Jul 8, 2015 | coins, currency, economy, foreign, news

Greece 1€ coin depicts an owl, copied from an ancient Athenian 4 drachma coin (ca. 5th century BCE)

Collecting numismatic items from distressed times can present an interesting challenge. While we have heard about Hard Times Tokens being a popular collectible, sales tax tokens produced during the Great Depression so that people could pay the exact fractions of a tax on low-value purchases.

Two of the more recent examples of numismatics based on distressed economic conditions are the Zimbabwe hyperinflation currency and the State of California’s Registered Warrants (IOUs). Although both have different origins from the Greek crisis, both show different ways of handling the situation.

When a country controls its own currency, it can manage that currency to maintain its value. In the United States, that is done by the Federal Reserve. It uses many programs from buying debt from its member banks to setting what it calls the Discount Rate, the rate that its member banks can borrow overnight to meet its liquidity requirements. In Zimbabwe, the central bank did not have the business and circulation in order to make this type of policy work because of the strife caused by wars and other ugliness. Their only choice was the print more money. The more money printed, the less it is worth. The less the money is worth the more it takes to buy daily goods and services. This result is that the more money that is added to the economy the higher inflation goes.

Zimbabwe’s 2009 $100 trillion hyperinflation note

California was a different story. It was a self-made crisis of politics in 2009 between the Republican Governor Arnold Schwarzenegger and the Democratic-controlled legislature. Since neither side could agree on a budget, Schwarzenegger declared a fiscal emergency and ordered the printing of IOUs to pay for state debts.

California Registered Warrant

A friend who was living in California at the time was issued an IOU for a small personal tax refund. Rather than be burdened with the rigors of cashing the warrant, the paper is now part of his collection. However, since the warrants were addressed to specific people, it is not likely that these items will be immediately collectible. Many years from now it is probable that these warrants will be a curious collectible like the old Series E or War Bonds.

Greece does not control its own currency nor does it have any potential backing to issue warrants. Since Greece has not been seen as creditworthy, it cannot issue bonds at any interest rate because the markets are not interesting in buying Greek debt. Unless a deal can be struck with the rest of the European Union, Greece may not have a choice but exit the pact that uses the Euro as the common currency.

Exiting the Euro will bring back the Greek drachma.

2000 Greece 20 Drachma coin features Dionysios Solomos, a poet and author of the Greek national anthem.

Before you search your ten pound bag of foreign coins looking for pre-Euro drachma, it is likely that Greece will keep those coins demonetized and not recognize them as official currency. If Greece wants to be able to control the amount of currency in circulation, then they will have to issue new coins and notes.

If Greece goes this route, experts are saying that the Greek government will allow the Euro to circulate alongside whatever is added to the market. Some people think it may take over a year to strike enough coins and print enough notes to be able to remove the Euro from circulation.

What will Greece do in the interim? Does the Greece Central Bank issue warrants like California did? If so, will the warrants become something that would become a collectible?

10,000 drachma note issued by the Bank of Greece in 1995 features the image of Dr. George Papanicolaou, inventor of the Pap smear

Image Credits

- Greek 1€ coin courtesy of EuroCoins.co.uk.

- California Warrant courtesy of MyMoneyBlog.com

- Zimbabwe $100 trillion note courtesy of Wikimedia Commons.

- 20 drachma coin courtesy of Numista.

- 10,000 drachma note courtesy of the Bank of Greece.

Jul 4, 2015 | celebration, coins, history

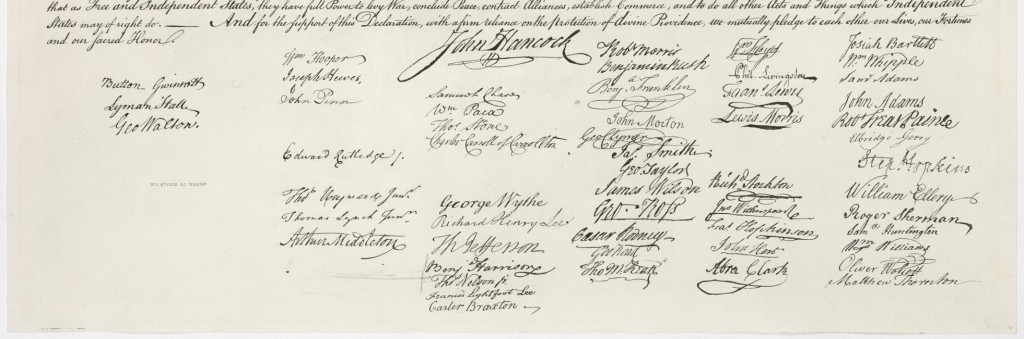

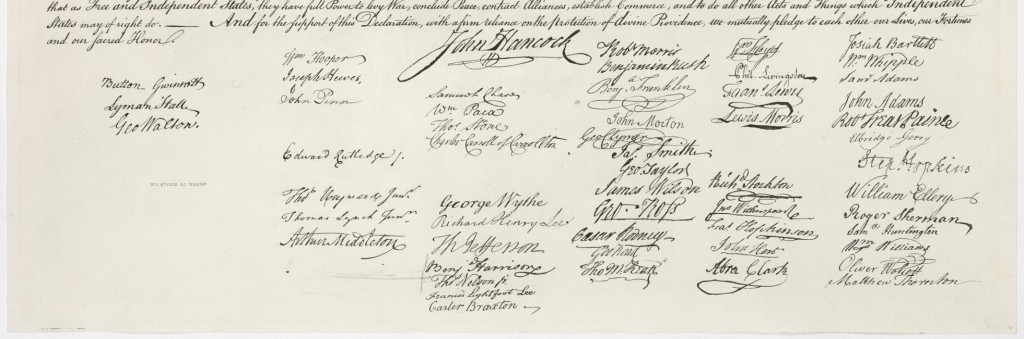

In CONGRESS, July 4, 1776

The unanimous Declaration of the thirteen united States of America

Thirteen sterling silver “Official Bicentennial Medals of the Thirteen Original States.”

After each state cast one vote in favor of the Declaration before the Committee of the Whole, the committee was adjourned. The measure was brought before the full First Continental Congress with the majority voting in favor of the Declaration. Although independence was declared from England it would not be fully realized until 1783 when the Treaty of Paris was signed.

We, therefore, the Representatives of the united States of America, in General Congress, Assembled, appealing to the Supreme Judge of the world for the rectitude of our intentions, do, in the Name, and by Authority of the good People of these Colonies, solemnly publish and declare, That these United Colonies are, and of Right ought to be Free and Independent States; that they are Absolved from all Allegiance to the British Crown, and that all political connection between them and the State of Great Britain, is and ought to be totally dissolved; and that as Free and Independent States, they have full Power to levy War, conclude Peace, contract Alliances, establish Commerce, and to do all other Acts and Things which Independent States may of right do. And for the support of this Declaration, with a firm reliance on the protection of divine Providence, we mutually pledge to each other our Lives, our Fortunes and our sacred Honor.

John Trumbull’s Declaration of Independence hangs in the U.S. Capitol Rotunda. It was used as the model for the reverse of the $2 Federal Reserve Note.

Jul 1, 2015 | coins, commemorative, commentary, legislative, policy

Reverse of the $2 Federal Reserve Note features an engraved modified reproduction of the painting The Declaration of Independence by John Trumbull.

On June 11, rather than let Jefferson continue his draft, the Continental Congress elected the Committee of Five to write the full document. John Adams, whose role in the Continental Congress would be that of the Majority Leader today, was a member of the Committee of Five but insisted that most of the writing be done by Jefferson. The other members of the Committee of Five were Ben Franklin, Roger Sherman, and Robert Livingston.

The committee presented the document to the Continental Congress on June 25. For the next seven days, the document went through the first ever mark-up session where members applied their edits to the document. Debate began on July 1 and by July 2 everyone who wanted to speak has their say before the vote. With each delegation allowed one vote, the final tally was 9 in favor of independence, 2 against (Pennsylvania and South Carolina), and one abstention (New York, their delegation did not have their legislature’s authority to cast a vote).

But if you thought that this was the end of the debate, you failed to remember that this was the beginnings of congress! The vote was conditional on Jefferson revising the document before it was adopted. The rewrite was completed and presented the final copy to the Continental Congress on July 4, 1776 where it passed with the same vote. Adams felt that July 2 should be considered Independence Day. A combination of the day that the text was adopted and what we would consider in today’s environment to be a clerical error, the Declaration of Independence was signed (on August 2, 1776) saying that independence was declared on July 4, 1776.

The moral of this story is that no matter how ridiculous the bill or idea, it is not law until the final version of the bill is approved and signed.

Congress had a busy June with regard to coin-related legislation. The bills that saw action were as follows:

H.R. 2722: Breast Cancer Awareness Commemorative Coin Act

Sponsor: Rep. Carolyn Maloney (D-NY)

• Introduced: June 10, 2015

• Referred to the House Committees on Financial Services and Budget

Track this bill at https://www.govtrack.us/congress/bills/114/hr2722

H.R. 2726: Apollo 11 50th Anniversary Commemorative Coin Act

Sponsor: Rep. Bill Posey (R-FL)

• Introduced: June 10, 2015

• Referred to the House Committee on Financial Services

Track this bill at https://www.govtrack.us/congress/bills/114/hr2726

H.R. 1698: Bullion and Collectible Coin Production Efficiency and Cost Savings Act

Sponsor: Rep. Bill Huizenga (R-MI)

• Introduced: March 26, 2015

• Passed the House of Representatives on June 23, 2015 by voice vote

• Received in the Senate on June 24, 2015 and referred to the Committee on Banking, Housing, and Urban Affairs

Track this bill at https://www.govtrack.us/congress/bills/114/hr1698

H.R. 893: Boys Town Centennial Commemorative Coin Act

Sponsor: Rep. Jeff Fortenberry (R-NE)

• Introduced: February 11, 2015

• Passed the House of Representatives on June 23, 2015 by voice vote

• Passed the Senate on June 25, 2015 by unanimous consent

• Presented to the President on June 26, 2015

Track this bill at https://www.govtrack.us/congress/bills/114/hr893

H.R. 2906: To require the Secretary of the Treasury to mint coins in recognition of the 50th anniversary of the Texas Western College National Collegiate Athletic Association men’s basketball championship.

Sponsor: Rep. Beto O’Rourke (D-TX)

• Introduced: June 25, 2015

• Referred to the House Committee on Financial Services

Track this bill at https://www.govtrack.us/congress/bills/114/hr2906

Jun 14, 2015 | coins, fun, news, technology, web

When I discussed the American Numismatic Association election, I noted that my posting has been more sporadic because of a business I started. This will continue at least for the next few months.

However, if you are looking for different types of coin news and information, I invite you to follow me on Twitter. You can find me @coinsblog. For those of you not familiar with Twitter, it is a social media site where users post information using 140 characters or less. This makes it difficult to post long diatribes of extensive notes. What it is good for is to post short messages with a link to longer stories.

However, if you are looking for different types of coin news and information, I invite you to follow me on Twitter. You can find me @coinsblog. For those of you not familiar with Twitter, it is a social media site where users post information using 140 characters or less. This makes it difficult to post long diatribes of extensive notes. What it is good for is to post short messages with a link to longer stories.

Those who either follow my Twitter feed on the web, using their favorite app, or the the box on the sidebar of this page will note that I will post links to coin, currency, and bullion-related stories from around the web. These stories are not from the usual set of numismatic-related websites like CoinNews.net, CoinWeek, Coin World, Numismatic News, etc. I figure that many of you would read these sites without my prompting. If you are not reading the articles on those sites, here is my endorsement for all of them. I read them all regularly.

Items I do post are from other news sources from around the web. Most of the articles are from media outlets but there are some financial blogs that make it into the mix.

The stories I post are about coins that have been about issued or planned to be issued coins and currency; news about bullion; some economic news that will affect circulating coins and currency; stories about shows where ever they appear; stories about collectors and collecting; or anything else that catches my eye.

The stories that end up in my Twitter stream are “hand selected.” This means I have a few saved searches and I periodically read through them looking for something interesting. Sometimes there are a lot of stories on one topic, such as the recent stories about France being upset with Belgium for striking a Waterloo commemorative. Other times it could be serious but amusing items like Zimbabwe phasing out its inflation currency at the rate of on U.S. dollar for ever Z$35 Quadrillion (that’s Z$35,000,000,000,000,000 or Z$35 thousand million) of inflation currency.

Similarly, I will post interesting pictures I find onto Pinterest. Pinterest is social media for pictures. Pictures are pinned to Pinterest like a bulletin board. You can follow those who pin on Pinterest (pinners) or their individual pin boards. I keep a few boards on Pinterest that I pin to as I look at the various articles. I try to pin something different than the usual coins. Most comes from the articles I find as I search for news stories.

Unless I find something different, most of the items from the news I post to my “In The News” board. One of my popular boards is “Coin & Currency Art” where I post items made from coins or currency or items made to look like coins and currency (that are not or intended to be counterfeit). If you like looking at interesting items, you might want to join Pinterest and start to follow many of the numismatic-related pinners already on the site.

I will try to finish some posts I started shortly. Until then, stay tuned and watch social media for my take on the on-going news.

Jun 3, 2015 | coins

A great metaphor for the politics of Washington is that June opens with the Belmont Stakes, the third and longest leg of Triple Crown of Thoroughbred Racing. At a mile-and-a-half it is horse racing’s longest race on one of the oldest tracks in the sport. It is traditionally called “The Test of Champions” because of its length and horses tire after running the Kentucky Derby and Preakness. Since Affirmed won the Triple Crown in 1978, there have been 12 horses to lose the Belmont after winning the the Derby and Preakness.

Like the Belmont, politics is a long race with lead changes and maneuvering through the straights to cross the finish line as a winner. The election of 2016 will be different in that it will probably feature more candidates than the number of horses running in the Belmont.

For watchers of the political maneuvering that is part of the sausage making process, it will be difficult to predict how the race for 2016 will affect what congress does. No doubt, there will be a lot of show horses trying to one-up the others. Since coin-related legislation is not a top priority, it will be interested to see how many coin-related bills are passed the rest of this session. Given congress’s recent dysfunction and the race not even to the first furlong, you may be better off reaching for your antacids than a scorecard!

Only one coin-related bill was introduced in May:

H.R. 2525: Hero Street USA Commemorative Coin Act

Sponsor: Rep. Cheri Bustos (D-IL)

• To require the Secretary of the Treasury to mint coins in recognition and celebration of Hero Street USA.

• Introduced: May 21, 2015

• Referred to the House Committee on Financial Services

Track this bill at https://www.govtrack.us/congress/bills/114/hr2525

May 28, 2015 | coins, Federal Reserve, news, US Mint

In an early morning press release, the U.S. Mint announced that they would be going from a two-shift operation to a three-shift operation citing increased production requirements for circulating coins.

In an early morning press release, the U.S. Mint announced that they would be going from a two-shift operation to a three-shift operation citing increased production requirements for circulating coins.

The main job of the U.S. Mint is to supply circulating coinage to the Federal Reserve banks. These Federal Reserve branch banks then circulate the coins to member banks and distributors where they will eventually enter daily commerce. As part of their operations, the Federal Reserve will order coins from the U.S. Mint to supplement the money supply and provide the a forecast for the next 12-months. In order to meet the production requirements, the U.S. Mint uses the forecast to adjust their operations.

During the downturn in the economy, the U.S. Mint adjusted to a 4-day, 10 hours per shift schedule. Halting production so that the machines do not run on Friday saved money by lowering the electricity requirements and allowed for a broader maintenance program. Along with the schedule adjustments, the U.S. Mint instituted production efficiencies that have lead to lower costs. The result has been a an increase in seigniorage for the agency even during the downturn in the economy and the rising cost of base metals that have lead to debates over coin composition.

With this move, the U.S. Mint is likely going back to a 5-day, 8 hours per shift schedule. This will make the U.S. Mint a 24-hour operation again. It also means that they will have to hire people to work at the world’s largest coin factories in Philadelphia and Denver. The U.S. Mint anticipate that an additional 46 people will be hired in Philadelphia and 40 in Denver. They will be hiring quickly since they want to be up and running with their third shift by the mid-June to July timeframe.

If you are interested in working for the U.S. Mint, the positions will be posted on the federal government’s jobs website usajobs.gov. You can also visit the U.S. Mint’s online careers page to learn more about working for the U.S. Mint.

May 26, 2015 | books, coins, gold, history, US Mint

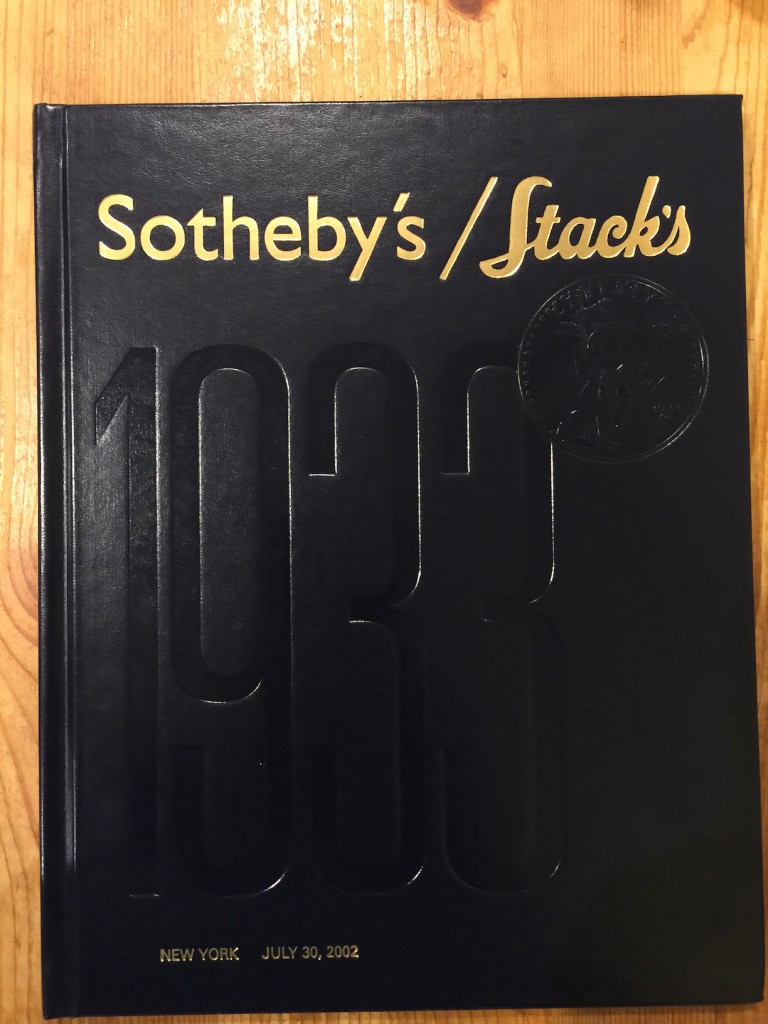

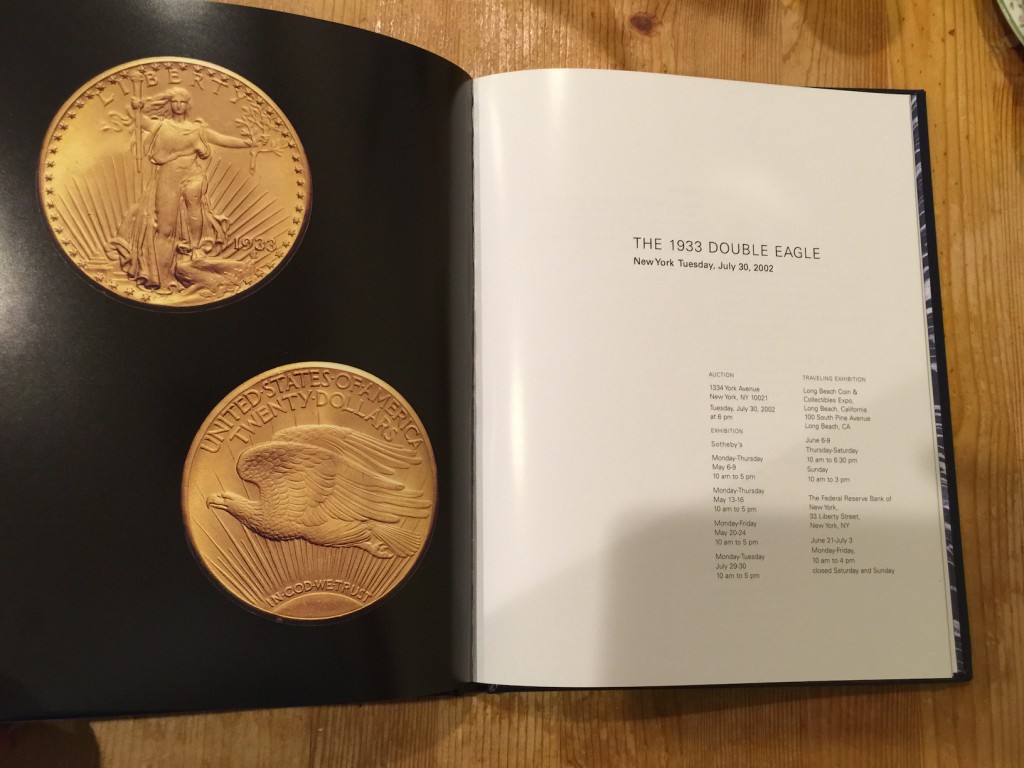

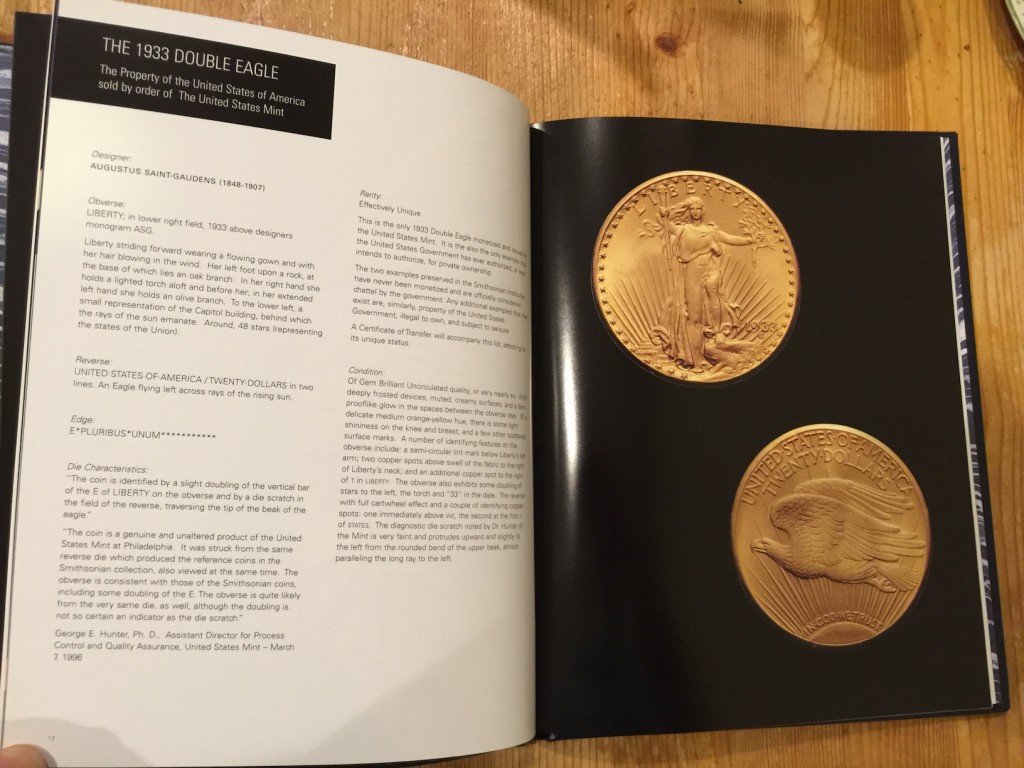

With the court ruling against Joan Langbord and forcing her to surrender the ten 1933 Saint-Gaudens Double Eagle gold coins she claims to have found, there remains only one legally to own 1933 Saint-Gaudens Double Eagle coin.

With the court ruling against Joan Langbord and forcing her to surrender the ten 1933 Saint-Gaudens Double Eagle gold coins she claims to have found, there remains only one legally to own 1933 Saint-Gaudens Double Eagle coin.

Currently, there is only one example of this coin that is legal to own. Dubbed the Farouk-Fenton 1933 Saint-Gaudens Double Eagle, researchers traced the coin was legally exported to Egypt for King Farouk.

In 2002, the coin sold at auction for $7,590,020 to a private collector. As part of the settlement that made the auction necessary, the proceeds were divided between the United States government and British coin dealer Stephen Fenton. The FBI arrested Fenton trying to sell the coin at the Waldorf Astoria Hotel in 1998.

The sale price stood as the most paid for a single coin until the sale of the 1794 silver dollar sold for $10,016,875 in January 2013. While the 1794 silver dollar had a great story, nothing compares to the sale of the coin known as the Farouk-Fenton Double Eagle.

The coin’s colorful history is documented in two books that span the coin’s history from the conditions of their beginning to the auction sale, including being removed from storage at the World Trade Center before its destruction on September 11, 2001.

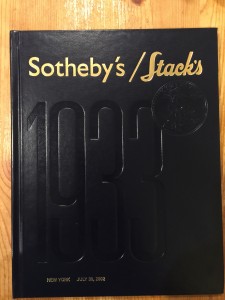

It is not a coin that an ordinary collector can own. Rather than owning the coin, why not own the auction catalog from that sale?

Stack’s partnered with Sotheby’s to auction the coin. It was the only lot in the auction held at Sotheby’s New Yor headquarters at 6:00 PM on Tuesday, July 30, 2002. The highest bid was $6.6 million when the hammer fell. A 15-percent buyer’s premium made the sale price $7,590,000. To monetize the coin, the government required the $20 face value payment that the Federal Reserve would have paid in 1933.

I purchased the auction catalog from Kolbe & Fanning during a recent sale. It is a special hardbound edition with over 50-pages about the coin, this sale, and its history. Most of the contents were written by David Tripp, who was then the director of Sotheby’s coin, tapestry, and musical instrument departments. Tripp later expanded on what he wrote for the catalog and published Illegal Tender: Gold, Greed, and the Mystery of the Lost 1933 Double Eagle.

It was a beautifully produced auction catalog. Even though the catalog is a summary of Tripp’s book, it is a piece of numismatic history. And since I cannot afford the coins, I bought the book instead of the coin.

Updated on March 12, 2021

May 14, 2015 | Canada, coins, commemorative, gold, nclt, silver

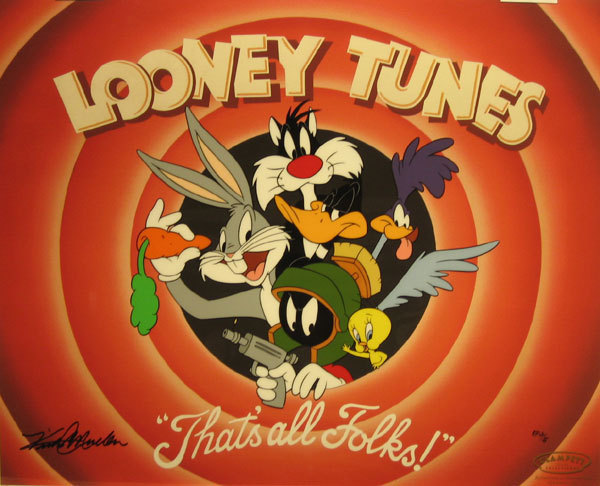

Eh… What’s up, doc?

Hey bub… did ya hear dat de Royal Canadian Mint is going Looney Tunes?

$250 Looney Tunes Silver Kilo Reverse

I will admit to having grown up watching Bugs, Daffy, Porky, Tweety, and all of their friends on the weekend morning cartoons. I spent many mornings in my bedroom before my parents woke up watching on an old black and white television wondering if Wile E. Coyote would ever catch the Road Runner? Would Sylvester ever learn that he should not eat Tweety Bird? Or will Pépé Le Pew ever figure out why he could never find a girl to go with him to the casbah? Of course, at that age, I didn’t know what the casbah was!

I guess I also have to admit that I am intrigued by some of these coins. Not the ones that seem to be enameled for the design because I have this thing about using paint for the design of the coin. But there are some coins that are going to be really engraved coins that are somewhat affordable. Apparently, if I examine my own preferences, I do not mind enhanced color that enhances the designs but not just splashing paint on the metal disks.

$100 Looney Tunes 14-karat Reverse

For those not familiar with the Royal Canadian Mint’s “20 for $20” program, they provide a limited mintage silver coin with a $20 face value for $20 (note that all prices are in Canadian dollars). These coins are 7.96 grams of .9999 silver and available for direct purchase to buyers in Canada and the United States.

As I type this $20 Canadian is worth $16.49 USD. A U.S. resident buying directly from the Royal Canadian Mint will have their credit card charged in Canadian dollars. Your credit card company will pay the Royal Canadian Mint at the rate at the time of the transaction plus an exchange fee. Exchange fees differ between credit card issuers.

Other options include:

Bugs Bunny $20 Silver coin reverse, part of the Royal Canadian Mint 20 for $20 program

- A $20 “Merrie Melodies” silver coin featuring Bugs Bunny and the gang in a design that is reminiscent of the Looney Tunes’ end credits. The coin is cleverly packaged in a box that mimics the ACME crate.

- A $20 silver four-coin set featuring Bugs Bunny, Daffy Duck and Tweety. If you buy the set as a subscription it will include a free Looney Tunes wrist watch.

- A 14-karat gold Bugs Bunny and Friends coin featuring Bugs Bunny, the Tasmanian Devil, Wile E. Coyote, Daffy Duck and Marvin the Martian. The Royal Canadian Mint claims that there is a “hidden surprise design element” in this coin. If you buy this coin you will also receive an “exclusive” pocket watch.

- Finally, the Royal Canadian Mint will issue one kilo gold and silver coins. The gold coin will have a face value of $2,500 and the silver will have a face value of $250. The design will feature every major Looney Tunes characters. The design of both coins features selective colored enamel applied by hand to Bugs Bunny who serves as the central focal point. He is surrounded by the entire cast of Looney Tunes characters.

As this posting was saved as a draft for the last few days, I have been contemplating what I wanted to do. With my new found nostalgia and admitted mid-life crisis, I look back at the Looney Tunes fondly. Where I grew up, Bugs Bunny sounded like he could have been one of my neighbors! Mel Blanc, who gave Bugs his voice, wasn’t even from New York yet nailed the accent, cadence, and attitude perfectly. I will probably order the Bugs Bunny “20 for $20” silver coin and take some time before I decide on others. if I do decide to do the whole series, I would probably buy the silver $10 coins because they are coins without painted on designs.

All coin images courtesy of the Royal Canadian Mint.

May 6, 2015 | BEP, coins, commemorative, currency, Federal Reserve, legislative, policy, US Mint

For those of us who are political junkies, April was a relatively quiet month. At least there was something to watch that was more related to the hobby than the usual partisan bickering. Here are the coin and currency-related legislation moving through congress:

S. 925: Women on the Twenty Act

Sponsor: Sen Jeanne Shaheen (D-NH)

• A bill to require the Secretary of the Treasury to convene a panel of citizens to make a recommendation to the Secretary regarding the likeness of a woman on the twenty dollar bill.

• Introduced: April 14, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

Track this bill at https://www.govtrack.us/congress/bills/114/s925

S. 95: A bill to terminate the $1 presidential coin program

Sponsor: Sen. David Vitter (R-LA)

• Introduced: January 7, 2015

• Discharged from Senate Committee on Homeland Security and Governmental Affairs by Unanimous Consent on April 14, 2015

• Referred to the Senate Committee on Banking, Housing, and Urban Affairs on April 14, 2015

Track this bill at https://www.govtrack.us/congress/bills/114/s95

S. 985: United States Coast Guard Commemorative Coin Act

Sponsor: Sen. Christopher Murphy (D-CT)

• To require the Secretary of the Treasury to mint coins in commemoration of the United States Coast Guard.

• Introduced: April 16, 2015

• Referred to the Senate Banking, Housing, and Urban Affairs Committee

Track this bill at https://www.govtrack.us/congress/bills/114/s985

Apr 26, 2015 | coins, currency, legislative, policy

A few weeks after the Women on 20s group began their campaign, they gained the attention of congress to have two bills submitted to require the change be made.

A few weeks after the Women on 20s group began their campaign, they gained the attention of congress to have two bills submitted to require the change be made.

First up is Sen. Jeanne Shaheen (D-NH) who introduced Women on the Twenty Act (S. 925) on April 14, 2015 and referred to the Committee on Banking, Housing, and Urban Affairs, the bill is eight co-sponsor. All eight co-sponsors are Democrats and six are women.

Simply, the bill seeks to add a new paragraph to the Federal Reserve Act (12 U.S.C. § 418) to say:

The Secretary of the Treasury shall convene a panel of private citizens of the United States to advise and make recommendations to the Secretary regarding the likeness of a woman to appear on the face of $20 Federal reserve notes. In carrying out the requirements of the preceding sentence, each of the Secretary and the panel shall consider and weigh input provided by the American people.

While you read that paragraph, you have to understand that there is a little Washington-speak in the proposed law. All it says is that the Secretary is required to appoint a panel of private citizens, not government employees or appointees, to make a recommendation. It does not say that the Secretary is required take the committee’s recommendation nor does it it say that the Secretary is to do anything with the recommendation.

Essentially, unless the wording is changed, there is nothing in the above statement to require a woman appear on the $20 Federal Reserve Note. “Thank you for your recommendation,” a Secretary of the Treasury can say, “and have a nice day.”

1999-W George Washington Commemorative using the design by Laura Gardin Frazer

Adding to the fray is a bill introduced by Louis Gutierrez (D-IL) whose title currently appears similar to that of Sen. Shaheen’s bill. Gutierrez’s bill (H.R. 1910) has no co-sponsors and was assigned to the House Financial Services Committee. As this is being written, the bill has not been published by the Government Printing Office making it difficult to compare this with S. 925.

Considering my last post about this topic, it will be interesting to see how this turns out. If I was to guess, one of the bills will be passed at the end of a session either by unanimous consent or an overwhelming vote in favor. A design will be produced but not in time to celebrate the 100th anniversary of suffrage. The wheels of politics and bureaucracy moves too slow and the engravers need time to engrave the plates.

Currency image courtesy of Wikimedia Commons.

Coin image courtesy of the U.S. Mint.

In an early morning press release, the

In an early morning press release, the