and Silver PAC.

Jun 7, 2013 | bullion, coins, Eagles, gold, news, silver, US Mint, video

This year, the U.S. Mint Facility at West Point, New York turn 75 years old. When opened in 1937, it was to be the nation’s silver bullion depository giving it the nickname “The Fort Knox of Silver.” In 1988, West Point was granted mint status.

This year, the U.S. Mint Facility at West Point, New York turn 75 years old. When opened in 1937, it was to be the nation’s silver bullion depository giving it the nickname “The Fort Knox of Silver.” In 1988, West Point was granted mint status.

The “W” mintmark on U.S. coins is highly prized since it is the only mint not to strike circulating coins with its own mintmark. While the West Point Mint did strike cents from 1973 through 1986, the coins produced were not struck with a mintmark.

Today, the West Point Mint only strikes precious metal coins. From commemoratives through bullion American Eagle coins, West Point produces more precious metal coins than any other Mint in the world, including the San Francisco Mint.

Located just outside the United States Military Academy, the West Point Mint does not allow visitors or tours for security reasons. However, exceptions are made. With the facility celebrating its 75th anniversary, the U.S. Mint has been allowing journalists to visit and take pictures of their operations.

Thus far, the best set of images were published in the Daily News. In the article, “West Point Mint, with $80 billion in precious metals, celebrates 75th anniversary,” the reporters visit the West Point Mint and bring back some very interesting picture. You can read the story on the Daily News’s website or if you just want to see the pictures, you can see this board I created on Pinterest.

The Daily News also created a two-minute video looking inside the facility. The video follows (if it begins with a commercial, it is being sent by the Daily News—the cost of embedding their video):

If you are having problems seeing the video, go here.

All images and the video courtesy of the Daily News.

Jun 5, 2013 | coins, gold, history, US Mint

Franklin Delano Roosevelt was inaugurated on March 4, 1933 at the height of the Great Depression. Unemployment was over 25-percent, inflations was rampant, farm prices have plummeted so low that it was cheaper for farmers to plow under crops, and banks were failing at record numbers.

Two weeks prior to his inauguration, FDR asked his old friend and Wall Street executive William H. Woodin, to be the Secretary of the Treasury and help implement a new monetary policy. Woodin rushed to Washington to work with Ogden Mills, President Herbert Hoover’s Secretary of the Treasury, in order to understand the issues. On the day of FDR’s inauguration, Mills resigned and voluntarily stayed in Washington to help Woodin with various policy changes.

Hours after FDR’s inauguration, the Senate approved the appointment of Woodin as the Secretary of the Treasury. With his new Treasury Secretary in place, Woodin’s first act was to declare a three-day bank holiday in order to try to stop the failures.

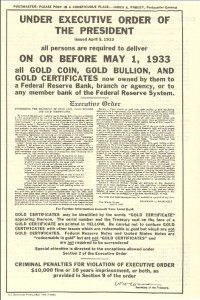

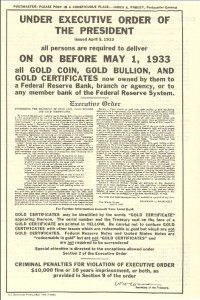

Handbill that was displayed in Post Offices calling for the recall of gold with the text of Executive Order 6102

Executive Order 6102 specifically exempted certain industrial uses of gold, art, and allowed people to keep up to $100 in face value in gold coins. It also exempted “gold coins having recognized special value to collectors of rare and unusual coins.” The protection of collectible coins was credited to Woodin since he was a collector of coins and patterns he acquired while director of the New York Federal Reserve Bank.

Although most of the country complied with the executive order, some challenged the law and started to sue the government to stop the gold recall. With the challenges mounting, on June 5, 1933, congress formally takes the United States off the gold standard by enacting a joint resolution (48 Stat. 112) nullifying the right of creditors to demand payment in gold.

For weeks after FDR issued EO 6102, the U.S. Mint continued strike gold double eagle coins because they did not have an order to stop. After receiving the stop work order, the coins were stored until they were ordered melted in 1934.

Even though the double eagles were melted, several examples of the 1933 Saint Gaudens double eagle gold coin did find its way out of the Mint. While most were tracked and confiscated, one example found its way to Egypt into the collection of King Farouk. This was the coin that eventually was sold in 2002 for $7,590,020 ($20 given to the government to monetize the coin) to a private collector. Half of the proceeds were paid to the government as part of a settlement with British coin dealer Stephen Fenton, who was arrested trying to sell the coin at the Waldorf Astoria Hotel in 1998.

-

-

-

Reverse of the iconic 1933 Saint Gaudens

$20 Double Eagle gold coin

But that does not end the story of the 1933 Saint Gaudens double eagle. Since the sale of the only legal tender 1933 Double Eagle, ten coins found by the family of the late jeweler and coin dealer Israel Switt. The coins were sent to the U.S. Mint for authentication and were subsequently confiscated when they were determined to be genuine.

These coins are known as the “Langboard Hoard,” named for Joan Landbord, the daughter of Israel Switt, who claims to have found the coins while searching through her father’s old goods. On more than one occasion, Switt has been accused of being the source of the 1933 Double Eagle coins that made it out of the Philadelphia Mint.

In July 2011, a jury ruled that the 10 coins in the Langboard Hoard belong to the government. The case is currently being appealed.

The story of 1933 Saint Gaudens double eagle is truly an example of the law of unintended consequences. In an effort to rescue the economy, the cascading series of events that took the United States off the gold standard turned what was supposed to be an ordinary coin into one of the most intriguing stories of the 20th and now 21st century.

All images courtesy of Wikimedia Commons.

Jun 5, 2013 | ANA, commentary, legal

I know I have not been writing a lot as of late. Those of us in the Washington, D.C. area know the problems that sequestration has caused on government agencies. It might take another month before we regain a rhythm that will allow me to plan my time better. I have a nice To-Do list of stories I want to post including four book reviews and a few iPhone apps that are interesting.

I also do not want to use this blog as a campaign vehicle because that would be boring for you to read and for me to write. But when something as big as the most recent news comes out and I am asked for a comment, I have no choice but to use this blog to answer the many email inquiries once so we can get on with life.

Contemplation of Justice by James Earle Fraser, outside of the U.S. Supreme Court, Washington, DC

The amended complaint is shocking and salacious. For those not familiar with the law and read that Shepherd is accusing the ANA of being a Racketeer Influenced and Corrupt Organization (RICO; 18 U.S.C. Chapter 96), it makes it look like the ANA is being compared to any number of organized crime figures you might have read about in the newspapers. Even though the RICO statutes were written to fight organized crime, using it is a common tactic by plaintiff lawyers to scare the defendants they are suing.

In order for a RICO charge to be accepted by the court, Shepherd and his lawyers will have to prove that a person as a member of an enterprise or the enterprise itself has committed to of 35 different crimes (18 U.S.C. § 1961). The crimes that Shepherd is alleging that the ANA has committed are racketeering, theft, and fraud.

Racketeering sounds like an ominous charge. Racketeering is a crime when two or more people conspire to fraudulently solve a problem. Shepherd alleges that a few employees of the ANA and members of the Board of Governors made up stories about Shepherd in order to find a way to relieve him of his duties for cause so they can invalidate his contract. The stories are salacious in nature and constitute Shepherd’s accusation of defamation that allows him to attach others to the case to show that there were more than two people involved.

The theft charge is from the guilty plea by former collections manager Wyatt Yeager. In January 2012, Yeager plead guilty to stealing items from the ANA Money Museum worth nearly $1 million. Yeager was sentenced to 27 months in a federal prison, two years of supervised probation, and ordered to pay restitution to the ANA.

With the theft charges already verified by a criminal court, Shepherd has to prove that the ANA committed fraud and at least two of the co-defendants conspired to fraudulently have him dismissed to resolve whatever issues the co-defendants perceived hurt the ANA. That would prove the case under RICO and hold the co-defendants and the ANA liable for Shepherd’s dismissal.

If you decide to read the pleading please remember that it is one side of the story. While the accusations are salacious and disturbing, we have not heard from the ANA or the co-defendants. This is a stark contrast to how they handled Shepherd’s dismissal when they could not stop talking. However, the ANA has a new general counsel who may be a little more cautious than the previous general counsel. The previous general counsel, Ron Sirna, is a co-defendant on this lawsuit.

Shepherd’s charges against the ANA and the co-defendants are disturbing. In fact, the nature of the salacious accusations is disturbing. If there is any truth in these accusations, those involved must be disciplined. Employees involved should be required to undergo remediation to keep their jobs or be dismissed if their action crossed the legal line.

According to the ANA Code of Ethics, members are required to “To base all of my dealings on the highest plane of justice, fairness and morality, and to refrain from making false statements as to the condition of a coin or as to any other matter.” Any member found to have be part of the racketeering that Shepherd’s lawsuit alleges, should be subject to an ethics review.

I was recently reminded of a quote from Inferno, the first part of Dante Alighieri’s epic poem The Devine Comedy: “The darkest places in hell are reserved for those who maintain their neutrality in times of moral crisis.” Therefore, members of the Board of Governors who did not “report any knowledge of waste, fraud, corruption or impropriety relating to the Association to all other Board members immediately upon learning thereof” (Code of Ethics, Section 12) should also be subject to an ethics review.

Shepherd is also not absolved from his part. While he may have a legitimate case, his timing is suspect. Why did he wait until the beginning of the election to amend his complaint laced with descriptions of salacious accusations at this time? Shepherd has to remember that while he makes accusations, it takes two to tango, which means that he may have had a part in acts that the pleading describes. It is also possible that Shepherd and his attorneys picked only examples that are in his favor. Until the ANA answers the charges levied by Shepherd we are left wondering what was left out?

The bottom line is that it is time to clean house. ANA members must elect a Board of Governors that will act more like a Board of Directors. People who will be professional, open, and work for the benefit of the ANA. The Board of Governors must treat the association like the $6 million business it is and set up programs for the professional office to support the association for the benefit of the members and not the benefit of the staff. While there may be a few people with issues, as described in Shepherd’s pleading, those few people are making the situation difficult for those who are doing a wonderful job.

If I am privileged to receive enough votes to be elected to the Board of Governors, I renew the promise I made previously that the first motion I will make will be to hire an executive management firm that has a verifiable background in helping non-profit organizations to review the entire ANA management structure. This stuff has to stop so that we can get on with the business of building our collections with all of the advantages the ANA can provide us, the members.

Image from Photographs from the Supreme Court’s Collection.

Jun 3, 2013 | coins, legislative, policy

H.R. 1905: Mother’s Day Centennial Commemorative Coin Act

Sponsor: Rep. David McKinley (R-WV)

• Introduced: May 9, 2013

• Referred to the House Committee on Financial Services

Track this bill at http://www.govtrack.us/congress/bills/113/hr1905

H.R. 1071: To specify the size of the precious-metal blanks that will be used in the production of the National Baseball Hall of Fame commemorative coins.

Sponsor: Rep. Richard Hanna (R-NY)

• This bill is a technical change to the National Baseball Hall of Fame Commemorative Coin Act.

• Signed by the President on May 17, 213

• This bill became Public Law 113-10

See the information about this bill at http://www.govtrack.us/congress/bills/113/hr1071

S. 1011: Boys Town Centennial Commemorative Coin Act

Sponsor: Sen. Mike Johanns (R-NE)

• A bill to require the Secretary of the Treasury to mint coins in commemoration of the centennial of Boys Town

• Introduced: May 22, 2013

• Referred to the Senate Committee on Finance

Track this bill at http://www.govtrack.us/congress/bills/113/s1011

On Friday, the American Numismatic Association announced that President Tom Hallenbeck will announce the results of the 2013 ANA elections online on July 3, 2013 at 4:30 P.M. Mountain Time (6:30 P.M. on the east coast). The broadcast will be over YouTube on the ANA’s YouTube channel. Walt Ostromecki, who ran for president unopposed, Jeff Garrett, who was unopposed for vice president, and the 14 members running for the remaining seven seats on the Board of Governors will participate by telephone.

On Friday, the American Numismatic Association announced that President Tom Hallenbeck will announce the results of the 2013 ANA elections online on July 3, 2013 at 4:30 P.M. Mountain Time (6:30 P.M. on the east coast). The broadcast will be over YouTube on the ANA’s YouTube channel. Walt Ostromecki, who ran for president unopposed, Jeff Garrett, who was unopposed for vice president, and the 14 members running for the remaining seven seats on the Board of Governors will participate by telephone.