Dec 22, 2014 | BEP, cash, currency, Federal Reserve, video

Last week, the Bureau of Engraving and Printing announced that the Federal Reserve had ordered the printing of 7.2 million Federal Reserve Notes for Fiscal Year 2015. This represents over $188 billion in currency.

Last week, the Bureau of Engraving and Printing announced that the Federal Reserve had ordered the printing of 7.2 million Federal Reserve Notes for Fiscal Year 2015. This represents over $188 billion in currency.

According to the Federal Reserve, the number of notes they order depends on the predicted growth in demand and the predicted number of notes that have to be destroyed because they are not usable any more. Both growth and demand are predicted to include world-wide usage of the United States Federal Reserve Note as it is the standard currency for many transaction. In addition to the demand and destruction is the predicted replacement of the old $100 Federal Reserve Note with the new note that has more advanced currency features. While the Federal Reserve will not recall the old $100 notes, they are removing them from circulation as they arrive back into the Federal Reserve system.

The following table is how the Federal Reserve says they broke down their order for 2015:

| Denomination |

Number of Notes |

Dollar Value |

| $1 |

2,451,200,000 |

$2,451,200,000 |

| $2 |

32,000,000 |

$64,000,000 |

| $5 |

755,200,000 |

$3,776,000,000 |

| $10 |

627,200,000 |

$6,272,000,000 |

| $20 |

1,868,800,000 |

$37,376,000,000 |

| $50 |

220,800,000 |

$11,040,000,000 |

| $100 |

1,276,800,000 |

$127,680,000,000 |

| Total |

7,232,000,000 |

$188,659,200,000 |

Included with the order are the notes that the Bureau of Engraving and Printing will sell to collectors. These are the same notes that collectors can purchase online at moneyfactorystore.gov and when the Bureau of Engraving and Printing attends shows.

As part of the announcement, the Federal Reserve released a video explaining how they decide the amount of currency to order.

[videojs mp4=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.mp4″ ogg=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.ogg” poster=”http://coinsblog.ws/library/videos/Question_4_FAQ_Video.jpg”]

Video courtesy of the Federal Reserve and the Bureau of Engraving and Printing

Dec 11, 2014 | BEP, legislative, news, US Mint

In a normal world, the United States congress will pass twelve different budget bills by August or September in time for the beginning of the federal government’s fiscal year, which begins on October 1. Anyone who has followed congress over the last 20-or-more years knows that the world they live in is not normal. Rather than pass real budget bills, congress has learned the irresponsible habit of voting on continuing resolutions and omnibus funding bills.

A continuing resolution (CR) is a bill that says to take the previously passed budget and extend it to a specific date. CRs can either continue the spending or make certain adjustments, such as reducing spending by a percentage. Omnibus, from the Latin “for everything,” are bills that are loaded with every bit of budget information in one very long bill.

Within the Omnibus budget bill are provisions to provide funding for the government’s money manufacturing operations. But this is different type of bill. It is an omnibus spending bill that covers most of the government through the end of this fiscal year (September) and a CR for the Department of Homeland Security so that the new congress can fight with the president over other policy matters. Reporters have been calling this a CRomnibus bill—which should never be confused with a cronut which is a very sweet treat! According to NBC News:

And the Washington word of the week is: “Cromnibus.” It’s the love child of a “continuing resolution” (CR) and “ omnibus” spending bill, two inside-the-Beltway terms for measures Congress has approved to keep the government funded.

TASTY!

Not so tasty!

For the U.S. Mint, the bill recognizes that their funding is provided by its seigniorage that is deposited in the United States Mint Public Enterprise Fund (31 U.S.C § 5136) and does not receive appropriations from the general Treasury. Congress can limit the amount that the U.S. Mint can spend from the Public Enterprise Fund. In the Omnibus Budget Bill waiting for congress to vote on, the U.S. Mint is limited to spending $20 million.

In the grand scheme of the U.S. federal government, $20 million is not a lot of money. However, it may be more than enough for the U.S. Mint to operate. According most fiscal year 2013 (FY13) annual report from the U.S. Mint, the latest report available when this is written, the U.S. Mint spent $11.89 million for FY13 and $12.03 million in FY12. If the cost cutting measures implemented by Deputy Director Richard Peterson this past year further reduces costs, the $20 million could be twice as much as the U.S. Mint needs to operate.

Appropriation for the Bureau of Engraving and Printing has a few different provisions. Although it does recognize that the BEP has what the bill calls an “industrial fund,” (31 U.S. Code § 5142), the bill does not place many limits on what the BEP can use. The bill says that the BEP cannot use the monies to redesign the $1 Federal Reserve Note making it the second oldest design used on U.S. money.

For double-extra brownie points, what is the oldest design used on U.S. money?

The other limit is that the BEP can use only up to $5,000 for “official reception and representation expenses.” Essentially, the BEP can only spend up to $5,000 for conferences and conference attendance. Does this mean that the BEP will not be at shows like the World’s Fair of Money because it would cost more than the $5,000 to bring their exhibit to Rosemont, Illinois next August? If the BEP does not attend the World’s Fair of Money or other shows, tell your representatives in congress that their short-sightedness is hurting the hobby!

Finally, the bill says that the money appropriated “may be used to consolidate any or all functions of the Bureau of Engraving and Printing and the United States Mint without the explicit approval of the House Committee on Financial Services; the Senate Committee on Banking, Housing, and Urban Affairs; and the Committees on Appropriations of the House of Representatives and the Senate.” In other words, if someone figures out that the BEP and U.S. Mint can become more efficient and further save money by combining certain functions they have to go to congress and ask for permission.

I wonder what congress would say if the BEP and U.S. Mint were to propose to consolidate their online and brick-and-mortar retail operations? Instead of two different operations, how much could be saved if these bureaus under the Department of the Treasury would have one fulfillment contractor or a combined storefront in their current locations?

Of course this is contingent on congress passing this budget. As I write this, the government is a few hours away from running out of money with no signs of being able to pass this bill. However, if the government shuts down the U.S. Mint and BEP will continue operating since they are self-funded organizations.

UPDATE: (12/12/14 00:45) The CRomnibus bill passed the House about 10:00 PM on Thursday but still needs to be passed by the Senate before it can be signed by the President into law. The House passed a stop-gap bill to give the Senate until this weekend to pass the CRomnibus bill. Crisis averted, but the money manufacturing process continues.

Image of the Cronut courtesy of

Dominique Ansel Bakery, where it was invented.

Cartoon about the Omnibus bill is actually Canadian by Gary Clement and appeared in the

National Post. Who cares if it’s Canadian. It’s fitting!

Oct 7, 2014 | BEP, coins, counterfeit, currency, gold, policy, US Mint

Prior to the public disclosure of secret documents, administrations have declassified documents at various levels for many different reasons that those of us who worked in these areas did not understand what was to be classified at what levels and for how long. Each department and agency had its own rule. However, everything that was classified was supposed to be declassified after 50 years.

In 2009, President Obama issued Executive Order 13526 to try to create some order out of this chaos. Aside from defining the classification levels, document marking requirements, it also allowed agencies to apply to keep documents classified and for longer periods than previous reviews. The purpose was to protect national interests and security while preventing controversial declassification of documents.

Whenever trying to instill a new policy on the government, there will be many barriers to this change. While there are fewer areas of confusion, chaos remains. Of course the disclosures by Chelsea (neé Bradley) Manning and Edward Snowden did not help.

So what does this have to do with numismatics? Both the U.S. Mint and the Bureau of Engraving and Printing applied and were granted exemption from automatically declassifying documents.

Treasury Department, Procurement Division, Public Buildings Branch, Fort Knox – United States Bullion Depository (1939)

What information could these agencies possibly have that would be classified?

According to Steven Aftergood, Director of the Federation of American Scientist Project on Government Secrecy, who interviewed John P. Fitzpatrick, director of the ISOO, the exemption for the U.S. Mint is for “security specifications from the U.S. Bullion Depository at Fort Knox, which was built in the late 1930s.”

In a comedic turn, Mr. Fitzpatrick told Aftergood, “Think ‘Goldfinger’.”

Then why does the Bureau of Engraving and Printing need an exemption from declassification for 25-years? A source familiar with the filing said that the exemption covers counterfeiting information. According to sources, there are anti-counterfeiting measures added to currency that have been planned for many years that have not been advertised. These are used by the United States Secret Service and other law enforcement organizations to detect counterfeiting. Many of the documents cover the planning for the changes that began in the 1990s.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

Sources also confirmed that there were other documents that the BEP and Treasury asked to be included in this exemption but not their general contents. Some hint was given that the classified information concerns long term and ongoing operations against international counterfeiters. Although not confirmed, it is suspected that the classified documents discusses enemy foreign governments actively working to counterfeit United States currency. No country was named but it has been rumored that North Korea has been attempting to counterfeit U.S. currency.

And you thought all the U.S. Mint and Bureau of Engraving and Printing did was manufacture money!

Aug 3, 2014 | BEP, coins, currency, Federal Reserve, US Mint

While doing my monthly review of the numismatic-related political news for the Gold & Silver Political Action Committee, I came across a bill that seems to have missed the numismatic press. One reason it was missed might be that the provisions are buried in a larger bill and has a name that might not be as noticeable. However, there are two issues buried in a larger bill. The bill is as follows:

H.R. 5196: Unified Savings and Accountability Act (or USA Act)

Sponsor: Rep. Mike Coffman (R-CO)

• To reduce waste and implement cost savings and revenue enhancement for the Federal Government.

• Introduced: July 24, 2014

• Referred to several committees based on jurisdiction of the provision.

Track this bill at https://www.govtrack.us/congress/bills/113/hr5196

Buried within the bill are two provision that may be of interest to collectors.

Sec. 203. Prohibition on non-cost-effective minting and printing of coins and currency.

If passed, Section 203 would require that the U.S. Mint stop striking any coin that costs more to manufacture than its face value four years following the passage of this bill. Using current standards, the U.S. Mint would be required to stop producing one- and five-cent coins by late 2018 because they cost more than their face value to produce. One of the problems with this bill is what would happen if the price of copper and zinc, the drivers in the price of both coins, were to fall and the costs were reduced to below face value? Would the coins be struck again?

Sec. 205. Replacing the $1 note with the $1 coin.

As the title suggests, Section 205 will replace the one-dollar Federal Reserve Note with the dollar coin. The section begins with requiring the Federal Reserve to “sequester” Susan B. Anthony dollars to remove them from circulation. There is a provision for their value as numismatic collectibles.

The plan to remove the $1 FRN is just to stop issuing the notes and replace them with coins as the notes come out of circulation after a one-year educational period. The Federal Reserve would continue to use the notes alongside the coins until 600 million coins are in circulation or for four years, whichever comes first. The bill allows the Bureau of Engraving and Printing to continue to print the $1 FRN for collectors.

Given the current state of congress, the likelihood of this bill passing is slim-to-none, and, as a friend liked to say, “Slim just left town.” Some of the other provisions of this bill might be introduced into an omnibus budget bill following the November elections, but it is doubtful that these sections will make it past this introduction.

Then again, who knows? Congress has surprised us in the past!

May 27, 2014 | BEP, currency, dollar, education, news, video

Time has come that there is once again change coming to the money in your pocket. This one is so subtle that you may not even notice the difference.

Changes to the $1 Note

For those who do not collect currency, the note-position identifier is the little letter followed by a number that identifies where on the sheet the note was printed. On the $1 FRN, the note position identifier is on the left side of the front of the note under the “1” and next to the Federal Reserve branch number.

Change in the Note Position Identifier

As part of this change, the BEP is also changing the position identifier code mechanism. On the 32 note sheets, the notes printed four-across and eight-down were divided into four eight-note blocks (or quadrants). Each block was given a number in columns where the top-left quadrant was #1, the bottom left was #2, top-right was #3, and bottom-right was #4. Within the quadrants, the note positions were lettered A-D in the first column and E-H in the second column. If you found a note with the note-position code of H3, the note would have been printed in the fourth row and fourth column of the sheet.

The new 50 note sheets simplifies the note-position numbering by assigning a letter to each of the 10 rows (A-J) and a number to each of the five columns. On this sheet, H3 would now be located on the eighth row and third column.

Position Identification layout of 32-note sheet

| A1 |

E1 |

A3 |

E3 |

| B1 |

F1 |

B3 |

F3 |

| C1 |

G1 |

C3 |

G3 |

| D1 |

H1 |

D3 |

H3 |

| A2 |

E2 |

A4 |

E4 |

| B2 |

F2 |

B4 |

F4 |

| C2 |

G2 |

C4 |

G4 |

| D2 |

H2 |

D4 |

H4 |

Position Identification layout of 50-note sheet

| A1 |

A2 |

A3 |

A4 |

A5 |

| B1 |

B2 |

B3 |

B4 |

B5 |

| C1 |

C2 |

C3 |

C4 |

C5 |

| D1 |

D2 |

D3 |

D4 |

D5 |

| E1 |

E2 |

E3 |

E4 |

E5 |

| F1 |

F2 |

F3 |

F4 |

F5 |

| G1 |

G2 |

G3 |

G4 |

G5 |

| H1 |

H2 |

H3 |

H4 |

H5 |

| I1 |

I2 |

I3 |

I4 |

I5 |

| J1 |

J2 |

J3 |

J4 |

J5 |

BEP has begun to deliver the new notes to the Federal Reserve currency distribution operations in all 12 Federal Reserve district branches. These new notes will enter circulation as per the policies of each branch. BEP has not said whether they will sell the 50-note sheets as part of their uncut currency products.

The $1 FRN is the first note to be printed on 50-note sheets. Over time, the BEP will transition the printing of other notes to 50-note sheets with the only design change being the subtle change in the note-position identifier.

As part of this change, the Federal Reserve created a video explaining the changes. You can watch the video here:

Images courtesy of the Bureau of Engraving and Printing.

Dec 22, 2013 | BEP, celebration, commentary, currency, Federal Reserve

It is that time of then when the pundit class of this country puts together their list of the best, worst, or most impactful stories of the year being concluded. There was even an advertisement on satellite radio about an upcoming show that will list the Top 10 moments in music for 2013. After a meeting of the Board of Directors for the Coin Collectors Blog (all three of us: me, myself, and I), the last ten days of the year will count down what we feel are the Top 10 Numismatic-Related Stories of 2013.

Number 10: Lew’s Lewpts

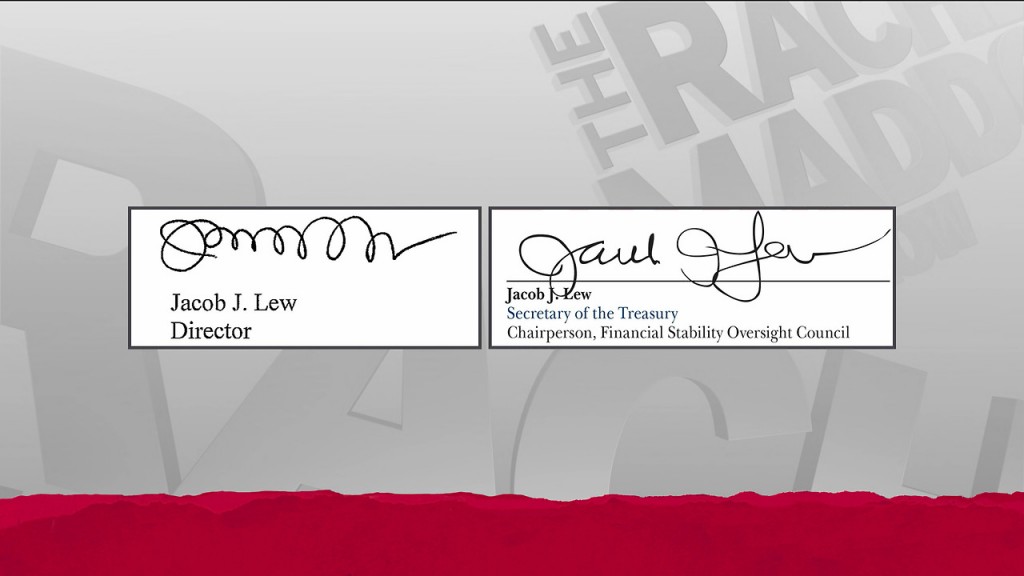

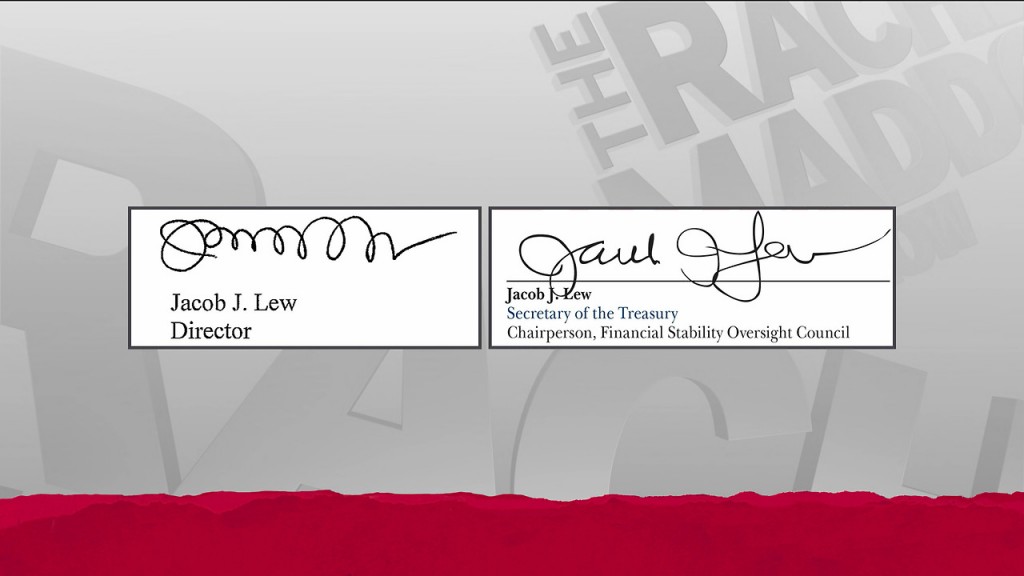

75th Secretary of the Treasury Jacob “Jack” Lew

Lew, whose autograph has been called “lewpty” and been compared to the decorative icing on a Hostess cupcake, made a promise to the president that he would do better with his penmanship. During his confirmation hearing, Lew told Sen. Max Baucus (D-MT), Chairman of the Senate Finance Committee, that he promised the president he would do better. This did not satisfy those with an ironic sense for the different when a petition appeared on the White House website to “Save the Lewpty-Lew.”

MSNBC on-air comparison of Jack Lew’s autographs: the original Lewpts on the left and what will appear on U.S. currency to the right.

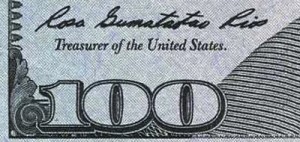

The other signature on U.S. currency is that of Rosa “Rosie” Gumataotao Rios, Treasurer of the United States. Rios was sworn in as Treasurer on August 20, 2009 and has served in that office ever since. Rios’s signature appears with former Secretary of the Treasury Timothy F. Geithner on Series 2009 notes. Ironically, Geithner also changed his signature when he became secretary.

-

-

Tim Geithner’s autograph before becoming Treasury Secretary.

-

-

Tim Geithner’s signature as it appears on U.S. currency

Rosie Rios signature on the older (Series 2009) $100 Federal Reserve Note

Notes that will include Jack Lew’s signature will appear on all Series 2009-A notes.

Glad we were able to resolve this pressing issue!

Dec 7, 2013 | BEP, coins, currency, news, US Mint

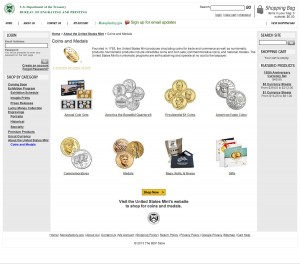

While the products that the U.S. Mint can offer are restricted to what congress allows them to do by law, it does not mean that congress controls how the U.S. Mint markets and sells its numismatic products. To try to get more people to buy its products, the U.S. Mint has made a series of announcements,

While the products that the U.S. Mint can offer are restricted to what congress allows them to do by law, it does not mean that congress controls how the U.S. Mint markets and sells its numismatic products. To try to get more people to buy its products, the U.S. Mint has made a series of announcements,

Free is still better

U.S. Mint’s Black Friday and Cyber Week sale of FREE SHIPPING for items sent via standard shipping that was supposed to end at 5:00 PM ET today, December 6th, has been extended to5:00 PM ET on December 17th. The U.S. Mint cited they are doing this for holiday “shoppers seeking online deals and discounts.” December 17 is also the first day of sale of the 2013 Teddy Roosevelt Coins and Chronicles set. Those interested in the Coins and Chronicles set can have it shipped free if they order the set on December 17.

New brick and mortar storefront

Last month, the U.S. Mint “partnered” with the Bureau of Engraving and Printing by cross advertising each other’s products on their websites. Essentially, these Department of the Treasury bureaus created a page on their respective websites pointing to each other.

Bureau of Engraving and Printing Washington, D.C. Headquarters

Credit for this move can probably be given to Deputy Director and Acting Director of the U.S. Mint Richard Peterson, Director of the Bureau of Engraving and Printing, Larry Felix, and Treasurer of the United States Rosie Rios. What makes this interesting is that Peterson and Felix are career government employees and were not appointed by the President.

Peterson began his work with the U.S. Mint in 2009 when he was hired as their Associate Director of Manufacturing.

Felix, a long-term professional employee of the Bureau of Engraving and Printing, has been the bureau’s Director since January 2006.

Although Rios was appointed by President Obama and took office in August 2009, has not been the prototypical political appointee. Rios has been outspoken in her support of the numismatic community and seeks out ways to participate. She is a staple at coin and currency shows autographic Series 2009 $1 Federal Reserve Notes that bear her signature—something she calls “Rosi notes.&rdquots; It would not be surprising to learn she was instrumental in making this cross-bureau initiative happen.

Get your Rosie Dollars autographed

Treasurer of the United States Rosie Rios

The BEP will allow visitors to exchange notes on site and have a supply of new $100 Federal Reserve Notes to purchase for Rios’s autograph. Having a $100 note autographed by Rios would be interesting. Many people may not spend $100 to set aside for this type of collectible making it possible that it could increase in value. How many speculators will there be at her next autograph session?

Last chance!

As we approach the end of the year, the U.S. Mint announced that they will be ending sales of the 2013 5-Star Generals Commemorative Coin Program and Girl Scouts of the USA Centennial Silver Dollar. Also on the last chance are 2012 coin sets, 2012 Platinum American Eagles, and 2012 First Spouse coins.

Will you trade $100 for a new $100 note to have it autographed by Treasurer of the United States Rosie Rios?

Nov 2, 2013 | BEP, coins, currency, legislative, policy, US Mint

Believe it or not, there was a little business actually being done by the congress other than the partisan bickering.

H.R. 3305 Currency Optimization, Innovation, and National Savings Act

Sponsor: Rep. Michael Fitzpatrick (R-PA)

• To improve the circulation of $1 coins, to remove barriers to the circulation of such coins.

• Introduced: October 22, 2013

• Referred to the House Committee on Financial Services

Track this bill at http://www.govtrack.us/congress/bills/113/hr3305

Oct 13, 2013 | BEP, coins, currency, news, US Mint, web

On Friday, the U.S. Mint and the Bureau of Engraving and Printing announced that they would be cross-promoting each other’s products. As one of the few agencies in full operation, the U.S. Mint and BEP updated their website with two pages, one provides information about the other agency and the other points to their online store.

This probably would have gone unnoticed except for the email announcement sent by the Bureau of Engraving and Printing to subscribers. It was sent in such haste that the link they provided to the U.S. Mint’s site is broken.

Promoting BEP’s Currency at the U.S. Mint

Promoting U.S. Mint’s coins at the BEP

Click on the preview to visit the site.

I bet you thought there was no good news to come out of Washington, D.C. last week!

Oct 10, 2013 | BEP, currency, dollar, Federal Reserve, news, video

With the fanfare of a hard cough, the Federal Reserve released the new $100 Federal Reserve Note on Tuesday, October 8, 2013 to financial institutions. Various factors will effect how quickly these notes are seen in circulation including the demand and ordering policy of the financial institutions. In fact, the launch was introduced with a video by Sonja Danburg, Program Manager of the U.S. Currency Education Program at the Federal Reserve.

With the fanfare of a hard cough, the Federal Reserve released the new $100 Federal Reserve Note on Tuesday, October 8, 2013 to financial institutions. Various factors will effect how quickly these notes are seen in circulation including the demand and ordering policy of the financial institutions. In fact, the launch was introduced with a video by Sonja Danburg, Program Manager of the U.S. Currency Education Program at the Federal Reserve.

This launch is three years in the making as Bureau of Engraving and Printing reported problems with folding during the printing of the new notes. The announcement on April 21, 2010 said that the new notes would be released on February 10, 2011. On October 1, 2010, the Federal Reserve announced that the new note would be delayed. Later, the folding problems were revealed following a report released by the Treasury Office of the Inspector General.

The reason for the new notes are for the addition of security features. Aside from the ecurity thread, portrait watermark, color-shifting ink, microprinting, and the strategic use of color, the new note has a 3-D security ribbon and the use of color-shifting ink used to reveal a bell in the inkwell. If you look at the blue ribbon on the front of the note, tilt the note and watch the bells on the ribbon change to “100s” as the reflection of light changes. The 3-D ribbon is embedded in the paper and not printed. Looking at the copper-colored inkwell on the front of the note, tilting the note will reveal a bell that was embedded using color-shifting ink. Using these light sensitive features, the Federal Reserve hopes to significantly reduce the number of counterfeit notes, especially overseas where half of the $100 notes are known to circulate.

The Federal Reserve released a video about the new anti-counterfeiting features:

As an aside, the Bank of England recently announced that they will be transitioning to polymer banknotes by 2015.

Last week, the Bureau of Engraving and Printing announced that the Federal Reserve had ordered the printing of 7.2 million Federal Reserve Notes for Fiscal Year 2015. This represents over $188 billion in currency.

Last week, the Bureau of Engraving and Printing announced that the Federal Reserve had ordered the printing of 7.2 million Federal Reserve Notes for Fiscal Year 2015. This represents over $188 billion in currency.