Nov 18, 2015 | BEP, cents, coins, commentary, currency, dollar, economy, Federal Reserve, US Mint

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Series 1935 $1 FRN Reverse Early Design

Every so often an article is written, usually by the political elite, about ending lower denomination coins for many reasons including the high cost of mintage or the inconvenience of their existence. Others point to rise of non-cash transactions and the rise of digitally created currencies as the future.

Those of us who work in areas outside the larger commercial world has experience with a cash economy that is not tied to economic status. One of those is the numismatics industry. While many dealers will take credit cards, and will pass along the fees along to the customer, many dealers have said that most of their off-line business is a cash-based business. While larger purchases are done using checks, most will leave shows with more hard currency than other types of payments.

1909-VDB Lincoln Cent

There are people who are leery of using credit and debit cards for every transaction. We use cash to limit our exposure. In this connected world, the credit and debit card leaves a digital breadcrumb that is available to be hacked. I cannot tell you how many times I watched people in local convenience stores punch in their codes in a matter I could see them and then leave their receipts behind. This could be used to steal your money and your debit cards are not covered the same as credit cards. But the public does not see this.

A week does not go by without a report of the hacking of personal information that should not be made public. Unfortunately, it is getting to be like rain on the hot-tin roof, after a while the sound blends into the background.

According to the Federal Reserve, there was approximately $1.39 trillion in circulation as of September 30, 2015, of which $1.34 trillion was in Federal Reserve notes. That represents a lot of money that would have to be accounted for if we were to go into a cashless society. It would take a significant effort that would not make for good public policy.

The calls to make changes to change are beginning to drone on as background noise like rain on a hot-tin roof.

Nov 12, 2015 | BEP, currency, video

UPDATE: English version of the video added below.

While looking at my timeline on Twitter, I found a tweet from what could be classified as the public relations office of Banco de México (Bank of Mexico), the Mexican central bank. Although my Spanish is barely above what I remembered from two semesters as an undergrad, I know enough that if I had any question to call up Google Translate for a fairly good translation.

This one was pretty easy and I understood it before asking for help. It asks “Do you know how banknotes are made in Mexico?” Looking at the question, I shrugged and thought they were made the same way they were made in the United States. While that is pretty much the case, seeing the process from another country’s perspective, especially a neighbor, could be interesting.

While the tweet was easy, the video is all in Spanish which really tested my translation skills. After I figured out that the first part talked about the early history of Mexican money and how it was initially produced by the American Banknote Company, I stopped thinking about the translation and just watched. I picked up a few things in context and liked the presentation. I like the scenes where they test the durability of the banknotes. I do not know if the Bureau of Engraving and Printing does that, but it is an interesting concept!

See the video for yourself:

UPDATE

Thanks to Coin Collectors Blog reader Rombat Stephan, he found that the Bank of Mexico published an English version of the video on YouTube:

Thank you Rombat Stephan!

Jun 18, 2015 | BEP, currency, Federal Reserve, news

The current $10 Federal Reserve Note featuring Alexander Hamilton

The new note is scheduled for release in the year 2020, which coincides with the passage of the 19th Amendment that declared:

The right of citizens of the United States to vote shall not be denied or abridged by the United States or by any State on account of sex.

According to the Treasury Department, the $10 note was selected to be redesigned to add Advanced Counterfeit Deterrence (ACD) based on their study of counterfeiting activity. This decision was made by the ACD Steering Committee, an inter-agency group that monitors a number of factors that go into the maintenance of U.S. currency. One of the factors includes the ongoing discussion of features that will help increase accessibility for the visually impaired as part of the court mandated Meaningful Access Program. Treasury reports that the new note “will include a tactile feature that increases accessibility for the visually impaired.”

The last time Treasury changed the portrait on U.S. currency was in 1928 when Andrew Jackson replaced Grover Cleveland on the $20 notes. Alexander Hamilton first appeared on the $10 note in 1923 when his portrait replace Andrew Jackson’s. Although the portraits have been redesigned, the same men have appeared on U.S. currency during small-sized note era (since 1928).

Series 1886 $1 Silver Certificate featuring Martha Washington (Fr #217)

Lew is asking the public to provide suggestions as to whom should be the new face on the $10 note. She should be a woman “who was a champion for our inclusive democracy,” according to the Treasury statement. You can submit comments on their new website thenew10.treasury.gov or make your suggestion on social media using the hashtag #TheNew10.

You can also visit the Bureau of Engraving and Printing in Fort Worth on June 24 and meeting with United States Treasurer Rosie Rios and Bureau of Engraving and Printing Director Len Olijar to give them your ideas. A similar event will be held at the Bureau of Engraving and Printing in Washington, D.C. on July 15. You can find more information on the BEP website.

Mockup of the $20 note featuring Harriet Tubman

Politico notes:

In fact, Hamilton shared his bed with more than one woman – making him one of the first subjects of a political sex scandal.

While his wife, Elizabeth, and kids were staying with relatives, Hamilton began an affair with a young woman named Maria Reynolds in 1791. He was secretary of the Treasury at the time, and Reynolds and her husband started extorting money from Hamilton. Hamilton eventually confessed to the affair in full detail in a pamphlet that also featured letters between him and his mistress.

Interestingly, according to Bloomberg news, “The $10 bill is the third least-circulated among the seven major denominations, accounting for 5.2 percent of 36.4 billion notes in use at the end of last year.” The $100 note is the most circulated of all U.S. currency notes.

Image of the current $10 note courtesy of the Bureau of Engraving and Printing

Image of the Series 1886 $1 Silver Certificate courtesy of Wikimedia Commons

Mockup of Harriet Tubman on the $20 note courtesy of Women on 20s

May 6, 2015 | BEP, coins, commemorative, currency, Federal Reserve, legislative, policy, US Mint

For those of us who are political junkies, April was a relatively quiet month. At least there was something to watch that was more related to the hobby than the usual partisan bickering. Here are the coin and currency-related legislation moving through congress:

S. 925: Women on the Twenty Act

Sponsor: Sen Jeanne Shaheen (D-NH)

• A bill to require the Secretary of the Treasury to convene a panel of citizens to make a recommendation to the Secretary regarding the likeness of a woman on the twenty dollar bill.

• Introduced: April 14, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

Track this bill at https://www.govtrack.us/congress/bills/114/s925

S. 95: A bill to terminate the $1 presidential coin program

Sponsor: Sen. David Vitter (R-LA)

• Introduced: January 7, 2015

• Discharged from Senate Committee on Homeland Security and Governmental Affairs by Unanimous Consent on April 14, 2015

• Referred to the Senate Committee on Banking, Housing, and Urban Affairs on April 14, 2015

Track this bill at https://www.govtrack.us/congress/bills/114/s95

S. 985: United States Coast Guard Commemorative Coin Act

Sponsor: Sen. Christopher Murphy (D-CT)

• To require the Secretary of the Treasury to mint coins in commemoration of the United States Coast Guard.

• Introduced: April 16, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

Track this bill at https://www.govtrack.us/congress/bills/114/s985

Apr 17, 2015 | BEP, coin design, currency, dollar, Federal Reserve, news

During the course of searching for information, I stumbled upon the website for Women on 20s. It is a site dedicated to replacing the image of President Andrew Jackson with a woman by 2020. The group has targeted the $20 Federal Reserve Note to be replaced 2020 because it is the 100th anniversary of the passage of the 19th Amendment that granted women the right to vote.

During the course of searching for information, I stumbled upon the website for Women on 20s. It is a site dedicated to replacing the image of President Andrew Jackson with a woman by 2020. The group has targeted the $20 Federal Reserve Note to be replaced 2020 because it is the 100th anniversary of the passage of the 19th Amendment that granted women the right to vote.

Jackson is being targeted because as we look back through the long lens of history, he was not exactly a model person judging by today’s standards. During the War of 1812, Jackson led U.S. Army troops against native tribes working with the British against the United States to regain the lands taken following the colonies’ independence. It was said that Jackson’s troops were brutal against the native tribes on his orders, killing them rather than taking prisoners.

After beating back the British in the Battle of New Orleans, Jackson declared martial law in New Orleans and used his troops to enforce martial law. Aside from having a magistrate arrested who sided with a newspaper reporter writing who was arrested for writing negatively about his rule, he had members of the local militia who sided with the British executed without trial and went on to use it as propaganda to allegedly maintain order.

As president, Jackson’s policies to relocated native tribes lead to the Indian Removal Act that codified his policies. This lead to the “Trail of Tears” that forced the relocation of Cherokee, Muscogee, Seminole, Chickasaw, and Choctaw nations from their ancestral homelands in the southeast to an area west of the Mississippi River that had been designated as Indian Territory. It is considered the most violent and brutal act against the native tribes in United States history.

To have Jackson’s portrait on the United States central banks’ currency is also a bit ironic. Jackson was against the concept of a central bank and refused to renew the charter of the Second Bank of the United States and vetoed the bill to continue its charter. After winning election in 1833, Jackson withdrew all of the country’s funds from the bank limiting the bank’s ability to conduct business. He gave power to local banks to lend money and issued the Specie Circular, an executive order requiring government transaction be done in gold and silver coin (specie).

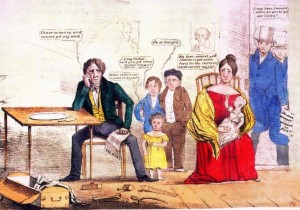

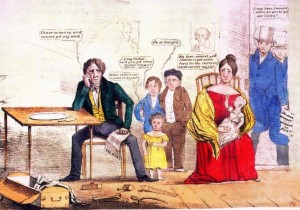

Poster issued by the Whig Party blaming Jackson for the Panic of 1837

The Women on 20s organization does not believe that this should be the legacy honored on U.S. currency. But if we look into the history of all of the men on U.S. currency, there are aspects of their pasts and personal lives that would make some blush, including Benjamin Franklin’s common law wife and illegitimate son.

Women on 20s do recognize that suffragette Susan B. Anthony did appear on a one dollar coin but the coin failed because of its confusion with the quarter. They also recognize that Sacagawea, the Shoshone guide to Meriwether Lewis and William Clark, appears on the current one-dollar coin. Aside from the 2003 Alabama State Quarter, no other woman has appeared on circulating coinage (they do not count commemorative issues). Since neither dollar coin has circulated well and since the Alabama quarter was a temporary issue, the organization believes a better tribute is warranted.

Women on 20s do recognize that suffragette Susan B. Anthony did appear on a one dollar coin but the coin failed because of its confusion with the quarter. They also recognize that Sacagawea, the Shoshone guide to Meriwether Lewis and William Clark, appears on the current one-dollar coin. Aside from the 2003 Alabama State Quarter, no other woman has appeared on circulating coinage (they do not count commemorative issues). Since neither dollar coin has circulated well and since the Alabama quarter was a temporary issue, the organization believes a better tribute is warranted.

In what looks like an addendum to their argument, they mention that a portrait of Martha Washington appeared on the Series 1886 (Fr. #215) and 1891 (Fr. # 223) $1 Silver Certificates. Both Martha and George Washington appeared on the reverse of $1 Series 1896 Educational Series note (Fr. #224).

To decide who they will try to lobby to appear on the $20 note, the organization started with 15 candidates. Voters were asked to select thee of the 15 candidates in this preliminary round. The top vote-getters will be subject to another final voting round.

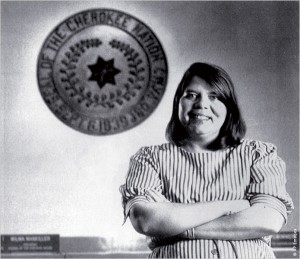

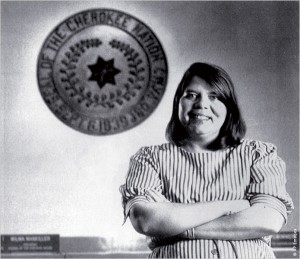

2012 First Spouse coin featuring Alice Paul

Women on 20s reported that 256,659 people had cast ballots when the first round ended on April 5, 2015. They reported that Eleanor Roosevelt, Harriet Tubman and Rosa Parks were named by as many as half of the voters as one of their top three. They added Wilma Mankiller to the final ballot. Mankiller, the first female Chief of the Cherokee Nation and the first female to be a chief of a native nation, was added because of a claimed “strong public sentiment that people should have the choice of a Native American to replace Andrew Jackson.”

Wilma Mankiller, the first female principal chief of the Cherokee Nation

Voting is open at the time this is being written. There is no closing date listed on their website.

Since congress does not control the design of the currency, Women on 20s will have to convince the Federal Reserve to change the design of the $20 Federal Reserve Note. If the Federal Reserve, whose chair is Janet Yellen, agrees to the change, they will work with the Bureau of Engraving and Printing for the design and the U.S. Secret Service to ensure that the appropriate anti-counterfeiting measures are included.

Design changes to any Federal Reserve Note can take 3-5 years to complete.

NOTE: I contacted the Women on 20s organization for comments via email. That email has not been returned at the time of writing this article. If they answer my questions, I will publish them in a follow up post.

Image of the $20 FRN and Whig Party poster courtesy of Wikimedia Commons.

Coin images courtesy of the U.S. Mint

Image of Wilma Mankiller courtesy of the

Native American Encyclopedia.

Apr 9, 2015 | BEP, currency, history, policy

NOTE: I am doing research into the policies that create our money. This is not a look into the economic policies but what happened after the economic policies are executed. For this series of articles, I wanted to know what happened after it was decided that the country would sell bonds in order to fund the Civil War. This is a summary of some of the research to answer one question and tie it in with history.

First of three parts.

Did you ever want to know how or why something was done but there was no answer? Or there may have been answers but nothing definitive that would make any of the answers true? It is this type of curiosity that had me searching for the answer to one question:

Why is the greenback green?

There are references that claim that the green printed back was to differentiate the currency of the United States from those from other countries. Other references call it an anti-counterfeiting mechanism. Neither claim can tie themselves to the actual events in such a way that we can say which is the truth. Or can we?

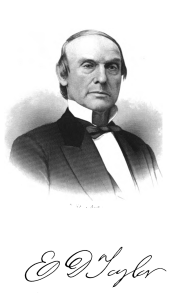

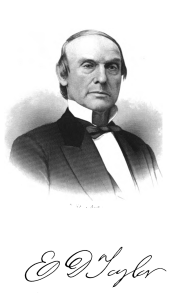

Col. Dick Taylor

Shortly after Taylor’s birth, the entire Taylor family moved to Kentucky because of exhausted lands in southern Virginia. They settled along the Ohio River outside of Louisville. In 1814, Giles moved his family Shawneetown, Illinois as one of the area’s pioneer settlers. Unfortunately, Giles died shortly thereafter leaving the family of little means.

Preferring to be called by his middle name, Taylor would be referred to by the common nickname of Dick and began travelling throughout the Midwest region to earn a living. At this time he would sign his name as “E.D. Taylor.” Dick Taylor demonstrated a lot of skill in organizing while operating as a trader on the frontier. By 1929, Taylor settled in Springfield, Illinois and married Margaret Taylor, the daughter of Col. Richard Taylor and sister of then Col. Zachary Taylor.

When the Black Hawk War broke out in 1831, he enlisted in the Illinois infantry and appointed as a colonel by the governor where he served with Jefferson Davis, General George Jones, and General Henry Dodge. Following the war he was elected to the Illinois House of Representatives then, after one term, was elected to the senate defeating a long-standing senator.

Taylor ran his senate campaign on a platform to move the capital from Vandalia to Springfield. To accomplish this, Taylor wrote a bill and worked with a representative named Abraham Lincoln, whom he met as a shopkeeper in New Salem. The bill was successful and Springfield has been the capital of Illinois since.

Taylor was a master at managing money and served the state in many capacities. In 1835, Taylor was appointed Receiver of Public Moneys in Chicago. Today, that position would be known at the comptroller. Under Taylor’s guidance, Chicago managed land sales better than any other city in the country and grew Chicago into the second largest city in the United States passing Philadelphia for that distinction. He was so well regarded in Washington, that not only did President Andrew Jackson hold a special dinner in Taylor’s honor, but appointed him to the commissions that oversaw the building of railroads in the upper Midwest.

With his connections from Springfield and working with Jackson, who is considered the father of the modern Democratic Party, Taylor became a member of the party and helped build the political machine that continues to run Chicago today. He was a friend and staunch supporter of Stephen A. Douglass and would travel the state stumping for Democratic candidates.

Taylor did not forget his friendship with Lincoln. Even though Lincoln had joined the then nascent Republican Party, he would also campaign with his friend in areas that were not strong Democratic strongholds. But for the presidential election of 1860, Taylor supported Douglas and campaigned throughout Illinois against Lincoln.

25th Secretary of the Treasury Salmon P. Chase

Knowing how Taylor turned around the finances of Chicago and then the railroad alliance, Lincoln turned to his old friend for advice. Taylor convinced Lincoln to ask congress to issue currency backed by the bonds but with no interest. Using what he learned in managing tickets sales for the railroads, Taylor provided Lincoln the outline for a currency system that was adopted with much reluctance by Chase.

First published in Abraham Lincoln, author Emil Ludwig found a letter acknowledging Taylor as the person who came up with the idea:

My dear Colonel Dick:

I have long determined to make public the origin of the greenback and tell the world that it was Dick Taylor’s creation. You had always been friendly to me. and when troublous times fell on us, and my shoulders, though broad and willing, were weak, and myself surrounded by such circumstances and such people that I knew not whom to trust, then I said in my extremity, ‘I will send for Colonel Taylor — he will know what to do.’ I think it was in January 1862, on or about the 16th, that I did so. Said you: ‘Why, issue treasury notes bearing no interest, printed on the best banking paper. Issue enough to pay off the army expenses and declare it legal tender.’ Chase thought it a hazardous thing, but we finally accomplished it, and gave the people of this Republic the greatest blessing they ever had — their own paper to pay their debts. It is due to you, the father of the present greenback, that the people should know it and I take great pleasure in making it known. How many times have I laughed at you telling me, plainly, that I was too lazy to be anything but a lawyer.

Yours Truly.

A. Lincoln

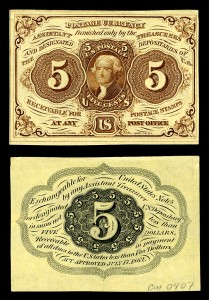

Lincoln, not one to miss an opportunity, used his executive authority to begin the production of a national paper currency in the form of Demand Notes as an extension of the Act of July 17, 1861 (12 Stat. 259) that authorized the printing of fractional currency.

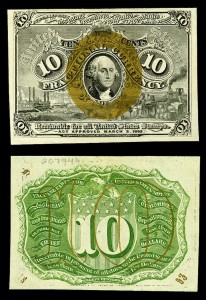

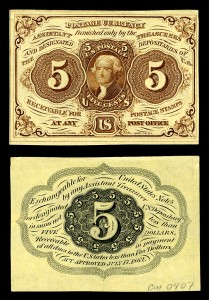

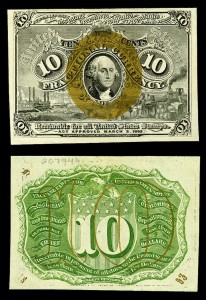

Since the federal government did not have printing facilities, the law was written to allow notes to be produced by a “New York bank note company.” The first four issues fractional currency were printed by the American Banknote Company and the National Banknote Company. By the fifth issue, the new Bureau of Engraving and Printing began to print these notes.

First issue: 5-cents, Thomas Jefferson (Fr. #1231)

Second issue: 10-cents, George Washington (Fr. #1246)

Third issue: 50-cents, Francis Spinner (Fr. #1328)

To save time and money, the first series of notes were printed four and six to a sheet in New York then shipped to Washington where the Treasury set up the Office of the Currency Comptroller to manage. As par of the OCC, the National Currency Bureau was created to do the cutting, bundling, and distribution of the currency.

Fourth issue: 50-cents, Abraham Lincoln (Fr. #1374)

Fifth issue: 25-cents, Robert Walker (Fr. #1308)

The process for the United States to print its own currency had begun. While Secretary Chase was leading the plan to build a printing operation, congress authorized Treasury to establish an engraving and security printing bureau. That law was approved on July 11, 1862 (12 Stat. 532). With construction for a printing facility underway, Treasury hired James Duthie as the first engraver. Although he was a temporary engraver, he was provided a $1,600 per year salary (the equivalent to just under $38,000 in current dollars).

In Part 2 we introduce you to a little known geologist who may have developed more than the theory of the greenhouse effect.

References:

- Conrad, Howard Louis. “The Originator Of Greenback Currency: Colonel Edmund Dick Taylor.” The National Magazine, June 1892, 209-14.

- Ludwig, Emil, Eden and Cedar Paul (translators). Abraham Lincoln. Boston: Little, Brown, 1930.

- Mitchell, Wesley C. A History of the Greenbacks, with Special Reference to the Economic Consequences of Their Issue: 1862-65. Chicago: University of Chicago Press, 1903.

- History of the Bureau of Engraving and Printing, 1862-1962. Washington: Treasury Dept.; 1964.

- Gurney, G., & Gurney, C. (1978). The United States Treasury: A pictorial history. New York: Crown.

- Friedman, Morgan. “The Inflation Calculator.” Accessed April 7, 2015. http://www.westegg.com/inflation/.

Credits:

- Image of Col. E.D. Taylor from The National Magazine, June 1892.

- Image of Salmon P. Chase from the Library of Congress via Wikimedia Commons

- All fractional currency images courtesy of Wikimedia Commons

Mar 30, 2015 | Baltimore, BEP, books, coins, commemorative, Red Book, tokens, US Mint

As it does three times per year, Whitman rolls into the Baltimore Convention Center for the Whitman Baltimore Expo. This time, rather than the showing being in Halls A and B it was held in E and F. The new location within the building was not as intuitive to find as walking to the end and Whitman did not do as good of a job as they could have in placing their signs. But for general access, which is was off of South Sharp Street, it provided a little better access than off of West Pratt Street, which is a main artery as it passes in front of the Inner Harbor.

As it does three times per year, Whitman rolls into the Baltimore Convention Center for the Whitman Baltimore Expo. This time, rather than the showing being in Halls A and B it was held in E and F. The new location within the building was not as intuitive to find as walking to the end and Whitman did not do as good of a job as they could have in placing their signs. But for general access, which is was off of South Sharp Street, it provided a little better access than off of West Pratt Street, which is a main artery as it passes in front of the Inner Harbor.

Although there were the same number of booths, the space felt smaller. Lights were brighter since these halls seem to have been converted to using LED lighting—the brighter space made the convention center seem less cavernous. Aisles were not as wide and some of the layout changed, but it seemed to have the same number of dealers. Some of the dealers who had larger spaces did downsize and the one vendor of supplies that is not Whitman did not set up at the show. It is not known if they decided not to attend or were not invited to attend. Since Whitman does not carry all books and supplies, it would be nice if they had another supplier.

On thing I have noticed is that since the death of numismatic book dealer John Burns in early 2014 there seems to be fewer numismatic book offerings at some of the east coast shows. Aside from missing his sharp wit, I was always able to find something a little off-beat or out of the ordinary amongst the books he had for sale. While there was a book dealer at this show, the items were more toward what I would consider ordinary. I hope someone steps in with some interesting items.

As I walked the floor and spoke to many of the dealers (late Friday afternoon), they all said that they were doing well. With the area still a bit chilly and no sports to take over the downtown Baltimore area (home opener for the Baltimore Orioles is on Friday, April 10), visitors to downtown Baltimore had plenty of time to visit. For those of us who like access to a major coin show, it is good to hear. If the dealers are doing well then they will keep coming back. If the dealers come back, the show goes on.

Both the U.S. Mint and Bureau of Engraving and Printing had booths at the show. While the U.S. Mint was showing current products, the Bureau of Engraving and Printing had some historical information. Although it is good to see the U.S. Mint at the show, it might be nice to see some historical artifacts. Since most of the U.S. Mint’s collection was given to the Smithsonian Institute, maybe they can be convinced to bring an exhibit to the show. Having the Smithsonian there would be very different than other shows since they have a different type of collection than the American Numismatic Association, for example.

2015 March of Dimes Commemorative Proof set will cost $61.95 when released

Another interesting find was the First Edition of the Red Book Deluxe Edition. While flipping through it at the show, it looks like the Red Book on steroids. There is more information, more detail on pricing, and some other features. A first impression is that it extends the Red Book franchise a bit beyond what they called their Professional Edition. While there is a lot of information, my first impression is that I wish it was more of a cross between the Professional Edition and the Coin World Almanac. Both books have their places, but to combine the pricing and information that is updated yearly (the Coin World Almanac is updated every 10 years) would be a great resource. Hopefully, I will get my hands on one to review.

Finally, no show would be complete with out my one cool find. After walking the floor for a few hours I finally stat at the table of Cunningham Exonumia and had a nice chat with Paul Cunningham while searching for something New York. While I have not given up coins or Maryland Colonial Currency, I seem to be having more fun trying to find tokens and other exonumia from New York City and my hometown of Brooklyn. I have seen Paul at many other shows and have purchased from him. He always has a great selection. For me, I may have exhausted some of his inventory. This time, the pieces he was offering this weekend I already have in my collection.

But it did not stop me from looking. Tokens are very interesting. They are alternatives to money and are more tied to the culture of the community than money. For me, a New York Subway token not only represented a ride on the subway, but it also represents a different part of my life. It makes collecting very person. Although I have a collection of subway tokens I continue to look because you never know what you can find—especially an error.

What I found was a large token with an error. It was sold as the “Large Y” token where the “Y” was supposed to be cutout. Those tokens were used from 1970-1978 and two fare increases starting out at 30-cents in 1970, 35-cents in 1972, then 50-cents in 1975. But what I found is not that token. After examine the token carefully and some others I have, this is an error to the “Solid Brass NYC” Token. Introduced with the 60-cent fare in 1980, the “Y” was part of the raised design and not cutout. The clue as came when examine the obverse (the side that says “New York City Transit Authroity”). Between the “N” and the “C” is the tail of the “Y” but without its top. That tail would not have existed on the earlier tokens because they would have been cut out. Instead, the is a die issue where only the tail of the “Y” on one side was struck.

Large Brass “NYC Token” used from 1980-1985 with partial “Y” (obverse)

Large Brass “NYC Token” used from 1980-1985 with missing “Y” (reverse)

It might not be the error I expected, but it is an error nonetheless! It also does not make it any less fun or valuable because it will fit nicely in my collection.

If you were not able to make it Baltimore, here are some of the pictures I had taken at the show:

Feb 3, 2015 | BEP, coins, currency, Federal Reserve, policy, US Mint

In celebration of a reoccurring activity but the government, on Groundhog Day the President released his Fiscal Year 2016 (FY16) budget request. Forgetting the usual politics surrounding congress’s reaction, the budget for numismatic-related production is largely irrelevant. Since 1950, the Bureau of Engraving and Printing has been funded using income from operations, mostly sale of currency to the Federal Reserve (Public Law 81–656, 31 U.S.C. § 5142). The United States Mint Public Enterprise Fund was established in 1996 to better manage the seigniorage earned from coin production (Public Law 104-52, 31 U.S.C. § 5136).

In celebration of a reoccurring activity but the government, on Groundhog Day the President released his Fiscal Year 2016 (FY16) budget request. Forgetting the usual politics surrounding congress’s reaction, the budget for numismatic-related production is largely irrelevant. Since 1950, the Bureau of Engraving and Printing has been funded using income from operations, mostly sale of currency to the Federal Reserve (Public Law 81–656, 31 U.S.C. § 5142). The United States Mint Public Enterprise Fund was established in 1996 to better manage the seigniorage earned from coin production (Public Law 104-52, 31 U.S.C. § 5136).

In short, both money production bureaus will be able to withdraw the money from their respective funds to fully support their operations.

Department of the Treasury requested that the BEP be allowed to withdraw $863 million for operations. The BEP have a total outlay of $918 million but will leverage $50 million from their current operating funds to make up the difference. Using projections from the previous years, the BEP anticipates an order for 8.3 billion notes or a 15-percent increase. Of the area that the BEP will be concentrating on includes additional research into anti-counterfeiting methods, make currency more accessible to the visually impaired, and modernizing the production process in Washington, D.C.

The budget does mention that the BEP was given legal authority to print currency for foreign countries with the approval of the State Department in 2005. However, the BEP has yet to be contracted by any country for this service. Many countries appear more interested in using the polymer substrate produced by the Reserve Bank of Australia than continuing to use cotton-fiber paper, which is favored in the United States.

Funding for the U.S. Mint is different in that while the Federal Reserve pays a fixed fee per currency note to the BEP, they pay face value for the coins they purchase from the U.S. Mint. Even though it costs more than face value to produce the one-cent and five-cent coins, the deficit is more than made up on the quarter dollar, the workhorse of the U.S. coin economy.

To fund its $3.59 billion operation, the U.S. Mint will be allowed to withdraw up to $20 million from their Public Enterprise Fund. That appropriation is only a cushion in case there is a shortfall in the anticipated $4.14 billion revenues. Although the U.S. Mint is now being run by Principal Deputy Director Rhett Jeppson, the organization is unlikely to reverse the production improvements implemented by former Deputy Director Richard Peterson.

One notable statement says, “The 2016 Budget includes a proposal to require the silver coins in United States Mint Silver Proof Sets to contain no less than 90 percent silver. Under current law, the half-dollar, quarter-dollar and dime coins in these sets “shall be made of an alloy of 90 percent silver and 10 percent copper.” Allowing the Mint to have flexibility in this composition will improve efficiency in the production process, lowering the costs for these products.” It appears that the U.S. Mint is asking congress to allow them to use another metal than copper while not changing the silver content. With the cost of copper rising to historic levels, using a less expensive metal on a coin that is not intended for circulation could be a cost savings.

While there will be political fireworks over other aspects of the president’s budget, those of us concerned with the money production by the Department of the Treasury can sit back and worry about other issues.

Jan 19, 2015 | BEP, counterfeit, currency, Federal Reserve

How an iodine pen reacts depends on the type of paper used.

As I was waiting to checkout, the person running the cash register was having difficulties with someone whose credit card was not being accepted. It did not matter what the problem was, the issue was holding up the line. While waiting, the gentleman next on line turned to me and said, “This is why I pay in cash.”

Apparently, my fellow line waiter and I had one thing in common, we both visited the bank prior to doing our shopping. He paid for his purchase with crisp, new currency. Just like my new currency, they were mostly $20 Federal Reserve Notes in serial number order fresh from a pack that was opened in the bank.

When the cashier counted the money, she picked up a pen and drew a line on each note. The pen was a counterfeit detection pen that contains an iodine-based ink used to determine whether the paper used is counterfeit.

These iodine pens test whether the paper is legitimate by checking if the iodine reacts with the starch that is used in commercial paper to make them look brighter. If the paper contains starch, then the ink turns dark indicating the paper is not real currency paper. Otherwise, the mark stays amber on the normal cotton bond paper.

There are two problems with this method of counterfeit detection. First, it is relatively easy to defeat the iodine pen by washing and bleaching a low denomination bill and reprinting a higher denomination on the same paper. By using legitimate currency paper, testing it with the iodine pen will not detect that it is counterfeit.

I remember there was a story on one of the television networks about how counterfeiters bleached $5 notes and passed them off as $20 notes after reprinting them. While searching, I found the following video of NBC’s Chris Hanson as he reported about this on Dateline:

Another problem with using iodine pens is that merchants that use them put their customers in danger who have iodine allergies. Those of us with severe iodine allergies can experience anaphylaxis, a serious reaction whose rapid onset can be so severe that it can cause death. As one of those people with severe iodine allergies, I watched this scene in horror.

Following a discussion with the manager, I consented to using a credit card since this was not one of those retailers that have been in the news for being hacked.

After all the Bureau of Engraving and Printing does to ensure that the new currency is more difficult to counterfeit and how the criminals are getting around these iodine pens by using real currency paper, it is incredible to think that these stores are still using tried but untrue measures for counterfeit detection.

In the meantime, the more serious counterfeiters are bleaching and overprinting $5 notes because as the criminal in the video says, nobody looks!

Jan 7, 2015 | BEP, currency, legislative, news

As congress convenes for its 114th session there are questions as to what the new Republican majority would do with their power. For numismatists waiting for congress to authorize the U.S. Mint to do anything, there may not be many changes from the last congress. Since financial bills are constitutionally required to start in the House of Representatives and since the House only increased its Republican majority, it is unlikely attitudes would significantly change. After all, in two years, the 113th congress passed only one commemorative coin bill.

Larry R. Felix, the 24th Director of the Bureau of Engraving and Printing

Felix, who was born in Port of Spain, the capital of Trinidad and Tobago, was raised in New York City where he attended New York City College of Technology (City Tech) and City College of New York. He has been working for the BEP since 1993 and became the bureau’s director in 2006.

Felix was 24th director of the BEP and was the first African-American to be the Director.

Under Felix, the BEP introduced the next generation of currency designs in conjunction with the Federal Reserve and the U.S. Secret Service to make it more difficult to counterfeit U.S. currency including the new $100 Federal Reserve Note that has been recognized as the most difficult note to counterfeit. As part of the upgrade in production capabilities, Felix lead the BEP into a transition that made the bureau more technologically advanced and made their production more efficient.

Recent accomplishments include working with groups representing the visually impaired to make currency more accessible as part of a program called Meaningful Access. As part of that effort, the Meaningful Access program produced Eyenote for iOS and IDEAL Currency Identifier for Android to allow smartphone users to identify currency with their phone’s built in camera. They also are making iBill available for free to qualified visually impaired people. IBill is a pocket device that can be used to read U.S. currency and audibly identify its denomination that does not require a smartphone.

More recently, the BEP began to print one-dollar Federal Reserve Notes in sheets of 50 notes. During the production cycle, one-third of the notes being produced are $1 notes where more than 80-percent of the notes produced are used to replace worn currency. To meet the demand and lower the production cycle, this 38-percent per sheet increase in production will reduced the number of printing cycles required better meeting the demands of the BEP’s primary customer, the Federal Reserve.

A view of the 50 Note Sheet of $1 Federal Reserve Notes.

BEP Deputy Director Len Olijar speaks to the Montgomery County Coin Club during their September 2014 meeting.

Unlike the U.S. Mint, the Director of the BEP is a career employee of the United States Government. BEP directors are members of the Senior Executive Service (SES), a program established as part of the Civil Service Reform Act of 1978 to “ensure that the executive management of the Government of the United States is responsive to the needs, policies, and goals of the Nation and otherwise is of the highest quality.”

Although most SES members are career employees, the government can hire qualified executives from outside of the government. These special appointments to the SES are renewable terms from three-to-five years where the appointee can only serve two appointments in the same position.

Since SES members are employees of the United States government, they are not subject to the Senatorial confirmation process political appointees must undergo. However, it is the job of the Secretary of the Treasury Jack Lew to appoint a new permanent director. It is likely Lew will make the appointment based on the recommendation of Treasurer Rosie Rios. Both Lew and Rios are political appointees whom have been confirmed by the Senate.

As an aside, the U.S. Mint has not had a director since the resignation of Edmund Moy in January 2011. Since the Director of the U.S. Mint is a politically appointed position, the U.S. Mint is legally managed by Treasurer Rosie Rios who has assigned Deputy Directory Richard A. Peterson to manage the day-to-day operations. Peterson, who is probably doing a better job than an appointee, is a career government employee and a member of the SES.

Image of Larry Felix courtesy of the Bureau of Engraving and Printing.

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

Over the summer, a Harris Poll was conducted to understand how Americans feel about abolishing the one-cent coin and the paper dollar note. Even though there are pundits calling for these changes and even the end of physical currency, Harris found that those wanting to keep the lowly one-cent coin continue to hold the majority opinion.

During the course of searching for information, I stumbled upon the website for

During the course of searching for information, I stumbled upon the website for